Market Insights: Friday, September 5th, 2025

Market Overview

Stocks reversed sharply on Friday after a weak jobs report confirmed growing concerns about a rapidly softening labor market. The S&P 500 gave back 0.3%, slipping from Thursday’s all-time closing high, while the Dow dropped 0.5% and the Nasdaq ended marginally lower. The losses marked a clear shift in tone following an early rally sparked by expectations that a rate cut from the Federal Reserve is now inevitable.

The Bureau of Labor Statistics reported just 22,000 new jobs were created in August—far below the forecast of 75,000. The unemployment rate also ticked higher to 4.3%, and backdated revisions showed fewer than 30,000 jobs created across June, July, and August combined. Notably, June’s data turned negative, marking the first monthly decline in employment since 2020. These numbers followed a week of soft labor indicators and capped a string of reports that have rattled Wall Street’s confidence in the economy’s strength.

In response, traders fully priced in a rate cut for the Fed’s upcoming September meeting, with many now betting on a larger 50 basis point move. Treasury yields plunged, with the 10-year yield falling to 4.07%—its lowest level since April—and the 30-year yield slipping below 4.79%. Political pressure on the Fed intensified, with President Trump again slamming Chair Jerome Powell on social media, calling him “Too Late” in his response to economic weakness. That criticism came just a day after Trump’s nominee, Stephen Miran, faced Senate scrutiny for refusing to resign from his White House post if confirmed to the Fed Board.

Meanwhile, tech offered a bright spot. Broadcom rallied 9% after announcing it had signed a deal to produce chips for OpenAI. Tesla also moved higher, gaining over 3% on reports of a proposed $1 trillion performance-based compensation package for CEO Elon Musk. These developments helped soften the market’s decline and kept hopes alive for further upside in the AI-driven trade.

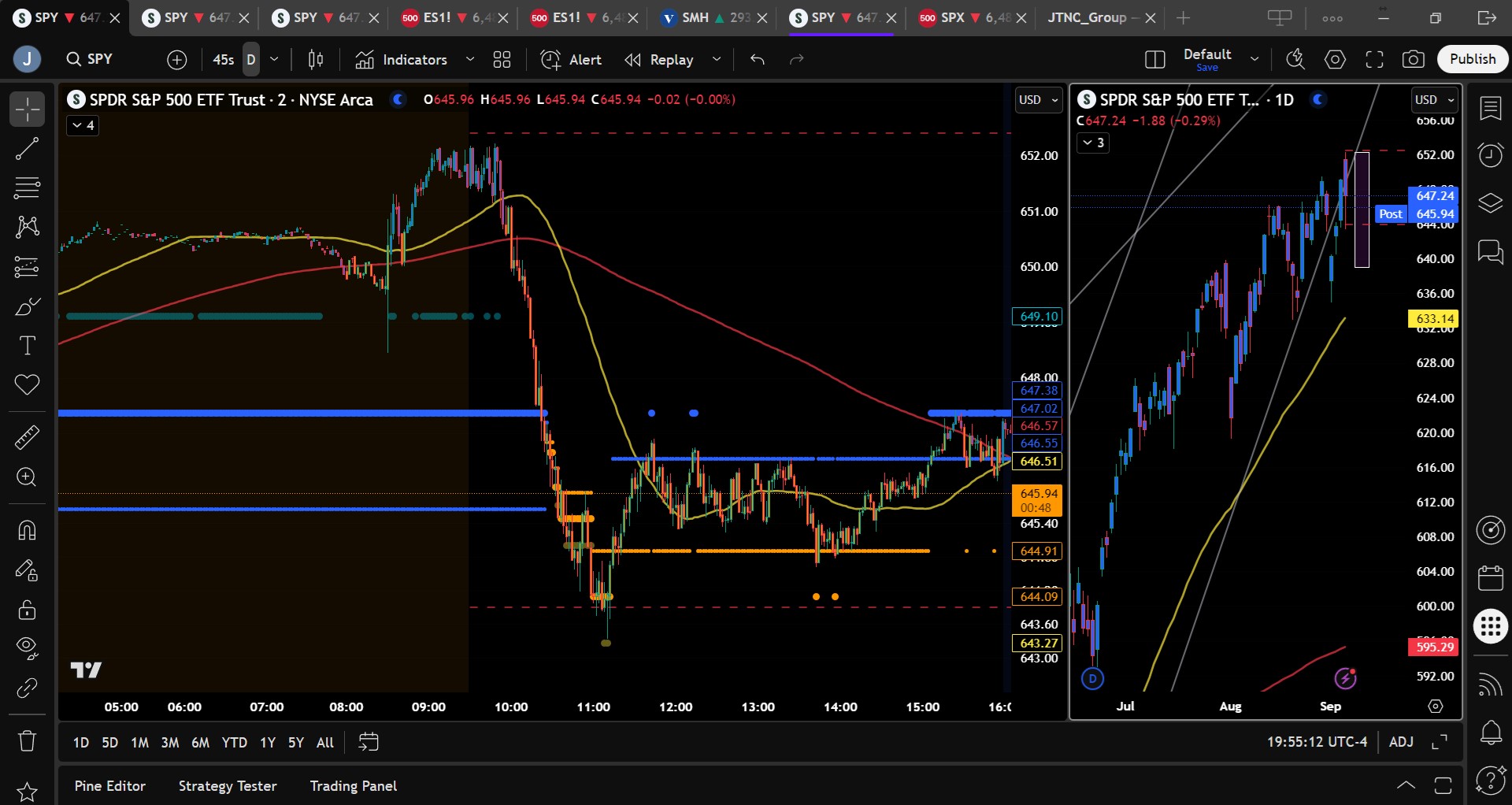

SPY Performance

SPY slipped 0.29% to close at $647.21 after opening at $651.61 and tagging a high of $652.21. The low of the day was set at $643.33 before dip buyers stepped in late in the session to lift the ETF back above the critical $645 level. Volume surged to 80.16 million shares, notably above average, which confirms both the selling pressure and the buying interest at key support levels. Despite the red close, the rally into the final hour kept SPY within its broader bullish trend and slightly above key trendline support.

Major Indices Performance

The Dow led the day with a 0.48% gain, defying the broader pullback thanks to strength in industrials and select defensive names. The Russell 2000 followed with a 0.38% rise, continuing its recent outperformance streak. The Nasdaq slipped 0.03% as tech stocks were mixed, while the S&P 500 declined 0.3%, weighed down by profit-taking and weak labor data. Early session euphoria around expected rate cuts faded quickly after the disappointing Nonfarm Payrolls report, which shifted focus toward the fragility of the labor market. Sector performance was split, with healthcare and consumer staples outperforming while financials and energy lagged.

Notable Stock Movements

It was a mixed session for the Magnificent Seven, with Tesla stealing the spotlight, surging 3.62% after news of a potential $1 trillion compensation deal for CEO Elon Musk if performance milestones are hit. Meta and Alphabet also managed to close in the green, while the rest of the group—including Amazon, Apple, Nvidia, and Microsoft—finished the day in the red. The uneven performance reflects a growing divergence within the group as traders rotate between names based on sector-specific catalysts and news flow. Overall, the strength in Tesla and Broadcom helped cushion the blow from weak jobs data, reminding traders that select tech names remain market drivers.

Commodity and Cryptocurrency Updates

Crude oil slid another 2.28% to settle at $62.03, continuing its methodical descent toward the $60 target that has been in our model for months. The ongoing drop suggests supply concerns have eased and demand fears are beginning to re-emerge. Gold rebounded 1.03% to close at $3,643 as risk-off sentiment returned and safe-haven assets found buyers again. Bitcoin gained 0.94% but remained below $111,400, indicating the crypto space is still moving largely in step with overall risk sentiment and lacks a clear standalone narrative for now.

Treasury Yield Information

Yields dropped sharply across the curve, with the 10-year falling 2.08% to close at 4.089%, its lowest since spring. The decline in yields is a direct reflection of the market’s belief that the Fed will be forced into cutting rates sooner—and possibly more aggressively—than previously expected. The 30-year yield also pulled back below 4.79%, marking a steep reversal from levels that had recently threatened the 5% mark. Equities remain supported as long as yields stay under pressure, but traders are watching carefully for any signs of yield reversion, especially above 4.5%, which could trigger renewed equity weakness.

Previous Day’s Forecast Analysis

Thursday’s newsletter projected a wide and potentially trending session, with SPY expected to trade between $643 and $656.50. The model anticipated a push toward $650 early, especially if the jobs data came in favorably, and outlined upside targets at $653 and $655. On the downside, support was pegged at $647, $644, and $640, with a break below $640 opening up the possibility for a test of $635 or $625. Long trades were favored above $644, while shorts were only considered viable below that level. The model highlighted that Friday’s jobs report would be the key catalyst and advised traders to reduce size and stay nimble.

Market Performance vs. Forecast

SPY’s actual performance aligned with much of the prior day’s forecast. After gapping up to $651.61, SPY briefly touched $652.21 before reversing sharply on the disappointing jobs data. It fell to a session low of $643.33—just above the critical $643 support level—and ultimately closed at $647.21. While the forecast anticipated bullish momentum, the reversal confirmed the caution embedded in the model’s language around macro uncertainty. Both support and resistance levels were respected, and traders who bought near $643 likely profited on the late-session bounce. The downside failed to break $640, keeping the bullish narrative intact but clearly under pressure.

Premarket Analysis Summary

In Friday’s premarket analysis posted at 7:10 AM, SPY was trading at $650.53 with a bias level set at $649.90. The model expected a gradual upward drift with resistance anticipated between $652.40 and $653, and a potential extension to $656 if momentum from the jobs data persisted. On the downside, support levels were identified at $646 and $643.90, and the analysis advised against short trades unless the bias level was lost. The tone leaned cautiously bullish, acknowledging external positioning support and expecting sideways to upward action barring a major surprise from the jobs release.

Validation of the Analysis

Friday’s price action closely mirrored the premarket roadmap. SPY opened above the bias level at $651.61 and initially pushed toward the first upside target before stalling at $652.21—just shy of the $652.40 target. After the jobs report missed badly, SPY dropped below the bias and tested the $643.33 level, which lined up closely with the downside target of $643.90. Dip buyers emerged at support, validating the premarket suggestion that rallies were more likely from lower levels. Traders who followed the analysis and avoided early shorts were well-positioned to take advantage of the bounce, affirming the day’s strategy.

Looking Ahead

With Friday’s jobs report now in the rearview, traders shift their attention to next week’s key inflation readings. Wednesday’s PPI and Thursday’s CPI releases will shape expectations for the size and timing of future Fed moves. These reports are likely to bring significant volatility, especially with the market already leaning heavily toward a rate cut in September. Monday and Tuesday are quiet on the economic calendar, offering markets a brief window to consolidate before the data storm arrives mid-week.

Market Sentiment and Key Levels

SPY closed at $647.21, holding above the important $645 support level but below Thursday’s high. The overall sentiment remains cautiously bullish, though Friday’s reversal off all-time highs adds a note of caution. Bulls continue to control the trend as long as SPY holds above $644, with upside resistance now set at $648, $650, and $655. A break above $650 could invite a retest of highs, while a push through $655 would confirm a broader breakout. On the downside, support sits at $645, $644, and $640, with $635 marking a deeper pullback level. So far, bears remain mostly sidelined until SPY breaks below $640.

Expected Price Action

Our AI model projects SPY to trade between $639 and $652.25 on Monday, a slightly narrower range than Friday’s. This is actionable intelligence generated by our AI model. With SPY closing near key support and failing to hold new highs, Monday may open with two-way trading and potential chop. Bulls will need to reclaim $650 early to push toward $655, while a failure to hold $645 could trigger a move back to $640 and possibly $635. A breakout above $650 likely brings $653 and $655 into view, with $660 needed to confirm a full breakout. Below $644, the downside risk increases quickly.

Trading Strategy

Long trades are favored above $644, targeting $648, $650, and $655. A breakout above $655 opens the door to $660. Short setups are viable below $644, with targets at $640 and $635, and possibly $630 if momentum builds. Volatility remains low with the VIX at 15.18, but traders should remain cautious heading into next week’s inflation data. Tight stops are advised around known economic events. With Friday’s reversal off highs, failed breakout and breakdown setups offer excellent trade opportunities. Stay light and flexible, especially early in the week, as markets digest last week’s labor data and prepare for inflation releases

Model’s Projected Range

SPY’s projected range for Monday sits between $639 and $652.25, with the Call side dominating in a steady band that suggests periods of trending action with intermittent chop. A much weaker-than-expected Jobs report initially drove prices to new all-time highs on interest-rate euphoria, but reality quickly set in and the market sold off before recovering modestly in the final two hours to close down just 0.29% at $647.21. A new high followed by a selloff is rarely a good sign, and while the morning decline reached a low of $643.25, dip buyers once again stepped in, keeping SPY above $645 and leaving the bulls in control of the broader narrative. Heavy volume reinforced the risks to the market even as it continues to print new highs almost weekly. We continue to expect SPY to rally or consolidate sideways into FOMC on the 17th before picking a clearer direction. Until then, dips are likely to be bought and new highs remain probable. The bears tried but failed to push below $640, and while participants may again attempt to break $644.50 and retest today’s low at $643.33, any successful defense or quick recovery at those levels should see the uptrend resume. A failure at $644.50, however, opens the door to $643.33, and a break there would bring $640 back into play. Until SPY falls to $640 or lower, the bears will only dabble, while the bulls maintain the upper hand. Our base case remains a 10–15% pullback at some point, yet we continue to view any weakness as a buying opportunity until FOMC and recommend buying every dip above $640. With SPY closing above $645, a retest of today’s highs and a run toward $655 is a distinct probability, with $660 still required to confirm the breakout. Failure to reach that level would suggest a near-term top, particularly given September’s reputation for negative returns, though current momentum favors bulls reaching it before FOMC, further proof that seasonal patterns are unreliable at best. For Monday, trending action is likely, with resistance at $648, $650, and $655, and support at $645, $644, $640, and $635. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Today Mag stocks were mixed with Tesla, Google, and Meta rising while others declined. Until weakness emerges in these leaders, or ETH closes below $4300, prices are likely to grind higher. We continue to favor quick profit-taking and caution with overnight holds. The VIX fell 0.78% to 15.18, and while September often sees VIX near 20, contango in VXX futures suggests volatility may drift lower into FOMC. Still, if you haven’t added protection to your long book, now is the time, as a “buy the rumor, sell the news” setup is possible into the meeting. VIX below 23 supports the bullish case, but a breakout above it could finally spark the long-anticipated pullback. SPY closed right at the lower bound of the bull trend channel from the April lows, teetering on a line where a red day could signal the start of a downtrend, while a green day would push it back into the current steep, uncorrected bull channel.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a narrow Bullish Trending Market State, with SPY closing just below MSI resistance. While there were no extended targets into the close, both bullish and bearish extended targets printed in the premarket and morning session. As has been the pattern for weeks, bulls drove prices to new highs before reversing course and pushing price back to major support. The MSI rescaled lower during that drop into a bearish state, though the narrow profile suggested the herd was only dipping its toe below the $645 level. Extended targets stopped printing just after 11 AM, and the MSI shifted into a ranging state, with price moving mostly sideways until the final hour, when it rescaled to its current bullish state. For Sunday and into the Monday premarket, the MSI is forecasting slightly higher prices, though more likely with a retest of lower levels before any material push higher. MSI support is at $646.51, with resistance at $647.02.

Key Levels and Market Movements:

On Thursday we wrote, “Friday brings the government’s monthly jobs report, which means the market can, and likely will, swing $10 in either direction,” and noted, “we continue to favor longs above $640 and will be cautious with shorts, even on bad news, as negative headlines may simply trap bears and reverse sharply higher,” while also stating, “The bears have no claim on the market unless price closes below $640. We expect new all-time highs overnight and into Friday, with our bias remaining to favor buys on dips while also considering short setups on failed breakouts near $650.” With that context, and with the MSI opening in a Bullish Trending Market State with extended targets above in the premarket, we were eager to find a long entry, but with SPY already at major resistance near $652 and knowing every recent new high had been an opportunity to short, we waited for extended targets to stop printing and for SPY to set up a failed breakout. That setup came at 9:46 AM, so we entered short at $652 with a very tight stop in case price pushed to $655. T1 was set at the premarket level of $649.90, which hit quickly as profit taking began, and T2 was placed at MSI resistance turned support at $647.43, which also came just as fast. With 90 percent of our position locked in and solid gains secured, we moved our stop to breakeven and trailed as the MSI rescaled lower and extended targets began printing. We held as price pushed to the premarket level of $643.90 almost to the penny, where SPY formed a textbook failed breakdown, and we exited the short and reversed long once extended targets below stopped printing. Long at $644.70, we set T1 at MSI resistance at $646.59 and looked for T2 at the premarket level of $649.90. Momentum stalled, and a retest of MSI support had us concerned we might lose on the trade, but price held and in the final two hours moved higher as the MSI rescaled to a bullish state. We took T2 at MSI resistance at $647.40 and, with just 30 minutes left in the session, went flat at this level to end the day. We finished two for two with one monster short and a decent countertrend scalp, closing the week strong without a losing trade, once again thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Monday has no economic news, which means the market is likely to take a breather as long as no external catalyst triggers a melt up or melt down. We expect price to retest lower levels around $645, but dips should be bought once again, allowing SPY to resume its uptrend. The bulls remain in control, since the bears have no claim to the market unless price closes below $640. As such, it is very possible we continue to see new all-time highs before FOMC on the 17th. Our bias remains to buy on dips while also considering short setups on failed breakouts near the all-time highs or on a break below today’s lows. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $650 to $661 and higher strike Calls while also buying $648 to $649 Calls indicating the Dealers desire to participate in any rally on Monday. Dealers are no longer selling at the money Puts. The ceiling for Monday appears to be $655. To the downside, Dealers are buying $649 to $595 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move lower Monday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $648 to $670 and higher strike Calls indicating the Dealers belief that prices may pause next week and not move significantly higher. The ceiling for the week is likely $655. To the downside, Dealers are buying $647 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting a bearish outlook for next week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed Friday at $647.21, just above the critical $645 support level but well below its earlier highs, creating both opportunity and caution. Traders should continue to favor long trades above $644 with targets at $648, $650, and $655. A break above $655 could lead to a fast move to $660. Short trades are only recommended below $644 with quick downside targets at $640 and $635 or on failed breakouts at or near today’s highs. The VIX is at 15.18, signaling continued low volatility, but next week’s inflation data may change that quickly. Manage risk tightly, especially on breakouts or breakdowns. As always, review the premarket analysis posted before 9 AM ET to account for any changes in our model’s outlook and in Dealer Positioning.

Good luck and good trading!