Market Insights: Tuesday, September 30th, 2025

Market Overview

US stocks rose Tuesday as investors weighed the fallout of President Trump's expanding trade offensive and braced for the first government shutdown in seven years. The Dow gained 0.19%, setting a new record close, while the S&P 500 rose 0.38% and the Nasdaq climbed 0.30%. Both the Nasdaq and S&P 500 closed out their best third quarter since 2020 and their strongest September since 2010, with equity strength carrying into quarter-end despite significant macro and political risks.

Markets are on edge as lawmakers failed to reach a funding agreement in Monday’s Oval Office meeting. Vice President JD Vance said, “I think we're headed to a shutdown,” with Polymarket placing the odds at 93%. If a deal isn’t struck by 12:01 a.m. ET Wednesday, the shutdown will trigger the suspension of all Bureau of Labor Statistics activity, delaying the release of Friday’s jobs report and other key data the Fed relies on for policy decisions.

Tuesday’s JOLTS report, potentially the last labor update for some time, showed job openings rising more than expected, though hiring slowed and layoffs fell—evidence of the “low-hire, low-fire” dynamic shaping the labor market. Separately, consumer confidence fell to its lowest level since April, driven largely by worsening job market sentiment. This comes amid mounting pressure from President Trump’s latest tariffs, including levies on lumber, timber, furniture, and a proposed 100% duty on foreign-made movies—adding to last week’s plans targeting imported pharmaceuticals. Global concerns are rising, particularly as economic data from China and Japan show ongoing factory weakness.

Despite the uncertainty, equities managed another positive session, aided by quarter-end repositioning. Gold surged again, capping its best third quarter since 1986, while the S&P 500 and Nasdaq continue to ride September momentum. With the shutdown deadline looming and Friday’s jobs report now in question, markets are bracing for volatility, even as the path of least resistance remains higher for now.

SPY Performance

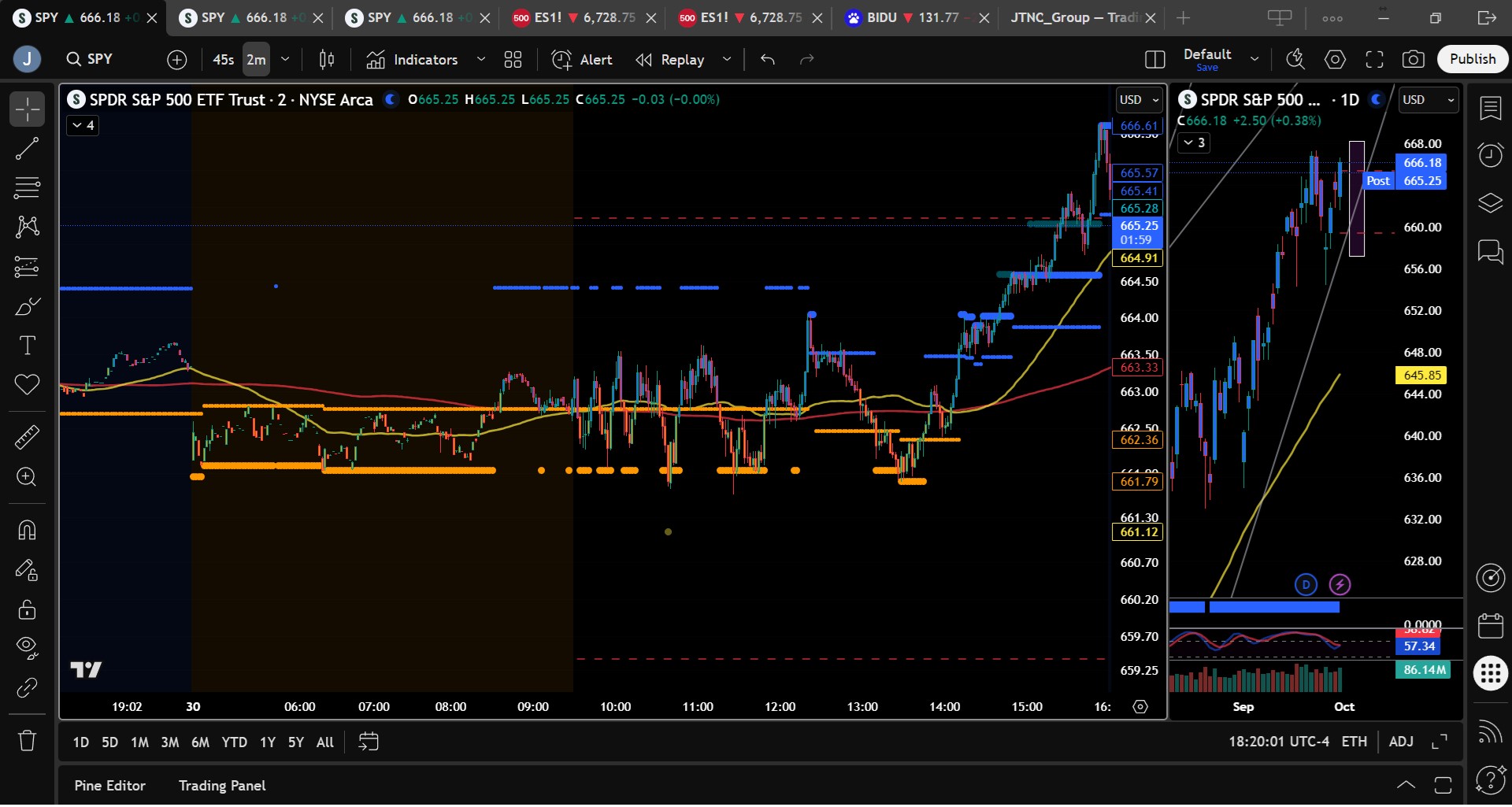

SPY gained 0.38% to close at $666.20 after opening at $662.92 and trading between $661.61 and $666.65. Volume rose to 73.34 million shares, slightly above average as quarter-end flows influenced positioning. The day began with a retest of prior support near $661, but buyers held the line once again. A slow, steady grind higher carried SPY above $663 by midday and toward the $666 level in the final hour, confirming a close firmly above both $660 and $663. Though the breakout lacked major force, the technical picture continues to favor bulls, at least until shutdown headlines resolve.

Major Indices Performance

The Dow led with a 0.19% gain and closed at a record high, while the S&P 500 rose 0.38% and the Nasdaq added 0.30%. The Russell 2000 advanced 0.13%, continuing to lag the broader market. Among the Mag Seven, half the group closed green, while Alphabet, Amazon, Netflix, and Meta fell. Meta led to the downside, dropping as much as 1.27%. Market breadth remains mixed, and large-cap leadership is still uncertain, but dip buyers continue to step in at key levels.

Notable Stock Movements

Meta, Netflix, Alphabet, and Amazon posted losses, while Tesla, Microsoft, Nvidia, and Apple all advanced. The uneven action across the Mag Seven reflects investor caution heading into quarter-end, particularly with uncertainty around the shutdown and potential delays to economic data. Energy stocks fell with crude, while gold miners continued to benefit from rising bullion prices. Nike was in focus after the bell, with earnings due to cap a volatile September stretch.

Commodity and Cryptocurrency Updates

Crude oil dropped 1.45% to settle at $62.53, extending a multi-day slide that supports our model’s call for a pullback to $60 before year-end. Gold rose 0.78% to close at $3,885, posting its best third quarter since 1986. Bitcoin edged up 0.07% to close above $114,300. Crypto markets remain broadly stable, with Bitcoin and Ethereum signaling steady liquidity conditions despite macro stress.

Treasury Yield Information

The 10-year Treasury yield rose slightly by 0.17% to close at 4.148%. Though still below the critical 4.5% threshold that pressures equities, yields remain a key watchpoint. Any spike above 4.8% could spark equity weakness, and a move to 5% or above may trigger a deeper correction. The bond market remains sensitive to inflation expectations and fiscal uncertainty, with potential volatility ahead if the shutdown materializes.

Previous Day’s Forecast Analysis

Monday’s model projected a range of $658.50 to $668.75, with bulls favored above $663 and upside targets at $665 and $667. Resistance was pegged at $665.35 and $667.35, while downside support was expected at $659.40 and $658.40. The roadmap called for chop early with bullish continuation if the bias level at $663 held, noting consolidation and hesitation were likely.

Market Performance vs. Forecast

Tuesday’s price action followed the model well. SPY opened below the bias level, dipped to $661.61, then recovered to reclaim $663 by midday. The high of $666.65 fell just shy of the projected $667.35 target, while support held precisely at the forecasted $661 area. Price trended higher with late-session acceleration, confirming the model’s expectation for upward grind. The roadmap captured the day’s structure with precision.

Premarket Analysis Summary

Tuesday’s premarket report, published at 7:05 AM, set $663 as the key bias level. It anticipated potential for gains toward $665.35 and $667.35 if that level held, but noted the market remained hesitant. Support was projected at $659.40 and $658.40. The analysis warned of churn and noted broader support remained firm despite rising news-driven risks. As expected, the early dip was bought and the targets above were tested into the close.

Validation of the Analysis

The premarket roadmap played out accurately. SPY tested below the bias level but reversed strongly, reclaiming $663 and extending toward $666. The bounce from $661.61 confirmed the support zones, and buyers pushed through resistance to reach the upper band of the forecast. The roadmap again provided clear direction, helping traders frame expectations for a session that began in hesitation but resolved with strength.

Looking Ahead

Wednesday features ADP Employment Change and PMI in the premarket, but the main event remains the looming government shutdown. SPY closed firmly above both $660 and $663, suggesting bulls are back in control—at least temporarily. Bulls need to clear $668 and $670 to continue the breakout, while bears must drive a breakdown below $655 to regain momentum. Wednesday’s session may bring more volatility, especially if shutdown headlines escalate. We expect two-way action with spikes in either direction depending on news flow.

Market Sentiment and Key Levels

SPY closed at $666.20, well above the $663 pivot and nearing resistance at $668. Resistance now sits at $668, $670, and $673. Support rests at $665, $660, $657, and $655. The $663–$665 zone remains a key control area. Bulls must hold above $663 to press higher, while a move below $657 would invite selling. The market is still vulnerable to policy headlines, but dip buyers continue to defend key zones.

Expected Price Action

SPY’s projected range for Wednesday is between $657.25 and $668.25, with the Put side dominating. The market is expected to show choppy price action with brief trending periods. ADP and PMI could move markets slightly, but shutdown risk remains the major catalyst. Buyers defended $661 repeatedly Tuesday, and SPY pushed higher into the close. We suspect quarter-end flows helped drive gains, and those may unwind if a shutdown occurs. Volume was above average, and while the bulls hold the edge above $663, the upside may be capped if no resolution emerges. Bears need a break below $655 to regain traction.

Trading Strategy

Longs are favored above $663, with pullbacks to $660 or $657 offering buy zones. Targets include $668, $670, and $673. Shorts may be taken on failed breakouts near $670 or if price breaks below $655. VIX rose 0.99% to 16.28, a small uptick that could foreshadow volatility. Protection is warranted. We recommend quick profit-taking and caution with overnight exposure, especially heading into shutdown headlines.

Model’s Projected Range

SPY’s projected range for Wednesday sits between $657.25 and $668.25 with the Put side dominating in a steady band that suggests choppy price action interlaced with periods of trending action, with ADP Employment Change and PMI due in the premarket that may move the market slightly, though the bigger risk remains the looming government shutdown, which if it occurs carries a high probability of sparking a selloff, and while we still believe there will be a last-minute deal to avert a shutdown, these are strange times with an unconventional White House so nothing should surprise market participants; overnight the market moved slightly lower and tested the prior day’s lows which held once again, with SPY bouncing off the $661 level repeatedly as buyers stepped in on every test, though the day was mostly sideways until the last hour which saw SPY move higher to close up 38 basis points at $666.18, firmly above both the $660 breakout level and the $663 level where the bulls rule, though we view the last hour push more as technical quarter-end repositioning than an actual push to new highs and suspect this reverses overnight or Thursday, but again, it all hinges on whether the government shuts down or not; volume was higher than average today, again a function of quarter-end positioning, and with SPY above $663 we favor the bulls taking back full control of the market and pushing toward new highs, with the index still well above the critical $645 threshold and dips consistently bought suggesting bulls are likely to continue recovering last week’s losses, while the bears need to move SPY below $655 to take back near-term control, and if that level fails the market likely drops to $650, yet a decisive break of $640 is needed to signal a true shift in the market and trigger our base case of a 10–15% pullback this year; for Wednesday, resistance sits at $668, $670, and $673 with support at $665, $660, $657, and $655, and since reclaiming $585 SPY has held a steady uptrend fueled by dip buyers, though Mag stocks were mixed today with Meta, Amazon, Netflix, and Google dropping while the others rose, and ETH hovering near $4200 remains a variable, as continued recovery supports the bull case but a sustained close below $4300 combined with weakness in Mag leaders would point to market softness, so we continue to favor quick profit-taking and caution with overnight holds, especially as the VIX rose 0.99% to 16.28 suggesting Futures traders may know something we do not, and surely if you haven’t added protection to your long book, now is the time since VIX below 23 supports the bullish case, but a breakout above it could finally trigger the long-anticipated pullback, with SPY closing above the redrawn lower bull trend channel from the April lows which we will watch closely to determine whether the uptrend remains intact or if a new bear trend is emerging.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing mid-range. There were extended targets into the close and with these absent for most of the day. The MSI spent virtually all day in a ranging state after rescaling higher overnight. But by the open, the MSI had rescaled to a ranging state which lasted for much of the day. While there were periods of a bearish MSI, these were quite narrow and with MSI support resting at $661, SPY could do little to break this prior day low. And then in the last hour, reshuffling of quarter end positions caused the MSI on volume to go through a series of rapid rescalings higher with extended targets that saw SPY stage a late day rally. For Wednesday the MSI is implying further gains but we would be very cautious with a quarter end rally at the end of the day. Overnight we expect the MSI to rescaled and provide more clearly direction for Wednesday. MSI support is $665.28 with resistance at $666.61.

Key Levels and Market Movements:

On Monday we wrote, “with a close above $663 the market skews to the bulls,” and noted, “given price is only tentatively holding this level at best, be prepared for a retest of the day’s lows at a minimum, which needs to hold for the bulls to push prices higher,” while also stating, expect “more two-way trading as we continue to buy dips at major support or short on weakness at or near $665 or on a failed breakout.” With that context, and with the MSI rescaling both higher and lower overnight without extended targets, by the open with the MSI in a ranging state, we decided the only trade possible was a retest of the prior day’s lows where we might like to go long. Since the best setups for this type of reversal trade are failed breakdowns and while price did test the prior day’s low before 10 am, we passed this signal given it didn’t have the pattern we like to trade. But at 11:24 am we got a less than perfect failed breakdown at MSI support and without any extended targets below, we entered long with our first target at the premarket level of $663. With T1 secured by noon and the MSI rescaling back to a ranging state, we didn’t love the trade so we set T2 at MSI resistance at $664.40 and moved our stop to breakeven just in case. SPY moved up slightly and the MSI rescaled to a narrow bullish state leading us to lower T2 to MSI resistance at $664 to secure a bit more profit. Then SPY then fell fairly quickly and although we really thought about closing the trade on a less than perfect failed breakout (we should have), we didn’t, and as such our trailer was stopped out at breakeven for the remaining 10% of our position. Given the time of day and how horribly choppy the day was, we decided to hang it up by 2 pm with a partial win which we registered as a victory. And while the MSI once again did provide another long late in the day, we went into profit protection mode and decided we would wait for a resolution to the government shutdown before trading again. But one for one nonetheless thanks once again to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Wednesday has ADP and PMI which might move the market, but the risk of a shutdown is more serious and potentially more impactful for price action. Be prepared to trade what you see given this macro risk. Absent an external shock, with a close above $663 the market skews to the bulls, and a move above $667 would likely result in new all-time highs. Should $663 fail, however, the likelihood is that price once again tests $660, and if that fails to hold, price could move as low as $655 which represents an absolute worst-case level for the bulls. If $655 fails, the market is likely to fall hard with only a pause at $650 on the way to much lower levels. While this is a low-probability event, it is worth noting since good news regarding the government shutdown would allow the bull trend to continue and price to march back toward all-time highs. As such, watch price action tomorrow and look for the MSI to provide direction, with expectations for more two-way trading as we continue to buy dips at major support or short on weakness at or near $666 or on a failed breakout, remembering that the bears come to life in scale only on a drop below $640. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $669 to $680 and higher strike Calls while buying $667- $668 Calls implying the Dealers belief that prices may continue higher on Wednesday and as such, they wish to participate in any rally. The ceiling for Wednesday appears to be $670. To the downside, Dealers are buying $666 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying little concern that prices could move lower tomorrow. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $667 to $690 and higher strike Calls implying the Dealers belief that prices may tread water near current levels. The ceiling for the week appears to be $670. To the downside, Dealers are buying $666 to $540 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a bearish to neutral outlook for the week. For the week Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $666.20, maintaining bull control. The path remains upward if $668 is cleared, but downside risks persist if $655 breaks. Quarter-end positioning, macro data, and government funding talks will all drive action. Trade with discipline, respect MSI levels, and stay nimble.

Good luck and good trading!