Market Insights: Tuesday, October 21st, 2025

Market Overview

Stocks were mixed Tuesday as the broader market paused following Monday’s rally, with the Dow closing at a record high thanks to strength in earnings from Coca-Cola and 3M. The Dow rose 0.47%, while the S&P 500 ended virtually flat, and the Nasdaq dipped 0.16% as Tesla and Nvidia weighed on the tech-heavy index. Earnings were in focus, with Coca-Cola and GM both beating expectations, and GM raising full-year guidance. Tesla and Netflix loomed ahead, with Netflix set to report after the bell. Despite soft tech action, the underlying tone remained bullish, supported by strong breadth and falling volatility.

Investor focus remained on earnings, with traders positioning around upcoming reports from Tesla, Amazon, and others later this week. At the same time, the market shrugged off macro concerns, including the prolonged government shutdown, now in its third week with no progress toward resolution. Economic data continues to be delayed, adding uncertainty ahead of Friday’s CPI and PMI releases. In commodities, gold suffered its worst day in over a decade, plunging more than 5% as traders rotated out of safe-haven assets. President Trump’s rare earths agreement with Australia provided some geopolitical relief, and VIX dropped to its lowest level in weeks, signaling reduced investor anxiety.

SPY Performance

SPY opened at $671.37, traded in a tight range between $669.98 and $672.99, and closed nearly flat at $671.23, down just 0.01%. Volume came in below average at 51.91 million shares as traders digested Monday’s breakout and awaited earnings from key tech names. The consolidation above $663 held cleanly, maintaining the bullish trend. The lack of strong directional movement reflected caution ahead of catalysts but confirmed buyers remain in control, with no sign of aggressive selling pressure.

Major Indices Performance

The Dow led with a 0.47% gain, hitting a new all-time high as earnings from Coca-Cola and 3M lifted the index. The S&P 500 closed flat after failing to follow through on Monday’s breakout, and the Nasdaq dipped 0.16%, dragged lower by weakness in Tesla, Alphabet, and Nvidia. The Russell 2000 underperformed with a 0.52% loss, continuing its pattern of relative weakness. Despite the uneven performance, overall breadth was healthy, and the dip in volatility suggested continued bullish control.

Notable Stock Movements

Among the Magnificent Seven, Amazon outperformed with a 2.56% gain, while Microsoft, Apple, and Meta saw modest advances. Tesla fell 2.39%, and Nvidia and Alphabet also declined, contributing to the Nasdaq’s underperformance. Gold miners sold off sharply alongside the collapse in the metal, while crude oil names posted modest gains. Bitcoin-related stocks continued their quiet recovery as crypto held recent support.

Commodity and Cryptocurrency Updates

Crude oil rose 0.70% to $57.42, reclaiming ground after dipping below $57 in recent sessions. As forecasted, the test of $60 appears complete, and sellers may now reassert control if price fails to hold above current levels. Gold collapsed 5.37% to $4,125 in its largest single-day loss in over a decade, driven by profit-taking and rotation out of safety plays. Bitcoin rose 0.69% to close above $111,800, extending its rebound as crypto tracked broader risk-on sentiment.

Treasury Yield Information

The 10-year Treasury yield dropped 0.60% to 3.961%, holding below the 4% mark and continuing to support risk asset valuations. The recent drop in yields has removed some pressure from equities, but traders remain focused on the key 4.5% and 4.8% thresholds. A sustained move above those levels would likely trigger broad equity weakness. For now, the falling yield trend reinforces the positive equity backdrop and has helped fuel recent buying.

Previous Day’s Forecast Analysis

Monday’s forecast projected a range of $666.75 to $677, with $671.75 identified as the key bias level. SPY opened slightly below bias and consolidated throughout the session, peaking at $672.99 before fading slightly. The forecast warned of potential stalling near $672.75, and that zone effectively capped the move. The session followed the projected structure, with consolidation above $663 and no follow-through despite Monday’s strength.

Market Performance vs. Forecast

SPY followed the forecast nearly point for point, holding above key support and respecting upper resistance. The roadmap’s guidance to expect quiet digestion played out as expected. Price movement was contained, and levels were respected with precision, offering low-risk setups and clear trade planning opportunities.

Premarket Analysis Summary

Tuesday’s premarket levels identified $671.75 as the bias pivot with targets at $672.75 and $675.75. SPY traded up to $672.99 intraday, tagging and stalling at the second target. Support was identified at $670 and $668.75, both of which held intraday. The premarket message suggested cautious continuation, and the actual session delivered exactly that: a muted grind into resistance and a modest fade to close.

Validation of the Analysis

The market structure aligned well with model projections. Support at $670 was tested and defended, and resistance at $672.75 acted as a ceiling. SPY traded well within the expected range, validating the roadmap and confirming the importance of key pivots. Traders who followed the model’s structure had multiple opportunities to execute intraday trades with confidence.

Looking Ahead

SPY’s projected range for Wednesday is $668 to $675, with potential upside toward $678 if earnings surprise to the upside. With Netflix reporting after Tuesday’s close and Tesla following on Wednesday, the setup is ripe for either a breakout continuation or a failed rally. Support remains at $670, $668, $665, and $660. Resistance stands at $673, $675, $678, and $680. Friday’s CPI remains a wildcard, and dealer positioning continues to lean slightly bullish but cautious.

Market Sentiment and Key Levels

SPY closed at $671.23, above all major support zones, reinforcing the bullish structure. The VIX dropped to 17.61, a new recent low, reflecting cooling volatility and reinforcing a risk-on environment. As long as SPY remains above $663, buyers are in control. A break below $660 would shift the tone, but until then, the bulls continue to dominate. Key zones to watch include $673–$675 on the upside and $668–$665 on the downside.

Expected Price Action

Expect more two-way action on Wednesday unless earnings from Netflix or Tesla ignite a strong directional move. SPY is likely to trade within Tuesday’s range initially, with breakouts or breakdowns dependent on earnings reactions. Above $675, bulls can target $678–$680. A move below $665 would be a warning sign for the uptrend. Choppy price action remains the base case, with opportunities at both edges of the range.

Trading Strategy

Remain patient and fade moves into resistance unless earnings create strong follow-through. Longs near $668–$670 remain viable, and shorts near $675–$678 are actionable with tight stops. Avoid chasing midday strength or weakness and let the roadmap and MSI guide decisions. Position sizing should remain moderate heading into major earnings and CPI.

Model’s Projected Range

SPY’s projected maximum range for Wednesday sits between $667 and $676.75, with the Call side dominating in a narrow band that suggests choppy price action interlaced with short bursts of trending movement. There is no scheduled economic data, but with earnings season in full swing and every headline from the White House sparking reactions, the market remains extremely sensitive to short-term news flow, so it’s essential to trade what you see and stay alert for key earnings like Netflix after the bell and Tesla Wednesday after the close. Today the market took a well-deserved breather from Monday’s breakout, closing flat at $671.29, comfortably above the $663 bull/bear control level. The bulls have resumed complete dominance, and as such, we anticipate new highs in the coming days. Below $663, SPY could again drift toward recent lows, but for the bears to have any realistic chance at reversing the longer-term trend, SPY must break last Friday’s low at $653; if that happens, $640 becomes the key level where bulls must make a decisive stand to avoid a confirmed bear market. The bulls continue to show resilience, buying dips after the open and maintaining prices above $670 all session. Even when the administration tweeted about China, the bulls used the weakness to add to longs. While macro risks remain high with the ongoing government shutdown and renewed tariff tensions, the bulls continue to shrug off these external threats and are putting capital to work to avoid missing a potential year-end rally. Continue to trade the market in front of you, not the one you expect. For Wednesday, resistance sits at $673, $675, $678, and $680, with support at $670, $668, $665, and $660, virtually identical to today, suggesting tomorrow may be a carbon copy unless a catalyst emerges. Above $675 lies a dense wall of resistance likely to cap gains near $678, while below $665 there’s little structural support to hold prices up. Since reclaiming $585, SPY has maintained a broad uptrend fueled by dip buyers despite recent volatility, though that structure has weakened modestly. Crypto was slightly higher today along with most Mag stocks, reinforcing the risk-on tone and continuation of the bullish uptrend. As we’ve emphasized for weeks, until persistent weakness emerges in key market leaders and crypto, the broader trend remains higher. Sustained softness in those areas could still trigger the 10–15% correction we’ve been forecasting into year-end. The bulls maintain complete control, and the bears remain sidelined unless price dips back below $663. The VIX fell 3.4% to 17.61, signaling an easing in volatility, and SPY closed mid-bull channel from the April lows, a structure that has softened slightly but continues to support the ongoing uptrend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing in the upper end of the range. Extended targets printed off and on in the premarket which led to the days’ push back toward the all-time highs. But the session was listless and the MSI rescaled to a very wide bullish state a few times which looked a lot like a ranging state. This very wide MSI implies more consolidation and sideways action likely tomorrow with a slight drift higher. Overnight the MSI held steady in the face of a pullback from yesterday’s close. As the dip was bought, the MSI rescaled higher and price moved to the highs of the day before pulling back on news out of the administration. For tomorrow the MSI is forecasting slightly higher prices with MSI support at $667.96 and with resistance at $672.93.

Key Levels and Market Movements:

On Monday we wrote, “the administration remains noisy, and the market continues to react sharply to every tweet or post out of the White House,” and noted, “after such a strong move off the lows, it’s time to take a step back and let price discovery unfold, especially since volume today was just average,” while also stating, “Overnight, the bulls want to defend $666, and if that level holds, the market is likely to push toward $675.” With this context, and with the MSI holding its bullish state overnight with a few scattered extended targets, we looked for a long setup in line with the prevailing trend. That opportunity came on a textbook failed breakdown at 10 a.m. to major support at $670, a key premarket level, so we entered long and set T1 at another premarket level, $671.75. With T1 achieved, price quickly pulled back to our entry, and for a moment we thought we might end up with a losing trade, but we held our conviction and set T2 at the next premarket level of $672.75. SPY reversed course once again, rallied, and reached our T2 just after noon. With both targets secured and price sitting right at major resistance without any extended targets above, we decided to fade $672.75, exiting the long and reversing short, expecting price to stall at that level given a developing failed breakout. We set T1 at $671.75 and, after a tweet about China from the White House, took profits and moved our stop to breakeven due to the countertrend nature of the trade. We then set T2 at $670, anticipating the day might remain confined to a $2 range. Price didn’t keep falling, and after a less-than-perfect failed breakdown we questioned holding the short much longer. A quick pop followed by a drop back to $671.10 convinced us to close the position and call it a day and we were glad we did, as the rest of the session was confined to a tight $1 range throughout the afternoon. Two for two once again, thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels, with the MSI continuing to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Wednesday has no scheduled economic news, yet the administration remains noisy, and the market continues to react sharply to every tweet or post out of the White House. While VIX dropped again today, it remains above 17, meaning price moves are still likely to be exaggerated. Today the market paused after yesterday’s breakout as the bull trend resumed and price discovery continued. Volume was below average, typical of a sideways consolidation day. The bulls remain firmly in control, and the next push higher will likely test the all-time highs. For the bears to even hint at participation, SPY must drop to at least $668 overnight; otherwise, the path of least resistance remains higher. External catalysts, positive or negative can still move markets abruptly, so it’s essential to trade what you see and stay flexible. With a close well above $663, the bulls clearly rule the tape, and with the MSI in a bullish state, the market will likely drift higher tomorrow. The projected range for Wednesday is narrow, implying continued consolidation and two-way trading. Failed breakouts and failed breakdowns remain the highest-probability setups in this type of environment. Overnight, the bulls want to defend $668, and if that level holds, the market is likely to push toward $675 or even $678, where resistance could lead to a pause or rejection. Should $668 fail, $663 comes into play, opening the door for the bears, though $640 remains the critical line that must hold to preserve the broader bull trend. The bears only gain full control on a decisive drop below $640. As always, trading failed moves remains one of the most reliable setups in this type of market. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

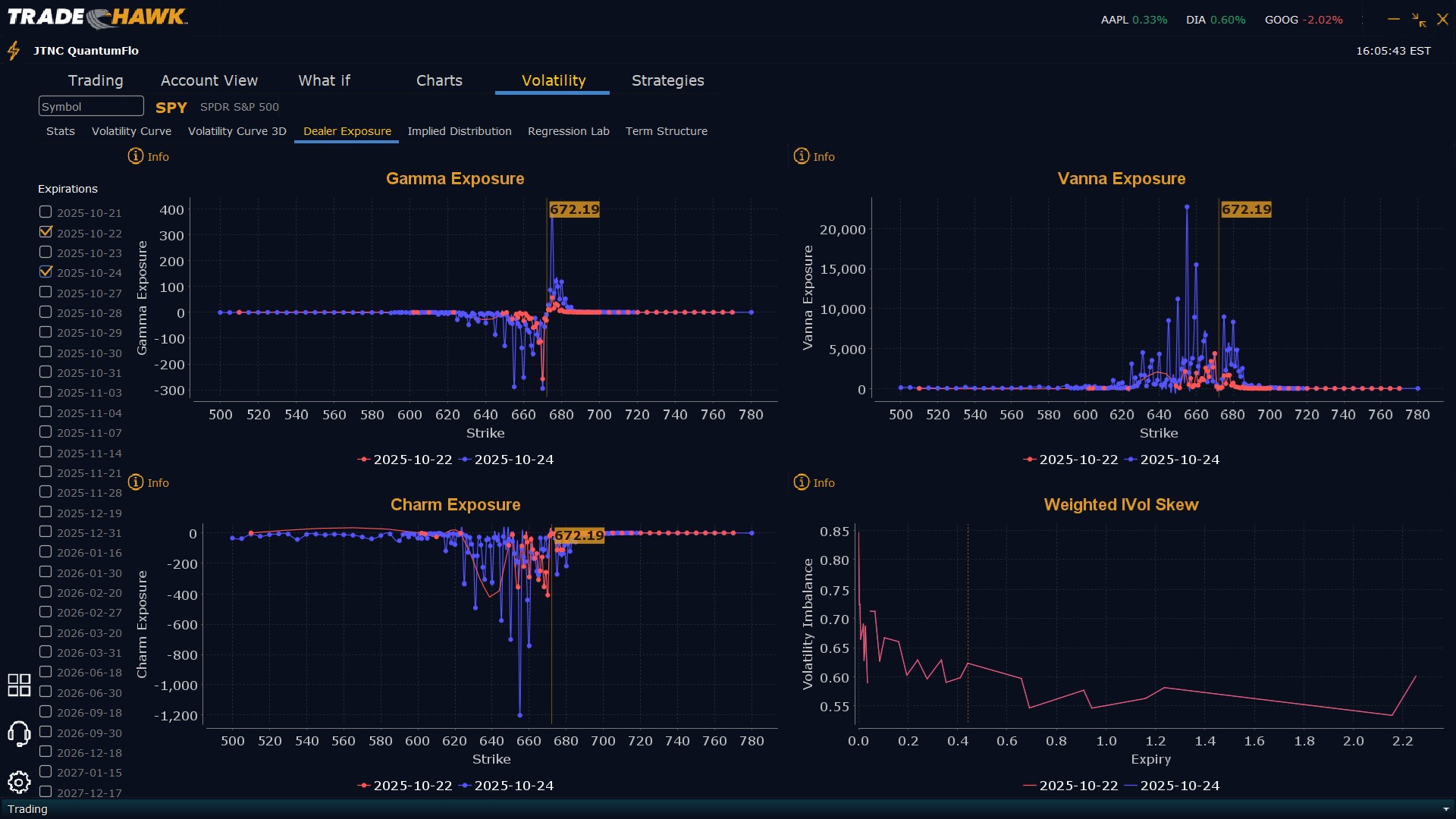

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $673 to $690 and higher strike Calls indicating the Dealers’ belief that prices may stall at current levels. Dealers are no longer selling ATM Puts. The ceiling for tomorrow appears to be $675. To the downside, Dealers are buying $672 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $673 to $690 and higher strike Calls indicating the Dealers’ belief that prices may pause at these levels or rise only slightly. The ceiling for the week appears to be $675. To the downside, Dealers are buying $672 to $540 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Stay tactical and trade the range. The bulls still have control above $663, but resistance is building near $675. Use the MSI and roadmap to guide intraday execution. Wait for strong setups and avoid chasing noise. This market rewards preparation, not prediction. Trade the levels and let the tape confirm your thesis.

Good luck and good trading!