Market Insights: Wednesday, July 23rd, 2025

Market Overview

Stocks climbed on Wednesday, driven by fresh trade optimism and anticipation surrounding tech earnings, as Wall Street digested a new agreement with Japan. The S&P 500 and Nasdaq both closed at record highs, while the Dow surged more than 450 points, ending just four points shy of its first record close of 2025. The catalyst was a U.S.-Japan deal that replaces a threatened 25% tariff with a more moderate 15% rate. In return, Japan committed $550 billion in U.S. investment, a development President Trump touted as “a great deal for everybody.” Market hopes are now pinned on a wave of agreements ahead of the broader August 1 tariff deadline. Reports suggest progress with the EU and China is materializing, which buoyed sentiment throughout the session.

After the bell, Tesla missed both top- and bottom-line estimates for Q2 but held firm in after-hours trading as it reaffirmed 2025 production plans for a new, lower-cost vehicle. Alphabet, on the other hand, delivered a beat on both revenue and earnings thanks to robust ad and cloud performance, but shares fell over 1% after the company revealed it would increase capital spending to $85 billion, up from the $75 billion it previously guided. Meanwhile, Chipotle disappointed with a larger-than-expected drop in same-store sales, sending its stock down more than 7%. Despite mixed earnings reports, the market held firm, underpinned by improving trade sentiment and strong investor appetite for risk.

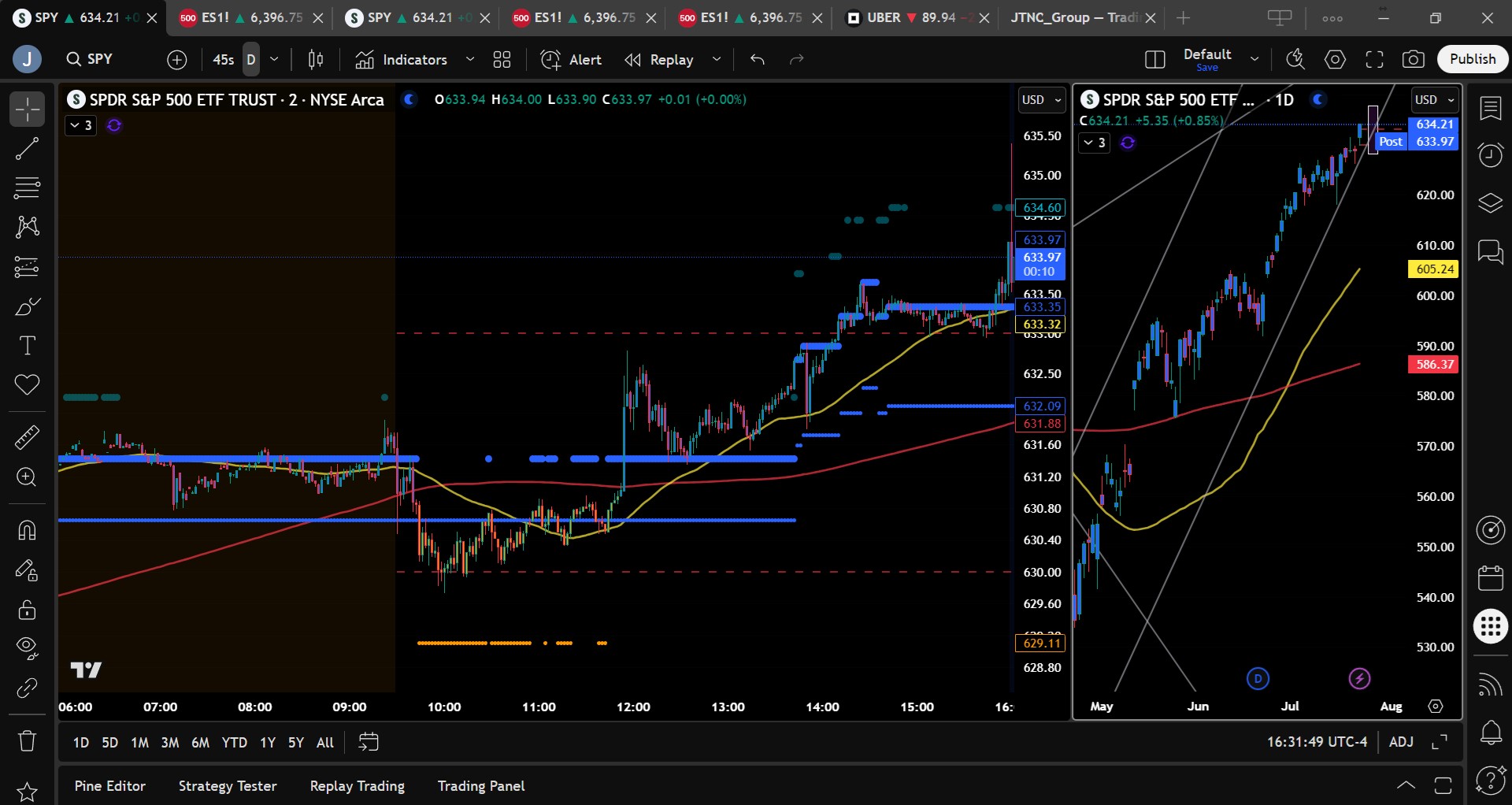

SPY Performance

SPY gained 0.84% on Wednesday, closing at a new all-time high of $634.14 after opening at $631.75. The ETF briefly pulled back to an intraday low of $629.73 but rallied throughout the day, peaking at $634.16. Volume rose to 64.47 million shares, above average and signaling renewed momentum. The upward move reinforces the bullish trend, with SPY continuing to respect key support levels and push into fresh territory.

Major Indices Performance

Small caps led the way as the Russell 2000 climbed 1.54%, outpacing all other major indices and reflecting strong risk-on sentiment. The Dow surged 1.14%, driven by trade-related optimism and a rally in industrial names, and closed just shy of a record. The S&P 500 added 0.84% for another all-time close, while the Nasdaq rose 0.61%, lifted by strength in tech despite some post-market earnings volatility. Sector performance was broadly positive, with cyclicals and financials benefiting most from renewed global trade hopes. The session marked a decisive shift in tone, as progress on tariffs fueled buying across equities.

Notable Stock Movements

Nvidia led the Magnificent Seven with a strong 2.27% rally, recovering from Tuesday’s losses and helping push the broader tech sector higher. Gains were more limited across the group, with Tesla, Amazon, and Meta closing slightly higher. Alphabet, Netflix, and Apple saw declines, with Netflix extending its recent slide and Alphabet slipping after hours despite an earnings beat. Overall, the group posted a mixed performance, reflecting ongoing investor selectivity amid an intense earnings season and growing sensitivity to forward guidance.

Commodity and Cryptocurrency Updates

Crude oil edged up 0.23% to settle at $64.46, but price action remains constrained by lackluster demand and global economic uncertainty. The model maintains a bearish outlook, projecting a decline toward $60 later this year. Gold fell 1.28% to $3,399.50, retreating after a multi-day rally as risk appetite improved. Bitcoin also slipped, down 1.12% to close just above $118,400, showing weakness after recent speculative gains. The pullback across safety trades signals a modest shift toward risk assets amid easing geopolitical concerns.

Treasury Yield Information

The 10-year Treasury yield rose 1.18% to finish at 4.385%, approaching the critical 4.5% threshold that typically triggers equity market concern. While not yet at danger levels, any move above 4.8% would likely spark broader selling, with 5.2% historically signaling a major correction. For now, the modest increase reflects tempered inflation expectations and cautious optimism, but traders are keeping a close eye on the bond market for signs of renewed volatility.

Previous Day’s Forecast Analysis

Tuesday’s forecast anticipated SPY trading between $625 and $633.75 with a bullish bias, supported by a firm bid at $625 and upside targets at $630 and $632. The model expected buyers to defend dips and warned that resistance near $632 could cap gains unless earnings acted as a catalyst. Long trades were favored on pullbacks to $625 or $626.50, with a breakout scenario eyeing moves to $635 or higher. The VIX’s muted reading of 16.50 supported the view of a stable but reactive market, primed for volatility around major headlines.

Market Performance vs. Forecast

SPY traded nearly in lockstep with Tuesday’s projection, moving within the expected range of $625 to $633.75 and ultimately exceeding it with an intraday high of $634.16. After opening at $631.75, SPY briefly dipped to $629.73, just above the model’s key support, and then pushed through resistance at $632, reaching the upper target of $635 before closing at a record $634.14. The forecast correctly highlighted the bullish bias and likely support at $630, with upside continuation driven by positive earnings and trade news. Long trades off support once again proved highly effective, reinforcing the accuracy of the projected bias and range.

Premarket Analysis Summary

In Wednesday’s premarket analysis posted at 7:39 AM, SPY was trading at $631.13 with resistance targets at $633 and $641, and support at $631, $630, $627.50, $626, and $625.50. The bias level was identified at $630, and the forecast leaned bullish above this level. The strategy advised buying dips into support while warning that failure at $630 could trigger downside moves toward the $625 range. The tone was cautious, favoring long trades on strength while being prepared to exit quickly near lower support zones.

Validation of the Analysis

Wednesday’s market action validated the premarket outlook perfectly. SPY opened above the $630 bias level and quickly tested support around $630 before bouncing higher. The move to the $633 target unfolded smoothly by midday, followed by consolidation and a late-day push to new highs. Resistance at $633 was briefly challenged before SPY tapped the $634–$635 zone, which had been discussed as a stretch target if momentum sustained. The analysis correctly anticipated both the intraday reversal off support and the upward extension, giving traders actionable entries and clear targets throughout the day.

Looking Ahead

Thursday’s session will be shaped by fresh economic data, with Unemployment Claims and PMI readings set to be released. These indicators will provide a clearer read on the health of the labor market and broader economic activity. With SPY closing at record highs and sentiment leaning bullish, traders will be watching for signs of either validation or reversal from the incoming data. Volatility could pick up if the numbers surprise in either direction, especially as the market nears a critical technical zone.

Market Sentiment and Key Levels

SPY heads into Thursday trading at $634.14, riding a wave of bullish momentum and sitting just beneath heavy resistance in the $635–$640 zone. Sentiment remains firmly risk-on, supported by strong earnings and cooling tariff tensions. Key resistance levels to watch are $635, $636, $639, and $640. Support levels are stacked at $630, $628, $627, and $625. Bulls are in clear control as long as SPY holds above $625, but a break below this level could spark a deeper retracement toward $622 or even $620. Traders should stay alert as macro data hits the tape.

Expected Price Action

Our AI model projects SPY to trade between $630 and $636 on Thursday, suggesting a narrowing range but with potential for continued upside. This is actionable intelligence. The bullish bias remains intact, with targets at $635 and $640 if SPY holds above $630. A breakout above $640 would be a strong bullish confirmation, but that level is likely to attract significant profit-taking. If SPY fails to hold $630, expect a retest of $627, with a break below that opening the door to $625 and $622. The tone remains constructive, but volatility may increase following Thursday’s data releases. Traders should look for continuation setups or failed breakdowns near major support.

Trading Strategy

With SPY sitting just below the $635 resistance zone, traders should continue to favor long setups on dips toward $630 and $628. If those levels hold, upside targets remain $635 and $640, where tighter stops are advisable given the potential for rejection. Short trades are viable only on confirmed breaks below $625, targeting $622 and $620. Given SPY’s current momentum and the low VIX reading of 15.38, volatility remains subdued, but that could change quickly if economic data disappoints. Traders should remain flexible, use conservative sizing, and adjust stops based on market behavior around key levels.

Model’s Projected Range

The model projects SPY’s maximum range for Thursday between $628.25 and $637.75, with the Call side dominating within a narrow, 5-point band suggesting choppy price action punctuated by occasional trending moves. Overnight, the market moved higher on favorable earnings and tariff news, with SPY opening at $631.55, right up against major resistance at $632. SPY briefly pulled back to key support at $630 before rallying midday, driven by news that 15% tariffs on Japan were being considered, widely seen as a win for U.S.-Japan relations. The ETF then consolidated throughout the afternoon before resuming its climb to new all-time highs, breaking above $635 intraday and closing at a record high of $634.21. Earnings strength and a calmer tariff environment continue to drive price action. The bulls remain firmly in control, with dip buyers consistently stepping in on even the slightest pullbacks. The new all-time high close reinforces the prevailing bullish trend, and there’s little indication the bulls are ready to cede ground. This bullish dominance has held since SPY reclaimed the $585 level. With a close near $635, bullish momentum is solidly intact, setting the stage for a potential push into the $635–$640 range, where we expect meaningful resistance and likely profit-taking. That said, tariff-related headlines remain a key risk. Should any negative developments surface, the tone could shift quickly, but in the absence of such surprises, the broader uptrend remains intact. Key resistance levels heading into Thursday are $636, $639, and $640, while major support lies at $628, $627, $625, and $622. Momentum favors continued upside, with near-term action likely to revolve around defending the $632 level. A healthy pullback to that area would offer bulls another opportunity to reset. Failure to hold $632 could prompt a retest of today’s lows at $630. A successful defense of $630 keeps the ultra-bullish scenario in play, with upside targeting $640. If $630 fails, the next critical support is $625. While we expect buyers to step in there, a decisive break below $625 opens the door to a deeper pullback toward $622 or even $620. Our model turns bearish below $622, and while the probability is low, a break below $600 would significantly raise the odds of a retest of the $585 level. Last week, early signs of potential weakness emerged as we approached August, but the strength of the past two sessions has reduced those risks. Any seasonal weakness may now be deferred to September or October. With SPY closing above the lower edge of a redrawn bullish channel from the April lows, the uptrend remains intact and strong. However, the $635–$639 resistance zone is dense and could moderate near-term upside. The market remains sensitive to macroeconomic data, bond yields, inflation readings, tariff developments, and fiscal policy changes. Notably, the VIX fell 6.79% to 15.38, reflecting a clear risk-on tone. We continue to recommend maintaining hedges on long books at these levels, particularly via 90-day out-of-the-money VIX calls, as we anticipate elevated volatility later this quarter.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a Bullish Trending Market State, with SPY closing well above MSI resistance turned support. Extended targets printed into the close and consistently in the afternoon session indicating the herd was participating in today’s break higher. Overnight the MSI rescaled higher several times with extended targets above setting up the tone for the day. A brief pullback after the open with the MSI rescaling to a ranging state was short lived as the MSI rescaled back to a bullish state and remained in this state for the entire afternoon session. Several rescalings higher with extended targets and the market could only go up to close at new, all time highs. Overnight our model suggests SPY may pull back and consolidate around the $632 level however with the MSI in a bullish state and with extended targets printing into the close, higher prices are likely on Thursday. MSI support is currently $632.09 and higher at $633.35.

Key Levels and Market Movements:

On Tuesday, we wrote, “we continue to expect the broader bullish trend to persist.” We also noted that “with bulls aiming to defend $627. If that level holds, it could support a move toward $635,” and added, “For Wednesday, we favor long setups above $626, with potential short opportunities near $632 or on failed breakouts.” With this plan in hand and SPY opening just below $632, the MSI was in a narrow bullish state without extended targets, and with a less than perfect failed breakout, we entered short at $631.50, setting our first target (T1) at the premarket level of $630, just below MSI support. That target was hit quickly, and since it was a countertrend setup, we turned to the MSI for our second target at $629.11. However, that move failed to materialize. At 10 a.m., following a textbook failed breakdown and with the MSI shifting to a ranging state, we reconsidered the short. Given the strength of the overnight session, we exited and reversed long at $630.15, setting our first target at MSI resistance near $631.50. SPY surged just before noon, and with T1 achieved, we booked profits on 70% of the position and set T2 at the premarket level of $633. A brief pullback to MSI support held, and by mid-afternoon, T2 was hit for another 20% of our position. With a stop at breakeven on the remaining 10%, we held on, watching the MSI rescaling higher and printing extended targets. We ultimately exited the remaining piece at MSI resistance at $633.31, just ten minutes before the close. While we missed the final-minute pop, two well-executed trades were more than enough green for the day. Once again, having a plan, sticking to it with discipline, and trusting the MSI’s directional cues, aligned with our broader market model and levels, made all the difference. The MSI remains a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday brings Unemployment Claims and PMI data, both of which have the potential to move markets so be ready to trade what you see. After the close, Tesla and Google will report earnings, which could also introduce volatility into the mix. As such, Thursday may be a good day to observe and let the MSI provide clearer guidance before initiating any trades. That said, in the absence of market-moving data, emotion and FOMO continue to drive price action. Without a new external catalyst, the market is likely to grind higher. The projected range remains stable at 5 points, indicating a continuation of sideways movement with room for trending action. We expect the broader bullish trend to persist, supported by stronger-than-expected Q2 earnings and new highs. Odds favor SPY churning in a range overnight, with bulls looking to defend the $632 level. If that support holds, it could pave the way for a move toward $640. However, if $632 fails or doesn't recover quickly, a decline to $630 becomes likely, and a sustained break below $630 would increase the probability of a deeper move toward $625. While our model had begun to reflect a rising probability of a 10–15% pullback in August, today’s strength caused that risk to fade, suggesting any meaningful pullback may now be delayed into September or beyond. Until that probability becomes actionable, we continue to favor dip buying at major support levels and on failed breakdowns, as bulls remain in clear control of the broader trend. Traders should stay alert to any tariff-related developments out of the White House, but in their absence, the market is likely to grind higher with periods of consolidation. The market's resilience in the face of potential risks only strengthens the case for continued upside. With the MSI currently in a Bullish Trending Market State, printing extended targets into the close, we expect higher prices on Thursday. Looking longer term, a decisive break below $600 would be required for bears to gain meaningful traction. For Thursday, we favor long setups above $630, with potential short opportunities near $638 or on failed breakouts and breakdowns below $621, particularly if the MSI begins to weaken. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $635 to $641 and higher strike Calls while buying $631 to $634 Calls indicating the Dealers desire to participate in any rally on Thursday. They nailed the positioning yesterday for today. The ceiling for tomorrow appears to be $636. To the downside, Dealers are buying $630 to $575 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying implying little concern that prices may move lower on Thursday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $635 to $645 and higher strike Calls while selling $630 Puts in small size indicating the Dealers belief that prices will not decline beyond $630. Dealers only sell near the money Puts when they are confident in higher prices. The ceiling for the week appears to be $640 but $638 also represents major resistance. To the downside, Dealers are buying $634 to $500 and lower strike Puts in a 6:1 ratio to the Calls they’re selling, reflecting a bearish outlook for the week. Dealers have not increased their hedges this week and this ratio is likely more a reflection of protection as opposed to bearish concerns. With August 1st as another tariff deadline, and given the seasonally weak period for the market, Dealers are protecting from any potential downside which is showing up in our model. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY continues to trade near heavy resistance at $635 following another record-setting session. Long setups remain favorable on dips to $630 and $628, with targets set at $636 and $640. If SPY breaks above $640, momentum could accelerate, but this level is likely to bring in profit-taking. On the downside, short trades may be considered if SPY breaks below $625, with downside targets at $622 and $620. The VIX declined to 15.38, showing continued complacency, but Thursday’s economic releases could bring a swift change in sentiment. Use smaller positions around resistance and tighten stops on strength.

Review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!