Market Insights: Thursday, September 4th, 2025

Market Overview

Stocks surged on Thursday, with the S&P 500 hitting a fresh record high ahead of Friday’s critical jobs report. The S&P 500 climbed 0.8% to close at 6,502.08, a new all-time high, while the Nasdaq gained nearly 1%, and the Dow added 0.77%. Traders leaned into the growing belief that the Federal Reserve is nearing a rate cut, especially after new labor data showed the job market may be losing steam. ADP reported private sector job growth of just 54,000 in August, well below expectations of 65,000. Weekly jobless claims also exceeded forecasts, climbing to their highest level since June, which reinforced the dovish outlook for the Fed.

However, not all data signaled weakness. The ISM Services PMI came in better than expected, suggesting that the consumer economy remains resilient. That said, hiring in the sector continues to lag, marking the third consecutive month of contraction. With traders now pricing in a 97% chance of a rate cut at the next Fed meeting, up from 91.7% the day before, sentiment turned decisively bullish. All eyes are now on Friday’s Nonfarm Payrolls report, which could either confirm or disrupt the current momentum.

Meanwhile, political headlines added some intrigue, as a Senate hearing to confirm Stephen Miran for the Federal Reserve Board reignited debate over central bank independence. Miran, a Trump nominee, faced scrutiny for saying he would not step down from his current White House post if confirmed. On the corporate side, American Eagle shares jumped following a forecast for stronger sales, aided by high-profile marketing campaigns. Investors also watched for earnings from Broadcom, Lululemon, and DocuSign, which were expected after the close.

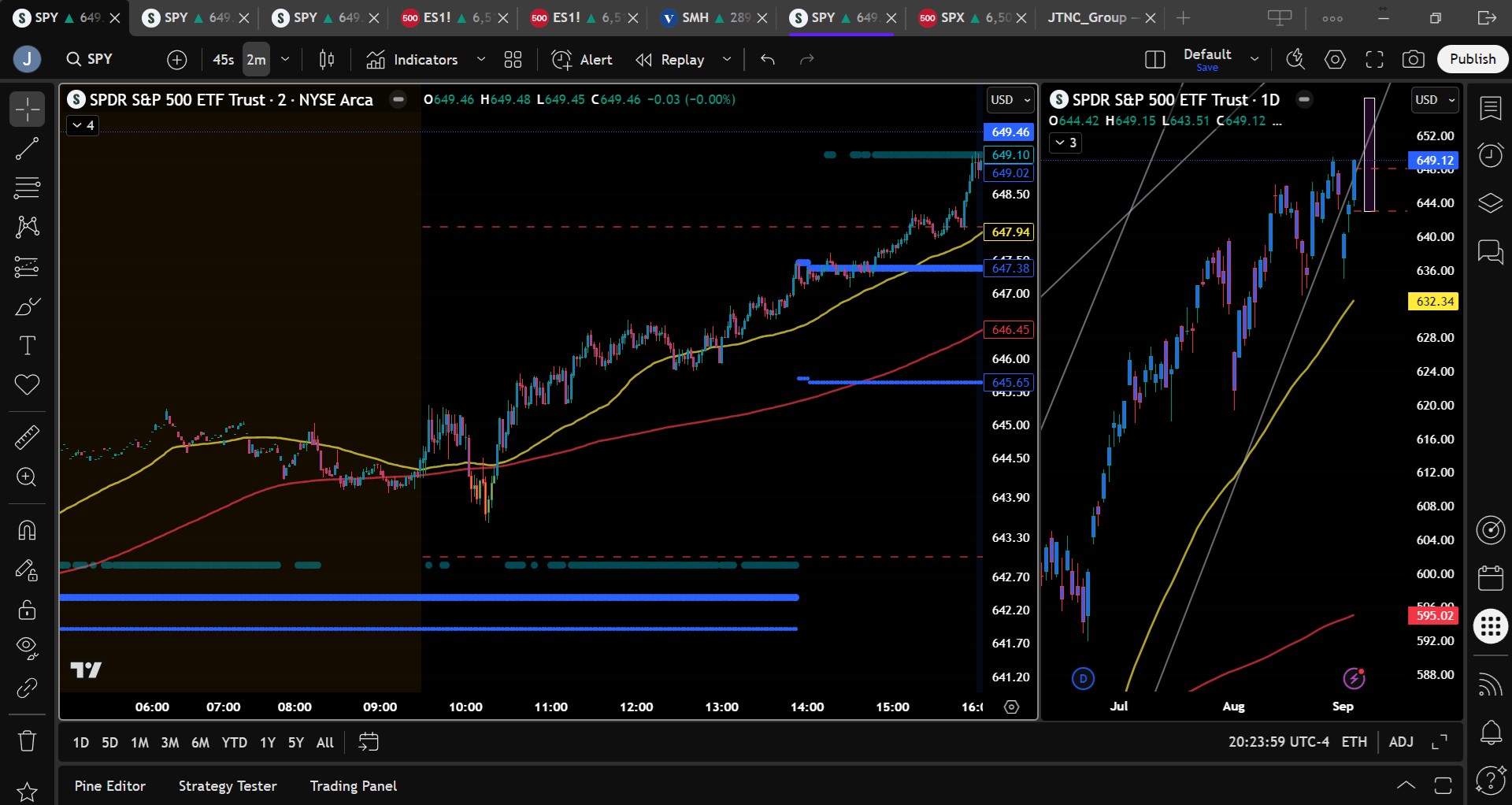

SPY Performance

SPY rallied 0.81% to finish at $648.97, after opening at $644.42 and reaching an intraday high of $649.15. The session low of $643.51 was tested early but quickly bought, marking another day where dip buyers dominated. Volume came in at 57.96 million, slightly below average but healthy enough to support the advance. The strong close above the long-watched $645 resistance level pushed SPY back into its bullish trend channel and just a few points shy of new all-time highs.

Major Indices Performance

The Russell 2000 led the charge with a 1.19% gain, followed by the Nasdaq, which rose 0.98% on strength in tech and semiconductors. The Dow tacked on 0.77%, while the S&P 500 climbed 0.8% to notch a new record. Investors welcomed weaker-than-expected ADP job gains and elevated unemployment claims, which together fueled hopes for a rate cut as early as September. At the same time, upbeat Services PMI data suggested that consumer-driven sectors remain healthy, offering a soft landing narrative that markets cheered. Sector performance was broadly positive, with leadership from tech, discretionary, and small caps.

Notable Stock Movements

It was a green day across the Magnificent Seven, with Amazon stealing the spotlight after surging 4.27%, helping to lift broader indices. The rally was widespread among the group, with notable strength in Netflix and Meta, while Nvidia recovered slightly after a recent pause. The coordinated move higher among the mega-caps reinforced bullish sentiment and added fuel to the idea that tech remains the market's leadership group. Traders continue to view Big Tech as a safe harbor amid economic uncertainty, especially with signs the Fed could soon pivot.

Commodity and Cryptocurrency Updates

Crude oil slipped 0.67% to settle at $63.28, continuing its gradual move toward the $60 target our model has forecasted for months. Gold fell 0.79% to $3,606 as risk appetite returned and investors rotated out of safe-haven assets. Bitcoin lost 0.91%, closing below $111,000, under pressure as crypto continues to move in lockstep with broader risk-on sentiment. Both gold and crypto appear to be in consolidation mode as markets wait for clearer signals from economic data.

Treasury Yield Information

Treasury yields dipped again, with the 10-year falling 0.31% to 4.163%. The continued decline reflects rising expectations of rate cuts, especially after Thursday's labor data showed growing softness in the job market. Yields remain well below critical danger zones; however, the market remains alert. A sustained rise above 4.5% could spell trouble for equities, and anything approaching 5% or higher may trigger a significant selloff. For now, the move lower in yields is seen as supportive for equity valuations.

Previous Day’s Forecast Analysis

Wednesday’s forecast called for SPY to trade between $638 and $649.50 with a cautiously bullish bias. The model emphasized the importance of a breakout above $645, which would shift the narrative toward higher prices, while downside risks were linked to a break below $638. Bulls were advised to stay long above $642 and use any dip toward $640 as a buying opportunity, while shorts were only favored below $638. The strategy leaned toward patient long trades with the VIX at 16.35 suggesting low volatility and tight risk parameters.

Market Performance vs. Forecast

SPY’s Thursday performance tracked closely with the forecast. After opening at $644.42, SPY quickly tested and held support at $643.51 before surging to a high of $649.15 and closing at $648.97. This move respected the projected range and confirmed the bullish bias, as buyers aggressively defended support and drove price through the $645 resistance zone. The breakout above $645 allowed long trades to hit multiple upside targets, including $647 and nearly $649. No breakdowns occurred, and the key support at $638 never came into play. Traders following the model were rewarded with solid long entries and a clean upward trend throughout the day.

Premarket Analysis Summary

In Thursday’s premarket analysis posted at 7:14 AM, SPY was trading at $644.99 with a bias level at $643. The model expected a consolidative structure with potential upward drift if SPY could remain above the bias level. Upside targets included $646.75 and $648, while downside levels were noted at $643, $641.75, and $639.75. The analysis leaned toward favoring long setups on dips and noted a cautious approach to shorting unless SPY rejected upper resistance levels. The expectation was for potential sideways chop unless aggressive intraday buying stepped in.

Validation of the Analysis

Thursday’s action validated the premarket roadmap nearly to the letter. SPY held above the $643 bias level early and tested $643.51, right near the initial downside target, before rallying strongly to tap $649.15. Both upside targets—$646.75 and $648—were surpassed, confirming the bullish tilt and strength of the day’s move. The market never sustained a move below the bias level, and traders following the guidance to avoid early shorts and look to buy dips were well-positioned. The day’s rally proved that premarket levels and sentiment once again offered clear and actionable guidance.

Looking Ahead

Friday brings the main event of the week: the August Nonfarm Payrolls report. With multiple data points already pointing to a weakening labor market, Friday’s report could further solidify expectations for rate cuts or derail the current rally if the numbers come in too hot. Traders should be prepared for significant volatility at the open, particularly if the jobs data diverges meaningfully from expectations. After Friday, the calendar is light until Wednesday’s PPI and Thursday’s CPI—two critical inflation reads that will shape the Fed's next move.

Market Sentiment and Key Levels

SPY ended the day at $648.97, just below all-time highs and well above the prior $645 resistance zone. Market sentiment is bullish, with dip buyers continuing to control price action and traders now anticipating a push toward $650 and beyond. Key resistance lies at $650, followed by $653 and $655. Above that, $660 remains the line needed to confirm a full breakout. On the downside, support sits at $647, then $644 and $640. As long as SPY holds above $642, bulls are firmly in control. Bears remain sidelined until a breakdown below $640 materializes.

Expected Price Action

Our AI model projects SPY to trade between $643 and $656.50 on Friday, suggesting a wide and potentially trending session. This is actionable intelligence generated by our AI model. With momentum favoring the bulls, we expect a test of $650 early, and a strong jobs report could drive a move through $653 and $655. A breakout above $655 opens the door to $660 and possibly new all-time highs. Conversely, if SPY fails to hold $647 or $644 after the jobs release, sellers could press for a quick test of $640. A break below $640 would open downside targets at $635 and $625. Tomorrow’s range allows for two-way trading but leans bullish as long as price holds above $642.

Trading Strategy

Long setups are favored above $644, with targets at $647, $650, and $653. If SPY breaks $650 post-jobs data, expect bulls to aim for $655 and possibly $660. Short trades are only viable below $644, with quick targets at $640 and $635, and lower if momentum builds. However, short trades carry higher risk given current bullish momentum. With the VIX down another 6.42% to 15.30, volatility is compressed but could spike quickly if the jobs report surprises. Use tight stops, reduce size around major data releases, and be ready to reverse if price action flips. Monitor $640 closely—if it breaks, momentum could shift swiftly to the downside.

Model’s Projected Range

SPY’s projected range for Friday sits between $643 and $656.50, with the Call side dominating in an expanding band that suggests periods of trending action with intermittent chop. A weaker-than-expected ADP Employment Change and higher-than-expected Unemployment Claims set the stage for prices to rally as market participants leaned into the view that the Federal Reserve is more likely to cut rates at the next FOMC meeting. Services PMI came in better than expected, signaling that the consumer is not yet under strain, and while the market initially did little with the news, bulls eventually pressed higher, driving prices to within a whisper of new all-time highs. There is no reason to fight this momentum as markets often run further and longer than seems reasonable. Every dip is being bought, and we forecast new highs tomorrow and likely into FOMC on the 17th. With SPY closing at $648.97, well above $645 and on lighter volume, the bears are sidelined until price falls to $640 or lower. While our base case remains a 10–15% pullback at some point, we continue to view any weakness as a buying opportunity and recommend buying every dip above $640. Still, tomorrow is the big event of the week with the monthly jobs report, and everything can change quickly; absent a shock, we expect bulls to defend $643–$642 in order to trap shorts, and we will look to buy those dips. If SPY holds above $645 after the jobs report, a breakout above $650 could fuel a run toward $655, with $660 still required to confirm the breakout. Failure to reach that level would suggest a near-term top, especially given September’s reputation for negative returns, though current momentum suggests the bulls could get there before FOMC, a reminder that seasonal patterns are unreliable at best. Bears will not engage meaningfully until $640 breaks, as the $640–$650 range remains thick with support. If $640 fails, the door opens to a swift move to $635 and potentially $625. For Friday, trending action is likely, with resistance at $650, $653, $655, and $660, and support at $647, $644, $640, and $635. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Today every Mag stock rallied, led by Amazon and Netflix, and until weakness emerges in these leaders, or ETH closes below $4300, prices are likely to push higher. We continue to favor quick profit-taking and caution with overnight holds. The VIX fell 6.42% to 15.30, and while September often sees VIX near 20, contango in VXX futures suggests volatility may drift lower into FOMC. Still, if you haven’t added protection to your long book, now is the time, as a “buy the rumor, sell the news” setup is possible heading into the meeting. VIX below 23 reinforces the bullish case, but a breakout above it could finally spark the long-anticipated 5–10% pullback. With SPY closing back inside the bull trend channel from the April lows, another green day would push it deeper into this steep, uncorrected channel.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a narrow Bullish Trending Market State, with SPY closing well above MSI resistance turned support. Extended targets printed into the close and for most of the premarket and the regular session, indicating the herd was ready to push prices higher and that is exactly what they did. Before 2 pm the MSI rescaled higher to an average range Bullish Trending Market State but with extended targets printing without lapse, price pushed up against the all-time high. The MSI is forecasting new highs tomorrow and possibly overnight. MSI support stands at $647.38, and lower at $645.65.

Key Levels and Market Movements:

On Wednesday we wrote, “expect more two-way price action as bulls look to push above $645 while bears aim to break today’s lows,” and noted, “A successful reclaim of $645 would open the door for SPY to push toward new all-time highs,” while also stating, “Our bias continues to favor buys on dips while also considering short setups on failed breakouts near current levels and until $645 is reclaimed.” With that context, and with the MSI opening in a Bullish Trending Market State that printed extended targets in the premarket, we looked for a spot to get long. There was little of interest at the open, but a less-than-perfect failed breakdown at 10:15 AM had us long at $643.90 with a first target at the premarket level of $646.75, a big first target, and one some doubted could be reached. Doubters may doubt, but SPY pushed straight up and our model once again nailed it with a monster T1. We then looked to the premarket level at $648 for T2, but the MSI rescaled higher and gave us $647.38 as resistance. We exited at that level, then trailed into the close as price reached and exceeded another premarket level. One and done, but a monster trade, the equivalent of two or three trades on a normal day, delivered once again thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Friday brings the government’s monthly jobs report, which means the market can, and likely will, swing $10 in either direction. If you’ve had a strong week, don’t risk profits on a day that could see major volatility. Absent this external catalyst, we continue to favor longs above $640 and will be cautious with shorts—even on bad news, as negative headlines may simply trap bears and reverse sharply higher. With a wide range in play, trending price action is expected, with the bulls firmly in control. The bears have no claim on the market unless price closes below $640. We expect new all-time highs overnight and into Friday, with our bias remaining to favor buys on dips while also considering short setups on failed breakouts near $650. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $650 to $661 and higher strike Calls while also selling $644 to $649 Puts indicating the Dealers belief that prices will continue to rally on Friday. Dealers do not sell at the money Puts unless they believe prices are set to rally. The ceiling for tomorrow appears to be $655. To the downside, Dealers are buying $643 to $595 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $650 to $670 and higher strike Calls indicating the Dealers belief that prices may take a pause next week and not move significantly higher. The ceiling for the week is likely $660. To the downside, Dealers are buying $649 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling, reflecting a bearish outlook for next week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed Thursday at $648.97, within reach of record highs and firmly back inside its bullish trend channel. Traders should consider initiating long trades on dips above $642, targeting $650, $653, and $655. If the jobs report surprises to the upside, a breakout above $655 could trigger a fast move to $660. Short trades are only favored below $640 with downside targets at $635 and $630 or on a textbook failed breakout above $650. The VIX at 15.30 is signaling low volatility, but with the jobs report ahead, traders should size down and prepare for a volatility spike. Stay disciplined, watch for failed breakouts or breakdowns, and trade what you see, not what you think. Review the premarket analysis posted before 9 AM ET to account for any changes in our model’s outlook and in Dealer Positioning.

Good luck and good trading!