Market Insights: Friday, May 9th, 2025

Market Overview

Markets ended the week on a softer note Friday, with traders cautiously awaiting high-stakes trade negotiations between the U.S. and China set for this weekend in Geneva. President Trump once again turned to social media to stoke trade optimism, teasing multiple new deals and suggesting tariffs on Chinese imports could be lowered to 80% from the current 145%, a shift that markets took as a sign of softening rhetoric. Despite the upbeat tone, the major indices couldn't hold onto Thursday’s momentum. The Dow dropped 0.3%, the S&P 500 slipped just below flat, and the Nasdaq finished unchanged, with all three posting weekly losses of less than 0.5%. Tesla stood out, jumping more than 4% and reaching its highest level since February on expectations for a third consecutive weekly gain. Bitcoin briefly topped $104,000 overnight before settling above $102,000. On the earnings front, Pinterest surged after issuing strong revenue guidance, pointing to resilience in ad spending, while Expedia fell short on revenue, citing softening U.S. travel demand. As Treasury Secretary Scott Bessent prepares to meet with Chinese officials, markets are likely to stay on edge awaiting updates that could set the tone for next week’s price action.

SPY Performance

SPY slipped 0.15% on Friday to close at $564.22, retreating modestly after Thursday’s surge. The ETF opened and closed at the same price, with both the high and low recorded at $562.76, signaling an exceptionally tight trading session. Volume came in well below average at just 33.45 million shares, reflecting a lack of conviction as traders held back ahead of the weekend’s trade talks. With SPY stuck just under the $565 resistance level, Friday’s price action reflected indecision rather than reversal.

Major Indices Performance

The Russell 2000 led the major indices with a 0.16% gain, while the Nasdaq closed flat. The S&P 500 edged slightly lower, and the Dow dropped 0.3%, reversing morning gains. The minor declines capped a week of modest losses across the board. Thursday’s rally had lifted hopes, but with no economic data Friday and eyes turning to geopolitics, markets drifted. Sector rotation continued with no clear leadership, though risk appetite remained intact in parts of the market.

Notable Stock Movements

Tesla surged over 4.7%, marking its highest close since February and locking in a third consecutive weekly gain. Among the rest of the Magnificent Seven, performance was mixed—Alphabet, Meta, Nvidia, and Netflix posted slight declines, while Amazon, Microsoft, and Apple closed higher. Tech sentiment remained generally constructive, with Tesla’s rally offering a bright spot in an otherwise muted session. The stock’s strength echoed growing confidence in EV demand and reflected the week’s broader trade optimism.

Commodity and Cryptocurrency Updates

Crude oil added 1.84% to close at $61.01, continuing its recent upward move as the dollar weakened. Despite the rally, our outlook remains bearish with an expectation of a pullback toward $50 where buyers are likely to reemerge. Gold rebounded 0.85% to $3,334 as traders took shelter ahead of the weekend. Bitcoin rose 0.72%, closing just above $103,300 after briefly topping $104,000 overnight. Our strategy remains to buy dips in Bitcoin between $83,000 and $77,000, with profit targets above $85,000. We remain cautious below $77,000 due to the risk of accelerated downside.

Treasury Yield Information

The 10-year Treasury yield rose 0.27%, closing at 4.393%, inching closer to the 4.5% threshold that typically pressures equities. Market participants remain wary of further increases, with 4.8% seen as a potential tipping point and 5.2% as the danger zone where a 20% market correction could materialize. For now, yields continue to drift upward, and equities remain sensitive to even incremental shifts in rate expectations.

Previous Day’s Forecast Analysis

Thursday’s model called for a trading range of $560 to $571 with a bullish bias. The key level to watch was $565, which served as a pivot, and the analysis favored long trades above $562. Expected resistance targets were $567, $570, and $575, with downside support marked at $560, $558, and $555. The framework leaned toward upward movement as long as SPY held above support, while warning of potential profit-taking if price failed at the higher levels. The market was forecast to be call-dominated with room for either continuation or consolidation.

Market Performance vs. Forecast

Friday’s SPY performance closely mirrored expectations of a consolidation day. SPY hovered right around the $564 mark, respecting the key $560 support zone but failing to challenge the $565 pivot with strength. Price remained within the model’s projected range, with neither a breakout above resistance nor a breakdown below support. The lack of volume confirmed traders were sidelined, awaiting further clarity. While the session lacked momentum, it validated the model’s call for a subdued day, providing clear boundaries and low-risk opportunities for intraday traders near key levels.

Premarket Analysis Summary

In Friday’s premarket analysis posted at 8:08 AM, SPY was quoted at $566.29 with the model identifying $566.75 as the bias level. Resistance above that was bunched tightly at $568.25 and $570, suggesting strong overhead supply. Downside levels were noted at $564.75, $560.25, and $557. The analysis warned of congestion and advised caution, favoring short entries if SPY dipped below $564.75. Long trades were only recommended on sustained strength above the bias level, with an upper target of $575 deemed a stretch without a catalyst.

Validation of the Analysis

The market followed the premarket blueprint with remarkable accuracy. SPY never made a serious attempt to break the $566.75 bias level, confirming the model’s expectation that momentum would be capped without a catalyst. The ETF hovered around $564.22, and with volume well below average, price action remained muted. The model’s focus on congestion, cautious positioning, and rangebound dynamics proved reliable, helping traders manage expectations and avoid false setups. Once again, the premarket levels provided a high-value roadmap that helped frame the day’s action with precision.

Looking Ahead

Monday brings no scheduled economic data, offering a calm before the storm as markets await Tuesday’s CPI report and Thursday’s PPI, Retail Sales, and Powell’s remarks. Walmart earnings and fresh jobless claims could also move the tape later in the week. Until then, traders will likely focus on the outcome of this weekend’s U.S.-China trade talks. Any news from Geneva could trigger sharp moves at the open, so preparation is key. Expect volatility to return by midweek as macro headlines take center stage.

Market Sentiment and Key Levels

SPY closed at $564.22, just under the critical $565 pivot, which continues to act as both resistance and sentiment gauge. Bulls still hold the edge but are losing momentum as the market stalls beneath $567. Key resistance remains at $567, $570, and $575, while support has firmed at $560, $557, and $555. A confirmed move above $567 could launch a test of the 200-day moving average near $572. However, failure to hold $560 would invite renewed selling down to $555. Sentiment remains cautiously bullish, but conviction is fading as traders wait for fresh macro cues.

Expected Price Action

Our AI model projects a trading range of $560 to $570 for Monday, with a continued bullish bias despite waning momentum. This is actionable intelligence. A sustained push above $565 would favor upside toward $570 and $572. If SPY breaks through $572, bulls could attempt a run toward $575. Conversely, a failure to reclaim the $565 pivot would open the door to downside tests of $560 and $557. The current range suggests a potentially choppy session unless headlines from the weekend provide directional fuel. Watch price reaction closely at key inflection points to determine whether a breakout or breakdown is taking shape.

Trading Strategy

SPY remains rangebound, with actionable setups emerging at major levels. Long trades are favored above $560, with targets at $565, $568, and $570. If SPY reclaims $567 with strength, breakout longs toward $572 and $575 are valid, though stops should be tightened as SPY nears resistance. On the short side, entries below $560 targeting $557 and $555 remain viable, especially if the market fails to regain the $565 zone early, while failed breakouts above $565 are also attractive. The VIX closed at 21.90, still below the 23 pivot, indicating slightly easing volatility. In this environment, stay tactical with tight stops, favor high-probability levels, and reduce size until the market chooses a clearer direction.

Model’s Projected Range

The model’s maximum projected range for Monday is $553.50 to $575.75, with the Call side dominating in an expanding range suggesting further consolidation with periods of trending behavior. There is no significant economic news scheduled for Monday. Following Thursday’s strong rally and the late-day sell-off, the market continued to consolidate around the critical $565 pivot level, a zone that has taken on increased importance over the past week. This was in line with our expectations, as noted yesterday: “we anticipate a relatively quiet session on Friday.” Although the projected trading range has expanded slightly, SPY remains confined within a well-defined zone, indicating continued sideways pressure rather than a clear continuation of the recent bullish trend. For several sessions, we’ve noted that as SPY approaches the $565–$585 area, institutional traders are likely to reduce exposure and initiate protective strategies to lock in recent gains. While a move toward the 200-day moving average remains likely, that level continues to act as a significant hurdle for bulls. The bullish case remains intact unless SPY begins to test key support levels lower down. A confirmed close above $585 would indicate the bulls have reclaimed the broader uptrend, while a break below $545 could trigger a move toward $535. Should that level give way, a gap-fill move toward $530 becomes more probable, shifting momentum back in favor of the bears. Key technical levels to watch on Monday include resistance at $568, $570, $572, and $575, and support at $560, $557, $555, and $550. Resistance between $568 and $575 remains firm, while support below $560 has begun to build. This support was weakening throughout the week, but it now appears the bulls are attempting to confine price action within a tight $560–$570 range on Monday. Looking ahead, over the next 60 days, macroeconomic factors such as tariffs, bond yields, and inflation are expected to remain dominant drivers, barring clearer policy direction from the White House. The VIX closed slightly lower at 21.90, just below its 23 pivot. Moves above that level tend to pressure equities, while dips below often support them. With SPY settling at $564, bulls will likely attempt to push toward $570 on Monday, though a breakout above that level will likely require an external catalyst. If $560 fails, a test of $555 becomes probable. A sustained break below that could give the bears enough traction to challenge deeper support levels as May progresses. SPY is currently trading within a steep, newly formed bullish trend channel that began at the April lows. This channel may be too steep to sustain, and we anticipate it will flatten as price either consolidates or pulls back to retest prior levels. Momentum still favors the bulls, but in such a volatile environment, it remains critical to stay nimble and ready for sudden shifts in sentiment.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a narrow Ranging Market State, with SPY closing near the midpoint of the range. From the overnight session into the open, the MSI remained in a Bullish Trending Market State, though price action was confined to a tight range, reaching as high as $568. Shortly after the open, SPY sold off, prompting the MSI to rescale into a Ranging Market State, which persisted for most of the session. While there were brief transitions between all three market states, the overall price range remained narrow, fluctuating mostly between $563 and $565. No extended targets printed after the open, and volume was notably low, with market participants appearing to adopt a wait-and-see approach before committing capital. Given the current MSI state, further consolidation and choppy trading are likely on Monday. Current MSI resistance is at $565.03, with support at $563.75.

Key Levels and Market Movements:

On Thursday, we noted: “the absence of extended targets above signals a weakening of the current uptrend.” We also stated, “We expect SPY to trade between $560 and $570,” and highlighted that “as price enters the $565–$570 zone, increased hedging activity may act as a drag on further upside.” Armed with this actionable intelligence, we entered Friday’s session prepared. At the open, price struggled to hold above $567 and formed a head and shoulders pattern with premarket price action. As soon as extended targets stopped printing, we initiated a short position from the premarket resistance level of $566.75. Our first target was set at MSI resistance turned support at $565.50, consistent with our rule to never take less than $1 on a first target. SPY reached that level quickly, and we then targeted lower MSI support at $563.25. That target hit soon after, allowing us to lock in another 20% of our position. With 90% of our position booked, we moved our stop on the remaining 10% to breakeven to see if further downside would develop. However, a failed breakdown at MSI support of $563.12 and the absence of extended targets below prompted a quick reversal. Recognizing the narrow bearish MSI and likelihood of a ranging session, we exited the short and flipped long. We set our initial long target at $564.75, just below MSI resistance and within our minimum reward parameters. By 11:00 a.m., we had secured profits on 70% of the position. Our next target was $565.60, a key MSI resistance level and the level which has served as a major pivot all week. As the market began to chop and the MSI rescaled to a ranging state, never our favorite, we moved our stop to breakeven to eliminate risk and held for the second target. That hit just before noon. With SPY exhibiting a narrow range, no extended targets, and cycling through all three MSI states in the morning alone, we decided to exit the final 10% of our position just below resistance and called it a day. Two trades, both wrapped up by noon on a Friday, capping off a solid week without any losses. Given how tight SPY traded all week, we couldn’t ask for more. Once again, our success was driven by disciplined execution, a clear plan, and precision from the MSI. The MSI consistently reveals who’s in control, when control shifts, and where actionable levels lie, enabling sharp entries and timely exits. Paired with our structured framework, it keeps us aligned with dominant market forces and helps avoid traps, stay in sync with momentum, and capture profits confidently. We continue to strongly recommend integrating the MSI into your trading process. When combined with a clear, structured plan, it becomes a powerful engine for long-term performance.

Trading Strategy Based on MSI:

Monday brings no major economic news, so SPY is likely to remain rangebound. The MSI is currently in a narrow Ranging Market State, implying a degree of confusion and uncertainty heading into the new week. Our models suggest SPY will likely trade between $560 and $570 as it builds momentum for a potential breakout toward the 200-day moving average (200 DMA). As long as $560 holds, the bulls will continue to push for a move above $565 to gain traction. As we've stated all week, once price enters the $565–$570 zone, increased hedging activity may act as a drag on further upside. Bulls still control the tape, but bears are watching closely for a break below $555, which could open the door for a test of $550. That said, any sustained bearish momentum would require a break below $545. Until then, failed breakdowns below $560 and failed breakouts above $565 present the most profitable setups. This backdrop supports a two-way trading environment with opportunities on both sides. A confirmed break below $545 would likely target $535, with a potential gap-fill move toward $525. Conversely, if bulls can reclaim and hold above $570, a push toward the 200 DMA at $573 becomes more likely. Given the significance of that level, expect more of a gradual grind rather than a sharp rally. Above $585, bulls would clearly reassert control, likely targeting new highs. For Monday, look for two-way trading opportunities from the edges. Avoid trading during periods when the MSI is in a Ranging State, and, as always, trade what’s in front of you. The MSI continues to prove invaluable in this type of environment, offering real-time insight into structural shifts and momentum. When paired with levels from the Premarket Report, it highlights high-probability targets and clean entry points, helping traders stay aligned with dominant flows and avoid costly missteps. If you’re not yet using the MSI and model levels, now is the time. Reach out to your rep as these tools can make a real difference in your trading.

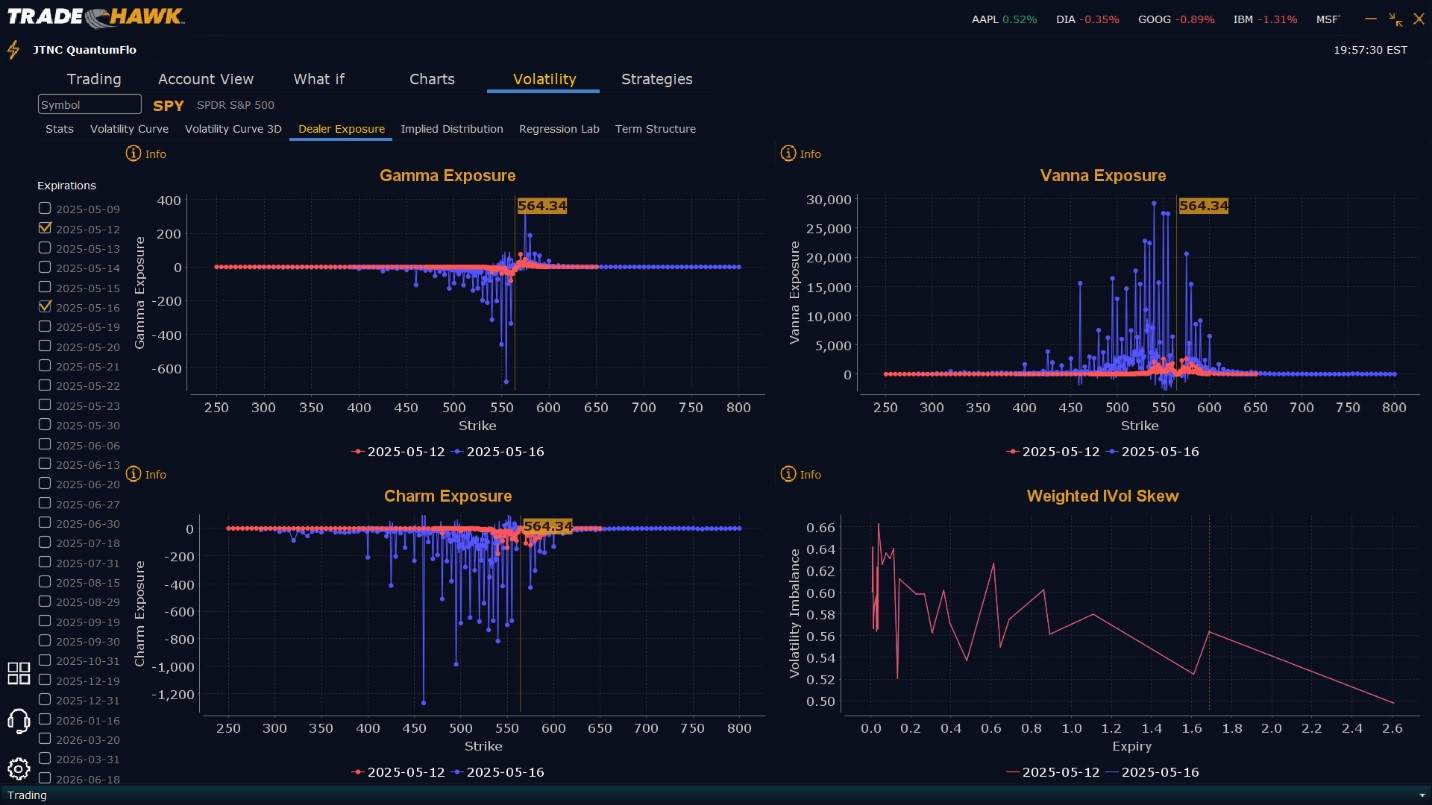

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling $565 to $600 and higher strike Calls in size implying a likely tight trading range on Monday. The upside appears limited to $570 for Monday. To the downside Dealers are buying $564 to $500 and lower strike Puts in a 2:1 ratio to the Calls they are selling, implying a neutral posture for Monday. Dealer positioning has changed from slightly bearish to neutral. Dealers seem ready for the market to move both higher toward $570 or drop to $550.

Looking Ahead to Next Friday:

Dealers are selling $565 to $610 and higher strike Calls while also selling $551 to $564 Puts indicating the Dealer’s belief that the market is likely to remain in a tight range next week with little movement either way. Dealers do not sell near the money Puts without confidence that prices will remain above a specific threshold. Dealers also appear to believe the peak for SPY for next week is $575. To the downside, Dealers are buying $550 to $460 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a slightly bearish outlook for next week. Dealers are heavily protected should $550 fail but are also open to prices reaching $575 next week. Dealer positioning has changed from bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY’s close just below $565 keeps it on the edge of a major inflection zone. Long setups remain valid above $560, with upside targets at $565 and $570. Short trades may develop below both $560, with downside targets at $557 and $555 and above $565 on failed breakouts. The VIX remains just under 22, suggesting a cautious but tradable environment. Use tight stops near resistance and remain patient for clean setups. Monday may be quiet early but could turn volatile fast depending on weekend developments. Always review the premarket analysis before 9 AM ET for updates to model levels and Dealer Positioning.

Good luck and good trading!