Market Insights: Tuesday, November 25th, 2025

Market Overview

Stocks extended their rally for a fourth straight session on Tuesday, with the Dow jumping 1.41%, the S&P 500 gaining 0.93%, and the Nasdaq climbing 0.67%. The session’s gains were fueled by growing expectations of a December rate cut and confirmation that inflation pressures are easing. PPI data came in below forecasts, and Retail Sales met expectations, reinforcing the soft-landing narrative. Alphabet and Apple closed at fresh all-time highs, while Meta surged 3.80%. Nvidia, however, dropped more than 3% after reports emerged that Meta may shift some AI chip investment toward Alphabet, challenging Nvidia’s dominance. The rally was accompanied by strong breadth and above-average volume, and while resistance remains overhead, the bulls have regained firm control for now. With just one full day and two half sessions left this week, traders are watching Wednesday’s price action to see if the bullish momentum can carry through Thanksgiving and into December.

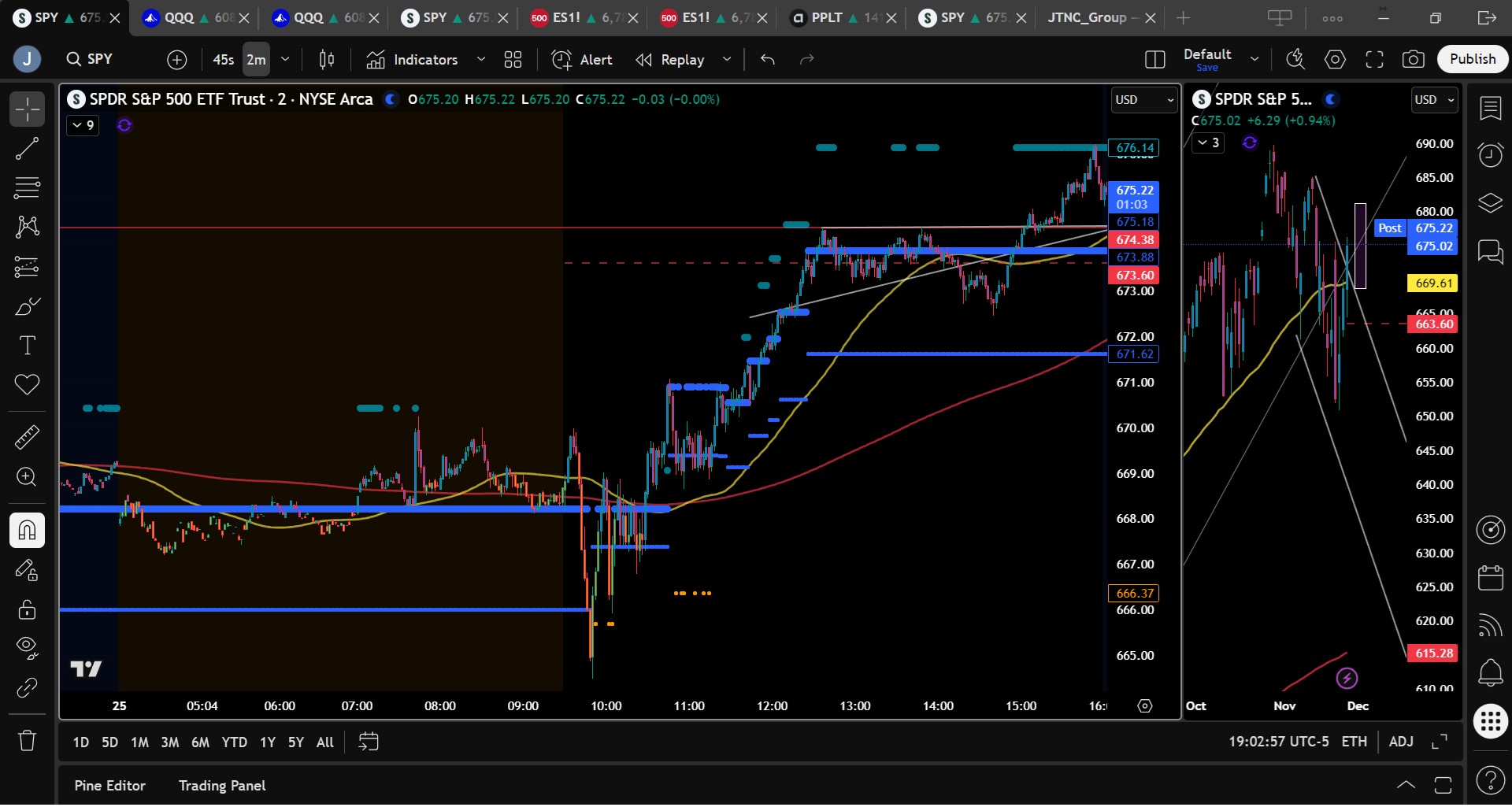

SPY Performance

SPY opened at $668.45, fell to an early session low of $664.49, and then surged higher throughout the day, closing at $674.96, up 0.93%. Volume came in at 73.69 million shares, above average and a positive signal confirming the strength behind the rally. SPY broke above the key $670 level, reclaiming territory lost during the recent pullback, and is now pushing into critical resistance between $675 and $680. Holding $670 overnight will be essential to preserve this breakout, and a sustained move above $675 opens the door to test $680 and beyond. Failure to hold $670 could lead to a quick retest of $665 or lower. Bulls have regained the short-term trend, but overhead supply could make further progress more difficult without a new catalyst.

Major Indices Performance

The Dow was the standout performer with a 1.41% rally, while the Russell 2000 jumped 2.19%, showing continued strength in small caps. The S&P 500 advanced 0.93% and the Nasdaq rose 0.67%, with all four major indices logging their third or fourth consecutive daily gains. The rally is being led by mega caps and cyclical names, with rate-sensitive sectors benefiting from falling yields. Leadership broadened meaningfully, helping reinforce the shift in tone. The key now is whether Wednesday’s economic data can validate the move or trigger another round of risk-off sentiment.

Notable Stock Movements

Meta led the Magnificent Seven with a 3.80% gain, followed by strong sessions from Apple and Alphabet, both of which closed at new record highs. Alphabet is now approaching a $4 trillion market cap. Tesla and Amazon also closed higher, while Nvidia and Netflix were the only names in the group to finish in the red. Nvidia slid over 3% after reports that Meta may begin investing more heavily in Google’s AI chips, raising concerns about potential market share erosion. Despite that, the broader AI and mega cap tech space remains firmly in control of sentiment.

Commodity and Cryptocurrency Updates

Crude oil declined 1.63% to $57.96, continuing its volatile range below the $60 threshold. Our models maintain that as long as crude stays above $56, a rebound toward $70 remains on the table. Gold slipped 0.11% to $4,165, holding recent gains but showing little momentum. Bitcoin fell 1.95%, closing just above $87,400, and remains in a consolidation zone after last week’s recovery. While crypto is soft, risk appetite in equities appears unaffected for now.

Treasury Yield Information

The 10-year Treasury yield dropped 0.82% to close at 4.002%, supporting the market’s dovish interpretation of inflation data and Fed commentary. The steady decline in yields over the past week has been a key tailwind for equities. However, a reversal in rates, especially back above 4.5%, would pose a major challenge for valuations. For now, yields are helping stabilize financial conditions and encouraging the shift back into growth names.

Looking Ahead

Wednesday brings Unemployment Claims which are unlikely to move the market. With no news scheduled for Thursday or Friday, the turkey rally is likely to continue unabated. Bulls will look for SPY to clear $675 and extend gains toward $680 and $685. A failure to hold above $670 could quickly unravel today’s progress. If economic data comes in hot or surprises hawkishly, a reversal may unfold quickly. But barring that, bulls remain in charge for now, and the seasonal rally looks to be gaining traction.

Market Sentiment and Key Levels

SPY closed at $674.96, just shy of the critical $675 level. Resistance lies at $675, $677, $680, and $685. Support rests at $670, $667, $665, and $660. Holding $670 overnight is essential to maintain the bullish structure. Above $680, gains may slow as resistance thickens, while a break below $670 invites a pullback to $665 or lower. The VIX fell 9.55% to 18.56, signaling reduced fear but not yet reflecting full bullish conviction. The broader trend remains bullish above $640, and near-term control favors buyers.

Expected Price Action

SPY’s projected range for Wednesday is $670 to $680. Dealer positioning reflects a dominant Call bias, but the band has narrowed, suggesting the possibility of choppy action with pockets of momentum. If SPY holds above $675, expect a test of $680. If $670 breaks, look for a retracement to $665 or $660. Gamma positioning still supports sharp reversals, so traders should be ready for two-way volatility, especially around economic data releases.

Trading Strategy

We prefer buying dips near support at $670 or $672 with targets at $677 and $680. Avoid chasing strength into resistance unless volume confirms the breakout. A clean break above $680 could carry SPY to $685, but risk increases the higher we go into low-volume holiday trading. Failed breakdowns near $667 or $665 may offer long setups, while a break below $665 shifts bias back to short. Continue to trade tactically, lean bullish above $670, and remain cautious into Wednesday’s key data.

Model’s Projected Range

SPY’s projected maximum range for Wednesday sits between $668.75 and $681.25, with the Call side dominating in a narrowing band that signals choppy price action with brief trending periods, and today the market built on Monday’s rally by closing up 0.94% at $675.02 which gives the bulls a clear advantage heading into the holiday week. Overnight price moved mostly sideways and at the open SPY tumbled to $665 where buyers stepped in quickly and drove price straight up for the remainder of the session, closing near the highs. PPI came in lower than expected and Retail Sales met expectations which suggests inflation may be cooling and increases the odds of a future rate cut, though the Fed’s favored gauge, PCE, will not be released until next Friday, so momentum is likely to continue until an external catalyst disrupts the holiday strength. Unemployment claims are due tomorrow and unless the data is shocking, the bulls will likely attempt to push price back above $680 to maintain dominance into December and extend the seasonal Thanksgiving rally. Overnight the bulls need to hold $670 to build on today’s move, and failure to do so would invite a retest of $665, but if $670 holds, targets shift to $680 and then $685. Volume was higher than average which confirms the strength behind today’s rise. Absent a catalyst, resistance sits at $677, $680, and $685, with support at $672, $670, and $667. Above $680 gains will likely be muted due to heavy resistance while below $670 price could slide toward $660. The broader trend remains bullish above $640 and the near term favors the bulls, so for Wednesday we defer to the prevailing trend and prefer longs from support near $670 while watching for short setups as price approaches $680. Crypto stalled today, but all Mag stocks except Nvidia and Netflix rose which reduces the odds of the ten to fifteen percent correction we have been warning about, and until weakness returns in these leading groups the market is likely to continue to rise. VIX fell 9.55% to 18.56 and remains in neutral territory waiting for a catalyst. With one full day and two half days of trading left this week, anything can happen, so traders must stay flexible and trade what they see. SPY closed above the top of the redrawn bear trend channel and broke past resistance at $670 with support still anchored at $640.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Bullish Trending Market State, with SPY closing well above MSI resistance turned support. There were extended targets into the close and for most of the day, just like yesterday. The day began with the MSI in the bullish state from Monday but with periods of extended targets above, after a brief dip and rescale to a ranging state, the MSI rescaled higher several times in rapid succession which saw price gain close to 1%. For Tuesday the MSI is forecasting higher prices still and at a minimum a push to reclaim $680. MSI support is $673.88 and lower at $671.62.

Key Levels and Market Movements:

On Monday we stated “because the highs held into the close, traders should expect more of the same on Tuesday”, while adding “Our bias now shifts to favor the long side above $670”, and also stating “If the bulls clear $670 and hold it, they will have reclaimed the advantage”, and with this context and with the MSI in a bullish state with extended targets in the premarket we looked for longs to see if the market might at least test $670 if not break above, and SPY provided the perfect setup on a textbook failed breakdown at major support and MSI support at $665 about fifteen minutes into the session which had us go long with T1 at MSI resistance at $668.19, and after a quick pop we set T2 at the next higher MSI level at $669.40 which hit before 11 am leaving us with only a ten percent trailer which we held because a reclaim of $670 would send price toward $675, and that is exactly what happened as extended targets continued to print so we waited for either a test of $675 or a failed breakout to exit, and a late day surge finally tagged $675 just before the close where we took profits and wrapped up the session. A massive one and done winner, thanks to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Today’s move higher was once again impressive, and because the highs held into the close, traders should expect more of the same on Wednesday unless an external catalyst intervenes. The MSI is forecasting higher prices, though the move may be more sideways than the straight up action seen today. Our bias favors the long side above $670, with a potential short near $680 and certainly below $665. If the bulls hold $670 overnight, they are likely to make a run at $680 to take complete control of the market and reverse the two week slide in November. If $670 fails to hold, the market is likely to test lower levels and possibly reach $660. Price has now cleared the 50 DMA, which now acts as support. Traders should stay alert for news from Venezuela or other macro events that could impact markets, but absent those risks, look to buy dips above $665 and, more cautiously, fade rallies near $680 on failed breakouts. Sell below $665 if the market dips that low. The long term bull trend remains intact above $640, and the bears have given up virtually all of their edge, so favor the bulls and the long trend as long as price remains above $670. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $676 to $700 and higher strike Calls while also selling $671 to $675 Puts indicating the Dealers’ belief that the bottom is in and that higher prices are likely on Wednesday. Dealers only sell ATM Puts if they strongly believe prices will rally. The ceiling for tomorrow appears to be $680. To the downside, Dealers are buying $675 to $565 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $676 to $700 and higher strike Calls while also selling $674 to $675 Puts indicating Dealers’ belief that the bottom is in and that higher prices are likely on Wednesday. The ceiling for the week appears to be $680. To the downside, Dealers are buying $673 to $565 and lower strike Puts in a 6:1 ratio to the Calls they’re selling/buying, reflecting a market that continues to be concerned about lower prices. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Reduce exposure on moves toward $680 unless volume and breadth confirm a breakout. Remain tactical and favor buying dips into $670 or $667, with stops just below. Avoid aggressive shorting unless $665 breaks decisively. Stay patient and aligned with MSI levels. The short-term trend favors the bulls, but data-dependent volatility could return quickly.

Good luck and good trading!