Market Insights: Monday, November 3rd, 2025

Market Overview

U.S. stocks ended Monday mixed as AI-driven optimism continued to propel select tech names higher, while broader participation remained limited. The Nasdaq rose 0.46%, led by Amazon and Nvidia, both nearing record highs on renewed enthusiasm around artificial intelligence. The S&P 500 gained 0.17%, while the Dow declined 0.47%, weighed down by weakness in non-tech sectors. Despite the uneven tone, the session extended the bullish momentum that defined October, with dip buying once again supporting intraday weakness.

Amazon jumped more than 4% after announcing a $38 billion partnership with OpenAI that will give the ChatGPT creator access to hundreds of thousands of Nvidia chips through AWS. Nvidia rose more than 2% on the news, helped further by an analyst upgrade, and shares approached new record territory. The AI narrative continued to dominate headlines, though gains were not evenly distributed, as several mega-cap names traded flat or reversed lower. Kenvue surged 14% after being acquired by Kimberly-Clark in a $32 billion deal that sent the latter down over 13%, highlighting continued rotation across sectors.

Earnings season remains in focus, with nearly 300 S&P 500 companies having reported Q3 results so far. This week brings another 100+ reports, including Palantir, AMD, and Super Micro. Despite mixed economic signals, corporate results have largely met or exceeded expectations, reinforcing the “soft landing” narrative. However, data remains thin due to the ongoing government shutdown, with Monday’s weaker-than-expected Manufacturing PMI showing contraction for the eighth consecutive month. The absence of the jobs report and other macro releases has elevated the importance of second-tier data and earnings.

Market participants are also watching Washington, where the shutdown continues to delay key economic reports. Meanwhile, the Supreme Court is set to review the legality of President Trump's sweeping tariffs, a move that could affect trade sentiment. The University of Michigan consumer sentiment report, due Friday, will also be closely watched as fears of a pullback in consumer spending begin to mount. For now, the bulls remain firmly in control, with selective strength in AI and mega-cap names keeping the broader market bid.

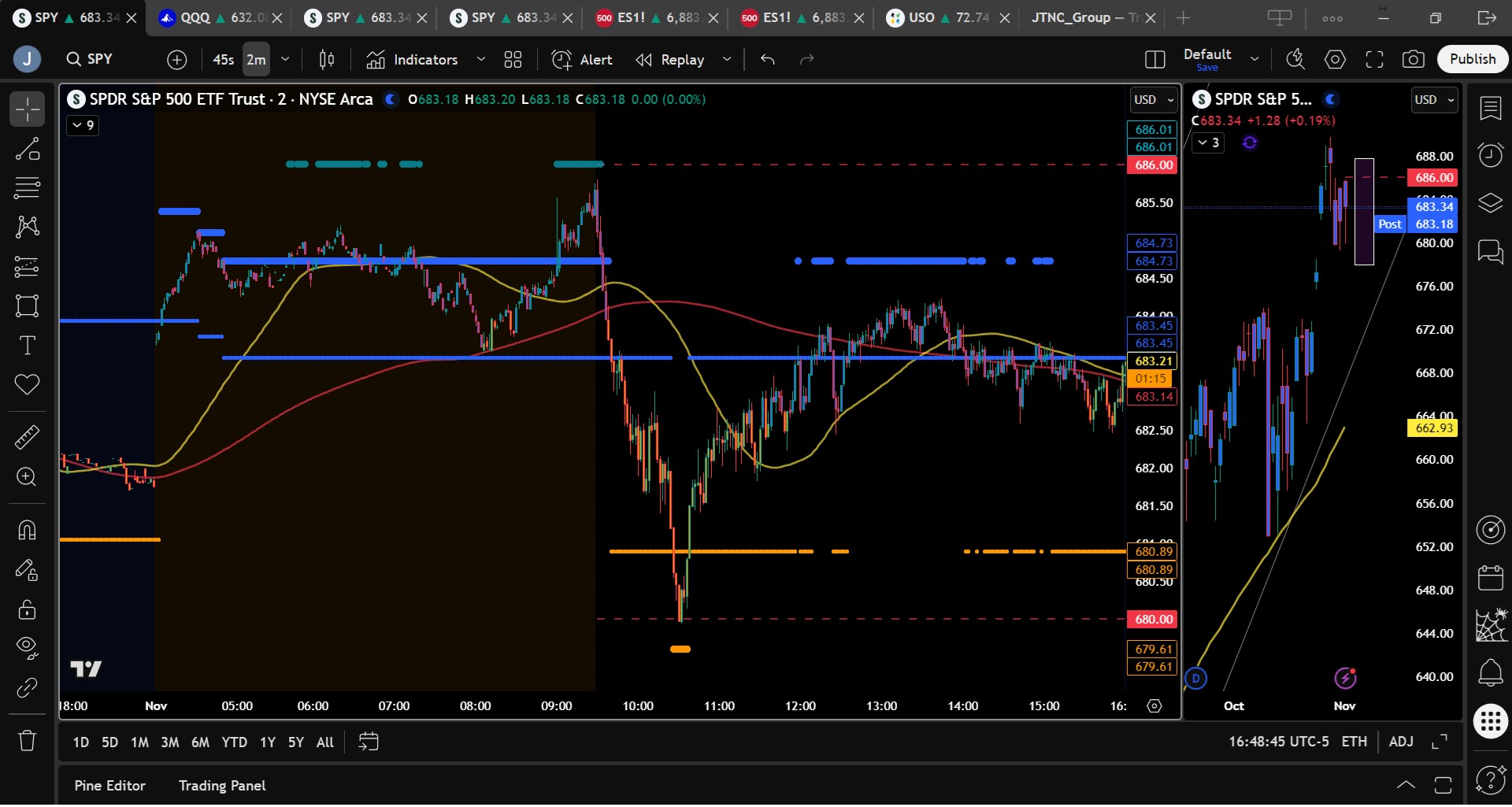

SPY Performance

SPY opened at $685.70 and traded both sides of the range before closing at $683.21, down 0.17%. Despite slipping from the open, price action remained orderly, and volume was light at 50.06 million shares well below average. Monday’s dip was minor and lacked follow-through, reflecting continued demand near key support levels. While SPY closed off highs, it managed to bounce twice near $683 intraday, keeping the uptrend intact.

Major Indices Performance

The Nasdaq rose 0.46%, again leading on the strength of Amazon and Nvidia. The S&P 500 edged up 0.17%, while the Dow fell 0.47% as weakness in consumer staples and industrials weighed. The Russell 2000 dropped 0.35%, continuing its recent underperformance as investors focused on large-cap tech leadership. Market breadth remained mixed, with gains concentrated in a handful of AI-driven names.

Notable Stock Movements

Amazon rallied 4.03% to a record high after unveiling its $38 billion OpenAI deal, cementing its central role in the next wave of cloud-based AI. Nvidia rose more than 2% on the back of the announcement and a bullish analyst call. Alphabet and Tesla also posted gains, while Apple, Meta, and Microsoft drifted lower. Kimberly-Clark dropped over 13% following its acquisition of Kenvue, which surged 14% in response to the deal.

Commodity and Cryptocurrency Updates

Crude oil inched up 0.10% to $61.01, continuing to hover near our longstanding $60 target. The trend remains neutral, though holding above $56 keeps the possibility of a rally toward $70 alive. Gold rose 0.60% to $4,020, benefiting from slight risk-off flows. Bitcoin dropped sharply by 3.06% to close just above $106,600, pressured by a rising dollar and increased profit-taking after its recent surge.

Treasury Yield Information

The 10-year Treasury yield ticked up 0.10% to 4.093%, still hovering near the psychologically important 4% level. Equities remain comfortable here, though further moves toward 4.5% would likely begin to weigh on sentiment. As a reminder, levels above 4.8% tend to trigger equity outflows, and a push to 5.2% could lead to a broader market correction of 20% or more.

Previous Day’s Forecast Analysis

Friday’s forecast projected SPY to range between $678 and $687.75, with resistance at $685 and $687. SPY opened at $685.70 and failed to push higher, reversing near resistance and slipping into the low $683s before closing at $683.21. The forecast correctly anticipated a limited upside move and potential consolidation below $686. The roadmap again proved prescient in mapping resistance and support zones.

Market Performance vs. Forecast

Price action respected the projected range, rejecting the upper targets and fading toward support. SPY’s dip found buyers near $683, as forecasted. With low volume and no major catalysts, the market remained technical, and the roadmap levels once again provided clear entry and exit signals for patient traders.

Premarket Analysis Summary

Monday’s premarket bias level was $684.30, with $686 and $687.80 as upside targets and $682.80 and $681 as lower supports. SPY opened just above bias and immediately rejected higher prices, moving into the lower support range and testing $683 repeatedly. The session aligned well with the roadmap, offering clear structure despite the slow pace.

Validation of the Analysis

SPY adhered closely to the forecast, topping near $685 and testing below $683. While momentum was sluggish, key levels held. The day’s slow action provided limited trading windows, but those who followed the model were able to catch small rotations around clean technical zones. The roadmap once again provided accuracy in both direction and magnitude.

Looking Ahead

SPY’s projected maximum range for Tuesday sits between $678 and $687.75. Resistance is seen at $685, $686, $687, and $690, while support rests at $679, $678, and $675. With no economic data scheduled for Tuesday and Monday’s weak Manufacturing PMI already priced in, markets are likely to remain choppy, driven by earnings headlines and trade-related developments.

Market Sentiment and Key Levels

SPY closed at $683.21, above the $679 key support and far from the bear line at $670. The VIX dipped 1.49% to 17.18, reinforcing the prevailing “risk-on” tone. As long as SPY holds above $679, bulls maintain the upper hand. A breakout above $686 could trigger a test of $690, while a loss of $678 may spark a deeper pullback toward $675.

Expected Price Action

Without a clear catalyst, expect continued chop between $679 and $687, with potential brief trending moves if earnings surprise. A break above $686 with confirmation could fuel a run to $690. However, a failure to hold $679 would bring $678 and $675 into focus. Bulls want to see continued strength above bias, while bears need a clean rejection at resistance to regain control.

Trading Strategy

Remain long above $680 with resistance targets at $685 and $687. Avoid chasing breakouts above $690 unless volume confirms. Short setups are viable on failed tests of $686 or a break below $678 with follow-through. Watch the MSI closely and avoid trading during ranging states. Discipline remains key as the market grinds higher.

Model’s Projected Range

SPY’s projected maximum range for Tuesday sits between $678 and $687.75, with the Call side dominating in a narrowing band that suggests choppy price action punctuated by brief trending periods. There is no scheduled economic data for Tuesday, and with Manufacturing PMI released today showing a weaker-than-expected reading and marking eight consecutive months of contraction, the market’s attention will remain focused on earnings and trade-related developments. With the ongoing government shutdown delaying additional reports, earnings from firms such as AMD and Palantir will likely shape sentiment in the near term. So far, most companies have reported results that meet or exceed expectations, helping sustain the broader narrative of steady economic growth. Today, SPY rose 0.19%, testing both Friday’s highs and lows before closing at $683.37, essentially flat. Once again, the dip was bought, underscoring that the bulls remain firmly in control. As we’ve highlighted since April, pullbacks have typically lasted no more than one or two days before dip buyers stepped in, and as long as SPY holds above $670, the broader bullish structure remains intact. Volume came in well below average, reflecting the slow, range-bound tone of the session. Momentum continues to favor the bulls, with $679 marking the first key downside test; below that, $678 and $675 are likely levels where buyers should step up. Bulls must hold above $679 to sustain the uptrend on Tuesday. A failure at that level without a swift recovery could open the door to $675, a major line in the sand for the bulls. If $675 breaks, there is little structural support below, and a sharper pullback could develop. Conversely, maintaining price above $679 would allow the bulls to retake $686, a significant resistance level that must be cleared for a move toward $690 and new highs. A rejection near that zone, however, could extend the current back-and-forth price action seen over recent sessions. Absent a catalyst, resistance for Tuesday sits at $685, $686, $687, and $690, with support at $679, $678, and $675. Above $690, momentum could accelerate rapidly; below $675, a deeper correction becomes increasingly likely. Crypto fell sharply today, and Mag stocks traded mixed, reflecting ongoing uncertainty among investors. As we’ve noted for weeks, persistent weakness in these leadership names and in crypto could still trigger the 10–15% correction we’ve projected, though with each passing week that risk window shifts further into early 2026. For now, the bulls maintain firm control, and the overall market structure continues to support higher prices. The VIX fell 1.49% to 17.18, remaining comfortably below the 23 stress threshold. SPY closed mid-channel within its April bull trend, a formation that remains structurally supportive of further upside momentum.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Ranging Market State, with SPY closing at MSI resistance. There were no extended targets all day as the market was mostly sideways with the MSI in the current wide-ranging state for most of the day. There were two brief periods of both bullish and bearish MSI but they were both narrow and without extended targets, did little to move price. Overnight the MSI rescaled both higher and lower and there were extended targets at the open, but SPY reached major resistance at $686 which held and saw the MSI move into the current ranging state. For Tuesday the MSI is forecasting more sideways price action with the likelihood of price once again testing both sides of the range. MSI support is $680.89 with resistance at $683.45.

Key Levels and Market Movements:

On Friday we wrote, “It’s probable that SPY retests the recent lows, which must hold to prevent a deeper pullback,” and noted, “On the downside, $679 is key support.” With this context, and with the MSI opening in a narrow bullish state near $686, our plan was to either fade the highs or buy a pullback to MSI support. At the open, extended targets were printing above, so we waited for them to stop before initiating a short at $684.80, right at MSI resistance. We set T1 at MSI support at $683.44, anticipating a quick bounce that would allow us to exit and reverse long—but that bounce never came. Instead, SPY continued to sell off, and given the strength of the move, we expected a test of $680. We set T2 at the premarket level of $682.40, which hit by 10 a.m. With T1 and T2 secured, we moved our stop to breakeven and trailed the rest, targeting $680 or lower. As the MSI rescaled to a wide ranging state, we waited patiently for the next signal. It eventually shifted into a narrow bearish state, and with price right at $680, we took profits on our remaining short and reversed long, noting the absence of extended targets below and the narrowing MSI range. We set T1 at MSI resistance and the premarket level of $681, which hit quickly, and then set T2 at the next premarket level of $682.80. With T2 reached, we again went into trail mode, holding for a potential move higher. SPY spent much of the afternoon grinding upward until it reached $684, where a double top formed near midrange MSI resistance. That was our cue to exit the long and call it a day, two well-executed trades in opposite directions, and a solid start to the week, thanks again to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Tuesday could once again see SPY test both the day’s lows and highs, with direction hinging largely on headlines from the White House or any major earnings misses. The $679 level remains the key line in the sand and if it holds, the broader bull trend stays intact; if it fails, a deeper pullback and potential gap fill become increasingly likely. Should SPY reclaim $686, the bulls will aim to clear $688 and then $690, and holding near $690 would likely pave the way for new all-time highs. With the market driven primarily by external catalysts and limited meaningful economic data ahead, it’s critical to trade what you see and stay flexible. On the downside, while dip buyers continue to defend $679, repeated tests at that level suggest weakening liquidity and a growing risk of acceleration toward $677 or even $675 if it gives way. Our preference remains to trade in alignment with the prevailing bullish trend but avoid pressing longs aggressively near support. We remain open to shorting a clean breakdown of $679 or fading failed breakouts between $686 and $690, depending on price action and MSI confirmation. External catalysts will likely dictate the session’s rhythm, so rely on the MSI to stay synced with real-time market state shifts. With the VIX near 17, the bulls maintain a clear “risk-on” environment and remain focused on defending key supports. The bears need a decisive break below $679 to regain traction, but with SPY closing above that level, bullish momentum continues to dominate. We continue to favor dip buys while remaining nimble and alert for volatility driven by earnings or macro developments. The key level for the broader bull market remains $640, and only a decisive break below that threshold would hand full control to the bears. Failed breakouts and failed breakdowns remain the highest-probability setups in this environment, and with major data releases hitting in the premarket, traders should stay flexible, avoid entries during Ranging Market States, and ensure full alignment with the MSI before acting. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $683 to $705 and higher strike Calls while also buying $688 Calls reflecting the Dealers’ desire to participate in any rally above $688 should it materialize. But the fact that Dealers are selling ATM Calls indicate their conviction of higher prices is waning. The ceiling for tomorrow appears to be $686. To the downside, Dealers are buying $682 to $600 and lower strike Puts in a 4:1 ratio to the Calls they’re selling displaying some concern that prices could move lower. Dealer positioning is unchanged from bearish to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $685 to $705 and higher strike Calls while also buying $683 to $684 Calls reflecting the Dealers’ desire to participate in any rally this week. The ceiling for the week appears to be $690. To the downside, Dealers are buying $682 to $600 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting a market that is hedged heavily given its’ lofty levels. This is not necessarily bearish, but instead with options relatively inexpensive, Dealers are fully hedged for what may come. We suggest any long book do the same. For the week Dealer positioning is unchanged from bearish to bearish but again Dealers have added protection as SPY makes new highs. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Trade the roadmap. Longs are favored above $680, with resistance at $686 and $690. Fade failed breakouts unless momentum is confirmed. Shorts are viable below $679 with targets at $675. Use MSI for timing and avoid entries during Ranging states. Bulls remain in control, but key support levels must hold to maintain trend integrity.

Good luck and good trading!