Market Insights: Tuesday, February 3rd, 2026

Market Overview

US stocks sold off sharply on Tuesday as a flood of tech-focused earnings, renewed geopolitical anxiety, and lingering government shutdown concerns combined to knock markets lower. The tech-heavy Nasdaq Composite led declines, falling 1.43% as selling pressure accelerated throughout the session. The S&P 500 dropped 0.86%, while the Dow Jones Industrial Average bucked the broader trend and rose 1.06%, highlighting significant divergence beneath the surface. Early optimism quickly faded after the market opened above $696, as fear tied to a potential escalation with Iran and continued uncertainty around the government shutdown weighed heavily on sentiment. The session unfolded as another reminder of how fragile confidence remains when headline risk collides with elevated valuations.

Technology was the clear source of weakness. Despite Palantir delivering surprisingly strong quarterly results that initially suggested the AI trade still had room to run, sentiment deteriorated rapidly as investors continued to rotate out of software and semiconductors. Nvidia fell nearly 3% amid reports of strained relations with OpenAI, which is reportedly dissatisfied with Nvidia’s latest AI chips, complicating discussions around a potential $100 billion investment. Microsoft and Amazon also moved lower as the broader software selloff deepened, with pressure exacerbated by news that AI startup Anthropic unveiled a new productivity tool aimed at in-house legal teams, intensifying competitive concerns across enterprise software. Attention now turns to AMD’s after-hours earnings, which are viewed as a critical test for the AI trade amid growing fears of Big Tech overspending and a potential AI bubble. Results later this week from Amazon and Alphabet are expected to further shape sentiment.

Earnings outside of tech added to the volatility. PayPal shares plunged more than 20% after the company missed earnings and revenue expectations and announced that HP CEO Enrique Lores will take over as its new chief executive. Reports from Pepsi, Pfizer, and Chipotle were also in focus, while Disney shares fell after the company named parks chief Josh D’Amaro as its next CEO, set to replace Bob Iger in March. Meanwhile, precious metals continued their historic whipsaw. Gold surged nearly 7%, marking its biggest daily gain since 2008 after suffering its steepest drop in more than four decades last Friday. Silver rebounded more than 9% as dip buyers rushed back into the battered space. Despite the sharp equity selloff, the late-day rebound off SPY’s lows once again reinforced a familiar theme: aggressive selling pressure continues to attract buyers near key technical support, keeping the broader bull trend intact for now.

SPY Performance

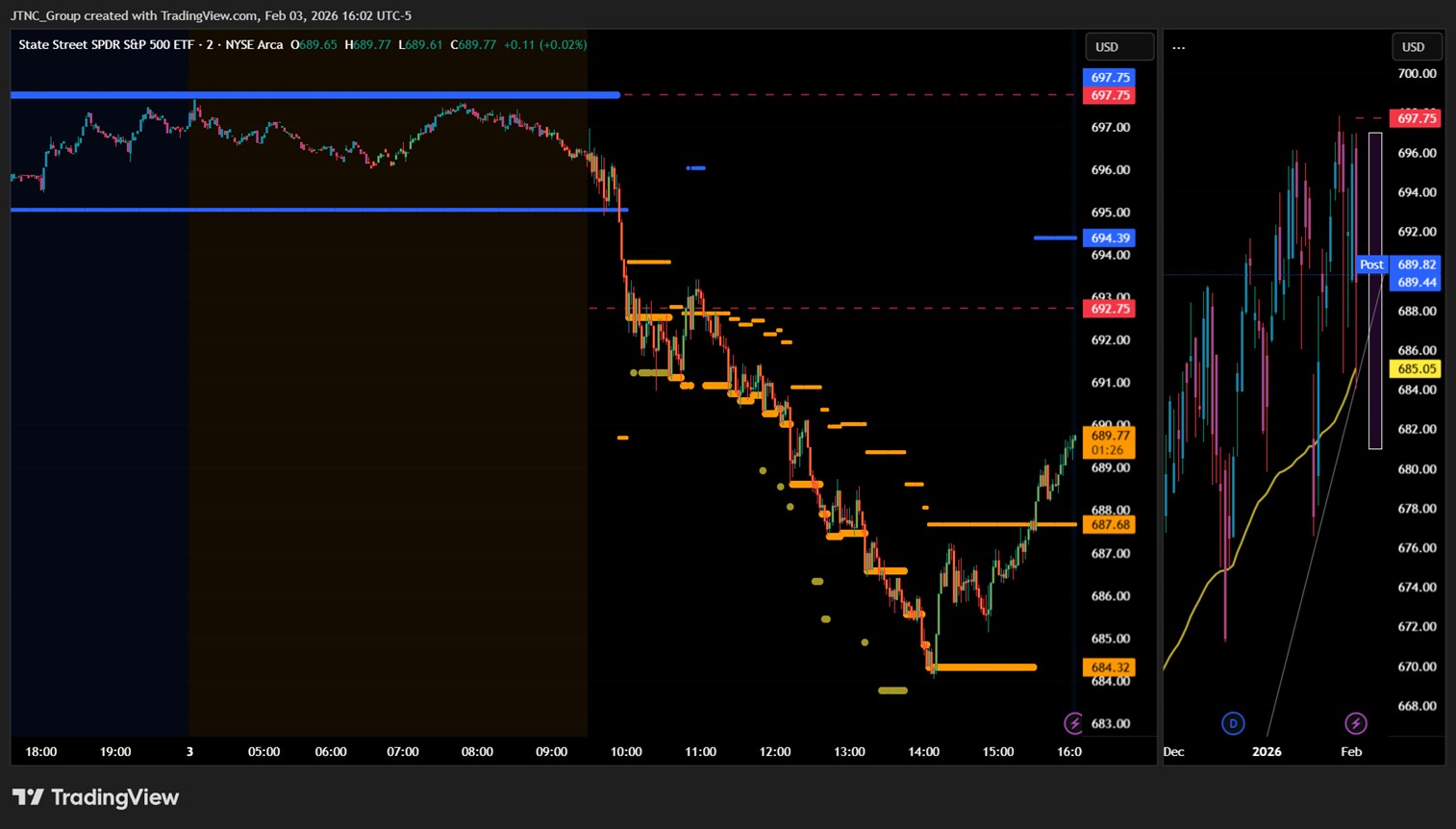

SPY experienced a violent session marked by a sharp selloff followed by a meaningful late-day recovery. The ETF opened at $696.26, pushed to an intraday high of $696.96, and then sold off relentlessly through most of the session, bottoming at $684.03 before buyers stepped in aggressively. That rebound cut losses nearly in half, with SPY closing at $689.45, down 0.86% on the day. Trading volume surged to 97.75 million shares, well above average, reflecting heightened emotion and strong participation. Once again, SPY found support almost exactly at structural trend support near $684, reinforcing the repeated pattern of sharp declines being met with decisive buying as long as $685 holds.

Major Indices Performance

Performance across the major indices was highly fragmented. The Nasdaq fell 1.43%, driven by broad weakness across technology and software. The S&P 500 dropped 0.86%, reflecting tech’s outsized influence, while the Dow rose 1.06%, supported by strength in non-tech components. The Russell 2000 added 0.18%, signaling relative stability among small caps despite elevated volatility.

Notable Stock Movements

It was an all-red session across the Magnificent Seven, led lower by Netflix, which fell 3.41%. Tesla was the lone exception, finishing marginally higher by 0.04%. Broad weakness across megacap technology weighed heavily on sentiment, though sustained downside across both megacaps and crypto would still be required to confirm a larger trend change.

Commodity and Cryptocurrency Updates

Commodities and crypto reflected elevated stress. Crude oil surged 3.03% to $64.02 as Middle East tensions intensified. Our model has been forecasting crude’s move toward $60 for several months, and while volatility remains likely, holding above $56 keeps the door open for a rally toward $70. Gold jumped 6.90% to $4,973, continuing its historic volatility. Bitcoin fell 2.11% to close above $76,800, marking another weak session for crypto after recent heavy selling.

Treasury Yield Information

The 10-year Treasury yield fell 2.28% to close near 4.265%, easing pressure on equities late in the session. In our framework, yields above 4.5% are problematic for stocks, above 4.8% typically coincide with sharper selloffs, and moves above 5% signal serious equity risk, with a 20% or greater correction likely near 5.2%. Tuesday’s decline in yields helped stabilize the late-day rebound.

Previous Day’s Forecast Analysis

Monday’s framework emphasized that above $685 the bulls retain control and that sharp downside moves were likely to be bought absent a true macro shock. We highlighted the market’s tendency toward large down moves followed by aggressive recoveries.

Market Performance vs. Forecast

Tuesday’s session validated that outlook. SPY sold off aggressively, briefly appearing as though the bull trend might fail, but buyers once again stepped in near $684, preserving the broader structure and keeping $700 firmly in play.

Premarket Analysis Summary

In Tuesday’s premarket notes published at 7:21 AM, SPY was trading near $696.85 with a bullish bias above $695.25. Upside targets were set at $697.75 and $700.25, while downside levels were identified at $695.25, $694, and $692.75. The plan favored upside continuation unless the bias level failed.

Validation of the Analysis

The session moved sharply against the bullish bias early, slicing through multiple downside levels before finding support at structural trend support. While upside targets were not reached, the expectation that the market would not collapse proved correct, as buyers reclaimed control into the close.

Looking Ahead

Wednesday brings ADP Employment data and ISM Services PMI, neither of which is expected to materially move markets. Attention remains focused on earnings and geopolitical headlines ahead of Friday’s critical jobs report.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish despite rising volatility. SPY continues to trade above $685, keeping bulls in control. Resistance sits at $690, $693, $694, and $698, while support rests at $687, $685, $684, and $682. The $693–$695 zone remains heavily defended, favoring failed-breakout setups.

Expected Price Action

SPY’s projected maximum range for Wednesday is $686 to $699, with the Put side dominating in a wide and expanding band that signals trending price action with intermittent chop.

Trading Strategy

As long as SPY holds above $684–$685, longs remain favored on pullbacks. Shorts are preferred on failed breakouts near $693–$695. With volatility elevated and February historically prone to surprise selloffs, discipline and patience remain critical.

Model’s Projected Range

SPY’s projected maximum range for Wednesday is $686 to $699, with the Put side dominating in a wide and expanding band that signals trending price action with intermittent chop. Wednesday has ADP Employment numbers and Services PMI, neither of which is likely to do much to shape the market. Today there was no economic news, but fear of a war with Iran and a continued government shutdown shook the market, which opened above $696 but quickly sold off for most of the day, with a late-day recovery off $684 that cut losses almost in half. SPY closed down -0.85% at $689.53, but it was much weaker throughout the session and once again appeared as though the bull trend may have come to an end. But that was not to be as the bulls stepped up once again right at the 50 DMA and pushed price off the lows to close the day down only modestly. We have repeated for weeks that above $685 the bulls control the market, and today’s decline was once again bought, keeping the bull trend alive and the bulls firmly in control of the narrative with $700 still firmly in play despite geopolitical headlines. Bulls continue to support price with remarkable consistency, stepping in almost on command, and as long as SPY holds above $685, the path toward $700 remains intact. Volume was significantly above average, which is both good and bad, as the relentless push lower came somewhat out of left field, but the recovery off the lows is exactly what the market has been doing for months. Big down followed by big up equals big confusion, which is the trademark of a trading range, leading us to believe the market is waiting for Friday’s jobs report before resolving this large range. Overnight the bulls want to hold above today’s lows at $684 to keep the recovery moving on Wednesday. If they are able to do so, SPY can rally to $693, pause, and then move toward $695 where it is likely to stall. The bears were trapped at the lows today and are unlikely to engage again unless $684 fails, and even then would need a break of $680 to generate meaningful downside pressure. If $684 holds overnight, another attempt toward $700 is likely, though a strong catalyst may be required to clear that level. We have warned for a few weeks that February is historically prone to surprise selloffs, and that any deeper pullback should be viewed as a buy-the-dip opportunity for a spring or summer rally given the long-term bull trend remains intact above $640. Absent a catalyst for tomorrow, resistance sits at $690, $693, $694, and $698, while support is at $687, $685, $684, and $682. The $693–$695 zone remains heavily defended, favoring failed-breakout shorts, while longs are favored above $684. Crypto fell again today and is at levels not seen in some time, while every MAG stock except Tesla declined. Sustained weakness across both groups would be required for a larger pullback, so the question remains whether today marks the start of something more ominous or simply another attempt to shake out weak longs. VIX jumped 10.16% to 18, moving into neutral territory and approaching bearish conditions. SPY closed inside a redrawn bull trend channel from the April lows, with structural support near $684, which is exactly where SPY found support today.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in wide Ranging Market State with SPY closing in the lower half of the range. There were no extended targets at the close but for several hours in the morning session until 2 pm, extended targets to the downside displayed the herd was participating in the day’s decline. Overnight the MSI remained in its narrow bullish state from the close and at the open, the MSI rescaled to a ranging state followed by several rescalings lower in a bearish state. When this occurs with extended targets, ride the trend and do not fade it until extended targets stop and the MSI range stops rescaling. That happened right after 2 pm ET and SPY reversed and moved back above $685, keeping the bulls in the driver’s seat. For Wednesday the MSI forecasts choppy trading which could retest the day’s lows or rip higher to MSI resistance or both. MSI resistance is $694.39 with support at $687.68.

Key Levels and Market Movements:

Monday we stated, “remain aware of global events, as they could shape price action ahead of Friday’s jobs report,” and added, “the primary trend remains bullish as long as SPY holds above $685, and the bulls continue to defend that level,” while also noting, “the bias for Tuesday favors selling failed breakouts above $697 and buying dips down to $688.” With the MSI opening in a narrow Bullish Trending Market State above $696, it was not immediately obvious whether MSI support should be bought, and those who did were not wrong, as market structure initially supported higher prices. However, external catalysts tied to war concerns and a potential government shutdown quickly changed the narrative. Once SPY lost MSI support, the correct move was to wait and observe, and the MSI soon made it clear that price was moving lower with the herd actively participating in the selloff. Shorting MSI resistance around 11 am was the best trade of the day, and allowing that position to run toward the day’s lows was effectively telegraphed by the MSI well in advance. Once extended targets stopped printing, looking for a long near the $685 level also made sense, as the ensuing rally recovered a large portion of the day’s decline. The session may have included one losing trade early, followed by two clean winning trades that more than compensated for any initial loss. This day once again reinforced the importance of context, patience, and flexibility, using the MSI, premarket levels, and market structure together to guide execution rather than forcing trades when conditions are less than ideal. These were the only clean and actionable setups of the day, and they were identified by adhering to the premarket levels, post-market roadmap, and MSI signals within our established framework for structure, trend, and execution. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Wednesday’s economic news is unlikely to move the market, but external catalysts remain a clear and ongoing risk. This week includes earnings from several large companies and Friday’s Jobs report, either of which could support higher prices or introduce additional weakness. Absent an external catalyst, the primary trend remains bullish as long as SPY holds above $685 and the bulls continue to defend that level. This reinforces what we have said for weeks: above $685, the bulls have full control and the bears struggle to gain traction. A sustained hold above $695 opens the door for a push toward $700 and potentially higher. The bias for Wednesday favors selling failed breakouts above $695 and buying dips down to $688, while shorts are favored on acceptance below $688. Expect trending price action and use the MSI to determine the intraday trend as it rescales. For the bears to regain any meaningful traction, SPY must break below $680 and remain there. The long-term bull trend remains intact above $640. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $699 to $715 and higher strike Calls while also buying $690 to $698 Calls indicating the Dealers’ desire to participate in any continuation of the relief rally on Wednesday. Dealers are no longer selling ATM Puts and took a substantial loss on yesterday’s positioning. The ceiling for tomorrow appears to be $700. To the downside, Dealers are buying $689 to $635 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $696 to $720 and higher strike Calls while also buying $690 to $695 Calls indicating the Dealers’ desire to participate in any continuation of the relief rally this week. The ceiling for the week appears to be $699. To the downside, Dealers are buying $689 to $585 and lower strike Puts in a 5:1 ratio to the Calls they’re selling/buying, reflecting a market that is concerned about lower prices. For the week Dealer positioning has changed from slightly bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Wednesday, respect the bullish structure but remain selective. Favor buying pullbacks that hold above $684–$688 and selling failed breakouts near $697–$700. Avoid trading during Ranging Market States and allow MSI signals, structure, and confirmation to guide execution rather than reacting to headlines.

Good luck and good trading!