Market Insights: Wednesday, August 20th, 2025

Market Sentiment Recap for Wednesday, August 20th, 2025

Market Overview

Stocks were mixed on Wednesday, with the Dow managing a modest gain while the S&P 500 and Nasdaq fell again under pressure from the tech sector. The Nasdaq led the downside, weighed down by persistent selling in chip and AI-related names as concerns mount over the durability of the recent tech rally. Palantir, after plunging nearly 10% on Tuesday, dropped another 1% despite an early session bounce, continuing to signal caution around formerly hot AI plays. Nvidia, Alphabet, Amazon, and Apple also posted losses, underscoring a broad risk-off tone within tech. Meanwhile, the latest Fed minutes showed only limited disagreement among policymakers, with most supporting the decision to keep rates steady. This dampened hopes for an imminent rate cut and left markets in a holding pattern ahead of Friday’s speech from Fed Chair Powell. Retail earnings remained in focus as Target posted mixed results, narrowly beating earnings estimates but warning of ongoing consumer pressure. Shares slid 6% as tariffs and economic uncertainty clouded the outlook for its newly appointed CEO, Michael Fiddelke. All eyes now turn to Walmart’s report on Thursday for further clues into how consumers are managing in a high-rate, high-cost environment. Investors continue to look for signals in this week’s data and Fed commentary to gauge the path forward for interest rates, inflation, and risk appetite.

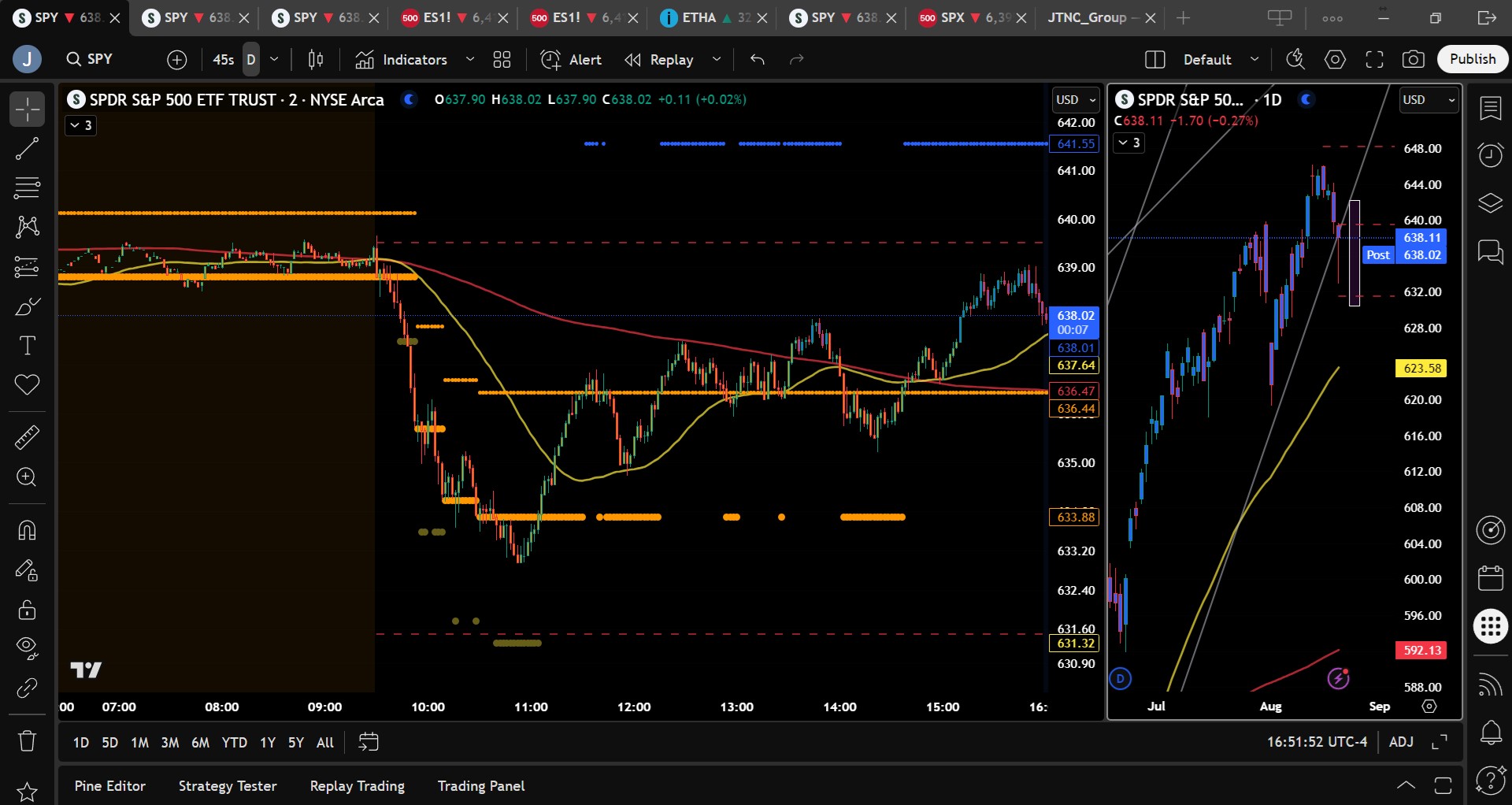

SPY Performance

SPY slipped 0.27% to close at $638.11 after a volatile session that saw early losses deepen before an afternoon rebound trimmed the damage. Opening at $639.40, SPY briefly rallied to $639.66 before falling sharply to an intraday low of $632.96. Bulls stepped in hard just before noon, driving a strong bounce that recaptured much of the session’s drop. Trading volume surged to 80.16 million shares, well above average, with much of the activity coming from aggressive dip buying. While the ETF couldn’t reclaim the key $640 level into the close, the strong recovery from below $633 underscores that buyers remain active despite the day’s red print.

Major Indices Performance

The Dow led the major indices with a modest 0.04% gain, buoyed by strength in defensive names and its lower weighting in tech. The Russell 2000 followed with a 0.43% decline, reflecting continued caution in small caps. The S&P 500 dropped 0.2%, while the Nasdaq lagged once again, down 0.67% as the selloff in chips and AI continued for a second day. Despite midday pressure across all indices, broad market internals improved late in the session as buyers stepped in, particularly in Real Estate and Consumer Staples. While tech weakness dominated headlines, the underlying tone revealed selective rotation rather than full-blown risk aversion, at least for now.

Notable Stock Movements

It was another broadly red day for the Magnificent Seven, with Apple and Amazon leading the losses, each down more than 1.86%. Palantir dipped for the second straight day, briefly down 9% before paring losses to end off just 1%. Nvidia, Alphabet, and Microsoft also traded lower, while Tesla and Meta closed down slightly. With tech once again under pressure, investors are rotating into less speculative areas of the market. The persistent weakness in AI-related stocks suggests the bubble-like enthusiasm around the space may be fading, at least temporarily, as traders lighten up ahead of Powell’s Jackson Hole speech.

Commodity and Cryptocurrency Updates

Crude oil rebounded 1.86% to settle at $62.92, reversing recent losses as bargain hunters stepped in ahead of what many expect will be a push toward the long-standing $60 price target later this year. Gold rallied 0.98% to close at $3,390, suggesting some renewed demand for safety assets despite low realized volatility. Bitcoin gained 0.45%, finishing just above $114,000 and recovering modestly from Tuesday’s decline. The bounce in crypto and gold may reflect positioning ahead of upcoming Fed commentary, with traders hedging potential surprises at Jackson Hole.

Treasury Yield Information

The 10-year Treasury yield dipped slightly to 4.293%, a 0.21% decline that reflects cautious optimism around upcoming Fed communication. While yields remain comfortably below the 4.5% red-alert threshold, traders are watching closely for any signs of hawkish shifts. A sustained move above 4.8% could still trigger a broader equity selloff, while a drift lower would provide cover for bulls to press higher. For now, the bond market seems content to wait for Friday’s developments.

Previous Day’s Forecast Analysis

Tuesday’s forecast anticipated SPY trading between $636 and $643 with a cautiously bearish bias beneath $640. Key downside targets were $638 and $636, with deeper levels near $632 if those failed. Upside targets included $645 and $648 in the event of a strong rally above $642. The model favored short setups on rallies toward resistance, while long trades were only considered on strength above $642 or failed breakdowns below $638. With rising volatility and rate jitters, the strategy encouraged nimbleness, tight stops, and smaller trade size ahead of Wednesday’s FOMC minutes.

Market Performance vs. Forecast

SPY’s actual range was $632.96 to $639.66, falling squarely within the model’s expected range. The session opened just under the $640 pivot and quickly tested $638 before slicing through that level and dropping to $633, just above the $632 target mentioned in the forecast. A strong bounce off those lows recovered most of the session’s losses, validating the model’s expectation that a dip toward $636–$632 would trigger buying. Short trades below resistance early in the session worked well, while a failed breakdown below $633 around noon offered a solid long entry for sharp recovery gains. Once again, the model levels and strategy provided highly actionable guidance, confirming that the key levels are functioning as reliable inflection points in this volatile environment.

Premarket Analysis Summary

In today’s premarket analysis posted at 6:56 AM, SPY was trading at $638.88, with the bias level clearly defined at $639.50. The model leaned bearish beneath that level and projected downside targets at $638, $635, and potentially $631.50 if selling accelerated. Upside targets were identified at $641, $642, and $644.50 if a rally gained momentum. The note emphasized that persistent dip-buying conditions remained a key dynamic and cautioned that any sharp downside move could unwind rapidly. The preferred approach was to take profits near support and fade weak rallies, while remaining nimble given the potential for sharp reversals either way.

Validation of the Analysis

Wednesday’s session adhered closely to the premarket game plan. SPY opened just below the bias at $639.40 and quickly dropped through $638 to hit the $635 target, eventually finding intraday lows at $632.96 nearly to the penny of the model’s $632 level. Buyers then stepped in exactly as anticipated, with the ensuing rally reclaiming nearly all the losses and pulling SPY back to the $638 zone. The bias level held firm as resistance, and traders who followed the strategy of shorting beneath $639.50 or buying near deep support had multiple chances to profit. This reinforces the precision of the premarket analysis and the effectiveness of the levels provided in guiding intraday decisions.

Looking Ahead

Thursday brings unemployment claims and PMI data, both of which have the potential to move markets, particularly if surprises emerge. However, the main event for the week remains Fed Chair Jerome Powell’s speech at Jackson Hole on Friday. Until then, markets may drift sideways as traders brace for potential fireworks. Expect light positioning and rangebound price action Thursday, with a focus on key support and resistance zones that could define the pre-Powell landscape.

Market Sentiment and Key Levels

SPY finished at $638.11, just under the psychological $640 level and holding just above its intraday low of $632.96. Market sentiment is now leaning cautiously bearish, though the strong bounce off $633 shows that buyers aren’t going away quietly. Resistance now sits at $640, $642, and $644.50, while support is found at $635, $632, and $630. A break below $632 could trigger a drop to $628 or even $625, while reclaiming $642 would open the door back to $645 and beyond. Until Powell speaks Friday, expect markets to react sharply to any surprises while otherwise staying rangebound. The bulls remain on watch to defend recent lows, but if tech weakness deepens, sentiment could deteriorate fast.

Expected Price Action

Our AI model projects SPY to trade between $631.50 and $642 on Thursday, with a continued bearish bias unless bulls can reclaim $640. The trading range suggests potential for trending moves with brief pauses, rather than choppy sideways action however we tend to believe the market will move more sideways than trend. A break below $632 could push prices toward $630 or $628, while a strong move above $640 would invite a retest of $644.50. This forecast is actionable intelligence, and traders should prepare for failed breakdowns and breakout setups around these inflection zones. With the market holding near major support, bulls must hold $633 to avoid triggering deeper losses. Keep risk tight and prepare for sudden volatility around economic headlines or Powell commentary.

Trading Strategy

With SPY closing just under $640 and the VIX up 0.83% to 15.70, traders should remain defensive. Short trades are favored on weak rallies into $640 or $642, targeting $635 and $632 for profits. Longs should only be taken if SPY convincingly reclaims $642, targeting $644.50 or higher, or if price fails to break below $633 and begins to reverse. Today’s reversal off $633 showed how quickly sentiment can flip, so don’t overstay trades and keep stops tight. Given current volatility levels, smaller positions are recommended. Monitor price action closely and trade with the trend, especially if momentum builds following key data releases.

Model’s Projected Range

The model projects SPY’s maximum range for Thursday between $630.50 and $642.25, with the Put side dominating in an expanding band that suggested trending price action with periods of consolidation. After drifting slightly lower overnight, testing the prior day’s lows, SPY opened just below $639 within striking distance of the $638 level we mentioned yesterday which was a level likely to give way with repeated tests. Overnight we got those tests several times, all of which were bought. But levels eventually run out of liquidity the more they are tested, which makes them vulnerable to failing. After another test of $638 at the open, SPY fell off a cliff and didn’t stop dropping until it found the day’s lows at $632.96. It should be no surprise to anyone reading these newsletters that this scenario was likely to play out as we stated a dip below $638 would lead to a test of $636 and if that failed, price would move toward $632. Traders sometimes complain that the levels are not to the penny. Trading is like horseshoes and hand grenades, close is the best you can do and certainly today, close to these levels is what we got. Once at the lows, SPY finally found support before noon and reversed course, recovering most of the day’s decline. So once again the dip was bought with the bulls displaying their strength once again. While the day was a red one, a small dip is nothing to be concerned with. More important is the strength by which the market bounced after being down 1%. The bulls almost sealed the deal by getting trying for a close above $640. But they came up a tad short at $638.11, enticing the bears for a second day. Volume was high and while the day saw a 27 basis point decline, most of the volume came from the buy side off the lows further supporting the bullish scenario. Heading into tomorrow, PMI and Unemployment Claims may potentially move the markets. But the broader markets are waiting for Friday and the Fed speak which should follow. As such, expect more sideways than heavy trending behavior on Thursday as markets prepare for Friday. Overnight the bulls will attempt to defend the day’s lows at $633 to set up for the coin flip on Friday where the market could move $10 either way. A failure at $633 could open the door to $630 and potentially $628–$625. Below $625 there is little to hold up this market. A successful defense however could push SPY back toward $642, with resistance expected at $638, $640, and $644, above which supply will likely cap further gains. Support for tomorrow rests at $635, $632, $630 and $628. Since reclaiming $585, SPY has remained in a persistent uptrend with dip buyers stepping in almost every time. Mag stocks once again took it on the chin led lower by Apple and Amazon, which each dropped over 1.86%. If this rotation out of tech continues for another week or so, it is highly probable the market will begin a steeper sell-off as the bears will think it is time to feast. Again we continue to view the recent parabolic advance as high risk and low reward, favoring quick profit-taking, avoiding overnight holds, particularly as signs continue to point to a potential correction between September and mid-October. The VIX rose 0.83% to 15.70, nothing given the scale of the initial decline. But this can change quickly and while volatility below 23 remains broadly supportive of equities, a breakout above that level could spark the widely anticipated 5–10% pullback. Thursday expect sideways-to-down price action absent an external catalyst. SPY dropped below the bull trend channel from the April lows but recovered nicely to close just above the lower channel, to the penny, once again.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Ranging Market State, with SPY closing mid-range. During the regular session the MSI spent the morning rescaling lower in a Bearish Trending Market State with extended targets below until just after 11 am. The MSI remained in a wide bearish state until SPY reclaimed $636.50 which saw the MSI rescale to its current Ranging Market State. In the current state, the MSI is warning that there is no trend likely for Thursday. Big up followed by big down = big confusion which is the hallmark of a ranging market. Watch the MSI for a rescale to determine the next trending leg. MSI support is currently $636.46 with resistance at $641.55.

Key Levels and Market Movements:

On Tuesday we wrote, “Wednesday brings the release of FOMC minutes, which could move markets” and noted, “we expect dip buyers to emerge as long as $638 holds, with the expanding range suggesting more trending price action.” We also stated, “bears are pressing their luck in hopes of breaking $638, and while a move as low as $636 could trap shorts before a bullish reversal, a clean failure of $636 would target $632.” With that context, and with the MSI in a narrow Bearish Trending Market State at the open and resting at major support, most may have thought the initial trade was to buy MSI support at $638.80 to stick with the prevailing trend. We would not have necessarily blamed anyone for thinking this way. But with so many tests of $638 both yesterday and overnight, we knew that liquidity at this level was gone and it was more probable price would fail. So at the open, with SPY just barely breaking higher at the premarket resistance level of $639.50, we entered short as price broke below the MSI at $638.40 and set our T1 at the premarket level of $635. The MSI began a series of rapid rescalings lower with extended targets, so we adjusted T1 to MSI support at $635.67 to make sure we were in the money on the first trade. Fortunately, the MSI kept rescaling lower, so we set T2 at MSI support at $634.23 and trailed with our remaining 10%. The MSI continued printing extended targets, and we were convinced we’d reach the premarket level of $631.50. But then the FOMC minutes came out, and for whatever reason, the market took this information as a positive and set up a textbook failed breakdown at the day’s lows. Since extended targets were still printing below, we closed our short but held off going long until they stopped printing. At 11:06 they did, so we entered long at $634.50 and set T1 at MSI resistance at $636.40. Another target and we returned to the premarket to find T2. The nearest level was $638, where support became resistance, so we set T2 there and just waited. Price chopped around for over two hours before pushing to within a penny of our target. We took another 20% off for T2, moved the stop to breakeven, and trailed the remaining 10% of our position. Another dip mid-afternoon looked like it could send price back to our stop. We even considered reentering short. But with the MSI in a ranging state, and two solid trades in the bank, we went into profit protection mode and let the risk-free runner play out. Price moved back up into the close, reaching $639 which was close enough to the premarket level of $639.50 to get us flat. Two huge trades made our day and our week, thanks to a clear plan, disciplined execution, and strong alignment between MSI signals, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday brings the PMI and Unemployment Claims, which could certainly impact the market. As such, be prepared to trade what you see. Absent this catalyst, most market participants appear to be waiting for Friday before making major trading decisions. Friday will be a binary event that could go either way, so expect the markets to trend both higher and lower overnight in a Ranging MSI state, which could carry into Thursday. The bulls will do all they can to defend today’s lows, which we expect to hold on the first test. However, should those lows fail, prices could enter a free fall down to $625. While the expanding range suggests more trending price action tomorrow, we suspect it will be choppier than cleanly directional, with conditions favoring two-way trading. With a close below $640, the bears are still engaged even though many were trapped at the day’s lows. As long as $632 holds, the bulls are likely to attempt a reclaim of $642, with potential upside toward $645. The overall structure still favors the bulls despite today’s dip and recovery. For bears to seize real control, a decisive break below $632 is needed, with $625 marking the line that could shift the outlook and raise the risk of a 10% or greater correction. We continue to favor long setups above $632, while remaining open to short opportunities on a confirmed break below $632 or a failed breakout near $640. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

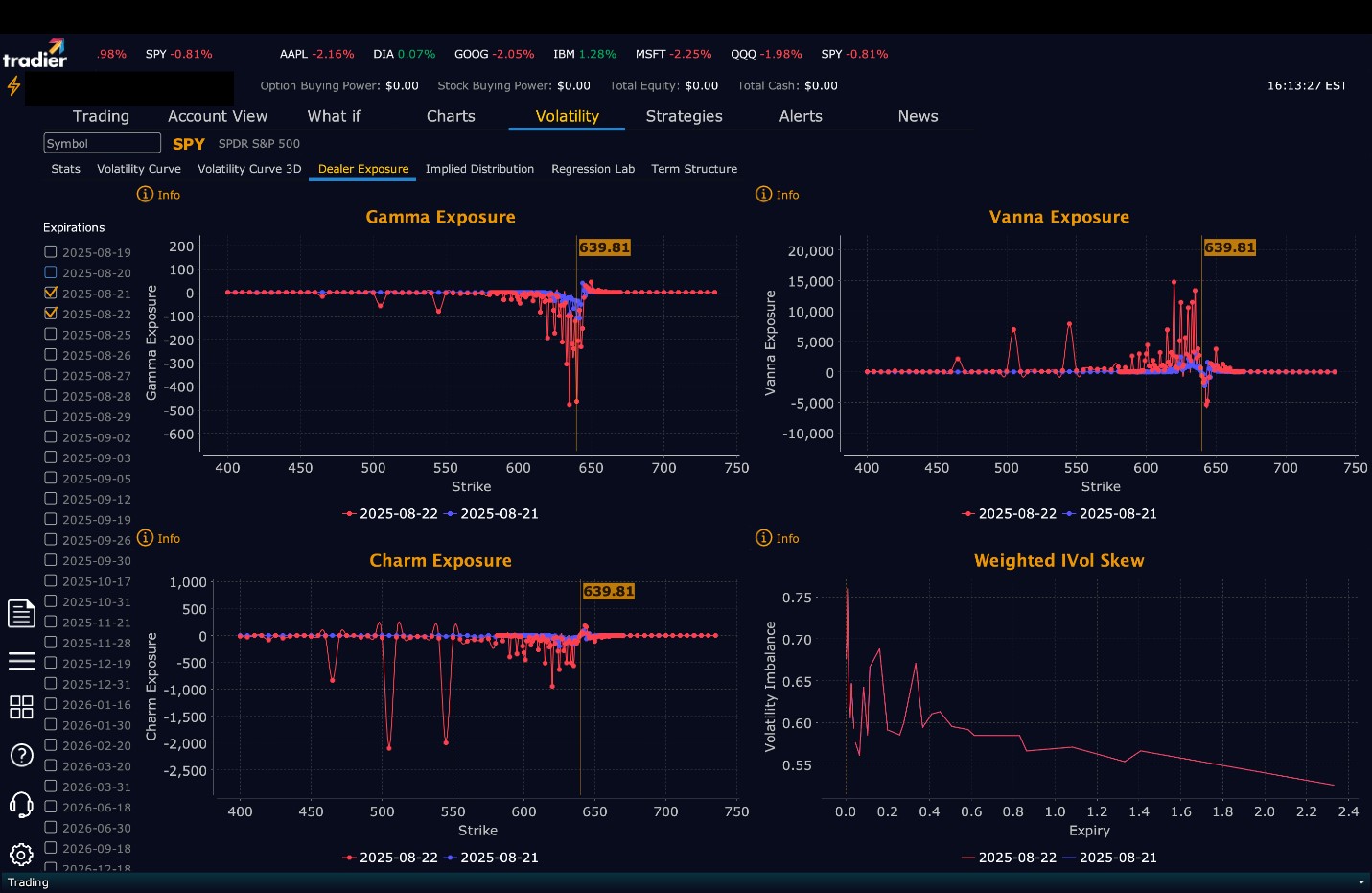

Summary of Current Dealer Positioning:

Dealers are selling SPY $643 to $655 and higher strike Calls while buying $639 and $642 Calls indicating the Dealers desire to participate in any rally on Thursday. The ceiling for tomorrow appears to be $644. To the downside, Dealers are buying $638 to $575 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower on Thursday. Dealer positioning is unchanged from bearish to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $644 to $665 and higher strike Calls while buying $639 to $643 Calls indicating the Dealers desire to participate in any rally later this week. The ceiling for the week appears to be $650, although $645 looks like material resistance. To the downside, Dealers are buying $638 to $575 and lower strike Puts in a 7:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

With SPY closing just under $640 and the VIX ticking up to 15.70, short setups remain favored on weak rallies toward $640 and $642 with downside targets at $635 and $632. Long trades may develop if SPY holds above $633 or reclaims $642 with momentum, targeting $644.50 and potentially $648. Traders should keep size small ahead of Powell’s Friday speech and remain flexible around macro data. Tight stops are essential in a rising volatility regime, especially with market sentiment on edge. Be sure to review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!