Market Insights: Thursday, August 14th, 2025

Market Overview

Stocks hit the pause button Thursday as a surprisingly hot Producer Price Index (PPI) report clipped momentum from the recent rate-cut rally. Wall Street was initially riding high on hopes of a jumbo rate cut in September, but that optimism was tempered after July’s PPI came in much hotter than expected. Month-over-month, producer prices surged 0.9%—far above the 0.2% forecast—while the annual rate hit 3.3%, the highest since February. Even more alarming, core PPI posted its sharpest increase in three years, reigniting fears that inflation could prove sticky.

The S&P 500 still managed to eke out its third straight record close, rising just enough to stay green, while the Dow slipped slightly and the Nasdaq hovered just under its all-time high. Earlier in the week, traders had fully priced in a September cut, with some even calling for a 50-basis-point move. But Thursday’s data shifted expectations: jumbo cut bets evaporated, and roughly 10% of the market is now pricing in a rate hold. Crypto, which had benefited from the rate-cut narrative, also reversed course, with Bitcoin and Ethereum pulling back from recent highs. Notably, Bullish jumped 10%, nearly doubling its IPO price, and Intel surged 7% after reports that the U.S. government may consider taking a stake in the company. Traders are now looking to Friday’s retail sales for the next potential catalyst.

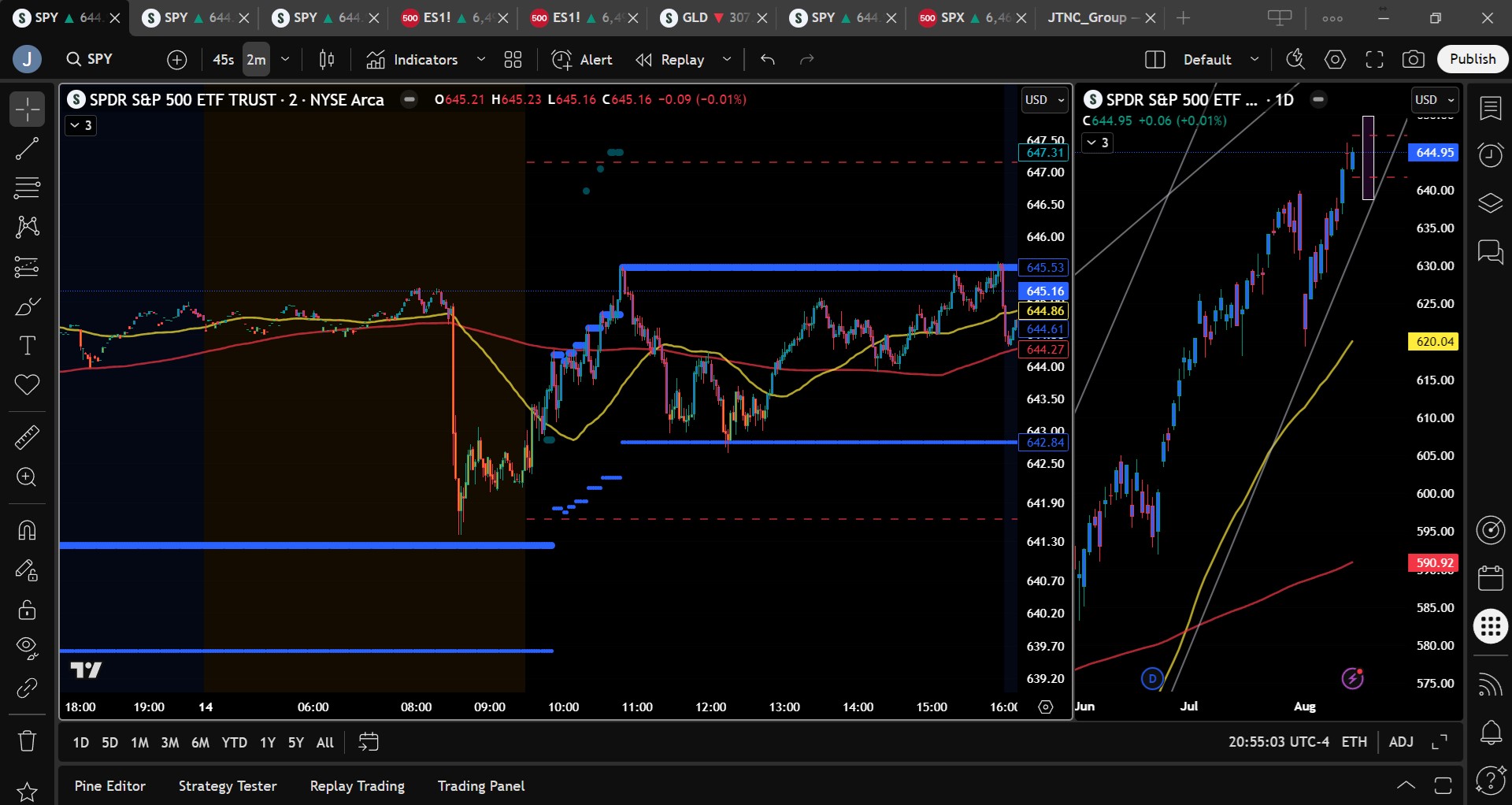

SPY Performance

SPY inched higher by 0.01% to close at $644.94, a fresh all-time high, though the gain came on lighter volume of 53.63 million shares. After opening at $642.84, it quickly tagged a high of $645.62 before retreating modestly, bouncing between support and resistance in a relatively narrow range. The sluggish price action, despite a record close, suggests some hesitation among buyers as they await more clarity on the inflation front. Still, bulls successfully defended support and pushed the index to another close in record territory.

Major Indices Performance

Among the major indices, the S&P 500 led with a marginal gain of 0.01%, enough to secure another record close despite broader market caution. The Nasdaq dipped 0.01%, just under its all-time high, while the Dow edged down 0.02%. The Russell 2000 lagged significantly, sliding 1.35% as rate-sensitive small caps reversed their recent rally. The hotter-than-expected PPI report sparked concerns about the Fed’s next move, causing investors to pause after a strong two-day surge. While the broader trend remains bullish, leadership narrowed and sector rotation was less apparent, signaling more selective buying across the board.

Notable Stock Movements

The Magnificent Seven had a mixed day, but overall leaned green. Amazon and Microsoft posted solid gains, while Alphabet, Nvidia, and Meta also closed higher. Tesla led to the downside with a 1.12% decline, and Apple slipped 0.24%, reversing some recent strength. These movements reflect a cautious tone as traders reassess the rate outlook. With the broader indices stalling, the gains in tech helped keep SPY afloat, though enthusiasm was notably more muted than earlier in the week.

Commodity and Cryptocurrency Updates

Crude oil climbed 2.15% to close at $64.00, continuing its short-term bounce even as our model maintains a $60 downside target. Gold pulled back 0.72% to settle at $3,380, reversing some of its recent strength amid revived inflation concerns. Bitcoin dropped sharply, sliding 4.15% to close above $117,760 after briefly reaching record territory on Wednesday. The drop in crypto coincided with a shift in rate-cut sentiment, suggesting traders are growing cautious on risk assets as inflation data surprises to the upside.

Treasury Yield Information

The 10-year Treasury yield rose 1.07% to close at 4.285%, continuing to hover below the 4.5% level that typically spells trouble for equities. Still, the move higher in yields reflects some unease following the hot PPI print. While yields remain well below the 5% threshold that would threaten a broad equity correction, the upward drift is a red flag for growth stocks and may cap gains if inflation pressures persist. Markets are closely watching the next round of data for signs the Fed might reconsider its dovish tilt.

Previous Day’s Forecast Analysis

Wednesday’s forecast projected a trading range for SPY between $641 and $648 with a bullish bias above $642, targeting $645 and $648. The model favored long trades on dips above $642 and warned that failed breakouts near $645 could prompt some short-term selling. Support was outlined at $642, $640, and $638, and the broader expectation was for a consolidative session with potential for a push higher. With PPI on deck, traders were advised to remain flexible and monitor for any signs of sentiment shifts tied to inflation data.

Market Performance vs. Forecast

Thursday’s session largely respected the forecasted levels. SPY opened at $642.84 and reached a high of $645.62 before closing at $644.94, essentially tracking the model’s bullish bias above $642. The day’s low of $642.34 was just above major support, and the test of $645 followed by intraday pullbacks provided solid trading opportunities. While SPY didn’t reach the stretch target of $648, the late-session recovery allowed for respectable upside action. The predicted sideways range with breakout potential held, and traders following the model had several chances to profit from long setups on dips and recoveries.

Premarket Analysis Summary

In today’s premarket analysis posted at 7:15 AM, SPY was trading at $644.59 with a bias level set at $643.15. Upside targets were identified at $647.15 and $648, while downside levels were pegged at $643.15, $641.65, and $640.20. The session was expected to be defined by a slow upward drift, with resistance from positioning keeping SPY somewhat range-bound. The analysis suggested that dips would likely be bought, though aggressive moves were not expected. Short setups were discouraged, with the focus on letting price action dictate trades near key levels.

Validation of the Analysis

The premarket analysis held up well. SPY remained above the bias level of $643.15 throughout the day, reaching an intraday high of $645.62 and closing at $644.94. While SPY didn’t touch the upper targets of $647.15 or $648, it stayed well within the projected range, and the anticipated upward drift materialized with a few shallow pullbacks that were bought quickly. The analysis correctly identified that the session lacked momentum for a breakout but still leaned bullish, helping traders focus on support levels and avoid shorting into strength. Once again, the premarket blueprint delivered actionable, accurate levels.

Looking Ahead

Friday brings fresh economic data with Core Retail Sales, Headline Retail Sales, University of Michigan Consumer Sentiment, and Inflation Expectations all on deck. While none of these are expected to be major market movers on their own, surprises in consumer spending or sentiment could shift the inflation narrative once again. With OPEX also hitting Friday, volatility may rise, especially if data conflicts with current rate-cut expectations. Traders should prepare for choppy moves and stay alert to sudden sentiment shifts heading into the weekend.

Market Sentiment and Key Levels

SPY closed at $644.94, sustaining its bullish momentum but failing to break above $645 with conviction. The broader market tone remains positive, but inflation fears are beginning to weigh on sentiment. Key resistance levels are now $645, $648, and $650, while support lies at $642, $640, $638, and $633. A break above $648 could accelerate upside momentum, while a move below $638 could usher in a deeper pullback. Bulls are still in control for now, but signs of hesitation are emerging, and Friday’s session may offer clues about near-term direction.

Expected Price Action

Our AI model projects SPY to trade between $638.75 and $649.75 on Friday, offering a broader range that suggests increased volatility heading into OPEX. The market maintains a bullish bias above $642, with upside targets at $645, $648, and $650. Should SPY push above $648 early, expect buyers to test $650, though resistance may stiffen near these highs. If SPY breaks below $642, watch for a potential dip to $638 or even $633. This forecast is actionable intelligence, anticipating either continued drift upward or a reactive pullback if sentiment shifts. Key economic data could push SPY through its current range, so traders must stay nimble and ready to act around these pivotal levels.

Trading Strategy

With SPY sitting near record highs and VIX rising to 14.83, the market is still favoring long trades, but caution is warranted. Longs remain preferred on dips toward $642 or $640, with profit targets at $645, $648, and $650. Stop-losses should be tightened near each resistance level to lock in gains. Shorts may only be considered on failed breakouts above $645 or a confirmed breakdown below $640, with downside targets at $638 and $633. Volatility is creeping in, so size down and stay flexible, especially ahead of Friday’s data. The VIX remains below the danger zone, but a spike above 23 would shift the market’s risk tone. Expect whipsaws near major data and be ready to reverse if setups fail.

Model’s Projected Range

The model projects SPY’s maximum range for Friday between $638.75 and $649.75, with the Call side dominating in a steady range, suggesting consolidation with intermittent trending moves. Overnight, markets traded sideways in anticipation of the PPI release, and following the data, SPY dipped to support at $641.50 and hovered near that level into the open. As has been the pattern, the dip was quickly bought, and SPY rallied sharply at the open, approaching yesterday’s all-time high. While it didn’t quite reach that mark, it came close. At $645.50, profit-taking set in, leading to a pullback, but once again, dip buyers stepped in and pushed prices back toward the day’s highs before a slight fade into the close. SPY notched another record close at $644.95, though on subpar volume, raising some concern about the rally’s underlying strength. Tomorrow is OPEX, which often brings heightened volatility, making it a good day to scale down and stay nimble. Yet with another record close, the market continues to signal potential for further upside on Friday. While Friday brings Retail Sales and University of Michigan Sentiment data, neither is expected to be a material market mover. Absent a new external catalyst, bulls will likely aim to defend the $642 level overnight to set up another leg higher. A failure to hold this level could trigger a move down toward $638 or lower. Since reclaiming $585, SPY has remained in a strong uptrend, consistently finding support on dips, a trend likely to persist unless leadership falters or a macro shock intervenes. Most “Mag” stocks traded higher today, continuing to drive SPY to new highs. We continue to view this parabolic move as high risk and low reward and therefore recommend quick profit-taking with no overnight holds. Early signs are emerging that suggest a potential correction could begin in early September and last through mid-October. While not yet high-probability, the risk is building. With a record close, there's little immediate resistance to further gains, with key resistance levels to watch on Friday at $645, $648, and $650, above which upside could accelerate. Support lies at $642, $640, $638, and $633, with a break below $633 potentially opening the door to a swift move down to $625. The broader trend remains bullish as long as SPY holds above $642, with dip-buying expected to dominate. Despite typical seasonal weakness from August through October, bears remain largely sidelined as bulls drive SPY well higher in its April bullish channel. The VIX rose 2.35% to 14.83, and while the increase today should be watched carefully, this level still reinforces the overall bullish tone. We continue to recommend hedging long exposure in anticipation of rising volatility this fall. A VIX below 23 remains supportive of equities, while a breakout above 23 could spark the widely anticipated 5–10% pullback.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing at the upper end of the range. There were no extended targets at the close or for the bulk of the day. Those that did print in the morning session quickly faded. The MSI however rescaled higher several times in the am session which saw price recover from the PPI sell off. The MSI currently is in a wide bullish state which implies a continuation overnight of the bull trend. SPY spent most of the day today within the confines of the MSI moving from support to resistance which as long term readers know, occurs more than 70% of the time MSI trending states. We expect SPY to drift slightly higher, perhaps reaching yesterday’s highs where we believe profit taking will once again ensue. That said, liquidity at the highs is slowing being absorbed. After multiple tests of the all time highs, its likely SPY breaks higher once again, continuing to make additional new highs. MSI support is currently $642.34 with resistance at $643.53.

Key Levels and Market Movements:

On Wednesday we wrote, “Thursday brings PPI, which could materially impact the market,” and added, “a close above $640, paired with new highs, will likely continue to pressure market participants to buy, driving prices higher.” We also noted, “We expect the market to drift lower overnight toward the $642 area, which is likely to attract buyers once again.” With that context, and with the MSI in a Bullish Trending Market State and price opening just below $643 after a textbook failed breakdown in the premarket at MSI support, we bought the dip at the open and targeted MSI resistance at $644.18 for T1, which came quickly; with the MSI rescaling higher and extended targets printing above, we waited to set T2 until the MSI settled down, then took T2 at MSI resistance at $645.40. Immediately after hitting this target, extended targets stopped printing above, and a failed breakout at this level had us exit and reverse short, targeting the premarket level of $643.15 for T1 and MSI support at $642.85 for T2; just after noon we hit both targets and moved our stop to breakeven. A less-than-perfect failed breakdown after noon had us exit and reverse once again at $643, targeting MSI resistance at $645.50; while it didn’t look like we would reach this level, we held for the entire afternoon and exited the position at a single, monster target at MSI resistance at $645.40. Three-for-three with large targets made for a day that padded the bank account nicely, thanks to a clear plan, disciplined execution, and strong alignment between MSI’s directional cues, our broader market model, and key technical levels. The MSI continues to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Friday brings UoM Consumer Sentiment and inflation data, both of which could move the market, so trade what you see; it’s also OPEX, which tends to bring whippy, choppy action with large swings in both directions, so we recommend caution with smaller positions and quick in-and-out trades. In the absence of a catalyst, a close above $642 paired with new highs will likely continue to pressure market participants to buy, driving prices higher, though the anticipated range suggests more chop than trending price action. We expect the market to drift higher overnight toward the $646 area, which could attract sellers. But the bulls remain in control as long as SPY holds above $638; we’ll look to buy dips while price stays above that level, while a break of $638 could trigger a move toward $630 with support expected along the way, especially near $635. Our model still favors the bulls with further all-time highs in play, but for bears to regain real control a clean break below $638 is needed, followed by a breach of $635 to draw in more sellers, with a failure at $635 potentially opening the door to $625, and a confirmed break below $600 significantly shifting the outlook and raising the risk of a 9–10% correction. With the MSI still in a Bullish Trending Market State, the bias remains for higher prices on Friday, favoring long setups above $638 and shorts only on a confirmed break below $638 or a failed breakout near $646. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $647 to $665 and higher strike Calls while buying $645 and $646 Calls indicating the Dealers desire to participate in any rally on Friday. The ceiling for Friday appears to be $650. To the downside, Dealers are buying $644 to $575 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying continuing to display little concern that prices could move much lower on Friday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Next Friday:

Dealers are selling SPY $645 to $670 and higher strike Calls indicating the Dealers belief that prices may be topping out near current levels. The ceiling for next week appears to be $655 although $650 will also provide material resistance. To the downside, Dealers are buying $644 to $575 and lower strike Puts in a 6:1 ratio to the Calls they’re selling, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish, but has moved slightly more bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

With SPY holding above key support and notching another record close, long setups remain preferred into Friday. Look to enter long trades on dips toward $642 or $640, targeting $645, $648, and $650. Stop-losses should be tightened on any approach to these resistance levels. Shorts may only be attempted on failed breakouts above $646 or a confirmed breakdown below $638, targeting $636 and $633. With the VIX rising to 14.83, traders should be prepared for larger intraday swings, especially heading into Friday’s data. Reduce position sizes, maintain tight risk controls, and stay nimble. Don’t get caught overexposed heading into OPEX. Be sure to review the premarket analysis posted before 9 AM ET to confirm key levels and monitor Dealer positioning for the latest read on market sentiment.

Good luck and good trading!