Market Insights: Wednesday, October 1st, 2025

Market Overview

US stocks rallied to fresh records Wednesday as Wall Street shrugged off the first government shutdown in seven years and doubled down on bets that the Federal Reserve will cut interest rates this month. The S&P 500 rose 0.30% to close above 6,700 for the first time ever, while the Dow gained 0.09% to notch a second consecutive record close. The Nasdaq added 0.42%, reversing morning losses and finishing near its own all-time high. Wednesday’s move followed Tuesday’s strong Q3 finish and best September performance since 2010, with the market seemingly unfazed by mounting political dysfunction.

The shutdown, which officially began overnight, comes as President Trump’s latest wave of tariffs took effect, including 100% duties on pharmaceutical imports and 25% tariffs on heavy-duty trucks. Despite the economic risk, markets remain focused on monetary policy. Weak ADP employment data revealed a surprise loss of 32,000 private payrolls in September, compared to expectations for a gain of 50,000. The data sharply increased the probability of a Fed rate cut this month, with market pricing now showing a 99% chance of easing. Odds for a December cut jumped to 87%.

The Bureau of Labor Statistics, responsible for the official monthly jobs report, has shuttered operations as part of the shutdown, meaning Friday’s nonfarm payrolls release will be delayed. Economists warn the longer the shutdown persists, the greater the hit to growth, especially for sectors dependent on federal spending. President Trump vowed further “massive cuts” to government staffing, and markets will be watching closely as agencies activate contingency plans. Still, investor appetite for risk remains intact, with equity markets pressing higher and volatility indicators stable. Until evidence of real economic harm emerges, the bulls are in control.

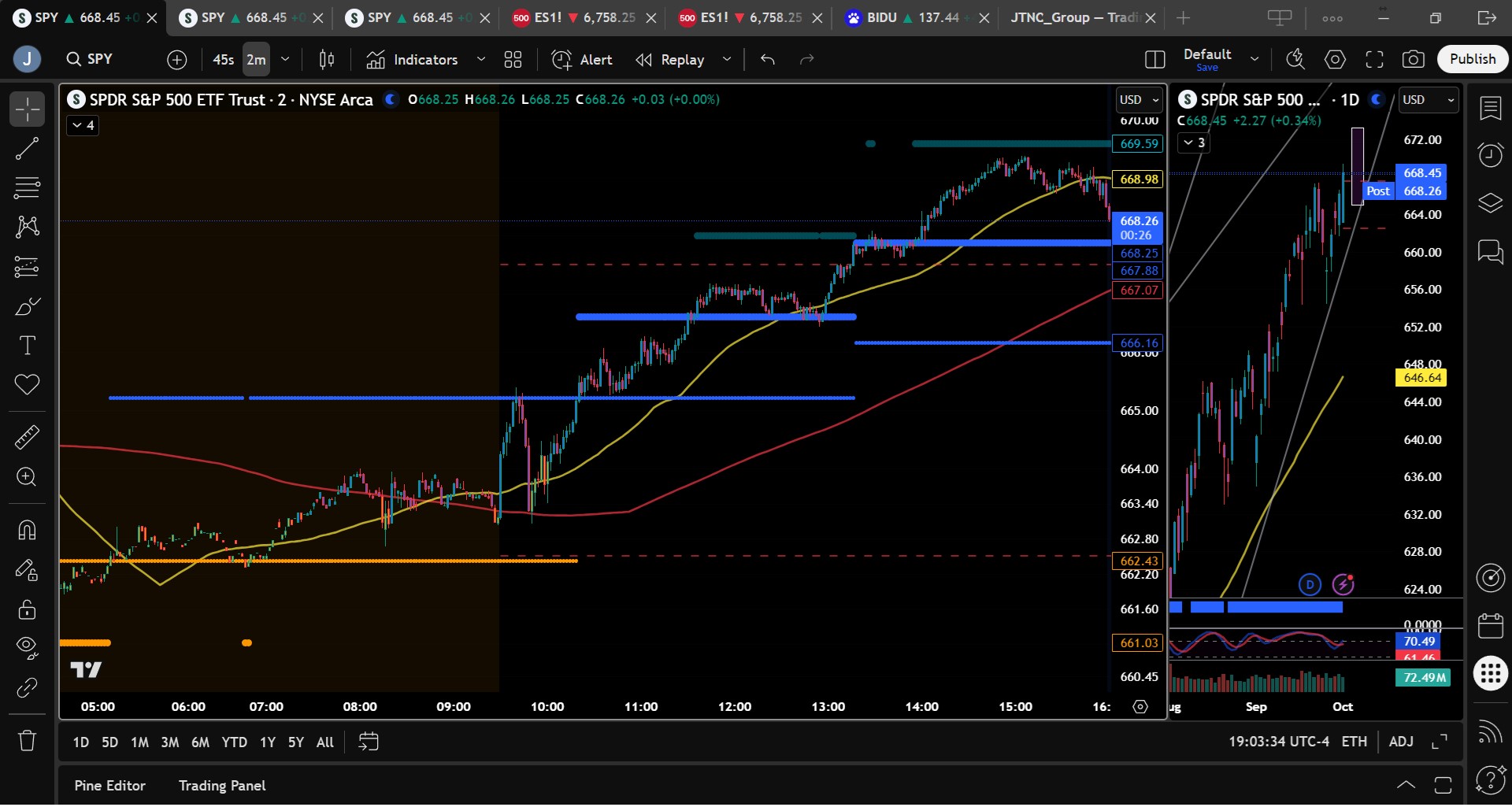

SPY Performance

SPY climbed 0.35% to close at $668.50 after opening at $663.20 and trading between $663.07 and $669.37. Volume totaled 66.11 million shares, near average but slightly lighter than Tuesday. SPY broke above key resistance at $668, confirming bull control with a strong push through prior highs. Buyers stepped in early at the $665 area and drove price steadily upward throughout the session, finishing just below the day’s peak. Though the breakout was orderly rather than explosive, it marked another leg higher in a market driven by dip buyers and rate cut optimism.

Major Indices Performance

The S&P 500 rose 0.30%, while the Nasdaq gained 0.42% and the Dow added 0.09%, marking its second consecutive record close. The Russell 2000 climbed 0.28%, continuing to lag slightly. Among the Magnificent Seven, five stocks closed higher, while Meta and Netflix fell. Meta declined 2.32% and Netflix lost 2.34%, the worst performers of the group. Despite weakness in select large caps, overall breadth remained solid as buyers remained active into quarter-end.

Notable Stock Movements

Meta and Netflix led the Mag Seven laggards with sharp losses, while Nvidia, Tesla, Apple, Microsoft, and Alphabet closed higher. The continued divergence among mega caps reflects growing investor selectivity, though rotation into strong names continues to support the broader indices. Energy stocks dipped as crude oil fell again, while gold miners posted further gains. Broad participation and strong technicals are keeping the uptrend intact for now.

Commodity and Cryptocurrency Updates

Crude oil declined another 0.59% to close at $62.00, continuing its downtrend toward our model’s long-standing $60 target. Gold advanced 0.47% to $3,891, notching another multi-month high amid demand for safe-haven assets. Bitcoin surged 2.41% to close above $117,300, extending its recent rebound. The crypto rally is lending further support to risk assets and reflects improving liquidity conditions.

Treasury Yield Information

The 10-year Treasury yield fell 1.08% to close at 4.103%. Though still elevated, the drop eased pressure on equities and bolstered rate cut bets following the weak ADP report. Yields remain the key watchpoint: above 4.5% pressures equities, above 4.8% triggers corrections, and above 5% risks a larger selloff. A decisive break of 5.2% would likely bring a 20% or more drawdown. For now, falling yields are supporting the rally.

Previous Day’s Forecast Analysis

Tuesday’s model projected a range between $657.25 and $668.25, with bullish setups favored above $663. The model flagged $667 as the ceiling, with $657 as strong support. Premarket notes expected consolidation and warned of resistance near $666.50 and $667.50. The roadmap suggested early chop with bullish grind higher if $664 was held.

Market Performance vs. Forecast

Wednesday’s session delivered exactly as forecasted. SPY opened at $663.20, dipped slightly to $663.07, and rallied the rest of the day, topping out at $669.37. Resistance near $667 was broken cleanly, confirming upside control. The premarket roadmap and model levels proved accurate once again, mapping out the structure of the session with remarkable precision.

Premarket Analysis Summary

The premarket report, issued at 8:12 AM, set $664 as the key bias level. Upside targets were $666.50 and $667.50, with support at $662.50, $660.50, and $657.50. The analysis predicted upward consolidation and favored early profit-taking on strength. The session unfolded in line with expectations as the market churned near support before lifting into the close.

Validation of the Analysis

The roadmap and MSI guidance worked perfectly again. SPY held the bias level early, respected the initial dip zones, and rallied to both upside targets. The breakout through $667 confirmed the roadmap’s call for a steady grind higher. The alignment between model, MSI, and premarket levels delivered another clear and actionable session.

Looking Ahead

Thursday features Unemployment Claims, but with the shutdown delaying key data releases, the market is likely to slow and consolidate recent gains. SPY sits firmly above key breakout levels, and buyers are still in control. A break above $673 could accelerate momentum, while a drop below $664 would suggest a pause. News around the shutdown remains a wildcard, and while markets are ignoring it for now, surprises could shift sentiment quickly.

Market Sentiment and Key Levels

SPY closed at $668.50, firmly above the $663 pivot and above near-term resistance. Resistance now lies at $669 and $673. Support levels sit at $664, $662, $660, and $658. Bulls remain in control as long as SPY holds above $663. A move below $657 would shift momentum and bring downside risk back into play. For now, the market’s bullish structure remains intact.

Expected Price Action

SPY’s projected range for Thursday is $665 to $673. The Call side is dominant, suggesting bullish lean, though the narrowing band points to chop with occasional momentum. With limited economic data and the shutdown ongoing, we expect a slower session, possibly a breather after recent strength. The rally through $668 was technically significant, but without heavy volume, bulls may struggle to extend gains much further without a catalyst. Watch $664 on the downside and $673 on the upside for directional clues.

Trading Strategy

Longs are favored above $664, with support buys at $662 or $660. Targets include $669 and $673. Shorts may be considered near $673 resistance or on a failed breakout. With the VIX rising just 0.06% to 16.29, market complacency remains high. Add protection to long books if not already done, and stay cautious with overnight positions. Volatility could return quickly, especially if shutdown fallout accelerates or jobs data surprises post-reopening.

Model’s Projected Range

SPY’s projected range for Thursday sits between $665 and $673.25, with the Call side dominating in a narrowing band that suggests choppy price action interlaced with periods of trending action. With only Unemployment Claims due tomorrow and likely delays in other government reports due to the current shutdown, the market is likely to take a breather and move more sideways as current macro risks unwind. Our hopes for a last-minute deal didn’t materialize, and in spite of the government shutting down, the market rallied to a new all-time high, closing at $668.43. This shutdown is more serious than others in the past, yet the market continues to be oblivious to these macro risks. This will not end well, and at some point the market will take these external threats into consideration and multiples will contract. But until we see signs of weakness, it’s higher and higher we go until the balloon pops. Overnight SPY once again retested the $661 level only to find buyers waiting. By the open, SPY was back to the prior day’s close, and after a quick dip at $665, it was off to the races the rest of the day, closing up 34 basis points and pressing toward $670, firmly above both the $660 breakout level and the $663 level where we noted bulls resume full control of the market. Volume was average, which doesn’t necessarily support today’s break to new highs. But a strong start to October and we are back to buying dips while being very careful fading any rallies. With the index well above the critical $645 threshold and dips consistently bought, bulls are likely to continue pushing the market to new highs. Bears are back sleeping as they need to move SPY below $655 to take back any near-term control. Should that level fail, the market likely drops to $650. Yet a decisive break of $640 is required to signal a true shift in the market and trigger our base case of a 10–15% pullback this year. For Thursday, resistance sits at $669 and $673, with support at $664, $662, $660, and $658. There is a massive wall of resistance above $669 all the way to $676 which may slow the current trajectory on Thursday. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Mag stocks were mostly higher today with only Netflix and Meta falling while the others rose. ETH has once again moved back above $4300, supporting the bull case. A sustained close below $4300 combined with weakness in Mag leaders would point to market softness. We continue to favor quick profit-taking and caution with overnight holds. The VIX rose 0.06% to 16.29, suggesting continued market strength. We still recommend adding protection to any long book. VIX below 23 supports the bullish case, but a breakout above it could finally trigger the long-anticipated pullback. SPY closed well above the redrawn lower bull trend channel from the April lows, reinforcing the bull trend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing above MSI resistance turned support. There were extended targets into the close which also printed for much of the day after 11 am. The MSI spent virtually all day in a bullish state after rescaling lower overnight. But the overnight dip to MSI support was once again bought so by the open, the MSI had rescaled to a ranging state and then to a bullish state into the close. For Thursday the MSI is implying further gains. MSI support is $667.89 and lower at $666.17.

Key Levels and Market Movements:

On Tuesday we wrote, “Be prepared to trade what you see,” and noted, “Absent an external shock, with a close above $663 the market skews to the bulls, and a move above $667 would likely result in new all-time highs,” while also stating, “Should $663 fail, however, the likelihood is that price once again tests $660.” With that context, and with the MSI rescaling lower overnight but back to a ranging state by the open, with price above $663 and the dip once again bought, we looked for a chance to go long to retest the all-time high. A quick dip at the open but a hold at $663 had us take a crack at a long on a triple bottom at this level, targeting $665.15 for our first target. That came quickly, and with the MSI rescaling higher, we set T2 at MSI resistance at $666.65 which was also hit before noon. At that point we had little to do but trail with a stop at breakeven. With a premarket high target of $667.50, we initially thought we would close the trade near this level. But with extended targets printing above and the MSI rescaling higher, we decided to let the trade run further. Before 3 pm price finally slowed, and after making a new high, our experience told us that every new high in recent days was sold. So on a double top, we exited our remaining position at $669.20 for a monster one-and-done trade, thanks once again to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday has Unemployment Claims and not much else, although news of a resolution to the shutdown would certainly be welcomed by the broader market. Absent an external shock, with a close above $668 the market heavily skews to the bulls. Today’s move was the result of a short squeeze and after a move like this, the market needs time to digest and consolidate, so it’s a good idea to pause and give the market the time it needs to build energy for the next leg. Generally we believe the market may consolidate or retrace, but given the strength we are going to be very careful fading any pushes higher, making failed breakouts especially useful in this instance. Overnight the bulls want to defend no lower than $661, and if it holds once again, the market will continue to make new highs. A break of $661 will likely lead to $655 and perhaps $650, though this remains a low-probability event. As such, watch price action tomorrow and look for the MSI to provide direction, with expectations for more two-way trading as we continue to buy dips at major support or short on weakness at or near $669 on a failed breakout, remembering that the bears come to life in scale only on a drop below $640. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $669 to $680 and higher strike Calls implying the Dealers belief that prices may stall at current levels on Thursday. The ceiling for Thursday appears to be $673. To the downside, Dealers are buying $668 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $669 to $690 and higher strike Calls implying the Dealers belief that prices may tread water near current levels. The ceiling for the week appears to be $672. To the downside, Dealers are buying $668 to $540 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a bearish to neutral outlook for the week. For the week Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $668.50, solidifying bull control. The next test is $673. With the shutdown in effect, macro volatility remains a threat. Trade level to level, respect MSI signals, and stay flexible. Protect gains, and prepare for sudden shifts in sentiment.

Good luck and good trading!