Market Insights: Wednesday, July 16th, 2025

Market Overview

Markets bounced off session lows Wednesday to close higher after President Trump walked back reports that he was considering firing Federal Reserve Chair Jerome Powell. Stocks had slipped early in the session following a Bloomberg article claiming Trump was “close” to removing Powell, citing unnamed White House officials. However, in an Oval Office appearance later in the day, Trump dismissed the reports, stating, “We’re not planning on doing anything,” though he followed up with characteristic criticism of Powell’s performance. The reassurance helped ease market tensions and reversed earlier losses. Trump confirmed that he asked Republican lawmakers during a private meeting whether he should fire Powell, noting that most of them supported the idea. While denying rumors about a drafted termination letter, the president made clear his dissatisfaction with Powell’s reluctance to cut rates more aggressively.

The session was already on edge after Tuesday’s surprise inflation data, and investors were further digesting corporate earnings from key players. Solid results from Bank of America and Johnson & Johnson helped the broader market, particularly as BofA’s trading desk benefited from recent volatility driven by trade headlines. Meanwhile, Morgan Stanley and Goldman Sachs also showed resilience, offering some reassurance on the health of financials amid tariff uncertainty. The inflation picture got some relief from the Producer Price Index (PPI), which came in flat month-over-month and up just 2.3% year-over-year, both lower than expectations and a welcome contrast to Tuesday’s hotter CPI print. Overall, markets took the day’s volatility in stride, recovering steadily into the close as Powell’s job appeared safe for now.

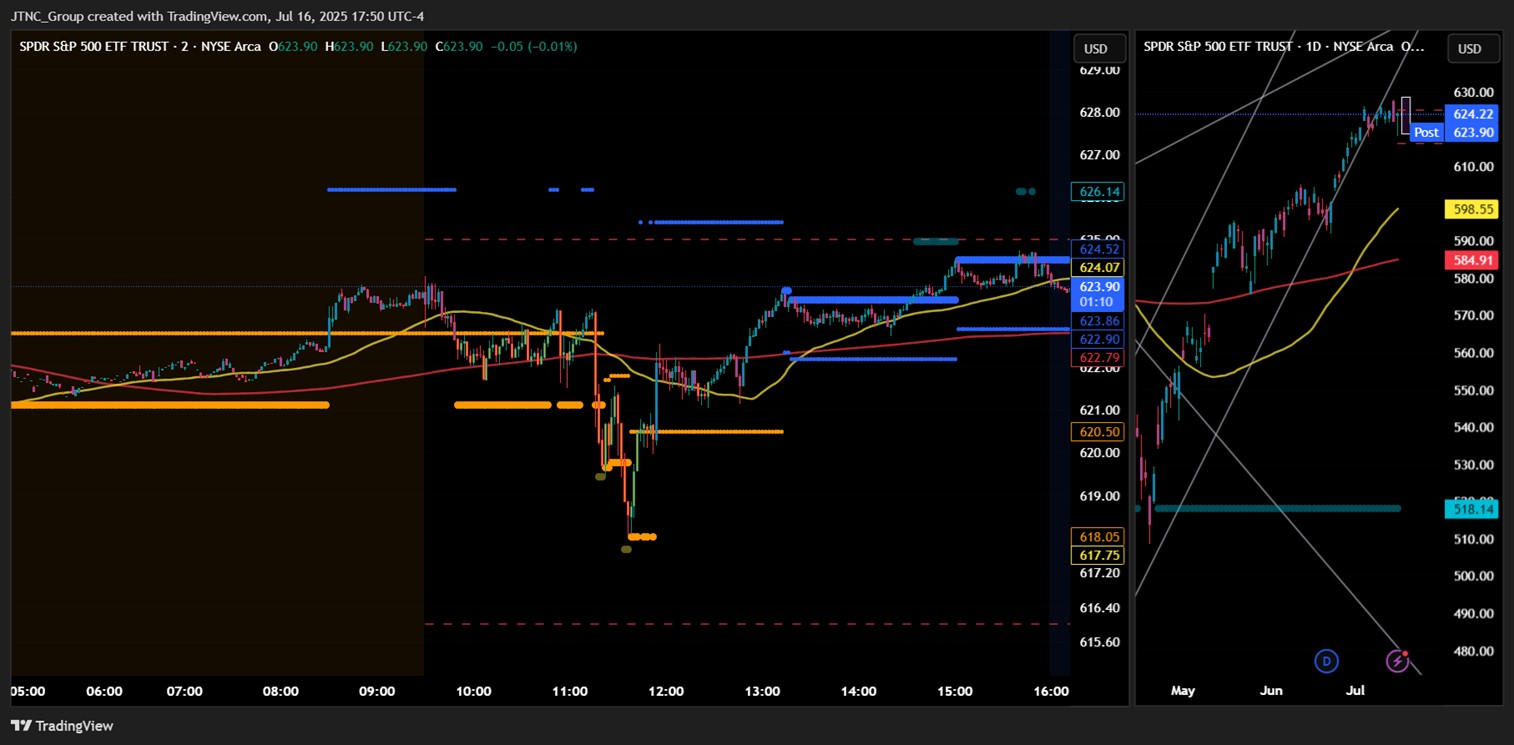

SPY Performance

SPY edged lower by 0.33% on Wednesday, closing at $624.22 after opening at $623.74. The ETF dipped to an intraday low of $618.07 before rebounding and finishing near the day’s highs. Volume surged to 85.36 million shares, well above average and signaling active trading in response to both the PPI release and political headlines out of Washington. The session's reversal from the midday lows highlighted ongoing dip-buying support, particularly near the $618 level, despite broader market anxiety over interest rates and geopolitical developments.

Major Indices Performance

Small caps once again led the pack, with the Russell 2000 gaining 1.00% as investors showed renewed interest in domestically focused names. The Dow followed with a 0.53% rise, bouncing back from Tuesday’s steep losses. The Nasdaq added 0.26% and closed at another record high, continuing to benefit from strength in select tech names. The S&P 500 ticked up 0.3% as solid bank earnings and a cooler-than-expected PPI print helped ease inflation worries. Defensive sectors like health care saw modest gains, but leadership was mixed as investors weighed rate and tariff concerns. Despite a rocky start, the major indices maintained a cautious but resilient tone into the close.

Notable Stock Movements

The Magnificent Seven delivered a mixed performance Wednesday. Nvidia and Apple posted gains, helping lift the broader Nasdaq. However, Amazon, Meta, and Netflix slipped on the day, underperforming the group. Tesla and Microsoft also managed to notch small gains. The divergence across mega-cap tech reflects underlying market indecision, with sector rotation continuing amid macroeconomic uncertainty. Nvidia continues to stand out as a leader, maintaining bullish momentum following Tuesday’s surge on trade-related news.

Commodity and Cryptocurrency Updates

Crude oil rose slightly by 0.27% to close at $66.70, continuing to hover in a tight range. Our model still anticipates a test of the $60 level later this year due to ongoing demand concerns. Gold advanced 0.58% to settle at $3,356.27, rebounding from recent weakness as investors sought a hedge against inflation and geopolitical risk. Bitcoin jumped 2.32% to finish just above $119,350, recovering from Tuesday’s losses as sentiment improved and macro concerns stabilized, at least temporarily.

Treasury Yield Information

The 10-year Treasury yield fell 0.85% to close at 4.453%, pulling back slightly after testing the psychologically important 4.5% threshold. A drop in wholesale inflation helped ease pressure on yields, though they remain elevated and continue to be a focal point for equity valuations. Should yields climb decisively above 4.8% or 5%, the equity market could face significant headwinds. For now, the easing in rates provided a modest tailwind for risk assets.

Previous Day’s Forecast Analysis

Tuesday’s forecast projected SPY to trade between $618 and $628.50, with a bearish tilt unless $620 held firm. The model highlighted $626 and $628 as resistance levels and flagged $615 and $613 as potential downside targets if $620 failed. A long setup was preferred above $620, while short trades were recommended near overhead resistance if buyers failed to hold momentum. The strategy emphasized caution amid rising volatility and the impact of fresh CPI data.

Market Performance vs. Forecast

SPY followed the forecasted blueprint almost exactly, respecting the model’s projected range and confirming the key levels. The ETF opened at $623.74, briefly popped to $624.73, and then dipped sharply to a session low of $618.07, just above the forecasted $618 support zone. Buyers stepped in aggressively at that level, reversing the decline and lifting SPY back to a close of $624.22, which was near the high of the day. The session’s behavior provided clean setups on both sides of the market, as the short trade near $624 and the long trade near $618 both worked well. The model’s guidance around $620 and $628 held up once again, reinforcing the precision of our projected levels.

Premarket Analysis Summary

In Wednesday’s premarket analysis posted at 8:08 AM, SPY was trading at $621.76 with resistance targets at $621.90, $623.90, $625, and $628. Support levels were flagged at $621, $620, and $616. The outlook called for bi-directional trading with a likely rally attempt off lower support zones, particularly around $619 to $620. A bearish bias was expected if SPY remained below the $623.90 pivot, favoring short trades near resistance and profit-taking near the $620 zone. A breakout above the bias level could shift control back to bulls with upside targets toward $628.

Validation of the Analysis

Wednesday’s market action validated the premarket analysis with impressive accuracy. SPY initially rallied just shy of the $625 resistance zone before sellers took control, sending it sharply down to the forecasted $618 level. Just as predicted, dip buyers reemerged at support, reversing the trend and lifting SPY into the close at $624.22. The $623.90 bias level served as a key inflection point throughout the session, and both long and short setups near modeled levels proved actionable. Once again, traders who aligned their entries with the morning analysis had clear, profitable opportunities.

Looking Ahead

Thursday brings fresh economic data with Retail Sales and Unemployment Claims due out premarket. These reports could shake up sentiment, especially after Tuesday’s hot CPI and Wednesday’s cooler PPI numbers. Strong retail numbers could reinforce the Fed’s cautious stance, while a disappointing read may revive hopes for rate cuts. Traders should stay alert for potential volatility around the release, as the market remains sensitive to macro data.

Market Sentiment and Key Levels

SPY enters Thursday trading around $624, sitting above key support and inside a newly forming range. Sentiment has stabilized slightly, but caution persists due to political uncertainty and elevated bond yields. Resistance is now found at $625, $628, $630, and $635, while support sits at $620, $618, and $613. The bulls will try to defend $618 overnight to maintain momentum, while bears will look to exploit any breaks below that level. Holding above $624 could open the door for a test of $628, but failure to hold $620 could quickly put $615 back in play.

Expected Price Action

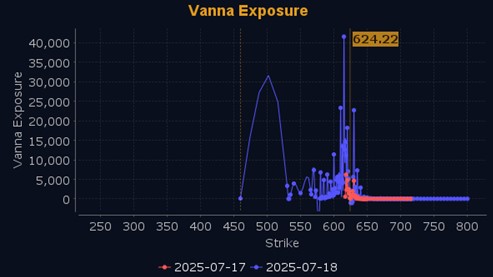

Our AI model projects SPY to trade between $618.75 and $628.75 on Thursday, a narrow 10-point range suggesting more sideways action. This is actionable intelligence. Market sentiment remains cautiously bullish, with the call side now in control, reflecting growing interest in upside participation. If SPY holds above $624, we could see a push toward $628 and potentially $630. If it breaks below $620, watch for swift moves to $618 or $615. Any surprise in Thursday’s economic data could cause a shift in momentum. Traders should prepare for potential reversals and remain nimble around key inflection points.

Trading Strategy

With SPY closing above $624, long trades are favored above this level, targeting $628 and possibly $630. Look for confirmation with volume and trend continuation before entering. On the downside, if SPY breaks below $620, short entries may target $618 and $615, where buyers are expected to reemerge. As always, failed breakouts or breakdowns offer high-probability setups. With the VIX falling 1.27% to 17.16, volatility is still present but slightly easing. Traders should remain cautious, using tight stops and smaller sizes until a directional move develops. Risk management is key as macro risks remain elevated.

Model’s Projected Range

The model projects SPY’s maximum range for Thursday between $618.75 and $628.75, with the Call side dominating within a narrow 5-point band, suggesting choppy price action punctuated by occasional trending moves. After drifting lower overnight, SPY opened above $623 but quickly came under pressure, breaking below major support around noon and testing the $618 level, as anticipated in both yesterday’s and today’s newsletters. Once again, dip buyers stepped in, reversing the intraday downtrend and pushing SPY to close near the highs of the day at $624.22. Volume was above average, reinforcing bullish control. As has been the case in recent weeks, the broader uptrend remains intact despite ongoing tariff uncertainty, provided SPY holds above $585. Key resistance levels are noted at $625, $628, $630, and $635, while support lies at $620, $618, and $613. The market remains in complex, rangebound chop that may take time to resolve. Bulls will aim to defend the $618 level overnight to sustain upward momentum. A break below this level could trigger a swift pullback toward $615. While SPY may continue to grind higher, any significant catalyst could lead to a more decisive move. Downside risk remains limited unless SPY breaks below $600, which could open the door for a retest of $585, though our model currently assigns a low probability to that scenario. In the absence of a clear catalyst, dips toward $620 are still expected to be bought. Below $615, our stance turns bearish, with $610 as the next downside target. SPY closed just outside the lower edge of the redrawn bull channel from the April lows, with strong resistance expected in the $625 to $630 zone, which could limit further upside. The market remains highly sensitive to macroeconomic data, bond yields, inflation readings, tariff developments, and fiscal policy changes. Meanwhile, the VIX fell 1.27% to 17.16, maintaining a cautious risk-on tone. Given the VIX’s recent four-day back-and-forth, a degree of caution is still warranted. Last week, we recommended that long books consider buying out-of-the-money calls with 90-day expirations. We continue to support this strategy for those who have not yet acted. Preparing for potential volatility with this or a similar hedge remains prudent.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a Bullish Trending Market State, with SPY closing mid-range. The MSI rallied opened the day in a ranging state and quickly rescaled to a bearish state with brief periods of extended targets below. The MSI range was narrow, indicating a weak bear trend. Price found MSI major support at $618 and reversed after Trump signaled he would not terminate Powell. The market rallied on this news going through a ranging state to the current bullish state. Extended targets printed briefly in the afternoon session which saw price close near the highs of the day, which implies some continuation of the bull trend on Thursday. Currently MSI resistance stands at $623.52 and with resistance at $622.90.

Key Levels and Market Movements:

On Tuesday, we wrote: “While caution remains warranted, we still expect the market to grind higher with bulls stepping in overnight.” We also noted, “If the bulls can hold $620, a push to $628 is possible on Wednesday. A failure to hold $620 could lead to a test of $618 and potentially $615, where we once again expect buyers to step in,” and added, “we anticipate that buyers will continue supporting dips.” With SPY opening above $623 and the MSI in a ranging state, we waited for a setup before entering a trade. SPY chopped within this range, with brief dips into a narrow bearish state. Given that the odds of price moving from resistance to support in a bearish MSI are just under 70%, we entered short at MSI resistance at $623 with a first target at MSI support at $621. That level was reached before noon, so we set a second target at the next lower MSI support on the rescaled MSI at $620. After hitting that, we moved our stop to breakeven and trailed the remainder, aiming for a potential test of $618. Price did reach $618 and printed a textbook failed breakdown, prompting us to reverse long in the narrow bearish MSI, which showed no extended downside targets. We flipped the trade with T1 at $621, T2 at $623, and continued to trail. Later in the session, MSI shifted into a bullish state and briefly printed extended targets, so we held into the close and exited at $624. Two-for-two on the day, thanks to disciplined execution, the MSI’s clear directional cues and timing, and its seamless alignment with our broader model. The MSI remains a cornerstone of our consistent trading process.

Trading Strategy Based on MSI:

Thursday brings retail sales and unemployment claims, neither of which are expected to move the markets significantly. With no scheduled news on Friday, the current complex sideways chop is likely to continue, with the market grinding higher as it waits for a meaningful catalyst. There is a growing probability that August could bring a challenging pullback of up to 15%, potentially ending the current dip-buying trend. However, until that probability rises to actionable levels, we continue to buy dips at major support levels and on failed breakdowns. The bulls remain in control, and while we may not see new all-time highs before a potential August decline, our bias remains to the upside until the market signals otherwise. Traders should remain alert to any tariff-related threats from the White House, though in their absence, a slow grind higher with occasional consolidation remains the likely path. The market’s ability to overlook these risks increases the chance of a continued rally. While caution is still warranted, we expect the market to continue grinding higher with overnight support from buyers. If bulls can hold $618, a push to $628 is possible on Thursday. A failure to hold $618 could bring a test of $615, where we again expect buyers to step in. A decisive break below $615 would raise the odds of a deeper pullback toward $600. Until then, we anticipate continued dip-buying unless unexpected negative headlines emerge. If key levels hold, the market appears poised to resume its steady climb toward $635. Currently, the MSI remains in a Bullish Trending Market State, suggesting higher prices overnight. For bears to gain traction, a break below $600 is needed, while a close above $625 strengthens the case for a move toward $635. We continue to favor long setups above $615, while short opportunities may arise near $627 or on failed breakouts and breakdowns below $615 particularly if the MSI shows signs of weakening. As always, failed moves remain among the highest-probability setups. Stay nimble, avoid trades during Ranging Market States, and ensure full alignment with MSI. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $625 to $640 and higher strike Calls indicating the Dealers belief that prices are rangebound for tomorrow. The likely ceiling for tomorrow is $630. To the downside, Dealers are buying $624 to $575 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying implying some concern that prices may move lower on Thursday. Dealer positioning is unchanged from slightly bearish/neutral to slightly bearish/neutral.

Looking Ahead to Friday:

Dealers are selling SPY $628 to $650 and higher strike Calls while also buying $625 to $627 Calls indicating the Dealers desire to participate in any rally this week. Dealers are positioned for SPY to move as high as $630 but not likely beyond this level. To the downside, Dealers are buying $624 to $555 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a bearish outlook for the week. Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY reclaimed the $624 level and is now approaching key resistance at $625 and $628. Traders should consider long setups above $620 with upside targets at $628 and $630. If SPY fails to hold above $620, look for short setups toward $618 and $615. The VIX declined to 17.16, suggesting slightly calmer conditions, though headline risk remains elevated. Smaller position sizes and disciplined stop-losses remain the best approach. Stay focused on the major support and resistance levels and trade with the trend whenever possible.

Review the premarket analysis posted before 9 AM ET to align with the latest model levels and Dealer Positioning.

Good luck and good trading!