Market Insights: Friday, June 27th, 2025

Market Overview

The S&P 500 and Nasdaq both surged to record highs Friday, overcoming early volatility sparked by renewed trade tensions. While markets initially dipped following President Trump’s abrupt announcement that he was ending all trade talks with Canada due to the country’s digital services tax, stocks rallied strongly in the afternoon. Trump also declared that new tariffs on Canadian goods would be set within a week, briefly shaking investor confidence. Despite this, sentiment quickly rebounded as optimism around a newly formalized U.S.-China trade agreement lifted market spirits. The two nations confirmed the terms of a previously reached truce, including China’s commitment to deliver rare earth minerals to the U.S., prompting Commerce Secretary Howard Lutnick to say American countermeasures would soon be lifted.

Adding to the bullish backdrop, Treasury Secretary Scott Bessent stated the U.S. expects to finalize major trade negotiations by Labor Day, further softening the perceived July 9 deadline. Meanwhile, investors also digested the Fed’s preferred inflation gauge, which showed price pressures remain elevated, complicating the path to potential rate cuts. While Fed Chair Jerome Powell has reiterated that persistent inflation could delay easing, signs of economic cooling within the same report left traders increasingly confident that a dovish shift may still come sooner than expected. Despite the day’s drama, the S&P 500 and Nasdaq closed at new all-time highs, showcasing the market’s resilience and the strength of investor appetite heading into the end of the quarter.

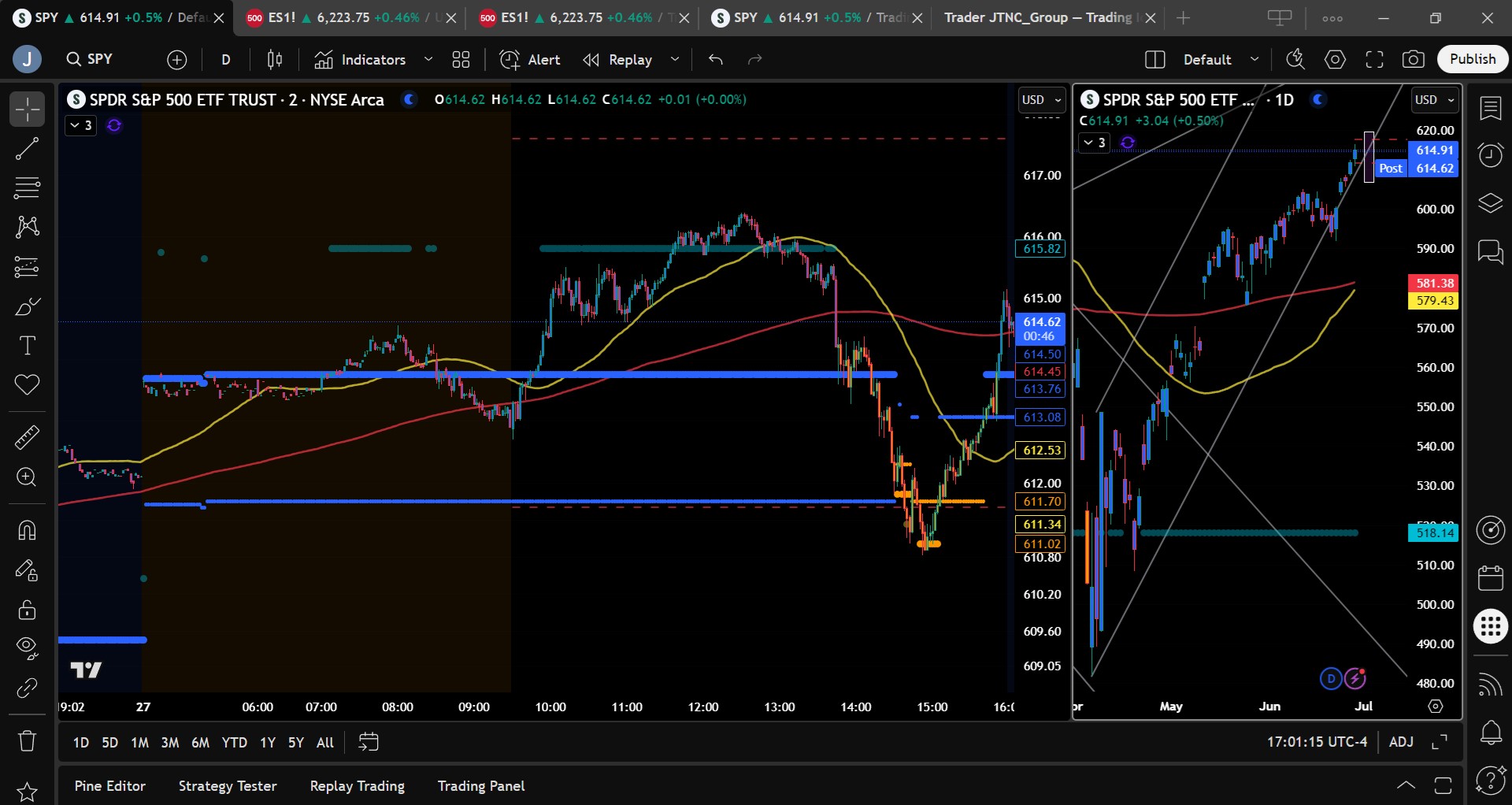

SPY Performance

SPY rose 0.50% on Friday, closing at $614.91 after opening at $612.88. The ETF reached an intraday high of $616.39 and pulled back to a session low of $610.83 before settling just below the resistance zone. Volume picked up to 81.60 million shares, well above average, confirming sustained buying interest as SPY climbed past its prior record of $613.23. The clean break to new highs solidifies the bullish trend, reinforcing positive momentum as we close out the month.

Major Indices Performance

The Dow Jones Industrial Average led the major benchmarks with a strong 0.90% gain, continuing its recent rebound and finishing near session highs. The Nasdaq followed with a 0.52% increase, notching a fresh record close, fueled by strength in heavyweight tech names. The S&P 500 added 0.50%, setting a new all-time high in a sign of broad-based market strength. The Russell 2000 lagged slightly, eking out a modest 0.02% advance as small caps paused after recent gains. Market sentiment remained largely positive, buoyed by a formalized U.S.-China trade agreement and diminishing fears over a hard July 9 tariff deadline. Sector-wise, cyclicals and tech outperformed, while defensive names remained mixed amid a risk-on backdrop.

Notable Stock Movements

It was a mostly green day for the Magnificent Seven, with Nvidia, Alphabet, and Amazon leading the group, each rallying more than 1.76%. These tech giants benefited from continued AI enthusiasm and a supportive macro backdrop. Apple, Meta, and Netflix also saw gains, though more muted. Tesla and Microsoft were the exceptions, each posting slight losses as traders rotated selectively within the mega-cap space. Overall, leadership from key growth names continues to anchor the market’s rally, providing the stability and momentum necessary to sustain new highs.

Commodity and Cryptocurrency Updates

Crude oil slipped 0.2% to settle at $64.11, continuing its slow decline as the Middle East ceasefire holds and supply concerns fade. The market remains in line with our model’s long-standing forecast for a gradual return toward $60, assuming no re-escalation of conflict. Gold took a sharper hit, falling 1.84% to $3,286 amid rising yields and receding inflation fears. Bitcoin dropped 0.68% to close just above $107,000, continuing its tight range. Our strategy remains long-only between $83,000 and $77,000, with caution below that lower boundary due to the risk of accelerated declines.

Treasury Yield Information

The 10-year Treasury yield climbed 0.40% to 4.269%, ticking higher after the PCE report showed persistent inflation pressures. Though still comfortably below the key 4.5% threshold that could rattle equities, this uptick reminded markets that the Fed may need more convincing before fully pivoting dovish. Equity markets brushed off the move for now, but continued increases in yields could introduce volatility in coming sessions. For now, the yield environment remains relatively benign for risk assets.

Previous Day’s Forecast Analysis

Thursday’s forecast set a range for SPY between $607 and $615, with a bullish lean above the $608 support level and key resistance levels at $612 and $615. The strategy favored long entries on dips near $608 and $607, targeting moves toward $612 and $615. A break above $615 was seen as a potential launchpad toward record highs, while downside levels at $605 and $600 were viewed as re-engagement zones for buyers. The model emphasized cautious optimism heading into the PCE release, advising against overexposure and highlighting failed breakouts or breakdowns as actionable signals for intraday positioning.

Market Performance vs. Forecast

Friday’s market performance was a strong validation of the forecast. SPY opened at $612.88, dipped to $610.83, and then rallied to close at $614.91, narrowly missing the $615 target while remaining within the forecasted range. The bullish bias above $608 held firmly, and resistance near $615 capped the move as anticipated. The forecast’s support levels acted as reliable springboards, with long trades off early session weakness delivering clean upside opportunities. The projected upside bias and strategy to target $612 and $615 played out with precision, giving traders a solid framework to navigate Friday’s choppy yet constructive session.

Premarket Analysis Summary

In Friday’s premarket analysis posted at 7:13 AM, SPY was trading at $613.76, and the outlook maintained a bullish bias above the 611.60/611 support zone. The analysis expected consolidation near the 613 level early in the session, followed by potential pushes to 615 and even 617.60 if upward momentum held. Downside targets were set at 611, 609.60, and 608.10, though the tone leaned against aggressive shorting, suggesting the market remained buyer-controlled. Long trades were favored at known support levels, with caution advised around any stalls at upper resistance.

Validation of the Analysis

Friday’s price action closely tracked the premarket blueprint. SPY hovered around $613 early on, briefly pulling back to $610.83 before pushing up to $616.39 and closing at $614.91. The $611 level held firm intraday, supporting the long bias, while the resistance near $615 acted as the magnet for the upward move. The cautious stance on short entries proved prudent, as dips were consistently bought and the broader trend remained intact. Traders who followed the premarket roadmap found multiple opportunities to trade with the momentum, particularly through clean long entries around the $611 zone. Once again, the premarket analysis provided reliable direction and actionable clarity.

Looking Ahead

Next week’s economic calendar is packed, with Tuesday bringing the ISM PMI and JOLTS reports, followed by a speech from Fed Chair Powell. Wednesday features the ADP Non-Farm Employment report, setting the stage for Thursday’s marquee event, the monthly Jobs Report and unemployment data. With markets closed Friday for the July 4th holiday, positioning ahead of Thursday could become increasingly active. The heavy data slate, particularly Powell’s remarks and the labor market indicators, could reset expectations around the Fed’s rate path and determine the market’s next leg.

Market Sentiment and Key Levels

SPY ended Friday at $614.91, firmly above previous resistance and clearly in breakout territory. Sentiment remains bullish, supported by strong economic data, a formalized trade agreement with China, and cooling trade fears with Canada. Resistance is now seen at $615, $620, and $625, while support has firmed at $610, $608, and $605. A decisive move above $620 would confirm another leg higher, while failure to hold above $610 could open the door to a retest of $605. Momentum continues to favor the bulls, but upcoming economic data could test their resolve. Traders should watch these levels closely for signs of either sustained upside or an emerging reversal.

Expected Price Action

Our AI model projects SPY to trade between $608 and $618 on Monday. This wide range suggests trending potential with intermittent choppy moves. The dominant theme remains bullish, especially with SPY closing above the prior record high. Actionable intelligence favors long setups above $610, targeting $615, $620, and $625. A breakout above $620 could fuel an extension into the upper range. Conversely, if SPY falls below $610, look for tests of $608 and possibly $605. A break below $605 could spark a retest of $600. As always, failed breakouts or breakdowns should be closely monitored for quick trade setups around these key levels.

Trading Strategy

Traders should continue to favor long setups on pullbacks to $610 and $608, aiming for upside targets at $615, $620, and $625. If SPY pushes through $620, look for possible accelerations toward the upper end of the model range. Short trades may be considered on failed breakouts near $620 or reversals from that level, with targets back toward $610 or $608. The VIX dropped again to 16.32, indicating low volatility and favoring measured risk-taking. However, next week’s data could introduce larger price swings, so tight stop-losses and modest sizing remain key. This is especially true approaching Powell’s remarks and Thursday’s Jobs Report.

Model’s Projected Range

The model projects SPY’s maximum range for Monday between $606.75 and $619.50, with Call-side dominating within an expanding band, suggesting choppy price action punctuated by brief trending moves. Today’s session extended the prevailing bullish trend, with SPY closing above the prior all-time high of $613.23. While uncertainties, particularly surrounding tariffs warrant cautious optimism, the broader uptrend remains intact as long as SPY stays above $585. On Monday, bulls will aim to defend the $610 level, which could pave the way for another leg higher. A failure to hold this level may prompt a pullback toward $605 or even $600; however, meaningful downside is unlikely unless $590 is breached. In the absence of a major catalyst, our model continues to suggest that dips will be bought, with the market likely grinding higher. We maintain our view that pullbacks should be used as buying opportunities. Resistance is now seen at $615, $620, and $625, while support lies at $610, $608, and $605. SPY remains above the lower boundary of the redrawn bull channel from April. Although resistance in the $615–$620 zone is dense, a breakout above $620 could open the door to $625. Conversely, a drop below $610 could introduce downside risk, though likely still within the context of a broader uptrend. Market direction continues to hinge on macroeconomic indicators, bond yields, inflation data, tariffs, and fiscal policy, all of which will shape sentiment absent a significant shift. Meanwhile, the VIX declined 1.63% to 16.32, reflecting reduced investor caution and a persistent risk-on tone. Still, traders should stay nimble amid the potential for rising volatility.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a very narrow Bullish Trending Market State, with SPY closing above MSI resistance turned support. Extended targets printed for much of the day’s session which kept the herd pushing price beyond prior all-time highs. SPY closed at a new all-time high at $614.91. The MSI only briefly rescaled to a very narrow bearish state after 2 pm which didn’t last long. In fact SPY quickly reversed and the MSI rescaled through a ranging state to close in its current bullish state. Overnight SPY gapped up once again which saw the MSI rescale twice higher, remaining in a bullish state at the open. While the MSI range at the close is narrow, on Sunday watch for another rescale to determine the path of prices on Monday. Currently MSI support stands at $613.76 and lower at $613.08.

Key Levels and Market Movements:

On Thursday, we noted: “Friday brings the Fed’s preferred inflation gauge, PCE, which has the potential to move the market, alongside chatter about extended tariff deadlines,” and added, “the setup favors continued upside.” We also stated, “With a close above $610, a move toward $615 and new highs becomes highly probable.” With this actionable roadmap in hand and SPY opening above $612, our focus was clear: find a way to get long. SPY pulled back below MSI resistance, setting up a clean failed breakdown right at the open at $612.71. While a deeper pullback to MSI support at $611.70 would have been ideal, we chose to enter long as SPY reclaimed $613.25, setting our first target at the premarket level of $615. SPY quickly cooperated, hitting our initial target. With extended targets printing, our next move was to look for a second target. We identified the next premarket level at $617.60, far from our entry, but opted to sit tight in case SPY accelerated to new highs. By noon, SPY formed a textbook failed breakout. Given the continued strength, we didn’t go short but did trim another 20% of our position, leaving 10% to run with a stop at breakeven. At 1:45 p.m., news of Canadian tariffs hit the wire, and SPY dropped sharply. We exited our long near MSI resistance-turned-support and decided it was time to fade the rally. We entered short at MSI resistance at $613.75, targeting MSI support at $611.70 for our first take-profit. This level was hit by 2:40 p.m., and with $611 as the next premarket support, we set T2 at that level. After banking both targets and noting the MSI was narrowing around key support levels, we exited our short on a failed breakdown and reversed long for one final push into the close. The market rewarded us again, first hitting MSI resistance at $613, then at $613.75. With a stop at breakeven and just minutes left in the session, we exited our runner at $615, capping off a stellar day: three trades, three wins, and two delivering outsized gains. It was a highly profitable week, the kind we aim for, driven by a structured plan, disciplined execution, and strategic use of MSI for directional control, timing, and actionable levels. Integrated within our broader framework and model levels, MSI remains an indispensable tool for delivering consistent trading performance.

Trading Strategy Based on MSI:

Monday brings no scheduled economic news, but tariff chatter may still move markets in either direction. The Fed’s preferred inflation gauge, PCE, came in slightly hotter than projected, potentially slowing the pace of the interest rate cuts the market anticipates. That said, the PCE print wasn’t terrible, just a touch above expectations and the market appears poised to continue overlooking negative data in favor of the prevailing bull trend. As long as SPY holds above $585, bulls remain firmly in control. For Monday, maintaining levels above $610 will be key to pushing beyond Friday’s highs. Volume confirmed the session’s strength, and for bears to gain traction, a break below $600 would be required, though even that might only yield modest downside. With a close above $614, a move toward $620 and new highs looks increasingly likely. While external risks like tariff headlines could still influence sentiment, the breakout from the $575–$595 consolidation zone signals increasing strength. Holding $610 keeps the door open for a move toward $620, while a break below that level could trigger a test of $605 and potentially draw in sellers. Still, barring a significant breakdown, the path of least resistance remains higher. We continue to favor long setups above $605, while selective short opportunities may arise above $618 or on failed breakouts and failed holds below $600, especially when MSI signals weakening conditions. Failed moves continue to offer high-quality trading opportunities. Stay nimble and avoid trades during Ranging Market States, ensuring full alignment with MSI. Offering real-time insight into market control, momentum shifts, and actionable levels, MSI when combined with our Pre-Market and Post-Market Reports significantly enhances execution precision and trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $615 to $630 and higher strike Calls while also selling $613 to $614 Puts in small size, indicating the Dealers belief that prices will move higher on Monday. Dealers do not sell Puts close to the money if they are concerned about price falling. The ceiling for Monday appears to be $620. To the downside, Dealers are buying $612 to $575 and lower strike Puts in a 2:1 ratio to the Calls/Puts they’re selling implying little concern that prices may move lower on Thursday. Dealer positioning has changed from bullish to neutral.

Looking Ahead to Next Thursday:

Dealers are selling SPY $615 to $635 and higher strike Calls while also selling very small quantities of $607 to $614 Puts indicating the Dealers belief that prices will move higher next week. Dealers do not sell close to the money Puts if they have concern about prices falling. The likely ceiling for next week is currently $620. To the downside, Dealers are buying $606 to $540 and lower strike Puts in a 2:1 ratio to the Calls/Puts they’re selling, reflecting a neutral outlook for the next week. Dealer positioning has changed from slightly bearish/neutral to neutral. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

With SPY now trading in new high territory and clearing major resistance, long setups remain favorable. Traders should consider entries on dips toward $610 and $608, with upside targets at $615 and $620. A break above $620 could extend the move toward $625, while short trades are best reserved for clear rejections near $620 or failed breakouts. Downside targets for such reversals include $610 and $608. With VIX holding at a low 16.32, market conditions still support active trading, but next week’s economic data could introduce more volatility. Position sizing should be conservative heading into Powell’s Tuesday remarks and the Thursday Jobs Report.

Review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!