Market Insights: Wednesday, October 8th, 2025

Market Overview

US stocks marched higher on Wednesday as Wall Street resumed its record rally, lifted by renewed optimism around interest rate policy and continued strength in the tech and crypto spaces. The Nasdaq surged over 1%, closing above 23,000 for the first time, while the S&P 500 climbed 0.59% and the Dow ended flat. The bullish action followed a brief pullback on Tuesday and was further supported by a fresh all-time high in gold and the release of the Federal Reserve’s latest meeting minutes, which hinted at more rate cuts ahead.

Markets pushed to session highs in the afternoon after the Fed minutes revealed that most policymakers believe further rate easing is appropriate this year, despite differing views on how restrictive current policy remains. The dovish tilt added fuel to the risk-on environment, already buoyed by dip buying and strong performance from large-cap tech. At the same time, caution lingers in the background as questions continue to mount about AI spending, valuations, and whether recent gains reflect an early-stage bubble. The government shutdown added to uncertainty, with President Trump reiterating threats to withhold back pay for furloughed workers as the standoff drags into its second week.

Gold broke above $4,060 to notch a new all-time high, as investors rotate into hard assets amid fears of dollar debasement. The metal is now up more than 55% year to date. Crypto also rebounded, with Bitcoin rising above $123,500 and Ethereum remaining strong above $4,300. Despite the ongoing data blackout from the shutdown, markets remain firmly in bullish territory, driven by favorable liquidity conditions and anticipation of further Fed support.

SPY Performance

SPY rose 0.59% to close at $673.04 after opening at $670.31 and trading between $669.43 and $673.21. Volume came in at 55.25 million shares, slightly below average. The day began with SPY testing key support overnight at $668 before gapping up and holding above the critical $670 level through the session. A steady advance followed, capped by a strong close just below resistance. Bulls defended every dip and kept the index in record territory, reinforcing the strength of the uptrend.

Major Indices Performance

The Nasdaq led with a 1.12% gain, driven by renewed interest in mega-cap tech and AI leaders. The S&P 500 advanced 0.59%, notching another all-time high, while the Dow ended unchanged as weakness in financials and industrials offset broader gains. The Russell 2000 rose 0.96%, showing solid participation from small caps. The all-green session for most of the Magnificent Seven signaled firm breadth behind the rally, with only Alphabet closing slightly lower.

Notable Stock Movements

It was a green day across the Magnificent Seven, except for Alphabet, which dipped 0.48%. Tech broadly outperformed, with Nvidia and Tesla bouncing after Tuesday’s declines. Amazon and Netflix continued to lead, and chip stocks rallied again as the AI narrative regained traction. Gold miners surged alongside the metal, and crypto-linked equities rose with Bitcoin. Despite recent concerns about valuations and AI spending, investors showed a renewed willingness to embrace risk and momentum plays.

Commodity and Cryptocurrency Updates

Crude oil rose 1.05% to settle at $62.38, continuing its march toward our model’s long-standing $60 target. Gold jumped 1.45% to close at $4,062, building on its historic breakout above $4,000. Bitcoin climbed 1.33% to close above $123,500, recovering from Tuesday’s pullback. Ethereum remained firm above $4,300, maintaining the risk-on tone and reinforcing investor appetite for alternative assets.

Treasury Yield Information

The 10-year Treasury yield was nearly unchanged, dipping 0.02% to close at 4.132%. While still within a benign range for equities, any move above 4.5% would begin to pressure valuations. Levels above 4.8% remain a warning zone, and a push to 5% or higher would threaten a sharp equity selloff. Our models continue to project a 20%+ correction should yields breach 5.2%. For now, yields remain supportive of higher stock prices.

Previous Day’s Forecast Analysis

Tuesday’s roadmap projected a range of $663.25 to $674.25 with downside support at $668, $665, and $661. Resistance was set at $670, $674, and $675. The premarket note emphasized that holding above $670 would open the door to upside targets, with a lean toward more consolidation unless $673.50 was cleared with conviction. A dip below $670 would bring $667.50 and $665.50 into view.

Market Performance vs. Forecast

SPY opened at $670.31 and quickly moved above bias, advancing steadily toward $673.21 before closing just under that level. The roadmap anticipated a choppy session with upward bias and correctly called the breakout after bulls defended the $668 level. Price respected the key levels throughout the session, and the move confirmed the bullish path laid out in both the roadmap and premarket notes.

Premarket Analysis Summary

Wednesday’s 7:12 AM premarket note placed the bias at $670.50 and called for targets above at $671.50 and $673.50. Below bias, it warned of downside risk toward $667.50 and $665.50. The note emphasized that holding above $670.50 would be critical for further upside. SPY did exactly that, holding support and rallying toward the upside targets. The roadmap was again validated as a reliable guide for intraday structure and expectations.

Validation of the Analysis

The roadmap and premarket analysis were fully validated as SPY held $670, reclaimed $671.50, and pressed into the $673 zone. Resistance at $673.50 capped the move, as expected. There was no material violation of support, and dip buying was consistent. The analysis once again provided clarity and precision, helping traders position effectively in a trending session.

Looking Ahead

Thursday brings weekly unemployment claims, assuming no further data disruption from the shutdown. Market structure remains bullish, with SPY above all key levels. The range between $665 and $675 is narrowing, and a breakout could occur with even modest catalysts. Continued strength in gold, crypto, and tech suggests buyers remain in control. Bears would need a break below $665 to gain traction, while bulls are eyeing $675 and higher.

Market Sentiment and Key Levels

SPY closed at $673.04, just under key resistance at $675. Additional resistance levels sit at $677, $680, and $682. Support is now seen at $672, $669, $665, and $660. The index remains well above the critical $663 level, which defines bull control. Below $660, bears may begin to press, but only a decisive break of $640 would trigger a structural reversal. Until then, bulls remain firmly in charge.

Expected Price Action

SPY’s projected range for Thursday is $670 to $676, with the Call side dominating in a narrowing band. This suggests a choppy session with a bullish bias and potential for upside extension. A clean move above $675 opens the door to $677 and possibly $680. Support remains firm at $669 and $665, with buyers likely to step in on dips. With few economic releases, momentum remains the key driver.

Trading Strategy

Longs remain favored above $665, with entries near $669 and $672 offering favorable risk/reward. Short setups can be considered near $675–$677 on failed breakouts. Crypto and ETH strength support the risk-on trade. The VIX fell 5.45% to 16.30, reinforcing the bullish tone. Continue to hedge long books and avoid overnight risk where possible. Dip-buying remains the strategy until proven otherwise.

Model’s Projected Range

SPY’s projected range for Thursday sits between $669 and $677.25, with the Call side dominating in a narrowing band that suggests choppy price action interlaced with brief trending periods. With only Unemployment Claims due tomorrow, there is little economic news to drive the market. SPY will continue to trade in a range between $665 and $675, waiting for a catalyst to break one way or the other. The market is likely to grind higher, testing both ends of this range. Today SPY made a new all-time and closing high after testing the lower end of the range overnight at $668. Once again, that dip was bought, just as we anticipated, and from shortly after the open the market moved steadily higher into the close, finishing at $673.11 in record-breaking territory. Yesterday we noted that “this type of price action, driven by the bulls, is designed to lure bears back to the table, only to trap them and squeeze prices back toward new highs,” and that is exactly what transpired today. SPY would need to close below $640 for these bullish conditions to change. The index remains comfortably above $663, the level that defines bull control. Macro risks persist with the ongoing government shutdown, and the longer it lasts, the greater the potential impact on the market. So far, investors have looked past these external threats, but a prolonged shutdown could eventually force a repricing of risk and compress multiples. Until meaningful weakness emerges, however, the trend remains higher, with dips continuing to offer buying opportunities. Overnight SPY tested $668, then gapped up and held above $670, making it clear by the open that the bulls had control. The $668 level was successfully defended, keeping the bulls firmly in charge. Although today’s volume was below average, dip buyers remain active. Options data indicates institutions are heavily hedged, but until SPY breaks below key levels, the trend remains bullish. We continue to buy dips while being very cautious about fading rallies. With the index well above the critical $640 threshold, bulls are likely to keep pushing prices to new highs while bears stay on the sidelines. Bears will gain confidence only if SPY drops below $670 in the near term. Should that level fail, the market could test $665, but if it holds, it will likely be another bear trap. To truly shift control, $660 would need to fail, and even then, a decisive break below $640 is required to confirm a trend reversal and trigger our base case of a 10–15% pullback this year. For Thursday, resistance sits at $675, $677, $680, and $682, with support at $672, $669, $665, and $660. Above $675 there is a heavy wall of resistance that will likely limit gains. Since reclaiming $585, SPY has maintained a steady uptrend fueled by dip buyers. Mag stocks were all green except Alphabet, which slipped slightly. Crypto and ETH moved modestly higher, with ETH comfortably above $4300, supporting the risk-on bull environment. A sustained close below $4300, combined with weakness in Mag leaders, could be an early warning sign of softness, but until then the path of least resistance remains higher. We continue to favor quick profit-taking and caution with overnight holds. The VIX fell 5.45% to 16.30, reflecting continued market strength. We still recommend adding protection to any long book, as VIX below 23 supports the bullish case, but a breakout above it could finally trigger the long-anticipated pullback. SPY closed just above the redrawn lower bull trend channel from the April lows, reinforcing the bull trend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing well above resistance turned support. There were extended targets printing at the close and for virtually the entire day session. The MSI opened the day in a ranging state but quickly rescaled to its current state and with extended targets, it was apparent that SPY had nowhere to go but up. For Thursday the MSI is implying higher prices albeit at a slower rate of ascent. MSI support is $671.21 and lower at $670.33.

Key Levels and Market Movements:

On Tuesday we wrote, “Absent a catalyst, it is likely the market attempts to reverse today’s decline and recover some of the lost ground,” and noted, “The market continues to trade in a range between $665 and $675, with $668 acting as a magnet that will likely be tested again as the bulls build energy to break out of this range,” while also stating, “Overnight, the bulls want to defend $668, and if it holds, the market will continue to make new highs.” With this context, and with the MSI opening in a Bullish Trending Market State while $668 held overnight, we looked for an opportunity to go long. That opportunity came early on a less-than-perfect failed breakdown at 9:44 am, which triggered a long entry at $670 with a first target at MSI resistance at $671.23. A quick pop followed, hitting T1 and putting us in the green, so we set T2 at the premarket level of $671.50, which also came quickly. With both targets achieved, we moved our stop to breakeven and began trailing the position, as extended targets continued to print, signaling SPY was likely moving higher. And so it did, validating the setup and reinforcing our approach of sticking with the trend until proven otherwise. We weren’t going to fade the rally given the strength so we held into the close for a massive one and done trade thanks to having a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday has only Unemployment Claims, which are unlikely to move the market. As such, watch the MSI for clues and trade what you see, given the broader macro risks. Absent a catalyst, it is likely the market continues to grind higher, setting new records along the way. The market is expected to test the upper end of the $665 to $675 range, with $670 acting as a magnet that will likely be tested again as the bulls build energy for a breakout. Dips to as low as $665 will likely trap bears and spark another short squeeze, pushing prices higher. The market still needs time to digest and consolidate recent gains, but any good news could easily push SPY out of this range and into new all-time highs. Given the strength of the current trend, we will be very cautious fading any pushes higher, making failed breakouts particularly useful setups. Overnight, the bulls want to defend $670, and if it holds, the market should continue its march to new highs. A break of $670 will likely lead to a test of $665, which is also expected to hold. With no meaningful news, watch the MSI and price action closely tomorrow for directional cues. We expect more two-way trading as we continue to buy dips at major support or short weakness at or near $675 on failed breakouts. The bears come to life in scale only on a drop below $640. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

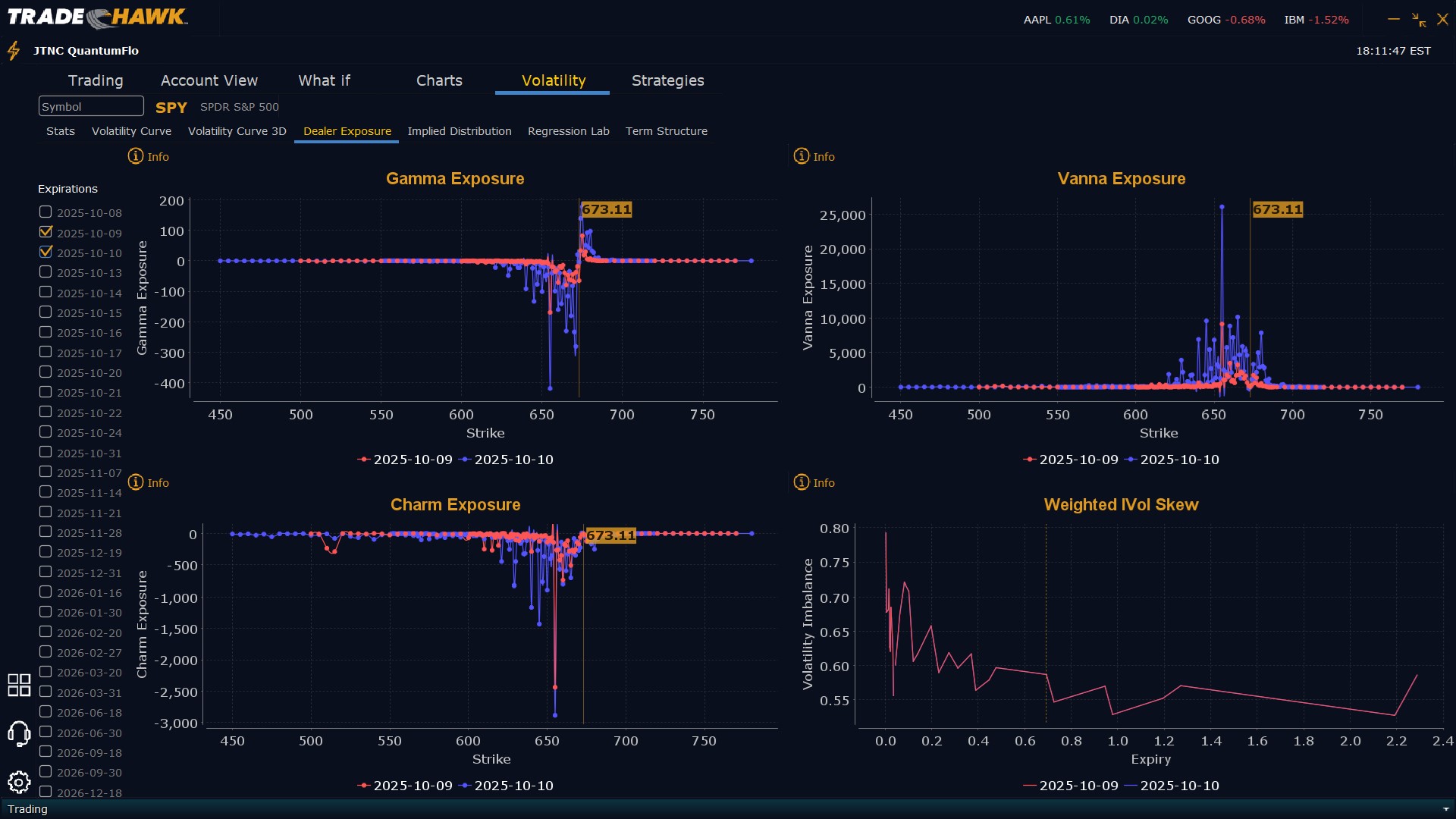

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $674 to $690 and higher strike Calls implying Dealers believe prices may stall at the current levels. The ceiling for tomorrow appears to be $675. To the downside, Dealers are buying $673 to $600 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower tomorrow. Dealer positioning is unchanged from bearish to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $674 to $690 and higher strike Calls implying Dealers believe prices may stall at the current levels. The ceiling for the week appears to be $680. To the downside, Dealers are buying $673 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting a more bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $673.04, a fresh record and just below key resistance. Dip-buying remains the preferred strategy. Watch for failed breakouts at $675–$677 and failed breakdowns near $669–$665. Use MSI, roadmap levels, and dealer flows to guide entries. Take quick profits, hedge when needed, and stay cautious as the rally matures.

Good luck and good trading!