Market Insights: Wednesday, October 15th, 2025

Market Overview

Markets fought through another volatile session Thursday, buoyed by strong bank earnings and dovish commentary from the Fed but weighed down by persistent US-China trade tensions. The S&P 500 rose 0.43%, while the Nasdaq led gains with a 0.66% advance. The Dow edged lower by 0.04%, erasing earlier gains as investor optimism faded into the close. The day began with a strong tone following earnings from Bank of America and Morgan Stanley, both of which posted double-digit profit increases driven by robust dealmaking activity. Bank of America’s 23% profit surge and Morgan Stanley’s 45% gain helped fuel early bullish sentiment, especially after the Fed’s Jerome Powell noted that downside risks to employment have risen—a signal interpreted by markets as an opening for rate cuts.

Despite the positive earnings and Fed messaging, tensions with China remain an overhang. President Trump’s renewed threat of an embargo on Chinese cooking oil, in retaliation for Beijing’s soybean snub, escalated fears of another trade standoff. Meanwhile, China’s fresh sanctions on five U.S.-linked Korean shipping subsidiaries and new port fees on American vessels kept geopolitical anxiety elevated. Treasury Secretary Scott Bessent attempted to ease concerns by confirming Trump still plans to meet Xi Jinping this month, while also hinting at a possible tariff pause extension. However, the ongoing government shutdown continues to disrupt data releases, forcing investors to rely on Fed guidance and corporate reports to assess market health.

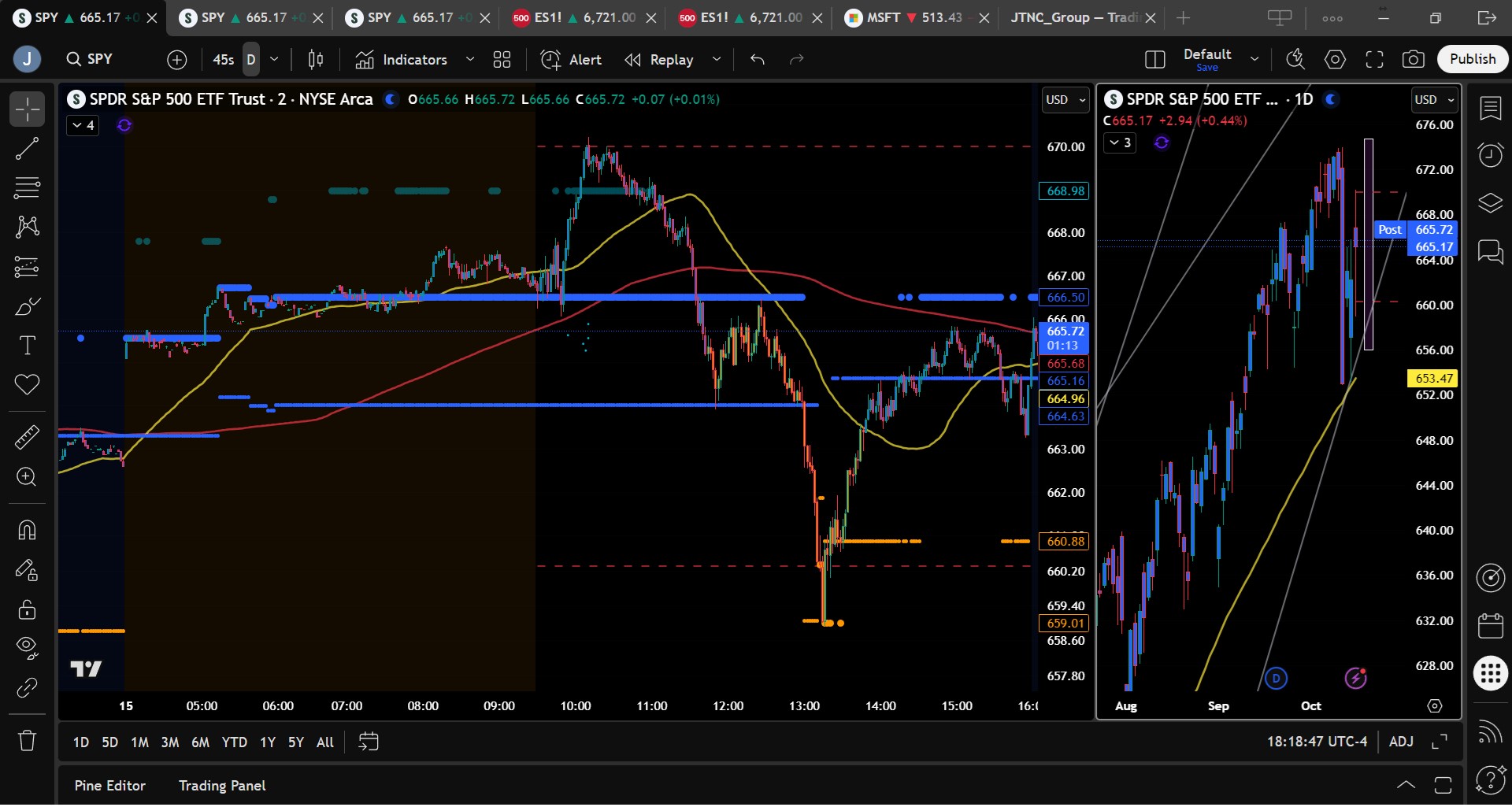

The intraday tone was choppy, with early strength giving way to a sharp pullback before another late-session rebound. SPY briefly hit $670.23 before reversing hard to test major support at $659. After bouncing off the lows, the ETF closed at $665.09, up 0.43% on the day. While bulls successfully defended key support levels, the continued inability to hold intraday highs reflects a market struggling for direction. With volatility elevated and no clear macro data on the calendar, traders continue to lean heavily on earnings, technicals, and geopolitical headlines to guide positioning into week’s end.

SPY Performance

SPY closed at $665.09, up 0.43% after opening at $666.71 and climbing to an intraday high of $670.23 before reversing sharply to test a low of $658.95. Volume came in at 76.88 million, about average, reflecting steady interest amid back-and-forth action. The close above $664 keeps the bulls in the game, though the late-session weakness tempered early optimism. SPY remains locked in a wide range between $658 and $670, with $666 emerging as the new short-term pivot.

Major Indices Performance

The Nasdaq led the way with a 0.66% gain, supported by strength in tech and a mostly green showing among the Magnificent Seven. The S&P 500 climbed 0.43%, while the Dow lost 0.04% as profit-taking hit cyclicals and financials. The Russell 2000 outperformed again, rising 0.89% and suggesting a growing appetite for small-cap exposure despite the uncertain macro environment.

Notable Stock Movements

The Magnificent Seven delivered a mixed performance Thursday, with most names closing green except Amazon, Nvidia, and Netflix. Netflix lagged the group, down nearly 1%, while Microsoft and Alphabet led gains. AMD held firm after Wednesday’s AI chip deal with Oracle, while financials saw early strength fade as the session wore on. The sector remains in focus with more major banks reporting this week. Crypto-related equities dipped in line with broader weakness in digital assets, adding a layer of caution.

Commodity and Cryptocurrency Updates

Crude oil slipped 0.36% to close at $58.49, continuing its break below the key $60 threshold. Our model continues to forecast a potential move down toward $50. Gold surged 1.52% to $4,226, reflecting ongoing demand for safe havens amid geopolitical stress. Bitcoin fell 1.38%, closing just above $111,400, while Ethereum also declined. The risk-off tone in crypto highlights fragility beneath the surface of the equity rally.

Treasury Yield Information

The 10-year Treasury yield edged up 0.40% to close at 4.041%, still well below danger territory but inching toward key levels that could weigh on equities. Market consensus remains that anything above 4.5% would start to strain risk assets, with levels beyond 5% likely to trigger a major correction. For now, yields remain rangebound and supportive of continued equity strength—though risks remain elevated.

Previous Day’s Forecast Analysis

Wednesday’s model expected a range between $654 and $669.25, with $660 as a magnet and two-way action likely. SPY opened at $666.71, pushed briefly to $670.23, and then sold off sharply to test $658.95 before recovering into the close. This action validated the expectation for whipsaw movement and range-bound trading, with the shift in the dividing line from $663 to $666 emerging as a key development during the session.

Market Performance vs. Forecast

Thursday’s trading perfectly tracked the projected range, with the upper level of $670.23 tested early and the lower level of $658.95 respected as support. The warning that the bulls might not yet have full control proved prescient as the market reversed midday despite a strong open. SPY closed slightly below the new pivot at $666, reinforcing the need for bulls to reclaim that level to resume the uptrend.

Premarket Analysis Summary

Thursday morning’s 7:18 AM premarket update warned of a potential stall in upside momentum near $667.30, with downside targets at $664.80, $663.30, and $660.30. Price respected each of these zones as SPY first pushed above bias before reversing sharply. The premarket note favored short entries on upper target rejections, a strategy that paid off mid-session. Ultimately, the forecast correctly anticipated a range-bound day with a bearish tilt into support.

Validation of the Analysis

The roadmap’s emphasis on fading range extremes once again proved valuable. The model identified $667.30 as a ceiling, which held despite a brief overshoot, and highlighted $659–$660 as a likely support zone. Price action confirmed these levels as the market chopped between them. SPY continues to test key levels with precision, allowing for structured entries and exits even in a headline-driven environment.

Looking Ahead

SPY’s projected maximum range for Friday is $656 to $674.75. Thursday’s action, while technically bullish on the surface, masked underlying indecision. A close above $666 would give bulls clear control, while a move below $660 could lead to another test of $640. The market remains vulnerable to external shocks, particularly in the absence of scheduled economic data due to the shutdown. Traders should continue to fade the range until a breakout confirms new directional momentum.

Market Sentiment and Key Levels

Thursday’s close at $665.09 puts SPY just below the new dividing line at $666. Resistance sits at $666, $669, $670, and $672, with support at $662, $660, $658, and $654. Above $670 lies a dense resistance band likely to limit gains without a fresh catalyst. Below $654, structural support thins quickly toward $640. Despite recent volatility, SPY remains in an uptrend above $640, but momentum has slowed. Crypto weakness and mixed Mag stock leadership continue to raise caution flags.

Expected Price Action

The model expects SPY to trade between $656 and $674.75 on Friday. Thursday’s “big up, big down” pattern adds to overall market confusion, and until SPY can decisively break above $670 or below $654, choppy two-way trading remains likely. A close above $666 would shift control back to bulls, while a breakdown below $660 could confirm the beginning of a deeper pullback. Until then, the broader trend remains constructive, if fragile.

Trading Strategy

Friday favors tactical execution with a focus on fading extreme moves near $656 and $670. Longs above $666 targeting $669–$674 are valid, while shorts below $660 targeting $654–$650 are favored if price confirms. The lack of economic news makes headlines the primary risk driver. Maintain tight stops, align with the model and MSI, and continue fading emotional moves until a clear breakout establishes trend direction.

Model’s Projected Range

SPY’s projected maximum range for Thursday sits between $656 and $674.75, with the Call side dominating in an expanding band that suggests trending price action interlaced with periods of chop. There is no scheduled economic data, but earnings season has begun, which could shape short-term direction. Today continued yesterday’s relief rally, followed by a sharp selloff to major support at $659, only for the market to reverse once again and close up just 44 basis points at $665.17. Another big up, big down day equals big confusion, and we expect more of the same until the market finally breaks out of its current range. The question remains whether the bottom is truly in or if the bulls still have work to do before ending the recent weakness. We don’t have a strong directional bias for Thursday as there’s simply too much back-and-forth for the model to pick a clear path. As such, traders need to stay flexible and trade what they see. The range appears to sit between $658 and $670, with $666 emerging as the new dividing line. Above this level, bulls are likely to drive prices higher, while below it, price could once again move toward recent lows. $663 has served as the dividing line for some time, but as the market evolves, this key level is shifting higher. Currently, the bulls need a close above $666 to regain full control and push toward all-time highs, while a break below $660 would likely lead to another leg lower, potentially testing $640 where the bulls must make a stand. Once again, the bulls bought the dip and continue to build on that momentum. With price still well above the $640 “line in the sand,” the bulls remain in the game and will defend lower levels aggressively. Though it was a red day, today’s close was higher than the prior session’s, signaling that the bulls are slowly making progress, just not in a straight line. It remains likely that SPY will test lower levels again before breaking out of this range, so expect two-way trading on Thursday that favors fading moves at the range extremes. Macro risks remain high with the ongoing government shutdown and renewed tariff tensions, so continue to trade the market in front of you. As we’ve repeated for weeks, until persistent weakness emerges, the broader trend remains higher, and one or two down days do not make a bear market. For Thursday, resistance sits at $666, $669, $670, and $672, with support at $662, $660, $658, and $654. Above $670 lies a heavy wall of resistance that will likely limit gains, while below $654 there’s little structural support. Since reclaiming $585, SPY has maintained a steady uptrend fueled by dip buyers despite recent turbulence. Crypto fell today, while Mag stocks were mostly higher but mixed overall. Continued weakness in these leaders could help trigger the 10–15% correction we’ve been forecasting into year-end. The bulls still hold the advantage, but the picture is less clear, and any external shock could quickly hand control back to the bears. The VIX fell 0.82% to 20.64, signaling lingering volatility. A VIX below 23 supports the bullish case, but a sustained breakout above that level could finally ignite the long-anticipated correction. SPY has now closed three straight sessions below the lower bull trend channel from the April lows, and today the model redrew that channel to encompass the recent lows. While this weakens the bull trend channel, the prior slope was too steep to be sustainable. A mild weakening of the channel does not yet signal a bear market. It simply reflects a topping process, which can last for weeks or even months while price still moves higher. For now, until major support levels break, the broader bias remains bullish.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing at mid-range. There were no extended targets at the close but some early in the session as SPY tested $670. Overnight the MSI rescaled from a ranging state to a bullish state and printed extended targets above which saw SPY rally overnight and early in the day session. But that didn’t last long as SPY sold off and the MSI rescaled lower to a relatively narrow Bearish Trending Market State and without extended targets, this state contained price until 1 pm when SPY reversed hard off MSI support. The MSI then rescaled to a ranging and then to its current bullish state. For tomorrow the MSI is forecasting some follow-through to the bounce off the day’s lows with price possibly testing the day’s highs at $670. MSI resistance is $666.50 with support at $664.63.

Key Levels and Market Movements:

On Wednesday we wrote, “Markets remain on edge following the recent tariff and China headlines, making it essential to trade what you see,” and noted, “With a close just below $663, the bulls have regained control, but only slightly,” while also stating, “The market will likely move both higher and lower on Wednesday, testing each side of the range.” With this context, and with the MSI rescaling overnight to a bullish state and extended targets printing above, we looked for an early long entry to test higher levels. While we don’t normally trade MSI resistance turned support, the fact that this level held throughout the premarket and extended targets were still above gave us confidence to take the setup. We entered long on a test of MSI support at $666.65 and set T1 at the premarket level of $670. SPY ripped higher, and T1 was reached quickly. With no additional upside levels identified in the premarket report, we decided to take partial profits again at $670 for T2 and move our stop to breakeven, trailing only 10% of our position to protect gains. A less-than-perfect failed breakout tempted us to short, but with extended targets still printing, we stayed disciplined and avoided fading the move. We exited the remainder of our position and waited for a clearer opportunity. SPY later fell sharply, reaching MSI support at $664.08, where we went long again, setting T1 at MSI resistance at $666.50. With T1 achieved but momentum fading, we moved our stop to breakeven as we shifted into profit protection mode. Sure enough, the market sold off quickly, and we were stopped out of 30% of the position at breakeven. As prices continued to fall, we considered a short, but with the MSI in a ranging state, we waited for a better setup. That came at 1:12 p.m. with a textbook failed breakdown to premarket support, prompting a new long entry at $660.20. This trade worked beautifully. We set T1 at the premarket level of $663.30 and T2 at MSI resistance at $664.70, both of which hit quickly. With profits locked in, we moved our stop to breakeven and trailed the final 10%. When SPY formed a double top at $665.50, we took the cue to close our position and lock in gains. Two for two with a small bonus third trade, made for another solid day, thanks once again to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday has no scheduled economic news, yet markets remain on edge following recent tariff and China headlines, making it essential to trade what you see. With a close just above $665, the bulls have regained control—but only marginally. With the MSI in a narrow bullish state, the market will likely attempt to build on today’s bounce off the lows. However, SPY may still move both higher and lower, testing each side of the range unless an external catalyst shifts sentiment. As such, remain flexible and monitor the MSI closely for directional cues. The projected range for Thursday is wide, so aligning with the MSI trend and staying with it remains the best approach to capture gains. Failed breakouts and failed breakdowns continue to offer the highest-probability setups in this environment. Overnight, the bulls want to defend $660, and if that level holds, the market is likely to test the day’s highs near $670. Should $660 fail, support at $658 and possibly $654 comes into play, with $640 serving as the critical line that must hold to preserve the broader bull trend. A break above $670 would likely lead to new all-time highs, while the bears only gain full control on a decisive drop below $640. As always, trading failed moves remains one of the most reliable setups in this type of market. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

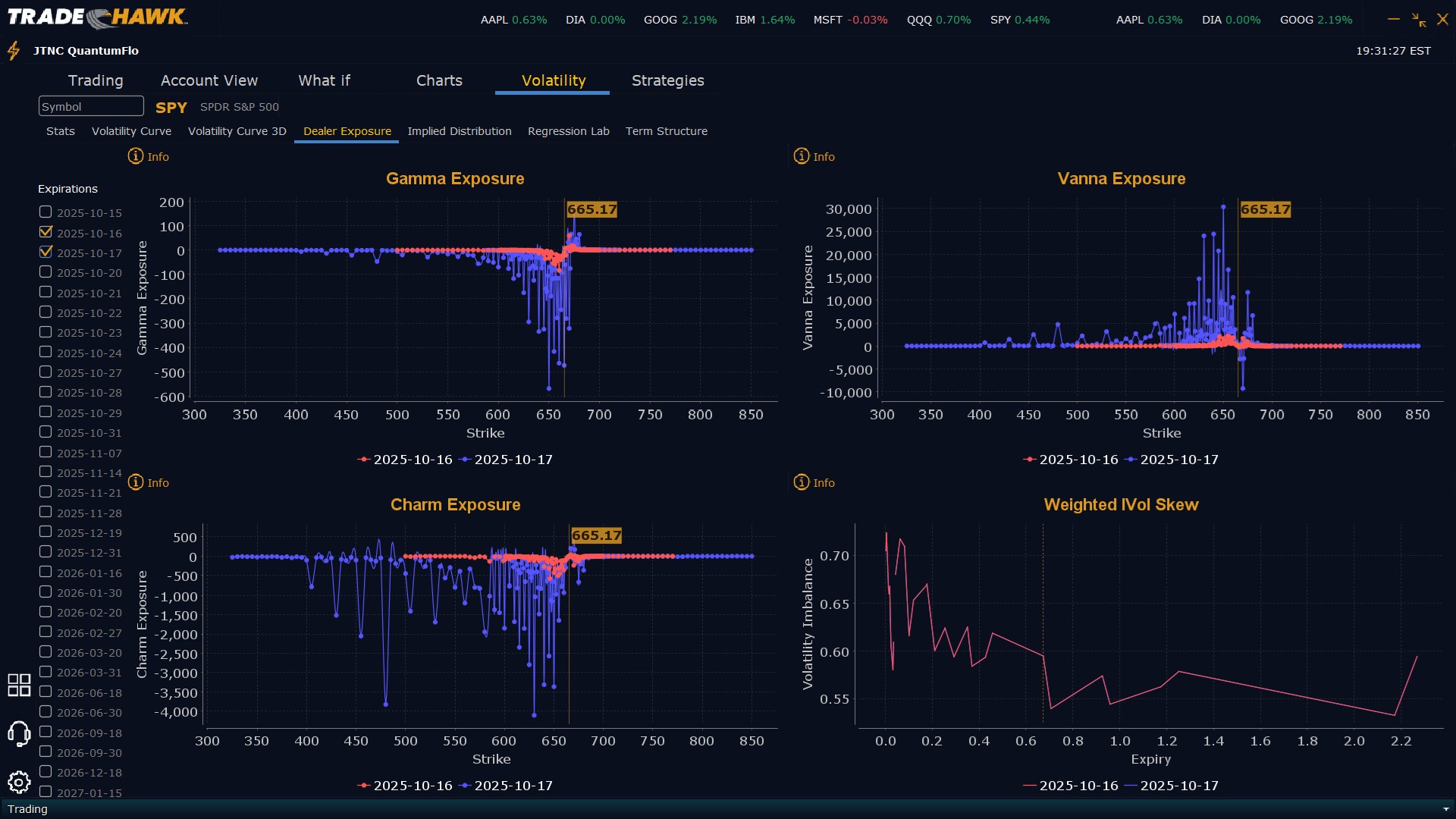

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $667 to $690 and higher strike Calls while also buying $666 and $671 Calls indicating the Dealers’ desire to participate in any continuation of the rally tomorrow. The ceiling for tomorrow appears to be $670 and it looks like it will be extremely difficult to overcome this level. To the downside, Dealers are buying $665 to $600 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from bearish to bearish, but slightly more so.

Looking Ahead to Friday:

Dealers are selling SPY $672 to $690 and higher strike Calls while also buying in size $666 to $671 Calls indicating the Dealers’ desire to participate in any relief rally this week. The ceiling for the week appears to be $675. To the downside, Dealers are buying $665 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY remains in a wide and choppy range. Wednesdays’ close below $666 keeps the bulls in play but limits conviction. Traders should continue fading extremes near $656 and $670 and avoid chasing moves in the middle of the range. With earnings season heating up and macro risk still looming, patience and discipline are key. Stay nimble, focus on process, and trade what’s in front of you, not what you expect.

Good luck and good trading!