Market Insights: Monday, December 8th, 2025

Market Overview

Stocks fell Monday as Wall Street prepared for the Fed’s final policy meeting of the year while deal drama between Netflix and Warner Bros. Discovery continued to play out. The S&P 500 slipped 0.40%, the Dow fell 0.50%, and the Nasdaq dipped 0.20%, snapping a four-day win streak for the two larger indices. Markets remain firmly focused on the Fed’s upcoming decision, with futures pricing in an 88% probability of a rate cut Wednesday, up from 67% a month ago. While a tame September PCE print reinforced dovish hopes, policymakers remain split on balancing inflation and labor risks. Meanwhile, Nvidia rose over 1% on reports that the Trump administration will approve the sale of H200 chips to China. WBD surged on a $108.4 billion hostile bid from Paramount, upending Netflix’s $72 billion acquisition attempt. NFLX fell more than 3% on the news. Despite the recent dip, expectations remain high for a bullish close to the year—so long as Powell doesn’t disappoint.

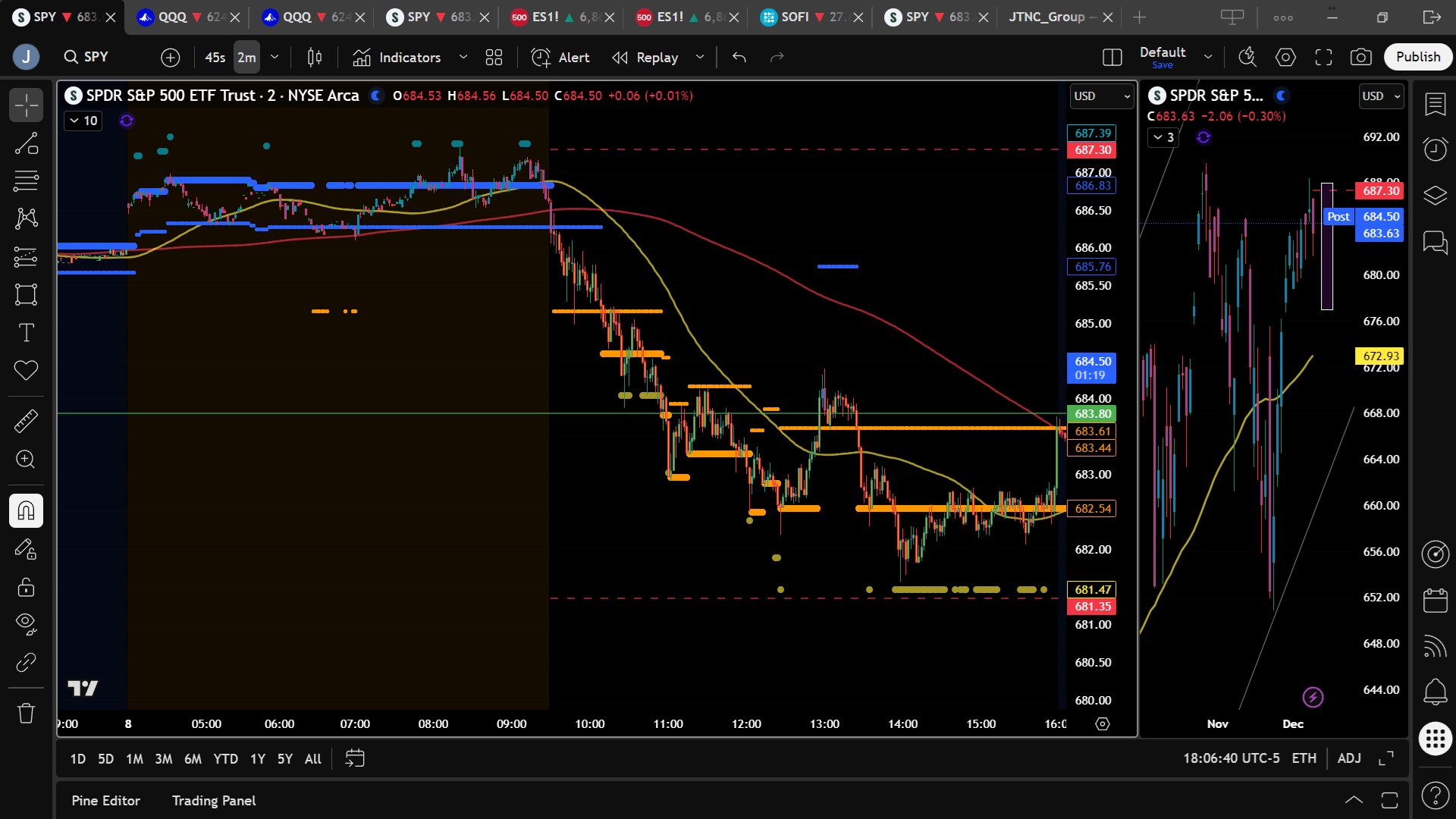

SPY Performance

SPY opened at $686.47, hit a session high of $686.64, and fell steadily before bouncing from an intraday low of $681.57 to close at $683.65, down 0.30% on the day. Volume was light at 50.87M, slightly below average, confirming a lack of strong conviction behind the selloff. The ETF dropped below Friday’s critical $685 support level early and failed to reclaim it throughout the session, signaling a weak follow-through from last week’s breakout attempt. Price now sits near the center of the well-established $675–$685 range that has defined the past two weeks. Bulls remain in control on the larger timeframe above $680, but short-term structure has deteriorated as SPY awaits direction from the Fed.

Major Indices Performance

The S&P 500 lost 0.40%, the Dow slid 0.50%, and the Nasdaq fell 0.14%. The Russell 2000 eked out a gain of 0.05%, breaking from its recent trend of underperformance. The Magnificent Seven group was mixed, with Microsoft and Nvidia rising 1.63% and 1.73% respectively, while the rest declined. Crude oil fell sharply, dropping 2.01% to $58.87, as it continues to hover above critical support at $56. Gold slipped 0.52% to $4,220. Bitcoin rose 0.69% to close above $90,800, suggesting continued interest despite recent volatility.

Notable Stock Movements

Nvidia rose sharply after reports indicated potential approval to export advanced chips to China, boosting confidence in its international revenue stream. Microsoft also saw solid gains. Meanwhile, Netflix fell 3% following renewed acquisition competition, as Paramount’s $108 billion offer for Warner Bros. Discovery disrupted NFLX’s own deal. WBD rallied on the bid. These large-cap headlines dominated trading sentiment, reinforcing the role of individual stock catalysts within a macro-driven environment.

Treasury Yield Information

The 10-year Treasury yield rose 0.70% to close at 4.169%, holding well below the critical 4.5% threshold that typically triggers equity stress. Rates have stabilized, but any hawkish commentary from Powell could reignite bond market volatility. A move toward 5% would pressure equities significantly, with 5.2% seen as the level that could trigger a broader correction.

Looking Ahead

Tuesday’s data includes ADP and JOLTS, offering an early read on labor market conditions. The main event comes Wednesday with the Fed’s rate decision and Powell’s press conference, which are expected to drive market direction into year-end. Thursday features PPI and Unemployment Claims. No major data is scheduled for Friday, so market momentum will likely be set by midweek. With expectations high for a dovish outcome, disappointment could trigger a sell-the-news reaction, though bulls still have momentum on their side—pending confirmation.

Market Sentiment and Key Levels

SPY’s projected range for Tuesday is $677 to $688. Resistance now stands at $685, $688, $690, and $692, while support sits at $680, $675, $672, and $670. Losing $685 flips short-term momentum back to neutral and puts pressure on $680. Below $680, bears may regain near-term control. Above $688, gains will likely stall into FOMC. SPY remains structurally bullish above $640, and for now the longer-term trend remains intact.

Expected Price Action

Today’s failed breakout and rejection from $687 confirms that buyers are hesitant ahead of the Fed decision. Without a near-term catalyst, SPY is likely to remain in the $675–$685 range, barring a surprise CPI or Fed move. Watch for choppy price action with brief bursts of momentum that quickly fade. The second red day in two weeks isn’t yet a trend change, but does reinforce the need for caution ahead of macro catalysts.

Trading Strategy

Buyers should remain defensive until after Wednesday’s FOMC outcome. Intraday longs near $680 may offer a high-risk entry with tight stops. Fade rallies near $687–$689 for tactical shorts, especially if volume fades. SPY continues to coil, and the breakout—whether higher or lower—will likely be fast and directional. Stay light, wait for confirmation, and don’t force trades ahead of major news. Watch MSI levels for precision and remain flexible.

Model’s Projected Range

SPY’s projected maximum range for Tuesday sits between $677 and $688, with the Put side dominating in a narrow band that signals choppy action with brief trending periods. Today the market finally delivered a pullback day, only the second in two weeks, marked by low volatility, slow movement, and heavy chop, with SPY closing down 0.30% at $683.63 after a last-minute spike. We noted Friday that “it is still early to know if this ($685) holds,” and that proved accurate as SPY pushed to $687 overnight but sold off immediately at the open. SPY continued to fall steadily until a small bounce at $681.50 around 2 pm, where the bulls finally bought the dip but at lower levels they previously protected. Repeated tests drain liquidity and weaken support so now back below $685, the bears will attempt another move lower. That said, context matters since two red days in two weeks is not a structural concern and SPY has simply returned to the $675–$685 range, where it may remain until FOMC, which could either spark a Santa Rally or become a sell-the-news event if already priced in. Overnight, if $680 fails, SPY may produce another red session into FOMC and test $675, with a break opening the door to $672. Today’s well-below-average volume does little to validate the day’s selloff. Absent a catalyst, resistance sits at $685, $688, $690, and $692, with support at $680, $675, $672, and $670. Above $688 gains should remain muted due to heavy resistance while a break below $675 could send price toward $667. The broader trend remains bullish above $640. For Tuesday we defer to the trend and prefer longs from support above $680 while watching for shorts near $687. Crypto was unchanged today while most Mag stocks fell except Nvidia and Microsoft, and as noted for weeks, the market is likely to continue rising until meaningful weakness returns in these leadership groups. VIX rose 8.11% to 16.66 and remains in neutral territory awaiting a catalyst. Traders should stay flexible and trade what they see, leaning slightly bullish for continuation of the recent rally, though price may hold steady as FOMC approaches. SPY closed mid-channel within the redrawn bull trend, suggesting that higher prices remain likely.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a narrow Bearish Trending Market State, with SPY closing at MSI resistance. There were no extended targets at the close, although there were plenty throughout the session right until the close. This pushed SPY lower all day and only after they stopped printing did the herd step back which allowed SPY to rise into the close. Overnight the MSI rescaled higher and by the open, the MSI was forecasting higher prices for the day with sporadic extended targets above. But the MSI range was extremely narrow and extended targets were not continuous in the premarket so at the open, these had stopped printing and the MSI started rescaling lower several times until reaching the day’s lows. For Tuesday the MSI is forecasting slightly lower prices although it’s likely SPY moves higher and attempts to clear $685 first. Should SPY clear $685, the bulls will return in force and push prices back toward the all-time highs. Watch for the MSI to rescale higher on Tuesday to support such a move. That said it would also not surprise us to see SPY also retest today’s day’s lows. MSI support is currently at $682.54 with resistance at $683.61.

Key Levels and Market Movements:

On Friday we stated “We expect price to retest today’s highs but also to fail there or slightly higher,” and added “for Monday we defer to the long trend while remaining open to a failure at major resistance at $689 that could repeat today’s fade back toward $685,” while also noting “For Monday we will look for bounces toward $682 and also seek shorts up to $690.” With this context, and with the MSI trading in the premarket above $687 but with only brief extended targets above and a very narrow MSI, we wanted to fade the push higher and see if a second red day in two weeks might unfold. We entered short at MSI resistance at $686.82 at the open and set T1 at the premarket level of $685.80, meeting our $1 minimum target. Once T1 hit, we set T2 at MSI support as the MSI rescaled lower to $685.20, which also filled quickly, leaving us to hold the remaining 10% runner with a stop at breakeven as the MSI began a series of rapid rescalings lower. We continued holding even though a midday failed breakdown looked like a reasonable exit cue. Instead, we reloaded the short at MSI resistance at $683.60 and set T1 at MSI support at $682.55, but with the day already deep in profits, we shifted to profit protection mode and closed the remaining position at $682 on another failed breakdown at 2 pm, calling it a day. Two for two to start the week, thanks to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Today was once again a messy, choppy, and sloppy day with the only excitement coming in the first two hours, and even then the move to the day’s lows was slow, suggesting Tuesday may deliver more of the same as the market drifts sideways into FOMC. The bulls want to reclaim $685 but must first hold above $682 overnight, and a failure there will test $680, while a break of $680 will likely produce another red day. We expect price to attempt a push above $685, yet it is also likely to face major resistance holding above that level, and even if SPY clears $685 the market will probably only retest today’s highs before pausing as it waits for an external catalyst and FOMC. Any sustained move below $680 shifts probabilities toward lower prices, and a failure at $680 overnight will lead to a test of $678, with a break there likely accelerating price toward $675 and possibly $670. Crypto moved slightly higher today while Mag stocks were mostly lower, so remaining conservative into FOMC is wise and monitoring these leadership groups will help confirm whether the December bull trend remains intact. For Tuesday we will look for bounces toward $682 and also seek shorts up to $690 for another rangebound session, staying alert for macro risks such as Venezuela or other developments that could affect markets, and with the long-term bull trend intact above $640 we continue to favor the bulls and the larger trend as long as price holds above $680. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $687 to $705 and higher strike Calls while also buying $684 to $686 Calls indicating the Dealers’ desire to participate in any relief rally on Tuesday. Dealers are no longer selling ATM Puts and Friday’s positioning cost them. The ceiling for Tuesday appears to be $690. To the downside, Dealers are buying $683 to $565 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower on Tuesday. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $688 to $709 and higher strike Calls while also buying $684 to $687 Calls indicating the Dealers’ desire to participate in any rally this week. The ceiling for the week appears to be $700. To the downside, Dealers are buying $683 to $565 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a market that is less concerned about lower prices. For the week Dealer positioning is unchanged from slightly bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Use strength into $687–$689 to trim longs or initiate tactical shorts. Buy dips toward $682–$680 with defined risk. Until FOMC, respect the range and don’t overtrade. Stay focused on MSI levels and trust the model to guide execution. Avoid overcommitting ahead of Powell, and prepare for volatility starting Wednesday.

Good luck and good trading!