Market Insights: Monday, August 18th, 2025

Market Overview

Stocks closed little changed Monday as traders turned their attention to a pivotal week filled with geopolitical developments and a key speech from Fed Chair Jerome Powell. The Dow and S&P 500 edged slightly lower, while the Nasdaq notched a modest gain. The tone was cautious as investors digested news from Washington, where Ukrainian President Volodymyr Zelensky met with President Trump and European leaders amid pressure for a peace deal that could favor Russian interests. This followed Trump’s controversial meeting with Vladimir Putin in Alaska, which stirred fresh concerns over shifting U.S. foreign policy. Still, markets remained focused on the upcoming Jackson Hole Symposium on Friday, where Powell is expected to deliver a widely anticipated address. Many expect it to be his final speech as Fed Chair, and traders are bracing for potential policy signals around inflation and rate cuts following last week’s mixed data. The release of July FOMC minutes on Wednesday will provide further context as traders look for clarity. Meanwhile, the Q2 earnings season is winding down with mostly positive results so far. On Monday, Intel slid after reports suggested the Trump administration is considering a 10% stake in the chipmaker, a reversal from last week’s rally tied to potential CHIPS Act funding. Earnings from retail giants like Walmart, Target, Home Depot, and Lowe’s are still ahead, likely offering insight into consumer strength and inflation’s bite. For now, investors appear to be in wait-and-see mode, keeping markets in tight ranges until the fog around policy direction clears.

SPY Performance

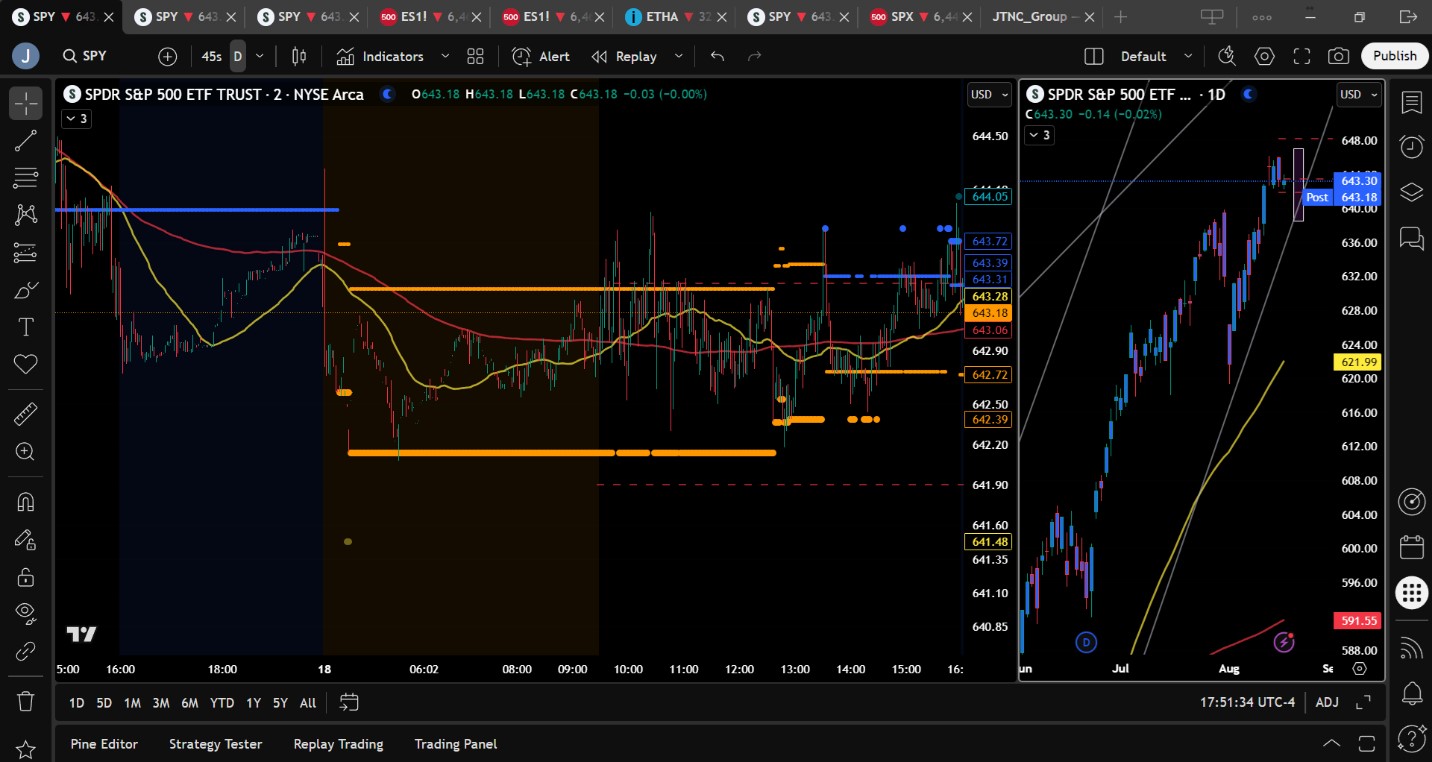

SPY slipped just 0.02% to close at $643.30 after opening at $642.87 and reaching a high of $643.93. The ETF traded in a tight range all day, with an intraday low of $642.18 and below-average volume of 41.93 million shares. This muted action reflected trader hesitation ahead of a heavy news week. Once again, buyers defended the $642 area, suggesting bulls still hold the reins, though the lack of momentum above resistance levels confirms growing caution among participants.

Major Indices Performance

The Russell 2000 led the day with a gain of 0.40%, rebounding from recent underperformance. The Nasdaq managed a modest uptick of 0.03%, while the S&P 500 slipped fractionally. The Dow lagged with a 0.08% decline as investors weighed geopolitical tensions and uncertain policy signals. Defensive sectors were mixed, while tech remained a stabilizing force. The narrow moves across indices suggested a market in limbo, as traders await guidance from upcoming Fed commentary and retail earnings later in the week.

Notable Stock Movements

The Magnificent Seven posted a mixed session, but it was Tesla, Netflix, Nvidia, and Amazon that posted green closes, helping offset broader market weakness. No standout winners or losers emerged, but chip stocks like Intel came under pressure after Bloomberg reported the Trump administration is considering a strategic stake in the company. That news reversed last week’s optimism and raised new questions about political influence in tech. Overall, stock action reflected indecision as participants chose to reduce exposure ahead of key macro events.

Commodity and Cryptocurrency Updates

Crude oil gained 1.08% to settle at $62.65, partially rebounding after last week’s decline, though our model continues to project an eventual move down toward $60 in the coming months. Gold dipped slightly by 0.12% to close at $3,380, holding firm in the face of ongoing inflation uncertainty. Bitcoin fell 1.00%, finishing just above $116,400 as crypto remains in consolidation mode. The lack of strong directional moves across commodities and crypto further underscores a market environment lacking clear catalysts.

Treasury Yield Information

The 10-year Treasury yield ticked higher by 0.25% to end at 4.338%, continuing its slow march upward after last week’s hot inflation data. While still below the danger zone of 4.5%, this creeping yield increase is on the radar for equity investors. A sustained push above 4.8% would likely pressure risk assets significantly, and at 5.2%, historical patterns suggest the potential for a 20% or more correction. For now, the equity market appears to be tolerating the rise, but any spike from here could change sentiment quickly.

Previous Day’s Forecast Analysis

Friday’s forecast projected SPY to trade between $640 and $647 with a bullish bias above $642. Key resistance levels were noted at $645, $649, and $650, while support sat at $640, $637, and $635. The strategy favored long trades near $641 or $640 with profit targets around $645 and above. Shorts were only recommended below $640 or on failed breakouts above $645. The model anticipated a consolidation-heavy session, with choppy trading and brief trending moves, driven largely by positioning ahead of midweek data.

Market Performance vs. Forecast

SPY’s actual performance on Monday respected the model’s forecast nearly perfectly. After opening at $642.87, the ETF hit a high of $643.93 and dipped to $642.18 before closing at $643.30, staying entirely within the projected range. The bias level of $642 held throughout the day, validating the long setups recommended in the forecast. While SPY failed to approach the upper resistance near $645, dip buyers stepped in repeatedly near support, affirming the model’s bullish bias and preference for long trades. The muted action provided limited but predictable trading opportunities for disciplined entries and quick exits.

Premarket Analysis Summary

In today’s premarket analysis posted at 7:04 AM, SPY was trading at $642.98 with a bias level identified at $641.90. The model leaned “timidly bullish,” expecting a potential bounce from $643.40 and suggesting upward progress could continue if SPY held above the bias. Resistance targets were set at $645 and $648.35, while downside levels to watch included $640 and $638.40. Traders were advised to favor long trades above the bias and take quick profits into resistance, while shorts were suggested only below the bias with tight downside targets. Consolidation was expected, and profit-taking was emphasized on both sides.

Validation of the Analysis

The premarket analysis proved accurate once again. SPY hovered near the bias level throughout the session, never violating the key downside support at $640. The session high at $643.93 approached the first upside target of $643.40 but failed to make further progress. As expected, most upward attempts faded quickly, reinforcing the strategy of selling into strength. The intraday dip to $642.18 was shallow, and the bounce confirmed the model’s guidance to stay long above $641.90. With SPY closing at $643.30 and volume light, the muted day aligned closely with the premarket outlook, offering traders a clean, low-risk environment to capture minor gains.

Looking Ahead

Tuesday brings no scheduled economic news, keeping traders focused on Wednesday’s FOMC minutes and the looming Friday speech from Fed Chair Powell. These events could reset expectations around interest rate policy and create significant volatility. In the meantime, retail earnings will provide additional insight into consumer behavior. Until then, markets are likely to remain rangebound, with limited momentum until a fresh catalyst appears.

Market Sentiment and Key Levels

SPY closed at $643.30, hovering just above the key support zone of $642, a level that has repeatedly drawn dip buyers. The overall sentiment remains cautiously bullish, as long as this support holds. Resistance sits at $645, $647, and $650, where sellers have stepped in recently. A break above $647 would open the door for a retest of highs, while failure to hold $642 could lead to a slide toward $640 and $637. For now, bulls remain in control, but momentum is fading slightly, and markets are vulnerable to sharp moves if policy headlines surprise later this week.

Expected Price Action

Our AI model projects SPY to trade between $642 and $646 on Tuesday, suggesting another narrow range and a day of likely consolidation. The bias remains bullish above $641.90, with upside targets at $645 and $646. A move above $646 could trigger a push to $647 and potentially test $650, but fading momentum means gains are likely to be capped without a strong external driver. A break below $641.90 may push SPY to $640 or $638.40, where bulls would be expected to step in. This forecast is actionable intelligence, guiding traders to anticipate short bursts of momentum followed by quick reversals. The cautious tone reflects a market awaiting Powell’s guidance later in the week.

Trading Strategy

With SPY closing just above support and the VIX slipping to 14.99, long trades remain favored on dips near $641 or $640, targeting $645, $647, and $648.35. Traders should consider tightening stops near each resistance level and avoid holding through uncertain news flow. Short trades are lower probability and should only be considered on failed breakouts above $645 or confirmed breaks below $640, with quick profit targets at $638.40 and $637. The drop in VIX reflects a calm surface, but with major Fed news looming, traders should remain cautious, reduce size, and avoid overexposure in tight conditions.

Model’s Projected Range

The model projects SPY’s maximum range for Tuesday between $638.50 and $647, with the Call side dominating in a narrowing band, suggesting consolidation with limited trending moves. Overnight, markets swung both lower and higher as participants awaited possible clarity from the Fed on rate cuts later this week at the Jackson Hole Symposium. At the open, SPY tested major resistance just under $643 before sliding to intraday lows just above $642. For most of the session, price action remained trapped in a tight, choppy range on very low volume, ultimately closing flat. Dip buyers once again defended the $642 level, keeping the bullish structure intact. Looking ahead, absent an external catalyst, bulls are likely to defend $642 overnight. A failure at this level could target $640, while a successful defense may push SPY toward new highs later this week. Key resistance sits at $645, $647, and $650, where heavy supply could cap gains, while support rests at $639, $637, and $634 with little to slow a deeper slide if $634 fails. Since reclaiming $585, SPY has remained in a persistent uptrend with buyers stepping in on nearly every dip. For this structure to falter, weakness must appear in the market leaders driving the rally, but today the “Mag” stocks were mixed, showing no decisive cracks in leadership. We continue to view the parabolic advance as high risk and low reward, favoring quick profit-taking and no overnight holds. Early signs still point to a potential correction between early September and mid-October, but for Tuesday sideways consolidation remains the higher probability outcome. The VIX slipped 0.66% to 14.99, reinforcing the bullish tone. A VIX below 23 remains supportive of equities, while a breakout above 23 could spark the widely anticipated 5 to 10 percent pullback this fall.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a narrow Ranging Market State, with SPY closing at the upper end of the range. There were no extended targets all day as the MSI spent much of the day in a very tight range with the MSI for the most part in a bearish state. But without extended targets and very narrow ranges, SPY did nothing all day but chop from MSI support to resistance and vice versa. Late in the day the market attempted to stage a slight rally which saw price end the day unchanged. Overnight the MSI rescaled lower to a bearish state but as price tested MSI support at $642.20, the MSI flip flopped between a bearish state and ranging state. With the MSI currently in a ranging state, the overnight session and possibly Tuesday is likely to see more sideways than higher or lower price action. We recommend watching the MSI for changes in the premarket given price is resting at MSI resistance which could lead to the MSI rescaling higher. MSI support is currently $642.75 with resistance at $643.40.

Key Levels and Market Movements:

On Friday we wrote, “Monday is likely to bring sideways consolidation with two-way trading between $642 and $647,” and noted, “market participants are likely to continue buying all dips.” We also noted, “We expect the market on Sunday to drift lower, testing $642, where dip buyers should reemerge.” With that context and with the MSI in a Bearish Trending Market State with no extended targets above, and the premarket setting up a textbook failed breakout, we entered short at MSI resistance at $643.50 targeting MSI support at $642.14. SPY got close to our first target by 11 am but immediately reversed higher and we thought we had a loser on our hands, leaving us no choice but to hold on and accept the consequences. SPY then respected MSI resistance again and fell, allowing us to take T1 off at $642.37. We set T2 at the premarket level of $642 where we expected to exit and reverse. Just before 1 pm SPY staged a less than perfect failed breakdown, and we decided this was as far as it would go, so we exited and reversed long at $642.40 at MSI support. We set T1 at MSI resistance at the premarket level of $643.40 and, once that was hit, set T2 at $643.55. With both targets achieved, we moved our stop to breakeven and trailed. After a triple top at $643.50 we considered closing the trade but, with a risk-free runner, we let it run. SPY fell sharply and nearly hit our stop before reversing once more. While we considered reentering long, we chose not to since we already had two profitable trades in a choppy, low-volume day with little edge left to exploit. As SPY moved back up, we treated anything above $643.50 as a solid exit and the textbook failed breakout at the day’s highs gave us that chance. We closed the trade and called it a day, two for two on a session where most traders would have been better off not trading, thanks to a clear plan, disciplined execution, and strong alignment between MSI’s directional cues, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Tuesday has no scheduled economic news, though the Ukraine situation remains in focus and the White House could release developments that move the market. Absent such a catalyst, Tuesday is likely to bring sideways consolidation with two-way trading between $642 and $646. With another close above $642, participants are likely to continue buying dips, keeping bulls in control as long as this level holds. We expect the market overnight to drift slightly higher without breaching $645 or breaking below $642. A break of $642 could trigger a move toward $640 or lower, while a clean break below $635 would shift the outlook and raise the risk of a 10 percent or greater correction. Our model still favors the bulls with further all-time highs possible later in the week. With the MSI in a Ranging Market State, choppy conditions are likely until it rescales, so we favor long setups above $640 and shorts only on a confirmed break below $640 or a failed breakout near $645. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $647 to $665 and higher strike Calls while buying $644 and $646 Calls indicating the Dealers desire to participate in any rally on Tuesday. The ceiling for tomorrow appears to be $647. To the downside, Dealers are buying $643 to $575 and lower strike Puts in a 4:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower on Tuesday. Dealer positioning has changed from slightly bearish/neutral to bearish.

Looking Ahead to Friday:

Dealers are selling SPY $646 to $670 and higher strike Calls while buying $644 to $645 Calls indicating the Dealers desire to participate in any rally during later this week. The ceiling for the week appears to be $650. To the downside, Dealers are buying $643 to $575 and lower strike Puts in a 7:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY remains in a tight range with low volume and a bullish structure above $642, but the failure to gain momentum above $645 suggests caution is warranted. Long trades are still preferred near support levels at $641 or $640, with upside targets at $645, $647, and $648.35. Short trades may be considered on failed breakouts above $645 or breakdowns below $640, aiming for quick exits at $638.40 or $637. The VIX closed at 14.99, indicating continued low volatility, but with potential for sharp reversals later this week. Stay nimble and manage risk closely. Be sure to review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and Dealer Positioning.

Good luck and good trading!