Market Insights: Tuesday, July 1st, 2025

Market Overview

U.S. equities finished the first day of July on solid footing, capping a remarkable second-quarter comeback as the S&P 500 and Nasdaq pushed to fresh all-time highs. The upbeat tone followed progress in global trade negotiations, easing investor fears of a renewed tariff war. Markets welcomed Canada’s last-minute decision to scrap a planned digital services tax targeting U.S. tech firms, an olive branch that helped revive trade talks and settle nerves ahead of a looming July 9 tariff deadline. President Trump’s comment that an extension likely won’t be necessary helped fuel optimism that tensions are cooling. So far, limited trade accords have been struck with both China and the UK, with the British deal officially taking effect on Monday.

Attention also turned to Washington, where Senate lawmakers began a marathon voting session on the proposed $4.5 trillion tax cut package. The bill’s hefty price tag expected to add $3.3 trillion to the deficit, remains a sticking point, but momentum is clearly building for passage. As legislative wrangling continued, investors kept one eye on the bond market, where the 10-year Treasury yield slipped five basis points to 4.23%, signaling expectations for potential rate cuts later this year. With markets set for a shortened week due to the July 4th holiday, traders are focused on Thursday’s June Jobs Report, which could determine the next leg for equities.

SPY Performance

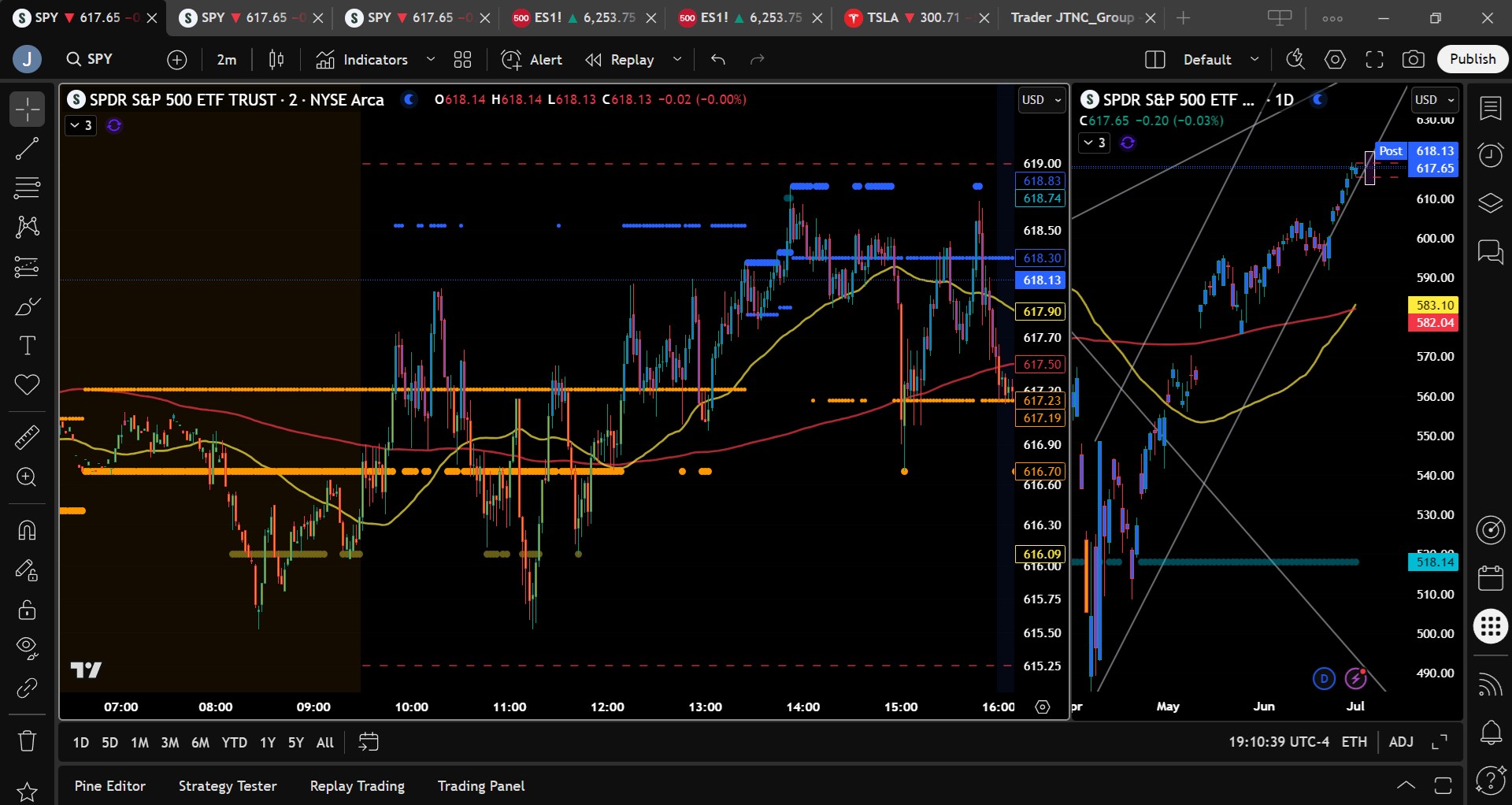

SPY posted a marginal loss on Monday, dipping 0.04% to close at $617.60. The ETF opened at $617.38 and ranged modestly between $618.83 and $615.52 in a session defined by lower-than-average volume at 65.54 million shares. Despite the tight trading range, SPY continues to trade just beneath its record highs, showing resilience near key support. With bullish momentum intact, the slight pullback appears more like a pause than a reversal.

Major Indices Performance

The Russell 2000 led the major indices with a 1.03% gain, followed by the Dow Jones Industrial Average, which climbed 0.91% to edge closer to its record levels. The S&P 500 was nearly unchanged, while the Nasdaq slid 0.82%, dragged down by weakness in mega-cap tech. Sector performance was mixed, with value stocks and cyclicals driving the Dow and small caps higher, while the tech-heavy Nasdaq reflected investor rotation ahead of Powell’s upcoming remarks. The market mood remained cautiously optimistic, buoyed by signs of progress in trade talks and anticipation of Thursday’s key jobs data.

Notable Stock Movements

Tesla led decliners among the Magnificent Seven, plunging more than 5.34% as profit-taking hit the EV space. Most other members of the group also traded lower, though Amazon and Apple bucked the trend with modest gains. The uneven performance underscores a slight cooling in the high-flying tech sector, even as broader market strength persists. Microsoft came off recent highs, while Nvidia and Meta paused after setting records the prior session. These divergences signal possible consolidation ahead in the mega-cap space.

Commodity and Cryptocurrency Updates

Crude oil rose 0.92% to settle at $65.72, continuing its upward grind as tensions in the Middle East ease and supply chains remain steady. The climb remains in line with our model’s long-standing forecast for a return toward the $60 level. Gold surged 1.24% to $3,348, reinforcing its role as a hedge amid economic uncertainty. Meanwhile, Bitcoin fell 2.11% to close just above $105,300. While price remains within our favored long-only buy range of $83,000 to $77,000, we continue to avoid adding below $77,000 due to elevated downside risk.

Treasury Yield Information

The 10-year Treasury yield rose 1.14% to close at 4.25%, a slight uptick from the prior session’s level of 4.231%. While still comfortably below the equity red-zone threshold of 4.5%, this move suggests some upward pressure may return if upcoming economic data surprises to the upside. Equities remain supported for now, but persistent yield increases could shift sentiment quickly, particularly if the Fed delays action.

Previous Day’s Forecast Analysis

Monday’s forecast called for SPY to trade within a $615 to $621 range, with the model favoring long trades above the $615 level. Upside targets included $619, $621, and potentially $625, while a break below $615 could have led to pullbacks toward $611 and $609. The model emphasized long setups on dips, citing failed moves around support as high-probability entries. The overall tone was bullish, but cautious given the approaching economic data releases and early-week positioning.

Market Performance vs. Forecast

SPY opened at $617.38 and traded in a narrow $3.31 range, peaking at $618.83 and dipping to $615.52 before closing at $617.60. The action remained well within the projected range, validating the model’s $615 bias level as effective support. Although SPY didn’t reach the full upside target of $621, long trades initiated near $615 were profitable, particularly for those aiming for a move toward $619. The model accurately predicted the limited volatility and offered traders clear entry and exit zones for intraday setups.

Premarket Analysis Summary

In Tuesday’s premarket analysis posted at 7:36 AM, SPY was trading at $616.97, with the bias level identified at $615.25. The forecast leaned bullish, projecting progress toward upside targets at $619, $621.25, and possibly $623, provided SPY held above the bias level. On the downside, a drop below $614 could trigger a move toward $610, though this was considered less likely. The model advised traders to favor long entries at known support levels but warned that gains could be limited due to overhead pressure and clustering.

Validation of the Analysis

Tuesday’s session closely followed the premarket script. SPY respected the $615.25 bias level throughout the day, briefly touching $615.52 but quickly rebounding, validating long trades from that zone. While the ETF didn’t quite reach the $621.25 upper target, it did approach the $619 area, satisfying the initial upside target. The forecast correctly anticipated a rangebound session with slight upward bias, and traders who followed the levels had several clean long opportunities with low drawdown risk. The premarket roadmap once again proved accurate and actionable.

Looking Ahead

Wednesday brings the ADP Non-Farm Employment report, which will serve as a precursor to Thursday’s all-important June Jobs Report and unemployment rate. With markets closed Friday for the July 4th holiday, traders are expected to continue front-loading activity midweek. Any surprises in labor data could significantly impact market sentiment and shape expectations for the Fed’s next move. Traders should be prepared for increased volatility ahead of Thursday’s report.

Market Sentiment and Key Levels

SPY closed Tuesday at $617.60, holding firmly above key support and remaining within a strong bullish channel. The market sentiment continues to favor the bulls, supported by easing trade tensions, stable yields, and optimism around potential Fed easing. Key resistance now sits at $621, $624, and $626, with major support levels at $616, $610, $608, and $605. A breakout above $621 could open the door for a move toward $625 or higher, while a drop below $610 may lead to a deeper test of support near $605. Despite minor headwinds, the broader uptrend remains intact.

Expected Price Action

Our AI model projects SPY to trade between $615 and $621 on Wednesday. This narrow range points to a likely session of choppy, two-way price action. With a continued bullish bias, traders should watch for SPY to test resistance at $621 and possibly $624 if momentum picks up. Actionable intelligence suggests long trades remain favored as long as SPY holds above $615, with key upside targets at $619, $621, and $624. Should SPY break below $615, downside probes toward $610 and $608 may follow, though major declines appear unlikely unless external data surprises to the downside.

Trading Strategy

Traders should continue favoring long setups on dips to support near $615 or $610, with upside targets at $619, $621, and potentially $624. A breakout above $621 could accelerate momentum toward $626, and stop-losses should be tightened as SPY approaches those resistance levels. Short setups remain low-probability but can be considered on failed moves near $621 or clean breakdowns below $610, targeting $608 and $605. With the VIX ticking slightly higher to 16.83, traders should brace for choppy conditions and adjust sizing accordingly. Avoid oversized positions ahead of Thursday’s jobs data and prepare for volatility spikes.

Model’s Projected Range

The model projects SPY’s maximum range for Wednesday between $613.50 and $622, with the Call side dominating within a narrowing range, suggesting choppy price action. Today’s session remained confined to a tight $3 range but upheld the prevailing bullish trend, with SPY closing at $617.65. While uncertainties particularly around tariffs warrant cautious optimism, the broader uptrend remains intact as long as SPY stays above $585. On Wednesday, bulls will look to defend the $615 level, potentially setting the stage for another leg higher. A failure to hold $615 could prompt a pullback toward $610 or even $605, though meaningful downside remains unlikely unless $590 is breached. Absent a major catalyst, our model continues to indicate that dips will be bought and the market will grind higher. We maintain our view that pullbacks are buying opportunities. Resistance is now noted at $621, $624, and $626, while support is seen at $616, $610, $608, and $605. SPY continues to ride above the lower boundary of the redrawn bull channel from the April lows. Although resistance in the $619–$621 zone remains dense, it begins to ease above $621, with any move toward $625 likely to be gradual. Conversely, a drop below $610 could introduce some downside risk, though still within the context of the broader uptrend. Market direction remains sensitive to macroeconomic indicators, bond yields, inflation data, tariffs, and fiscal policy, all of which will shape sentiment in the absence of a major catalyst. Meanwhile, the VIX rose 0.60% to 16.83, still low enough to reflect reduced investor caution and a continued risk-on tone. Nevertheless, traders should stay nimble amid the potential for rising volatility.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a wide Ranging Market State, with SPY closing at the bottom of the range. The MSI spent the morning session mostly in a bearish state which saw some extended targets below. But after testing the $615 level, these targets ceased printing and SPY reversed and rallied to the day’s highs with the MSI rescaling to a bullish state. The day was filled with the MSI scaling through all three states which implies a market which is confused and likely to continue to tread water. This is virtually the same analysis as yesterday which played out as predicted. Currently MSI support stands at $617.23 with resistance at $618.30.

Key Levels and Market Movements:

On Monday, we noted: “Tuesday brings Manufacturing PMI, JOLTS Job Openings, and a speech from Powell. Any of these could move the market, but none are likely to derail the prevailing bull trend.” We added, “the market appears set to drift toward $621,” and stated, “holding $615 keeps the door open for a push toward $621.” With this actionable roadmap in hand and SPY opening above $616.36 while the MSI was in a bearish state with extended targets printing below, our focus shifted to identifying a short entry toward $615 support. We needed SPY to cooperate by pushing above MSI resistance and then setting up a failed breakout, which arrived at 10:00 a.m. Although we don’t typically trade when MSI is in a ranging state, we entered short at $617.75 at 10:20 a.m., targeting MSI support at $616.75. That level was hit quickly, so we moved our stop to breakeven and set our second target (T2) at the premarket level of $615.25. Price reached the premarket low of $615.50 and formed a less-than-ideal failed breakdown. Given this occurred at a major support level from both the prior day and the premarket, we waited for extended targets to stop printing and reversed long at $616.35. Our first target (T1) was set at MSI resistance of $617.35, and once hit, we set T2 at $619. Price reversed back to our entry, causing concern, but a higher low and only one extended target at major support reaffirmed our confidence in the bull trend. We reloaded to full size, again targeting $617.35 first, which hit quickly, enabling us to set T2 once more at $619. Price then tightened into a narrow range, and on the second test of $618, we removed T2 as a precaution and moved the stop to breakeven. SPY eventually surged, and MSI shifted into a narrow bullish state. With 90% of our position locked in, we held for $619. SPY got close before setting up a textbook failed breakout at 1:50 p.m., prompting us to exit and wrap up for the day. With three successful trades, we weren’t interested in risking our gains on a fourth. One or two quality trades a day is plenty and in a $3 range session, there was no reason to press further. We finished before 2 p.m., 3-for-3, thanks to a clear plan, disciplined execution, and strategic use of MSI for directional clarity, timing, and actionable levels. Integrated into our broader framework and model levels, MSI continues to be an indispensable tool for consistent trading performance.

Trading Strategy Based on MSI:

Wednesday brings ADP Employment Change, which is unlikely to move the market. Like Tuesday, it’s expected to mirror today’s action, with no major economic news likely to disrupt the prevailing bull trend. Thursday’s jobs report remains the key event of the week and may keep markets in a holding pattern until then. As with today, the market appears set to drift toward $621 and potentially $626, continuing to discount negative data in favor of strong bullish momentum. As long as SPY holds above $585, bulls remain firmly in control. For Wednesday, maintaining levels above $615 will once again be critical to pushing beyond today’s highs. Volume was average, and in a shortened holiday week, that reinforces the prevailing bull trend. For bears to gain traction, a break below $600 would be necessary, though even that might produce only modest downside. With a close above $617, a move toward $621 and new highs appears increasingly likely. While external risks such as tariff headlines could shift sentiment, holding $615 keeps the door open for a push toward $621, whereas a break below could trigger a test of $610 and potentially attract sellers. Still, absent a meaningful breakdown, the path of least resistance remains higher. We continue to favor long setups above $610, while selective short opportunities may arise above $621 or on failed breakouts and failed holds below $600 particularly when MSI signals weakening conditions. Failed moves continue to offer high-quality trade setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, MSI—when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $618 to $630 and higher strike Calls indicating the Dealers belief that prices will drift higher on Wednesday. The ceiling for tomorrow appears to be $620. To the downside, Dealers are buying $617 to $575 and lower strike Puts in a 2:1 ratio to the Calls they’re selling implying little concern that prices may move lower on Wednesday. Dealer positioning is unchanged from neutral to neutral.

Looking Ahead to Thursday:

Dealers are selling SPY $618 to $635 and higher strike Calls indicating the Dealers belief that prices will likely move slightly higher this week. Dealers are no longer selling close to the money Puts. The likely ceiling for the week is currently $620. To the downside, Dealers are buying $617 to $550 and lower strike Puts in a 2:1 ratio to the Calls they’re selling, reflecting a neutral outlook for the week. Dealer positioning is unchanged from neutral to neutral. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

With SPY grinding higher but stalling beneath dense resistance, traders should continue favoring long entries on dips toward $615 or $610, with targets at $619, $621, and $624. A clean breakout above $621 could trigger a push toward $626, though gains may be modest unless backed by strong macro data. Short trades may be considered near resistance zones that produce clear failed breakouts, targeting $615 and $610. The VIX remains low at 16.83, but its rise suggests caution is warranted. Reduce size around key economic events, tighten stops near inflection points, and remain nimble as we head into midweek volatility. Review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!