Market Insights: Wednesday, June 3rd, 2025

Market Overview

Stocks extended their advance on Tuesday as upbeat April JOLTS data and surging momentum in Nvidia fueled optimism across the board. Nvidia briefly overtook Microsoft to become the world’s most valuable company, hitting a market cap of $3.444 trillion before closing just shy of that mark. The strength in big tech carried the major indexes higher, with the S&P 500 climbing 0.6%, the Nasdaq adding 0.8%, and the Dow gaining 0.5%. Small-cap stocks joined in, with the Russell 2000 popping 1.5% for its best day in weeks. The JOLTS report showed job openings rising to 7.39 million, with an uptick in the hiring rate—evidence that the labor market remains resilient ahead of this week’s key ADP and Nonfarm Payrolls data. Globally, concerns resurfaced as the OECD lowered its growth forecast, citing U.S. tariff policy and weakening global investment trends. In China, manufacturers reported their steepest decline since 2022, and progress on trade negotiations remained stalled, with the White House pressuring allies to accept new tariff frameworks.

In corporate news, Wells Fargo scored a significant regulatory win after the Federal Reserve lifted the $1.95 trillion asset cap imposed following the bank’s fake accounts scandal. The Fed credited “substantial progress” in resolving longstanding issues. CEO Charles Scharf, who’s led the overhaul since 2019, hailed the decision as a transformative milestone, noting that 13 consent orders have now been addressed, including seven this year alone. Wells Fargo shares jumped as much as 4% in after-hours trading and are now up more than 50% during Scharf’s tenure. While the lifted cap opens the door to more aggressive growth strategies, executives warned that material gains won’t be immediate, with some compliance restrictions still in place.

SPY Performance

SPY rose 0.57% on Tuesday to close at $596.09 after opening at $592.34. The ETF briefly dipped to a low of $591.85 before rallying to a high of $597.08 in the early afternoon. Volume registered 59.07 million shares, slightly above the average, reflecting strong participation in the bullish move. The session marked another successful test and hold above the $590 support level, reinforcing the broader uptrend as SPY continues to grind toward resistance near the $600 mark.

Major Indices Performance

The Russell 2000 led Tuesday’s advance, jumping 1.58% as small-cap stocks caught a bid amid broad-based risk appetite. The Nasdaq followed with a gain of 0.81%, fueled by a surge in Nvidia. The S&P 500 added 0.6%, continuing its bullish streak, while the Dow rose 0.51%. Markets were lifted by strong JOLTS data showing unexpected strength in job openings, reinforcing confidence ahead of Wednesday's ADP and Friday's Jobs Report. Sector participation was widespread, though technology and cyclicals continued to outperform defensives.

Notable Stock Movements

Nvidia was the standout performer in the Magnificent Seven, jumping over 2.8% and briefly becoming the world’s most valuable company. The rest of the group posted mixed results—Alphabet, Meta, Amazon, and Netflix edged lower, while Tesla and Apple gained modestly. The bifurcated action signals an ongoing rotation within the group but remains constructive as leadership broadens beyond just one or two names. Nvidia’s performance bolstered sentiment and helped drive the Nasdaq higher.

Commodity and Cryptocurrency Updates

Crude oil was nearly flat, rising just 0.09% to close at $63.40. While the bounce appears modest, the broader trend remains lower. Our model continues to forecast a drop to the $50 range as dollar strength resumes with rising interest rates. Gold slipped 0.24% to $3,381 as safe-haven demand softened amid rising equities and solid labor market data. Bitcoin nudged 0.20% higher to finish just above $105,800. We continue to recommend buying Bitcoin between $83,000 and $77,000, cautioning against entries below $77,000 due to elevated downside risks.

Treasury Yield Information

The 10-year Treasury yield ticked down slightly by 0.27% to 4.450%. The modest decline reflects the market’s mixed signals on growth and inflation expectations, but with yields inching toward 4.5%, equity bulls remain cautious. Any sustained breakout above 4.5% would likely put downward pressure on equities, especially ahead of Friday’s critical jobs report. For now, yields remain in a range that still supports bullish sentiment.

Previous Day’s Forecast Analysis

Tuesday’s forecast called for a trading range between $587 and $595, with a bullish bias above $585. Key upside targets were identified at $593, $595, and $597, while support was expected at $585, $583, and $580. The model emphasized long trades above $585, cautioning that failure at that level could shift momentum. It also anticipated early consolidation with potential directional movement driven by JOLTS data and expectations for upcoming employment figures.

Market Performance vs. Forecast

Tuesday’s session closely tracked the forecast, validating the model’s projected range and bias. SPY opened at $592.34, held the $590 level firmly, and moved decisively through $595 to close at $596.09. Resistance at $597 was tested intraday, and the predicted upside zone of $593–$597 offered profitable setups for long trades. The anticipated floor at $585 was never breached, reinforcing the bullish call. Traders who followed the long bias and looked to fade resistance moves were rewarded as SPY respected all major forecasted levels.

Premarket Analysis Summary

In Tuesday’s premarket analysis posted at 7:42 AM, SPY was trading at $591.60 with a bias level noted at $592. The analysis suggested a cautious tone, expecting early weakness unless SPY could reclaim $592 decisively. Upside targets were set at $594.50 and $598, with downside targets at $590 and $585. Traders were advised to look for strength above $592 for long setups and treat rejections as short opportunities, albeit with quick profit-taking due to limited downside momentum.

Validation of the Analysis

Tuesday’s market action largely validated the premarket analysis. SPY initially traded just below the $592 bias level but quickly reclaimed it, confirming the long-side setup. The ETF rallied through the $594.50 target and briefly touched $597.08, narrowly missing the $598 level. There was no sustained weakness, and the expected consolidation mid-range never fully materialized as buyers stepped in aggressively at $590. The roadmap provided clear guidance for long trades, with intraday levels unfolding in a highly predictable fashion.

Looking Ahead

Wednesday brings the release of ADP Employment data and the Services PMI before the market opens. These reports could set the tone for the session, especially as traders gear up for Friday’s Nonfarm Payrolls, the most impactful event of the week. Any deviation from expectations in job creation or service sector strength could drive volatility in early trading. With sentiment currently leaning bullish, these data points may either confirm upward momentum or spark a reevaluation of risk.

Market Sentiment and Key Levels

SPY ended Tuesday at $596.09, holding solidly above key support and pressing into a thick zone of resistance. Market sentiment remains cautiously bullish, especially with continued strength in the labor market and tech leadership. Immediate resistance sits at $597, $600, and $601, with support at $595, $590, and $585. A push above $597 could bring a test of all-time highs near $600–$605, while a drop below $590 may suggest a return to the broader $575–$595 consolidation zone where institutional selling and downside protection are concentrated.

Expected Price Action

Our AI model projects a range between $590 and $598 for Wednesday, in a narrower band suggesting a possible squeeze leading to a breakout. The bias remains bullish above $590, and if SPY holds that level, upside targets include $597, $600, and $601. A clean move above $600 would likely ignite further momentum. However, if SPY loses $590 support, expect a drift lower into $587 or even $585. This is actionable intelligence: expect volatility around economic releases and be ready for both trending and two-way moves as the week’s data unfolds.

Trading Strategy

Traders should favor long setups above $590, targeting $597, $600, and $601. A breakout above $600 could lead to fast gains, but resistance builds quickly toward $605. On the downside, a failure to hold $590 opens a path to $587 and $585, both of which could serve as bounce zones. Short trades are more viable near resistance levels, particularly if rejection occurs at $600 or higher. With the VIX at 17.69, volatility remains subdued, but that can change rapidly with the economic calendar heating up. Maintain discipline and tighten stops when trading near key resistance.

Model’s Projected Range

The model’s maximum projected range for Wednesday is $590.50 to $601, with the Call side dominating in a narrowing band suggesting choppy price action punctuated by brief trending moves. The latest JOLTS job openings report showed an increase, reflecting continued strength in hiring. Attention now turns to Wednesday’s pre-market releases of ADP employment data and the Services PMI. However, the primary market focus remains on Friday’s Jobs Report, which is expected to have the most significant impact on near-term direction. No major headlines are expected before then, although the potential for surprise tariff-related developments cannot be ruled out. During Tuesday’s session, SPY opened relatively unchanged but attracted strong buying interest at the $590 level, sending prices sharply higher and just shy of the March highs. The upward move was steady and decisive, cutting through major resistance levels and closing the day up 0.57%. The rally peaked by midday, after which the market moved sideways into the close. For nearly three weeks, the bullish narrative has hinged on SPY closing above $585, a level that once again proved accurate on Tuesday, confirming the bulls’ upper hand. Although momentum has moderated, the model still suggests a high probability of testing last week’s highs near $598.50, along with the March highs, before any significant pullback takes shape. However, a pullback from current levels is not guaranteed, and the likelihood of a breakout to new all-time highs increases with each day of market strength. Key resistance levels are now identified at $595, $600, $601, and $605, while support sits at $595, $587, and $585. SPY continues to ride the lower boundary of a steep, uncorrected bull trend that began in April. The angle of ascent appears increasingly unsustainable. Above $600, resistance builds quickly up to $605, which could act as a cap on near-term upside. On the downside, solid support is forming below $595, stretching down to around $585. Consequently, without a new catalyst, SPY may continue to trade within a range between $575 and $595. If SPY holds above $590 on Wednesday, a push toward $600 appears likely. On the other hand, a drop below $590 could signal a return to the $575–$595 zone, where institutional investors have been gradually reducing exposure and increasing downside protection. Trading volume on Tuesday was average, indicating a fairly balanced session. Since early April, market direction has been heavily influenced by macroeconomic data, bond yields, inflation trends, tariff news, and fiscal policy, a dynamic that is expected to persist unless a major policy shift occurs. Meanwhile, the VIX declined by 3.65% to close at 17.69, remaining comfortably below the key 23 level, which typically supports a favorable environment for equities. Given ongoing macro uncertainty and volatility, traders are encouraged to stay nimble and adaptable as new data and events unfold.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a broad Bullish Trending Market State with SPY closing below MSI resistance. There were no extended targets printing for most of the afternoon session. This implies a weakening bull trend but one which may still have some gas in the tank for Wednesday. Overnight the market dipped slightly with the MSI rescaling lower to a ranging state. By the open, the MSI rescaled back to a bullish state which held all day. Just prior to and at the open, the MSI began printing extended targets above which led prices higher. The MSI rescaled higher three more times while printing extended targets above. By 1:50 pm extended target ceased printing at MSI resistance and SPY pulled back slightly, closing with back-to-back days of solid gains. Currently MSI support stands at $593.88 with resistance at $596.60.

Key Levels and Market Movements:

On Monday we noted: “We anticipate a continuation of the current environment, with SPY potentially testing $589 overnight before resuming its move higher toward $595 or even $597.” We also stated: “We continue to favor long setups on pullbacks,” and added: “Tactical shorts may be considered above $593, but only in the event of a failed breakout accompanied by a weakening MSI.” Once again, we had a clear and actionable plan. When SPY opened the day bouncing off MSI resistance-turned-support at $592, with extended targets printing, we had only one thought: go long with a stop below MSI support. So, we entered long at the open, targeting a first objective at the premarket level of $594.50. This level was reached by 11:00 a.m., and we then set our sights on a second target at another premarket level of $598. While this was a stretch, with extended targets printing, we stayed in the trade and let it run. By 12:40 p.m., the MSI rescaled higher and provided a more realistic second target at $596.50. We took T2 there and trailed the final 10% of our position. Price popped to $597, printing a failed breakout at that level. With strong gains already locked in, we decided to exit the final 10% and shift focus to a potential mean-reversion short. That opportunity presented itself at 1:48 p.m. when MSI stopped printing extended targets. We entered short at $596.60, targeting T1 once again at $594.50. However, price never reached this level as the bull trend remained too strong. Recognizing the strength of the move and prioritizing profit protection, we exited the short at $595.50 and wrapped up our day. One thing we never do is let a green day turn red. Taking a quick scalp counter to the prevailing trend is smart and something we teach every day. A massive first trade and a modest scalp to finish, done by 2:00 p.m. and we once again padded the wallet. Thanks to a clear, well-structured plan, disciplined execution, and the MSI providing invaluable insights into market control, timing shifts, and actionable levels, we were able to execute with precision. When paired with our structured trading framework and model levels, the MSI remains an indispensable tool for consistency and performance.

Trading Strategy Based on MSI:

Premarket economic news on Wednesday is unlikely to have significant market impact. The bigger fireworks are expected Friday with the Monthly Jobs Report. Until then, tariff-related headlines from the White House remain the primary risk catalyst. As we noted yesterday, traders appear increasingly desensitized to these developments, but should new headlines emerge, the best course remains to trade the market in front of you. In the absence of a major catalyst, we anticipate a continuation of the current environment, with SPY potentially testing $593 overnight before advancing toward $597 or even $600. Upward momentum remains intact, and dips continue to be bought. As long as $590 holds on Wednesday, the upside potential extends to $605. However, a break below $590 would shift focus to $585. A failure there could trigger a deeper pullback toward $580 or lower, potentially marking a critical inflection point and signaling a shift in control back to the bears. This would bring the $575–$595 range back into play, an area where institutional participants have been actively hedging long exposure. Barring such a breakdown, the path of least resistance remains to the upside. A sustained move above March’s highs could open the door to new all-time highs. We continue to favor long setups, with support extending down to $585. Tactical shorts may be considered above $597, but only in the event of a failed breakout accompanied by a weakening MSI. Currently, the MSI remains in a bullish state, reinforcing the case for continued follow-through on Wednesday. However, as we approach Friday’s job report, the probability of sideways, two-way action increases. As long as SPY holds above $585, long positions remain favorable. A sustained move below this level could invite renewed bearish pressure. Failed breakdowns continue to offer high-quality long entries. Stay alert and responsive as these setups emerge. Always align your strategy with the MSI and avoid trading during Ranging Market States. The MSI provides real-time insight into market control, momentum shifts, and actionable levels. When paired with our Pre-Market and Post-Market Reports, it enables more precise execution and higher-probability trades. If you haven't yet integrated the MSI and model levels into your trading process, now is the time. Contact your representative to get started as these tools can make a meaningful difference in both consistency and performance.

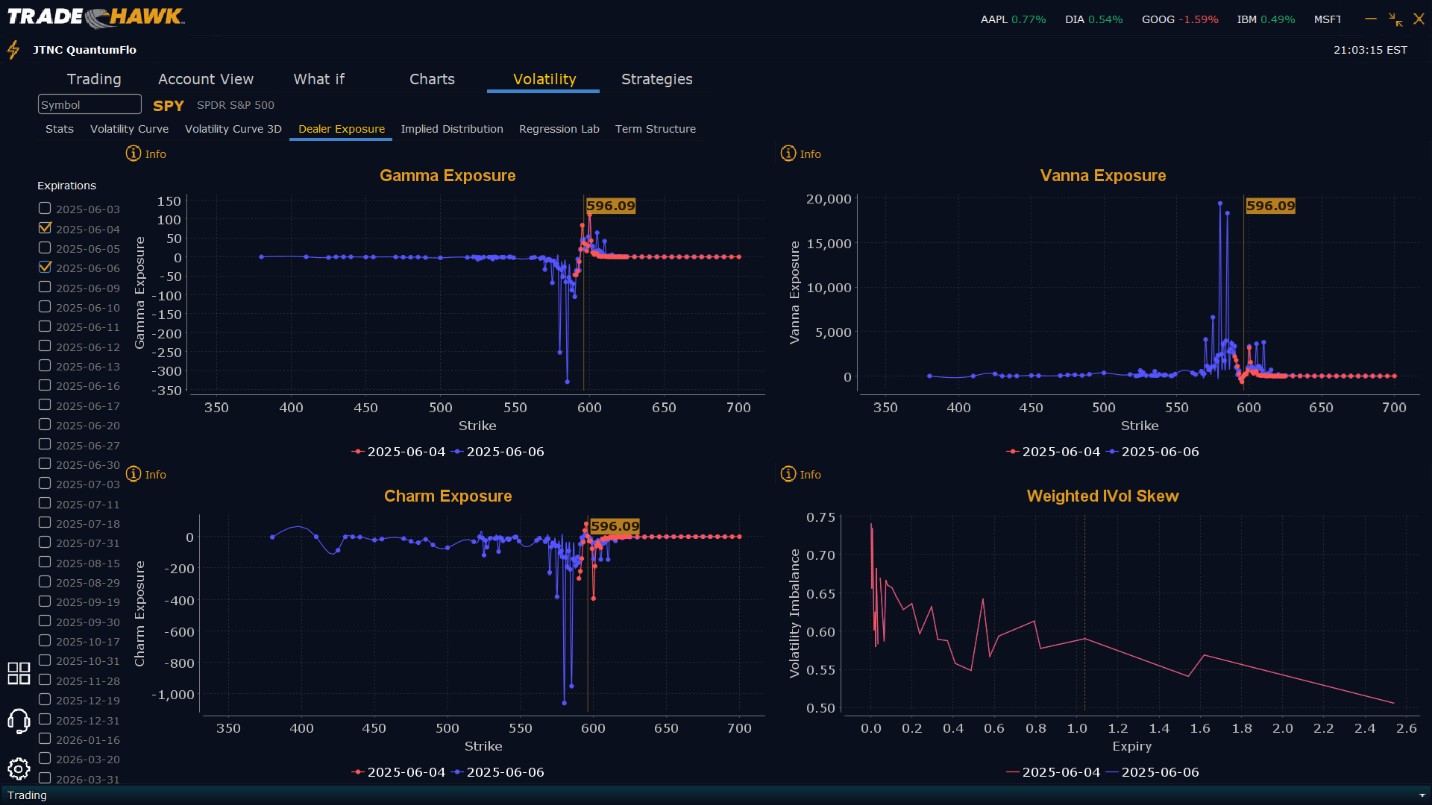

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $597 to $605 and higher strike Calls indicating the Dealers belief that price may stall near the current levels. Any rally on Wednesday appears to have a peak of $601. To the downside, Dealers are buying $596 to $550 and lower strike Puts in a 2:1 ratio to the Calls they’re selling. Dealer positioning is unchanged from neutral to neutral for Wednesday reinforcing the bull trend.

Looking Ahead to Friday:

Dealers are selling $597 to $615 and higher strike Calls implying a likely ceiling in the market this week of $605. Dealers are positioned for a rally to $600 but price could stretch beyond to $605. To the downside, Dealers are buying $596 to $520 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a slightly bearish outlook for the week. Dealer positioning is unchanged from slightly bearish to slightly bearish. Dealer positioning hasn’t changed materially in a few days which once again further reinforces a continuation of the bull trend. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders:

Traders should remain focused on SPY’s action around the $590 and $597 levels. Long trades remain the preferred strategy if SPY holds above $590, targeting upside levels at $600 and $601. If SPY breaks below $590, look for quick pullbacks toward $587 or $585, which may offer bounce setups. Short trades should be considered near the $600 level only if there’s clear rejection and a loss of upward momentum. The VIX remains low at 17.69, suggesting calm conditions, but surprises from Wednesday's economic data or Thursday’s claims figures could shift sentiment quickly. As always, keep position sizes moderate and stop-losses tight when trading into resistance zones. Be sure to review the premarket analysis posted before 9 AM ET to adapt to any overnight developments in model projections or Dealer Positioning.

Good luck and good trading!