Market Insights: Monday, October 6th, 2025

Market Overview

US stocks kicked off the week with another record-setting session as the AI boom continued to dominate sentiment, pushing the S&P 500 and Nasdaq to fresh all-time highs. The Nasdaq surged 0.71% on the back of a 23% rally in AMD, while the S&P 500 gained 0.36%, and the Dow slipped 0.14% as Verizon shares dropped following a leadership shakeup. AMD’s announcement of a multiyear chip supply deal with OpenAI sparked the latest wave of enthusiasm, positioning the semiconductor maker to generate tens of billions in annual revenue. The agreement also gives OpenAI the option to acquire up to 10% of AMD, elevating it as a formidable rival to Nvidia.

The AMD-OpenAI partnership lifted the broader chip sector, with notable gains in Applied Materials, Micron, and TSMC. The AI trade continues to provide a bullish tailwind even as the federal government shutdown enters another week. With economic data from official sources on pause, investors are leaning heavily on private releases and forward-looking indicators. The University of Michigan’s consumer sentiment report is expected Friday and may shape expectations for interest rate cuts. On the Fed front, Governor Stephen Miran speaks Wednesday and Chair Powell follows Thursday, both of whom could provide clues on policy direction.

Despite the ongoing shutdown and delayed jobs data, the equity market remains resilient. Risk appetite is strong, and crypto added to the rally with Bitcoin climbing more than 2% to settle above $125,000. While a prolonged shutdown remains a threat to earnings and credit markets, for now the focus remains on momentum, tech leadership, and a growing belief that the AI boom is still in its early innings.

SPY Performance

SPY rose 0.36% to close at $671.59 after opening at $671.60 and trading between $669.46 and $672.51. Volume was slightly below average at 51.06 million shares. Monday saw a tight session that started with an early dip to $669.60, which was quickly bought. A new high was reached around 2 PM, and the remainder of the session was marked by consolidation near the highs. Despite modest movement, bulls maintained the upper hand, holding SPY above support and confirming continued momentum.

Major Indices Performance

The Nasdaq led with a 0.71% gain, driven by AMD’s massive rally. The S&P 500 added 0.36%, while the Dow declined 0.14%, weighed down by a 5% drop in Verizon following a leadership change. The Russell 2000 rose 0.31%, showing continued strength in small-cap names and broad participation beyond mega caps. The AI trade remains the primary engine behind index performance, lifting semiconductors and tech broadly.

Notable Stock Movements

AMD soared over 23% after announcing its deal with OpenAI, triggering a rally in chipmakers across the board. Applied Materials, Micron, and TSMC all gained, while Nvidia and Apple were the only major tech names to close in the red. The rest of the Magnificent Seven saw green across the board. Verizon dragged the Dow lower after announcing a CEO transition. Crypto-linked stocks also rose, riding the wave of Bitcoin strength. Microsoft and Tesla both extended recent gains, reinforcing the market’s appetite for growth and innovation-led names.

Commodity and Cryptocurrency Updates

Crude oil rose 1.45% to close at $61.76, staying near our model’s forecasted $60 target and suggesting continued downside risk remains. Gold jumped 1.93% to $3,984 as demand for safe-haven assets increased in the face of political uncertainty. Bitcoin gained 2.15%, closing above $125,300 and hitting another milestone in its rally. Crypto strength continues to support the broader risk-on environment.

Treasury Yield Information

The 10-year Treasury yield rose 1.12% to close at 4.166%. Though still below the danger zone, rising yields remain a potential threat to equities. Levels above 4.5% would begin to apply pressure, while 4.8% would likely trigger selling, and 5% or higher could bring a major correction. At 5.2%, our models expect a 20% or greater drop. For now, yields remain manageable and are not yet triggering a repricing of risk assets.

Previous Day’s Forecast Analysis

Friday’s roadmap projected a range of $663.50 to $674.75 with a bullish lean and noted resistance at $672.50 and $675. Support was pegged at $668.50, $667, and $665. The roadmap also stated that failed breakouts above $672 and dips near $668 would likely define the day. With no new data expected Monday, consolidation was forecast to dominate unless buyers broke through resistance convincingly.

Market Performance vs. Forecast

SPY opened near $671.60, dipped early to $669.46, then climbed to a high of $672.51 before closing at $671.59. The move aligned precisely with the roadmap’s structure. Resistance held at $672.50 and dips were bought at the projected support zone. Price action showed tight consolidation with upward bias, confirming bullish expectations. SPY remained comfortably within the modeled range, validating both the bias and levels provided premarket.

Premarket Analysis Summary

Monday’s 7:48 AM premarket report placed bias at $671 and identified upside targets at $672.10 and $674.10, with downside levels at $669.10 and $667.60. The roadmap suggested early strength could lead to progress toward $674 if $671 held. Otherwise, a drop below bias would open a path to lower supports. SPY respected all levels, with price bouncing near $669 and topping out at $672.51. The day’s action validated the roadmap, confirming the consolidation thesis and the usefulness of premarket levels.

Validation of the Analysis

Price respected the roadmap’s structure throughout Monday’s session. SPY never materially broke below bias, and both the intraday high and low fit precisely within the roadmap’s expected zones. Once again, the market validated the technical picture laid out in premarket. The analysis correctly anticipated a choppy but bullish session that allowed bulls to maintain control and prepare for the next move higher.

Looking Ahead

Tuesday has no scheduled data releases, leaving technicals and positioning to guide markets. SPY remains above key levels, and bulls continue to buy dips. We expect more grinding action between $667 and $675, with a possible breakout attempt above $675 if momentum accelerates. A drop below $665 could bring $663 into play, though bulls are likely to defend this zone. The shutdown remains a background risk, but until it hits earnings or credit spreads, its market impact remains minimal.

Market Sentiment and Key Levels

SPY closed at $671.59, setting another all-time high. Resistance lies at $672, $675, $677, and $680. Support levels are found at $670, $668, $665, and $663. The market continues to ignore macro threats and rewards risk-taking. Bulls remain in charge above $663, and any break of $665 will need to be watched carefully. A decisive move below $640 remains the trigger for a significant trend reversal, but for now, the structure supports higher prices.

Expected Price Action

SPY’s projected range for Tuesday is $667.75 to $675.50, with the Call side dominating in a tightening band. The roadmap anticipates another day of consolidation punctuated by potential breakouts. If SPY can hold $670 and clear $672, a push to $675 is likely. Above that lies heavy resistance. If $668 fails, expect a test of $665 and possibly $663. Price continues to trade well above the key $645 bull trend line, and with crypto and AI leading, the market remains in strong hands.

Trading Strategy

Longs remain favored above $665 with dips to $668 and $663 offering strong entries. Targets include $672, $675, and $677. Shorts can be attempted near $675–$680 on failed breakouts. The VIX dropped 1.68% to 16.37, suggesting market calm remains. We advise protecting gains and using quick exits, as options remain expensive and imply institutional hedging. Keep stops tight and continue to respect momentum until proven otherwise.

Model’s Projected Range

SPY’s projected range for Tuesday sits between $667.75 and $675.50, with the Call side dominating in a narrowing band that suggests choppy price action interlaced with periods of trending action. With very little economic news early in the week, it is likely the market continues to grind higher with pauses at major support to consolidate and trap shorts. Once again today, another new all-time high was made which, like recent highs, pulled back slightly to entice shorts. SPY closed up 36 basis points at $671.61. The macro risk remains the shutdown, and the longer it goes the greater the risk. The market continues to look past these external risks as it should, but a long shutdown will eventually force investors to take these threats into consideration and multiples will contract. Until we see signs of weakness, however, it’s higher and higher we go in the everything rally. Overnight SPY gapped up and around 2 pm made a new all-time high. A pullback in the morning session to $669.60 was bought and by the end of the day, it was a new high with mostly consolidation above $671. We’ve noted for several days that above $663 the bulls maintain complete control of the market. While today’s volume was below average, the bulls continue to buy dips and add risk. Options are especially expensive, implying significant hedging activity, suggesting institutions are preparing for a potential pullback. But until that happens, it’s higher we go. We continue to buy dips while being very careful fading rallies. With the index well above the critical $645 threshold, bulls are likely to continue pushing the market to new highs while bears remain sidelined. Bears need to see SPY below $665 to even consider stepping in. Should that level fail, the market likely drops to $663, but if that holds, it will be another trap and the bulls will put on the squeeze once again. A decisive break of $640 is required to signal a true shift in the market and trigger our base case of a 10–15% pullback this year. For Tuesday, resistance sits at $672, $675, $677, and $680, with support at $670, $668, $665, and $663. Above $675 there is a heavy wall of resistance which will likely limit gains on Tuesday. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Mag stocks were mostly green today with only Nvidia and Apple falling, while crypto and ETH moved strongly higher, resting comfortably above $4300 and supporting the risk-on bull case. A sustained close below $4300 combined with weakness in Mag leaders may point to market softness, but until that happens the market will move higher. We continue to favor quick profit-taking and caution with overnight holds. The VIX fell 1.68% to 16.37, suggesting continued market strength. We still recommend adding protection to any long book, as VIX below 23 supports the bullish case but a breakout above it could finally trigger the long-anticipated pullback. SPY closed well above the redrawn lower bull trend channel from the April lows, reinforcing the bull trend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing above MSI resistance turned support. There were no extended targets at the close but for most of the premarket and day session, extended targets above were present indicating the herd was participating in today’s rally. The MSI spent almost the entire day in a bullish state after rescaling higher overnight. A brief dip to $669.60 with the MSI in a wide ranging state was bought and from there on out, SPY simply kept moving up and to the right with the MSI supporting the move all day. For Tuesday the MSI is implying sideways to slightly higher prices. MSI support is $671.21 and lower at $670.50.

Key Levels and Market Movements:

On Friday we wrote, “it is likely the market retests lower levels such as $665 and possibly $660, only to trap bears and squeeze higher,” and noted, “it’s probable price moves in a range between $665 and $672,” while also stating, “we will be very careful fading any pushes higher.” With this context, and with the MSI rescaling higher overnight with extended targets above, we waited for an opportunity to go long on a failed breakdown. We had no intention of fading the open given extended targets printed for several hours in the premarket. A dip to $669.50 with a gap fill provided our setup, and we entered long at $670 with T1 at the premarket level and MSI resistance at $671. With T1 in hand by 11 am, we set T2 at the premarket level of $672.10. It took some time to reach this level, but by 1 pm with T2 secured and our stop moved to breakeven, we had little to do but trail, especially with extended targets printing above. By 2 pm it was clear the market was going to do what it has been doing for weeks, make a new high and pull back into the close. With a triple top that nearly matched the overnight high, we exited our trailer at $672.35 and called it a day. One and done, thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Tuesday has no news so watch the MSI for clues and trade what you see, given the external risks to the market. Absent a catalyst, it is likely the market continues to move higher but within a range from a low of $665 to a high of $675, with $668 acting as a magnet that will be tested as the bulls build energy to break out of this range and put in additional new highs. Dips to as low as $665 will trap bears, and the bulls will put on another short squeeze to continue pushing prices higher. The market needs time to digest and consolidate, but any good news is likely to break SPY out of this range and send it to new highs. Given the market strength, we will be very careful fading any pushes higher, making failed breakouts especially useful. Overnight the bulls want to defend no lower than $668, and if it holds, the market will continue to make new highs. A break of $668 will likely lead to a test of $665, which is also likely to hold. With no news, watch the MSI and price action tomorrow for direction. We expect more two-way trading as we continue to buy dips at major support or short weakness at or near $673 on a failed breakout. The bears come to life in scale only on a drop below $640. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

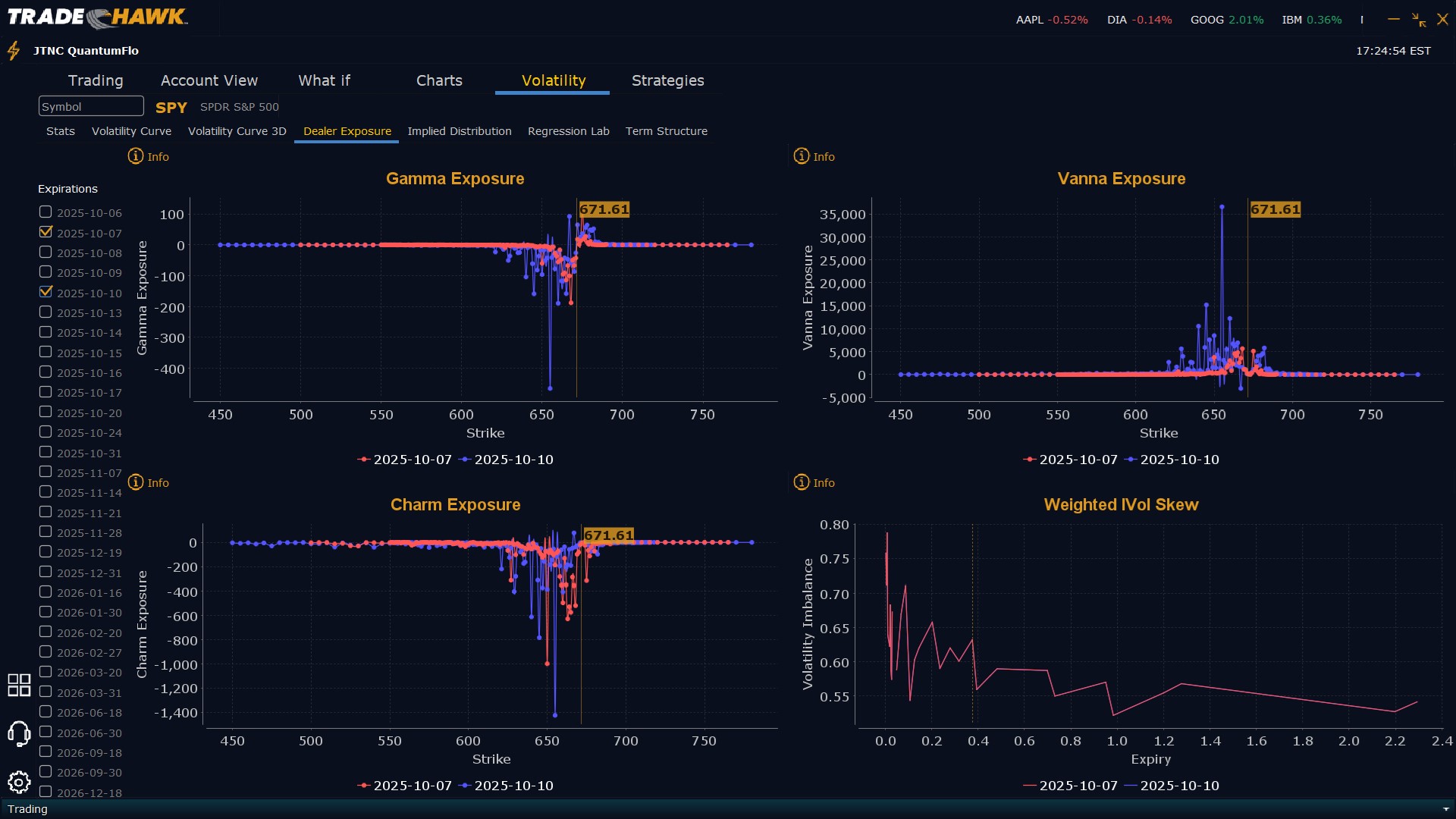

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $672 to $690 and higher strike Calls implying the Dealers’ belief that prices may stall tomorrow near current levels. The ceiling for Tuesday appears to be $675. To the downside, Dealers are buying $671 to $600 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying displaying little some that prices could move lower tomorrow. Dealer positioning has changed from slightly bearish/neutral to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $672 to $690 and higher strike Calls while selling $667 Puts implying the Dealers belief that prices may tread water near current levels but not fall below $667. Dealers only sell near or ATM Puts when they believe prices will move higher. The ceiling for the week appears to be $682. To the downside, Dealers are buying $671 to $540 and lower strike Puts in a 4:1 ratio to the Calls/Puts they’re selling, reflecting a bearish outlook for the week. For the week Dealer positioning has changed from slightly bearish/neutral to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $671.59, just off the highs and well within the bull zone. We continue to buy dips and sell resistance. Watch for failed breakouts and use the roadmap, MSI, and dealer flows to guide entries and exits. Stay disciplined, protect gains, and respect the market’s message.

Good luck and good trading!