Market Insights: Friday, September 19th, 2025

Market Overview

US stocks closed at record highs for a second straight day on Friday, capping off a strong week as tech stocks continued to rally and investors welcomed signs of progress in US-China trade talks. The Nasdaq led the major indices with a 0.94% gain, while the S&P 500 climbed 0.48% and the Dow added 0.72%, with all three benchmarks finishing at new all-time highs. The rally was driven by renewed momentum in the “Magnificent Seven” tech names and market optimism following a call between President Trump and Chinese President Xi Jinping.

In a post on Truth Social, Trump said the conversation yielded progress on key topics, including trade, fentanyl, Ukraine, and a TikTok deal. Though specific details remain unclear, reports suggest a potential agreement would see a consortium including Oracle, Silver Lake, and Andreessen Horowitz take an 80% stake in TikTok to allow continued US operations. Chinese state media confirmed the discussion but emphasized the need for fair trade rules and warned against new US restrictions that could undermine the talks.

Apple helped lead Friday’s rally, rising on optimism around strong demand for its new iPhones, while Tesla surged nearly 8% on the week, followed by Alphabet and Amazon. Nvidia was the lone laggard among the Mag 7 group, pulling back modestly after Thursday’s outsized gain. Elsewhere, nuclear energy stocks including Oklo and NANO Nuclear surged amid sector enthusiasm, while Micron dipped ahead of its earnings report due next week. Broadcom also retreated, giving back some of last week’s sharp gains. Overall, Friday’s session added to a market narrative that continues to lean bullish into quarter-end.

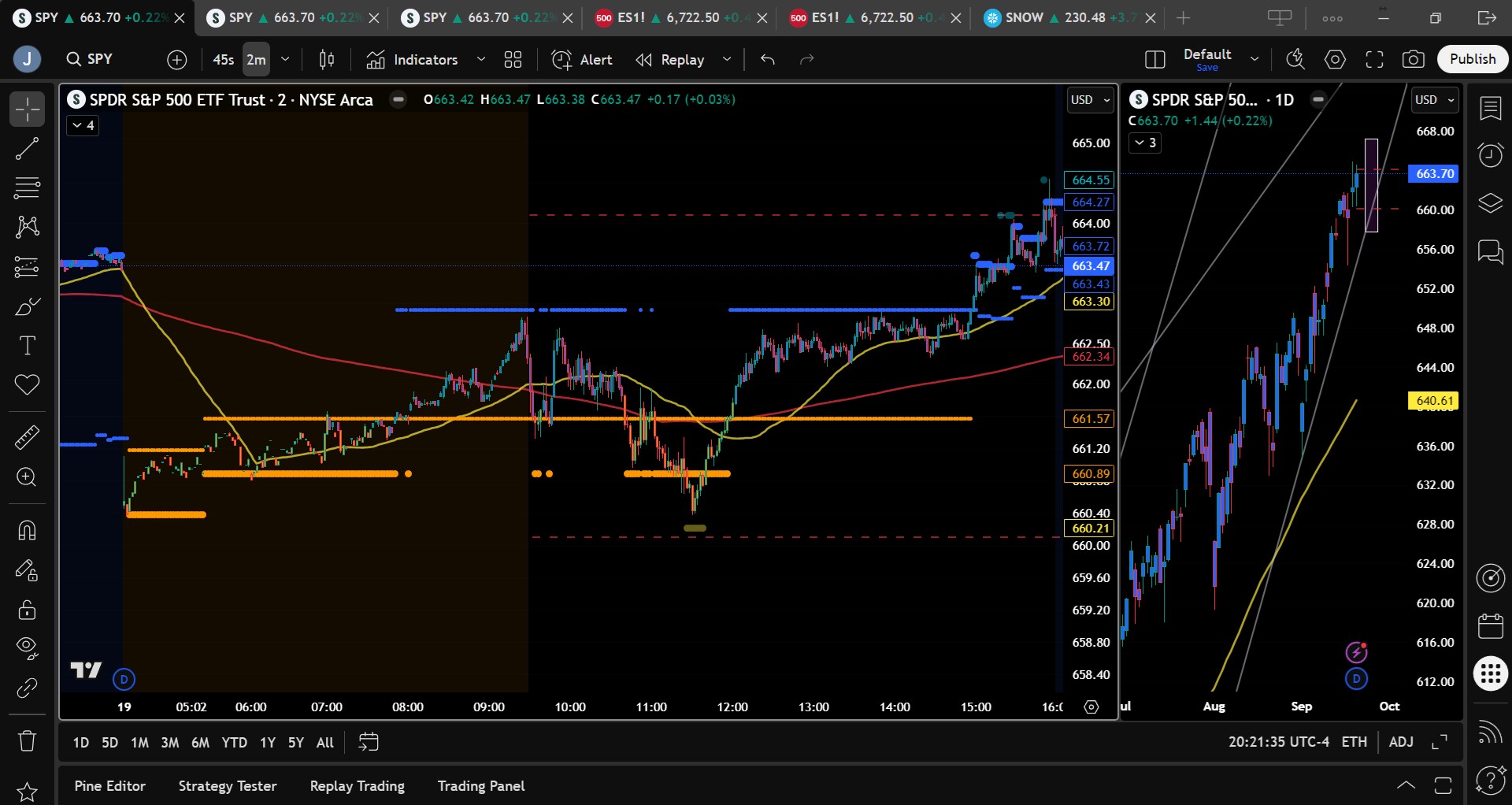

SPY Performance

SPY gained 0.48% to close at $663.60, marking its fourth consecutive higher close and another all-time high. The ETF opened at $662.12, dipped to a low of $660.37, and climbed to an intraday high of $664.55 before settling near the highs. Volume came in at 81.82 million shares, above average, supported by monthly options expiration. The session confirmed bullish continuation, with SPY consistently attracting dip buyers and holding above key breakout levels. The rally remains well-anchored by strong institutional demand and reinforced technical momentum.

Major Indices Performance

The Nasdaq led with a 0.94% gain as Apple and Alphabet paced tech sector strength. The S&P 500 rose 0.48%, continuing its breakout trajectory, while the Dow climbed 0.72% on broad sector participation. The Russell 2000 lagged, dropping 0.86% after Thursday’s outsized gain. Despite the small-cap pullback, overall breadth remained solid, and all three major indices logged their second straight weekly advance. The S&P and Nasdaq posted weekly gains of 1.2% and 2.2% respectively, while the Dow added 1%, all reinforcing the bullish tone.

Notable Stock Movements

Friday was a broadly green day for the Magnificent Seven, with only Meta ending slightly lower. Tesla led the group with a nearly 8% weekly gain, followed by strong performances from Alphabet and Apple. Nvidia paused after Thursday’s jump but remains a central focus for chip investors. Micron slipped modestly ahead of its earnings report, while Broadcom pulled back after a volatile prior week. Nuclear names like Oklo and NANO Nuclear gained on sector optimism, and traders watched for developments following the Trump-Xi call. With major tech stocks continuing to lead, risk appetite appears intact.

Commodity and Cryptocurrency Updates

Crude oil fell 1.38% to settle at $62.69, continuing its slow drift toward the model’s $60 target. Gold rebounded 1.05% to $3,716 after recent weakness, supported by renewed demand as a safe-haven hedge. Bitcoin dropped 1.91% to close just above $115,200, retreating from recent highs but still maintaining a constructive trend. While energy remains pressured, precious metals and crypto markets reflect broader risk-on positioning with underlying support.

Treasury Yield Information

The 10-year Treasury yield rose 0.58% to close at 4.127%, remaining safely below the 4.5% redline for equity markets. While the move higher signals caution among bond investors, yields remain far from danger zones. If the 10-year rises above 4.8%, markets could wobble, and a break above 5% would likely trigger deeper selling. At 5.2%, a 20% or greater correction is expected. For now, yields are supportive of continued equity gains, though upcoming inflation data could shift sentiment.

Previous Day’s Forecast Analysis

Thursday’s forecast called for SPY to trade between $656 and $669, with a bullish bias above $659 and a continuation signal above $665. Support was flagged at $656 and $652, while resistance stood at $663, $665, and $670. With no scheduled news on Friday, price action was expected to lean toward digestion, with trending continuation a possibility based on momentum and dealer flows.

Market Performance vs. Forecast

Friday’s action played out within the model’s projected range, with SPY opening at $662.12, dipping to $660.37, and rallying to a high of $664.55 before closing at $663.60. Resistance at $663 and $665 acted as magnets, and price respected support zones throughout the session. The model’s bullish tilt above $659 was validated once again, as dip buyers stepped in aggressively. The forecast captured both the range and direction, continuing its strong track record.

Premarket Analysis Summary

Friday’s premarket notes, published at 7:28 AM, set the bias level at $661.60 and noted potential continuation toward $662.60 and $665.75 if that level held. Support was seen at $660.10, $659.10, and $657. The model emphasized long setups near support with early profit taking, warning that rejections at the bias level could lead to consolidation. It also anticipated potential choppiness driven by options expiration and cautioned against overaggressive upside chases.

Validation of the Analysis

The premarket roadmap delivered another clean trading framework. SPY held the $661.60 bias level early, briefly dipped below, then rebounded and pushed higher toward $664.55. Targets at $662.60 and just shy of $665.75 were approached, validating the upside structure. Dips to the $660 zone were quickly bought, and resistance near $663 provided both a magnet and a potential short fade area. The notes helped traders stay patient and selective, particularly on a choppy expiration session.

Looking Ahead

Monday has no scheduled economic data, suggesting a quieter session unless weekend headlines emerge. Traders will be watching closely for follow-up details on the TikTok deal and additional commentary from China on trade. The bull trend remains strong, but the lack of news and the recent string of gains may open the door for light consolidation. That said, momentum still favors upside, and any dips are likely to be bought as long as support zones hold.

Market Sentiment and Key Levels

SPY closed at $663.60, once again exceeding its previous record. Key support now lies at $658, $655, and $650. Resistance is set at $665, $670, and $672. Bulls remain in clear control above $645, and the longer SPY holds this zone, the more likely higher highs will follow. Traders should watch for rejection above $665 or weakness below $658 as potential inflection points, but otherwise maintain a buy-the-dip bias.

Expected Price Action

Our AI model projects SPY to trade between $660 and $666 on Monday. With no economic news due, price action may drift, with intraday direction driven by positioning and macro sentiment. Resistance sits at $665, $670, and $672, while support is layered below at $658, $655, and $650. Bulls will aim to defend $658 overnight, and any move below that could target $655 or $650. However, until SPY breaks below $640 or volatility picks up materially, the trend remains bullish.

Trading Strategy

Long trades are favored above $658, targeting $665 and $670. Shorts can be considered on failed breakouts above $665 or confirmed weakness below $655. Dip-buying remains the dominant strategy, especially with strong tech leadership and seasonality at play. The VIX fell to 15.45, still well below the 23 threshold that would indicate rising volatility risk. Until that changes, market conditions remain supportive of higher equity prices.

Model’s Projected Range

SPY’s projected range for Monday sits between $657.75 and $667.25, with the Call side dominating in a narrowing band that suggests choppy price action with intermittent trending periods. There is no news due on Monday. SPY once again posted a new all-time closing high, following through on Friday’s rally. Weakness continues to be bought, with SPY now closing above the breakout confirmation level of $660. As a result, prices are likely to continue moving higher into the fourth quarter. Overnight, the market fell to $660 but was quickly bought. By the open, price had moved up to $663 before retesting the overnight lows. Buyers stepped in again, pushing price to the highs of the day and securing another record close. With OPEX driving higher-than-average volume, the move carried extra weight and reinforced the trend to new highs. With SPY well above the critical $645 threshold and every dip being bought, the bulls remain in complete control of the broader narrative. On Sunday and into the premarket, the bulls will look to defend $658, which must fail for price to move lower. A failure there opens the door to $655, while a break below that would bring $650 into play. Until SPY falls to $640 or lower, however, the bears remain sidelined. Our base case for a 10 to 15 percent pullback this year has weakened but remains on the table. We continue to view any weakness as a buying opportunity and recommend buying every dip above $645. For Monday, resistance is $665, $670, and $672, with support at $658, $655, and $650. Since reclaiming $585, SPY has held a steady uptrend fueled by dip buyers. Today Mag stocks were all green with the exception of Meta, which slipped slightly. Until consistent weakness emerges in these leaders, or ETH closes below $4300, the market is likely to grind higher. We continue to favor quick profit taking and caution with overnight holds. The VIX fell 1.59% to 15.45, and while September often sees VIX reach 20, contango in VXX futures suggests volatility may drift lower. If you have not added protection to your long book, now is the time. VIX below 23 supports the bullish case, but a breakout above it could finally spark the long-anticipated pullback. SPY closed firmly within a redrawn bull trend channel from the April lows, as the model continues to see higher odds of a continuation of the bull trend than a pending selloff.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing mid-range. Extended targets printed briefly in the morning session and again into the close. The MSI rescaled lower overnight to a narrow bearish state but without extended targets, price bounced off MSI support and moved higher into the open. At the open the MSI was in a ranging state which briefly rescaled to a bearish state. But the narrow MSI didn’t do much more than attract dip buyers who quickly reversed the decline and pushed price back into an MSI ranging state. At 3 pm the MSI began rescaling higher as institutions repositioned they books into quarter close with the MSI printing extended targets above. Each MSI rescale however was narrow and as such, just before the close, SPY pulled back slightly but still managed a 22 basis point rally and a record close. For Monday the MSI is implying a weak bull trend but it would not surprise us to finally see a manic Monday. With a narrow MSI, we expect more chop and two-way trading. MSI support is $663.47 with resistance at $664.27.

Key Levels and Market Movements:

On Thursday we wrote, “with OPEX in play we are likely to see messy two-way trading that favors the long side,” and noted, “The bulls want to defend $660,” while also stating, “it remains likely we continue to see new all-time highs, and our bias stays to buy on dips.” With that context, and with the MSI rescaling lower overnight, we wanted to find a short trade at the open for a retest of the overnight lows. But with the MSI in a ranging state, we chose not to participate and instead waited for a long setup near the $660 level. That opportunity came at 11:40 AM, but with extended targets printing we waited a few minutes for them to clear before entering long at $661.10. We set T1 at the premarket level of $662.60 and T2 at MSI resistance at $662.92. Both targets were reached early in the afternoon, so we moved our stop to breakeven and trailed. A late afternoon pop carried SPY near the premarket level of $664.10, just below MSI resistance, and we decided to close our final 10 percent runner there. Another one-and-done, highly profitable trade, once again thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Monday has no scheduled news, but weekends often bring surprises with the current administration, so remain alert for any twists that might move the markets. Absent an external macro shock, we expect two-way trading that continues to favor the long side. As such, we will still buy dips. The bulls want to defend $660, with SPY holding no lower than $658 overnight. Either dip should be treated as a buying opportunity. We will consider shorts below $658 and on failed breakouts near today’s high. Even if $657 fails, the bears will only come to life on a drop below $640. As such, it remains likely we continue to see new all-time highs, and our bias remains to buy on dips. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $664 to $680 and higher strike Calls implying the Dealers belief that prices may tread water at recent levels. Dealers are no longer selling ATM Puts, but they certainly nailed the $660 low with the sale of these Puts on Thursday. The ceiling for Monday appears to be $670. To the downside, Dealers are buying $663 to $600 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling displaying little concern that prices could move lower on Monday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $664 to $690 and higher strike Calls while also selling $663 Puts implying the Dealers belief that prices will likely slow their ascent around current levels but remain above $663. This is aggressive positioning for a weekly chart. We would look for this to change on Monday potentially but clearly is displays the Dealers confidence in higher prices. The ceiling for the week appears to be $670. To the downside, Dealers are buying $662 to $540 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a bearish outlook for the week. This is likely more hedging than a bearish prediction. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $663.60, another record high confirming continued strength. Long trades are favored above $658, with targets at $665 and $670. Shorts may be taken on failed moves above $665 or breakdowns below $655. Use model and MSI levels to manage risk and remain nimble into a week with key data including GDP, unemployment, and PCE. Bulls remain in control, and until technical or macro conditions shift, dip-buying remains the strategy of choice.

Good luck and good trading!