Market Insights: Tuesday, June 10th, 2025

Market Overview

Stocks climbed on Tuesday as renewed optimism around U.S.-China trade talks helped fuel a broad market rally. Negotiators resumed their discussions in London following Monday’s positive tone, with both sides signaling a willingness to keep talking despite significant hurdles. The S&P 500 gained 0.5%, while the Nasdaq rose 0.6% and the Dow ticked higher by 0.2%. Both the S&P and Nasdaq are inching closer to their record highs, boosted by resilient earnings, upward revisions in growth forecasts, and optimism over a potential tariff deal. Still, investor sentiment remained somewhat cautious. Negotiators are wrestling with complex issues, particularly over U.S. access to China’s rare earths, a sticking point with broad economic implications. While President Trump struck a somewhat measured tone, saying “China’s not easy,” White House officials hinted the talks have been productive so far. A sudden dip in Chinese equities during Tuesday’s session reflected ongoing skepticism in overseas markets. Meanwhile, a stronger-than-expected NFIB small business optimism reading added to bullish sentiment, showing a bounce in confidence amid the trade pause. Still, anxiety over the administration’s pending tax-and-spending bill kept some traders on edge. All eyes are now on Wednesday’s CPI release, which could determine whether the market continues its climb or faces another hurdle.

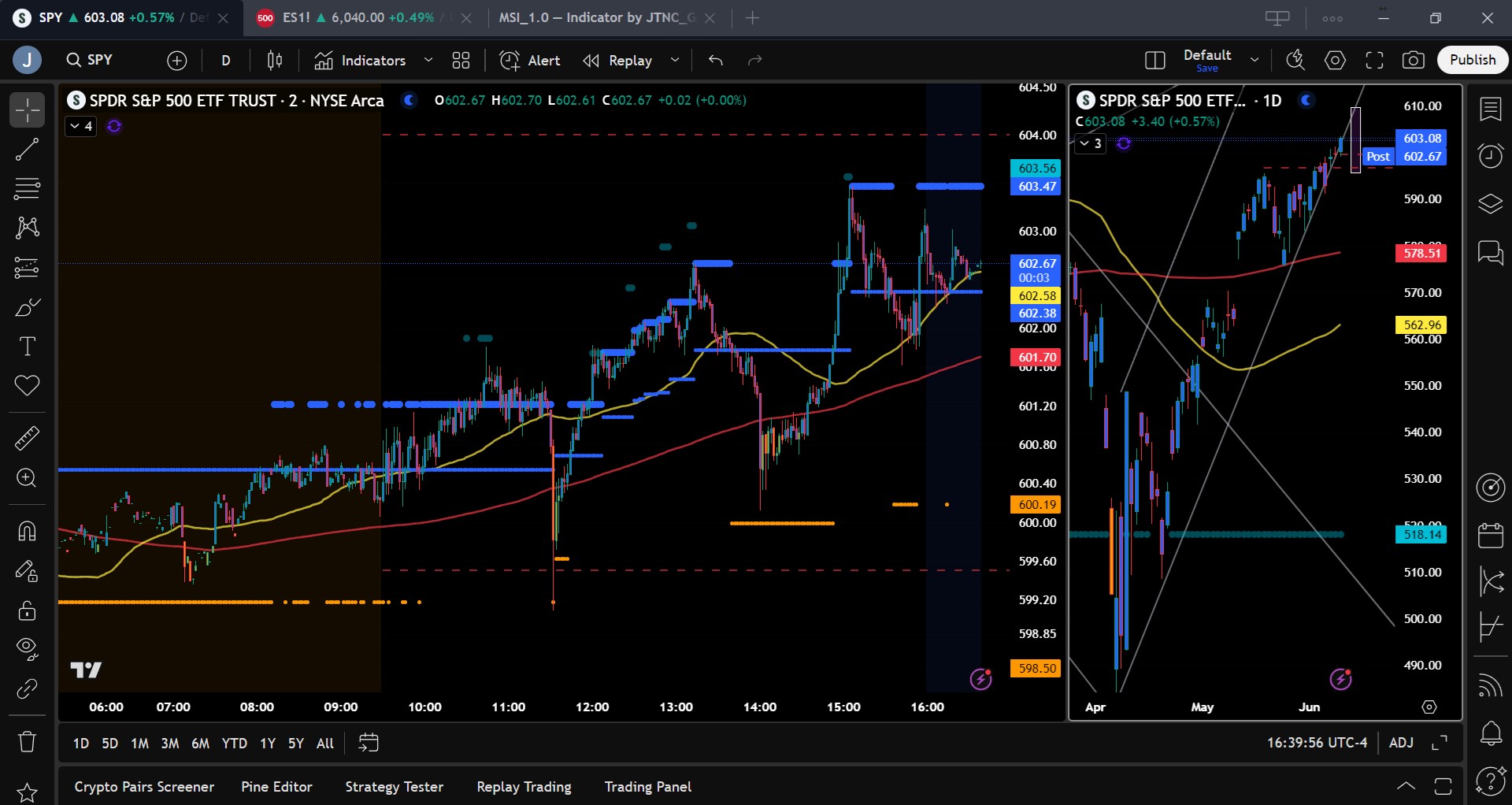

SPY Performance

SPY ended Tuesday with a solid gain of 0.57%, closing at $603.08 after trading between $599.10 and $603.47. The ETF opened at $600.22 and broke above the psychologically significant $600 level early in the session, continuing to push higher before meeting resistance near $603.50. Volume came in slightly below average at 58.52 million shares, but the rally was notable given the recent series of narrow, low-energy trading sessions. SPY is now approaching the top end of its recent range, and with inflation data on deck, traders will be watching closely to see if momentum can continue.

Major Indices Performance

The Nasdaq led the way Tuesday with a 0.63% rise, supported by strength in key technology names. The Russell 2000 followed with a 0.60% advance, showing ongoing appetite for small-cap exposure. The S&P 500 climbed 0.5%, while the Dow trailed slightly with a 0.25% gain. Sentiment was bolstered by steady progress in trade talks and a rebound in business confidence. Defensive sectors underperformed as traders rotated back into cyclicals. Investors appeared comfortable maintaining exposure ahead of Wednesday’s inflation data, reflecting cautious optimism that the rally may extend.

Notable Stock Movements

The Magnificent Seven stocks were broadly higher Tuesday, led by a standout performance from Tesla, which surged again to build on recent gains. Alphabet and Meta also helped drive the group higher, while Netflix and Microsoft posted small losses. This mixed showing suggests investors remain selective, rewarding stocks with momentum and growth catalysts while continuing to trim exposure to overvalued or lagging names. Tech stocks overall benefited from the return of risk appetite, aligning with broader bullish sentiment.

Commodity and Cryptocurrency Updates

Crude oil slipped 0.67% to settle at $64.85, as near-term dollar weakness failed to offset longer-term pressures tied to rising interest rates. Our model continues to forecast lower prices ahead, targeting a move to $60 and potentially $50, where we would become buyers. Gold dipped 0.23% to $3,347, continuing its recent trend of stagnation as risk assets regain favor. Bitcoin advanced another 0.70%, closing above $109,400. We remain buyers between $83,000 and $77,000, but caution against entries below $77,000 due to potential for deeper downside.

Treasury Yield Information

The 10-year Treasury yield edged down to 4.473%, a 0.22% decline, as bond traders showed restraint ahead of Wednesday’s CPI data. The slight drop kept yields below the key 4.5% threshold, offering equities some breathing room. Should yields climb toward 4.8% or higher following the inflation print, risk assets, particularly high-growth stocks, could come under pressure. For now, yields remain in a zone that supports continued market strength.

Previous Day’s Forecast Analysis

Monday’s forecast projected a slightly bullish bias for SPY, with a suggested range of $596 to $603 and critical support at $595. The analysis emphasized long setups above $595 targeting $603 and $605, noting that resistance thickened into the upper $600s. It warned of fading momentum and a fragile bullish bias, stressing the importance of watching inflation data midweek. The trading strategy urged caution near resistance zones, with short trades considered only on failed breakouts or breakdowns below $595.

Market Performance vs. Forecast

SPY’s Tuesday session tracked closely with Monday’s forecast. The ETF opened at $600.22 and moved higher, tagging $603.47 before closing at $603.08, just above the top end of the projected range. The move respected the $595 support level, never testing the downside as buyers stepped in early. The expected resistance near $603 proved valid, capping the advance late in the day. Traders following the forecast likely found profitable long entries near the open, especially with the afternoon strength confirming the upside bias. The model’s expectations for a slow grind higher proved accurate once again.

Premarket Analysis Summary

In Tuesday’s premarket analysis posted at 7:20 AM, SPY was trading at $599.40 with a bias level set at $599.50. The analysis anticipated modest upside continuation toward $602 and possibly $604, provided the bias level held. A failure to maintain this level was expected to prompt consolidation in the $596–$597 zone, with $594 noted as the downside floor. Long trades were favored, but with caution around potential stalling near the highs. The market was described as hesitant but biased slightly higher in the absence of strong selling.

Validation of the Analysis

Tuesday’s market performance affirmed the accuracy of the premarket analysis. SPY held above the $599.50 bias level, dipping only briefly to a low of $599.10 before surging toward the $602 and $603 targets. Traders who followed the premarket plan could have captured gains by initiating long entries above support and locking in profits as SPY approached resistance. The cautious approach to short trades was validated, as no major reversal developed and dips were quickly bought. The clear roadmap provided in the premarket call once again proved effective for navigating intraday moves.

Looking Ahead

All eyes now turn to Wednesday’s Core CPI report, which is expected to influence short-term Fed policy expectations. A hotter-than-anticipated print could stall the rally and push Treasury yields higher, pressuring equity valuations. On Thursday, traders will digest Core PPI and jobless claims, followed by sentiment and inflation expectations data on Friday. These releases could introduce meaningful volatility into a market that has otherwise been slowly grinding higher. The inflation data will be crucial in determining whether SPY breaks out toward new all-time highs or reverses back into its recent range.

Market Sentiment and Key Levels

SPY closed Tuesday at $603.08, marking a decisive break above the $600 resistance zone. Market sentiment remains cautiously bullish, supported by softening geopolitical tensions, improving business confidence, and anticipation of dovish inflation data. The bulls remain in control as long as SPY stays above $595, with new resistance now at $604, $605, and $610. Support is building at $600, $595, and $590. A push above $605 could open the door to fresh all-time highs, while failure to hold $600 would likely trigger a test of lower support zones.

Expected Price Action

Our AI model projects an expected range for SPY on Wednesday of $599 to $608. This wide band suggests a potential trend day, particularly with the CPI print due before the open. The model maintains a slightly bullish stance, favoring a continuation higher if SPY holds above $600. Upside targets are set at $605 and $610. If SPY breaks below $600, a retracement to $595 or $590 becomes likely. This is actionable intelligence: bulls remain favored above $600, but momentum may wane quickly if inflation data disappoints. Traders should remain nimble and alert to premarket volatility.

Trading Strategy

With the VIX slipping 1.22% to 16.95, volatility remains tame, though CPI could change that. Long trades remain favored above $600 with upside targets at $605 and $610. Consider tightening stops as SPY approaches resistance to lock in gains. Short trades can be initiated on a confirmed breakdown below $600, with downside targets at $595 and $590. If a breakout above $605 stalls, tactical shorts may be considered, but with tight risk parameters. Use smaller position sizes in anticipation of post-CPI volatility and avoid overexposure until a clear directional trend is established.

Model’s Projected Range

The model projects a maximum expected range for SPY on Wednesday of $595.75 to $609.75. The Call side continues to dominate within an expanding range, indicating a potential trend day on Wednesday, likely driven by the upcoming CPI release in the premarket. SPY managed a strong close above the $600 level after an early-session rejection, finishing the day up 0.57% amid optimism surrounding a potential trade truce with China. With CPI due tomorrow, a hotter-than-expected print could stall the rally, while a cooler reading may propel markets toward all-time highs, which are now less than 2% away. The bullish narrative remains intact as long as SPY holds above $585, barring any external catalyst that disrupts the current trend. Momentum is showing signs of slowing, but today’s close above $600 on solid volume reinforces our model’s slightly bullish outlook. It continues to favor a gradual grind higher, provided no material changes occur. A decisive close below $585 would meaningfully shift the short-term outlook. Key resistance is now at $604, $605, and $610, while support lies at $600, $595, and $590. SPY ended the day just above the lower bound of a steep, uncorrected bull channel that began in April. This current rate of ascent appears unsustainable, and any weakness could necessitate a redraw of the channel or mark the end of the rally altogether. Above $605, resistance thickens to $610 which could cap near-term upside. On the downside, support below $595 is beginning to erode. Without a fresh catalyst, SPY may revert to the broader $575–$595 range that has largely defined price action since May 13. If SPY holds above $600 on Wednesday, a move toward $605 and possibly $610 becomes increasingly likely. Conversely, a break below $600 could trigger a pullback toward $595 or $590, both key levels for maintaining the current bullish structure. Since April, market direction has been closely linked to macroeconomic data, bond yields, inflation readings, tariff developments, and fiscal policy updates, a trend that is likely to persist in the absence of major policy shifts. Meanwhile, the VIX slipped 1.22% to 16.95, well below the 23 threshold that typically signals a shift to risk-off sentiment. Any uptick in volatility could suggest rising investor unease and increase the potential for price instability if negative surprises emerge. Given the persistent uncertainty, traders are advised to stay nimble and responsive to data releases and headline risk as the week unfolds.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in an average-width Bullish Trending Market State, with SPY closing mid-range. Extended targets above printed sporadically throughout the session, first as SPY attempted and failed to break above the $601 level, and again on a second and third attempt. Overnight, the MSI rescaled lower into a ranging state, but by the open had shifted to a narrow-range bullish state, prompting another push at the $600 level. SPY pulled back to retest $599, causing the MSI to rescale to a ranging state, only to reverse again and develop a series of upward rescalings back into a bullish state. A subsequent failure at $602.50 triggered another rescaling to a ranging state, with SPY testing $600 once more before reversing sharply and rallying into the close. No extended targets printed at the close, suggesting a moderately bullish environment though one that may shift quickly depending on upcoming CPI data. On CPI days, we recommend trading what you see, as this type of data can rapidly alter the prevailing market dynamic. Currently, MSI support stands at $602.38 with resistance at $603.47.

Key Levels and Market Movements:

On Monday, we noted: “There is little expected to move the market on Tuesday. The most significant potential catalysts remain developments from the White House, the LA riots, and ongoing China tariff discussions.” We also stated: “Upward momentum remains intact, and dips continue to be bought. As long as SPY holds above $595 on Tuesday, the upside potential extends to $605.” Finally: “We continue to favor long setups, with key support down to $585. Tactical shorts may be considered above $602, but only if a breakout attempt fails.” With this plan in hand, we approached the open and with the MSI in a ranging state, we remained patient, looking for a long opportunity per our strategy. The MSI soon rescaled to a narrow bullish state, which we knew carried a 70% probability of reaching MSI resistance. However, with less than $1 of width and no extended targets printing, we passed on this scalp long. Instead, we waited to see if a mean reversion short would set up just above MSI resistance at $601.20. Sure enough, SPY printed a textbook failed breakout at 10:45 AM. However, extended targets were still printing, so we held off. By 10:50 AM, extended targets had ceased, and we entered a short at $601.50, targeting MSI support at $600.50. The drop came quickly. With T1 achieved, we set sights on T2 at $599.50, a premarket resistance level turned support. That target hit as well, and we moved our stop to breakeven. SPY then printed a textbook failed breakdown at $599.50. While we typically avoid trades in a ranging MSI, the index printed a one-bar bearish state without extended targets below. We exited our short trailer and entered a long, setting our first target at MSI resistance at $600.70. This hit quickly. As the MSI rescaled to a bullish state, we set T2 at $601.25. Another swift move hit our target, leaving us in a free trade with 10% of the position trailing. The MSI continued to rescale higher, with extended targets printing above. At 1:15 PM, SPY staged another textbook failed breakout at $602.65. Once extended targets stopped printing, we reversed short at $601.75. Given the narrow MSI ranges all day, we expected two-way action. With MSI support less than $1 away and no ideal level in play, we took a discretionary $1 profit for T1, the minimum we take for any trade. The MSI then rescaled to a wide ranging state, our least favorite to trade. However, statistics show a >50% chance of reaching the midpoint in this state, so we set T2 at $600.75. With a breakeven stop, we held, hoping the rejection at $602 would yield more. It didn’t. SPY printed an imperfect failed breakdown, and with three winning trades secured, we went into profit protection mode, closing our trailer and calling it a day. Later in the session, SPY rallied sharply on China-related news, but by 2 PM we were flat and not interested in risking gains. The MSI set up a strong long into the close, but with three solid trades already behind us, we stuck to our rule: don’t push when green. We generally only aim for one or two trades a day. Hitting three for three is a direct result of a clear, structured plan, disciplined execution, and the strategic use of the MSI for control, timing, and actionable levels. Integrated into our broader trading framework and model levels, the MSI remains indispensable for delivering consistent performance.

Trading Strategy Based on MSI:

With CPI looming, expect the market to move within a broader range than seen over the past few sessions. Developments from the White House, the LA riots, or ongoing China tariff discussions may also act as catalysts. In the event of a surprise, the best approach is to stay nimble and trade the market in front of you. Absent a major catalyst, SPY is likely to drift higher, consolidating or flagging slightly lower as it builds energy for a potential move to all-time highs. Upward momentum remains intact, and dips continue to be bought. As long as SPY holds above $600 on Wednesday, upside potential extends to $610. A break below $600, however, could bring $595 into play. Failure to hold that level may trigger a deeper pullback toward $585 or lower, marking a key inflection point that could shift control to the bears and reintroduce the $575–$595 range, where institutions have been actively hedged. Unless a breakdown occurs, the path of least resistance remains higher. A sustained move above $605 could open the door to new all-time highs. We continue to favor long setups, with key support extending down to $585. Tactical shorts may be considered above $605, but only if a breakout attempt fails and the MSI begins to weaken. As long as SPY remains above $585, long positions remain favorable. Failed breakdowns continue to offer high-quality long opportunities. Stay alert and responsive as these setups emerge. Avoid engaging during Ranging Market States and always align your strategy with the MSI. The MSI provides real-time insights into market control, momentum shifts, and actionable levels. When paired with our Pre-Market and Post-Market Reports, the MSI enhances execution precision and improves trade quality. If you haven’t yet integrated the MSI and model levels into your trading process, now is the time. Contact your representative to get started as these tools can significantly improve consistency and performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $604 to $615 and higher strike Calls implying the belief that the market may continue to move higher on Wednesday. The peak from this positioning appears to be $610 although $605 is likely to offer significant resistance. To the downside, Dealers are buying $603 to $550 and lower strike Puts in a 1:1 ratio to the Calls they’re selling. Dealer positioning has changed from neutral to bullish for Wednesday. This is a relatively new development which implies Dealers see all time highs as an increasingly likely probability.

Looking Ahead to Friday:

Dealers are selling $604 to $620 and higher strike Calls implying the belief that the market may continue to drift higher this week. The likely ceiling for the week is $610 but clearly Dealers are positioned for the rally to continue. To the downside, Dealers are buying $603 to $505 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a slightly bearish outlook for the week. Dealer positioning is unchanged from slightly bearish to slightly bearish. Dealer positioning hasn’t changed materially in several days which once again further reinforces a continuation of the current trend. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY continues to hold above key resistance, now turned support, at $600, with bullish momentum intact heading into Wednesday’s critical CPI release. Traders should favor long trades above $600, targeting $605 and $610 if momentum continues. Short trades can be considered below $600, with downside targets at $595 and $590. If SPY breaks out above $605 and then stalls, look for a tactical short with tight stops, but do not fight MSI extended targets. The VIX has dipped to 16.95, indicating low volatility, but any surprises from the CPI report could spark rapid shifts. Stay nimble, manage risk tightly, and be ready to adjust quickly. Be sure to review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!