Market Insights: Monday, December 22nd, 2025

Market Overview

US stocks advanced for a third straight session on Monday as Wall Street moved into a holiday-shortened week with momentum increasingly tilting toward a potential year-end rally. The Nasdaq climbed 0.52%, while the S&P 500 rose 0.61% and the Dow gained 0.47%, marking steady, broad-based progress rather than an explosive risk-on surge. Tech continued to recover from its recent volatile stretch as investors balanced lingering concerns about an overstretched AI trade against renewed fear of missing out on a longer-term AI-driven growth cycle. Confidence in the AI theme improved again late last week following constructive developments around Oracle and Nvidia, and that strength carried into Monday’s session, with Tesla also pushing higher toward recent highs. The broader macro backdrop remained supportive, as cooling inflation and a softening but resilient labor market have kept expectations for 2026 rate cuts largely intact, allowing equities to grind higher without a significant rise in volatility. Outside of stocks, geopolitical tensions helped drive another surge in precious metals, with gold and silver hitting fresh record highs amid rising friction between the US and Venezuela. Crude oil also moved higher as energy markets reacted to escalating enforcement actions near Venezuelan waters, adding another layer of complexity to the global macro picture. Looking ahead, markets are entering the final stretch of 2025 trading within striking distance of record highs, with investors watching closely to see whether lighter holiday volume and supportive seasonality can sustain a Santa Rally into year-end.

SPY Performance

SPY posted a steady gain, opening at $683.97 and grinding higher through the session to an intraday high of $685.36 before pulling back modestly to close at $684.84, up 0.61% on the day. Trading volume came in at 57.10 million shares, slightly below average, which is consistent with the start of a holiday-shortened week and reflects reduced participation rather than waning conviction. Price action was controlled and methodical, with buyers stepping in on every minor dip and defending the $683 level throughout the session. While SPY once again failed to secure a decisive close above $685, the ability to hold near the highs signals that bulls remain firmly in control in the near term, even as overhead resistance continues to cap upside progress.

Major Indices Performance

Gains across the major indices were broadly consistent and reinforced the constructive tone. The Nasdaq added 0.52%, supported by continued strength in select megacap tech and AI-linked names. The S&P 500 rose 0.61%, tracking SPY’s grind higher and remaining just below key resistance levels. The Dow climbed 0.47%, showing improved participation from more cyclical components, while the Russell 2000 outperformed with a 1.08% gain, signaling growing confidence in smaller-cap names as financial conditions remain accommodative. The mix of index performance suggests improving breadth beneath the surface, even if leadership remains anchored in technology.

Notable Stock Movements

It was a mostly green session across the Magnificent Seven, highlighting continued stability in market leadership. Tesla led the group with a gain of up to 1.57%, extending its recent strength and reinforcing optimism around its longer-term growth narrative. Most other megacap names traded higher as well, though Netflix, Microsoft, and Apple lagged modestly, reflecting selective profit-taking rather than broad weakness. The overall tone within megacaps remains constructive, and importantly, leadership weakness has not aligned across both tech and crypto, a combination that would typically pressure equities more meaningfully.

Commodity and Cryptocurrency Updates

Commodities and crypto added another layer of confirmation to the improving risk backdrop. Crude oil surged 2.49% to $57.93, pushing further above the key $56 level that our model continues to flag as pivotal. While downside risks remain, holding above this zone keeps the door open for a move toward $60 and potentially $70 if demand holds and supply dynamics tighten. Gold jumped 2.08% to $4,478, extending its powerful 2025 rally and underscoring persistent demand for inflation and geopolitical hedges. Bitcoin rose 0.30% to close above $88,400, maintaining its broader uptrend and signaling steady, if unspectacular, risk appetite within digital assets.

Treasury Yield Information

The 10-year Treasury yield slipped 0.43% to close near 4.163%, easing some pressure on equity valuations and helping support the grind higher in stocks. In our framework, yields above 4.5% tend to create headwinds for equities, while moves above 4.8% and especially above 5% often coincide with more pronounced selloffs. At 5.2%, our model suggests the probability of a 20% or greater correction rises sharply. Monday’s dip in yields kept financial conditions supportive and reinforced the bullish seasonal backdrop.

Previous Day’s Forecast Analysis

In Friday’s newsletter, we projected SPY’s maximum range for Monday between $675 and $686 and emphasized that rangebound trade with a slight upward bias was likely in the absence of a major catalyst. We highlighted the importance of the $675 support zone and noted that while pushes toward $685 were possible, gains above that level would likely stall without improving volume and breadth.

Market Performance vs. Forecast

Monday’s action aligned closely with that outlook. SPY remained well within the projected range, held above $683 throughout the session, and tested the $685 area before pulling back modestly. The inability to close decisively above $685 confirmed that resistance remains intact, but the lack of meaningful downside follow-through reinforced the view that bulls retain the edge heading into the rest of the holiday week.

Premarket Analysis Summary

In Monday’s premarket notes published at 8:26 AM, SPY was trading near $683.57 with a bias level set at $683. We outlined upside targets at $685, $685.50, and $686.50, while noting that lower holiday volume warranted restraint. On the downside, we flagged $683, $681.50, and $680 as potential consolidation zones if the bias failed. The plan favored gradual upside expansion rather than aggressive breakouts.

Validation of the Analysis

The intraday tape validated that framework well. SPY held above the $683 bias for most of the session, pushed into the $685 zone, and consolidated rather than reversing sharply. Although the move stalled below $686.50, price action reflected steady accumulation rather than distribution, consistent with our expectation of controlled upside in a low-volume environment.

Looking Ahead

Attention now turns to Tuesday’s releases, which include ADP and GDP, followed by Unemployment Claims on Wednesday. While these data points could inject short-term volatility, the holiday-shortened schedule and lighter participation may limit follow-through. As a result, technical levels and positioning are likely to play an outsized role in near-term price action.

Market Sentiment and Key Levels

Sentiment continues to improve but has not yet shifted into full bullish control. SPY’s close near $684.84 places it just below the critical $685 level, where a decisive breakout would significantly weaken the bear case. Resistance sits at $685, $688, and $690, while support rests at $683, $681.50, and $680. Holding above $683 keeps the near-term rally intact, while a failure there would likely trigger consolidation rather than a trend reversal.

Expected Price Action

Our model projects SPY’s maximum range for Tuesday between $681 and $688, with the Call side dominating in a narrowing band that signals choppy action with brief trending periods. As long as SPY holds above $683, attempts to push through $685 remain likely, though progress is expected to be slow and measured. A rejection at $685 favors sideways action, while a clean break above opens the door to $688 and potentially $690.

Trading Strategy

Given the holiday backdrop, we continue to favor a disciplined, range-aware approach. For longs, we prefer entries near $683 down to $681 on confirmed support, with upside targets at $685 and $688. For shorts, failed pushes into $685–$688 remain attractive, particularly if volume fades or momentum stalls. With VIX falling to 14.07 and firmly in risk-on territory, moderate sizing and respect for key levels remain essential.

Model’s Projected Range

SPY’s projected maximum range for Tuesday is $681 to $688, with the Call side dominating in a narrowing band that signals choppy action with brief trending periods. SPY rallied 0.61% to close at $684.72, right below major resistance. Volume was average for a shortened holiday week, confirming participation. Overnight the bulls pushed prices higher in anticipation of a Santa Rally, and the session unfolded as a slow grind upward. When price reached $685, the bears stepped in and prevented a close above this key level. Even so, every dip was bought and the bulls have a significant edge for now. The $683 level is acting as support and the bulls will do their best to defend this level to keep the rally intact. The rejection at $685 favors sideways action with a slow upward bias rather than an explosive move. We still expect rangebound trading between $675 and $685 until a catalyst appears or until SPY closes decisively above $685, which would sideline the bears. Price favors higher highs, but full bull control only returns above $685, while the broader bull market remains intact above $640. A failure to hold $683 overnight opens $678 and then $676. A push above $685 targets $688, and a break there opens $690 and potential new highs. GDP is due tomorrow and could add volatility, but with the holiday approaching it would not be surprising to see limited movement once again. Traders should also monitor geopolitical headlines for surprises given the conflict with Venezuela. The 50 DMA near $675 continues to support dips and the odds of a Santa Rally continue to improve. Resistance for Tuesday sits at $685, $688, and $690, while support rests at $682, $678, and $675. Gains above $688 are likely capped, while a break below $675 risks a deeper decline. Absent a catalyst, we prefer shorts near $688 and longs near $682 down to $678. Crypto was flat today while most MAG stocks advanced, except Netflix, Apple, and Microsoft. Sustained weakness across both groups would be required for a meaningful pullback to develop. VIX fell 5.63% to 14.07, supporting risk on conditions for equities with SPY closing in the lower third of its bull channel from the April lows, with structural support near $671.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a wide, Bullish Trending Market State with SPY closing well above MSI resistance turned support. There were no extended targets into the close but extended targets did print for most of the overnight and morning sessions, indicating the herd was participating in the day’s rally. A gap up overnight led to the day’s rally but once price reached $685, the market stalled and moved mostly sideways in a very tight range for the entire afternoon. The MSI rescaled overnight to the current state and remained that way all day. Around 1 pm extended targets stopped printing and the market stopped moving so it was a slow and painful afternoon without anything worthy of trading. For Tuesday the MSI is forecasting higher prices but perhaps more of a range with a slow drift toward $688 rather than another big push higher. Support is at $680.48 and higher at $682.95.

Key Levels and Market Movements:

On Friday we stated, “SPY is likely to shift into more rangebound behavior on lighter volume,” and noted, “The MSI forecasts higher prices for Monday, but any push toward $685 is likely to be slow and measured,” while also adding, “Above $683 resistance weakens and momentum toward $688 could accelerate.” With this context, and with the MSI opening in a wide bullish state with extended targets printing above in the premarket and SPY trading just below $684, we waited patiently for a clean long opportunity targeting $685. That opportunity came quickly when SPY dipped to MSI resistance turned support at $683. We entered long on the first test of that level about ten minutes after the open and set T1 at the premarket level of $685. SPY chopped for nearly two hours, and while conviction was low, there was little to do but hold for T1. Around noon, T1 was secured and we set T2 at the next premarket level of $685.50. Price approached but failed to reach that target, and with a less than perfect failed breakout at this major level, we exited the trade and waited for another setup. SPY pulled back slightly but the broader trend remained higher, and with price action stalling for the remainder of the session, we decided one trade was sufficient for a short holiday week and called it a day. One for one thanks to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Tuesday has GDP in the premarket, which may set the tone or have little impact. With only one full trading day left this week, price is likely to range with a slight upward drift on low volume. The seasonal Santa Rally typically begins around the 24th, which keeps the door open for an attempt at new all time highs. The MSI forecasts higher prices for Tuesday, but any push above $685 is likely to be slow and measured, with $688 acting as the near term ceiling. Dips toward the $683 to $682 zone should continue to attract buyers. This sets up a range environment where fading both highs and lows makes sense. There is no meaningful bear case unless price moves below $675. The bulls will look to defend $683/$682 overnight. A failure there likely sends SPY to $678, and a break of $678 puts $675 into play. If the $683/$682 zone holds, the bulls will attempt another push above $685. Gains above $685 may stall until $688 is reclaimed. Above $688 resistance weakens and momentum toward $690 could accelerate. Crypto was flat and most MAG stocks rose, confirming continued leadership strength. Both groups would need to weaken together to trigger a deeper pullback. The long term bull trend remains intact above $640. In the near term, the edge stays with the bulls as long as price holds above $680. Any test of $688 remains a strong short candidate, but we favor longs off support as dips are likely to keep getting bought into the new year. As always, stay alert to macro risks and be prepared to trade what you see in the coming days. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

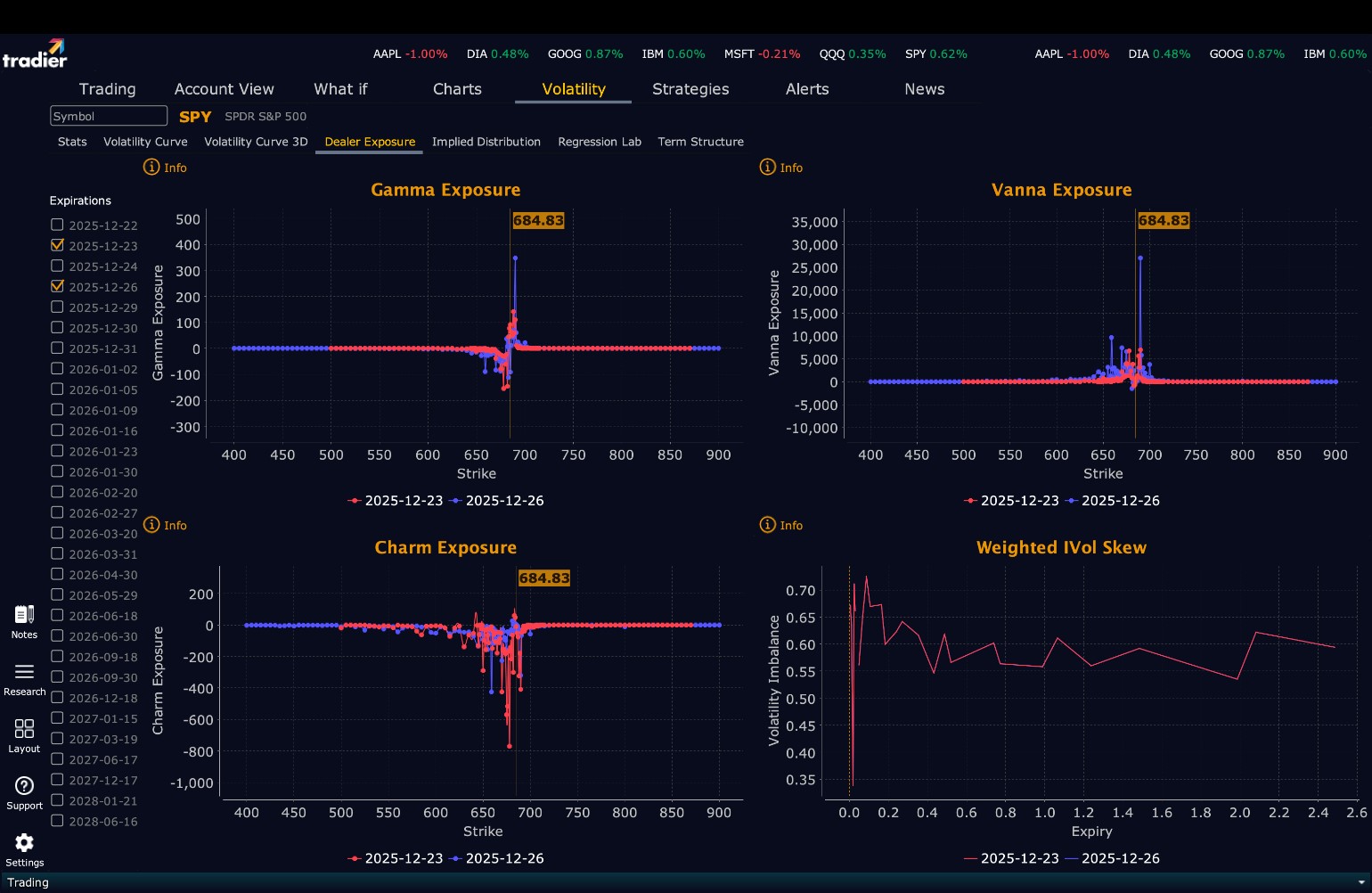

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $685 to $705 and higher strike Calls while selling $683 to $684 Puts indicating the Dealers’ belief that prices will continue to rally on Tuesday. Dealers only sell ATM Puts when they are convinced prices will move up. The ceiling for Tuesday appears to be $688. To the downside, Dealers are buying $682 to $565 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move significantly lower on Tuesday. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $685 to $710 and higher strike Calls while also selling $681 to $684 Puts indicating the Dealers’ belief that prices will continue to rally this week into Friday. The ceiling for the week appears to be $690. To the downside, Dealers are buying $680 to $565 and lower strike Puts in a 4:1 ratio to the Calls/Puts they’re selling/buying, reflecting a market that is less concerned about lower prices. For the week Dealer positioning has changed from bearish to less bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Tuesday, continue to treat the $683–$685 zone as the primary decision area. Favor cautious longs on confirmed support above $683 and shorts on failed pushes into $685–$688. With holiday conditions in place, expect lighter volume, slower moves, and more mean-reversion behavior. Stay patient, remain flexible, and let price action at key levels guide your decisions.

Good luck and good trading!