Market Insights: Tuesday, September 9th, 2025

Market Overview

Stocks climbed to new highs on Tuesday as a sharp downward revision to job data gave investors fresh conviction that rate cuts are on the horizon. The Dow rose 0.5% to close above 45,725, the S&P 500 gained 0.3% to end at a record 6,512, and the Nasdaq added 0.4% to notch its second straight all-time closing high. The bullish mood was driven in part by the Bureau of Labor Statistics' updated figures showing the US economy added 911,000 fewer jobs than initially reported through March 2025, a steeper drop than economists had expected. This shift underscores the view that the labor market is cooling, fueling expectations that the Federal Reserve may need to ease rates more aggressively than previously thought.

Markets are now squarely focused on Wednesday’s Producer Price Index (PPI) and Thursday’s Consumer Price Index (CPI), two critical inflation reports that could either confirm the case for a sizable rate cut or throw a wrench into it. Many traders are betting on a 25 basis point cut, though a growing chorus expects 50 basis points given the accumulating economic softness. Elsewhere, Apple’s highly anticipated fall event failed to excite, with the unveiling of the iPhone 17 and iPhone Air receiving a lukewarm response that sent shares down about 1.5%. On the M&A front, Tourmaline Bio and Nebius each jumped over 50% on deal news involving Novartis and Microsoft, respectively. With Oracle and GameStop set to report earnings after the close, corporate catalysts are beginning to compete with macro events for market attention.

SPY Performance

SPY added 0.23% to close at $650.29 after opening at $648.94 and moving between a low of $647.22 and a high of $650.86. Volume was slightly under average at 52.66 million shares. The ETF continued to respect the $645 support zone and managed to push through $650 intraday before pulling back slightly into the close. Price remains well within the expected trading range, showing a healthy appetite for dip buying as markets await the PPI report.

Major Indices Performance

The Russell 2000 led the major averages Tuesday, gaining 0.55% and continuing to show relative strength among small-caps. The Dow followed with a 0.43% advance, setting a fresh record close, while the Nasdaq climbed 0.37% to notch its second consecutive high. The S&P 500 also hit a new record, rising 0.3% as sentiment remained bullish following the sharp revision in job numbers. The labor market weakness is being interpreted as a green light for rate cuts, giving risk assets further room to run. Sector performance was broadly positive, with cyclicals showing leadership and defensive sectors trailing behind.

Notable Stock Movements

The Magnificent Seven mostly ended the day in the green, with only Tesla and Nvidia closing lower. Nvidia slipped 1.48%, extending its short-term pullback despite continued enthusiasm for AI. Tesla dropped another 1.24%, weighed down by lingering concerns over delivery delays and CEO-related news. Apple also slipped, shedding 1.5% after its annual product reveal failed to impress investors. On the upside, Amazon, Microsoft, Meta, and Google all posted gains, helping support the broader market’s push to new highs. The internal divergence among these tech giants reflects selective buying and cautious optimism heading into key inflation data.

Commodity and Cryptocurrency Updates

Crude oil climbed 0.66% to settle at $62.67, continuing its slow descent toward the $60 target our model has forecasted. Supply-side fears have eased while demand concerns persist, keeping a lid on further price increases. Gold dipped 0.23% to $3,668, reversing Monday’s gains as investors showed a slightly greater risk appetite. Bitcoin lost 0.65% to close just above $111,200, still tracking equity markets but remaining without a dominant narrative of its own for now.

Treasury Yield Information

Yields moved higher on Tuesday, with the 10-year Treasury yield rising 0.84% to close at 4.080%. While still comfortably below the danger zone of 4.5%, the uptick reflects some caution ahead of inflation data. If PPI or CPI surprises to the upside, yields could spike further, pressuring stocks. But as long as yields remain contained, the equity rally is likely to persist. Markets remain sensitive, with 4.8% a key threshold and 5% marking a likely trigger point for a significant correction.

Previous Day’s Forecast Analysis

Monday’s forecast anticipated SPY would trade between $645 and $651 with a bullish bias above $645. The model favored long trades above that level, targeting upside extensions toward $650, $653, and potentially $655. Resistance at $650 was flagged as a key challenge, while downside targets included $644 and $640 if the $645 level failed. Given the low volatility and lack of macro drivers on Monday, the model leaned cautiously bullish and advised traders to favor long trades above support with reduced size ahead of the mid-week inflation storm.

Market Performance vs. Forecast

Tuesday’s SPY action closely mirrored the forecast, with a session range of $647.22 to $650.86 staying well within the projected range of $645 to $651. SPY opened at $648.94, briefly surged above $650, and closed at $650.29, confirming the bullish bias and validating the long strategy above $645. The key support levels held as expected, and SPY's push above $650 offered clean breakout entries, though gains were modest before a late pullback. The forecast accurately predicted resistance near $650 would be tested and suggested buying dips above $645 would offer opportunities, which played out well for disciplined traders.

Premarket Analysis Summary

In Tuesday’s premarket analysis posted at 6:58 AM, SPY was trading at $649.28 with a bias level set right at $649. The report noted that as long as SPY held above this level, upside targets at $650 and a stretch toward $653 were possible. It also highlighted downside targets at $647.50, $645, and $644 if the bias failed. The tone remained cautiously bullish with an emphasis on slow, choppy action and warned that a breakdown below 647.50 could signal a deeper pullback, though any such move was likely to be short-lived.

Validation of the Analysis

Tuesday’s market confirmed the premarket roadmap almost exactly. SPY opened slightly above the bias level and quickly moved toward the $650 target before stalling. It briefly reached a high of $650.86, confirming the upper resistance zone called out in the premarket report. When price dipped to $647.22, it respected the $647.50 support zone almost perfectly before reversing higher. The premarket strategy to buy dips above $645 and stay nimble near $650 provided traders with actionable and profitable setups. Once again, the forecast proved highly accurate, especially for traders focused on key intraday levels.

Looking Ahead

Wednesday’s PPI release will be the main market catalyst, potentially sparking increased volatility depending on how the data aligns with rate cut expectations. A soft print could boost the odds of a 50 basis point cut, while a hotter-than-expected number might force markets to reprice and unwind some of the recent bullish momentum. Traders should prepare for rapid swings and stay light on positioning until clarity emerges. With CPI and UoM data still ahead later in the week, markets remain in a high-alert holding pattern.

Market Sentiment and Key Levels

SPY closed at $650.29, a strong finish above the key $645 support zone, keeping the bullish narrative intact. Market sentiment remains tilted toward the upside as dip buyers continue to step in at every opportunity. Resistance now sits at $653, $655, and $658, with $660 as the breakout trigger. Support is layered at $647, $644, $641, and $640. If SPY remains above $647, bulls retain control. A breakdown below $644 would invite stronger selling, but until SPY cracks $640, bears remain sidelined. Traders should monitor these zones closely as Wednesday’s inflation data could be a decisive catalyst.

Expected Price Action

Our AI model projects SPY to trade between $645 and $653 on Wednesday. This is actionable intelligence generated by our AI model. The range suggests a session filled with back-and-forth movement, especially with the PPI report on deck. The bias remains bullish, favoring upward movement toward $653 and $655 if SPY clears $650 early. A breakout above $655 would increase the odds of a test of $660, which remains the level required to confirm the broader breakout. On the flip side, if SPY loses $647, expect swift moves toward $644, with $640 as the major pivot below. The day could produce either a breakout or breakdown depending on how markets react to PPI data.

Trading Strategy

Long trades are preferred above $647, with price targets at $653 and $655. Should SPY break out above $655, traders can target $660 but should manage risk tightly as the move may reverse quickly. If SPY fails to hold $647, short setups become viable down to $644 and $640. Traders should be especially cautious during the PPI release and avoid oversized positions. The VIX closed at 15.04, indicating continued complacency, but that could change in a heartbeat if inflation surprises. Use tighter stops near resistance and be ready to reduce size or exit trades during high-volatility periods. Maintain discipline, stay nimble, and only initiate trades around clearly defined levels.

Model’s Projected Range

SPY’s projected range for Wednesday sits between $644.25 and $653.50, with the Call side dominating in a slightly expanding band that suggests choppy price action with intermittent trending periods. With PPI due out tomorrow there is potential for fireworks in either direction, so trade what you see. Today’s session was mostly sideways as expected until a late rally in the last 30 minutes pushed SPY to $651, but by the close it had fallen back into its range, finishing up 23 basis points at $650.33. This is well above the critical $645 threshold, and once again every dip continues to be bought. The job market is likely weaker than expected, which leaves the Fed with little choice but to cut rates by as much as 50 basis points next week. The bulls remain in control of the broader narrative. Volume today was just below average, showing the market is waiting for more information before either pushing higher or putting in a top. As we said yesterday, it is probable SPY makes new highs before FOMC, and we believe the odds of a sell-the-news event are at least 50 percent if not greater. Until then, we expect SPY to drift higher or consolidate sideways before choosing a clear direction. The bulls will defend $647 overnight, and a failure there opens the door to $645, while a break below that would bring $640 back into play. Until SPY falls to $640 or lower, the bears remain sidelined. Our base case remains a 10 to 15 percent pullback at some point, yet we continue to view any weakness as a buying opportunity until FOMC and recommend buying every dip above $640. With SPY closing near the highs of the day, it is likely the market retests last week’s highs with a run toward $655 a distinct probability. A move to $660 is still required to confirm the breakout, and failure to reach that level would suggest a near-term top, particularly given September’s reputation for negative returns. For Wednesday, choppy action is likely with periods of trending driven by PPI. Resistance is at $653, $655, and $658, with support at $647, $644, $641, and $640. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Today Mag stocks were all higher except Apple, which fell after a less-than-favorable product release. Until weakness emerges in these leaders, or ETH closes below $4300, prices are likely to grind higher. We continue to favor quick profit taking and caution with overnight holds. The VIX fell 0.46% to 15.04, and while September often sees VIX reach 20, contango in VXX futures suggests volatility may drift lower into FOMC. Still, if you have not added protection to your long book, now is the time. VIX below 23 supports the bullish case, but a breakout above it could finally spark the long-anticipated pullback. SPY closed just below the lower bound of the bull trend channel from the April lows, teetering on a line where a red day could signal the start of a downtrend, while a green day would push it back into the current steep, uncorrected bull channel.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing mid-range. There were extended targets into the close and during the regular session which saw SPY move once again toward the all-time high. The MSI rescaled higher overnight indicating the bull trend was still intact yet the market moved sideways for the entire day until a late afternoon surge which saw the MSI rescale higher once again. For Wednesday the MSI is forecasting slightly higher prices still with a likely push toward the all-time high. MSI support is at $649.13, with resistance at $650.86.

Key Levels and Market Movements:

On Monday we wrote, “We expect some upward drift overnight but mostly chop,” and noted, “The bulls will defend $645 overnight,” while also stating, “Our bias remains to buy on dips while also considering short setups on failed breakouts near the all-time highs.” With that context, and with the MSI opening in a Bullish Trending Market State mid-range, we waited for a chance to get long with the MSI. Although we considered a short at MSI resistance, we passed on the trade given the ongoing strength of the bull trend. By midmorning the MSI rescaled to a ranging state, which saw price fall and set up a textbook failed breakdown. While we hesitate to trade in this MSI state, the setup was too strong to ignore, so we entered long at $647.70 and set T1 at MSI resistance at $649.83. Expecting a move back to resistance, we sat on our hands for several hours until SPY reached our first target. The MSI then rescaled higher and began printing extended targets, so we set T2 at the new MSI resistance level of $650. That target was hit as well, and with a stop at breakeven and extended targets above, we decided to trail into the close. A late pop just before 4 PM had us exit our remaining 10% long just above $650 for a one-and-done, sizable trade on a day when the market did very little and rewarded almost no one. Our success once again came from a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Wednesday brings PPI, which is likely to move the market. A hot number may see SPY sell off, while a cool number is likely to send it sharply higher. We expect some upward drift overnight but mostly chop. The bulls will defend $647 overnight, which will keep the bull trend intact. A move below $647 could open the door to lower prices, but we view this as a low probability and expect dips to be bought once again. The bulls remain in control until the bears push price below $640. It is very possible we continue to see new all-time highs before FOMC on the 17th. Our bias remains to buy on dips while also considering short setups on failed breakouts near the all-time highs or on a break below $645. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

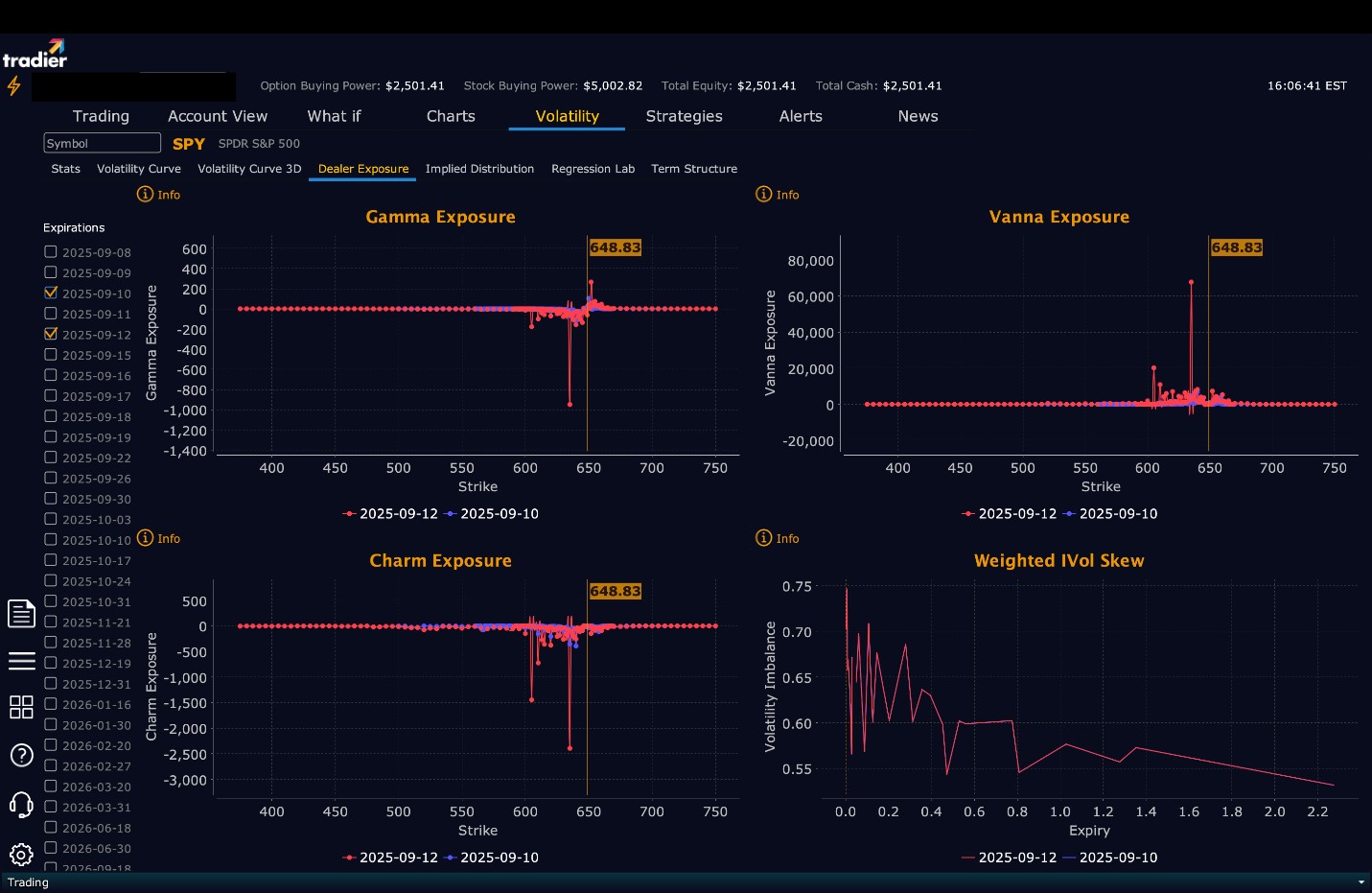

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $651 to $661 and higher strike Calls while also selling $650 Puts implying the Dealers belief that prices will rise on Wednesday, to perhaps a new all-time high. The ceiling for tomorrow appears to be $655. To the downside, Dealers are buying $649 to $595 and lower strike Puts in a 3:1 ratio to the Calls they’re selling displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $651 to $667 and higher strike Calls indicating the Dealers belief that prices may rally this week but likely stop at $655. While there is a chance that SPY reaches $660, the ceiling for the week is likely this $655 level. To the downside, Dealers are buying $650 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY continues to hold well above the critical $645 level, giving bulls the upper hand. Long trades remain favored above $647, targeting $653 and $655, with a possible breakout run to $660 if resistance is breached. Short trades should only be considered below $647, aiming for $644 and $640 or above the all time highs at $652 and on a failed breakout. With PPI on deck, expect volatility to rise. Keep stop-losses tight, manage position sizes, and avoid overexposure around key economic events. The VIX at 15.04 reflects market calm, but this can change rapidly if inflation surprises. Always monitor levels closely and adapt quickly. Remember to review the premarket analysis posted before 9 AM ET to account for any changes in our model’s outlook and in Dealer Positioning.

Good luck and good trading!