Market Insights: Friday, January 9th, 2026

Market Overview

US stocks surged to new all-time highs on Friday, closing out the first full trading week of 2026 with strong gains as investors digested the December jobs report, ongoing policy uncertainty, and fresh developments tied to Venezuela. The S&P 500 rose 0.6% to notch a record close, while the Dow Jones Industrial Average gained roughly 0.5%, also finishing at an all-time high. The Nasdaq Composite outperformed with a 0.8% gain, driven by strength in semiconductors and large-cap technology, marking a winning week for all three major indices. Market focus centered on two potential catalysts: the December nonfarm payrolls report and the possibility of a Supreme Court ruling on the legality of President Trump’s sweeping tariff policy. The jobs report showed the US economy added 50,000 jobs in December, below expectations of roughly 70,000, reinforcing bets that the Federal Reserve will hold rates steady at its upcoming meeting. Despite softer hiring, the unemployment rate fell to 4.4% from 4.6%, extending the 2025 theme of a “no-hire, no-fire” labor market that remains resilient but increasingly cautious. Markets also remained on alert for a Supreme Court decision on tariffs, which could have far-reaching implications for trade and inflation, though no ruling was issued Friday. The court indicated its next opinion day will be Wednesday, January 14, keeping uncertainty elevated. Geopolitical headlines added another layer of complexity as investors weighed US actions in Venezuela. President Trump said he canceled a second wave of attacks after cooperation emerged around plans to rebuild the country’s energy infrastructure, while the White House convened a meeting with global oil majors to discuss the future of Venezuela’s vast reserves. On the domestic front, Trump announced he directed Freddie Mac and Fannie Mae to purchase $200 billion in mortgage-backed securities in an effort to lower mortgage rates and address housing affordability, a move markets are still evaluating given limited details. Overall, Friday’s session reflected a market that welcomed softer labor data and policy support, leaned back into risk, and closed the week with momentum firmly in the bulls’ favor.

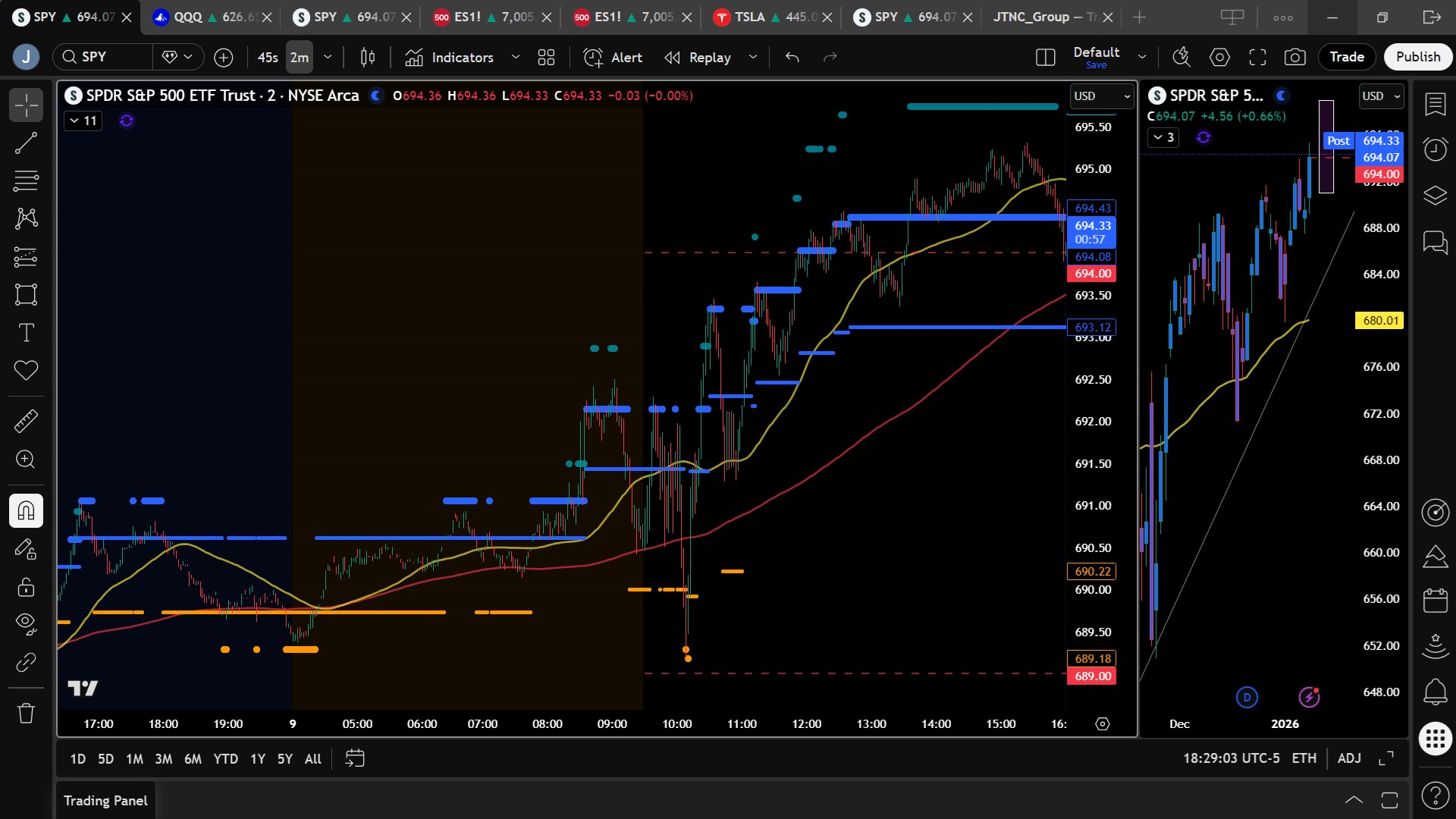

SPY Performance

SPY rallied strongly, opening at $690.58 and pushing steadily higher throughout the session to an intraday high of $695.31 before closing near the highs at $694.04, up 0.66% on the day. Trading volume reached 68.08 million shares, about average, confirming healthy participation rather than a thin, headline-driven move. After briefly dipping to $689.18 early in the session, SPY formed a clear failed breakdown that attracted buyers and set the tone for the rest of the day. From there, price ground higher in a controlled fashion, with only modest profit taking into the close. The ability to reclaim and hold above $690 reinforced bullish control and keeps $700 firmly in sight.

Major Indices Performance

Gains were broad-based across the major indices and reinforced the strength of the current uptrend. The Nasdaq jumped 0.82%, leading the advance as semiconductor and AI-related stocks outperformed. The S&P 500 rose 0.60%, closing at a new record, while the Dow added 0.48%, also finishing at an all-time high. The Russell 2000 gained 0.73%, signaling continued improvement in risk appetite and participation beyond megacap leadership.

Notable Stock Movements

It was a mostly green session across the Magnificent Seven, led by Tesla, which gained as much as 2.12%. Most megacap names participated in the upside, reflecting renewed confidence in growth leadership following a choppy start to the year. The main laggards were Nvidia and Netflix, with Netflix down as much as 1.20%, though weakness remained isolated rather than broad. The overall tone within leadership groups remained constructive, and sustained weakness across both MAG stocks and crypto would be required to signal a deeper pullback.

Commodity and Cryptocurrency Updates

Commodities and crypto broadly supported the risk-on narrative. Crude oil rose 1.78% to $58.79, continuing the rebound our model has been forecasting for several months. While downside risk remains, sustained trade above $56 keeps the door open for a move toward $60 and potentially $70 if supply dynamics tighten. Gold climbed 1.23% to $4,515, extending its historic rally and underscoring persistent demand for inflation and geopolitical hedges. Bitcoin slipped 1.02% but held above $90,300, signaling consolidation rather than a breakdown after recent volatility.

Treasury Yield Information

The 10-year Treasury yield fell 0.43% to close near 4.169%, easing financial conditions and providing a tailwind for equities. In our framework, yields above 4.5% begin to create headwinds for stocks, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals significant risk, with a 20% or greater correction becoming likely near 5.2%. Friday’s decline in yields reinforced the bullish reaction to the jobs data.

Previous Day’s Forecast Analysis

In Thursday’s newsletter, we emphasized that above $685 the bulls remain in control and that the market was likely coiling for a larger move once the jobs report and tariff uncertainty cleared. We noted that consolidation near $688–$690 was constructive rather than bearish and warned that a catalyst-driven breakout was likely.

Market Performance vs. Forecast

Friday’s action validated that outlook. SPY held well above $685, formed a failed breakdown near $689, and then rallied strongly to new all-time highs. The decisive close above $692 confirmed that bulls continue to control the tape and that the consolidation earlier in the week served as a reset rather than a topping process.

Premarket Analysis Summary

In Friday’s premarket notes published at 8:35 AM, SPY was trading near $691.21 with a bias level at $691.50. We outlined upside targets at $693.50 and $694 while noting that failure to hold the bias could lead to consolidation toward $690, $689, and potentially $688. Price quickly reclaimed the bias after the open and followed the bullish roadmap cleanly.

Validation of the Analysis

The intraday tape validated the premarket plan precisely. A brief dip below $690 failed, buyers stepped in, and SPY trended higher for most of the session. Upside targets were reached, and late-day profit taking did little to alter the bullish structure.

Looking Ahead

Looking ahead, the economic calendar is light early next week, with CPI on Tuesday and PPI and Retail Sales on Wednesday. With no major releases on Monday, markets may remain volatile and headline-driven as traders digest the implications of the jobs report, watch for a potential Supreme Court tariff ruling, and monitor geopolitical developments.

Market Sentiment and Key Levels

Sentiment has turned decisively bullish. SPY’s close near $694 places it firmly above the $685 bull-control level and keeps the path open toward $700. Resistance sits at $695, $698, $700, and $702, while support rests at $692, $689, $687, and $684. Holding above $690 keeps momentum intact, while a break below $680 would be required for bears to gain meaningful traction.

Expected Price Action

Our model projects SPY’s maximum range for Monday between $691 and $699. The Call side dominates in a narrowing band, signaling choppy action with brief trending moves. As long as SPY holds above $690, higher prices remain likely, though volatility may increase as new data approaches.

Trading Strategy

We favor buying dips near $690 on confirmed support and remain cautious about chasing strength into $700. Shorts are only favored below $690 or on failed breakouts above $698. With geopolitical risk and policy headlines still in play, discipline and flexibility remain critical.

Model’s Projected Range

SPY’s projected maximum range for Monday is $691 to $699. The Call side dominates in a narrowing band, signaling choppy action with brief trending moves. SPY rallied strongly today and made new all-time highs, closing up 0.66% at $694.07. A weaker-than-expected jobs report and no Supreme Court tariff decision reinforced expectations for future Fed rate cuts. Price remains well above $685, keeping bulls firmly in control. With $700 in sight, higher prices remain likely. Volume was average but sufficient at these levels. Overnight SPY recovered from the prior pullback and tested support near $688. By the open, price was back near $690 and ready to push higher. A brief dip to $689 formed a failed breakdown and reversed quickly. From there, SPY ground higher for most of the session. Late-day profit taking trimmed gains but did not change the trend. Bulls continue to control the tape above $685. A pullback into the $675–$685 range remains possible but looks lower probability. Over the weekend and Monday, bulls will aim to defend $692. A failure there likely leads to a test of $690, which should attract buyers. A sustained break below $690 opens the door to a deeper dip toward $680 and the prior range. Bears gain traction only below $680. Holding above $690 keeps the path open to new highs. Monday is likely to be choppy and volatile. Geopolitical risks remain in play. Resistance sits at $695, $698, $700, and $702. Support sits at $692, $689, $687, and $684. We favor buying dips near $690. We favor shorts only below $690 or on failed breakouts above $698. Crypto was flat and MAG stocks mostly rose, with minor weakness in Netflix and Nvidia. Broad weakness in both groups would be needed for a larger pullback. VIX fell to 14.49, confirming a risk-on environment. SPY remains in a strong bull trend with structural support near $681.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Bullish Trending Market State with SPY closing mid-range. There were no extended targets at the close but they were omnipresent virtually all day from just before the open. They stopped printing around 3:30 pm as a bout of profit taking kicked in but the day and the MSI showed strength all day which is likely to continue next week. The MSI rescaled higher several times after the late morning chop and kept moving higher with price until noon where it settled in its current state. For Monday the MSI is forecasting continued strength and new highs with support at $683.12 and resistance at $694.43.

Key Levels and Market Movements:

Yesterday we stated, “Friday has the jobs report and the Supreme Court decision on tariffs at 10 am, and both are likely to be major market movers,” and added, “The projected range for tomorrow is extremely wide, which favors a trend day,” while noting, “Gains above $693 may stall until $700 is cleared…and any test of $693 is a short candidate on a failed breakout, though fading the trend carries elevated risk.” With that context, and with the MSI opening in a ranging state, the correct approach was patience and waiting for a clean long entry aligned with the dominant trend. That opportunity came at 10 am with a textbook failed breakdown that provided an ideal long setup. The first target was MSI resistance, set at least $1 above entry, which was hit cleanly. As always, 70% of the position should be taken off at T1. Target two should always be the next MSI level higher, where we recommend removing another 20% of your position as the MSI rescaled upward. With T1 and T2 secured, move stops to breakeven and trail final 10% using the MSI or premarket levels. Extended targets printed throughout the session, which removed any reason to fade the move. No clean reversal setup appeared until very late in the day. The session produced one high-quality long trade, and disciplined execution and management made it a strong and straightforward winner. This is how trading can be made simple; having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Monday has no scheduled news. After a week of strong gains, price action is likely choppy and may show brief weakness. This does not signal a top. The trend remains bullish in the short term. We favor the bull trend with SPY above $685. We will not consider shorts unless price breaks below $690 or tests $697. Macro risks remain, so traders should stay alert to headlines. The MSI continues to forecast strength. Upside resistance sits near $700. Dips toward $690 and $685 should attract buyers. There is no meaningful bear case unless price falls below $680. Bulls will defend $692. A failure there likely sends SPY to $690. A break of $690 opens a move back into the $675–$685 range. If support holds, bulls will push toward $697 and then $700. Gains above $697 may stall until $700 is cleared. The long-term bull trend remains intact above $640. Near term control stays with the bulls above $685. Failed breakouts near $697 can be shorted with caution. Long setups are favored on pullbacks into support. As always, stay alert to macro risks and be prepared to trade what you see. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

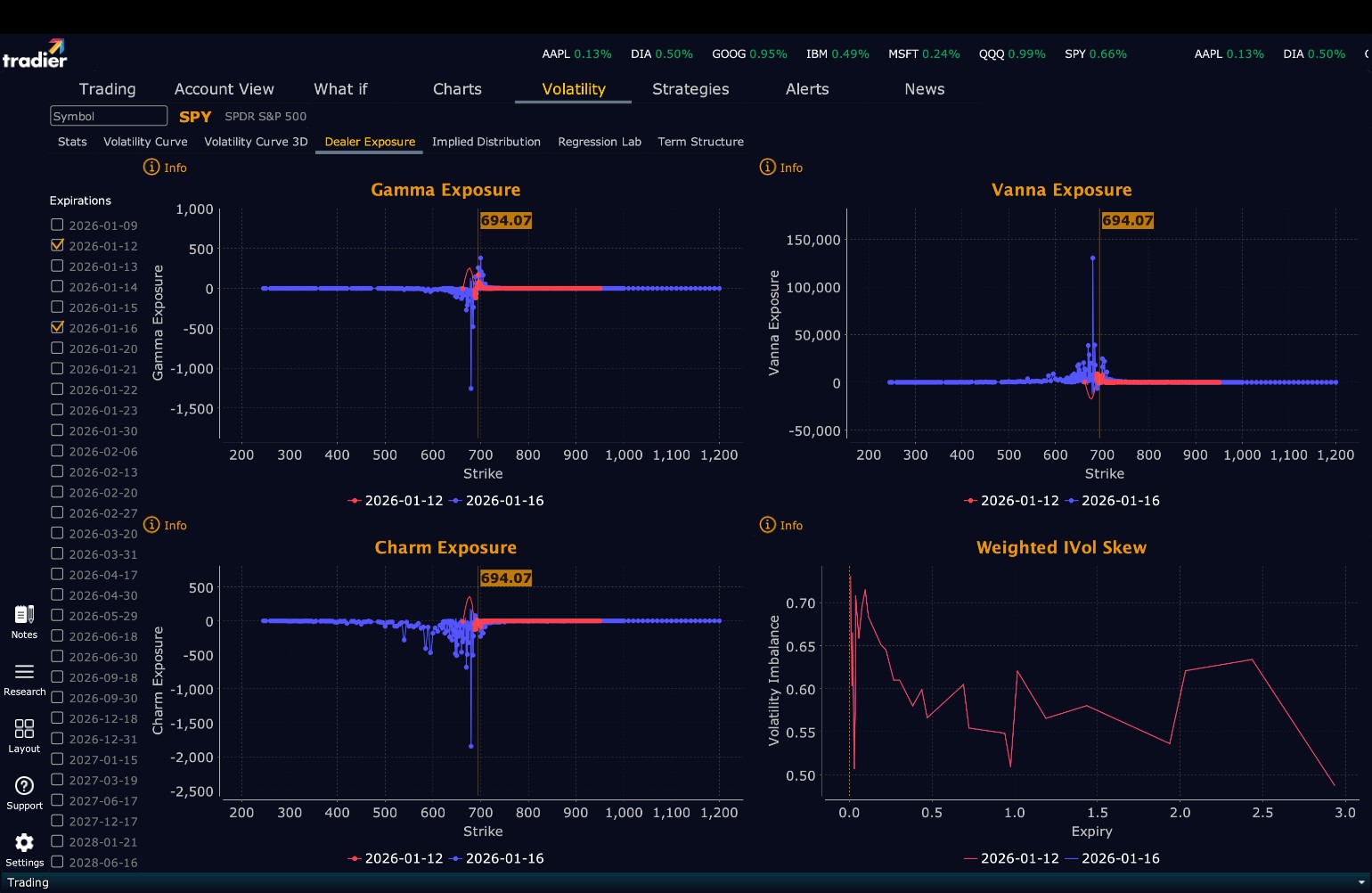

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $695 to $712 and higher strike Calls while also selling $693 to $694 Puts indicating the Dealers’ belief that prices will continue to rally on Monday or at least not fall below $693. While it’s a small position, Dealers only sell ATM Puts when they believe strongly that price will rise. The ceiling for Monday appears to be $700. To the downside, Dealers are buying $692 to $585 and lower strike Puts in a 2:1 ratio to the Calls/Puts they’re selling/buying displaying no concern that prices could move significantly lower. Dealer positioning is changed from neutral/slightly bearish to neutral/slightly bullish.

Looking Ahead to Next Friday:

Dealers are selling SPY $695 to $720 and higher strike Calls while also selling $689 to $694 Puts indicating the Dealers’ belief that prices will continue to rally next week or at least not fall below $689. Dealers only sell ATM Puts when they believe strongly that price will rise. The ceiling for the week appears to be $700. To the downside, Dealers are buying $688 to $585 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying, reflecting a market that is not concerned about lower prices. For the week Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Monday, respect the bullish structure but remain patient. Favor longs on pullbacks toward $692–$690 and limit shorts to failed breakouts near $698–$700. With volatility likely to remain low and headlines capable of shifting sentiment quickly, trade what you see, manage risk aggressively, and stay flexible.

Good luck and good trading!