Market Insights: Wednesday, December 10th, 2025

Market Overview

Stocks rallied on Wednesday following the Federal Reserve’s widely anticipated quarter-point rate cut, lifting the Dow more than 500 points and pushing the S&P 500 just shy of a record high. The Fed’s decision, its third cut this year, puts the benchmark rate in a range of 3.5% to 3.75%. Chair Jerome Powell’s press conference struck a confident tone on inflation and economic strength, though he acknowledged “tension” within the Fed’s dual mandate. Notably, he dismissed tariff-driven inflation as a one-time adjustment and emphasized AI-led growth as a positive force. Dissents from both hawks and doves highlighted internal policy debates, but markets cheered the absence of surprises. The Nasdaq clawed out a modest gain after early weakness, while the Russell 2000 surged to new all-time highs as lower rates favor smaller, debt-sensitive companies. GE Vernova soared over 15% after doubling its dividend, and attention now turns to Thursday’s earnings from Broadcom, Costco, and Lululemon for AI and retail sentiment cues.

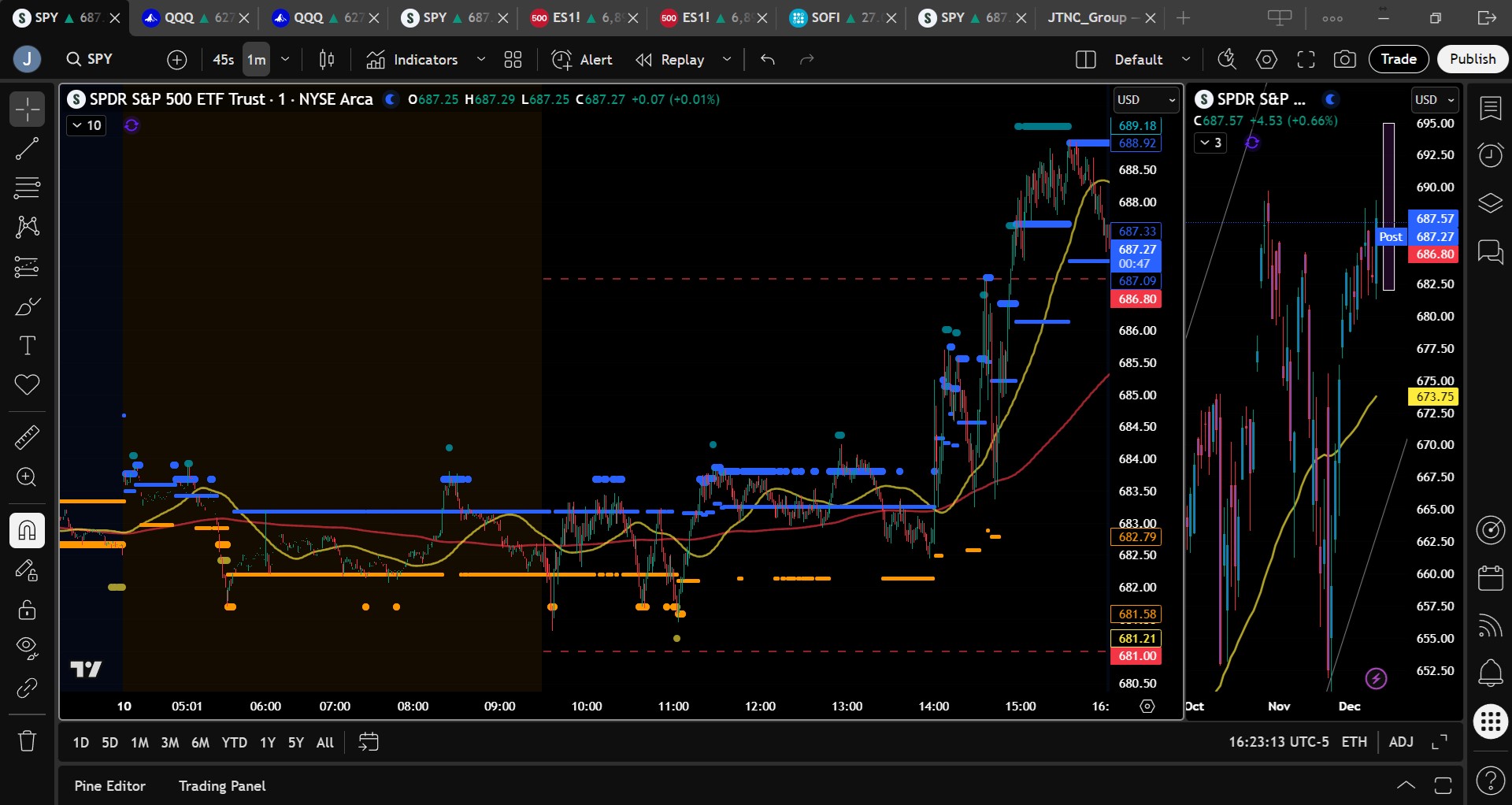

SPY Performance

SPY opened at $682.52, dipped to $681.31, and powered higher following the FOMC announcement, hitting a high of $688.97 before settling at $687.59, up 0.67% on the day. Volume came in higher than average at 76.49M. Most of the session was uneventful, with SPY trading in a tight range below $685 until the Fed’s 2 pm announcement. The subsequent breakout sent price nearly to all-time highs. With SPY closing well above $685, bulls have regained full control. The move was clean, supported by higher volume, and signals growing confidence in the Fed’s soft landing scenario. If $686 holds on any dip, the path remains open for new highs in the coming sessions.

Major Indices Performance

The Dow gained 1.05% for a strong breakout session, while the S&P 500 rose 0.67%, closing just shy of its record. The Nasdaq rose 0.33% despite early pressure, and the Russell 2000 surged 1.31% to another all-time high, confirming strong risk appetite. Crude oil climbed 1.22% to $58.99 and continues to hold above the critical $56 threshold that supports a bullish thesis. Gold rose 0.51% to $4,257, and Bitcoin added 0.33%, closing above $92,300. The 10-year Treasury yield fell slightly to 4.157%, still comfortably below the 4.5% caution zone, offering further relief to equity bulls.

Notable Stock Movements

Amazon led the Magnificent Seven with a 1.69% gain. Tesla, Apple, and Alphabet also posted gains, helping support the Nasdaq. Nvidia and Meta declined modestly as investors rotated slightly out of AI plays following the Fed. GE Vernova exploded higher on dividend news. JPMorgan stabilized after Tuesday’s slide. The broader market remains healthy, with small caps and retail names responding positively to rate cut expectations.

Treasury Yield Information

The 10-year yield slipped to 4.157%, down 0.76% on the day, a supportive move for equities. Yields remain well below the critical 4.5% level that would trigger concern. Should yields drift back toward 5%, markets may reassess valuations, but for now, the Fed’s dovish tone supports both risk assets and duration-sensitive sectors.

Market Sentiment and Key Levels

SPY’s projected maximum range for Thursday sits between $682 and $695, with Calls dominating across a wide band, indicating expectations for continued trending action. Today’s rally above $685 is significant, establishing it as key near-term support. Resistance lies at $689, $690, and $697. Support levels to watch are $686, $682, $680, and $675. A push above $690 may face resistance, but holding $686 should keep bulls in control. The broader trend remains firmly bullish above $640. With FOMC behind us, upside continuation is favored unless $680 breaks, which could expose $670.

Expected Price Action

Today’s explosive post-Fed move confirms the bulls’ control of the tape. We expect SPY to consolidate above $686 before probing higher toward $690–$695. Price action is likely to be orderly with bullish momentum, especially with volume confirming the breakout. A dip to $682 or $680 may be bought quickly. Caution near the highs is warranted, but upside pressure remains dominant.

Trading Strategy

With the Fed out of the way, we favor long setups from $682–$684 on dips, and will consider tactical shorts near $690 if price stalls. Failed breakouts may offer brief short windows, but trend remains bullish. Avoid chasing strength blindly at highs. Stay with momentum, lean long, and adjust if SPY breaks $680 on volume.

Model’s Projected Range

SPY’s projected maximum range for Thursday sits between $682 and $695, with the Call side dominating in a wide band that signals trending action with periods of chop. Today the market moved sideways in a very tight range until FOMC at 2 pm. The Fed Chair delivered a relatively dovish statement, and price surged higher as SPY closed up 0.66% at $687.57. Overnight SPY attempted a small rally but sold off in the premarket to $681.70 before bouncing. At the open SPY looked under pressure, and with price below $685 but above $682, the market was positioned to do virtually nothing until FOMC. That is exactly what happened, with SPY trading in a sub-$1 range until 2 pm. After the announcement the first move up did attract profit taking near $685.50, but once Chair Powell began speaking, SPY moved almost straight up and finished the session just shy of the all-time high. With a close above $685, the bulls have full control, and new highs are likely as long as price remains above that level. Overnight, if $686 fails, SPY may test $682, and a break there opens the door to $680. That level must fail for the bears to have any chance at lower prices; otherwise the dip will be bought. Volume was well above average, which is typical for FOMC but also supports higher prices in the coming days. Absent a catalyst, resistance sits at $689, $690, and $697, with support at $686, $682, $680, and $675. Above $690 gains should be muted due to heavy resistance, while a break below $680 could send price toward $670. The broader trend remains bullish above $640 and the bulls dominate the market. For Thursday we prefer longs from support above $682 while watching carefully for shorts near $690. Crypto was unchanged today while Mag stocks were mixed. The market is likely to rise until real weakness appears in these two leadership groups. VIX fell 6.85% to 15.77 and remains in neutral, risk-on territory. Traders should stay flexible with a bullish lean while noting caution near the all-time highs. The model sees $700 as a real possibility by month’s end with a seasonal Santa Rally. SPY closed mid-channel inside the redrawn bull trend, which still points to higher prices.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Bullish Trending Market State, with SPY closing at MSI support. There were no extended targets at the close, although sporadically throughout the day and after FOMC, extended targets were the norm. Overnight the MSI rescaled lower slightly higher and then slightly lower which was the indicator that price would move sideways into FOMC. By the open the MSI was in a narrow ranging state with the MSI spending the entire session before FOMC in a very narrow bullish state and a very narrow ranging state which saw price move sideways out of the gate until 2 pm. After the FOMC announcement the MSI rescaled higher several times in rapid succession and printed extended targets. While price whipsawed quite a bit until 2:30 pm, once Powell began speaking, it was straight up toward the all-time highs with the herd participating in full force. For tomorrow the MSI is forecasting higher prices but without extended targets at the close, expect price to move up more slowly and find resistance at the prior all-time highs. MSI support is currently at $687.07 with resistance at $688.92.

Key Levels and Market Movements:

On Tuesday we stated “Today was messy, choppy…Tomorrow is likely to look the same until 2 pm,” while also noting “we believe the real reaction will come after the press conference when the market interprets the Fed’s tone on rate policy,” and added “For Wednesday we favor the long trend until 2 pm while remaining open to shorting resistance at $685 and buying dips near $682, as everything between those levels is likely to be pure chop.” With this context, and with the MSI in a ranging state in the premarket between $682 and $685, the only trades that set up were fades of the extremes until FOMC. At the open SPY dipped to $681.50 and produced a textbook failed breakdown, which triggered a long to MSI resistance at $683.17. With T1 secured, we stayed cautious and set T2 slightly higher at the premarket level of $683.80. SPY immediately sold off again, yet sticking to the plan we kept our stop back, and as price approached our entry another failed breakdown appeared. That had us reload the long and take the same trade a second time with T1 at MSI resistance and T2 at the premarket level of $683.80. This time both targets hit, and with a stop at breakeven we looked for $685 as the likely pre-FOMC high. SPY tried to move higher around 1 pm, but with less than an hour before the announcement we shifted into profit-protection mode and closed the long at MSI resistance at $683.88, then waited for the release. We wanted to fade the first move up, as this is typically a high-probability trade, but the market moved too fast to give us a clean entry. With two winners already booked, we chose caution. We did nothing until 2:30 pm, and as the MSI rescaled higher and printed extended targets, we entered long at MSI support at $684.60 and set T1 at MSI resistance at $685.60 with T2 at the next MSI resistance at $686.57. Another failed breakout followed, so we closed the long and decided that three for three was enough, calling it a day. While there was another great and possibly the best long trade off MSI support at 2:45 pm, we were done, three for three, thanks again to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Tomorrow will be an interesting day. The bulls do not want to lose $685 overnight, and they will defend this level to keep the bull trend moving higher on Thursday. If $685 fails, the lowest they want price to retrace to is $682. If $682 does not hold, the bears will come right back, and the market will sell off. We believe this is a low-probability outcome, but it must be watched over the next few days. A retest of $682 would not surprise us, and a bounce from that level could send price back toward the all-time highs. If $685 holds overnight, the bulls remain very strong and are unlikely to give the bears even a small opening to test lower levels. Crypto moved sideways today and Mag stocks were mixed, showing the market is still undecided, which could weigh on equities. The long-term bull trend is intact above $640, so we continue to favor the bulls as long as price stays above $682. As always, stay alert to macro risks and be prepared to trade what you see in the coming days. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $688 to $710 and higher strike Calls while also selling $685 to $687 Puts indicating the Dealers’ belief that prices will not fall far on Thursday. Dealers only sell ATM Puts when they believe prices will rise. The ceiling for Thursday appears to be $690. To the downside, Dealers are buying $684 to $565 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $688 to $710 and higher strike Calls indicating the Dealers’ belief that prices may not rise too much the rest of the week. The ceiling for the week appears to be $695. To the downside, Dealers are buying $687 to $565 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a market that is not overly concerned about lower prices. For the week Dealer positioning is unchanged from slightly bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Use strength into $687–$689 to trim longs or initiate tactical shorts. Buy dips toward $682–$680 with defined risk. With FOMC behind us, the market may grind higher into year-end. Stay flexible, lean bullish, and trust the MSI for key intraday pivots. Avoid chasing breakouts without confirmation, and keep risk tight as we near all-time highs.

Good luck and good trading.