Market Insights: Wednesday, April 16th, 2025

Market Overview

Markets suffered a sharp selloff Wednesday as trade tensions flared and Fed Chair Jerome Powell issued his most pointed warning yet on the economic risks tied to the administration’s evolving tariff strategy. The Dow fell over 700 points, the S&P 500 sank more than 2.2%, and the Nasdaq plunged over 3% in a broad-based rout. Powell, speaking in Chicago, said the Fed will “wait for greater clarity” before taking any action on rates, adding that the tariffs may force the central bank into a difficult spot—balancing inflation risks with slowing growth. His remarks, combined with Nvidia’s revelation of fresh U.S. restrictions on chip exports to China, sent tech stocks reeling. Nvidia slumped about 7% after announcing the move could cost $5.5 billion in charges, while AMD projected an $800 million impact of its own. The fallout triggered a massive risk-off reaction, with investors scrambling to reassess the inflationary impact of tariffs and the likelihood of stagflation. Meanwhile, March retail sales surged 1.4%—the biggest jump in over two years—as consumers rushed to make purchases ahead of looming price hikes. Gold soared to a fresh record, reflecting the mounting fear across global markets. Despite talk from Treasury Secretary Scott Bessett suggesting progress with non-China trading partners within 90 days, the damage from the latest trade salvos left markets battered and sentiment shaky heading into Thursday.

SPY Performance

SPY fell 2.21% to close at $525.72, opening at $539.67 and hitting a low of $520.30 before buyers emerged late in the day. The sharp drop marked a clear break below the critical $535 support zone, ending a week-long consolidation. Volume surged to 70.58 million shares, above average, indicating heavy distribution. The collapse beneath $530 signals increasing bearish momentum, with sellers firmly in control following Powell’s remarks and chip sector shocks. Bulls now face an uphill climb to reclaim lost levels before the shortened week concludes.

Major Indices Performance

The Nasdaq led to the downside with a 3.07% plunge, weighed down by deep losses in the semiconductor sector. The S&P 500 dropped 2.21%, while the Dow fell 1.73%, nearly 700 points. The Russell 2000 showed relative strength but still lost 0.94%. Wednesday’s selloff was driven by renewed trade war fears and Fed Chair Powell’s hawkish comments on inflation risks. Tech was the weakest sector, with chip stocks hit especially hard after the U.S. announced fresh export restrictions targeting China. Defensive sectors like utilities and consumer staples held up slightly better, but selling was broad-based. The retail sales beat did little to support equities, as traders focused on the inflationary implications and potential stagflation signaled by the Fed.

Notable Stock Movements

It was a bloodbath for the Magnificent Seven. Nvidia led the decline with a steep 6.87% drop after disclosing the financial hit from new export restrictions. Tesla fell 4.93%, while Meta, Microsoft, and Apple each slid more than 3%. Even Amazon and Google weren’t spared, both posting sizable losses. The selloff was fueled by macro-level fear, with tech facing the brunt of policy-driven uncertainty. This marked a dramatic reversal from earlier in the week, highlighting just how quickly sentiment can flip when regulatory risk intensifies. The synchronized decline across these names reflected a market searching for footing amid headline-driven volatility.

Commodity and Cryptocurrency Updates

Crude oil climbed 2.25% to settle at $62.71, holding its bounce above the $60 threshold but staying within our model’s long-term view that sees prices revisiting $50 before establishing a base. Gold surged 3.52% to $3,354.59, setting a new all-time high as fear swept through risk assets. With central banks and retail investors piling into safe havens, gold’s rally reinforces the deep concern about inflation and geopolitical risk. Bitcoin dipped slightly by 0.55%, closing just above $84,500. We continue to favor long positions between $77,000 and $83,000 with profit targets above $85,000, though traders should remain cautious below $77,000 where downside risks accelerate.

Treasury Yield Information

The 10-year Treasury yield dropped 1.06% to close at 4.277%, extending its recent retreat. This move suggests continued demand for safety as equities falter. Despite the pullback, yields remain uncomfortably close to the critical 4.5% threshold, which, if breached again, could trigger a deeper equity selloff. The Fed’s hawkish tone and ongoing trade policy uncertainty leave markets on edge, with any push toward 4.8% or 5% signaling major trouble for risk assets. For now, lower yields are a modest cushion, but that support feels increasingly fragile.

Previous Day’s Forecast Analysis

Tuesday’s outlook projected a SPY trading range of $530 to $545, maintaining a slightly bearish lean with emphasis on $535 as a must-hold level. Upside targets included $540 and $545, while failure at $535 opened the door to $530 and $525. Long setups were favored above $535, while breaks below favored short trades. The guidance called for choppy action with possible direction shifts tied to news, especially Powell’s speech and Retail Sales data. The strategy stressed flexibility, advising traders to act based on how SPY reacted at key inflection points, with a close eye on failed breakouts and breakdowns.

Market Performance vs. Forecast

SPY’s actual move on Wednesday validated the bearish lean in Tuesday’s forecast, though it broke more aggressively than expected. SPY opened near $540 but immediately faltered, slicing through $535 support and tumbling to an intraday low of $520.30 before closing at $525.72. The projected $530 to $545 range was shattered to the downside, confirming that the $535 zone was pivotal. Once lost, sellers accelerated control, driving price toward the lower end of the forecast’s bearish scenario. The call for short setups below $535 proved highly profitable, as the breakdown created a fast move toward the $525 target. The intraday action emphasized the importance of reacting to breaks at support, underscoring the forecast’s accuracy in identifying key levels and warning of volatility tied to macro catalysts.

Premarket Analysis Summary

In Wednesday’s premarket analysis posted at 8:49 AM, SPY was trading at $532.89 with a bias level pegged at $534.50. The outlook highlighted downward pressure but noted a potential for recovery if price could reclaim and hold above $534.50. The setup favored short entries below this bias, targeting $530 and $525, while upside scenarios looked for a retest of $541 and potentially $543 if support held. Sentiment was described as fragile, with Powell’s speech seen as a likely market mover. Traders were advised to remain reactive, selling rallies below resistance and waiting for a true catalyst before expecting sustained upward momentum.

Validation of the Analysis

The day’s session followed the premarket blueprint with sharp precision. SPY never reclaimed the $534.50 bias level, instead fading quickly after the open and triggering downside targets. The move down to $530 and eventually to $520.30 mirrored the bearish roadmap laid out premarket. Traders who sold rejections at resistance were rewarded with rapid downside action, as Powell’s comments and trade war headlines compounded the technical breakdown. The analysis successfully identified both the bias level and key downside targets, once again proving that the premarket guide offered timely and actionable insight into the market’s trajectory.

Looking Ahead

Thursday brings weekly Unemployment Claims, and while not typically a major mover, they could influence sentiment if job losses show signs of accelerating. With markets still digesting Powell’s remarks and bracing for further trade fallout, any upside surprise in claims data might trigger renewed downside in equities. Friday’s market holiday compresses positioning into Thursday’s session, meaning traders may front-load reactions to macro data. With SPY closing near recent lows and sentiment fragile, the potential for another volatile session is high.

Market Sentiment and Key Levels

SPY closed at $525.72, well below the key $535 support level, which now flips to resistance. Market sentiment has turned decisively bearish following Powell’s speech and the Nvidia-led tech meltdown. Key resistance lies at $530, $532, and $535, with $540 likely out of reach unless bulls stage a surprise comeback. Support levels are found at $523, $520, and $515, and a break of $520 would likely trigger another wave of selling. The bulls have surrendered their grip and must now defend lower ground. Tariff uncertainty, inflation risks, and elevated bond yields remain dominant forces. With OPEX on Thursday and Friday’s closure, traders should expect continued whipsaw action as the week wraps up.

Expected Price Action

Our AI model projects a trading range of $515 to $535 for Thursday, with a bearish tilt. This is actionable intelligence. SPY is currently trending lower, and if $520 fails to hold, we expect a fast move to $515 or even lower. If bulls manage to reclaim $530, a squeeze toward $532 and $535 could unfold, but odds favor continued weakness. The market remains headline-sensitive, and absent a positive catalyst, the path of least resistance is down. Traders should avoid countertrend trades and focus on opportunities stemming from failed rallies or breakdowns. With the VIX elevated at 32.64, volatility remains a defining factor—expect sharp price swings and potential intraday reversals, especially near macro event headlines.

Trading Strategy

Look for short trades on failed bounces into $530 or $532, with targets at $523 and $520. A break of $520 puts $515 and $511.50 in play. Long trades are favored if SPY reclaims $530 and holds, opening up a path back to $535 or if $520 holds on a retest and a failed breakdown presents. Watch for failed breakouts and use tight stops above resistance when shorting. With volatility high, reduce position sizes and trade with caution. Use wider stops for longer trades and avoid overtrading until a clear direction is confirmed. VIX at 32.64 signals elevated fear—ideal for tactical short setups but dangerous for holding positions too long. Trade levels, not hope.

Model’s Projected Range

The model’s maximum projected range for Tuesday is $511.50 to $541.50, with the Put-side continuing to dominate. This suggests sustained weakness, punctuated by periods of consolidation within a tightening, albeit still wide, range. Expect two-way, choppy trading with periods of trending price action to persist until an external catalyst provides clear directional momentum. SPY closed at $525.66, well below the critical $535 level—now a key battleground that favors the bears. The bulls have surrendered the slight edge they previously held. While a short-term bottom may be in place, the broader market appears poised to resume its selloff should price reclaim $575–$585, potentially revisiting or even breaching recent lows. Historically, such declines tend to play out 4 to 16 weeks after an initial bottom. We strongly recommend considering protective strategies or reducing long exposure should the market push into stronger resistance zones. With earnings season underway, many companies are expected to cite tariffs as a reason for muted or cautious forward guidance, further stoking the elevated volatility already fueled by current administration policies. Key Technical Levels for Thursday: Resistance: $530, $532, $535. Support: $523, $520, $518, $515. With price below the $535 threshold and OPEX tomorrow—along with a shortened trading week—expect continued choppy and erratic price action into Friday. Should $520 fail, a sharp drop is likely, potentially retesting recent lows. However, if bulls can defend that level, SPY may back test $530 and possibly $535. Resistance at $535 remains firm, making any sustained move above it a key bullish signal, possibly opening the path to $540. Progress higher is expected to be slow and contested, with the bulls ultimately needing to reclaim $585 to decisively regain control. Market Drivers: Tariffs, bond yields, and inflation remain the dominant macro forces and are expected to shape market action over the next 90 days—or until clearer signals emerge from the White House. The VIX closed at 32.69, reflecting heightened fear and the potential for deeper declines. The broader bearish trend channel, originating from the December highs, remains intact, with price currently trading mid-channel. While movement in either direction is possible within this structure, we expect price action to stay largely contained, with notable resistance near $565 and support around $475. Momentum has become less directional. In this volatile environment, we continue to recommend staying nimble and prepared for swift shifts in market direction.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI is currently in a Ranging Market State, with price closing well in the bottom third of the range. The range is wide implying confusion and no clear direction for tonight and tomorrow. Overnight, price traded in a very narrow range until the open. The MSI rescaled to a ranging state prior to the open from a bullish state and flipped flopped between all three states until 1:30 pm when the MSI began a series of rescalings lower in a Bearish Trending Market State while printing extended targets below. This saw price drop to $520 before finding any material support. In the last thirty minutes SPY reversed the MSI rescaled from a wide bearish state to its current ranging state. Currently, MSI support stands at $520.84, with resistance at $531.34.

Key Levels and Market Movements:

On Tuesday, we noted: “The market continues to feel heavy at these levels, with uncertainty dominating the narrative. This fragile state may encourage traders to lighten positions ahead of the three-day weekend, potentially pushing prices below $535. If that happens, expect renewed bearish momentum and a stronger push lower.” We also stated, “Going into Wednesday: we anticipate a pullback overnight toward MSI support at $535, where the bulls will likely attempt a defense.” Finally, we said, “A failure at $535 opens the door to $532, then $530. Should $530 give way, the market could revisit $520 or lower.” With this plan in mind, SPY did pull back and, at the open, was testing major support turned resistance at $535. However, since the MSI was in a ranging state, we chose to sit on our hands and wait for a better setup. We do not favor trading in a range-bound MSI environment. Price broke through MSI support around 10 a.m., triggering a rescale to a bearish state with $530 marked as major resistance. With no extended targets below and a solid double bottom forming, we entered long, aiming for MSI resistance at $533.50 as our first target. That level was hit before 11:30 a.m., so we moved our stop to breakeven and waited for the MSI to offer a second target. We also had the premarket level of $534.50 in mind, in case the MSI didn’t rescale higher. The MSI did, in fact, rescale and provided a second target right at that premarket level. We took off another 20% of our position and held to see if price could reclaim $535. SPY did reach $535 but formed a failed breakout at that level. With no extended targets and a very narrow MSI, we reversed short, targeting MSI support at $533.50. That target was hit quickly as price accelerated lower. We took a second target after the MSI rescaled to support at $531. With our stop at breakeven, we trailed the remaining 10% of our position, hoping for a break of $530. That move finally came after Powell began speaking, and in the afternoon session, price gave way as the MSI continued rescaling lower. While we considered adding to our short, we weren’t confident price would fall as far as it did. Instead, we continued trailing the remaining 10%. Around 2 p.m., we debated closing, but with extended targets printing below and a fairly wide MSI range, we decided there was little downside to holding. Sure enough, SPY continued to decline, reaching $520 by 3:40 p.m. Recognizing this as a major post-market level, we reversed long after SPY formed a failed breakdown and the MSI stopped printing extended targets below. This allowed us to lock in monster profits on the short runner and look to cap the day with a quick long scalp to MSI resistance at $524. That target hit quickly, and we decided to hold the remaining 30%, exiting at the close for another solid trade. Three-for-three on the day—with the second trade being a home run and a small runner adding the grand slam. While we had zero trades Tuesday, Wednesday gave us three—exceeding our usual one or two setups per day. We followed our daily mantra: have a solid plan, execute with discipline, and let the MSI and model levels guide every decision. The MSI reveals who’s in control, when that control shifts, and where the key actionable levels are—empowering precise entries and exits. Paired with our model levels and daily strategy, the MSI keeps us aligned with dominant market forces. It continues to deliver with high precision—helping traders avoid traps, stay in sync with momentum, and take profits with confidence. We strongly recommend integrating the MSI into your trading toolkit. When paired with a structured plan, it becomes a powerful engine for long-term performance.

Trading Strategy Based on MSI:

Thursday brings Unemployment Claims and little else likely to move the market in a major way. Eventually, this report may start reflecting DOGE-related layoffs and tariff-driven employer cuts, which could become a meaningful market catalyst—perhaps not this week, but likely down the line. While any event can spark movement, we expect a choppy session with occasional bursts of trending price action. The wildcard remains the administration’s ongoing commentary around tariff policy—something that can shift sentiment quickly and without warning. Our lean heading into Thursday is for price to remain in a narrow overnight range, likely oscillating between $525 and $531. Bad news could push SPY to revisit Wednesday’s lows, while good news may drive a test of the $535 area. Neither level looks ready to give way easily. That said, the wall of resistance above $535 is larger and deeper than the wall of support below $520. If $520 breaks, it's the elevator down; if $535 breaks, it’s stairs up. Thursday is OPEX ahead of a three-day weekend, so expect a whippy, complex tape. SPY may look to back test $530 and then $535, where it's likely to fail on the first attempt and pull back. However, if SPY first decides to retest $520 and that level fails, expect a sharp leg lower toward $500 and beyond. Below $520, it’s lights out for the bulls. The bears have now regained control, and the bulls have lost any edge they built earlier in the week. Bulls don’t reclaim control until price is back above $535. A clean break above $535 shifts momentum back in their favor and opens the door to $545 and potentially $550. As always—trade what you see. Lean on the MSI and stay nimble. The MSI updates in real time, giving you actionable intraday structure and momentum data—keeping you from relying on stale narratives or outdated assumptions. For Thursday, two-way trading remains advisable, with a focus on failed breakouts and breakdowns. Avoid trading against extended targets or fighting a wide MSI state. The Premarket Report delivers fresh data and AI-driven insights to help shape your strategic plan, while the MSI reveals real-time momentum shifts and inflection points. Our model levels define high-probability targets and precise entry zones. As volatility cools, expect SPY’s pace to slow and the MSI’s range to normalize. Keep your eye on the MSI—it provides critical visibility into who’s in control and where momentum is concentrated. Respect extended targets—they reflect strong conviction and herd-driven behavior. Used together, the MSI and model levels keep you aligned with dominant market forces and help you avoid costly missteps. If you’re not already using these tools, now is the time. Connect with your rep—these are game-changers in markets like this.

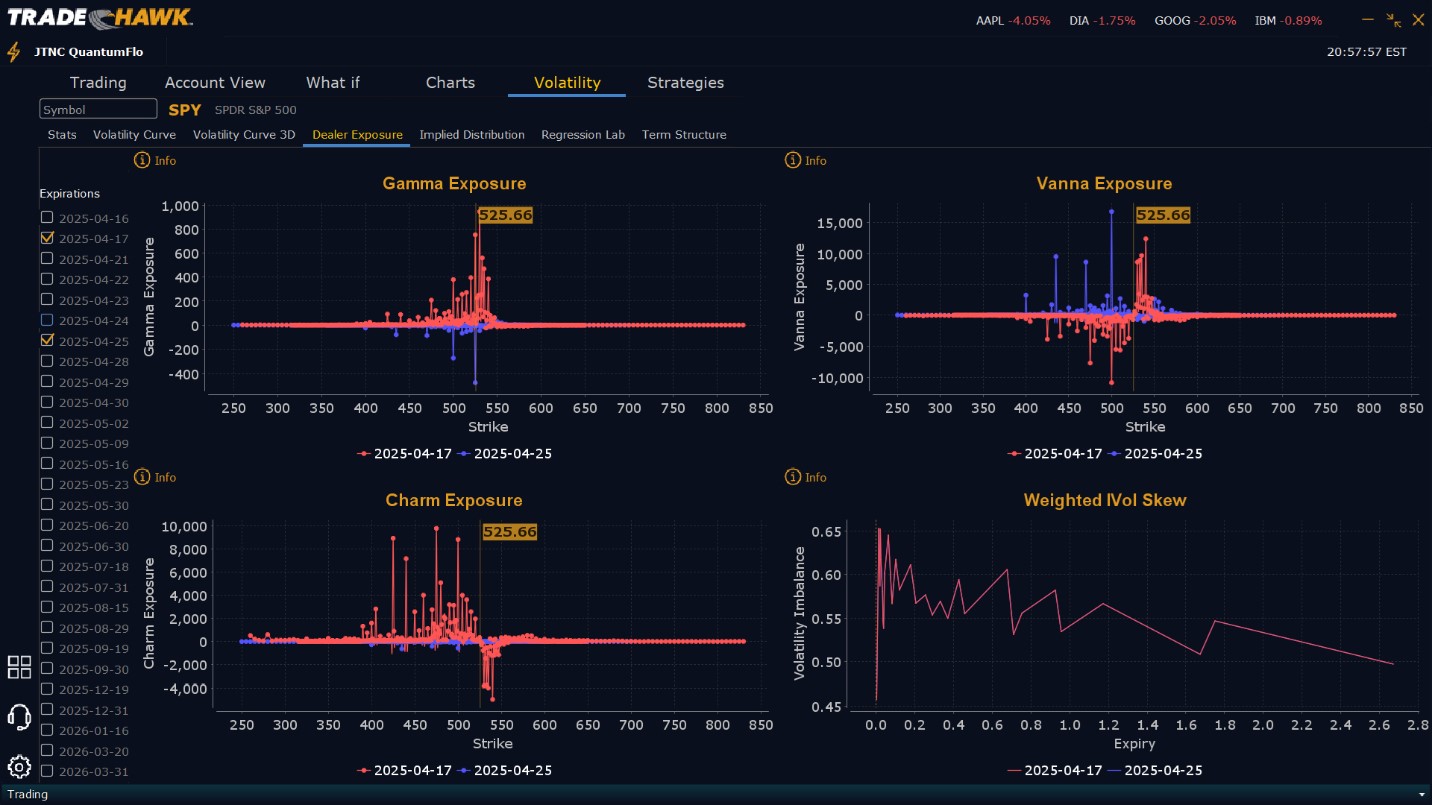

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling $527 to $550 and higher strike Calls while selling $524 to $425 Puts indicating the Dealers belief that price has nowhere to go but up on Friday. When Dealers sell very close to the money Puts, they are telling you they believe the market will rally the next day. To the downside while Dealers are buying $524 to $490 and lower strike Puts, the Puts they are selling dwarf the view of Vanna Exposure for Thursday. The ratio of Puts to Calls is almost irrelevant and virtually all of their exposure is in short Calls, and short Puts in a 10:1 ratio to the Calls/Puts they are selling/buying, implying an extremely bullish posture for Thursday. Dealer positioning has changed from slightly bearish to extremely bullish.

Looking Ahead to next Friday:

Dealers are selling $545 to $570 and higher strike Calls while also buying $526 to $544 Calls implying the Dealers desire to participate in any rally next week. To the downside, Dealers are buying $524 to $435 and lower strike Puts in a 4:1 ratio to the Calls they’re buying/selling. This reflects a bearish outlook for next week. Dealer positioning has changed from slightly bearish to bearish. Dealers have added to their downside protection, yet are also positioned for a rally that may develop next week. Given tomorrow is OPEX, it’s likely this positioning changes materially on Monday. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly, and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

SPY closed at $525.72, deep in bearish territory with key resistance now between $530 and $535. Traders should look to short failed rallies into this zone, targeting downside levels at $523 and $520. If $520 breaks, expect acceleration toward $515. Long trades are advisable if SPY reclaims $530 with strong momentum or on a successful test and hold of $520. Use tight stops given the elevated VIX at 32.64, which suggests high intraday volatility and fast-moving reversals. Maintain smaller position sizes and stay nimble. Trade with the trend, not against it, and always look for confirmation around major levels. As always, review our premarket analysis before 9:00 AM ET for fresh strategy updates and Dealer positioning insights.

Good luck and good trading!