Market Insights: Tuesday, May 13th, 2025

Market Overview

Markets extended their rally Tuesday as cooler-than-expected inflation data and improving trade sentiment kept buyers in control. After the S&P 500 closed at a new 2025 high on Monday, futures held steady overnight before Tuesday’s open, with modest gains in the Dow while the S&P 500 and Nasdaq futures traded flat. The rally gained traction during the session, powered by chipmaker Nvidia, which surged after news of a potential overhaul in chip regulations and a new partnership with Saudi Arabia. Sentiment continued to improve following President Trump’s 90-day tariff truce with China, reinforcing hopes of de-escalation in the ongoing trade battle. The April CPI report, which showed consumer prices increasing at their slowest pace since 2021, further boosted confidence that inflationary pressures may be abating, at least temporarily. President Trump seized on the data to renew his call for the Federal Reserve to cut interest rates, criticizing Chair Jerome Powell and demanding immediate action. However, analysts remain cautious, noting that the effects of tariffs may not yet be visible in economic readings. Meanwhile, earnings season remains overshadowed by macro developments, with American Eagle withdrawing guidance due to ongoing uncertainty, sending its shares sharply lower after hours. Looking ahead, earnings from Sony, Coreweave, and Cisco are set for release Wednesday and could offer additional signals on sector health and corporate sentiment.

SPY Performance

SPY added 0.65% to close at $586.79 on Tuesday, continuing its upward momentum following Monday’s explosive rally. The ETF opened at $583.41 and reached a high of $589.08 before dipping modestly into the close. Despite the gain, volume dropped to just 61.91 million shares, well below average, suggesting reduced participation ahead of Thursday’s key PPI report. SPY held firmly above the $585 level most of the session, reinforcing its bullish posture and strengthening the case for an eventual test of the March highs near $597.

Major Indices Performance

The Nasdaq led major benchmarks with a 1.61% surge, extending its recent dominance as tech stocks rallied behind Nvidia. The Russell 2000 gained 0.42%, continuing its rebound off April lows. The S&P 500 followed with a modest 0.65% gain, while the Dow slipped 0.64%, weighed down by underperformance in industrial and defensive names. Tuesday’s action reflected a market still focused on growth-oriented sectors, with investors continuing to favor tech over cyclical and value names. April’s CPI report was the primary driver of gains, helping calm fears of sticky inflation and reinforcing expectations that rate cuts, while not imminent, remain on the horizon.

Notable Stock Movements

Nvidia led the Magnificent Seven with a powerful 5.63% gain after announcing a chip regulation overhaul and fresh international partnership, reaffirming its leadership in AI. Tesla, Meta, Netflix, and Amazon all posted solid advances, contributing to the day’s tech-fueled rally. Apple also participated in the upside. Microsoft was the only notable laggard, slipping just 0.03%, as investors rotated out of defensive mega-cap names and into more cyclical growth opportunities. The strong showing in tech highlights renewed enthusiasm for innovation-driven names amid easing inflation concerns.

Commodity and Cryptocurrency Updates

Crude oil rallied 2.7% to $66.62, bucking recent weakness and extending a bounce from oversold conditions. While near-term upside is possible if the dollar continues to decline, we expect oil to resume its downtrend toward $60 and potentially as low as $50, where our model favors aggressive accumulation. Gold remained under pressure, falling another 3.11% to $3,239, as investors continue to unwind safe haven trades. Bitcoin dropped 1.94% to close just above $102,200. We remain long-only buyers between $83,000 and $77,000, targeting exits above $85,000. No new positions should be initiated under $77,000 due to high downside risk.

Treasury Yield Information

The 10-year Treasury yield ticked up 0.47% to close at 4.478%, holding just under the critical 4.5% level. While the slight rise in yields suggests growing confidence in the economic outlook, any break above 4.5% could cap equity upside. A move toward 4.8% or beyond would likely pressure stocks significantly. For now, the bond market remains a neutral to mild headwind, but traders should stay alert as inflation reports later this week could drive yields higher and spark volatility.

Previous Day’s Forecast Analysis

Monday’s forecast outlined a bullish scenario for SPY, calling for a trading range of $578 to $590 with a clear upward bias following the strong rally from the China tariff news. The model emphasized a long bias above $575, with resistance targets at $585 and $590. It noted that if SPY reclaimed $585, a push to March highs near $597 was likely. Support levels were defined at $580 and $575, with a caution that any break below $570 could shift sentiment. The trading plan favored long setups from support zones and warned of potential volatility around CPI data, though with an overall bullish lean.

Market Performance vs. Forecast

Tuesday’s market action aligned well with the previous forecast. SPY opened at $583.41 and reached a high of $589.08, falling just short of the $590 upside target before settling at $586.79. The move respected key resistance at $585, which was initially breached and held throughout the session. Support levels at $580 and $575 were never tested, confirming the forecast's upward bias. The market followed through on Monday’s strength, validating the model’s call for continuation. Traders who entered long above $580 had multiple opportunities to profit as SPY pushed higher toward $589, staying within the model’s projected range of $578 to $590.

Premarket Analysis Summary

In Tuesday’s premarket analysis posted at 8:41 AM, SPY was trading at $583.52 with $582 identified as the key bias level. The analysis suggested upside targets of $586 and $588.40, with support expected at $582, $580.50, and $578. The outlook remained bullish, driven by a cooler-than-expected CPI report, but emphasized that buying should be focused near support levels due to a lack of aggressive speculative interest. The analysis downplayed the likelihood of an intraday selloff unless driven by unexpected news and advised traders to favor long setups if SPY held above the bias level.

Validation of the Analysis

Tuesday’s session validated the premarket roadmap. SPY opened above the $582 bias level and never dipped below support, establishing a steady climb that hit the $586 upside target and approached the higher goal of $588.40. The session high of $589.08 showed the model's upper resistance was nearly achieved. As suggested, long setups from support levels paid off handsomely, and the projected range held firm without triggering downside stops. Once again, the premarket guidance proved reliable, offering clear, actionable levels that framed the day’s trading opportunities.

Looking Ahead

While Wednesday lacks major economic releases, Thursday’s calendar includes the Producer Price Index, Retail Sales, and jobless claims, with Fed Chair Powell scheduled to speak after the close. Walmart’s premarket earnings Thursday could provide clues about consumer spending trends. With no data due Wednesday, markets may consolidate, but traders should remain on alert for positioning ahead of Thursday’s heavy lineup, which could inject significant volatility.

Market Sentiment and Key Levels

SPY closed at $586.79, above the critical $585 threshold, suggesting bullish sentiment remains intact. The market is now pushing toward the March highs near $597, with bulls fully in control. Resistance levels to watch include $590, $593, and $595. Support begins at $585, followed by $583 and $580. If SPY breaks above $590, expect momentum to build quickly. Conversely, a move below $580 could spark a modest pullback or short-term consolidation. With macro data on deck, sentiment could shift rapidly, so traders should continue to monitor key levels closely.

Expected Price Action

Our AI model projects a trading range of $580 to $592 for Wednesday, offering actionable intelligence for navigating the session. With SPY trending upward, the bias remains bullish and a breakout above $590 could push the index toward $593 or $595. However, if SPY fails to hold $585 and slips under $580, a pullback to $575 becomes possible. The absence of major economic releases may produce a rangebound market, but volatility could increase as traders position ahead of Thursday’s data. Traders should watch for failed breakouts above resistance or failed breakdowns at support for high-probability entry points.

Trading Strategy

Long trades remain favored as long as SPY holds above $580. A push through $590 could spark momentum moves toward $595 and potentially $597. Traders should consider taking profits near resistance and trailing stops to protect gains. If SPY loses $580, short setups toward $575 and $570 may become viable, though caution is advised given the prevailing bullish trend. The VIX closed at 18.22, reflecting a stable volatility backdrop. However, traders should prepare for sharp swings around Thursday’s data. Risk should be managed tightly near resistance, and position sizes should be adjusted downward if price action becomes erratic or uncertain.

Model’s Projected Range

The model’s maximum projected range for Wednesday is $581.75 to $594.25, with the Call side dominating in a narrowing range suggesting consolidation with periods of trending behavior. Wednesday does not bring any major economic news likely to move the market. Today’s inflation data came in lower than expected, which drove a rally that continued through most of the session. However, a late-day sell-off pulled SPY to a close at $586.34, just above the important $585 level. This close keeps the bulls firmly in control. The next potential catalyst is the Producer Price Index, which will be released on Thursday. Unless there is an unexpected development from the White House, this report will be the next main event to watch. The market rallied in the premarket following the CPI release and continued climbing until the afternoon. The close above $585 puts the bulls in position to challenge the March highs near $597. If this level is reached, it could set the stage for a broader push toward new all-time highs. The bulls successfully held the $575 support level, which helped fuel today’s move higher. If the bulls remain committed tomorrow, they will aim to keep the price above $585. If that level is lost, the price could fall to $580, which may present a buying opportunity on any failed breakdown. If the bulls defend $580, the price may push to $590 and possibly higher. On the other hand, if $580 breaks decisively, the market may experience a pullback and mark a red day, which appears overdue. The question is not whether a red day is coming, but from what level it will begin. SPY currently sits just above the $565 to $585 range, which is an area where institutional traders look to reduce exposure. The price could drift back into this zone or continue to climb. As of today, the likelihood of higher prices appears greater than a retest of the April lows. Key resistance levels to watch on Wednesday include $590, $593, and $595. Support levels to monitor are $585, $583, and $580. Resistance is limited above $595, while support continues to build below $580. Since April 2, we have emphasized that macroeconomic forces such as tariffs, bond yields, and inflation are expected to remain the primary drivers of market direction over the next 60 days. This outlook holds unless the White House introduces a more defined policy shift. The VIX closed at 18.22, which is well below its pivot level of 23. Volatility readings above 23 typically put pressure on equities, while levels below tend to support bullish behavior. With SPY closing above $586, the bulls have full control and will likely attempt to push the price through $590 on Wednesday. SPY remains within a steep bullish trend channel that began at the April lows. However, the angle of ascent may be too sharp to sustain, which could result in a period of consolidation or a mild pullback. Although momentum currently favors the bulls, this is still a volatile market. It is important to remain flexible and ready to adapt quickly to changes in sentiment.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a very wide bullish trending market state, with SPY closing just below MSI resistance. Extended targets printed for much of the day but into the closed ceased printing. With the bulk of today’s move coming just after the open, extended targets showed the herd was in control and the market rallied with the MSI rescaling its current, wide bullish state. The MSI kept SPY contained right at resistance for most of the day with a very tight trading range developing in the $587 to $588 range. A late day profit taking sell off pushed SPY back in the MSI range, But with a wide MSI bullish state and extended targets for most of the day, the market will likely continue to press higher toward $595. While we don’t necessarily see $595 as a viable target on Wednesday, the MSI is advising to stick to the long side and buy all dips. Current MSI support is $581.71 and resistance is at $587.90.

Key Levels and Market Movements:

On Monday, we noted: “Momentum favors the bulls, and there's little reason to consider short setups.” We also stated, “The MSI remains in a strong bullish state, suggesting prices are likely to push higher on Tuesday,” and emphasized the importance to “align with the MSI and the bulls, who currently control the narrative.” With this actionable context and following a dovish CPI print, the opening setup was clear: with extended targets printing and the MSI confirming a strong bullish state, the only trade was to buy the premarket support level at $583.50 shortly after the open on a less-than-perfect failed breakdown. The MSI quickly expanded to a very wide bullish state, prompting us to aim for an initial target at MSI resistance. Confident in the trade’s over-70% success probability, SPY responded in kind, and we hit a substantial first profit target at $587.50, holding 30% of our position for further upside. Returning to the premarket roadmap, we identified a second target at $588.50, which was achieved in the early afternoon. With our stop moved to breakeven and solid gains secured, we held to see if price would extend. However, a failed breakout at 1:32 PM signaled that the move had likely exhausted. Despite continued extended targets, we exited the remaining 10% of our position and called it a day. Importantly, we did not short or fight the bullish structure; something we never do when extended targets are printing. One and done by early afternoon thanks to disciplined execution, a clear plan, and the precision of our model and the MSI. The MSI consistently reveals who’s in control, when control shifts, and where actionable levels lie, enabling sharp entries and timely exits. Paired with a structured framework, it keeps us aligned with dominant market forces, helps us avoid traps, and supports confident profit-taking. We continue to strongly recommend integrating the MSI into your trading process. Combined with a clear plan, it becomes a powerful engine for long-term performance.

Trading Strategy Based on MSI:

Wednesday brings no scheduled news, so the market is more likely to drift higher than surge. The MSI and our model suggest SPY may attempt a move toward $593 or even $595, levels that are likely to act as resistance. While there's no clear signal that a pullback is imminent, the market is due for one, and it could arrive at any time. As long as bulls hold the $585 level, the bias remains higher. A break below $585 could see a drop to $580, where we expect dip buyers to step in. A breakout above $595 would suggest acceleration to the upside, a low-probability scenario in the absence of an external catalyst. Momentum clearly favors the bulls, and there’s little reason to consider short setups. We recommend focusing on failed breakdowns at key support zones, specifically $585 and $580. The MSI remains in a wide bullish state, reinforcing the expectation of a slow upward drift on Wednesday unless interrupted by unexpected news. If $580 gives way, it doesn’t necessarily signal a bearish reversal. Instead, it may indicate a deeper probe into the $565–$585 zone. We could also see consolidation around the $585 area over the next few sessions, which would favor a two-way trading environment. However, until we see a confirmed red day, we continue to favor long setups and urge caution on the short side. Align with the MSI and the bulls, who currently control the narrative. Avoid trading when the MSI enters a Ranging State, and as always, stay disciplined and trade what’s in front of you. The MSI continues to provide invaluable real-time insight into momentum and structural dynamics. When combined with the Premarket and Postmarket Reports, it helps pinpoint high-probability targets and clean entry points keeping traders on the right side of the tape and away from costly mistakes. If you're not yet using the MSI and model levels in your process, now is the time. Reach out to your rep as these tools can make a real difference in your trading outcomes.

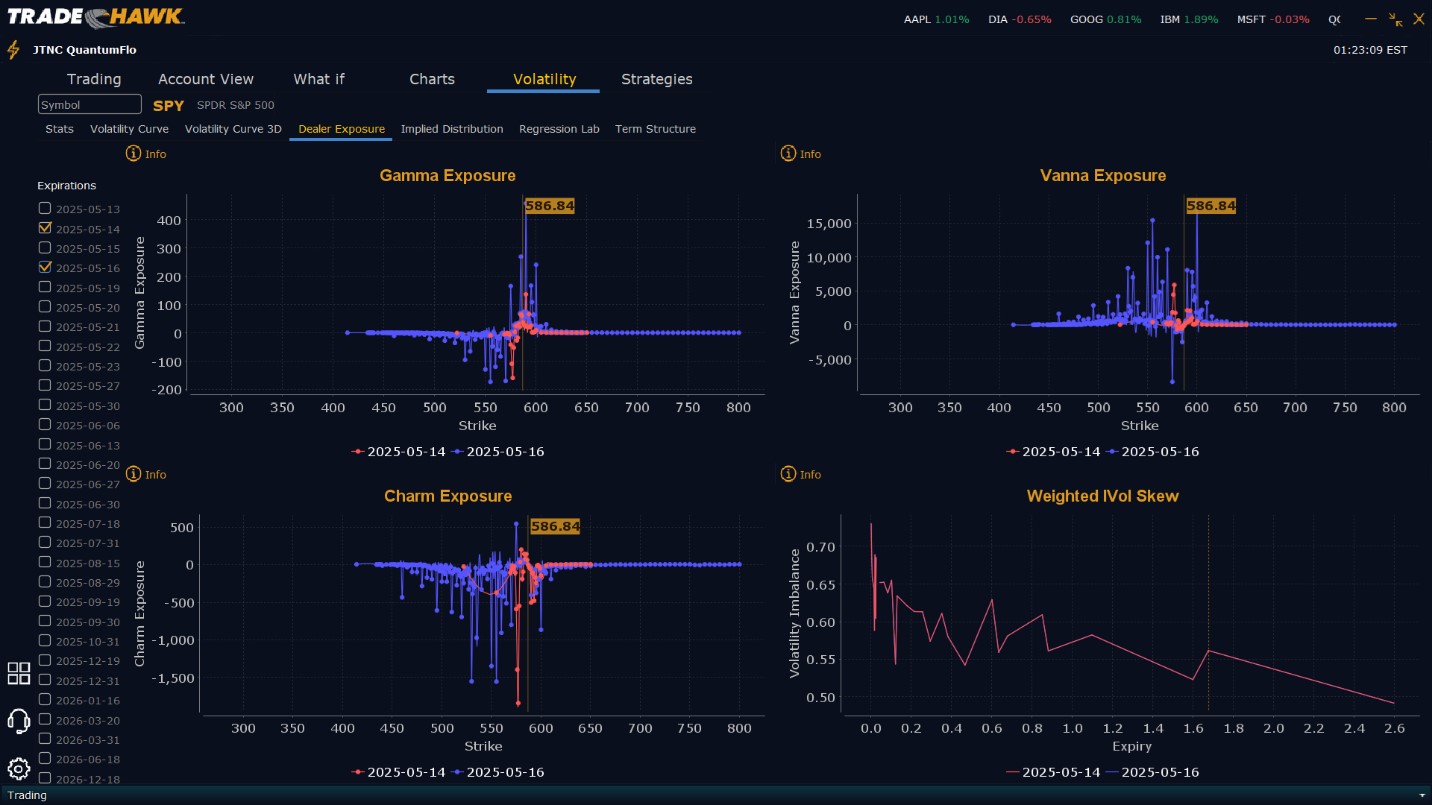

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling $587 to $600 and higher strike Calls while also selling $580 to $586 Puts. This implies the Dealers belief that prices will continue to rally on Wednesday. Dealers do not sell at the money Puts without a firm belief that higher prices will follow. To the downside Dealers are buying $579 to $515 and lower strike Puts in a 1:1 ratio to the Calls/Puts they are selling, implying a bullish posture for Wednesday. Dealer positioning is unchanged from bullish to bullish.

Looking Ahead to Friday:

Dealers are selling $587 to $610 and higher strike Calls while also selling $575 to $586 Puts indicating the Dealer’s belief that the market is likely to continue to rally into the end of the week. As we stated above, Dealers do not sell near the money Puts without confidence that prices will move higher. Dealers also appear to believe the peak for SPY for this week is $600. To the downside, Dealers are buying $574 to $460 and lower strike Puts in a 2:1 ratio to the Calls/Puts they’re selling, reflecting a neutral outlook for the week. Dealer positioning is unchanged from neutral to neutral. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY is sitting just above the key $585 support level with upside momentum still intact. Traders should focus on long trades above $580, targeting $590 and $593. A breakout through $590 could trigger a run toward the March highs near $597. If the price breaks below $580, short trades may become viable with downside targets at $575 and $570. But we still favor long setups in this bullish environment and recommend extreme caution with any short trades. Volatility remains low with the VIX at 18.22, but this may shift quickly with Thursday’s PPI and Powell’s speech. Stay nimble and manage position sizes carefully ahead of potential data-driven swings. Always review the premarket analysis before 9 AM ET for updates to model levels and Dealer Positioning.

Good luck and good trading!