Market Insights: Thursday, February 12th, 2026

Market Overview

US stocks turned sharply lower Thursday as fears of AI-driven disruption intensified and investors shifted decisively into risk-off mode ahead of Friday’s inflation report. The Dow Jones Industrial Average fell roughly 1.3%, losing more than 650 points, while the S&P 500 dropped 1.6% and the tech-heavy Nasdaq Composite slid more than 2%, as technology shares once again bore the brunt of the selling pressure. The decline marked a swift reversal from earlier optimism this week and underscored how fragile sentiment remains as markets reassess both AI’s disruptive potential and the path of Federal Reserve policy.

Technology stocks led the selloff as concerns that artificial intelligence could fundamentally disrupt traditional software models spread into adjacent industries, including trucking, logistics, and real estate services. Cisco Systems plunged more than 12% after issuing a gloomy profit outlook despite rising sales tied to Big Tech’s AI buildout. Nvidia fell alongside broader semiconductor weakness, while Meta, Amazon, and Apple all suffered steep losses, with Apple dropping roughly 5% in one of the weakest performances among the Magnificent Seven. The breadth of the decline reflected more than simple profit-taking; it signaled growing anxiety that AI innovation may compress margins and displace existing revenue streams faster than companies can adapt.

Alternative assets mirrored the risk-off shift. Gold futures sank approximately 3%, and bitcoin dropped toward $65,000, reinforcing the sense that investors were reducing exposure across speculative and momentum-driven trades. The retreat comes as attention turns squarely toward Friday’s Consumer Price Index report, which is expected to provide fresh clues about inflation trends and the likelihood of near-term rate cuts. A softer inflation reading could reignite hopes that price pressures are easing while economic growth remains intact, but Thursday’s move suggested traders were unwilling to take aggressive positions ahead of the data.

Earlier in the day, weekly jobless claims showed a smaller decline than expected, keeping focus on labor market resilience after last week’s nonfarm payrolls report revealed stronger-than-anticipated hiring. That strength complicates the Federal Reserve’s outlook, as a resilient labor market combined with sticky inflation reduces the urgency for rate cuts — a key catalyst behind much of the market’s prior rally. On the earnings front, McDonald’s shares edged higher following a beat, while attention shifted to Coinbase, Applied Materials, and Rivian after the close. Overall, Thursday’s action reflected a broad rotation out of risk, driven by AI disruption fears, earnings uncertainty, and anticipation surrounding inflation data that could determine whether this pullback deepens or stabilizes.

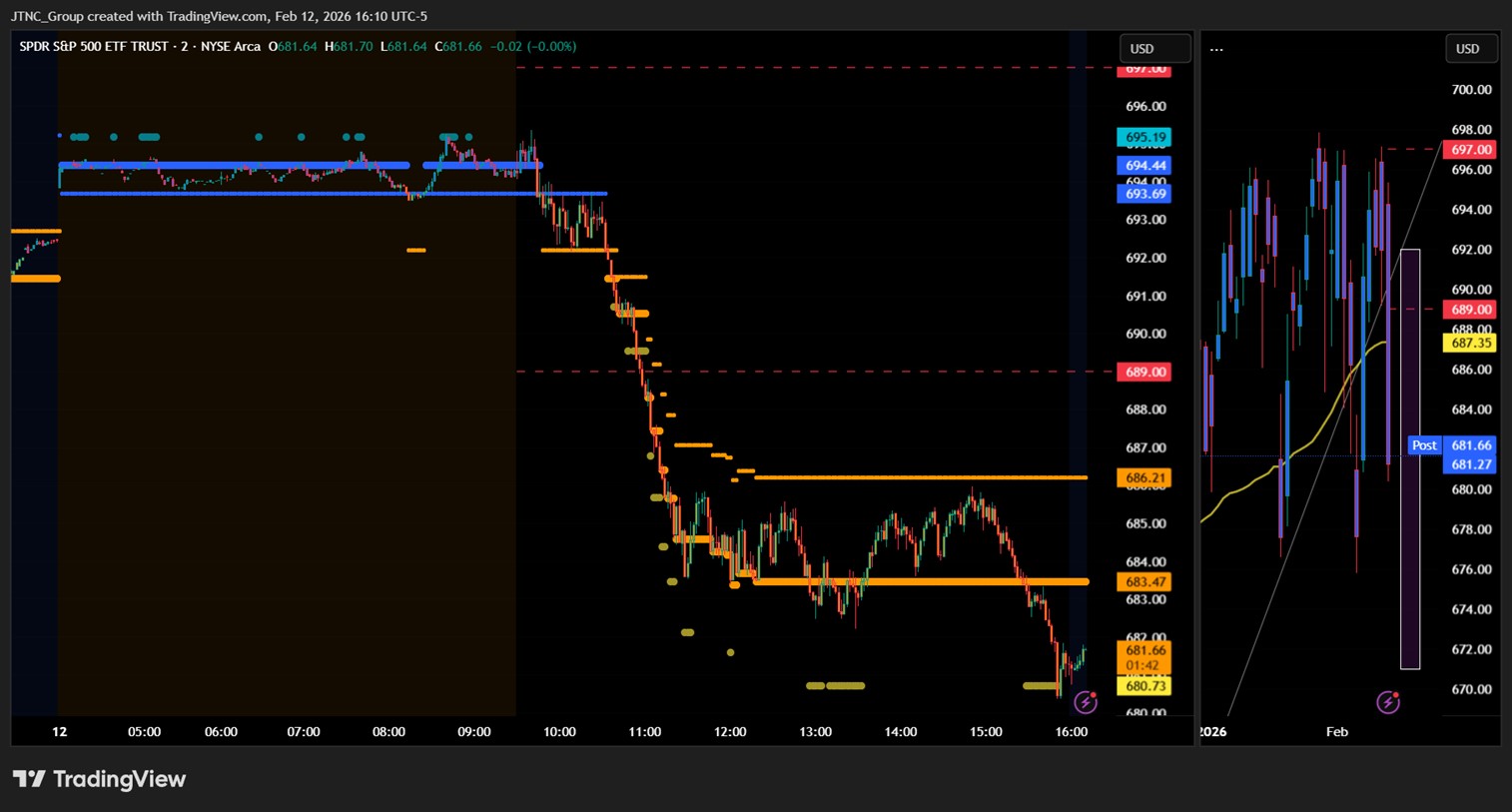

SPY Performance

SPY traded under heavy pressure throughout the session, reflecting persistent selling across technology and growth names. The ETF opened at $691.28 and briefly attempted to stabilize, but sellers quickly took control, pushing price steadily lower through midday. SPY reached an intraday low of $679.94 before a modest afternoon bounce trimmed losses. The ETF closed at $681.36, down 1.52% on the day. Trading volume surged to 94.18 million shares, well above average, signaling broad participation and elevated emotion. Most notably, SPY failed to hold the $685 level on a closing basis, confirming a structural shift in near-term control from bulls to bears.

Major Indices Performance

Losses were broad and decisive. The Nasdaq fell 2.04%, leading the decline as semiconductors and software stocks extended their drawdown. The S&P 500 dropped 1.62%, while the Dow declined 1.28%, reflecting expanding weakness beyond growth sectors. The Russell 2000 slid 1.74%, signaling risk aversion spreading into small caps. The synchronized nature of the decline marked a notable change from prior sessions characterized by rotation rather than broad selling.

Notable Stock Movements

It was a fully red session across the Magnificent Seven. Nvidia, Amazon, and Meta each fell sharply, while Apple’s roughly 5% drop stood out as one of the largest single-day losses among the group this year. Microsoft also weakened, reinforcing the shift away from AI leadership. Sustained downside across megacap technology and crypto now raises the probability of a deeper corrective phase rather than simple consolidation.

Commodity and Cryptocurrency Updates

Commodities and crypto reinforced the risk-off tone. Crude oil fell 1.98% to $63.65, slipping as growth concerns outweighed geopolitical premiums. Gold declined 2.91% to $4,962, retreating despite heightened equity volatility. Bitcoin dropped 4.83% to close near $65,300, extending its recent slide and confirming structural weakness in speculative assets.

Treasury Yield Information

The 10-year Treasury yield declined 1.12% to close near 4.125%, reflecting increased demand for safety. In our framework, falling yields tied to growth concerns often coincide with equity weakness rather than providing immediate support. Yields remain below the 4.5% threshold that historically pressures equities, but the direction of the move suggests rising caution about economic momentum.

Previous Day’s Forecast Analysis

Wednesday’s framework emphasized that resistance near $697 remained heavy and that failed breakouts should be sold, while dips near $685 remained buying opportunities as long as support held. We also noted that acceptance below $685 would shift near-term control toward the bears.

Market Performance vs. Forecast

Thursday confirmed that structural shift. SPY failed to reclaim upper resistance, broke decisively below $685, and closed beneath that level, signaling that dip-buying dynamics have weakened and that bears now control the near-term tape.

Premarket Analysis Summary

In Thursday’s premarket notes published at 7:28 AM, SPY was trading near $689.74 with upside targets at $691.50 and $694, and downside levels at $688, $685, and $681. We cautioned that acceptance below $685 would increase downside risk toward the $680 zone.

Validation of the Analysis

The session validated that roadmap. SPY failed to hold above $685 early, selling accelerated, and price extended toward the $680 area before stabilizing into the close. The breakdown occurred exactly as outlined in the premarket plan.

Looking Ahead

Friday brings the Consumer Price Index, the most significant inflation data point of the month. A hotter-than-expected print could deepen the correction, while a softer reading may trigger a relief bounce. Volatility is likely to expand sharply following the release.

Market Sentiment and Key Levels

Sentiment has shifted decisively toward risk-off. SPY now trades below $685, placing bears in control. Resistance sits at $685, $689, and $693, while support rests at $678, $675, and $670. Reclaiming $685 is critical to restoring bullish momentum.

Expected Price Action

SPY’s projected maximum range for Friday is $668 to $690, with the Put side dominating in a wide and expanding band that signals trending downside action with sharp intraday swings.

Trading Strategy

Below $685, selling bounces is favored. Failed rallies into $685–$689 present short opportunities, while aggressive longs carry elevated risk until price can reclaim key resistance. Strict risk management and reduced position size are recommended ahead of CPI.

Model’s Projected Range

SPY’s projected maximum range for Friday is $671 to $692, with the Put side dominating in an expanding and very wide band that suggests trending price action with intermittent chop. Friday has CPI which may excite the premarket but is unlikely to move the needle much during the day session. Unemployment Claims were generally in line with expectations, but the market chose to rotate back into the $675 to $685 range where it has spent much of the past few months, allowing the bears to reenter in size. Today was another massive move, this time to the downside, virtually erasing the entire recovery from earlier in the week. SPY closed down 1.54% at $681.27, with bears now clearly active. Overnight the market gapped up and initially looked ready to run higher, but the rally stalled within 15 minutes of the open and price trended lower for the remainder of the session, closing at the lows. Volume was nearly double average, reinforcing the validity of the decline. With SPY now below $685, the battle between bulls and bears intensifies and near-term direction is less certain. The long-term bull trend remains intact above $640, but new highs are off the table for Friday and possibly next week as February once again proves to be a difficult month for longs. We have warned for weeks that February often brings sharp selloffs and those dips should be used to position for a spring and summer rally. As long as price holds above key structural levels, this remains a broader dip-buying environment. That said, swing and intraday traders must stay focused on positioning and dealer flows, which are currently skewed short. Overnight bulls need to reclaim $685 to regain near-term control. Even if reclaimed, that does not signal an all-clear, as dealers are positioned for weakness up to $694. The $690 to $694 zone is likely to be heavy chop and resistance before any directional resolution. Above $694, the market opens toward $696 and potentially higher. However, if bulls fail to defend $680 overnight, downside opens quickly toward $675 where a bounce is possible, at least initially. Absent a catalyst, resistance sits at $682, $685, $686, and $689, while support rests at $680, $679, $677, and $675. We favor shorting rallies into $689 and failed breakouts, especially above $696. Dip buying should be approached cautiously, with preference given to failed breakdown setups below $680 rather than aggressive bottom fishing. Crypto fell more than 3% again and is now roughly 50% off its highs. All MAG stocks declined as well, led by Apple down over 5%, with Netflix not far behind. If something more ominous is developing, sustained weakness across both groups will continue to lead a broader market pullback. VIX surged 18.19% to 20.86, signaling risk-off conditions and approaching bearish territory. SPY closed well below the bull trend channel from the April lows, with structural resistance now near $691.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in Bearish Trending Market State with SPY closing well below MSI support turned resistance. There were extended targets at the close with extended targets both in the premarket above price and for most of the day session below price, indicating the herd participating heavily in the day’s declines. Overnight the MSI rescaled higher in a very narrow bullish state which held until just after the open when a series of rescalings lower in rapid succession with extended targets, led price to the lows of the day. For Friday the MSI is forecasting lower prices. MSI resistance is $683.47 and higher at $686.21.

Key Levels and Market Movements:

Wednesday we stated, “Overnight, bulls want to reclaim $695 to set up a push toward all-time highs. Above $697 is likely to be a slog with slow price action along the way,” and added, “Thursday is expected to be choppy with a slight upward drift and the potential to backtest as low as $688,” while also noting, “If $685 fails and price closes below that level, $680 becomes the next likely test.” With the MSI opening in a very narrow bullish state with little room to $697 and no extended targets at the open, the trade was to fade the less than perfect failed breakout right after the open. An entry here provided multiple targets once the MSI started to rescale lower. While we did not anticipate such a massive drop in the overnight or premarket reports, the MSI once again showed in real time what was transpiring, allowing traders to profit handsomely. Even missing the failed breakout at the open, with so many MSI rescalings lower, at any time a trader could have jumped in short at MSI resistance and ridden to MSI support. This is called level to level trading which is that the MSI is designed to provide. With extended targets virtually all day, there was nothing to do on the long side. So the day was likely one massive trade to the downside and done. Easy to see, easy to read, and easy to execute when the proper context, patience, and flexibility are applied, using the MSI, premarket levels, and market structure together to guide execution rather than forcing trades. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday only has CPI which again is unlikely to move the market. Overnight, the bulls want to reclaim $685 to regain control and to put the bears back to sleep. But even above $685, its likely to be a sell the rally market on Friday all the way to $694. Above $694 the market favors longs but only to $696 where once again, its likely the market at least stalls. We don’t see a realistic scenario for tomorrow where price reaches $696. Below $690 sell all rallies and be careful buying dips until $675 is reached. Absent an external catalyst, Friday is likely to see trending price action with a downside push to $675. If $685 is reclaimed, $689 is the likely peak where once again we see bears containing price. The long-term bull trend remains intact above $640 and failed breakouts and failed breakdowns continue to offer the highest-probability setups. Remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $698 to $715 and higher strike Calls while buying $682 to $697 Calls indicating the Dealers’ desire to participate in any relief rally on Thursday. The ceiling for tomorrow appears to be $696. To the downside, Dealers are buying $691 to $600 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $693 to $715 and higher strike Calls while buying $682 to $692 Calls indicating the Dealers’ desire to participate in any rally next week. The ceiling for the week appears to be $700. To the downside, Dealers are buying $681 to $575 and lower strike Puts in a 6:1 ratio to the Calls they’re selling/buying, reflecting a market that is concerned about lower prices. For the week Dealer positioning is unchanged from bearish to bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Friday, respect the bearish shift. Favor selling failed bounces below $685 and avoid countertrend longs unless CPI delivers a clear catalyst and price reclaims resistance with conviction. Stay disciplined, reduce exposure, and trade confirmed structure rather than anticipation.

Good luck and good trading!