Market Insights: Tuesday, August 12th, 2025

Market Overview

The S&P 500 notched a major milestone Tuesday, closing above 6,400 for the first time ever, as Wall Street cheered fresh inflation data and rate cut optimism surged. The broad rally followed the release of the July Consumer Price Index, which showed headline inflation rising 2.7% year-over-year, matching June and coming in softer than the 2.8% economists had expected. Core CPI, which excludes volatile food and energy costs, rose 3.1% over the past year — slightly hotter than June’s 2.9% — signaling that goods inflation is no longer fully offset by easing services prices. The data sparked a sharp jump in expectations for a September Fed rate cut, with CME Group data showing about 94% of traders now betting on that outcome.

Markets responded enthusiastically, with the Dow Jones Industrial Average gaining about 1.1%, or nearly 500 points, while the S&P 500 and Nasdaq each climbed roughly 1.1% and 1.4% respectively, both closing at record highs. The small-cap Russell 2000 outshined with a 3% surge, benefiting from the prospect of lower borrowing costs. The CPI release also marked the first major data report since President Trump dismissed Erika McEntarfer as commissioner of the Bureau of Labor Statistics earlier this month. Late Monday, Trump tapped E.J. Antoni, chief economist at the Heritage Foundation, as his nominee to lead the agency. In corporate news, Intel jumped more than 5% after CEO Lip-Bu Tan met with Trump, who had called for Tan’s resignation just last week. Trump later described the meeting as “very interesting” and praised Tan’s “success and rise” on Truth Social. With equities riding the tailwinds of cooling inflation and renewed policy support, traders are now looking toward Thursday’s PPI report and Friday’s retail sales data for the next read on economic momentum.

SPY Performance

SPY rallied 1.06% to close at $642.66 after opening at $638.29 and pushing to a fresh all-time high of $642.85. The ETF held early support at $636.79 before steadily climbing through midday and into the close, finishing essentially at its highs. Volume came in at 59.98 million shares, slightly above summer averages, underscoring strong participation in the breakout move above $640.

Major Indices Performance

The Russell 2000 led the charge with a 3.05% surge, fueled by rate-cut optimism that disproportionately benefits smaller, domestically focused companies. The Nasdaq followed with a 1.39% gain, setting a fresh record high on broad-based strength in mega-cap tech. The Dow Jones Industrial Average added 1.10%, marking a near 500-point advance and its strongest day in weeks, while the S&P 500 rose 1.06% to close above 6,400 for the first time. Gains were driven by easing inflation concerns and surging rate-cut bets, with cyclical sectors leading and defensive plays lagging.

Notable Stock Movements

The Magnificent Seven posted solid gains across the board, with Meta leading the pack, jumping over 3% on continued advertising strength and upbeat analyst commentary. All other members of the group advanced in step with the broader market, adding fuel to SPY’s push to new highs. The across-the-board green close in this group reflected renewed risk appetite, driven by expectations of easier monetary policy.

Commodity and Cryptocurrency Updates

Crude oil slid 1.25% to $63.16, extending its drift toward our model’s long-held $60 downside target. Gold edged lower by 0.20% to $3,398, holding steady after Monday’s pullback. Bitcoin gained 0.61% to settle above $119,500, keeping the crypto market in positive territory alongside equities.

Treasury Yield Information

The 10-year Treasury yield ticked up 0.42% to 4.303%, remaining comfortably below the 4.5% threshold that could pressure equities. With yields still well under the danger zone of 4.8%–5%, rate-sensitive sectors found room to run, helping sustain the rally sparked by the CPI data.

Previous Day’s Forecast Analysis

Yesterday’s forecast projected SPY to trade between $632 and $641, with a bullish bias above $635 and upside targets at $640, $643, and $645. Support was pegged at $634, $630, and $621. The model called for two-way trade ahead of CPI, with trending moves possible post-data. Long setups above $635 were favored, while shorts were suggested only on failed breakouts near $640 or confirmed breaks under $634. The expectation was for choppy action pre-release, followed by directional momentum if CPI surprised.

Market Performance vs. Forecast

SPY’s actual performance blew past the forecast range, opening at $638.29, briefly dipping to $636.79, and then surging on CPI data to hit a new high of $642.85 before closing at $642.66. The bullish bias above $635 proved highly accurate, with the breakout through $640 delivering sustained momentum into the close. Traders who took long positions on breaks above $637–$638 were rewarded with a smooth trend day, and the upside targets of $643 and $645 are now within striking distance.

Premarket Analysis Summary

In today’s premarket analysis, posted at 7:58 AM, SPY was at $635.24 with a bias level at $637. Resistance levels were identified at $637, $638.70, and $640.70, with downside targets at $634.70, $632.70, and $630.20. The plan leaned bearish under the bias level, expecting rallies to be sold and downside levels to be tested. A recovery above bias opened the door for long trades toward $640.70, though the odds of a large rally were seen as diminishing through the day.

Validation of the Analysis

The premarket bias level at $637 was a key pivot. After an early dip, SPY reclaimed this level decisively, setting off a rally that ran straight through upside targets to close at new highs. Traders using the premarket map had multiple clear long setups, with the CPI release providing the catalyst to blow past resistance. The day’s price action validated the importance of the bias zone and showed how quickly sentiment can flip when major economic data lands in the market’s favor.

Looking Ahead

With Wednesday’s calendar free of major data, traders will turn their focus to Thursday’s Core PPI, headline PPI, and unemployment claims, followed by Friday’s retail sales, consumer sentiment, and inflation expectations. These releases will provide further clarity on inflation trends and consumer demand, with the potential to reinforce or challenge the rate-cut narrative.

Market Sentiment and Key Levels

SPY’s close at $642.66 puts the bulls firmly in control, with near-term resistance at $645, $646, and $650. Support sits at $641, $640, and deeper at $635 and $632. Above $650, momentum could accelerate, while a failure to hold $640 could set up a retest of $635. The prevailing sentiment is strongly bullish, but traders should be alert for consolidation after today’s surge.

Expected Price Action

Our AI model projects SPY to trade between $641 and $648 on Wednesday, suggesting a moderately wide range that could produce trending action if resistance breaks. The bias remains bullish above $641, with $645 and $648 as immediate upside targets. A break below $640 would shift momentum toward $635 and $632. Traders should be prepared for early consolidation, with the potential for afternoon breakouts if buying pressure persists.

Trading Strategy

Long trades remain favored above $641, targeting $645, $646, and $650, with stops tightened as each level is approached. Shorts can be considered on failed breakouts near $645 or a confirmed break under $640, aiming for $635 and $632. With the VIX at 14.73, volatility is low, but caution is warranted given the potential for rapid sentiment shifts. Position sizes should be moderate, and traders should be ready to pivot if Thursday’s PPI data alters the market’s tone.

Model’s Projected Range

The model projects SPY’s maximum range for Wednesday between $638.75 and $646.50, with the Call side dominating in a narrowing range, suggesting consolidation with limited stretches of trending price action. Overnight, markets were virtually unchanged, drifting slightly lower, but immediately after the CPI release, the market surged higher and never looked back. While some opening chop trapped traders on both the long and short side, by 10:00 a.m. the direction was clear; upward to new all-time highs. Volume was average for a mid-summer day, which is supportive of today’s 1% push to record levels. At the open, SPY traded just above $638, whipsawed briefly, and then steadily climbed, reaching a new high of $642.85 late in the session. With a close essentially at the day’s highs, the market is signaling potential for higher highs on Wednesday. The breakout will require a move above $660 for confirmation, and failure to do so could see SPY pull back to retest $635 or possibly lower. Since reclaiming $585, the index has remained in a strong uptrend, with dips consistently bought, and this momentum is likely to persist unless weakness develops in leading names or a major external catalyst interrupts the move. Every “Mag” stock closed higher today, continuing to fuel SPY’s advance, and a close above $640 leaves little in the way of further all-time highs in the coming days. Key resistance levels are $645, $646, and $650, with upside potentially accelerating above $650. Support levels are $641, $640, $635, and $632, with a break below $630 risking a swift drop to $620. Overnight, bulls will aim to defend $638 to keep the strong bull trend intact and set up a push toward $650. While the market may consolidate some of these recent gains over the next day or two, something our model sees as highly probable, the prevailing strength should continue unless price drops below $630. As long as SPY holds above this level, dip-buying is expected to remain the dominant strategy. Seasonal volatility from August through October tends to favor bears, but they remain sidelined as bulls dominate, with SPY trading well above the lower bounds of its bullish channel from the April lows. Meanwhile, the VIX fell 9.35% to 14.73, further reinforcing the bullish backdrop. We continue to recommend hedging long equity exposure in anticipation of higher volatility into the fall. A VIX below 23 remains supportive of equities, while a breakout above 23 could spark the widely anticipated 5–10% pullback.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the day in a Bullish Trending Market State, with SPY closing well above MSI resistance turned support. Extended targets printed into the close which implies higher prices overnight and on Wednesday. In fact extended targets printed virtually all day after the 10 am hour which saw SPY move to new all time highs. Overnight the MSI remained in a ranging state but after CPI in the premarket, the MSI began a series of rescalings higher to a bullish state. The first 30 minutes after the open whipsawed a bit with the MSI moving to a ranging state. But by 10 am, it was off to the races with several, rapid rescalings higher in a bullish state and with extended targets above. As such SPY had one way to move and that was straight up. MSI support is currently $641.25 and lower at $639.62.

Key Levels and Market Movements:

On Monday, we wrote that “Tuesday’s CPI release means anything can happen,” adding, “we continue to favor the prevailing long trend, buying dips as long as price holds above $630,” and also noted, “our model still favors the bulls following a close above $635, with new all-time highs in play.” With this context, and with the MSI in a wide Ranging Market State at the open, we knew the plan was to seek longs, anticipating the CPI rally would have legs. But when a double top formed at the CPI high and with no extended targets above, we opted to short $639.75 just ten minutes after the open, positioning just below MSI resistance, setting T1 at MSI support at $638.75, which hit quickly, and then referring to the premarket report for T2, setting $637 as our next target, both of which were secured without trouble. At that point, with the MSI still in a wide ranging state and a convincing failed breakdown in play, we closed our short at T2 on the second test of that level. We chose not to reverse long immediately since our playbook avoids trading with the MSI in a ranging state. But when SPY began climbing and the MSI rescaled to a Bullish Trending Market State, we shifted gears, entering long at MSI support at $638.75 and setting T1 at $639.75, which hit just before 11 a.m.. The MSI began a series of rapid rescalings higher, now printing extended targets above, giving us confidence we were on the right side of the day and prompting us to set T2 at the next premarket level of $640.70, which also hit quickly, allowing us to move our stop to breakeven and trail the remaining 10% of our position into the afternoon. While we didn’t expect price to reach the day’s highs, the steady stream of extended targets and the absence of any failed breakout patterns kept us in the trade until the close for a massive long winner, making it two for two on the day, one clean short and one great long, thanks to a clear plan, disciplined execution, and tight alignment between MSI’s directional cues, our broader market model, and key technical levels, with the MSI continuing to be a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Wednesday has no economic news and little in the way of earnings as the season comes to a close, so the market is likely to continue doing what it has been doing, moving higher. The anticipated range for tomorrow is quite narrow, suggesting a sideways day with more two-way price action. We see the market moving higher overnight but likely pausing near $645, where a bout of profit taking may emerge. Yet this is not a rally to fade or fight as the bulls have little to fear from the bears as long as the largest cap stocks keep pushing higher. Even today’s 3% rally in the Russell was impressive, indicating the trend is expanding to small caps. We continue to favor the prevailing long trend, buying dips as long as price holds above $638, while a failure at $638 could trigger a drop toward $630, though buyers are likely to step in along the way, particularly near $635. Our model still favors the bulls following a close above $640 with additional new all-time highs in play. But for bears to regain any measure of control a decisive break of $638 is needed first, with a second break of $635 to entice more bears to the party. A failure at $635 could open the door to $625 as a short-term floor while a confirmed break below $600 would materially shift the outlook and raise the risk of a 9–10% correction, a scenario we currently view as a very low, almost meaningless probability for tomorrow. The MSI remains in a Bullish Trending Market State with extended targets printing into the close, so we expect SPY to push toward $645, while also noting the possibility of more two-way price action, which leads us to favor long setups above $635 and consider shorts only on a break below $630 or on a push toward $645. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

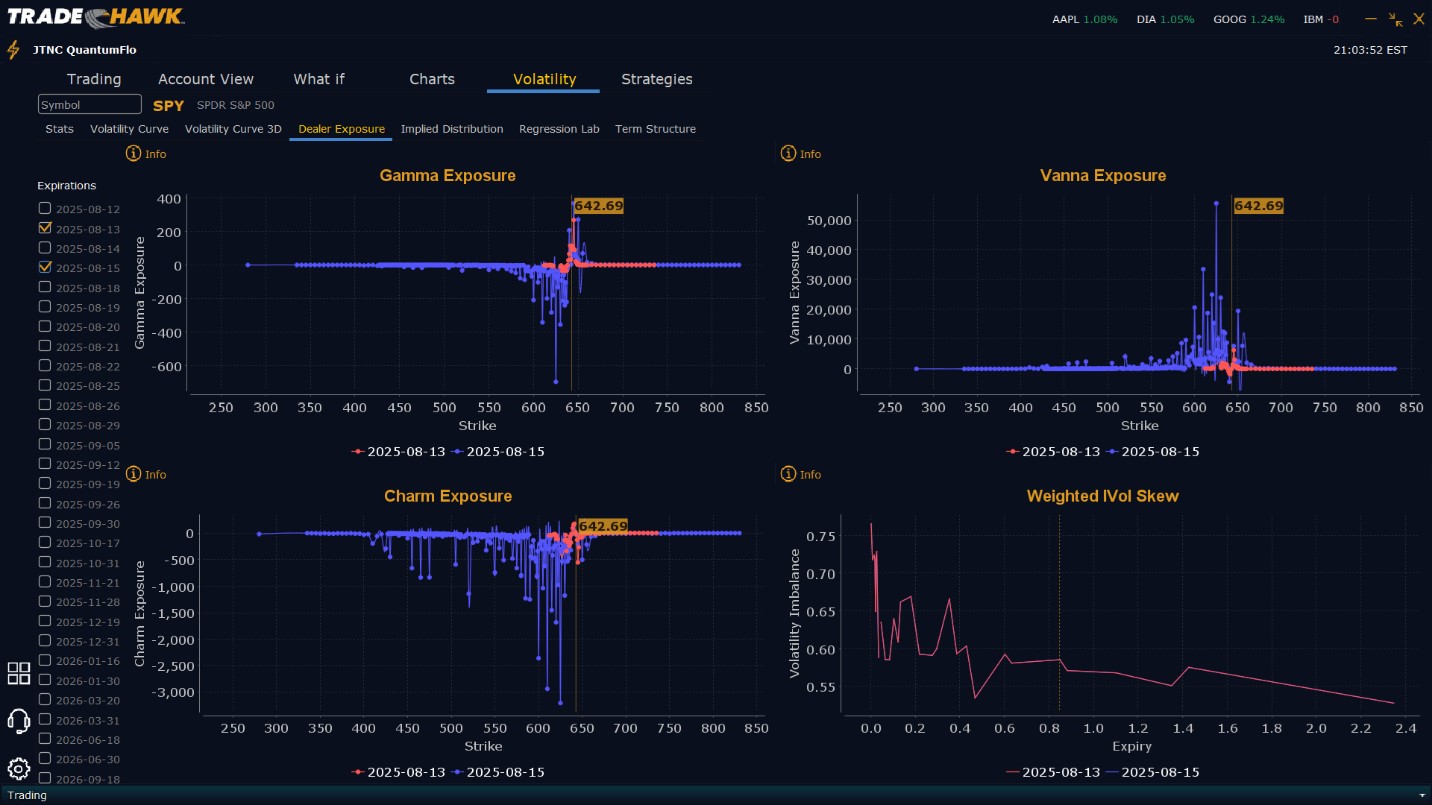

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $643 to $650 and higher strike Calls while also selling $638 to $642 Puts indicating the Dealers belief that prices can only move higher on Wednesday. Dealers only sell near the money Puts when they are convinced prices will rise. The ceiling for Wednesday appears to be $645. To the downside, Dealers are buying $637 to $575 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying continuing to display little concern that prices could move much lower on Wednesday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $643 to $665 and higher strike Calls while also selling $638 to $642 Puts indicating the Dealers belief that prices can only move higher into the end of the week. Dealers only sell near the money Puts when they are convinced prices will rise. The ceiling for the week appears to be $650. To the downside, Dealers are buying $637 to $575 and lower strike Puts in a 5:1 ratio to the Calls/Puts they’re selling/buying, reflecting a bearish outlook for the week. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

With SPY firmly above $640, the bullish case strengthens, and traders should continue favoring long setups on dips toward $638, targeting $643, $645, and $646. Shorts remain viable only on failed breakouts near $645 or confirmed breaks below $640, with downside targets at $635 and $632. Risk management is critical with volatility at low levels consider using tighter stops to protect gains. Always review the premarket analysis before 9 AM ET for the latest model adjustments and Dealer Positioning updates.

Good luck and good trading!