Market Insights: Wednesday, February 11th, 2026

Market Overview

US stocks finished little changed on Wednesday as investors digested a stronger-than-expected January jobs report that both reinforced labor market resilience and complicated the Federal Reserve’s path toward rate cuts. The Dow Jones Industrial Average slipped 0.1%, pulling back slightly from record highs, while the S&P 500 hovered near the flatline and the Nasdaq Composite edged down 0.1%. The muted reaction masked an important shift beneath the surface, as traders recalibrated expectations for monetary policy following data that showed hiring remained solid even as prior figures were sharply revised lower.

The Bureau of Labor Statistics reported that the US economy added 130,000 jobs in January, comfortably beating consensus estimates, while the unemployment rate ticked down to 4.3% from 4.4%. The headline strength suggested continued resilience in the labor market after a string of softer private payroll readings. However, the optimism was tempered by substantial downward revisions to 2025 payroll growth, which reduced the annual total from 584,000 to just 181,000 jobs, marking the weakest year for job creation since 2003 outside of a recession. That juxtaposition of strong monthly growth and weaker underlying trend left markets conflicted, reinforcing the narrative that the economy is cooling but not collapsing.

The data complicates the Federal Reserve’s rate outlook. Prior to the report, weak retail sales had bolstered expectations that policymakers could move toward rate cuts by early summer. Wednesday’s employment surprise, however, reduced urgency for immediate easing. Markets are now increasingly pricing in a scenario where the Fed holds rates steady through at least June, though most traders still expect two cuts by year-end. Earnings season continues to offer additional insight into consumer strength and corporate health. McDonald’s reported after the bell, while Kraft Heinz signaled it would pause its planned spin-off. Cisco also released results as it competes more aggressively in AI networking hardware, positioning itself alongside Nvidia in the race for Big Tech infrastructure spending. Overall, Wednesday’s session reflected a market processing mixed signals: a resilient labor market that delays rate relief, but underlying softness that prevents a decisively hawkish shift.

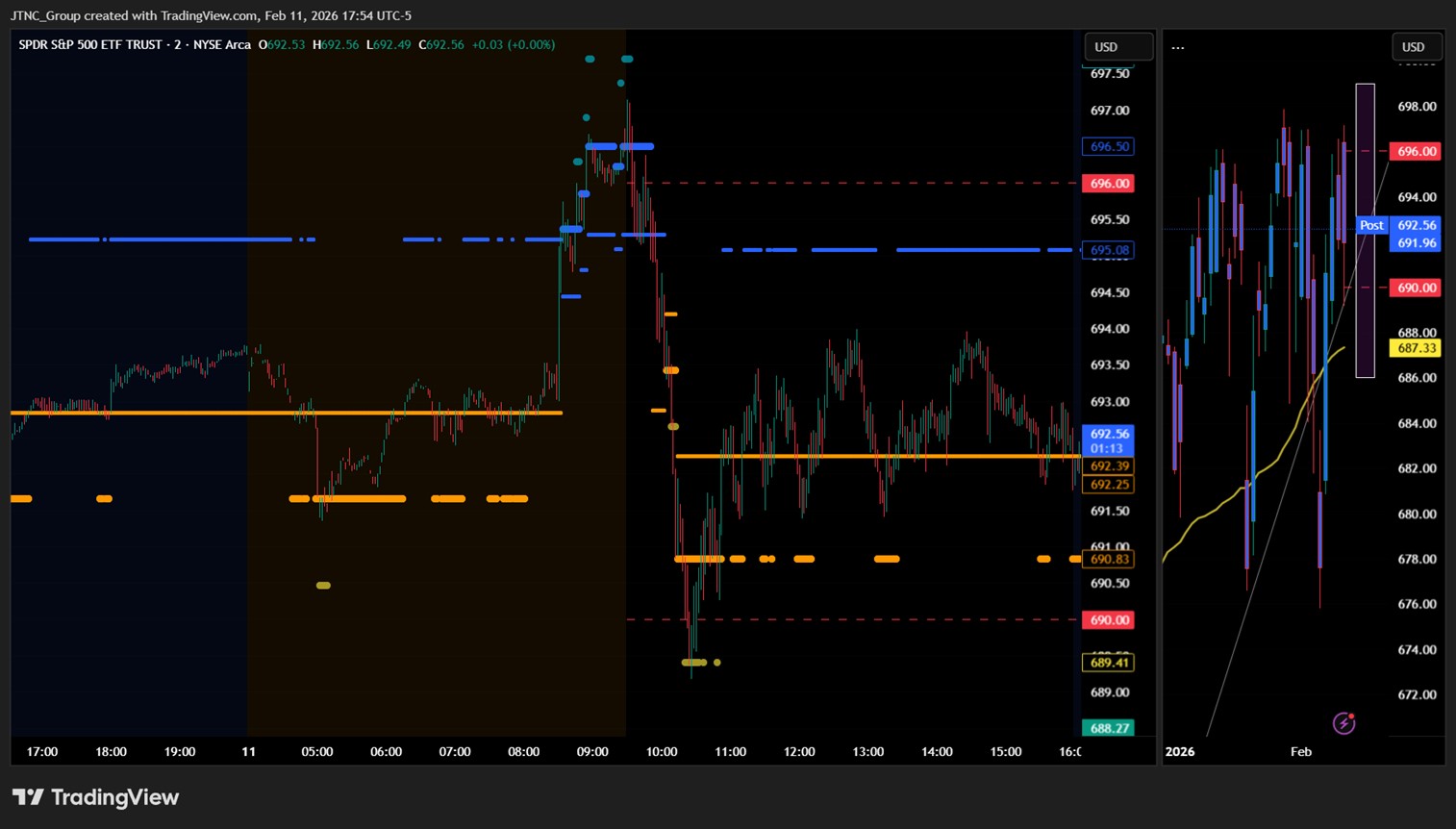

SPY Performance

SPY traded in a defined range following an early premarket pop triggered by the jobs report. The ETF opened at $696.42 and quickly pushed to a session high of $697.13 before sellers stepped in aggressively. Price fell sharply toward $690 by 10 AM, where buyers defended support and stabilized the tape. SPY ultimately closed at $691.87, down 0.04% on the day, with trading volume at 72.79 million shares, about average. The session reflected classic post-data volatility followed by consolidation, with price remaining firmly above the critical $685 level that defines bull control.

Major Indices Performance

Performance across the major indices was subdued. The Nasdaq declined 0.16%, the Dow slipped 0.13%, and the Russell 2000 fell 0.42%, while the S&P 500 finished essentially flat. The lack of follow-through in either direction reinforced the view that markets are in digestion mode following the strong jobs print.

Notable Stock Movements

It was a mostly red session across the Magnificent Seven, led lower by Netflix, which fell 3.16%. The notable exceptions were Nvidia, Apple, and Tesla, with Tesla leading gains of up to 0.80%. The mixed performance underscores selective rotation rather than broad-based risk aversion. Sustained weakness across both megacap technology and crypto would still be required to signal a larger pullback.

Commodity and Cryptocurrency Updates

Crude oil rose 1.53% to $64.94, continuing to trade above the $60 level our model has been forecasting for several months. As long as crude holds above $56, the longer-term path toward $70 remains intact. Gold climbed 1.59% to $5,110, reflecting continued demand for hedges despite the stronger jobs report. Bitcoin fell 1.69% to close above $67,400, marking another modest step lower in its recent consolidation phase.

Treasury Yield Information

The 10-year Treasury yield rose 0.65% to close near 4.172%. In our framework, yields above 4.5% create meaningful headwinds for equities, while sustained trade above 4.8% often precedes sharper selloffs. Wednesday’s move higher reflects reduced expectations for immediate Fed easing but remains below levels that historically disrupt equities.

Previous Day’s Forecast Analysis

Tuesday’s framework anticipated choppy price discovery ahead of the jobs report, with bulls needing to hold above $691 and resistance heavy above $696. We emphasized that February often brings volatility but that dips above $685 remain buying opportunities.

Market Performance vs. Forecast

Wednesday unfolded largely as expected. SPY briefly rallied toward $697 on the data release but failed to sustain momentum above resistance and rotated lower into the $690 area, where support held cleanly. The anticipated slog near resistance and defense of key support played out precisely.

Premarket Analysis Summary

In Wednesday’s premarket notes published at 8:10 AM, SPY was trading at $692.84 with upside targets at $694, $696, and $698, and downside levels at $692, $690, and $688. The plan outlined a balanced range ahead of the employment release, with $694 serving as the bias level for upward continuation.

Validation of the Analysis

The session validated that roadmap. SPY briefly surpassed upper targets in the premarket, reached $697.14, and then reversed sharply after the open, testing support at $690 before stabilizing. The defined range held, and no structural breakdown occurred.

Looking Ahead

Thursday brings Unemployment Claims, followed by CPI on Friday. Next week features FOMC Minutes, then GDP, PCE, and PMI. Macro data will remain the primary catalyst as markets assess whether economic resilience delays rate cuts.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish. SPY remains within striking distance of $700 and new all-time highs. Resistance sits at $693, $698, $699, and $700, while support rests at $691, $688, and $685. Holding above $685 keeps bulls firmly in control.

Expected Price Action

SPY’s projected maximum range for Thursday is $686 to $699, with the Call side dominating in a steady band that signals choppy price action with intermittent trending periods.

Trading Strategy

We favor buying dips down to $685 and shorting failed breakouts above $698. February volatility remains a factor, but as long as price holds above key structural support, dips remain opportunities rather than trend changes.

Model’s Projected Range

SPY’s projected maximum range for Thursday is $686 to $699, with the Call side dominating in a steady band that signals choppy price action with intermittent trending periods. Thursday has Unemployment Claims, but since the Jobs Report showed growth in hiring, it is unlikely to move the needle. Today the Jobs Report did move the needle, with SPY jumping in the premarket to a high of $697.14 after trading mostly sideways to lower overnight. But the pop was short lived. Immediately after the open SPY began selling off, dropping hard and fast until 10 am when buyers stepped in to defend $690 and pushed SPY back into the $692–$694 area to end the day essentially unchanged. SPY closed down 0.02% at $691.96, trading in a range for the entire afternoon session. SPY remains within striking distance of $700 and new all-time highs and as long as price remains above $685, the bulls are firmly in control while the bears remain sidelined and the task ahead is clear…hit $700 during earnings season. That said, we continue to reiterate that February often brings sharp selloffs and those dips should be used to position for a spring and summer rally. If we do get another large selloff, as long as price remains above key levels, it remains a dip-buying opportunity. Overnight, bulls want to reclaim $695 to set up a push toward $698 and beyond. Above $698 there is a heavy wall of resistance. We stated yesterday that “it’s likely along the way to $700 SPY dips before making the final push to this psychological level,” and today that played out perfectly. While we do not necessarily expect another sharp dip, it is likely to be a slog above $698 to $700 and even up to $703. Should $691 fail to hold overnight, SPY is likely to sell off and test as low as $688, which would still keep the bulls in control as long as that level holds. A failure at $688 opens the door to $685, which would reawaken bear interest. The long-term bull trend remains intact above $640. Absent a catalyst, resistance sits at $693, $698, $699, and $700, while support rests at $691, $688, and $685. We favor shorting failed breakouts above $698 and buying dips down to $685. Crypto fell again today while most MAG stocks declined with the exception of Apple, Nvidia, and Tesla. Sustained weakness across both groups would be required for a larger pullback. VIX fell 0.79% to 17.65, remaining in neutral territory. SPY closed above the bull trend channel from the April lows with structural support near $688.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in wide Ranging Market State with SPY closing at MSI support. There were no extended targets at the close but extended targets did print in the premarket after the jobs report and on the decline in the early morning session. But the bulk of the day as spent with SPY trading in the current MSI ranging state. Overnight the MSI rescaled lower briefly then after the jobs report higher several times. But each rescale higher was narrow which was a clear indication the herd was not really interested in higher prices. So by the open the MSI had settled into a bullish state but quickly changed gears to a bearish state with extended targets that saw price reach the days lows. That didn’t last long either and as soon as extended targets stopped printing, the MSI returned to a ranging state where it spent the rest of the day. For Thursday the MSI is forecasting choppy trading with a likely retest of the day’s lows and perhaps the day’s highs. MSI resistance is $695.08 with support at $692.25.

Key Levels and Market Movements:

Tuesday we stated, “Wednesday’s premarket includes the Jobs report, which is likely to dictate the day’s action once released,” and added, “Wednesday is expected to see trending price action with a slight upward drift,” while also noting, “Above $696, SPY may attempt a run at $700, but resistance in this zone is heavy and further upside will require a clear increase in volume. The bias favors selling failed breakouts above $697 and buying dips down to $685.” With the MSI opening in a bullish state just shy of the day’s highs and the major $697 resistance level we forecast yesterday, the correct trade was to wait for extended targets to stop printing and short the failed breakout that presented. This was a textbook setup at major resistance and fully aligned with the plan, so shorting just after the open with a stop above the highs was the proper read. The trade paid handsomely with multiple downside targets as the MSI rescaled lower and confirmed the shift in momentum. Then at the day’s lows, another textbook failed breakdown presented the opportunity to reverse from short to long and ride the move back up into the close, locking in two clean and well-structured winners. Easy to see, easy to read, and easy to execute when the proper context, patience, and flexibility are applied, using the MSI, premarket levels, and market structure together to guide execution rather than forcing trades. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Thursday has only Unemployment Claims which is unlikely to move the needle after a blowout jobs report. Overnight, bulls want to reclaim $695 to for a push toward all-time highs. Above $697 is likely to be a slog with slow price action along the way. But the path is clear…$700 during earnings. Absent an external catalyst, Thursday is expected to see choppy action with a slight upward drift, but with the potential to backtest as low as $688. The edge remains bullish as long as SPY holds above $685. If $685 fails and price closes below it, $680 becomes the next likely test. Above $697, SPY may attempt a run at $700, but resistance in this zone is heavy and further upside will require a clear increase in volume. The bias favors selling failed breakouts above $698 and buying dips down to $685, while any sustained move below $685 should be handled cautiously, allowing the MSI to define what comes next. The long-term bull trend remains intact above $640. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $697 to $715 and higher strike Calls while buying $693 to $696 Calls indicating the Dealers’ desire to participate in any rally on Wednesday. The ceiling for tomorrow appears to be $699. To the downside, Dealers are buying $692 to $635 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $697 to $715 and higher strike Calls while buying $693 to $696 Calls indicating the Dealers’ desire to participate in any rally into Friday. The ceiling for the week appears to be $701. To the downside, Dealers are buying $692 to $585 and lower strike Puts in a 6:1 ratio to the Calls they’re selling/buying, reflecting a market that is concerned about lower prices. For the week Dealer positioning is unchanged from bearish to bearish, but more so. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Thursday, respect the bullish structure but expect volatility. Favor reactive trades at defined levels rather than predictive positioning. Let price action confirm direction, and continue prioritizing failed breakouts and failed breakdowns as the highest-probability setups.

Good luck and good trading!