Market Insights: Friday, May 30th, 2025

Market Overview

Friday’s session was marked by an early pop and a mid-session fade, reflecting the market’s confused tone amid conflicting headlines and economic crosscurrents. The day started with optimism as markets briefly rallied on news that the President lacked the authority to enforce permanent tariffs, an initial boost that was quickly tempered by lingering uncertainty and weak follow-through. Core PCE data, released premarket, failed to energize the tape meaningfully. Though the reading was slightly softer than expected, traders appeared cautious, treating the report as a mixed bag rather than a green light for risk-on behavior. Price action revealed a market stuck between macro fatigue and headline sensitivity, with SPY fading throughout the day after a muted open, even as it managed to avoid breaching key downside levels. The broader story remains one of hesitation, not capitulation, with equities still leaning bullish but increasingly fatigued. Under the surface, sector rotation continues, with cyclical and tech names taking turns leading and lagging. Traders were left grappling with a market searching for direction while eyeing the week ahead packed with economic events and Powell’s speech. Friday’s tape reinforced a theme we’ve seen all week: without a decisive catalyst, the market continues to chop sideways, trapped in a range as bulls and bears battle for short-term control.

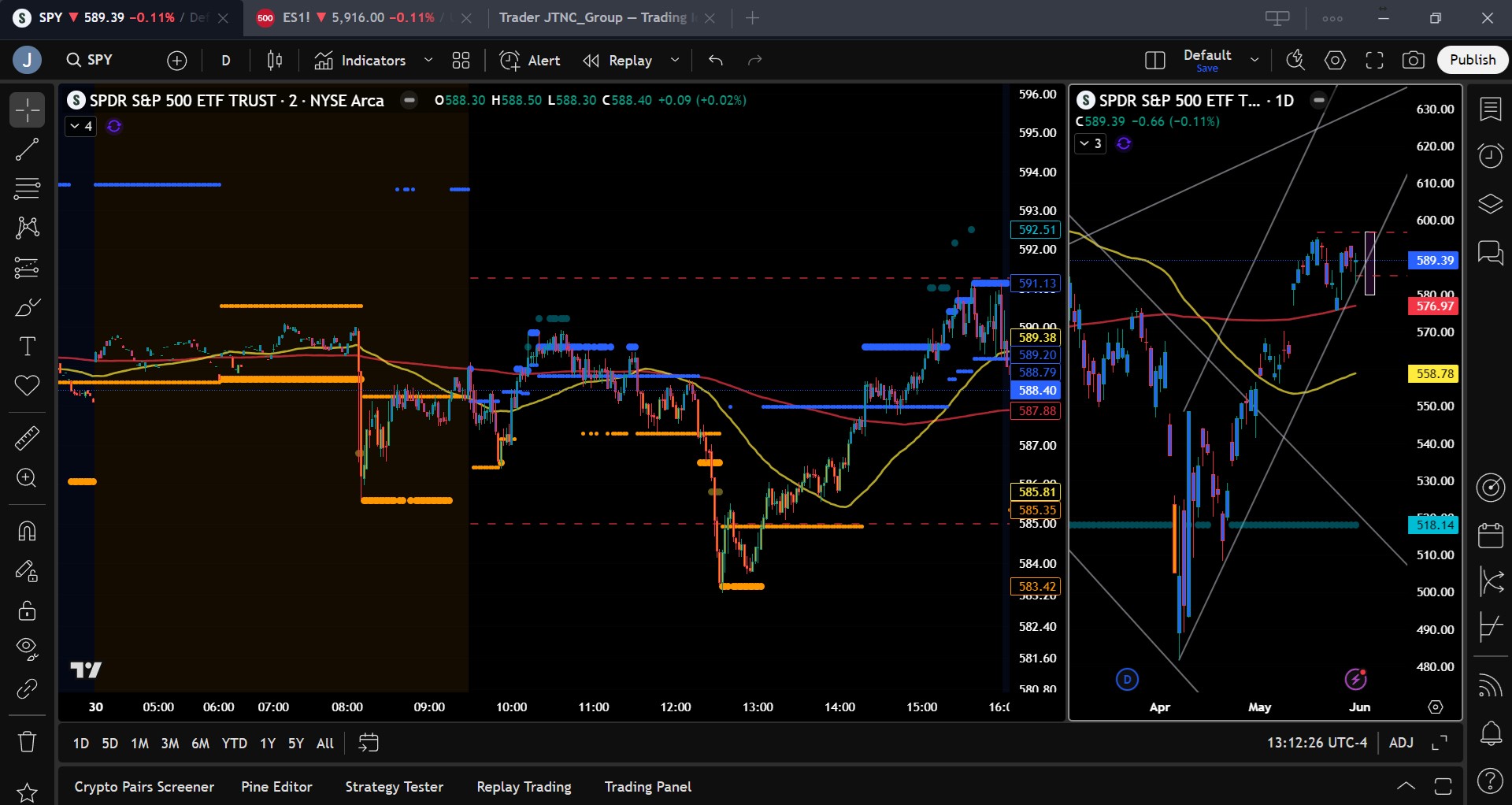

SPY Performance

SPY dipped 0.11% on Friday, closing at $589.39 after opening at $593.06. It briefly rallied to an intraday high of $591.13 before selling off sharply into the afternoon and hitting a low of $583.24. Volume surged to 82.12 million shares, well above average, pointing to active positioning around the PCE release and ahead of next week’s heavy data calendar. While the decline was modest, the session reinforced growing signs of indecision as SPY failed to hold the gains seen earlier in the week. Importantly, it held above the critical $585 support level into the close, leaving the broader bullish trend intact though cracks are beginning to form as momentum fades.

Major Indices Performance

The Dow led the way with a gain of 0.13%, continuing its recent trend of resilience amid broader market chop. The S&P 500 tracked closely with SPY, ending down 0.11%, while the Nasdaq lost 0.32%, dragged lower by weakness in large-cap tech. The Russell 2000 underperformed, falling 0.46%, extending its struggles amid concerns over interest rates and economic growth. Sector performance was mixed, with defensive names stabilizing and tech seeing selective profit-taking. Friday’s Core PCE data was expected to offer clarity but instead added to the noise. While not hot enough to spark fear, it wasn’t soft enough to shift the Fed’s stance leaving markets in a wait-and-see mode ahead of next week’s key jobs data and Powell’s comments.

Notable Stock Movements

It was another split tape for the Magnificent Seven. Microsoft, Meta, Apple, and Netflix all managed modest gains, providing some lift to the broader market. Nvidia and Tesla, however, saw steep declines of over 2.92%, weighing on tech sentiment and dragging down the Nasdaq. Nvidia’s drop came after a multi-session rally, suggesting profit-taking as traders repositioned ahead of more data. The mixed performance continues to highlight the fragility of market leadership, with rotations within the group offering little conviction. With no clear driver emerging from tech, the broader market was left rudderless, underscoring the ongoing consolidation phase.

Commodity and Cryptocurrency Updates

Crude oil edged lower by 0.25% to settle at $60.79, continuing its slow descent toward our long-held target of $50. Though a short-term bounce remains possible if the dollar weakens, we believe rising rates will ultimately support the greenback and cap any upside in oil. Gold dropped 0.85% to $3,330, reversing Thursday’s gains as safe-haven flows dried up in the absence of a new geopolitical or policy shock. Bitcoin fell 1.50% to close just above $104,000, continuing its correction from recent highs. Our outlook remains bullish between $83,000 and $77,000, but we caution against buying below $77,000, where downside risk significantly increases.

Treasury Yield Information

The 10-year Treasury yield slipped 0.47% to 4.403%, continuing to retreat from the key 4.5% level. This drop offered some support to equities early in the day, but the move wasn’t enough to spark sustained upside. The market remains highly sensitive to any move back toward 4.5%, with 4.8% marking a threshold that would likely trigger a broader sell-off. For now, yields are stable enough to allow for bullish setups, but the bond market’s next move will likely hinge on next week’s data barrage, starting with Monday’s PMI report and Powell’s speech.

Previous Day’s Forecast Analysis

Thursday’s forecast anticipated a potential range between $579.25 and $596.25 with a bullish bias above $585. It flagged $592 and $595 as upside resistance and identified $585 as a key support level below which downside targets at $582 and $580 came into focus. The strategy leaned long above $585, favoring pullback buys, while cautioning against shorts unless the market failed at resistance. The outlook acknowledged ongoing volatility and called for a choppy, two-way tape with trending potential emerging later in the day depending on PCE data and headline risk.

Market Performance vs. Forecast

Friday’s action followed the forecasted playbook closely. SPY opened at $593.06 and made an early attempt to push higher, reaching $591.13 before fading throughout the day. The decline brought SPY down to a low of $583.24 just below the $585 pivot before a late-session recovery helped it close at $589.39. While the close below $590 reflected soft momentum, SPY managed to avoid a full breakdown. The forecasted support at $585 briefly failed but was ultimately respected by the close, validating the model’s reliability. Traders who shorted into resistance near $591 or bought near $583 were rewarded with solid risk-adjusted gains. The forecast effectively mapped the session’s key moves, including the weakness beneath $589 and the consolidation around $585.

Premarket Analysis Summary

In Friday’s premarket analysis posted at 8:19 AM, SPY was trading at $586.77 with a bias level set at $589. The analysis warned that the market would remain choppy and uncertain if it failed to reclaim $589 early in the session. Upside targets were $589, $591.25, and a possible extension to $595, though the tone leaned cautious. Below, support was identified at $585 and $580. The premarket note advised traders to expect two-way action with early weakness likely unless buyers stepped in above $589, and it suggested fading rallies unless accompanied by strength.

Validation of the Analysis

Friday’s session validated the premarket analysis with notable precision. SPY failed to hold above the $589 bias early, and despite a brief morning rally, it spent most of the session trending downward demonstrating the expected chop and weakness in the midrange. SPY found support at $583.24, just below the $585 level, before bouncing modestly into the close. The analysis flagged this weakness and clearly outlined the path to $580 if $585 failed. While SPY didn’t reach that lower target, it came close enough to confirm the bearish risk. The upside levels of $589 and $591.25 were tested but not decisively broken. Traders who followed the premarket script were able to trade the fade from resistance and fade weakness with well-defined levels, underscoring the strength of the forecast.

Looking Ahead

Next week brings a stacked economic calendar, beginning Monday with the Manufacturing PMI and a speech from Fed Chair Jerome Powell. These events are expected to set the tone for a week filled with labor market data, culminating in Friday’s closely watched jobs report. Markets will be looking for signs of softening inflation and labor conditions to support the Fed’s cautious stance. Any surprises could trigger sharp moves in both equities and yields. With SPY hovering just above critical support, traders should expect a volatile week that may finally break the market out of its current range.

Market Sentiment and Key Levels

SPY ended Friday at $589.39, holding above the $585 support level but still within its broader range of consolidation. Market sentiment remains cautiously bullish, though momentum has clearly weakened. Resistance sits at $592, $595, and $600, while support holds at $585, $580, and $575. The battle between bulls and bears continues to center around the $585–$595 zone. A push above $595 could open the door to a run at all-time highs, while a break below $585 might trigger increased downside pressure into the $570s. With next week’s data likely to shape sentiment, traders should watch these levels closely.

Expected Price Action

Our AI model projects a trading range between $583 and $595 for Monday. This range reflects ongoing volatility and the potential for periods of trending behavior following a week of consolidation. The bias remains modestly bullish as long as SPY holds above $585 although momentum appears to be weakening. A move above $592 could lead to $595 and possibly $597 if momentum regains its footing. Conversely, a break below $585 would put $583 and $580 back on the table. This is actionable intelligence: expect initial choppiness, with directional clarity emerging after Powell’s speech or early economic data surprises.

Trading Strategy

Traders should continue to lean long above $583, with upside targets at $590 and $592. If SPY breaks through $595, $597 becomes the next level to watch. Short trades can be initiated on failed breakouts near $593 or if SPY breaks and holds below $585, targeting $582 and $580. As volatility increases with upcoming data, tighten stops into resistance and avoid chasing momentum. The VIX ticked lower to 18.57, reflecting a relatively calm backdrop, but traders should remain alert for headline-driven moves. Keep size in check and focus on clean setups around key levels.

Model’s Projected Range

The model’s maximum projected range for Monday is $580 to $597, with the Call side dominating in a slightly narrowing band suggesting choppy price action punctuated by brief trending moves. Manufacturing PMI data is set for release in the premarket, with Fed Chair Powell scheduled to speak at 10 a.m. ET. Both events could modestly influence market direction. No other major headlines are expected, although the risk of surprise developments from the White House remains ever-present. Today, markets traded within a range, briefly breaking the prior day’s low before recovering to finish the session relatively flat. Tariff concerns have resurfaced, adding to overall uncertainty. Despite this, bulls retain the upper hand, with SPY closing above $585. That said, dips below this level are awakening bearish sentiment. Momentum has softened, yet our model continues to suggest elevated odds of a retest of this week’s highs near $598.50 before any meaningful pullback. A breakout to new all-time highs remains on the table. Key resistance levels are now $592, $595, and $600, while support levels are seen at $586, $580, and $576. SPY is currently hovering just above the lower bound of its bullish trend channel, which appears increasingly unsustainable. This suggests a redrawing of the channel to reflect a shallower uptrend. Above $592, resistance is building, potentially capping further gains early next week. Additional resistance is also forming above $600. Conversely, firm support is developing below $585, extending down to $575, indicating that SPY may remain range-bound between $575 and $595 until a catalyst sparks a breakout. If $585 holds on Monday, a move toward $593–$595 is likely. A break below $585, however, could trigger a sharper pullback and reignite bearish momentum. The $565–$585 zone remains a critical battleground, with institutions actively trimming exposure and adding downside protection. Trading volume was elevated today, highlighting the ongoing tug-of-war between bulls and bears and reinforcing the market’s range-bound behavior. Since early April, market direction has been heavily influenced by macroeconomic data, bond yields, inflation trends, tariffs, and fiscal policy, a pattern likely to continue absent a significant policy shift. The VIX declined 3.18% to 18.57, remaining comfortably below the key 23 threshold, a level typically associated with supportive conditions for equities. Given persistent volatility and macro uncertainty, traders should remain nimble and attentive to evolving market dynamics in the days ahead.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a narrow Bullish Trending Market State with SPY closing at MSI support. There are no extended targets printing as of the close. Overnight the market moved sideways so by the open, SPY was virtually unchanged with the MSI in a wide-ranging state. The MSI moved through all three states during the day but each time the MSI rescaled, the ranges were narrow with only brief moments of extended targets. As such SPY did little to break this cycle all day. After breaking the prior day’s lows, the MSI began a series of rescalings higher which supported the rally off the day’s lows into the close. This type of behavior indicates more of the same is probable on Monday without an external catalyst to move the needle. A narrow range MSI at the close will likely rescale Monday. Currently MSI support stands at $589.20 with resistance at $591.13.

Key Levels and Market Movements:

On Thursday, we noted: “We expect the range-bound environment to persist, with a potential retest of today’s lows and a possible rally toward $593.” We also stated, “Upward momentum is likely to continue, and dips will likely be bought,” and finally, “We continue to favor long setups on pullbacks to as low as $585”. With this actionable plan in hand, SPY opened Friday virtually unchanged from the prior day’s close with the MSI in a Ranging Market State. We opted to sit on our hands at the open, as we generally avoid initiating trades in a ranging MSI. Shortly before 10 a.m., the MSI rescaled lower and set up a less-than-ideal failed breakdown. While not our favorite setup, there were no extended targets below, so we stuck to our plan and entered long at 9:52 a.m. at $587. Our first target was MSI resistance at $588.35. Price reached this level quickly, and we set our sights on T2 at the next MSI resistance level of $589. The MSI cooperated, rescaling higher and briefly printing extended targets above. With 90% of our position off with a profit, we shifted to protection mode, moving our stop to breakeven and trailing the remaining 10% of our position. Another MSI rescale higher, then lower followed, remaining within a bullish state. We didn’t love the lower rescale, especially with extended targets printing only sporadically, so we exited just above T2 and waited for a cleaner setup. We weren’t looking for shorts at this level, so we simply waited for the MSI to give us a clearer signal. SPY began drifting lower, but with the MSI reverting to a ranging state, we remained on the sidelines. The MSI then shifted into a very narrow bearish state around $587.25, tempting us to consider a short. We knew the odds of hitting MSI support in this state were close to 70%, but with less than $1 of range in the trade, we passed. The MSI soon rescaled to a wider bearish state but price was now at major support near $585, so again, we did nothing. Then, our favorite setup materialized: a textbook failed breakdown at $583.50. We waited for a reclaim of $585 per our plan, and entered long just below $585, placing a stop below the day’s low. Price briefly pulled back, and we feared it might be a losing trade. But support held, and the MSI rescaled to a ranging state. With no clear T1 from the premarket levels before MSI resistance, we set our first target at MSI resistance at $588 and waited. SPY cooperated, and we hit T1 just after 2 p.m. At that point, the MSI shifted into a bullish state. With a solid gain on the first target, we moved our stop to breakeven and set T2 at MSI resistance at $589.50. That level was reached just after 3 p.m., and we trailed the final 10% of our position. A couple more rescalings higher and a textbook failed breakout late in the session prompted us to exit the remainder of our long at $591, a strong finish and a great way to cap off a week with zero losing trades. This session once again highlighted the value of having a well-defined plan and sticking to it. The MSI offered clear insight into market control, timing shifts, and actionable levels that enabled precise entries and disciplined exits. Combined with our structured trading process and model levels, the MSI continues to be an indispensable tool for consistency and performance.

Trading Strategy Based on MSI:

PMI data and comments from Powell may influence market sentiment on Monday, but any impact is unlikely to be long-lasting unless a significant surprise emerges. Ongoing tariff-related headlines from the White House continue to pose a risk to market stability. Should developments arise, the best course of action remains to trade the market in front of you. In the absence of a major external catalyst, we expect a continuation of the current range-bound environment, with a potential retest of today’s lows followed by a possible rally toward $595. Upward momentum appears intact, and dips are likely to be bought. As long as $585 holds, Monday’s upside potential extends to $597. If $585 breaks, $583 becomes the next key support. A failure there could open the door to a decline toward $580 or lower. Such a move would mark a key inflection point, potentially shifting control back to the bears and bringing the $565–$585 zone into play, an area where institutional participants have been actively hedging long exposure. Barring such a breakdown, the path of least resistance remains to the upside. A sustained move above March’s highs could set the stage for a push to new all-time highs. We continue to favor long setups on pullbacks, with support extending down to $583. Tactical shorts may be considered above $592, but only in the event of a failed breakout accompanied by a weakening MSI. Currently, the MSI remains in a narrow bullish configuration, likely to recalibrate in the premarket. With sideways price action expected to persist, two-way trading opportunities remain. However, with bulls in control above $585, long positions remain favorable. A sustained move below that level could bring renewed bearish pressure. Failed breakdowns continue to offer high-quality long entries, so remain alert and ready to act when these setups present themselves. As always, align your strategy with the MSI and avoid trading during Ranging Market States. Stay disciplined and responsive to shifts in momentum and structure. The MSI provides real-time insight into both and, when used alongside our Pre-Market and Post-Market Reports, helps surface high-probability setups with greater precision. These tools keep you aligned with the tape and help mitigate costly errors. If you haven’t yet integrated the MSI and model levels into your trading process, now is the time. Contact your representative to get started as these tools can make a meaningful difference in your consistency and performance.

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $594 to $605 and higher strike Calls while buying $590 to $593 Calls indicating the Dealers desire to participate in any rally on Monday to $594 or higher. Dealers are positioned for prices not to move beyond $600 On Monday with a likely peak at $595. To the downside, Dealers are buying $589 to $553 and lower strike Puts in a 2:1 ratio compared to the Calls they’re selling/buying. Dealer positioning has changed from bearish to neutral for Monday.

Looking Ahead to Next Friday:

Dealers are selling $590 to $615 and higher strike Calls implying a likely ceiling in the market for next week of $600. Dealers are positioned for a rally to this level but not beyond. To the downside, Dealers are buying $589 to $520 and lower strike Puts in a 3:1 ratio to the Calls they’re selling, reflecting a slightly bearish outlook for next week. Dealer positioning has changed from bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY continues to hold above the critical $585 level despite choppy price action and increased volume, signaling underlying resilience even as momentum fades. Long setups remain preferred above $583, with initial upside targets at $590 and $592. A break above $595 could spark a push toward $597 and potentially retest the week’s highs near $598.50. On the downside, if SPY loses $585, watch for support at $583 and $580, where institutional buyers may step in. Short trades are viable below $5855 but must be managed tightly given the broader bullish structure. The VIX closed at 18.57, reflecting a relatively calm market, but traders should be on guard for volatility spikes tied to next week’s data. Review the premarket analysis posted before 9 AM ET to account for any changes in the model’s outlook and in Dealer Positioning.

Good luck and good trading!