Market Insights: Thursday, October 23rd, 2025

Market Overview

Stocks surged Thursday as investors welcomed President Trump’s confirmation of an upcoming meeting with Chinese President Xi Jinping and processed a deluge of corporate earnings. The Nasdaq led the advance with a 0.89% gain, followed by a 0.57% rise in the S&P 500, while the Dow added 0.31%. The announcement of a long-awaited meeting between U.S. and Chinese leaders reassured markets rattled by renewed tariff headlines earlier in the week. At the same time, earnings from Tesla, IBM, and others dominated headlines. Tesla shares erased early losses to end higher by 2.3% after mixed Q3 results, kicking off the Magnificent Seven earnings cycle. IBM slipped 1% as strong profits were offset by lukewarm software revenue.

Oil surged more than 5% after the U.S. announced sanctions on major Russian energy firms, sending crude prices to their highest levels in weeks. Brent topped $65 and WTI settled over $61, intensifying pressure on Russia amid the ongoing conflict in Ukraine. In other headlines, the Wall Street Journal reported that the Trump administration is considering taking stakes in several quantum computing firms, sparking rallies in IonQ, Rigetti, and others. Gold rebounded 1.57% as investors returned to the safe-haven asset following its recent collapse. Traders now turn to Friday's long-delayed CPI and PMI reports, which will provide rare insight into the inflation outlook during the government shutdown. With official data still limited, earnings and geopolitical headlines continue to drive market action in the near term.

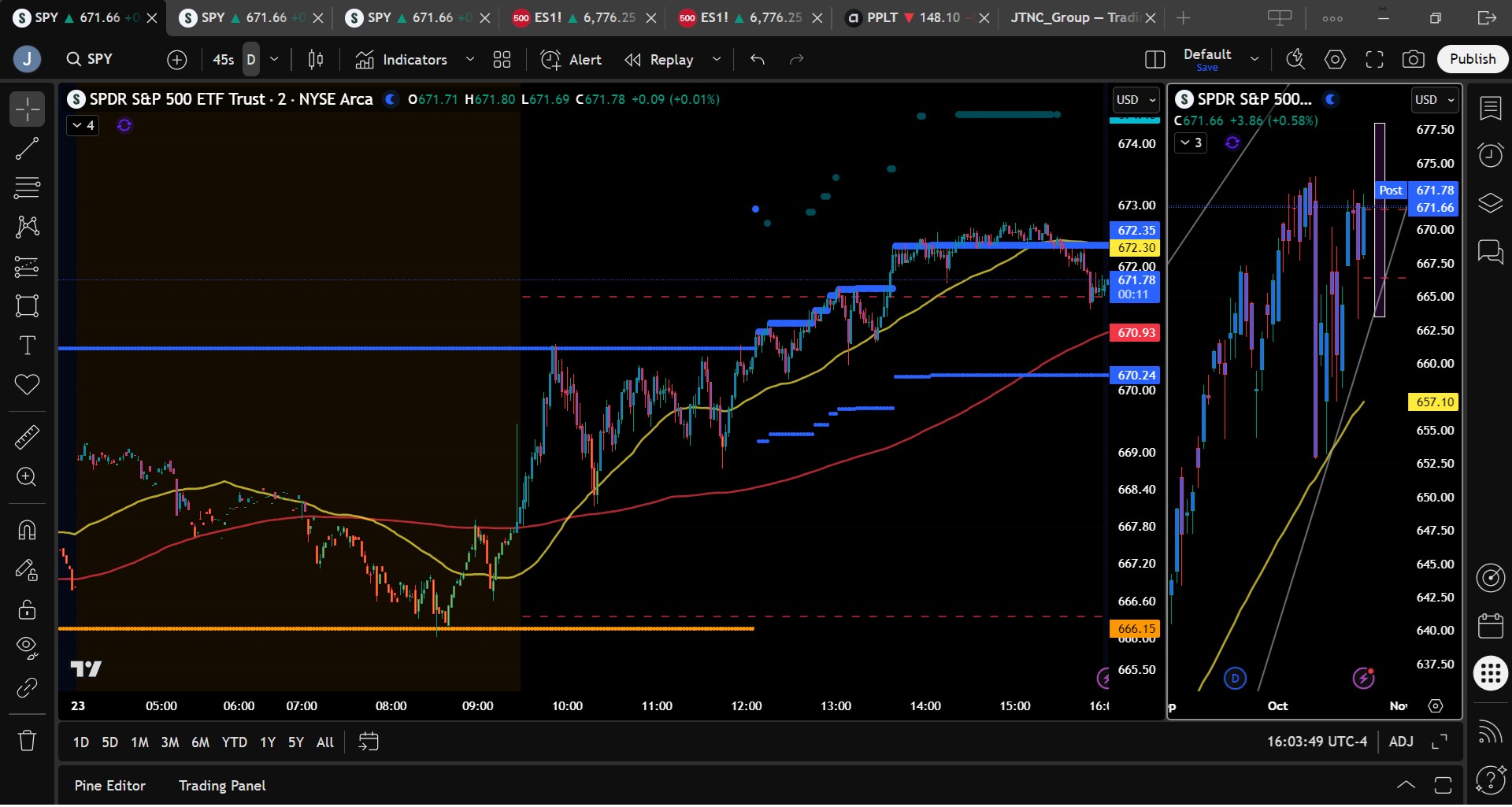

SPY Performance

SPY opened at $668.15, traded as low as $667.80 before rallying steadily throughout the day, hitting a high of $672.71 before closing at $671.60, up 0.57%. Volume was average at 59.3 million shares. The move was a strong recovery from Wednesday’s drop and put SPY back above key technical levels, including the $667 pivot and the $663 bull/bear dividing line. The clean reclaim of the lower range boundary and close near highs suggests bullish momentum has returned heading into Friday’s CPI release.

Major Indices Performance

The Nasdaq led with a 0.89% gain as tech rebounded across the board. The S&P 500 rose 0.57%, and the Dow gained 0.31%, driven by positive sentiment from geopolitical developments and earnings momentum. The Russell 2000 outperformed all major indices with a 1.21% surge, signaling improved appetite for risk. Breadth was strong, and all sectors participated in the rally, with energy and tech leading.

Notable Stock Movements

Tesla climbed 2.3% following mixed earnings, erasing early losses and showing resilience despite heightened scrutiny. Among the Magnificent Seven, all stocks traded higher except Netflix and Microsoft, reflecting renewed optimism around megacap tech. IonQ and Rigetti surged on reports that the U.S. government may take stakes in select quantum computing firms. Oil-related names were among the top gainers following fresh sanctions on Russian energy, while gold miners bounced alongside the rebound in precious metals.

Commodity and Cryptocurrency Updates

Crude oil spiked 5.32% to $61.61, decisively breaking above the long-watched $60 magnet level. The move aligns with the model’s forecast for a breakout and potential acceleration toward $65 or even $50 depending on follow-through. Gold rose 1.57% to $4,129, recovering further from Tuesday’s collapse. Bitcoin gained 2.15% to close above $109,900, continuing to hold recent support and confirming the broader risk-on tone.

Treasury Yield Information

The 10-year Treasury yield rose 1.32% to close at 4.004%, returning above the critical 4% threshold. While not yet at dangerous levels, any move toward 4.5% or above would pressure equities. The 4.8% level remains a significant stress point, and 5.2% is viewed as a critical trigger that could induce a broader 20% equity correction. For now, yields remain in a watch zone but not yet a headwind.

Previous Day’s Forecast Analysis

Wednesday’s premarket analysis projected bounce potential if SPY held above the $666.35 bias level. The model identified $668.35 and $671.50 as upper targets, both of which were achieved intraday. SPY opened above bias, dipped briefly, and then climbed steadily, validating the forecast. The roadmap warned of a possible test of Wednesday’s low, but that scenario was avoided as buyers stepped in early and maintained control throughout the session.

Market Performance vs. Forecast

Thursday’s session closely followed the projected path. After holding above support, SPY tagged every forecasted upside target. Price action confirmed the bullish bias and respected all key levels, from the bounce off $667.80 to the tag of $672.71. This alignment between model levels and actual movement reinforced the forecast’s utility in navigating intraday setups.

Premarket Analysis Summary

Thursday’s premarket levels provided a clean framework: bias at $666.35, with upside targets at $668.35, $668.85, and $671.50. SPY met or exceeded each of these intraday, validating the premarket thesis that dips should be bought as long as price stayed above bias. No test of downside targets was needed, and the market moved cleanly higher in line with the model.

Validation of the Analysis

Thursday’s action validated both directional and structural expectations. The bounce from support, the steady rally to key targets, and the close near highs all confirmed the model’s reliability. The roadmap successfully guided long entries near $667–$668, and offered precise exit zones for profit-taking into $671.50+. Traders using the MSI and roadmap had a clear edge in executing Thursday’s session.

Looking Ahead

SPY’s projected range for Friday is $663.50 to $678.00. With CPI and PMI on deck and major earnings coming next week, volatility is expected to increase. SPY remains in a bullish structure, but Friday’s inflation data could challenge that view. Above $675, SPY faces a dense resistance band. Below $667, support comes into play at $664 and $660. Bulls aim for a breakout close above $675; bears need a rejection and break below $663 to regain control.

Market Sentiment and Key Levels

SPY closed at $671.60, well above the $663 line and near the top of its recent range. The VIX dropped 7.10% to 17.28, confirming a risk-on sentiment and reducing short-term volatility risk. Key resistance levels for Friday are $673, $675, and $680. Support sits at $667, $664, and $660. The market remains resilient, with bulls defending dips and pressing higher into earnings and macro catalysts.

Expected Price Action

Friday’s session may begin with indecision ahead of CPI but could quickly resolve into a trending move based on the data. A break above $675 opens the door to $680 and potentially higher next week. A rejection at resistance combined with weak inflation data could send SPY back to $667 or even $663. Two-way volatility is expected, and traders should be ready for reactive movement to economic headlines.

Trading Strategy

Maintain a tactical approach with defined risk. Buy dips near $667–$664 and fade moves into $675–$680 unless strong momentum develops. Avoid overcommitting ahead of CPI, and be prepared for whipsaw action post-release. The path of least resistance remains higher, but headline sensitivity remains elevated. Use MSI and model levels to guide execution and trade the range with discipline.

Model’s Projected Range

SPY’s projected maximum range for Friday sits between $663.50 and $678.00, with the Call side dominating in a widening band that suggests trending price action interlaced with periods of chop. CPI and PMI are due tomorrow, and with other key economic reports delayed by the government shutdown, the market is likely to react more sharply to these data points. Earnings season is also in full swing, with next week bringing results from major players including Meta, Microsoft, Amazon, Apple, Google, Lilly, Visa, and Mastercard, among others. Without consistent economic data, earnings and White House headlines will continue to drive short-term volatility, making it essential to trade what you see and remain nimble. Today the market rallied strongly right out of the gate, with the bull advance lasting until the final hour when profit taking hit. But overall it was a constructive day with SPY closing up 0.58% at $671.66, well above the $663 dividing line between bulls and bears. Volume was average, and while the late-day pullback could suggest near-term consolidation, it doesn’t yet alter the broader bullish structure. Another breakout above the $653–$670 range, confirmed by a strong close, puts the bulls fully back in charge and likely leads to further strength next week. Overnight, SPY tested lower levels but found firm support at $666, above the prior day’s low, and from there it was a steady climb higher throughout the session. While we don’t expect new all-time highs tomorrow, the bullish momentum sets the stage for potential highs next week. For the bears to regain meaningful control, last Friday’s $653 low must break; if that occurs, $640 becomes the critical line where bulls must make a stand to avoid a confirmed bear trend. A close below $663 would reawaken the bears and could spark a retest of those lows. Until then, bulls remain in control, continuing to buy dips and showing strong resilience despite persistent macro risks such as the government shutdown and renewed tariff rhetoric. Ideally, a controlled test of $653 that holds would shake out weak hands and reinforce the bull trend, though at this point the odds of such a pullback are low without an external shock. For Friday, resistance sits at $673, $675, and $680, with support at $667, $664, and $660. Above $675 lies a dense wall of resistance likely to cap near-term gains, while below $660, structural support thins quickly. Since reclaiming $585, SPY has maintained a broad uptrend driven by dip buyers despite periodic volatility, though that structure has weakened modestly. Crypto and virtually all Mag stocks rallied today, reinforcing the market’s strength and risk-on tone. As we’ve emphasized for weeks, until sustained weakness emerges in major market leaders or crypto, the broader trend remains higher. Persistent softness in those areas could still trigger the 10–15% correction we’ve been forecasting into year-end, though with each passing week the probability shifts toward early 2026. For now, the bulls clearly hold the advantage and did plenty today to maintain it. Tomorrow’s CPI data could have a major impact on market direction, with bulls looking to defend $667 to push prices toward all-time highs, while a break of $667 opens the door to $663 and potentially lower levels. The VIX fell 7.10% to 17.28, signaling continued risk-on sentiment and remaining well below the 23 threshold that would suggest trouble. SPY closed mid-channel within its bull trend from the April lows, a structure that has softened slightly but continues to support the ongoing uptrend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing at the upper end of the range. Extended targets printed during the rally from mid-morning until 3 pm which saw price move back toward Tuesday’s highs. The MSI held steady overnight in a wide, ranging state but just before the open, SPY tested MSI support at $666 and took off higher moving straight up for the entire session. The MSI rescaled higher several times with extended targets, indicating the herd was participating in the day’s rally. Only in the last hour after extended targets stopped printing did SPY pull back slightly. For tomorrow the MSI is forecasting higher prices but with CPI and PMI due out in the premarket, it’s imperative to trade with the MSI to be on the right side of the market. MSI support is $670.24 and with resistance at $672.35.

Key Levels and Market Movements:

On Wednesday we wrote, “the administration continues to inject tariff headlines, and the market is reacting sharply to every tweet or post, making trading challenging at best,” and noted, “The bulls need to reclaim $670 to reassert full control from the bears,” while also stating, “we expect a test of $670 that should be faded on the first attempt.” With this context, and with the MSI in a ranging state at the open testing that $670 level, we took a calculated short at 9:50 a.m. at $670.50 despite normally avoiding trades when the MSI is in a ranging state. We set T1 at the premarket level of $668.85 and T2 at another premarket level of $668.35. Both targets were hit quickly, so we moved our stop to breakeven and looked for a push lower toward MSI support at $666. That move never materialized, and instead, SPY reversed sharply, taking out our stop for a scratch on the runner. As the session developed, the MSI began to rescale higher with extended targets printing above, but with no clear setup or pattern to lean on, we stayed patient, waiting for a valid long entry. None came as SPY simply drifted higher all day without any meaningful retrace or failed setup to trigger an entry. Finally, at 3:32 p.m., extended targets stopped printing, and while we briefly considered a short at MSI resistance at $672.30, the combination of limited time left in the session and the strength of the intraday trend kept us sidelined. Having booked gains from the morning short and with the market offering no high-quality setups into the close, we opted to lock in profits, preserve capital, and call it a day. Once again, discipline and adherence to process kept us green on a session that offered little beyond an early scalp and a lesson in patience. One and done once again, thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday brings delayed CPI and PMI data, both of which are likely to move the markets, especially since they’ll be released well before the open, meaning direction could be firmly established by the time regular trading begins. As such, it’s critical to trade with the MSI and respond to what you see rather than trying to predict reactions. No model can anticipate how the market will digest major economic releases, so traders must remain nimble and ready for anything that develops premarket. Continue to monitor tariff headlines and other administrative comments closely, as the market remains highly reactive to those posts, adding another layer of complexity to trading. With VIX pulling back sharply today, the bulls have issued a clear “risk-on” signal, implying the all-clear for the next 30 days. Yesterday’s 1% drop already feels distant as buyers reclaimed control and pushed SPY higher, setting the stage for new all-time highs based on today’s price action. The bulls are firmly in charge and will look to defend $667 overnight to fuel the next leg higher. The bears need $667 to fail to force price below $663; if that occurs, the market could quickly revisit last Friday’s lows, though absent a major catalyst, that remains a low-probability outcome. The broader path of least resistance is higher, and with a close well above $663, the bulls carry clear momentum into Friday. The MSI forecasts higher prices, and any dip toward $667 should be treated as a buying opportunity in alignment with the bullish trend. A failure at $667 could lead to a drop toward $663, which must hold to preserve bullish control; a break below it would open the door to $653, which becomes the next key level of defense before $640, the critical line that must hold to maintain the broader bull trend. A decisive drop below $640 would hand full control to the bears. Failed breakouts and failed breakdowns remain the highest-probability setups in this environment, and with major data releases hitting in the premarket, traders should stay flexible, avoid entries during Ranging Market States, and ensure full alignment with the MSI before acting. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $672 to $690 and higher strike Calls implying the Dealers’ belief that prices may stagnate near current levels. The ceiling for tomorrow appears to be $675. To the downside, Dealers are buying $671 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $672 to $700 and higher strike Calls implying the Dealers’ belief that prices may stagnate near current levels. The ceiling for the week appears to be $680. To the downside, Dealers are buying $671 to $560 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting an increasingly bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish but certainly Dealers have added lots of protection as SPY approaches the all-time high. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Trade the roadmap. Bulls hold the advantage above $667, but resistance is dense. CPI could shift momentum quickly, so stay reactive, not predictive. Longs near $664–$667 and shorts into $675–$680 offer defined risk setups. Let price confirm direction and maintain agility.

Good luck and good trading!