Market Insights: Monday, October 13th, 2025

Market Overview

Markets staged a sharp rebound on Monday, reversing much of Friday’s tariff-driven losses after President Trump walked back his aggressive stance on China, offering reassurances that the trade relationship would stabilize. The S&P 500 rose 1.56%, the Nasdaq outperformed with a 2.21% gain, and the Dow added 1.29%, closing nearly 600 points higher. In a Sunday post on Truth Social, Trump downplayed the threat of a full-scale trade war, stating that “it will all be fine” and praising President Xi, signaling a potential easing of tensions. This followed Beijing’s retaliatory measures and Trump’s earlier threat of a 100% tariff hike, which had sparked Friday’s rout and erased nearly $2 trillion in equity value.

Markets opened strong and held firm gains through the session as the mood turned cautiously optimistic. Much of the rally occurred overnight as global investors digested Trump’s softer tone. The move higher was bolstered by AI-related optimism after Broadcom and OpenAI announced a new partnership. Broadcom shares jumped nearly 10%, while Taiwan Semiconductor surged just under 8% after analysts projected a 28% rise in Q3 profit. Still, traders remain on edge as the U.S. government shutdown enters a second full week, delaying key economic data and clouding the Fed’s policy visibility.

Despite the bounce, questions linger. Is this a dead-cat bounce or the start of a renewed rally? Traders will look to the CPI report—now delayed to October 24—and to Fed Chair Powell’s Tuesday speech for clarity on inflation and policy direction. Earnings season also begins this week, with JPMorgan, Goldman Sachs, Citigroup, and Wells Fargo all set to report Tuesday. Analysts expect bank profits to rise 6% year-over-year, potentially adding support if results exceed expectations. Until then, macro risks remain high, but Monday’s move shows bulls are not giving up their ground without a fight.

SPY Performance

SPY climbed 1.55% to close at $663.13 after opening at $660.67 and hitting a high of $664.61. The low of the day was $659.77. Volume came in at 74.15 million, slightly above average, confirming renewed interest following Friday’s steep selloff. The close above $660 and near resistance suggests short-term buyers are regaining momentum. SPY now trades just above the dividing line between bull and bear control, with $663 as the key level to hold.

Major Indices Performance

The Nasdaq led the rebound with a 2.21% surge, powered by tech and semiconductor strength. The S&P 500 followed with a 1.56% gain, and the Dow rose 1.29%, recovering much of Friday’s losses. The Russell 2000 outperformed, jumping 2.62% as small caps benefited from renewed risk appetite. The broad-based rally lifted all sectors, and every major index posted a strong green candle, helping to neutralize some of the recent technical damage.

Notable Stock Movements

The Magnificent Seven stocks closed mostly higher, with Nvidia, Amazon, Apple, and Microsoft all advancing. Only Netflix closed in the red, down a marginal 0.09%. Broadcom soared nearly 10% on news of a partnership with OpenAI, while Taiwan Semiconductor surged nearly 8% on upbeat profit forecasts. Crypto-sensitive names rallied alongside Bitcoin, while defensive sectors lagged. The bounce was strongest in tech and semiconductors, reflecting improving sentiment toward AI and growth names.

Commodity and Cryptocurrency Updates

Crude oil regained some ground, rising more than 1.2% to close above $59, with Brent reclaiming $63. Gold jumped 3.17% to $4,127, extending gains as investors continued to hedge macro risks. Bitcoin climbed 0.77%, closing above $115,800, recovering from Friday’s sharp drop. Ethereum stabilized around $4,300, suggesting renewed risk appetite across crypto markets and a shift back toward risk-on positioning.

Treasury Yield Information

The 10-year Treasury yield slipped 0.07% to close at 4.052%, a relatively muted move as the market balanced Friday’s fear with Monday’s optimism. While still below the 4.5% threshold that would signal danger for equities, yields remain elevated. A push above 4.8% or 5% could still trigger a sharp equity selloff, but for now, bond markets remain stable and unalarming.

Previous Day’s Forecast Analysis

Friday’s forecast anticipated continued weakness below $660 with downside targets at $651 and $645. However, Sunday’s Trump reversal prompted a premarket rally that invalidated the bearish setup. The premarket roadmap for Monday shifted to a consolidating-upward view, and SPY opened above key levels. This led to an upside resolution, though the day remained within a modest range compared to Friday’s collapse.

Market Performance vs. Forecast

SPY opened strong at $660.67 and held above forecasted bias levels throughout the day. The upside targets at $661.85 and $665 were both tested, with price closing just under the second. The roadmap performed well, identifying both the shift in tone and probable levels of resistance. Friday’s extreme drop was not followed by new lows, confirming the roadmap’s guidance to avoid chasing breakdowns.

Premarket Analysis Summary

The 8:16 AM note set expectations for tentative recovery above $661.85, with potential for a move toward $665. SPY followed this path nearly to the letter, with price lifting steadily throughout the session. The premarket analysis highlighted consolidation and the potential for a reversal, provided the market held key levels. The clarity of this forecast, especially after Friday’s chaos, enabled traders to shift bias and participate in the rebound.

Validation of the Analysis

Monday’s price action validates the roadmap’s emphasis on flexibility and the importance of context. The roadmap warned against assuming Friday’s move would extend and called for signs of recovery if SPY held $659. This played out, and those who adjusted in real-time captured the recovery. Once price reclaimed $661.85, it steadily progressed toward $665, a clean execution of roadmap levels.

Looking Ahead

SPY’s close at $663.13 puts bulls back in the game. Tuesday’s earnings reports from major banks will be pivotal in determining whether the rebound sticks. CPI and other data remain delayed, so sentiment will be driven by corporate results and Powell’s Tuesday speech. If SPY can clear $665 and hold, the uptrend may resume. Failure to hold $657, however, could reopen downside toward $651 and beyond.

Market Sentiment and Key Levels

SPY sits just above the pivotal $663 level. Resistance now lies at $664, $667, and $670, while support is found at $662, $660, $657, and $655. Above $668, bulls regain full control. Below $657, the door reopens for another breakdown. The 50-day moving average at $651 was tested and held Monday, making it a crucial line to watch. The VIX dropped to 19.04, indicating reduced—but not vanished—volatility.

Expected Price Action

The projected range for Tuesday is $655.25 to $670.00, suggesting a day of expansion with potential for choppy intraday movement. If SPY holds above $663, momentum could carry it toward $667–$670. A drop below $657 increases the risk of testing $651 again. Options flow shows no clear directional bias, so expect intraday swings driven by headlines and earnings. Stay alert to traps on both sides.

Trading Strategy

With Monday’s bounce resetting the short-term structure, Tuesday presents an opportunity for bulls to press higher, especially if bank earnings impress. Long trades are viable above $663, targeting $667 and $670. Should SPY drop below $657, shift to short bias and target $655–$651. Avoid chasing strength or weakness early. The VIX decline suggests reduced risk, but overnight gaps and sentiment shifts remain likely. Fade rallies under $660; buy confirmed strength above $663.

Model’s Projected Range

SPY’s projected maximum range for Tuesday sits between $655.25 and $670.00, with the Put side dominating in a narrowing but wide band that suggests trending price action interlaced with periods of chop. There is no scheduled economic data, but earnings from major banks kick off after the close, which could shape short-term direction. Today it was tariff news out of the White House again, this time suggesting the China tariffs may not be as severe as expected which sent the market ripping higher, up 1.53% to close at $663.04, right at the dividing line between bull and bear control. On Friday, we cautioned that “drops of 2% or more are rare, so be careful about reading too deeply into a single session,” and today proved that point. Most of the rally occurred overnight, while the day session traded within a range of $660–$665 range. The big question now is whether the bottom is in or if today was simply a dead-cat bounce. The options market projects a wide trading range tomorrow without a clear directional bias, so watch the overnight and early-morning action closely and trade what you see. With the VIX dropping 12%, this may be a good time to consider scaling into additional hedges. Our expectation for Tuesday is that the bulls, having bought the dip once again, will try to keep momentum going and push through $665 to close firmly above $663. If they can do this, the uptrend resumes. A failure to hold $657, however, would likely see SPY test lower support levels and potentially break Friday’s lows. Be mindful that bulls may bait the bears by driving prices lower only to trap and squeeze them with another sharp rally. Above $668, the bulls will have clear control. With price still above the $640 “line in the sand,” the bulls remain very much in the game and will defend that level aggressively. They did well closing above $660 today, but a move below would likely break today’s lows and open the door for more downside. For now, we continue to favor fading rallies up to around $660, while above that level, long positions become more attractive. Macro risks remain elevated, between the government shutdown and renewed tariff rhetoric so trade the market you have, not the one you expect. For weeks we’ve noted that until persistent weakness emerges, the broader trend remains higher. One or two down days don’t make a bear market, and with crypto bouncing and all Mag stocks rising, weakness is still not pervasive. Sustained downside will be needed to trigger the 10–15% correction we’ve been forecasting by the end of the year. The 50-day moving average at $651 was tested in after-hours trading Monday and held, leading to today’s strong recovery. For Tuesday, resistance sits at $664, $667, and $670, with support at $662, $660, $657, and $655. Below $657, there’s little structural support to prevent further decline. Since reclaiming $585, SPY has maintained a steady uptrend fueled by dip buyers despite brief disruptions. Mag stocks and crypto all rallied today, with ETH back at $4300, signaling a renewed risk-on tone. While not an “all clear,” the strong rebound suggests buyers are still in control. Absent an external shock, this week’s action will likely determine the tone for the rest of October. The VIX fell 12.1% to 19.04, showing receding but lingering volatility. VIX below 23 supports the bullish case, but a breakout above it could finally spark the long-anticipated correction. SPY closed for a second straight day below the redrawn lower bull trend channel from the April lows, hinting at the early stages of a potential bear trend, though the model has not yet redrawn the channel. Several more closes below that boundary would confirm the formation of a new bear channel…stay tuned.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a wide Ranging Market State, with SPY closing at the lower end of the range. There were no extended targets all day or overnight and as such the market moved more sideways after the initial gap up. The MSI opened the day in a wide bearish state but with the monster overnight rally, SPY continued to drift higher with the MSI spending most of the day in its current, ranging state. For Tuesday the MSI is implying sideways, ranging prices perhaps as low as T$661 and as high as $668. MSI resistance is $657.92 with support at $661.35.

Key Levels and Market Movements:

On Monday we wrote, “It is highly probable the market will at least test the 50 DMA at $651 before attempting any meaningful recovery, and we do believe such a recovery effort will come,” and noted, “Rallies up to $660 should be viewed as opportunities to get short unless a new external catalyst shifts sentiment,” while also stating, “A break above $660 would likely lead to a test of $663.” With this context, and with the MSI holding in a bearish state overnight without any extended targets below, it was clear by the open that both the MSI and the market were giving mixed signals. Big up and big down = big confusion, so we expected a choppy day which is exactly what transpired. At the open, we hoped SPY would either move to MSI support for a long trade or set up a failed breakdown, but neither occurred. After a triple bottom at $660, however, we decided to take a shot on the long side to follow through on the overnight strength. We set T1 at MSI resistance at $661.30, which hit quickly. For T2, we targeted the premarket level at $661.85, just a few pennies higher, and that too was reached shortly after. With both targets secured, we moved our stop to breakeven and trailed the rest, looking for a potential move to the premarket level at $665 as our final target. SPY did make a push toward $665, but we didn’t get the exit we wanted. Still, with our stop protected, there was no downside to letting the trade play out. On the second push higher, we decided to call it a day, closing our remaining trailer at $664.50 around 1:00 pm. Another clean, disciplined trade that reflected the day’s choppy, indecisive tone perfectly. We didn’t fade the overnight push and with the MSI in a ranging state as we were hesitant to risk any of the day’s profits. So one nice trade on the day thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Tuesday has no scheduled economic news, but markets are still likely on edge following the recent tariff headlines, making it critical to trade what you see. With a close above $663, the bulls have taken back control—but only marginally. With the MSI in a wide-ranging state, the market will likely move both higher and lower on Tuesday, testing each side of the range unless an external catalyst shifts sentiment. As such, remain flexible and monitor the MSI closely for directional cues. Avoid fading extended targets. The projected range for Tuesday is narrowing but remains broad, so aligning with the MSI trend and staying with it is the best way to capture gains. Failed breakouts and failed breakdowns continue to offer some of the highest-probability setups in this environment. Overnight, the bulls want to defend $658, and if that level holds, the market is likely to break the day’s highs and push toward $667. Should $658 fail, support at $650 and possibly $645 comes into play, with $640 serving as the critical level that must hold to preserve the broader bull trend. A break above $667 would likely lead to new all-time highs, while the bears only gain full control on a decisive drop below $640. As always, trading failed moves remains one of the most reliable setups in this type of market. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

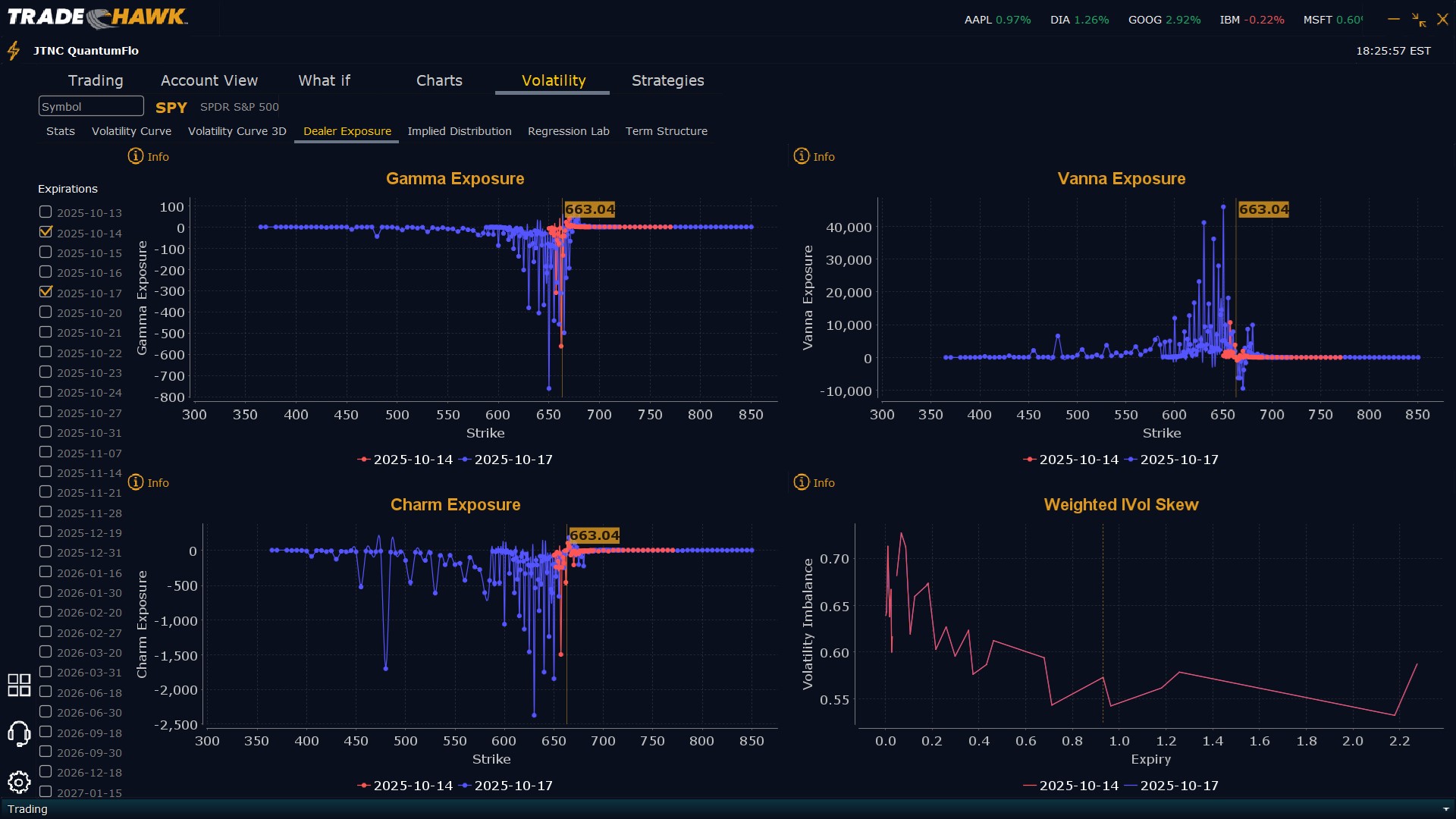

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $667 to $690 and higher strike Calls while also buying $664 to $666 Calls indicating the Dealers’ desire to participate in any further rally on Tuesday. Dealers are no longer selling ATM Puts but that trade worked out to perfection. The ceiling for Tuesday appears to be $670. To the downside, Dealers are buying $663 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower on tomorrow. Dealer positioning is unchanged from bearish to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $670 to $690 and higher strike Calls while also buying in size $664 to $669 Calls indicating the Dealers’ desire to participate in any relief rally this week. The ceiling for the week appears to be $675. To the downside, Dealers are buying $669 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY has recovered its footing, but the battle isn’t over. Price must stay above $663 to keep momentum alive. Below $657, bears return. Focus on risk management and alignment with MSI and model levels. Use failed moves at key levels for entries. With earnings and Powell ahead, volatility remains a feature. Stay reactive, not predictive. Trade the market in front of you, not the one you expect.

Good luck and good trading!