Market Insights: Wednesday, October 22nd, 2025

Market Overview

Stocks declined on Wednesday as disappointing earnings from Netflix and anticipation around Tesla’s after-hours report weighed heavily on sentiment. The Nasdaq led the pullback, falling 0.93%, with tech names under pressure throughout the day. The S&P 500 dropped 0.51%, while the Dow gave back 0.71%, reversing from Tuesday’s record high. Netflix tumbled over 10% after missing earnings expectations, citing challenges tied to a Brazil tax dispute, which dragged the broader tech complex lower. Gold rebounded modestly after Tuesday’s historic drop, and Bitcoin sold off, falling below $110,000.

Tesla’s results, expected after the bell, took center stage as traders awaited the next wave of megacap tech earnings. Tesla shares weakened ahead of the release, reflecting market nervousness as Wall Street recalibrates its expectations amid early signs of cracks in the momentum trade. Elsewhere, Mattel also declined after reporting weaker North American sales, while earnings from IBM and others were met with muted reactions. In geopolitics, President Trump stirred renewed trade tension with China, suggesting potential new restrictions on U.S. software exports. However, there was progress elsewhere, with reports that the U.S. and India may reduce tariffs on key Indian exports. As the government shutdown continues to delay official data releases, investor attention is now locked on Friday’s CPI report, which could reset Fed rate expectations ahead of next week’s meeting.

SPY Performance

SPY opened at $671.99 and immediately rolled over, touching an intraday low of $663.30 before recovering slightly to close at $667.88, down 0.51% on the day. Trading volume was above average at 75.67 million shares, signaling stronger conviction behind the selling. Despite the pullback, SPY closed above the $663 bull/bear dividing line, though it re-entered the broader range that has contained price since last Friday. The loss unwound part of Monday’s breakout but held key levels, preserving the broader bullish structure for now.

Major Indices Performance

The Nasdaq led declines with a 0.93% drop, dragged lower by Netflix’s 10.04% plunge. The Dow fell 0.71%, and the S&P 500 lost 0.51%, both giving back recent gains as investors moved to the sidelines ahead of key earnings. The Russell 2000 underperformed once again, falling 1.43%, as small caps continued to lag. The pullback was broad, with selling pressure extending across sectors, though some defensive names and select megacap techs like Meta, Microsoft, and Alphabet managed to close green.

Notable Stock Movements

Netflix sank 10.04% after reporting disappointing earnings and highlighting international headwinds. Tesla declined ahead of its highly anticipated post-close earnings release. Meta, Microsoft, and Alphabet bucked the trend and closed in the green, offering relative strength amid tech sector weakness. Gold miners recovered slightly alongside a bounce in the metal, while most crypto-exposed names declined in line with Bitcoin’s drop. Crude oil names rallied strongly, tracking the move in energy prices.

Commodity and Cryptocurrency Updates

Crude oil surged 3.49% to $59.24, finally breaking the $60 barrier that has served as a magnet for months. With the level now breached, the model suggests downside risk could increase, with a move toward $50 not out of the question if sellers take control. Gold rose 0.23% to $4,118, recovering marginally from Tuesday’s 5.37% collapse. Bitcoin dropped 2.59% to close just above $111,900, continuing to show signs of fatigue after recent gains. Weakness in crypto and precious metals confirmed the broad unwinding of momentum trades.

Treasury Yield Information

The 10-year Treasury yield dipped slightly by 0.13% to close at 3.956%, holding below the 4% level. While still low enough to support equities in general, the broader market remains sensitive to yield moves. Above 4.5% would begin to pressure stocks, with 4.8% and 5.2% acting as major stress thresholds. For now, yields remain supportive of equities, but traders continue to watch closely for any breakout higher.

Previous Day’s Forecast Analysis

Tuesday’s forecast called for a narrow consolidation range between $667 and $676.75, with resistance expected at $672.85 and $675.85. SPY opened near the highs at $671.99 but failed to sustain upward momentum, reversing sharply to test and hold the critical $663 support zone. The sharp drop after the open aligned with the roadmap’s warning that the market was stalling and prone to a pullback if momentum failed to build above $672.

Market Performance vs. Forecast

Wednesday’s action played out as a textbook reversal, following the roadmap’s alternative scenario of a break below the bias level leading to a test of deeper support zones. SPY reversed hard after tagging projected resistance and sold down to our key technical dividing line at $663, where buyers stepped in. The price action respected both upside rejection and downside support, giving clear validation to the forecast.

Premarket Analysis Summary

The premarket analysis highlighted $671.35 as the key bias level, with targets above at $672.85 and $675.85. Below, key levels were $670.85, $670, and $667.85. SPY opened near the bias level but quickly failed, breaking all listed support levels before finding footing at the $663 zone and rebounding into the close. The model’s structure correctly anticipated initial resistance and noted the increasing likelihood of a pullback absent momentum.

Validation of the Analysis

Price behavior validated both directional levels and the bias framework. The market opened strong but reversed below bias, setting the stage for a retest of deeper support. SPY found support exactly where expected, reinforcing the model’s reliability. The roadmap’s call for cautious continuation and potential reversal was proven accurate, with disciplined traders able to execute both long and short setups effectively.

Looking Ahead

SPY’s projected range for Thursday is $663 to $671. With Tesla and Amazon earnings on deck, volatility is expected to rise. SPY is now back inside the broad range that’s contained trade for over a week, with resistance at $669, $673, $675, and $676, and support at $665, $662, $660, and $654. Friday’s CPI looms large, and until then, traders can expect rangebound, choppy trading with sharp directional moves tied to earnings and other macro headlines.

Market Sentiment and Key Levels

SPY closed at $667.88, holding above the bull/bear line at $663 but back within the recent congestion zone. The VIX rose 4.03% to 18.59, reflecting a modest uptick in volatility but still well below levels that would signal real market stress. The bulls retain an edge, but momentum has clearly slowed. For bears to take control, a decisive move below $663 and ultimately a break of last Friday’s $653 low is required. Otherwise, dips are still being bought.

Expected Price Action

Thursday’s session may mirror Wednesday’s in tone, with price exploring both ends of the expected range and reacting to major earnings releases. Above $670, the bulls could push to $673 or even $675. Below $665, support at $662 and $660 could come into play quickly. Should Tesla or Amazon disappoint, price could slip rapidly toward $654. While macro catalysts remain on hold, headline risk is elevated.

Trading Strategy

Tactical trading remains essential. Longs near $662–$665 and fades near $673–$675 are still valid. Use MSI and model levels to frame entries and exits. Avoid chasing breakouts without confirmation, especially ahead of Friday’s CPI report. Failed breakouts and breakdowns continue to offer the best setups in a choppy, range-defined market. Position sizes should be managed tightly until a clear directional breakout emerges.

Model’s Projected Range

SPY’s projected maximum range for Thursday sits between $662.25 and $674.00, with the Put side dominating in a widening band that suggests trending price action interlaced with brief periods of chop. There is no scheduled economic data, but with earnings season in full swing and every headline from the White House sparking reactions, the market remains extremely sensitive to short-term news flow. It’s essential to trade what you see and stay alert for key earnings from firms like Tesla and Amazon. Today the market pulled back into the same range it broke out of on Monday, and after a tweet about additional tariffs, SPY fell sharply to, where else, the $663 dividing line between bulls and bears. This is not a coincidence; these levels are driven by institutional options flows and remain valid until we state otherwise. SPY closed down 0.52% at $667.80 on strong volume, still well above $663 but now back inside the broader range that has contained price since last Friday’s decline. We expect lower levels to be tested, and they must hold to preserve the bull trend. The bulls still retain an edge, though new highs this week look unlikely, with the market more likely to trade sideways and consolidate energy for a potential breakout above $670. Below $663, SPY could drift toward recent lows, but for the bears to have any real chance at reversing the longer-term trend, last Friday’s $653 low must break; if that occurs, $640 becomes the key line where bulls must make a stand to avoid confirming a bear market. Despite today’s decline, the bulls have shown resilience, buying dips even after large selloffs, and today’s pullback, while technically damaging, is actually healthy for the broader structure. A test of $653 that holds would shake out weak hands and strengthen the bull trend. Macro risks remain high with the ongoing government shutdown and renewed tariff tensions, but bulls have largely ignored these external threats and are likely to continue doing so as long as last Friday’s low holds. Continue to trade the market in front of you, not the one you expect. For Thursday, resistance sits at $669, $673, $675, and $676, with support at $665, $662, $660, and $654. Above $676 lies a dense wall of resistance likely to cap gains, while below $660 there’s limited structural support. Since reclaiming $585, SPY has maintained a broad uptrend fueled by dip buyers despite recent volatility, though that structure has weakened modestly. Crypto and most Mag stocks declined today, reinforcing the day’s weakness. As we’ve highlighted for weeks, until persistent weakness emerges in key market leaders and crypto, the broader trend remains higher. Sustained softness in these areas could still trigger the 10–15% correction we’ve been forecasting into year-end, though the later we move into October, the less likely that becomes, pushing the window for a deeper pullback into early 2026. The bulls retain the advantage, but the bears are probing again and will gain momentum if SPY dips below $663. The VIX rose 4.03% to 18.59, signaling modest risk concern but still well below the 23 threshold that would suggest real trouble. SPY closed near the lower end of its bull channel from the April lows, a structure that has weakened but still supports the ongoing uptrend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Ranging Market State, with SPY closing mid-range. Extended targets printed off and on today as the market pulled back to the range it broke out of on Monday. The MSI held steady overnight but as SPY fell @ 10:15 am, the MSI began rescaling lower several times until reaching the line in the sand $663 level, which held. The MSI stopped printing extended targets and began rescaling higher which cut the day’s sell off in half, ending the session with the MSI in a ranging state. For tomorrow the MSI is forecasting sideways price action which may test both the upper and lower end of the range. MSI support is $666.15 and with resistance at $670.67.

Key Levels and Market Movements:

On Tuesday we wrote, “the administration remains noisy, and the market continues to react sharply to every tweet or post out of the White House,” and noted, “While VIX dropped again today, it remains above 17, meaning price moves are still likely to be exaggerated,” while also stating, “the bulls want to defend $668, and if that level holds, the market is likely to push toward $675 or even $678, where resistance could lead to a pause or rejection. Should $668 fail, $663 comes into play.” With this context, and with the MSI holding in a ranging state at the open, there was little to do but wait for price discovery. With very narrow MSI ranges and no extended targets below, we opted to take a long off MSI support just after the open at $670.60, setting our first target at MSI resistance at $672.85. While price did pop slightly, it never reached our target and instead came back down to our entry. When SPY broke sharply below MSI support at $670.38, we exited and reversed short, recognizing that momentum had shifted and there was little left to drive prices higher. The MSI then rescaled lower, so we set T1 at MSI support at $668.92, which was quickly achieved, followed by T2 at the premarket level of $667.85. SPY got close but initially failed to hit T2, and while we thought we might have to take another loss, extended targets below gave us the confidence to hold, and by 11 a.m. T2 was reached for a solid win. Another sharp reversal followed, and without any extended targets below, we decided to exit our short on a textbook failed breakdown, locking in profits and moving into profit protection mode. From there SPY popped again but couldn’t sustain momentum, and while a tweet out of the White House triggered another quick drop and reversal, we couldn’t get positioned fast enough for a long entry off $664. As $667.85 support turned into resistance, we watched for another short setup and got it just before 1 p.m. at MSI resistance at $668, setting T1 at MSI support at $666.50 and T2 at $665.98. Both targets were hit quickly, and with a stop moved to breakeven, we trailed the remainder expecting a test of $663. SPY moved lower as expected, but then the unexpected happened; data stopped printing as OPRA went down for more than 30 minutes. When connectivity returned, bid/ask spreads were extreme, so we exited around 2 p.m. at $665.20 and called it a day. One small loser and two solid winners on a volatile, technically challenging session that tested both patience and discipline, proof once again that clear planning, disciplined execution, and trust in the MSI process make all the difference which left us with a green day, thanks again to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Thursday has no scheduled economic news, yet the administration continues to inject tariff headlines, and the market is reacting sharply to every tweet or post, making trading challenging at best. With VIX still above 18, price moves are likely to remain exaggerated. Today the market sold-off roughly 1% before finding support at $663 and reversing to close down just 50 basis points, with above-average volume reinforcing the day’s volatility. The bulls remain in control, but with SPY now back below $670, the next push higher is likely to be sold, keeping price contained within the $655 to $670 range. The bulls need to reclaim $670 to reassert full control from the bears, while the bears will look to push SPY back below $663; if that happens, the market could quickly revisit last Friday’s lows. While the broader path of least resistance remains higher, external catalysts, positive or negative, continue to dominate short-term direction, so it’s essential to trade what you see and stay flexible. With a close above $663, the bulls still hold the edge, but with the MSI in a ranging state, we expect a test of $670 that should be faded on the first attempt. A dip to as low as $663 will gauge whether buyers step in again. A successful defense of $663 should entice the bulls, but if it fails, the market likely rolls lower. Should $663 give way and SPY fall to $653, it must hold otherwise $640 becomes the next level down. This is a critical line that must hold to preserve the broader bull trend, as the bears only gain full control on a decisive drop below $640. Two-way trading remains the base case, with failed breakouts and failed breakdowns offering the highest-probability setups in this environment. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

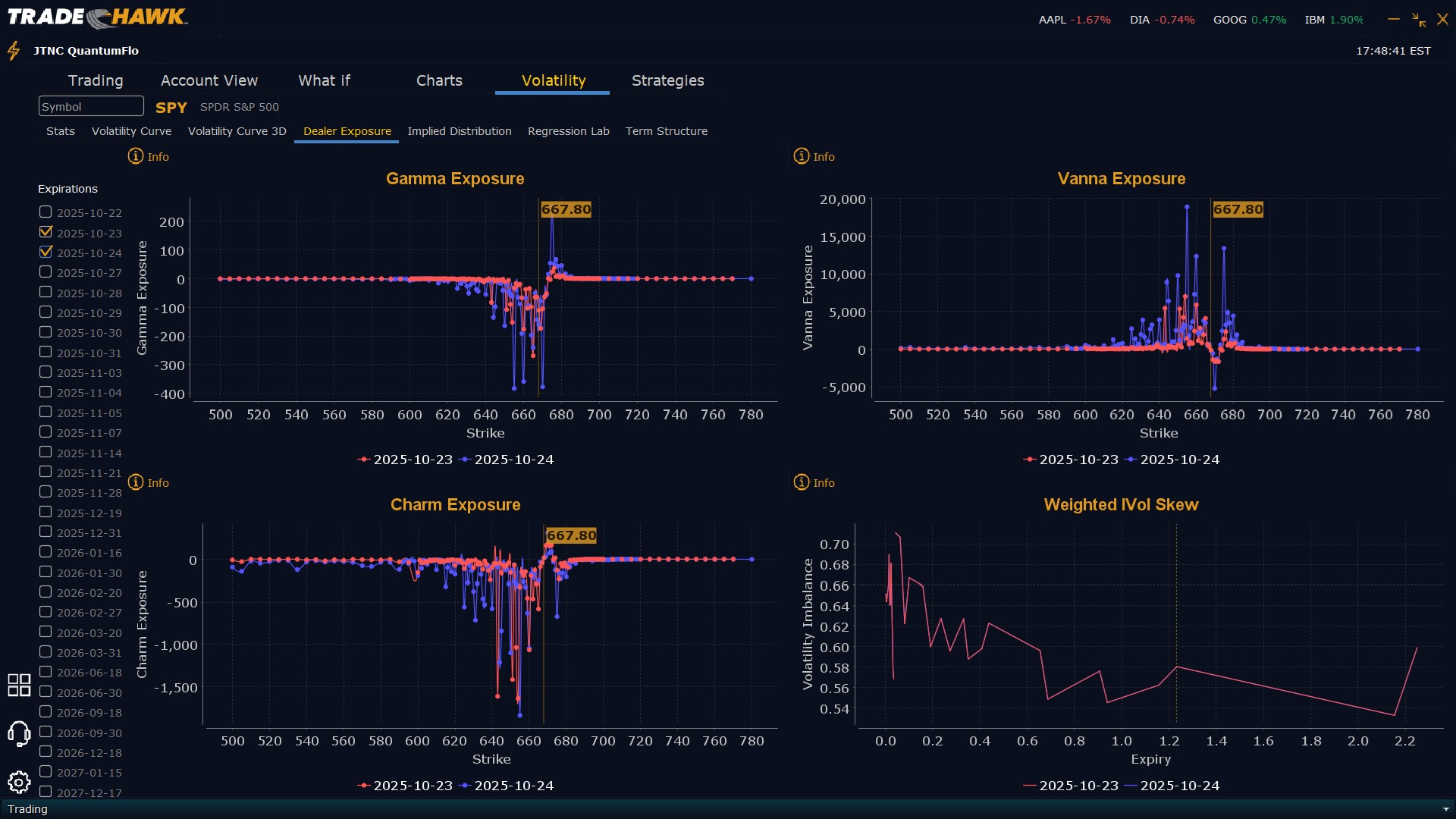

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $674 to $690 and higher strike Calls while buying $668 to $673 Calls indicating the Dealers’ desire to participate in any relief rally on Thursday. The ceiling for tomorrow appears to be $676. To the downside, Dealers are buying $667 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $673 to $690 and higher strike Calls while buying $668 to $672 Calls indicating the Dealers’ desire to participate in any relief rally into Friday. The ceiling for the week appears to be $675. To the downside, Dealers are buying $667 to $540 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Continue to trade the levels and let price confirm your setups. Bulls remain in control above $663, but upside momentum is fading. Short into resistance if earnings disappoint, and stay cautious with long entries unless support at $663 holds firmly. Patience and discipline remain key in this environment.

Good luck and good trading!