Market Insights: Thursday, June 4th, 2025

Market Overview

U.S. stocks turned in a mixed performance Wednesday as Wall Street digested a sharp slowdown in hiring alongside ongoing trade friction with China. The ADP National Employment Report showed private-sector job growth at just 37,000 in May, the weakest reading in over two years and far below expectations. This disappointing data drove Treasury yields lower, with the 10-year dipping to 4.36%, its lowest level since early May, as investors started to price in possible rate cuts. Despite the weak economic signals, the S&P 500 closed flat, while the Nasdaq ticked up 0.32%, buoyed by tech strength. The Dow slipped 0.22%, snapping a four-day win streak.

Elsewhere, trade worries reemerged as President Trump's doubled tariffs on steel and aluminum imports took effect Wednesday, with all trading partners but the UK hit by the higher duties. Trump also intensified pressure on the Federal Reserve, lashing out at Chair Jerome Powell and demanding rate cuts in response to the ADP report. The market shrugged off most of the trade noise, with analysts noting that tariff uncertainty has already been priced in. Barclays' Venu Krishna and Morgan Stanley's Mike Wilson both pointed out that although headline risks remain, the market has grown more desensitized to tariff drama, citing falling volatility as evidence that the worst trade policy headwinds may have already passed. Traders are now shifting their focus to Friday’s pivotal jobs report, which will offer more insight into the strength of the labor market and the Fed’s next move.

SPY Performance

SPY slipped 0.03% on Wednesday to close at $595.91 after opening at $596.96. The ETF traded in a tight range, reaching a high of $597.95 and dipping to a low of $595.49. Volume came in at 54.71 million shares, modestly below average and reflective of a market cooling off ahead of Friday’s critical data. The session held support at $595, confirming the consolidation zone, while resistance near $598 remained intact. Despite the small decline, SPY continued to show strength near the upper bounds of its multi-week range.

Major Indices Performance

The Nasdaq led Wednesday’s action, rising 0.32% on the back of renewed tech strength, while the S&P 500 held just above flat. The Dow pulled back 0.22%, weighed down by cyclicals and financials, snapping a modest win streak. The Russell 2000 fell 0.25%, underperforming as small caps struggled to keep up with the rest of the market. Economic data drove the day’s tone, with weaker-than-expected ADP payrolls and a Services PMI reading of 49.9 pointing to economic softness. Despite the gloomier signals, broad-based market resilience reflected a growing belief that bad news may soon translate into good news via lower interest rates. Sector rotation remained muted, with technology showing relative strength and defensive names remaining mostly stable.

Notable Stock Movements

Meta led the Magnificent Seven with a 3.16% surge, helping lift the Nasdaq. Tesla stood out on the downside, tumbling 3.55%, while Apple edged lower by 0.22%. The rest of the group posted mixed performance, offering further evidence that leadership continues to rotate within mega-cap tech. Meta’s strength helped sustain bullish sentiment despite soft economic data, while Tesla’s drop acted as a modest drag on broader risk appetite. The group remains pivotal for direction, and the ability of stocks like Meta to post strong gains highlights ongoing investor interest in growth leadership.

Commodity and Cryptocurrency Updates

Crude oil fell 1.06% to settle at $62.74, continuing its retreat toward the long-anticipated $60 level. With dollar strength likely to return as interest rates eventually rise, our model maintains its forecast for a potential drop to the $50 zone, where we see attractive buying opportunities. Gold added 0.60% to close at $3,397, as falling yields and safe-haven demand helped support prices. Bitcoin edged down 0.62% to finish just above $104,700. We remain long-term bullish on Bitcoin between $83,000 and $77,000 and caution against buying below that range due to heightened downside risk.

Treasury Yield Information

Yields slid sharply on Wednesday following disappointing economic data, with the 10-year Treasury falling 2.38% to close at 4.356%. This marks its lowest level since early May and reinforces expectations that the Fed may ease policy sooner rather than later. Lower yields typically support equities, and for now, the 4.5% threshold remains a ceiling that’s holding. However, continued declines in yields may reflect deeper concerns about economic momentum, suggesting that equity bulls should stay alert for volatility as Friday’s jobs report approaches.

Previous Day’s Forecast Analysis

Wednesday’s forecast anticipated a trading range of $590 to $598 with a bullish bias above $590. Key upside targets were $597, $600, and $601, while downside zones were identified at $587 and $585. The model emphasized long trades above $590, suggesting that SPY could press higher if the $595 area held. The forecast also noted that any dip below $590 would likely lead to a return to the broader consolidation zone between $575 and $595, underscoring the importance of support integrity.

Market Performance vs. Forecast

Wednesday’s session validated the forecast’s expectations for a contained trading range. SPY opened at $596.96 and posted a narrow high of $597.95, falling short of the $598–$600 resistance band before closing at $595.91. The day’s low of $595.49 respected support at $595, aligning with the model’s projected floor. The predicted long setups above $590 worked well, especially early in the session as SPY hovered above key support, although upside momentum faded. The model’s suggested resistance near $597 acted as a ceiling late in the day. Overall, the price action reinforced the reliability of the bias levels and highlighted solid opportunities for traders who focused on fading resistance and buying dips into forecasted support zones.

Premarket Analysis Summary

In Wednesday’s premarket analysis posted at 8:02 AM, SPY was trading at $597.47 with a bias level identified at $595.50. The analysis expected a thin upward rally, suggesting that as long as SPY held above $595.50, a grind toward the upside was likely. Upside targets were noted at $599, $600, and $602, while downside targets were listed at $595.50, $594, and $590. The premarket commentary highlighted that a slip beneath $594 could open the door for a more meaningful pullback. Longs were preferred from support, with shorts only considered after a breakdown below $594.

Validation of the Analysis

Wednesday’s market action confirmed the premarket analysis with impressive accuracy. SPY held firmly above the $595.50 bias level throughout the session, touching a high of $597.95 and closing just below at $595.91. There was no sustained break below $595.50, reinforcing the long bias suggested premarket. Although upside targets like $599 and $600 were not quite reached, the price action respected all major levels. Traders who followed the plan to stay long above $595.50 were rewarded with predictable intraday moves, while the caution against early shorts proved wise. The analysis once again provided a reliable roadmap for disciplined execution.

Looking Ahead

All eyes are now on Friday’s Nonfarm Payrolls report, the most critical economic release of the week. Thursday brings Unemployment Claims, which could offer early insight into labor market momentum. Any surprise weakness could add fuel to speculation about rate cuts, while stronger-than-expected data might challenge the Fed’s dovish lean. Until then, rangebound trading remains the most likely outcome, but headline risk, especially from tariffs, remains elevated and could stir volatility.

Market Sentiment and Key Levels

SPY closed Wednesday at $595.91, keeping it firmly within the upper range of its recent consolidation zone. Sentiment remains cautiously bullish as long as SPY holds above the $590 level. Immediate resistance sits at $598, $600, and $604, while support lies at $595, $591, and $590. A break above $598 could ignite a test of March highs near $600, with potential extension to $604. Conversely, a drop below $590 would signal a return to the broader $575–$595 range, where institutional hedging has been active. The bulls are still in control, but momentum is clearly fading, and traders should remain alert for signs of rotation or exhaustion.

Expected Price Action

Our AI model projects a range between $593 and $600 for Thursday. This is actionable intelligence: expect a continuation of rangebound action, with a slight bullish tilt. If SPY can hold above $595, a breakout through $598 would likely bring $600 and $604 into play. However, if SPY loses $593 support, we could see a drift back to $590 or even $587. The model still favors long trades above $585 but warns that momentum is slowing and false breakouts may increase. Friday’s jobs report looms large, and traders should expect choppy price action in anticipation.

Trading Strategy

Traders should look for long setups as long as SPY holds above $585, with upside targets at $595, $598, and potentially $600. A clean breakout above $600 could bring fast gains, but resistance thickens above that level. Short trades may be viable near resistance, especially if price rejects at $600 or higher. On the downside, if SPY breaks below $590, expect follow-through to $587 or $585, where bounce opportunities may arise. The VIX closed at 17.61, indicating low volatility, but economic catalysts could change that quickly. Keep position sizes moderate and stops tight around key levels to manage risk effectively in this uncertain environment.

Model’s Projected Range

The model projects a maximum range for SPY on Thursday between $591.25 and $602.50, with Call-side interest continuing to dominate in a steady band suggesting a likely continuation of current conditions. The latest ADP Employment Report pointed to a sharp hiring slowdown, while Service PMI came in below forecast, both indicating the economy may be losing steam. While this is clearly negative in fundamental terms, it could also pave the way for lower interest rates, which typically support equities. The next major economic catalyst is Friday’s jobs report. Until then, prices are likely to remain range-bound. No other major headlines are expected, though surprise developments related to tariffs remain a wildcard. On Wednesday, SPY traded within a tight band of $595 to $597.50, validating our warning that price action could flatten as Friday approaches. The bullish narrative remains intact as long as SPY closes above $585. Momentum has eased, but the model still suggests a high probability of retesting last week’s highs near $598.50, along with the March highs, before any meaningful pullback occurs. A pullback from current levels is not a given. In fact, the odds of a breakout to new all-time highs increase with each additional day of market strength. Key resistance is now identified at $600, $603, and $604, while support lies at $593, $591, and $590. SPY continues to track the lower edge of a steep, uncorrected uptrend that began in April. However, the current angle of ascent appears increasingly unsustainable. Above $600, resistance thickens quickly up to $605 and potentially $610, which could cap near-term upside. On the downside, strong support has developed between $595 and $590. As a result, in the absence of a new catalyst, SPY is likely to remain within the broader $575–$595 range. Should SPY hold above $590 on Thursday, a push toward $600 and potentially $604 looks likely. Conversely, a drop below $590 could suggest a retreat into the lower end of the range, where institutional investors have been gradually reducing exposure and increasing downside hedges. Trading volume on Wednesday was average, reflecting a relatively balanced session. Since early April, macroeconomic data, bond yields, inflation, tariff developments, and fiscal policy have largely driven market direction—a trend likely to persist barring a major policy shift. Meanwhile, the VIX fell 0.45% to close at 17.61, remaining comfortably below the key 23 level, which typically favors equities. Given continued macro uncertainty, traders should remain flexible and alert as new data emerges.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a wide Bullish Trending Market State with SPY closing mid range. No extended targets printed all day today as SPY moved in a very narrow range between MSI resistance and the middle of the range. This implies a weakening bull trend with little left to propel prices higher on Thursday. It would not surprise us to see the MSI rescale to a ranging or bearish state before tomorrows open. Overnight the MSI rescaled higher which saw prices reach the days highs just shy of $598 where they found MSI resistance as a wall they could not breach. Price then bounced back and forth within the MSI range and at the close, was virtually unchanged on the day. Currently MSI support stands at $594.65 with resistance at $597.63.

Key Levels and Market Movements:

On Tuesday, we noted: “We anticipate a continuation of the current environment, with SPY potentially testing $593 overnight before advancing toward $597.” We also stated: “Upward momentum remains intact, and dips continue to be bought.” Finally, we added: “We continue to favor long setups, with support extending down to $585. Tactical shorts may be considered above $597.” With this plan in hand, the market opened above $597, and with no extended targets suggesting strong herd participation, we looked for a failed breakout at MSI resistance as a short opportunity. That scenario materialized shortly after the open, triggering a short entry at $597.50 with a first target at the premarket level of $595.50. Price quickly dropped to a penny below this level, and we hit our first target. However, price promptly reversed and returned to our entry. On countertrend trades, we often move stops to breakeven after the first target, whereas with-trend trades, we typically allow more room until the second target is reached. As price revisited our entry, we had a decision to make, exit or reload. Observing that SPY was struggling to extend beyond the day’s highs, we chose to reload the short. Given the earlier reversal at $595.50 and with profits to protect, we opted for a more conservative first target at $596, anticipating a potentially choppy session. Again, our first target was achieved, and once more, the market sharply reversed to our entry. Not wanting to engage in a drawn-out game of cat and mouse, we exited the remaining 30% of our position at breakeven and called it a day. While the market did fall again into the close, we were satisfied with locking in one and a half winning trades. Once again the key to our success was having a clear, structured plan, executing with discipline, and leveraging MSI insights to identify market control, timing shifts, and actionable levels. When integrated with our trading framework and model levels, the MSI remains an indispensable tool for consistency and performance.

Trading Strategy Based on MSI:

Premarket economic news on Wednesday is unlikely to have significant market impact. The bigger fireworks are expected Friday with the release of the Monthly Jobs Report. Until then, tariff-related headlines from the White House remain the primary risk catalyst. Should new headlines emerge, the best approach remains to trade the market in front of you. In the absence of a major catalyst, we anticipate a continuation of the current environment, virtually identical to yesterday’s setup with SPY potentially testing $593 overnight and advancing toward $598 or even $600. Upward momentum remains intact, and dips continue to be bought. As long as $590 holds, the upside potential extends to $605. However, a break below $590 would shift focus to $585. A failure at that level could open the door to a deeper pullback toward $580 or lower, potentially marking a critical inflection point and signaling a shift in control back to the bears. This would put the $575–$595 range back into play, an area where institutional participants have been actively hedging long exposure. Absent such a breakdown, the path of least resistance remains higher. A sustained move above March’s highs could pave the way to new all-time highs. We continue to favor long setups, with support extending down to $585. Tactical shorts may be considered above $597, but only if a breakout attempt fails and MSI shows signs of weakening. Currently, the MSI remains in a bullish state, reinforcing the case for continued follow-through on Thursday. That said, with Friday’s jobs data looming, the likelihood of choppy, two-way action increases. As long as SPY holds above $585, long positions remain favorable. A sustained move below this level could invite renewed bearish pressure. Failed breakdowns continue to present high-quality long opportunities. Stay alert and responsive as these setups emerge. Always align your strategy with the MSI and avoid engaging during Ranging Market States. The MSI offers real-time insights into market control, momentum shifts, and actionable levels. When paired with our Pre-Market and Post-Market Reports, it enables more precise execution and higher-probability trades. If you haven’t yet integrated the MSI and model levels into your trading process, now is the time. Contact your representative to get started as these tools can make a meaningful difference in both consistency and performance.

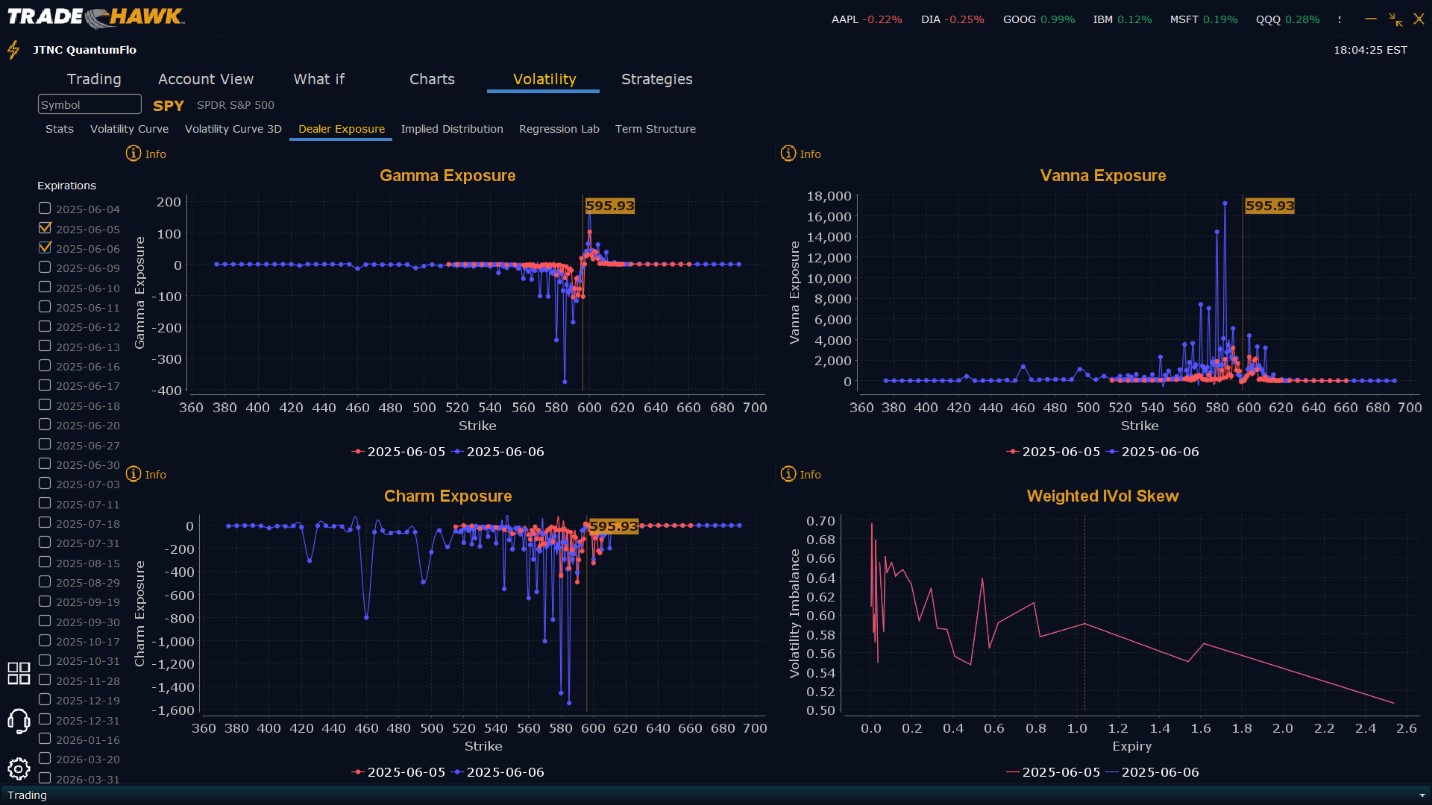

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $596 to $610 and higher strike Calls indicating the Dealers belief that price may stall near the current levels. Any rally on Thursday appears to have a peak of $600. To the downside, Dealers are buying $595 to $567 and lower strike Puts in a 2:1 ratio to the Calls they’re selling. Dealer positioning is unchanged from neutral to neutral for Thursday reinforcing the bull/neutral trend.

Looking Ahead to Friday:

Dealers are selling $596 to $615 and higher strike Calls implying a likely ceiling in the market this week of $600. Dealers are positioned for a rally to $600 but look increasingly convinced prices will not move beyond $600 by the week’s end. To the downside, Dealers are buying $595 to $545 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a slightly bearish outlook for the week. Dealer positioning is unchanged from slightly bearish to slightly bearish. Dealer positioning hasn’t changed materially in a few days which once again further reinforces a continuation of the bull/neutral trend. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY continues to hold within a tight range just under key resistance at $598. Traders should maintain focus on the $590 and $600 levels. Long trades are favored as long as SPY stays above $585, with upside targets at $600 and $604. If SPY breaks below $590, expect a possible drop to $587 or $585, where bounce trades may set up. Shorts should be reserved for clear rejection at $597 or higher. Volatility remains subdued with the VIX at 17.61, but traders should remain alert with Thursday’s claims and Friday’s jobs report ahead. Keep position sizes conservative and stop-losses tight. Be sure to review the premarket analysis posted before 9 AM ET to adapt to any overnight developments in model projections or Dealer Positioning.

Good luck and good trading!