Market Insights: Friday, October 17th, 2025

Market Overview

Markets ended the week on a positive note Friday, reversing early-week losses as tensions over China cooled and investor fears around regional banks subsided. The S&P 500 rose 0.56%, while the Dow and Nasdaq both gained 0.52%, rounding out a volatile five-day stretch with modest wins. The rally followed comments from President Trump stating trade talks with China were “back on track,” easing worries that the standoff might escalate. Trump added that his planned meeting with Chinese President Xi would proceed, and that the previously threatened 100% tariffs were “not sustainable” for either side’s economy. Traders took the remarks as a sign of potential détente, helping fuel risk appetite into the close.

Regional banks, which had come under sharp pressure earlier in the week, staged a recovery after Truist Financial, Huntington Bancshares, and Fifth Third Bancorp all posted better-than-expected earnings. Their upbeat reports helped counter Thursday’s loan fraud concerns that rattled the sector and reignited fears about credit quality following comments from JPMorgan CEO Jamie Dimon referencing “cockroaches in the system.” Although gold retreated on Friday, falling 1.43% to $4,243, it still posted its best weekly performance since 2020, highlighting continued investor interest in defensive positioning. With the federal government shutdown still unresolved and heading into its fourth week now tied for the third longest in U.S. history, concerns are mounting about the broader economic implications. Lawmakers are warning the impasse could stretch into November or beyond, delaying paychecks and economic data, and leaving markets more vulnerable to headlines.

SPY Performance

SPY opened at $659.38 and traded in a tight yet dynamic range before closing at $664.36, up 0.56% on volume of 86.28 million shares, which was above average. The ETF rallied steadily during the morning session, reaching a high of $665.76 before pulling back slightly in the afternoon. Support at $658.14 was tested early and held firm, suggesting the bulls remain in control of the lower end of the trading range. The close above the key $663 level is a subtle but notable shift in short-term market sentiment, and with the VIX retreating sharply, the bulls may have enough momentum to retest higher resistance levels heading into earnings season.

Major Indices Performance

All three major indices closed higher Friday, each gaining approximately 0.5% and securing weekly advances despite the roller-coaster price action earlier in the week. The Russell 2000 underperformed, falling 0.66%, continuing a trend of divergence from large-cap strength. The back-and-forth action reflected a market searching for direction amid an absence of macroeconomic data due to the shutdown. Earnings and geopolitical headlines have taken center stage, and investors are beginning to reposition for upcoming reports from tech giants.

Notable Stock Movements

It was a broadly green day for the Magnificent Seven, with all names closing higher except Amazon, which fell 0.67%. Nvidia led gains as AI enthusiasm resurfaced following a strong print from TSMC. Apple, Tesla, Alphabet, Meta, and Microsoft all posted modest gains, lending strength to the broader Nasdaq. Regional banks bounced back sharply on the heels of upbeat earnings from several mid-tier lenders, while the prior session’s fears surrounding fraud-linked loan disclosures receded. In the commodity space, gold miners underperformed as the metal pulled back from highs, while oil stocks stabilized alongside a modest uptick in crude.

Commodity and Cryptocurrency Updates

Crude oil rose 0.33% to $57.65, continuing its climb after reclaiming the long-watched $60 level earlier in the week. Our model has been forecasting a move toward $60 for several months, and now that it has broken that level, downside continuation toward $50 remains a possibility. Gold fell 1.43% to $4,243 but still logged its best weekly gain in five years. Bitcoin slipped another 1.26%, closing just above $106,400, as crypto continues to track broader risk sentiment with increasing sensitivity. The recent weakness in crypto may also reflect waning liquidity and risk tolerance as macro volatility persists.

Treasury Yield Information

The 10-year Treasury yield rose 0.78% to close at 4.006%, bouncing slightly after dipping below the 4% threshold midweek. While this move back above 4% remains within a tolerable range for equities, it reinforces the idea that rates remain on edge. Market participants continue to monitor key yield levels closely. Any push above 4.5% could begin to exert downward pressure on equities, with more serious damage likely above 4.8%. At 5%, risk assets become vulnerable to sharp repricing, and at 5.2%, we would expect a correction of 20% or more across equity markets.

Previous Day’s Forecast Analysis

Friday’s model called for SPY to move within a range of $647 to $672.25, with the bulls needing to reclaim $664 to regain short-term control. SPY opened at $659.38, tested lower to $658.14, and then climbed steadily to a high of $665.76 before closing at $664.36. The action respected all key model levels, particularly $664, which was identified as the new dividing line. The forecast warned of a fragile rally, and that proved accurate, with bulls defending early support before grinding higher. The bounce off the lows, combined with the hold above bias level, played out as projected.

Market Performance vs. Forecast

Once again, SPY stayed within the model’s expected range and respected both directional pivots. The recovery from $658 toward $664 and beyond aligned with the roadmap’s expectations of two-way trading followed by late-session strength. The upward momentum into the close validated the bullish bias above $660.75, and SPY’s ability to stay above $664 hints that bulls have the upper hand—at least for now. Traders who aligned with the model’s levels and timing windows had clear opportunities for execution.

Premarket Analysis Summary

Friday’s premarket forecast set the tone with a cautious view, citing fragile momentum despite early strength. The key bias level at $660.75 was identified as pivotal. SPY rose above this level after the open, triggering the expected push toward $664.25 and eventually $667.70. However, price stalled just shy of the latter target, peaking at $665.76. The downside path below bias was not explored after price reclaimed and held above the pivot, confirming the premarket note’s emphasis on cautious optimism and fast profit-taking if levels were tested.

Validation of the Analysis

Friday’s trading validated the roadmap precisely. SPY’s rally from just above $658 to near $666 aligned with model expectations, while the failure to reach $667.70 affirmed the importance of scaling out and protecting profits near upper targets. Traders who followed the MSI and roadmap had a clean day of setups. The close above $664, after defending lower support early, marked a transition back to bull control and highlighted how accurately the tools continue to map the market’s evolving structure.

Looking Ahead

SPY’s projected range for Monday is $655 to $672. The upward tilt remains, but the range has widened again as headline risk and earnings season heat up. Key resistance levels include $665, $667, $670, and $675, with support at $660, $655, $650, and $647. A break below $647 puts the $640 level in focus, where bulls must hold firm to prevent a structural breakdown. The market remains sensitive to short-term news flow, and while Friday’s close above $663 is encouraging, the inside-day formation signals indecision and the potential for more choppy two-way action.

Market Sentiment and Key Levels

With SPY closing at $664.36, bulls have reclaimed the dividing line from bears, but just barely. The move above $664 gives the bulls a slight edge heading into Monday, especially after defending the lower range on Friday. However, any failure to hold $660 early could lead to another test of $655 and below. Friday’s price action suggests a pause rather than a trend reversal. The VIX’s 17.90% drop to 20.78 confirms improved risk appetite, but we remain alert for renewed volatility if macro headlines intensify.

Expected Price Action

Two-way trading remains the base case. SPY is likely to test the lower part of its range early Monday before any sustained push higher. Bulls must continue to defend $660, while bears will look to trap any weak rallies below $667. A decisive move above $670 would signal a breakout attempt, while a breakdown below $647 could trigger a swift retest of $640. The trend remains up, but it is losing momentum. Until either edge is broken decisively, fade-the-range remains the best approach.

Trading Strategy

The game plan for Monday is to stay nimble, reduce size, and wait for price to approach either extreme. Longs near $653–$655 are viable if bulls defend the zone, with exits near $664–$667. Shorts become attractive above $670 if resistance holds. Avoid the middle chop. This is a market of extremes and false breakouts, so patience and discipline are critical. Let the MSI and key levels guide entries and exits.

Model’s Projected Range

SPY’s projected maximum range for Monday sits between $653 and $675.50, with the Call side dominating in a steady but wide band that suggests trending price action interlaced with periods of chop. There is no scheduled economic data on Monday, but with earnings season underway and every headline from the White House sparking reactions, the market remains highly sensitive to short-term news flow, so it’s essential to trade what you see. Today was yet another big up, big down, big confusion session, with SPY testing both the prior day’s lows and pushing toward the highs in the afternoon session before closing up 0.57% at $664.39, once again above the critical $663 level that defines bull control. The question remains whether the bottom is in or if the bulls still have work to do to end the recent weakness. The market’s wild swings and sharp reversals continue to reflect a struggle for direction, with algorithms driving volatility and quickly flipping positions, creating traps for all but the most nimble traders. This remains a time to reduce position size and focus on trading the edges of the range rather than the middle where whipsaws are common. The range still appears to be between $658 and $670, with $664 emerging as the dividing line; above this level, bulls are likely to drive prices higher, while below it, SPY could once again drift toward recent lows. If the market breaks last Friday’s lows, $640 becomes the key level where bulls must make a decisive stand to avoid a formal shift into a bear market. Once again, however, the bulls showed resilience, aggressively buying the overnight dip to $652 and pushing price back above $663. The “inside day” formation suggests a pause in momentum as neither side showed conviction, and with big up followed by big down, the result is big confusion and likely more sideways trading. Yet sideways movement builds energy for a breakout, and with the longer-term trend still up, that breakout typically favors the upside. SPY held above the prior day’s low, and with price still above the $640 “line in the sand,” the bulls remain in the fight. It remains likely on Monday that SPY will test lower levels again before breaking out of this range, so expect two-way trading that favors fading the extremes, with the bulls holding a slight edge. Macro risks remain high with the ongoing government shutdown and renewed tariff tensions, so continue to trade the market that’s in front of you, not the one you expect. For Monday, resistance sits at $665, $667, $670, and $675, with support at $660, $655, $650, and $647. Above $670 lies a dense wall of resistance likely to cap gains, while below $647 there’s little structural support until $640. Since reclaiming $585, SPY has maintained a broad uptrend fueled by dip buyers despite recent turbulence, though that trend continues to weaken. Crypto fell again today while most Mag stocks finished higher, reflecting the same mixed signals and confusion characteristic of a range-bound market. As we’ve emphasized for weeks, until persistent weakness emerges in key market leaders, the broader trend remains higher, but sustained softness in those names could trigger the 10–15% correction we’ve been forecasting into year-end. The bulls still technically maintain control, but they’ve opened the door for the bears, and should SPY fall to $640, it will be decision time for whether the bull market’s run is over. The VIX fell 17.90% to 20.78, signaling a slight easing in volatility, and as noted yesterday, “a move toward 30 may represent a fade point and potential short-term exhaustion in volatility,” which indeed played out with the market rallying hard off the lows as VIX reached 28.99. SPY closed near the lower end of the redrawn bull trend channel from the April lows, a structure that has weakened with each redraw. A break and close below the lower trend line near $655 would likely force the model to redraw the trend as a bear channel, signaling a formal shift in market structure.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing mid-range. There were no extended targets all day except very briefly late in the afternoon. Overnight the MSI rescaled sharply lower which saw SPY gap down only to find buyers at $652, reversing price well before the open. By the open the MSI had rescaled to a wide ranging state which indicates a sideways market. The MSI stayed in this state until 2 pm when it began a series of rescalings higher to end the day in a bullish state. For Monday the MSI is forecasting slightly higher prices and some follow through to the afternoon rally. But without extended targets above, the rally may be limited. Instead we forecast more two-way trading. MSI support is $662.58 with resistance at $665.76.

Key Levels and Market Movements:

On Thursday we wrote, “Friday has no scheduled economic news but it is OPEX, which is likely to add to this week’s volatility. With VIX above 25, market moves are expected to be exaggerated,” and noted, “With the MSI in a ranging state, the market will likely test both sides of the wide range as it seeks direction, and any external catalyst could quickly shift sentiment,” while also stating, “Overnight, the bulls want to defend $658, and if that level holds, the market is likely to test the day’s highs near $669. Should $658 fail, $654 comes into play.” With this context, and with the MSI rescaling lower overnight but settling into a ranging state by the open, there was little for us to trade since we typically avoid trading when the MSI is in this condition. However, a weak failed breakout at 10 a.m. presented an opportunity, so we entered short at $663.75 with a first target at the premarket report level of $660.75. With T1 achieved, we set T2 at another premarket level at $657.75. SPY came close to reaching our second target but didn’t quite get there, and with the MSI still in a ranging state, large intraday swings off the overnight lows, and OPEX adding to the noise, we decided to exit early, closing our short at $659 and calling it a day—locking in solid profits while avoiding unnecessary exposure in an unpredictable environment. One and done by 11 am which capped off an extremely strong week thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Monday has no scheduled economic news, but the administration remains noisy, and as such, the market is reacting sharply to every tweet or post out of the White House. While VIX dropped hard today, it remains above 20, meaning market moves are still likely to be exaggerated. Markets remain on edge following recent tariff and China headlines, along with other macro risks, making it essential to trade what you see. With a close above $663, the bulls once again hold a slight advantage heading into Monday. With the MSI in a bullish state, the market will likely attempt to move higher but may also test the day session lows as it searches for direction. Any external catalyst could quickly shift sentiment, so remain flexible and monitor the MSI closely for directional cues. The projected range for Monday is wide, and aligning with the MSI trend and staying with it remains the best approach to capture gains. Failed breakouts and failed breakdowns continue to offer the highest-probability setups in this environment. Overnight, the bulls want to defend $658, and if that level holds, the market is likely to move toward $670. Should $658 fail, $653 comes into play, with $640 serving as the critical line that must hold to preserve the broader bull trend. A break above $670 would likely lead to new all-time highs, though we view this as a low-probability event for Monday. The bears only gain full control on a decisive drop below $640. As always, trading failed moves remains one of the most reliable setups in this type of market. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

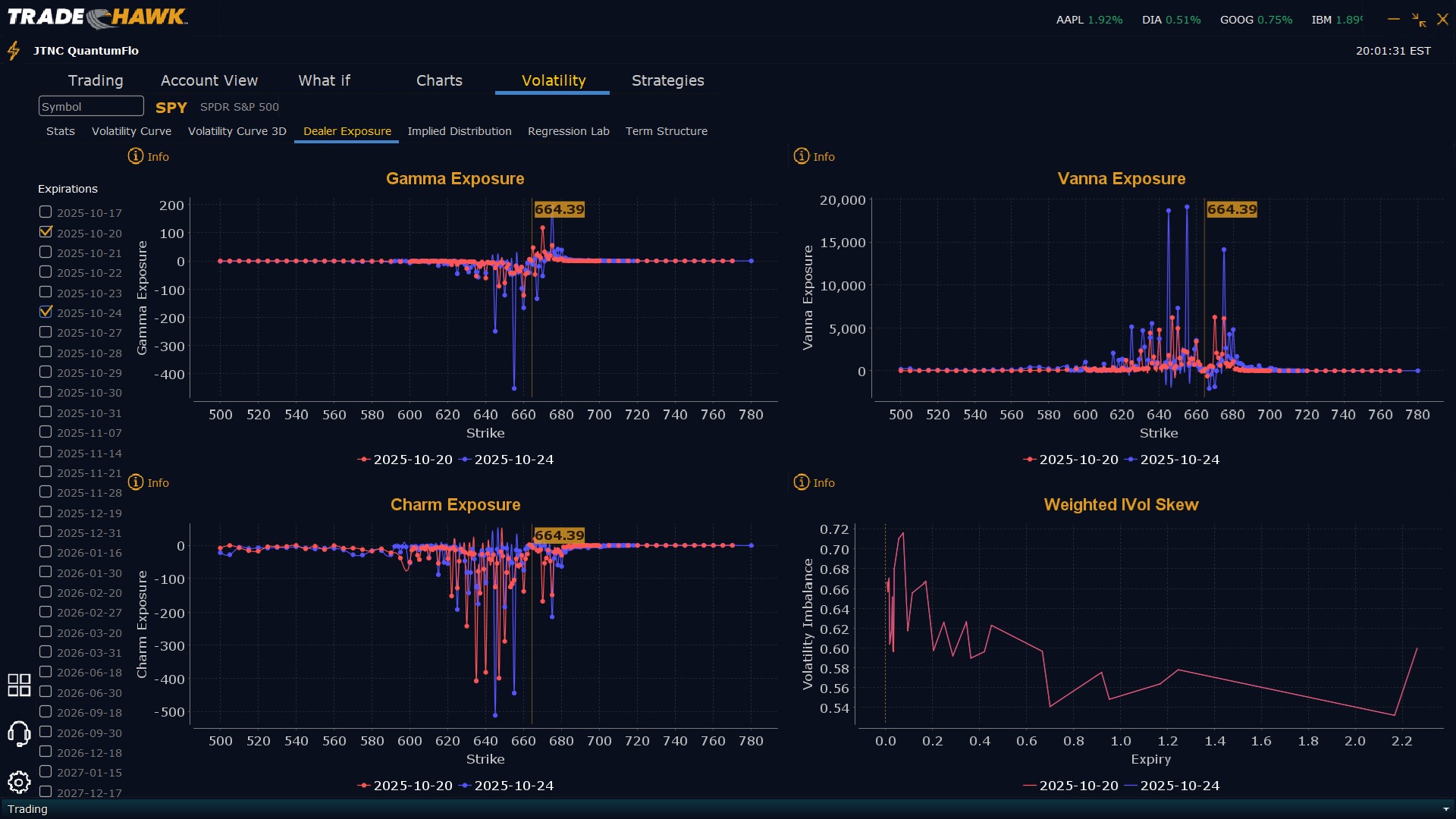

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $667 to $690 and higher strike Calls while also buying $665 and $666 Calls indicating the Dealers’ desire to participate in any continuation of the rally on Monday. The ceiling for Monday appears to be $675. To the downside, Dealers are buying $664 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower on Monday. Dealer positioning has changed from bearish to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $671 to $690 and higher strike Calls while also buying $665 to $670 Calls indicating the Dealers’ desire to participate in any rally next week. The ceiling for the week appears to be $675, which looks extremely difficult to overcome. To the downside, Dealers are buying $664 to $540 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week but less so. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY remains in a fragile uptrend. With Friday’s close above $664, bulls have a slight advantage, but bears are still in the game. Fade the extremes, trade with discipline, and use the MSI and roadmap levels to stay aligned with real-time market conditions. The trend is weakening, and volatility is rising. This market will reward execution, not prediction.

Good luck and good trading!