Market Insights: Wednesday, September 3rd, 2025

Market Overview

Stocks ended mixed on Wednesday as the Nasdaq and S&P 500 rose, boosted by strength in Big Tech, while the Dow slipped slightly following a weaker-than-expected JOLTS jobs report. Tech sentiment got a lift after Google avoided the harshest penalties in its landmark antitrust case, with the judge declining to force a breakup of its Chrome browser and allowing payments to Apple to continue. That ruling erased regulatory overhangs that had been weighing on Alphabet’s stock, and the rally spread to other major tech names, helping lift broader indices. However, under the surface, the latest JOLTS data showed job openings fell to 7.18 million, below estimates and another sign that the labor market is cooling. This stoked recession concerns even as it increased the odds of rate cuts later this year. Treasury yields eased in response, with the 10-year closing at 4.22%, helping ease pressure on equities. Still, the Dow lagged amid lingering political uncertainty and trade policy concerns tied to former President Trump’s proposals. As markets brace for Friday’s pivotal Nonfarm Payrolls report, today’s action reinforced that traders are increasingly leaning on every piece of labor data for forward-looking rate clues.

SPY Performance

SPY rose 0.52% to close at $643.60 after opening at $642.75 and climbing to an intraday high of $644.21 before dipping slightly in the final hour. The session low of $640.46 held firm as dip buyers stepped in during the afternoon, continuing the recent pattern of support at $638 acting as a line in the sand. Volume clocked in at 65.69 million, slightly below the prior day’s elevated level but still solid, indicating interest remains high. The late-session rally into resistance suggests bulls are not giving up control easily, even as key levels like $645 remain difficult to reclaim. The price action kept SPY beneath major breakout zones, reinforcing a cautious but constructive tone for the bulls.

Major Indices Performance

The Nasdaq led the day with a 1.02% gain, bolstered by a broad rally in tech after Alphabet’s legal win and upbeat action in Apple. The S&P 500 followed with a 0.52% advance, supported by tech strength and a slight drop in bond yields. The Russell 2000 slipped 0.10%, while the Dow underperformed, falling 0.06% as economically sensitive names struggled. The weaker JOLTS report raised rate cut hopes but also triggered fresh recession worries, contributing to diverging sector performance. Tech and communication services outperformed, while defensive and cyclical sectors saw mixed results. Markets remain in data-dependent mode, with each labor market release now carrying increased weight ahead of Friday’s jobs report.

Notable Stock Movements

It was a green day for the Magnificent Seven, with all names closing higher except Nvidia, which dipped 0.09% as traders continued digesting recent comments about AI chip supply. Google led the pack after avoiding the worst-case outcome in its antitrust battle, sending shares higher and removing a major overhang. Apple also rallied on the ruling, as its business model tied to Google search payments was left intact. The rally across mega-cap tech reinforced investor appetite for leadership from the largest names, signaling that the broader market still sees Big Tech as the safest place to park capital amid economic uncertainty.

Commodity and Cryptocurrency Updates

Crude oil fell 2.52% to close at $63.94, continuing its pullback toward our long-standing target near $60 as global demand signals weaken. Gold rose 0.84% to finish at $3,622, supported by falling yields and rising economic concerns, including signs of a softening labor market. Bitcoin added 0.66% to close at $112,140, stabilizing as crypto continues to track broader risk-on sentiment. Precious metals and digital assets both appear to be benefiting from a renewed flight to alternative stores of value amid market volatility.

Treasury Yield Information

Treasury yields fell across the curve, with the 10-year yield dropping 1.33% to close at 4.22%. The 30-year retreated from overnight highs near 5%, easing concerns about rising borrowing costs that had pressured equities earlier in the week. While yields remain elevated, the pullback suggests traders are re-evaluating the economic outlook in light of softer job openings data. A move below 4.2% on the 10-year would further support equity valuations, especially in tech, while a reversal higher toward 4.5% or more could once again drag risk assets lower.

Previous Day’s Forecast Analysis

Tuesday’s newsletter called for SPY to trade between $634 and $645 with a bearish bias, highlighting that a breakdown below $635 would likely trigger a move toward $630 and $625. Resistance was expected at $643 and $645, while support at $638 and $635 was flagged as key. The model emphasized a short bias below $640 with the potential for failed breakdown reversals near major support. The strategy leaned short early but remained open to long trades if bulls could reclaim $643 and push toward $645. It was also noted that the VIX at 17.18 supported tighter risk management and a defensive posture amid rising volatility.

Market Performance vs. Forecast

Wednesday’s price action aligned closely with the forecast. SPY opened at $642.75, above the $640 short trigger level, and briefly pushed through $644.21 before fading and finding support at $640.46. The late-day rally closed SPY at $643.60, nearly touching the $645 resistance zone called out in the forecast. The model’s bias toward two-way action played out, with early strength fading into the mid-session but reversing late in the day. Traders using the forecast had opportunities to go long on dips near $640 and take profits just beneath $644 and $645, as projected. The model's expected range of $634 to $645 held firm, with no major breakouts or breakdowns, validating the cautious and flexible strategy.

Premarket Analysis Summary

In Wednesday’s premarket analysis posted at 7:27 AM, SPY was trading at $643.50, with a bias level identified at $643.40. Upside targets included $644 and $646, while downside levels were noted at $641, $639, and $636. The model expected listless action early, with resistance directly overhead and decent support below. The analysis leaned bullish as long as SPY held above the bias level and favored long entries toward $644 and $646. If the bias level broke, a drift lower was expected, but short setups were not favored unless SPY lost $639 with conviction. Traders were advised to wait for better long setups near $641 or $639 rather than chase downside.

Validation of the Analysis

Wednesday’s market confirmed the premarket analysis nearly perfectly. SPY opened just above the bias level and made an initial move toward $644, tapping $644.21 mid-morning before fading. The dip found support at $640.46, just above the lower projected levels of $641 and $639, reinforcing the expectation that buyers would defend these zones. A final-hour rally drove SPY back above $643, closing at $643.60 and validating the upside targets. The premarket call to favor longs and avoid early shorts worked well, particularly for those who waited for pullbacks near $640 before entering trades. The analysis once again provided strong intraday guidance and actionable levels.

Looking Ahead

Thursday brings ADP Payrolls and weekly unemployment claims, two data points that could help clarify the labor market picture ahead of Friday’s key Nonfarm Payrolls release. While ADP is unlikely to significantly move markets on its own, a surprising result could cause ripples, particularly in light of Wednesday’s weaker JOLTS report. Traders should expect continued sensitivity to economic releases, especially those tied to employment, and be prepared for swift moves if Thursday’s data sharply diverges from expectations.

Market Sentiment and Key Levels

SPY closed at $643.60, just below the critical $645 resistance level that continues to cap upside momentum. Market sentiment remains cautiously bullish, with bulls regaining short-term control but struggling to reclaim key breakout zones. The $645-$647 area stands as the major overhead resistance; a breakout above could trigger a push toward $649 and $650. On the downside, support lies at $642, followed by $640 and the major pivot level at $638. A break below $638 would put $635 and $630 back in play. With Friday’s job report looming, bulls need to build on the late-session strength to push SPY back toward its bullish trend channel, while bears will try to cap price beneath $645 and reignite selling near $640.

Expected Price Action

Our AI model projects SPY to trade between $640 and $648 on Thursday, a moderately wide range that suggests potential for trending price action with intraday reversals. The bias remains cautiously bullish, as bulls defended $640 and are eyeing a break above $645. If SPY clears $645 early, upside targets include $647, $649, and possibly $650. A breakout above $650 could set the stage for a push toward prior highs, especially if Thursday’s data supports a dovish Fed narrative. Conversely, if SPY stalls again at $645 and slips below $642, sellers may press toward $640 and $638. A breakdown below $638 opens the door to $635 and $630. This is actionable intelligence generated by our AI model, and we continue to favor long trades above $642, while remaining nimble in the face of potential volatility heading into Friday’s job report.

Trading Strategy

Traders should favor long setups above $642, targeting $644, $645, and $647. If SPY breaks above $645 with strength, the next upside levels are $649 and $650. On the downside, a loss of $642 may bring a quick test of $640 and $638. A clean break below $638 could trigger a drop to $635, with further weakness possibly extending to $630 or even $625 if momentum accelerates. Short trades are only favored below $638, and even then, traders should be prepared to take profits quickly. The VIX dropped to 16.35, down 4.78%, indicating lower implied volatility but not complacency. Traders should continue to trim position size, maintain tight stops, and be especially careful around economic data releases. Smaller size and faster decision-making are key to navigating the current market environment.

Model’s Projected Range

SPY’s projected range for Thursday sits between $638 and $649.50, with the Put side dominating in a narrowing band that suggests periods of trending action with intermittent chop. A weaker-than-expected JOLTS Job Openings report weighed on the premarket, pulling price back from the overnight rally. But the dip was short-lived as bulls defended $641 and kept SPY above the $638 line in the sand, driving price above $644 by mid-morning. That strength faded as markets interpreted weaker job openings as a possible recession signal, sending SPY lower throughout the day until the final hour, when buyers stepped in at $640.46, again holding above $638, and reversed price sharply higher into the close at $643.74, up 0.54% and just below critical $645 resistance. Fewer job openings have historically been a leading recession indicator, and while we aren’t there yet, the dynamic that has persisted since the Covid recovery, more openings than workers to fill them, is changing, which could foreshadow a worse-than-expected jobs number on Friday. A weak print may boost equities by reinforcing the case for rate cuts, but ultimately a recession is negative for business, and the market will eventually reprice lower. Our base case remains a 10–15% pullback at some point, which we view as a buying opportunity given our expectation for SPY to potentially reach $750 by the end of 2026. Long-term, the market remains the place to be, so keep powder dry, wait for a correction, and reload long as prices will likely be higher next summer than this one. With SPY closing below $645 on average volume, bears are still active and will attempt to keep price capped under that level. For Thursday, with only ADP data on deck and unlikely to rock the market, absent an external catalyst the bulls want to build on the final-hour rally by defending $642 overnight and pushing through $645. Bears have little claim to control unless SPY breaks today’s $640.50 low; if that level gives way, $635 comes into play and potentially $630, where a breakdown could accelerate losses toward $625 with limited support below. If bulls hold today’s low, however, a push above $645 is likely as a step toward prior highs. As we’ve repeated for over a week, $660 is required to confirm the breakout, and failure to get there would suggest a near-term top, especially given September’s reputation for negative returns. With Thursday’s narrowing range, two-way trading is favored, with resistance at $644, $645, $649, and $650, and support at $642, $640, $637, and $634. Since reclaiming $585, SPY has remained in a steady uptrend supported by dip buyers; today all Mag stocks except Nvidia gained, with Google leading after a favorable court ruling. Weakness in these leaders, or ETH breaking below $4300, would be an early warning that prices could roll over, as the parabolic advance carries rising risk with limited reward. Until then, price is likely to continue higher, though we continue to recommend quick profit-taking and caution with overnight holds. The VIX fell 4.78% to 16.35, and while September often sees VIX near 20, contango in VXX futures implies volatility may decline, though we still lean toward VIX 20 printing this month. If you haven’t yet added protection to your long book, now is the time, given the coin-toss setup into September. VIX below 23 supports the bullish case, but a breakout above it could finally spark the long-anticipated 5–10% pullback. SPY closed just under the bull trend channel from the April lows, and another green day will push it back inside this steep, uncorrected bull channel.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a narrow Bullish Trending Market State, with SPY closing well above MSI resistance turned support. Extended targets printed into the close with the last hour reversing all of the day’s declines in less than an hour. This saw the MSI rescale from a narrow bearish state to a bullish state with extended targets above. During the overnight session, the MSI did not rescale and maintained the narrow bullish state from the prior day’s close. A test of MSI support initially led to a rally but once price reached $644, extended targets stopped printing and price fell with the MSI rescaling lower several times in a bearish state. But these were all quite narrow and extended targets printed only occasionally which implied a weak bear trend. And sure enough, price reversed course to close up on the day. Currently the MSI implies higher prices on Thursday but with its narrow width, watch for a rescale or the ceasing of extended targets which could lead to a repeat of today’s price action on Thursday. MSI support stands at $642.40, and lower at $641.92.

Key Levels and Market Movements:

On Tuesday we wrote, “Wednesday is expected to deliver more sideways, two-way trading as the market looks to build on today’s dip-buying off the lows,” and noted, “leaving bulls in control of the broader narrative…for now. Our bias remains to favor buys on a retest of today’s lows while also considering short setups on failed breakouts near current levels,” while also stating, “Overall, we expect the market to retest today’s lows to reveal how much strength the bulls have left.” With that context, and with the MSI opening in a Bullish Trending Market State that printed extended targets in the premarket, we looked for a test of MSI support to go long. That opportunity came just after 10 AM on a textbook failed breakdown, where price bounced off MSI support and reversed. We entered long at $642, setting our first target at the premarket support-turned-resistance level of $643.40, which SPY reached before 11 AM, allowing us to set T2 at the next premarket level of $644. That too was hit quickly, and after a less-than-perfect failed breakout we exited our long at $644 and waited for extended targets to stop printing before entering short. That came at 11:15 AM, with an entry at $643.75 as we looked to reverse the profitable long we had just exited. We set T1 at MSI resistance-turned-support at $642.40, which hit quickly, and T2 at MSI support at $641.86. Price chopped around before reaching that level, but with no extended targets and a narrow MSI we held on until T2 hit just before 1 PM. With a stop at breakeven, we trailed toward the premarket level of $641 as the MSI began rescaling lower, though weakly, with a narrow range and intermittent extended targets. At 2:40 PM, SPY set up a textbook failed breakdown, prompting us to exit our short and wait for extended targets to stop printing before reentering long at $640.75. We set T1 at MSI resistance at $641.92, which was hit on a quick pop after 3 PM, and then looked to T2 at $642.40 as the MSI rescaled higher. That too came quickly. So with a stop at breakeven and only a 10% trailer left, we held on for the premarket level of $643.40 once again. A sharp push carried price even higher, and we exited at the close at $643.75 with a massive winner off the day’s lows. Three for three with all large winning trades, thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday brings ADP employment data and unemployment claims, though these are unlikely to move the market with Friday’s monthly jobs report still the main event of the week. With the range narrowing, expect more two-way price action as bulls look to push above $645 while bears aim to break today’s lows. The bulls do not want to lose $642 overnight, but if they do, a retest and likely dip-buy near or just above today’s lows is expected. A successful reclaim of $645 would open the door for SPY to push toward new all-time highs, while failure to do so would leave room for bears to retest $640.50. The bears need a close below that level to generate momentum, and until then, the bulls remain in control. Our bias continues to favor buys on dips while also considering short setups on failed breakouts near current levels and until $645 is reclaimed. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

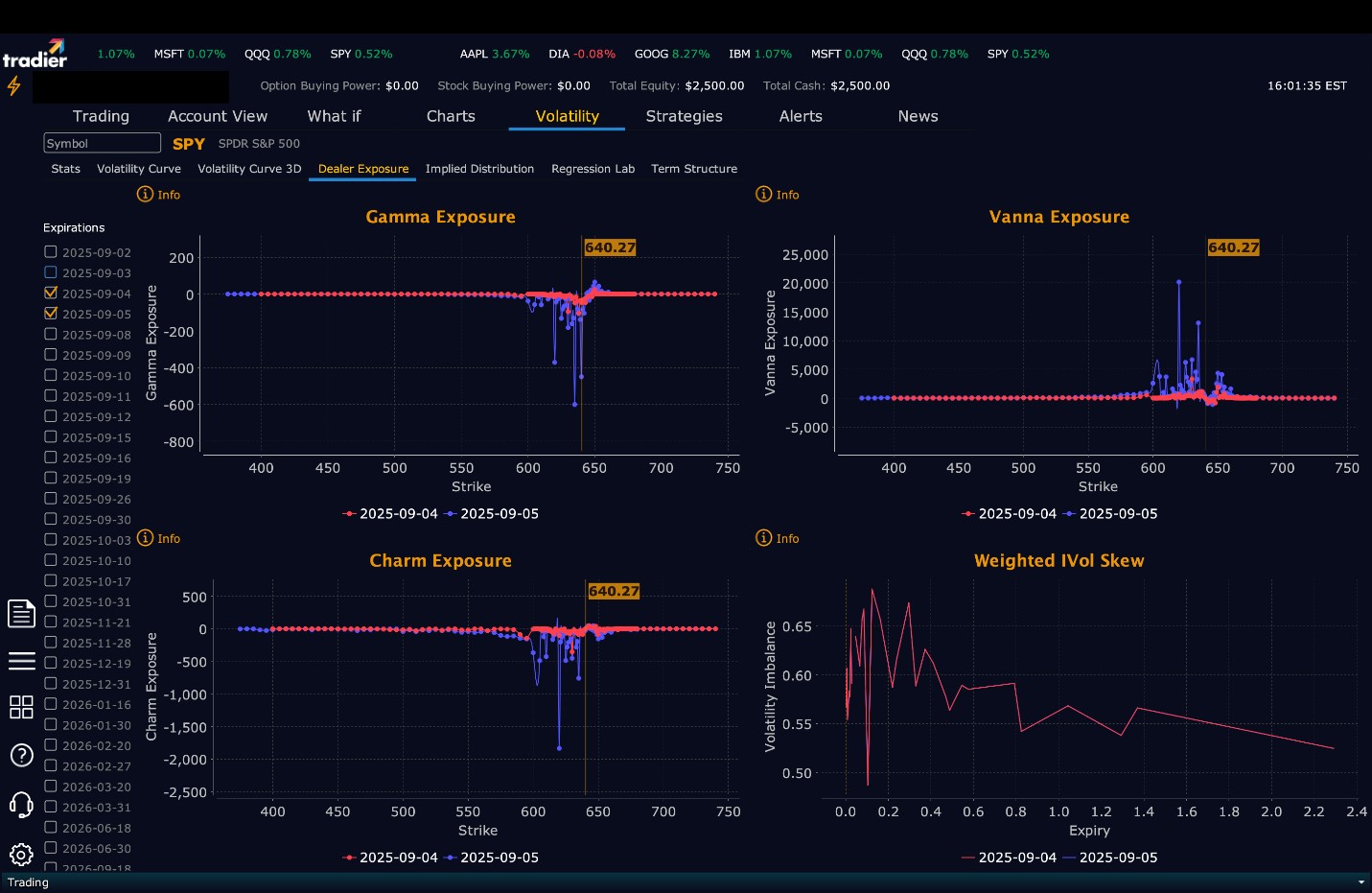

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $649 to $660 and higher strike Calls while also buying $644 to $648 Calls indicating the Dealers desire to participate in any rally on Thursday. The ceiling for tomorrow appears to be $650. To the downside, Dealers are buying $643 to $595 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower on tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $647 to $670 and higher strike Calls while also buying $644 to $646 Calls indicating the Dealers desire to participate in any rally this week. The ceiling for the week is likely $650. To the downside, Dealers are buying $643 to $540 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed Wednesday at $643.60, just beneath the key $645 resistance level. Traders should look to initiate long setups on breaks above $645 with targets at $647, $649, and potentially $650 or on retests of the day’s lows. Short trades can be considered if SPY fails at resistance and breaks below $642, with targets at $640, $638, and $635 or on failed breakouts above $644. The VIX remains subdued at 16.35, suggesting low volatility in the near term, but we remain cautious given macro data on deck. Use smaller position sizes, manage stops tightly near key levels, and be ready to pivot as Friday’s jobs data approaches. As always, review the premarket analysis posted before 9 AM ET to account for any changes in our model’s outlook and in Dealer Positioning.

Good luck and good trading!