Market Insights: Monday, June 16th, 2025

Market Overview

Markets rebounded sharply on Monday as investors grew more optimistic that the conflict between Israel and Iran may not spiral into a broader regional crisis. The Dow surged over 300 points, or roughly 0.75%, while the S&P 500 climbed 0.95%, and the Nasdaq led gains with a 1.52% rally. The move came after a bruising Friday session but found momentum following a Wall Street Journal report suggesting that Iran may be willing to resume negotiations over its nuclear program. This sparked hope that deescalation may be on the table, leading to a wave of risk-on sentiment across equities. President Trump acknowledged the report, saying, “Yeah… they’d like to talk, but they should have done that before,” as he addressed the issue during the G7 summit in Canada, where trade tensions with the EU and Canada also remain on the radar. Oil, which had spiked on Friday amid fears of supply disruptions, reversed course Monday, falling below $72 per barrel as concerns around energy market instability eased. Treasury yields inched higher to 4.42% while gold pulled back after its safe-haven surge. Bitcoin jumped over 3%, topping $109,000. The cautious optimism comes ahead of a major week for economic data, with investors awaiting Tuesday’s Retail Sales and the FOMC decision on Wednesday, which could further shape the market’s direction. For now, Monday’s rally reflected a fragile but growing belief that diplomacy might prevail in the Middle East, though risks remain far from resolved.

SPY Performance

SPY rallied 0.95% to close at $602.68 after opening at $600.40 and trading between $600.22 and $604.45 throughout the session. Volume clocked in at 70.56 million shares, slightly above average, as the ETF regained its footing after Friday’s steep decline. The move above $600 was significant, reclaiming a critical level of psychological and technical support that had failed last week. The push toward $604 reflects improved sentiment, though resistance in that area held firm. Price action showed strong follow-through early in the session before stabilizing into the close, suggesting buyers are beginning to reassert control.

Major Indices Performance

The Nasdaq led the charge with a 1.52% gain, driven by renewed strength in tech and growth names. The Russell 2000 followed with a 1.15% advance, signaling renewed risk appetite in small caps. The S&P 500 rose 0.95%, bouncing back from Friday’s sell-off, while the Dow posted a solid 0.75% climb. Monday’s rebound was fueled by hopes for de-escalation in the Israel-Iran conflict and anticipation that the upcoming Retail Sales and FOMC updates may support the current economic narrative. Most sectors saw gains, with technology and communication services pacing the rally. Defensive names underperformed slightly, consistent with the broader move into risk.

Notable Stock Movements

It was a strong day for the Magnificent Seven, all of which posted gains and reversed Friday’s declines. Meta led the group with a 2.91% surge, benefiting from broad tech enthusiasm and a rebound in advertising-related names. The rest of the group saw gains above 1%, reflecting investor willingness to rotate back into high-growth equities amid easing geopolitical fears. Monday’s bounce showed renewed appetite for riskier assets, with the group reclaiming leadership and helping to stabilize broader market sentiment.

Commodity and Cryptocurrency Updates

Crude oil slid 1.75% to close at $70.04, continuing its volatile response to Middle East tensions. Although concerns of supply disruption had driven a spike last week, hopes for diplomatic progress pulled prices lower. Our model continues to forecast a path toward $60 and potentially $50, where we would become active buyers. Gold fell 1.40% to $3,404, retreating from recent highs as risk-off flows eased. Bitcoin rallied 3.64% to close above $109,600, its highest in weeks. We remain long between $83,000 and $77,000 and advise against buying below $77,000 due to elevated risk.

Treasury Yield Information

The 10-year Treasury yield ticked up 0.52% to close at 4.447%, holding below the critical 4.5% threshold. The move reflects slightly firmer inflation expectations and a softening demand for safe havens. Should yields climb above 4.5%, equities could come under renewed pressure, and a move beyond 4.8% would likely trigger a deeper selloff. The current level supports the market’s rebound, but traders should remain cautious as macro uncertainty looms ahead of the Fed's rate decision.

Previous Day’s Forecast Analysis

Friday’s outlook projected a range between $593 and $602 with a bearish tilt below the $600 level. The forecast favored short setups below $599 targeting $595 and $590, while long trades were advised above $595 with tight stops. The model also warned of elevated volatility driven by geopolitical developments and reiterated that sustained strength above $600 would be necessary to shift sentiment more bullishly. Traders were cautioned against premature long entries without a solid reclaim of $600, given the fragile state of the market entering the week.

Market Performance vs. Forecast

Monday’s performance broadly aligned with expectations but leaned more bullish than Friday’s forecast anticipated. SPY opened at $600.40, broke cleanly above the $600 resistance, and climbed to a high of $604.45 before settling at $602.68. This pushed SPY through the top end of the projected range, confirming that the dip-buying interest identified on Friday returned with conviction. The strong close back above $600 flipped the short-term bias and gave traders a clean long opportunity once that level held early in the session. Though Friday’s caution was warranted, Monday's upside confirmed the market’s resilience, validating the model’s emphasis on key support and resistance levels.

Premarket Analysis Summary

In Monday’s premarket analysis posted at 7:12 AM, SPY was trading at $599.76 with the bias level set at $600. The report highlighted a cautiously optimistic tone, expecting that if SPY could reclaim and hold $600, an initial move to $601.50 was likely, with a possible stretch toward $605. On the downside, rejection of $600 would target $597 and potentially $595. The premarket noted fragile market structure and warned against chasing weakness given the potential for chop. It stressed that while upside was limited, downside risk was not dominant either, urging traders to be selective and defensive.

Validation of the Analysis

Monday’s session validated the premarket levels with impressive precision. SPY reclaimed $600 shortly after the open and pushed through both upside targets of $601.50 and nearly reached $605, topping out at $604.45. The premarket bias level of $600 proved pivotal, and once that level was held, the path higher unfolded in line with expectations. Traders had clear opportunities to go long with the market confirming strength above key levels. The premarket guidance helped frame a clean plan for navigating the session’s early strength and gave confidence to fade the bearish pressure from Friday.

Looking Ahead

Tuesday brings Retail Sales data, a key input for evaluating consumer strength and the Fed’s next steps. A strong number could reignite inflation concerns, while a weak print may bolster the case for holding or even cutting rates. Either way, expect the report to move markets and influence the tone heading into Wednesday’s FOMC announcement and unemployment claims. Traders should prepare for volatility and closely watch how SPY reacts to economic surprises.

Market Sentiment and Key Levels

SPY closed Monday at $602.68, back above the key $600 level, shifting sentiment back toward the bulls. Resistance lies ahead at $605, then $606 and $607, with a breakout above $607 potentially setting the stage for a move to $610. Support begins at $600, then $597 and $595. As long as SPY remains above $595, the bullish structure remains intact. A break below $595, however, would threaten a reversion back into the $575–$595 range that has capped progress since mid-May. Bulls are back in control for now, but upcoming data could quickly flip the script.

Expected Price Action

Our AI model projects SPY’s range for Tuesday between $597 and $605, suggesting potential for choppy action with room for directional breaks. The market leans bullish as long as SPY holds above $595, with upside targets at $600, $605, and a stretch to $610. Should SPY lose $595, support levels at $590 and $585 come into play. This is actionable intelligence: traders should favor long setups on pullbacks to $595 with confirmation, targeting $600 and above. Short trades are only favored on clean breaks below $595, with targets at $590 or on failed breakouts above $602. The market remains sensitive to macro headlines, especially from the Fed and geopolitics.

Trading Strategy

With the VIX easing 8.21% to 19.11, volatility is still elevated but improving. Long trades are favored above $595 with targets at $600 and $605. Use tight stops below $595 to minimize risk in case of reversals. Short trades can be considered below $595 with targets at $590 and $585, but these remain lower-probability unless news drives momentum. Traders should reduce size in rangebound markets and use wider stops in volatile conditions. Key trades involve failed breakdowns near $602 or breakouts past $605. As Retail Sales and the FOMC loom, flexible positioning and disciplined risk control are essential.

Model’s Projected Range

The model projects SPY’s maximum expected range for Tuesday between $596.25 and $607.75, with the Call side dominating across a narrowing band suggesting choppy price action with the potential for periods of trending action. Monday’s session reflected optimism that tensions in the Middle East may be easing, with hopes of a potential truce between Iran and Israel. The market rebounded from Friday’s sell-off, closing higher on strong volume. However, Middle East risks should not be underestimated, as escalation remains a real possibility. Accordingly, we maintain a cautious stance until greater clarity emerges. The broader bullish narrative remains intact as long as prices stay above $585. A break below $595 would serve as a warning that the market could revisit lower lows. In the absence of a major external catalyst, our model continues to suggest that dips are likely to be bought. Key resistance is now seen at $605, $606, $607, and $610, while support levels are identified at $597, $595, and $590. SPY once again closed below the lower bound of a steep, uncorrected bull channel that has been in place since April. This breach suggests a potential redraw and increases the risk of a broader pullback if weakness continues. Resistance from $604 up to $611 is expected to cap near-term upside, while support below $590 is sparse. Consequently, SPY appears poised to revert back into the $575–$595 range that has largely defined the market since mid-May, assuming geopolitical tensions remain contained. For Tuesday, holding above $595 would support a recovery toward $600 or even $605. A break below $595, however, could target $590, a critical level for preserving the current bullish structure. Since April, market direction has been closely tied to macroeconomic data, bond yields, inflation readings, tariff news, and fiscal policy developments. This dynamic is likely to continue barring a significant policy shift. Meanwhile, the VIX fell 8.21% to 19.11, remaining below the 23 level commonly linked to risk-off sentiment. While still elevated from Friday, this level signals lingering investor caution and an increased likelihood of price volatility in response to adverse headlines. In this environment, traders are advised to remain nimble and responsive to both economic releases and evolving geopolitical risks as the week progresses.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in very narrow Bullish Trending Market State, with SPY closing well above resistance turned support. There were no extended targets printing into the close which implies a weak bull trend which could test the overnight gap at $597 before recovering. The MSI opened higher with strength in the overnight session, which saw extended targets and prices spike to $604.50. Once there, just shy of major resistance, SPY spent the rest of the session drifting lower to close up but off the day’s highs. The MSI did not rescale all day which indicated weakness in the bull trend which could lead to weakness on Tuesday. Currently, MSI support stands at $600.25 and lower at $599.20.

Key Levels and Market Movements:

On Friday, we noted: “the bulls still control the narrative, and dips continue to be bought.” We also stated, “As long as SPY holds above $595 on Monday, upside potential extends toward $605,” and finally, “We continue to favor long setups above $595 and shorts above $600.” With that actionable plan in hand, and an overnight gap up accompanied by the MSI in a bullish state with extended targets printing above, we entered long at MSI resistance-turned-support at $600.50 just after the open. Our first target was the premarket level of $601.50, which satisfied our $1 minimum and was quickly hit. We then set T2 at the next premarket level of $605. Price continued higher, supported by the MSI’s extended targets and a strong trend. However, as price approached $604.40, a less-than-ideal head and shoulders pattern emerged. Despite extended targets still printing, we chose to take T2 at $604 and moved our stop to breakeven, aiming to capture an extra $0.50 if the market allowed. That move never materialized, and price began drifting lower. With 90% of our position already booked, and extended targets no longer printing, we exited the remaining 10% and wrapped up the trade. While not a home run, it was still a solid start to the week. We opted against shorting, as the failed breakout setup were seeking didn’t materialize. By 1 p.m., we called it a day. One and done felt sufficient for a Monday ahead of Wednesday’s FOMC. As we get closer to the announcement, the likelihood of sideways action increases. A half-day and a green day, thanks to a structured plan, disciplined execution, and the strategic use of MSI for control, timing, and identifying actionable levels. Integrated into our broader framework and model levels, MSI continues to prove indispensable for consistent trading performance.

Trading Strategy Based on MSI:

Tuesday brings Retail Sales data, but it's unlikely to move markets significantly given broader global dynamics. With escalating tensions in the Middle East, don’t assume today resolved the conflict or eliminated the associated risks. This may have been nothing more than a dead cat bounce—an opportunity to grab liquidity. As we've noted, the market remains priced for perfection. Any negative headlines could trigger a sharp selloff in SPY, potentially $10 or more. External catalysts, such as tariffs, continue to pose significant risks and could rapidly shift sentiment. When headlines hit, trade what you see. Absent such catalysts, bulls still control the narrative, and dips continue to be bought. Our model suggests a likely test of the overnight gap at $597. The $595 level is key; holding above it maintains upward momentum. A break below $595 could signal a reversion back into the $575–$595 range that has dominated since May. As long as SPY remains above $595 on Tuesday, upside potential extends toward $605. However, if $595 fails, a deeper pullback toward $590 or even $585 becomes likely. These levels form a critical inflection zone and could shift short-term control back to the bears. Unless a meaningful breakdown occurs, the path of least resistance remains higher. A sustained move above $605 would open the door to new all-time highs. We continue to favor long setups above $595 and shorts above $600. Tactical shorts can also be considered on failed breakouts or failed holds below $595, especially if the MSI begins to show signs of weakening. Failed breakouts and failed breakdowns remain high-quality opportunities. Stay alert and responsive as these setups develop. Avoid trading during Ranging Market States and always align your strategy with the MSI. The MSI delivers real-time insight into market control, momentum shifts, and actionable levels. When paired with our Pre-Market and Post-Market Reports, it sharpens execution and elevates trade quality. If you haven’t yet integrated the MSI and model levels into your trading process, now is the time. Contact your representative to get started as these tools are designed to promote consistency and improve performance.

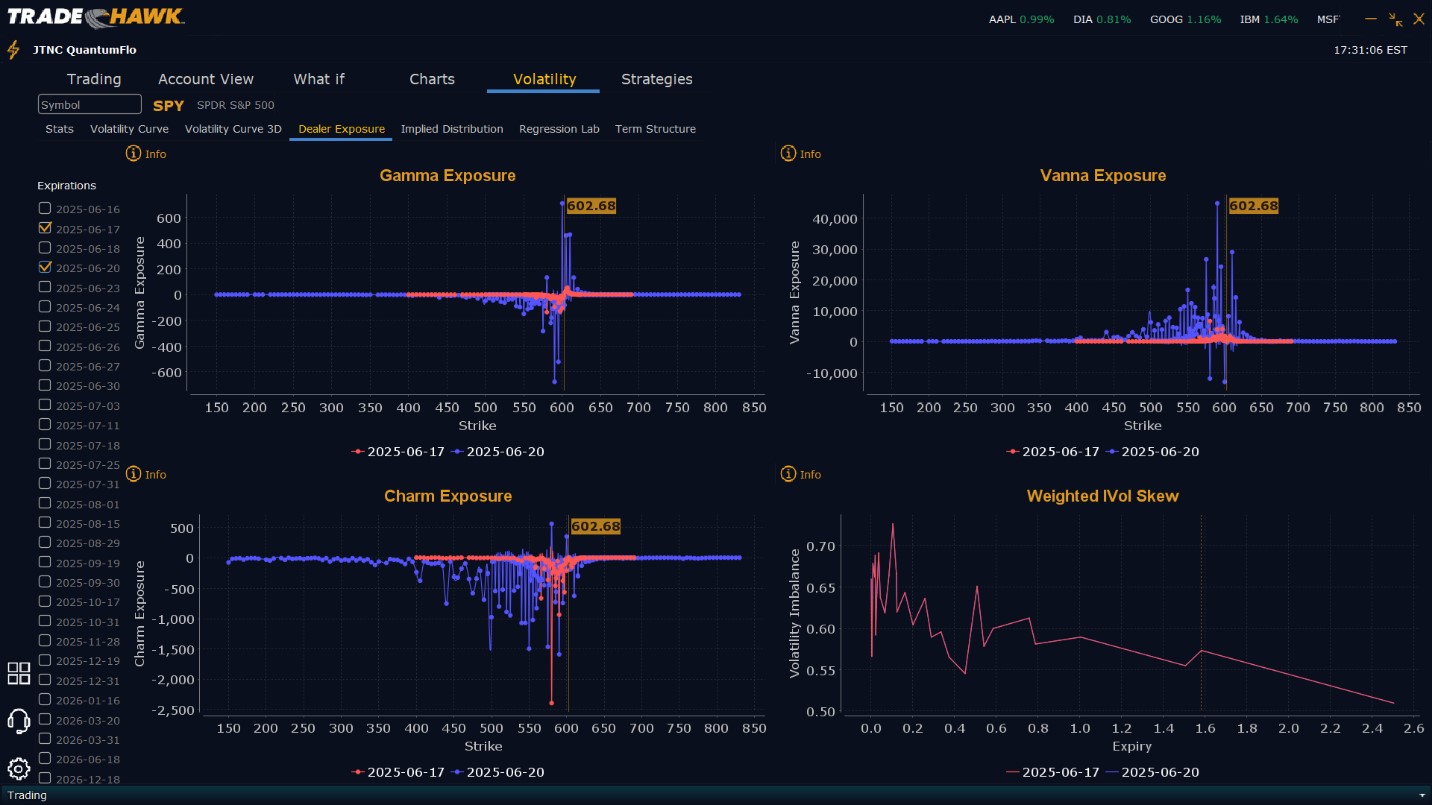

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $603 to $615 and higher strike Calls implying the belief that the market may continue to drift higher on Tuesday to as high as $606. To the downside, Dealers are buying $602 to $550 and lower strike Puts in a 3:1 ratio to the Calls they’re selling implying a bit of concern that prices may move lower. Dealer positioning is unchanged from slightly bearish to slightly bearish for Tuesday.

Looking Ahead to Friday:

Dealers are selling $603 to $620 and higher strike Calls while selling large quantities of $580 and $600 Puts implying the Dealers belief that if the market continues to fall, the floor is $580, however they are also suggesting $600 may be the low. This positioning is a bit unusual, especially with four days to expiry. Dealers so not sell close to the money Puts unless they firmly believe prices will move higher. We would be very careful assuming the $600 Puts are the floor in the current market. But perhaps they know something we do not. The likely ceiling from this positioning for the week is $610. To the downside, Dealers are buying $602 to $505 and lower strike Puts in a 4:1 ratio to the Calls/Puts they’re selling, reflecting a bearish outlook for the week. Dealer positioning is unchanged from bearish to bearish. We have not seen bearish positioning in some time so Dealers are implying concern that the bull trend may in fact be coming to an end or at least face headwinds. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY’s close above $600 signals renewed bullish strength, but risks remain. Long trades should be considered above $595 targeting $605 and $610 with stops near $595. Short trades may be taken on a firm rejection below $595, targeting $590 and potentially $585 if momentum builds, OR on a failed breakout above $602. With the VIX at 19.11, volatility is still elevated, so risk management is key. Avoid overexposure and stay agile, especially ahead of Tuesday’s Retail Sales report. Watch for headlines that could alter sentiment quickly. As always, review the premarket analysis posted before 9 AM ET to align with the latest levels and outlook.

Good luck and good trading!