Market Insights: Tuesday, February 10th, 2026

Market Overview

US stocks finished mixed on Tuesday as investors grew increasingly cautious ahead of Wednesday’s closely watched January jobs report, with softer consumer data and renewed concerns about AI-driven disruption weighing on sentiment. The Dow Jones Industrial Average edged higher by roughly 0.1%, posting its third consecutive record close, while the S&P 500 slipped about 0.3% and the Nasdaq Composite fell roughly 0.6%. Losses were concentrated in large-cap technology, with Nvidia and Alphabet leading the downside and pressuring the broader Nasdaq, even as the Dow continued to benefit from rotation into more defensive, blue-chip names. The session reflected a market that remains structurally supported after last week’s violent selloff and rebound, but increasingly hesitant to push aggressively higher ahead of key macro catalysts.

Fresh economic data set a more cautious tone early in the day. December retail sales came in flat versus the prior month, well below expectations and down sharply from November’s 0.6% increase. The report reinforced concerns that consumer momentum may be cooling as higher interest rates and lingering inflation pressures weigh on discretionary spending. In response, bond yields drifted lower and markets modestly increased expectations for Federal Reserve rate cuts later this year. While policymakers are still widely expected to hold rates steady in March and April, futures markets now imply a greater probability of the first cut arriving by June.

The retail sales data also sharpened focus on Wednesday’s delayed January jobs report, which has taken on outsized importance following recent signs of labor-market softening. Investors are looking for confirmation on whether last week’s weak ADP employment data and rising layoff announcements represent noise or the beginning of a more sustained slowdown. Friday’s Consumer Price Index reading looms as the next major test, with markets eager to see whether disinflation trends can continue alongside cooling growth.

Corporate headlines added to the uneven tone. Wealth-management stocks came under heavy pressure after an AI startup unveiled a tool designed to automate personalized tax and portfolio strategies, raising fresh fears that AI could disrupt advisory and brokerage business models. Shares of Charles Schwab, Raymond James Financial, and LPL Financial each fell more than 6%, echoing recent weakness across software and services firms exposed to automation risk. Elsewhere, earnings from Coca-Cola and CVS Health were digested, while Ford stood out positively after the close following strong guidance. Gold and bitcoin remained volatile, with gold slipping modestly after reclaiming $5,000 earlier in the week and bitcoin trading near $69,000 as confidence across speculative assets remained fragile.

SPY Performance

SPY traded lower in a controlled pullback as buyers stepped aside ahead of Wednesday’s data. The ETF opened at $694.18, pushed briefly higher to $695.02, and then sold off steadily through the session to an intraday low of $689.11 before stabilizing. SPY closed at $690.84, down 0.46% on the day. Trading volume totaled 63.22 million shares, slightly below average, signaling hesitation rather than panic. Price remained well above the critical $685 level that defines broader bull control, keeping the recovery structure intact despite the day’s weakness.

Major Indices Performance

Index performance reflected continued rotation. The Nasdaq fell 0.61%, driven by weakness in megacap technology. The S&P 500 declined 0.32%, while the Dow rose 0.10% to another record close. The Russell 2000 slipped 0.42%, indicating lingering caution toward small-cap stocks despite last week’s rebound.

Notable Stock Movements

It was a mixed session across the Magnificent Seven. Nvidia and Alphabet led declines, while Microsoft and Apple finished modestly higher. Amazon and Meta were little changed. The lack of synchronized selling across megacap technology suggests the pullback remains corrective rather than the start of a broader trend change, though leadership remains fragile.

Commodity and Cryptocurrency Updates

Commodities and crypto sent mixed signals. Crude oil slipped 0.84% to $63.81, consolidating after last week’s rebound. As long as crude holds above $56, the longer-term path toward $70 remains open. Gold fell 0.62% to $4,978, pausing after reclaiming the $5,000 level earlier in the week. Bitcoin declined 1.27% to close near $69,100, remaining under pressure after last week’s sharp drawdown.

Treasury Yield Information

The 10-year Treasury yield fell 0.41% to close near 4.181%, reflecting increased demand for safety ahead of the jobs report. In our framework, yields below 4.5% reduce pressure on equities, while sharp declines driven by growth fears tend to coincide with elevated volatility rather than sustained rallies.

Previous Day’s Forecast Analysis

Monday’s framework emphasized that after two strong recovery sessions, some consolidation or pullback was likely ahead of key data, while noting that holding above $685 would preserve bull control.

Market Performance vs. Forecast

Tuesday’s action aligned with that outlook. SPY pulled back modestly, held well above $685, and avoided any acceleration lower, confirming that selling pressure remains contained.

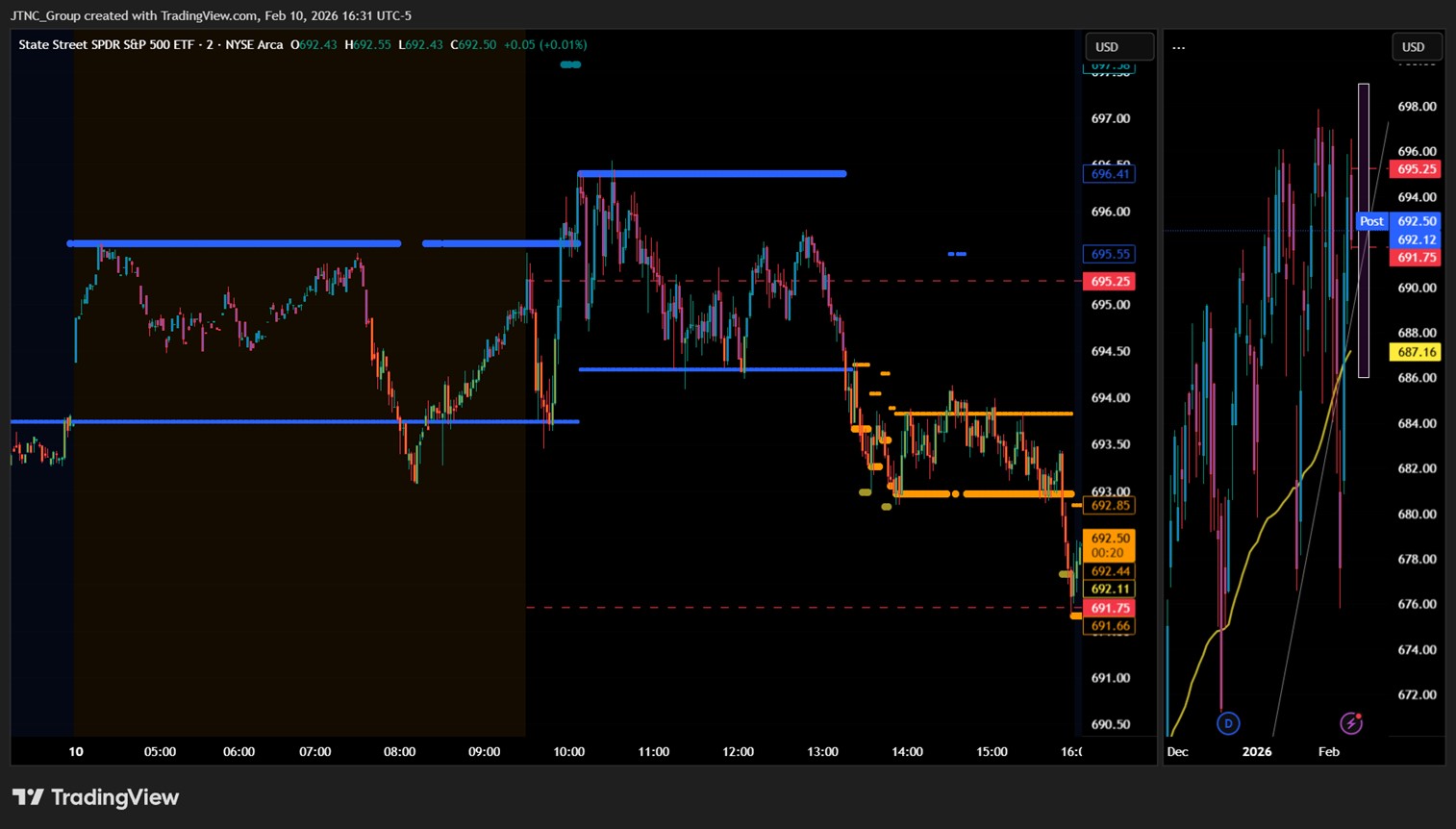

Premarket Analysis Summary

In Tuesday’s premarket notes published at 7:42 AM, SPY was trading near $693.88 with a bullish bias above $692. Upside targets were outlined at $694.50 and $697, while downside levels sat at $691.25, $688.75, and $685.50. The plan anticipated cautious trade ahead of economic data.

Validation of the Analysis

The session respected that framework. SPY failed to sustain upside above the bias level, rotated lower toward the mid-range, and stabilized well above deeper support, producing the expected pre-data consolidation.

Looking Ahead

Wednesday brings the delayed January Non-Farm Payrolls report, followed by CPI on Friday. These releases are likely to determine whether the market resumes its rebound or slips into a deeper consolidation.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish. SPY holding above $685 keeps bulls in control, though conviction has softened. Resistance sits at $694, $697, and $700, while support rests at $690, $688, and $685.

Expected Price Action

SPY’s projected maximum range for Wednesday is $682 to $701, with volatility expected to expand sharply following the jobs report.

Trading Strategy

Ahead of payrolls, patience is critical. Buying pullbacks that hold above $685 remains favored, while failed breakouts near $697–$700 present short opportunities. Position sizing should remain conservative given event risk.

Model’s Projected Range

SPY’s projected maximum range for Wednesday is $686 to $699, with the Call side dominating in an expanding band that signals trending price action with intermittent choppy periods. Wednesday has the all important Jobs report which surely has the ability to move the market. Today Retail Sales were flat indicating a consumer spending less which could weigh on the economy. But after two massive up days, the market today decided to take a much needed pause, falling 0.26% to close at $692.12, well above the $685 level that indicates bull control. SPY is still within striking distance of $700 and new all-time highs and as long as price remains above $685, the bulls are firmly in control and the bears are sidelined. But all that could change tomorrow depending on the jobs picture. We continue to reiterate that February often brings sharp selloffs and that those dips should be used to position for a spring and summer rally so if we do get another large sell off, as long as price remains above key levels, it’s a dip buying opportunity. The market initially rallied slightly overnight with SPY reaching $696.50 before sellers stepped in and closed the day near the lows. Overnight, bulls want to reclaim $695 to set up a push to $697 and beyond. Above $697 there is a heavy wall of resistance so its likely along the way to $700 SPY dips before making the final push to this psychological level. If $690 fails to hold overnight, SPY is likely to sell off and test as low as $685 which would still keep the bulls in control, as long as this level holds. A failure at $685 opens the door to $680 which would reawaken bear interest. The long-term bull trend remains intact above $640. Absent a catalyst for tomorrow, resistance sits at $695, $696, $698, and $700, while support rests at $692, $690, $688 and $685. We favor shorting failed breakouts above $697 and buying dips to as low as $685. We got the chop we expected today and suspect tomorrow will also be choppy in the premarket until 8:30 am ET when the Jobs Report is released and then expect heavily trending price action. Crypto fell slightly today, while most MAG stocks also declined with the exception of Netflix, and Tesla. Sustained weakness across both groups would be required for a larger pullback. VIX rose 2.48% to 17.79, remaining in neutral territory. SPY closed above the bull trend channel from the April lows, with structural support near $688.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in narrow Bearish Trending Market State with SPY closing mid ranget. There were no extended targets at the close but extended targets did print briefly at the open, around 1:30 pm and just before the close. Overnight the MSI rescaled higher continuing its bullish state which saw SPY rally after the open off MSI support. There were extended targets briefly which supported the move to the days highs. But these faded quickly and SPY remained rangebound with the MSI in a bullish state until 1 pm when the MSI began a series of rapid rescalings lower. Each rescaling was very narrow and with extended targets only printing briefly, it was clear SPY was not going to move much with the MSI in this state. SPY moved sideways all afternoon until a late dip caused the MSI to rescale once more but again, in a narrow range which implies prices are unlikely to continue falling overnight. For Wednesday the MSI is forecasting a likely test of the day’s lows but not much more beyond that. MSI resistance is $692.85 with support at $691.66.

Key Levels and Market Movements:

Monday we stated, “Tuesday we expect a period of price discovery with a slight upward drift, but with the potential to backtest as low as $686, although the bulls will do their best to hold above $691,” and added, “Above $691, the market may test $700, but resistance above $696 is heavy,” while also noting, “The bias favors selling failed breakouts above $698 and buying dips to as low as $686.” With the MSI opening in a bullish state, the first dip and test of MSI support was the signal to go long toward MSI resistance, especially with extended targets printing above. Once price reached the premarket level of $695.25 and failed three times to clear MSI resistance, the correct move was to exit the long and reverse short, targeting MSI support for the first objective. Holding for lower levels also made sense, as SPY never regained the mid-range of the MSI after bouncing off support. However, with very narrow bearish MSI ranges on each rescale, it was prudent to take T2 at MSI support and consider closing the trade on the late retest of that level. It was a choppy and difficult session to trade, so identifying and executing two clean setups was a clear win. This once again reinforces the importance of context, patience, and flexibility, using the MSI, premarket levels, and market structure together to guide execution rather than forcing trades. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Wednesday’s premarket includes the Jobs report, which is likely to dictate the day’s action once released. Trading what you see is critical. Overnight, bulls want to reclaim $695 to position for positive news and a push toward all-time highs. Watch price action closely before the open and use the premarket report for updated levels. Absent this or another external catalyst, Wednesday is expected to see trending price action with a slight upward drift, but with the potential to backtest as low as $685. The edge remains bullish as long as SPY holds above $685. If $685 fails and price closes below it, $680 becomes the next likely test. Above $696, SPY may attempt a run at $700, but resistance in this zone is heavy and further upside will require a clear increase in volume. The bias favors selling failed breakouts above $697 and buying dips down to $685, while any sustained move below $685 should be handled cautiously, allowing the MSI to define what comes next. The long-term bull trend remains intact above $640. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $697 to $715 and higher strike Calls while buying $693 to $696 Calls indicating the Dealers’ desire to participate in any rally on Wednesday. The ceiling for tomorrow appears to be $699. To the downside, Dealers are buying $692 to $635 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Friday:

Dealers are selling SPY $697 to $715 and higher strike Calls while buying $693 to $696 Calls indicating the Dealers’ desire to participate in any rally into Friday. The ceiling for the week appears to be $701. To the downside, Dealers are buying $692 to $585 and lower strike Puts in a 6:1 ratio to the Calls they’re selling/buying, reflecting a market that is concerned about lower prices. For the week Dealer positioning is unchanged from bearish to bearish, but more so. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Wednesday, respect the bullish structure but expect volatility. Favor reactive trades at key levels rather than predictive positioning. Let the jobs report set direction and trade confirmed moves rather than anticipation.

Good luck and good trading!