Market Insights: Monday, February 9th, 2026

Market Overview

US stocks extended last week’s powerful rebound on Monday as technology shares continued to bounce and investors looked ahead to a packed stretch of economic data and earnings. The S&P 500 rose roughly 0.5%, moving back within striking distance of record highs, while the tech-heavy Nasdaq Composite gained close to 1% as buyers remained active in growth names. The Dow Jones Industrial Average edged slightly higher, marking its second consecutive close above the historic 50,000 level after first breaking that threshold late last week. The session reflected a market regaining balance after extreme volatility, with risk appetite improving but still tempered by ongoing debate around AI spending and macro uncertainty.

Concerns around artificial intelligence remained a key theme beneath the surface. Shares of Monday.com sold off sharply, falling as much as 22%, after the software company issued revenue and profit guidance that missed Wall Street expectations, reigniting fears that AI-driven disruption could pressure traditional software business models. That weakness contrasted with continued strength across other major technology names. Nvidia and AMD both gained more than 3% as optimism around AI infrastructure demand stabilized, while Oracle surged nearly 10% and Microsoft added more than 2%, helping lift the broader Nasdaq. The divergence highlighted a market that is no longer selling technology indiscriminately, but instead rotating aggressively between perceived winners and laggards within the AI ecosystem.

Gold and bitcoin remained in focus following last week’s violent selloff. Gold futures climbed back above the $5,000 level as investors continued to hedge macro and geopolitical risk despite the equity rebound, while bitcoin hovered near $70,000 after suffering its sharpest single-day decline since 2022 last Thursday. Both assets remain highly volatile, underscoring fragile confidence across alternative markets even as equities push higher. On the macro front, investors largely stayed in wait-and-see mode ahead of key data later this week. The delayed January jobs report is scheduled for release Wednesday, with markets watching closely for further signs of labor-market cooling after last week’s weak ADP private payrolls data. Consumer inflation data from the Bureau of Labor Statistics is also due Friday and will be closely scrutinized for confirmation that disinflation trends remain intact. On the earnings front, ON Semiconductor reported after the close, with results later this week expected from Coca-Cola, McDonald’s, and Cisco. Overall, Monday’s session reflected cautious optimism, with bulls maintaining control as long as key technical levels continue to hold, but with markets clearly sensitive to upcoming economic and earnings catalysts.

SPY Performance

SPY continued to build on Friday’s historic reversal, extending gains in a steady but controlled advance. The ETF opened at $689.45, rallied to an intraday high of $695.87, and pulled back modestly to a low of $688.34 before closing near the highs at $694.04, up 0.50% on the day. Trading volume totaled 65.97 million shares, about average, signaling healthy participation without signs of panic or euphoria. Price remains well above the critical $685 level that defines bull control, keeping the broader uptrend firmly intact and leaving bears sidelined for now.

Major Indices Performance

Gains were broad across the major indices. The Nasdaq rose 0.90%, driven by strength in large-cap technology. The Dow finished slightly higher with a 0.04% gain, extending its record run above 50,000. The Russell 2000 advanced 0.68%, reflecting improving participation beneath the surface as small caps stabilized after recent volatility.

Notable Stock Movements

It was a mostly green session across the Magnificent Seven, led by Microsoft, which climbed as much as 3.13%. The notable laggards were Netflix, Amazon, and Apple, with Apple down as much as 1.20%. The overall strength across megacap technology reinforced that last week’s selloff failed to produce sustained weakness across leadership, a key requirement for a larger pullback.

Commodity and Cryptocurrency Updates

Commodities and crypto sent mixed but informative signals. Crude oil rose 1.26% to $64.35, continuing to trade above the $60 level our model has been forecasting for several months. While further downside is possible, sustained trade above $56 keeps the door open for a future rally toward $70. Gold jumped 2.40% to $5,099, reclaiming the psychologically important $5,000 level as investors continued to hedge macro risk. Bitcoin slipped 0.15% but held above $70,600, signaling consolidation rather than renewed breakdown after last week’s extreme volatility.

Treasury Yield Information

The 10-year Treasury yield slipped 0.12% to close near 4.198%. In our framework, yields above 4.5% begin to create headwinds for equities, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals major equity risk, with a 20% or greater correction becoming likely near 5.2%. Monday’s decline in yields provided a modest tailwind to risk assets.

Previous Day’s Forecast Analysis

Friday’s framework emphasized that the violent selloff into the December lows was likely to generate at least a temporary recovery and that reclaiming $685 would restore bull control. We warned that February remains prone to sharp selloffs but that those dips should be used to position for a spring and summer rally.

Market Performance vs. Forecast

Monday’s session validated that outlook. SPY remained firmly above $685, extended higher toward resistance, and continued to build on Friday’s historic reversal without giving back meaningful ground.

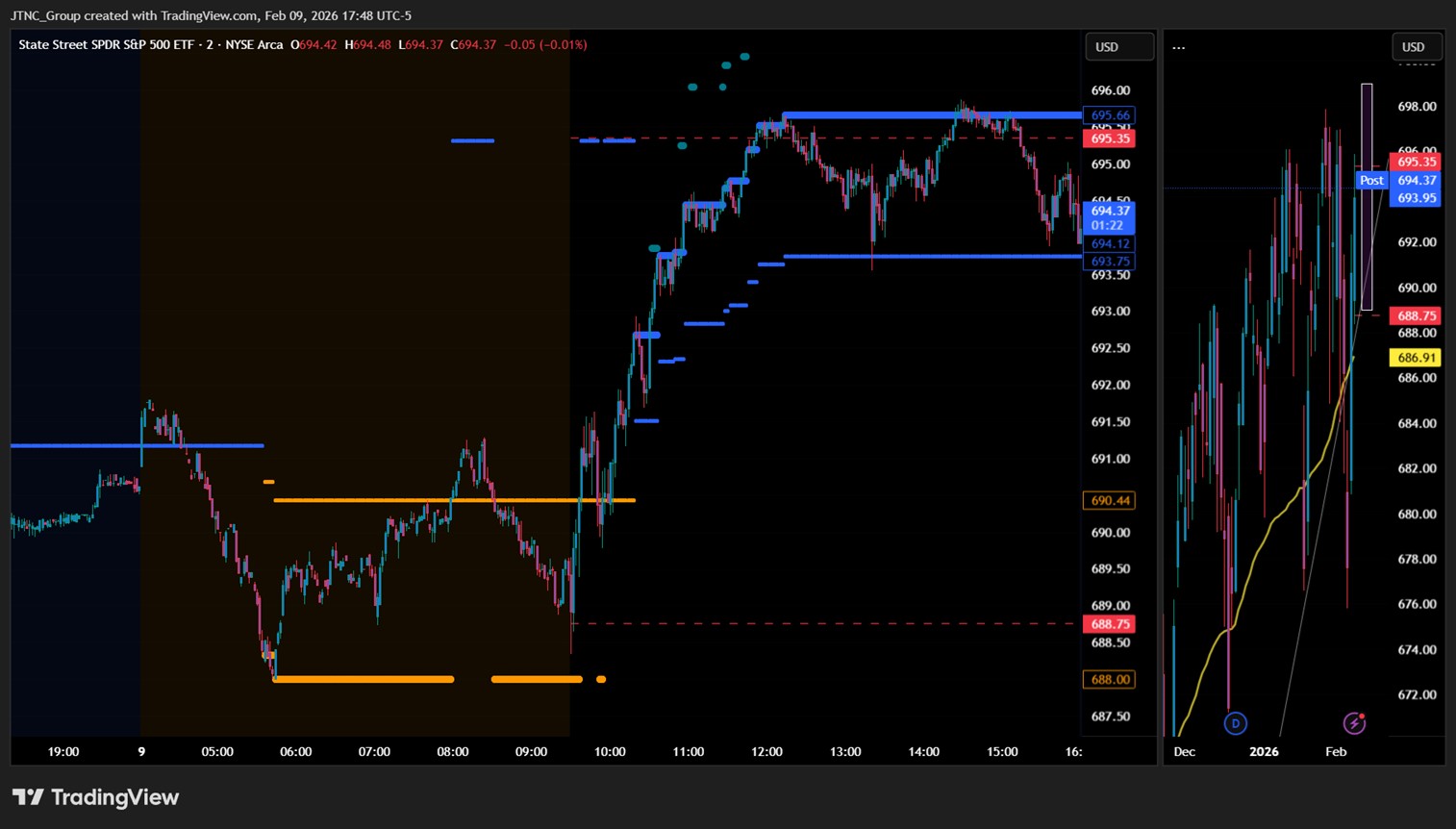

Premarket Analysis Summary

In Monday’s premarket notes published at 7:50 AM, SPY was trading near $690.03 with a bullish bias above $690. Upside targets were outlined at $692.85 and $695.35, while downside levels were identified at $688.75 and $685.35. The plan favored consolidation with upward attempts as long as the bias level held.

Validation of the Analysis

The session followed that roadmap closely. SPY held the $690 bias early, pushed toward the upper targets, and closed strong without breaking key support, confirming the expectation for controlled upside rather than aggressive trend acceleration.

Looking Ahead

Tuesday features Retail Sales, which is unlikely to be a major catalyst. Wednesday brings CPI, followed by Unemployment Claims on Thursday and CPI again on Friday. Economic data will take center stage as markets assess whether the recent rebound can be sustained.

Market Sentiment and Key Levels

Sentiment remains bullish but cautious. SPY holding above $685 keeps bulls firmly in control. Resistance sits at $696, $698, and $700, while support rests at $691, $686, and $684. Holding above $691 increases the odds of another attempt at $700, while a failure of $686 would open the door to a backtest of $680.

Expected Price Action

SPY’s projected maximum range for Tuesday is $689 to $699, with the Call side dominating in a narrow band that signals choppy price action with intermittent trending periods. After two strong sessions, some price discovery is likely.

Trading Strategy

After the sharp rebound from the December lows, patience is warranted. We favor buying dips toward $686 as long as support holds and shorting failed breakouts above $698. With heavy resistance between $696 and $702, quick profits and disciplined risk management are advised.

Model’s Projected Range

SPY’s projected maximum range for Tuesday is $689 to $699, with the Call side dominating in a narrow band that signals choppy price action with intermittent trending periods. Tuesday has Retail Sales, which is unlikely to move the market. SPY continued to rally today, building on Friday’s record session and adding 0.48% to close at $693.95, once again within striking distance of $700 and new all-time highs. Price remains well above $685, which keeps the bulls firmly in control and leaves the bears sidelined. This sharp rally off the December lows once again highlights how powerful the bulls are in the current environment. We warned for weeks that February often brings sharp selloffs and that those dips should be used to position for a spring and summer rally, and so far February is playing out as expected. After the last two sessions, the market likely needs a day or two of price discovery to confirm the next directional move. Overnight, bulls want to hold above $691 best case, and no lower than $686 worst case, to remain in control. If $691 holds, SPY is likely to make another attempt at $700 on Tuesday. If $691 fails but $686 holds, expect chop as price consolidates. A failure of $686 opens the door to a backtest of $680 and would reawaken bear interest. The long-term bull trend remains intact above $640. Absent a catalyst, resistance sits at $696, $698, and $700, while support rests at $691, $686, and $684. We favor shorting failed breakouts above $698 and buying dips to $686. We did not get the chop expected today, which increases the odds that Tuesday delivers slower, choppier trade, especially with heavy resistance between $696 and $702. Crypto rallied slightly, while most MAG stocks were higher, with Apple, Netflix, and Amazon lagging. Sustained weakness across both groups would be required for a larger pullback. VIX fell 2.25% to 17.36, remaining in neutral territory. SPY closed above the bull trend channel from the April lows, with structural support near $687.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in Bullish Trending Market State with SPY closing at MSI support. There were no extended targets at the close but late morning until round noon and briefly in the afternoon session, extended targets were present indicating the herd was continuing to drive the day’s rally. Overnight the MSI rescaled lower to a narrow bearish state before reversing right at the open to a narrow bullish state. The MSI continued to rescale higher several times in rapid succession indicating a strong trend, punctuated by extended targets. But the MSI ranges on each rescale were narrow so eventually SPY found a top at $696 and into the close, sold off to MSI support. It’s likely we see at least some back testing on Tuesday with SPY remaining above $686. MSI resistance is $695.66 with support at $693.78.

Key Levels and Market Movements:

Friday we stated, “the bulls will do their best to hold above $685,” and added, “Above $685, the market may test $695,” while also noting, “The bias favors selling failed breakouts above $695 and buying dips to as low as $685.” With the MSI opening in a narrow bearish state, the initial read was to sell MSI resistance, which did not work. But the beauty of the MSI is that it quickly reversed course and began a series of rapid rescalings higher, so reversing and going long at MSI support anytime after 10:20 was the correct read and put traders on the right side of the market. That long setup offered several targets from both the post- and premarket reports, as well as MSI resistance. A late-day selloff was also projected once extended targets stopped printing. While the selloff did not produce gains comparable to the morning longs, it was sufficient to pad the wallet and offset losses from the initial short. Three potential trades with one loser reinforced the importance of context, patience, and flexibility, using the MSI, premarket levels, and market structure together to guide execution rather than forcing trades. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Tuesday has minimal economic news but there are always geopolitical risks so remain vigilant. For Tuesday we expect a period of price discovery with a slight upward drift, but with the potential to backtest as low as $686, although the bulls will do their best to hold above $691. Absent an external catalyst, the edge is bullish as long as SPY remains above $685. If $686 fails and price closes below that level, $680 becomes a likely test, though we see this as a low-probability outcome without new catalysts. Above $691, the market may test $700, but resistance above $696 is heavy, making further upside difficult without a significant increase in volume. The bias favors selling failed breakouts above $698 and buying dips to as low as $686, while any sustained move below $686 should be approached cautiously, letting the MSI define what comes next. The long-term bull trend remains intact above $640. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

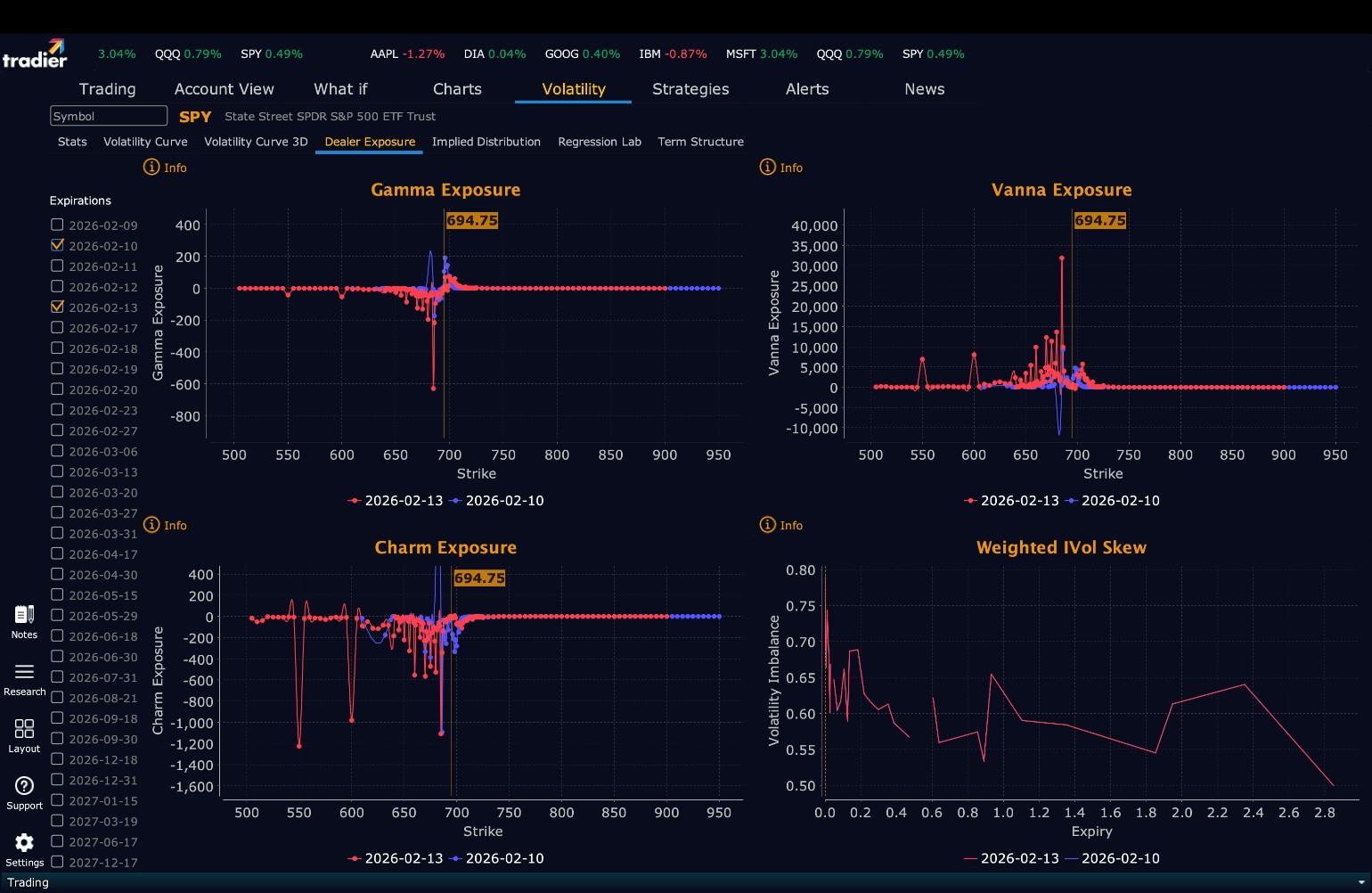

Dealer Positioning Analysis

Dealers are selling SPY $694 to $715 and higher strike Calls indicating the Dealers’ belief that Tuesday may see a period of calm with prices staying in a relatively tight range. The ceiling for Tuesday appears to be $698. To the downside, Dealers are buying $693 to $635 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $694 to $718 and higher strike Calls indicating the Dealers’ belief that this week may see a period of calm with prices staying in a relatively tight range, at least until the Jobs Report. The ceiling for the week appears to be $705. To the downside, Dealers are buying $693 to $585 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a market that is concerned about lower prices. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Tuesday, respect the restored bullish structure but avoid chasing strength. Favor buying dips that hold above $685 and selling failed breakouts near $695–$700. Stay flexible, manage risk tightly, and let price action confirm the next move as the market digests last week’s historic reversal.

Good luck and good trading!