Market Insights: Thursday, January 8th, 2026

Market Overview

US stocks closed mixed on Thursday as investors rotated out of technology, selectively added exposure to cyclicals, and positioned cautiously ahead of Friday’s highly anticipated jobs report. The Nasdaq Composite fell roughly 0.4%, marking its first loss of the week, as megacap pressure from Nvidia, Apple, and Meta weighed on the index. The S&P 500 finished near flat after pulling back from record territory, while the Dow Jones Industrial Average gained about 0.5%, supported by a sharp rebound in defense stocks and strength in industrials. Defense names surged after President Trump said he wants to increase military spending by 50% to roughly $1.5 trillion annually, reversing some of the sharp losses seen Wednesday after the president threatened to block buybacks and dividends unless contractors increased production. Northrop Grumman and Lockheed Martin jumped as much as 8% intraday before trimming gains, helping lift the Dow and offset weakness elsewhere. Beyond sector rotation, markets remained focused on labor-market signals. New data from Challenger, Gray & Christmas showed planned layoffs fell to their lowest level of 2025 in December, offering a modestly positive sign after a year of softening employment trends. This followed earlier reports showing subdued private hiring and anemic job openings, setting the stage for Friday’s December jobs report, which investors see as pivotal for near-term Federal Reserve expectations. Geopolitical risk also remained elevated, with continued focus on US strategy toward Venezuela and the potential for America to oversee and control Venezuelan oil revenue for an extended period, adding uncertainty to energy markets. Adding to headline risk, investors are watching for a potential Supreme Court decision on the legality of tariffs imposed under President Trump, with Friday scheduled as an opinion day and markets bracing for a ruling that could have meaningful trade and inflation implications. Overall, Thursday’s tape reflected a market in wait-and-see mode, balancing rotation, headline risk, and upcoming macro catalysts rather than pressing aggressively in either direction.

SPY Performance

SPY spent the session chopping within a tight range as traders reduced exposure ahead of key catalysts, closing essentially flat at $689.49, down just 0.01% on the day. The ETF opened at $688.76, dipped early to an intraday low of $687.49, and later rallied to a high of $690.61 before fading back toward the midpoint of the range into the close. Trading volume came in at 59.82 million shares, about average, reflecting a clear pause rather than a conviction-driven move. Price remained firmly above the critical $685 level that has defined bull control for weeks, reinforcing that Thursday’s action was consolidation rather than distribution.

Major Indices Performance

Index performance diverged as rotation continued beneath the surface. The Nasdaq declined 0.44%, weighed down by weakness across much of the megacap tech complex. The S&P 500 finished essentially unchanged, reflecting offsetting strength and weakness across sectors. The Dow outperformed with a 0.55% gain, driven by defense and industrial stocks, while the Russell 2000 rose 1.13%, signaling improving sentiment toward smaller-cap names as investors selectively rotated away from crowded tech positions.

Notable Stock Movements

It was a mostly red session across the Magnificent Seven, led lower by Nvidia, which fell 2.17% and dragged on the broader tech complex. Apple and Meta also declined, while Microsoft slipped modestly. The exceptions were Alphabet, Tesla, and Amazon, with Amazon leading the group on a 1.96% gain. Defense contractors rebounded sharply after Wednesday’s selloff, while many cyclical and small-cap stocks found buyers as investors rotated exposure rather than exiting risk entirely.

Commodity and Cryptocurrency Updates

Commodities delivered a strong signal despite equity indecision. Crude oil surged 4.61% to $58.57, continuing the rebound our model has been forecasting for several months. While additional volatility is possible, sustained trade above $56 keeps the door open for a move toward $60 and potentially $70 if supply dynamics tighten. Gold rose 0.55% to $4,486, extending its powerful rally and underscoring persistent demand for inflation and geopolitical hedges. Bitcoin was effectively unchanged, down 0.01% but holding above $91,000, signaling consolidation rather than a breakdown after recent volatility.

Treasury Yield Information

The 10-year Treasury yield rose 1.11% to close near 4.185%, reflecting caution ahead of Friday’s jobs report and the potential tariff ruling. In our framework, yields above 4.5% begin to create headwinds for equities, while sustained trade above 4.8% often coincides with deeper selloffs. A move above 5% historically signals significant equity risk, with a 20% or greater correction becoming likely near 5.2%. Despite Thursday’s rise, yields remain below danger levels, allowing equities to consolidate rather than sell off.

Previous Day’s Forecast Analysis

In Wednesday’s newsletter, we emphasized that above $685 the bulls control the tape and that profit taking near record highs would be healthy rather than bearish. We highlighted resistance near $691 to $697 and noted that a one- to two-day pullback could help reset positioning without damaging the broader trend.

Market Performance vs. Forecast

Thursday’s session unfolded largely as expected. SPY remained above $685 throughout the day, chopped within a defined range, and failed to trend meaningfully in either direction. The lack of downside follow-through confirmed that bears remain sidelined, while the inability to push decisively higher reflected caution ahead of major catalysts.

Premarket Analysis Summary

In Thursday’s premarket notes published at 7:33 AM, SPY was trading near $688.55 with upside targets at $689, $690, $690.50, and $692.50, and downside levels at $687.50 and $685. The plan anticipated consolidation and favored selling rallies before buying dips unless price could take and hold $690.

Validation of the Analysis

The intraday tape validated that framework closely. SPY tested both sides of the range, dipping toward $687.50 and rallying toward $690.50, but failed to establish sustained momentum. The session rewarded traders who faded extremes and punished those looking for trend continuation, consistent with expectations for a choppy consolidation day.

Looking Ahead

All eyes now turn to Friday’s December Jobs Report, Unemployment Rate, and University of Michigan Sentiment, along with a potential Supreme Court decision on tariffs. Either development has the potential to move markets sharply and break the current range.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish. SPY is firmly above $685, keeping bulls in control, but momentum has slowed as traders await clarity. Resistance sits at $690, $693, $695, and $700, while support rests at $688, $685, $680, and $678. A sustained break below $685 would shift the near-term tone, while holding above it keeps the path open for renewed highs.

Expected Price Action

Our model projects SPY’s maximum range for Friday between $682 and $696, with the Put side dominating in a wide, expanding band that suggests trending price action mixed with periods of chop. Direction is likely to be dictated by the jobs report and tariff ruling rather than technicals alone.

Trading Strategy

Given headline risk, we do not carry a strong directional bias. Under normal conditions we would favor shorts near $696 on failed breakouts and longs near $680 on confirmed support, but Friday is unlikely to be a normal session. Trade what you see, size down, and respect volatility.

Model’s Projected Range

SPY’s projected maximum range for Thursday is $682 to $696, with the Put side dominating in a wide and expanding band that suggests trending price action mixed with periods of chop. SPY did essentially nothing today and closed up 0.01% at $689.51 as the market waits on Friday’s jobs report and the Supreme Court decision on tariffs. Either event has the potential to move markets sharply in either direction. Price remains firmly above $685, which keeps the bulls in control. Volume was much lower than average, signaling a clear wait-and-see approach by market participants. Overnight SPY pulled back slightly and tested support near $688. By the open, price dipped to retest the overnight lows and found buyers waiting. The session was nothing but chop and extremely difficult to trade. There was no trend unless traders faded highs and bought lows. We have stated for weeks that above $685 the bulls control the tape, and that remains true. However, the market is deciding whether it wants to slip back into the $675–$685 range or break higher toward $700 and new highs. Absent tomorrow’s catalysts, today likely represents a second consolidation day meant to flush weak hands. Overnight the bulls must defend $685 to preserve upside momentum. A failure at $685 opens the door to $680, and a break below $680 brings last Friday’s lows into play. A move below $680 would give bears a chance to press lower, though this remains a low-probability outcome without an external catalyst. Holding above $685 keeps the path open for additional all-time highs. Price action tomorrow is likely to trend once the jobs report and tariff decision hit the tape. Bears have little influence unless price falls below $680, while the broader bull market remains intact down to $640. Traders should stay alert to geopolitical headlines, especially developments around Venezuela, the jobs report, the tariff ruling, and government shutdown risk. Resistance sits at $690, $693, $695, and $700. Support sits at $688, $685, $680, and $678. We do not carry a directional bias given headline risk. Under normal conditions we would favor shorts near $696 on failed breakouts and longs near $680, but tomorrow is unlikely to be normal. Trade what you see. Crypto was flat and MAG stocks were mixed, with most slightly lower except Tesla, Alphabet, and Amazon. Sustained weakness across both leadership groups would be required for a deeper pullback. VIX rose modestly to 15.45 and remains in risk-on territory. SPY closed in the lower third of its bull trend channel from the April lows with structural support near $680.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a narrow, Bearish Trending Market State with SPY closing just above MSI resistance turned support. There were no extended targets all day today, but they were present overnight below price. These stopped printing by 8 am and didn’t reappear all day. The MSI rescaled lower but only made a narrower MSI without actually moving lower. This indicated a very tight market which was waiting on a catalyst. For tomorrow the MSI is forecasting a holding pattern without any true indication of what may appear. As such it’s necessary to watch for the MSI to rescale as news is released for clues about the day. Support is at $689.62 and lower at $689.29.

Key Levels and Market Movements:

Yesterday we said the projected range would be narrow and that price action would be slow, choppy, and directional. We also said dips toward $688 and $685 should attract buyers and favor range trading. With that context, and with the MSI opening in a bearish state, we waited for a clean setup. At 9:42 am a textbook failed breakdown triggered a long entry near support. We set T1 at MSI resistance at $689.29. T1 hit cleanly. We then set T2 at MSI resistance at $690.40. The market chopped sideways for hours with no momentum. Given the poor structure, we moved our stop to breakeven and waited. Late in the session T2 finally hit. A clear failed breakout followed, so we exited and ended the day. We considered fading $690, but after four hours of chop we chose to stand down and wait for a catalyst tomorrow. One and done thanks again to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday has the jobs report and the Supreme Court decision on tariffs at 10 am, and both are likely to be major market movers. Traders must trade what they see, because trying to predict tomorrow’s outcome is a fool’s errand. We continue to favor the bull trend with SPY above $685, but that bias can change quickly as news hits the tape. Additional macro risks remain, so traders should stay alert for sudden moves, especially from geopolitical headlines. The projected range for tomorrow is extremely wide, which favors a trend day. The MSI is not forecasting direction and will likely move violently as information is released. Moves are expected to be fast and dangerous. Upside resistance sits near $700, while dips toward $685 and $680 should attract buyers. Tomorrow is likely to be one-way trading, so align with the MSI trend and stay with it. There is no meaningful bear case unless price falls below $680. The bulls will look to defend $688 overnight. A failure there likely sends SPY to $685, and a break of $685 opens the door to $680. If support holds, the bulls will attempt another push above $693. Gains above $693 may stall until $700 is cleared due to heavy resistance. The long-term bull trend remains intact above $640. In the near term, bulls stay in control as long as price holds above $685. Any test of $693 is a short candidate on a failed breakout, but fading the trend tomorrow carries elevated risk. Long setups are favored on pullbacks into support. As always, stay alert to macro risks and be prepared to trade what you see. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

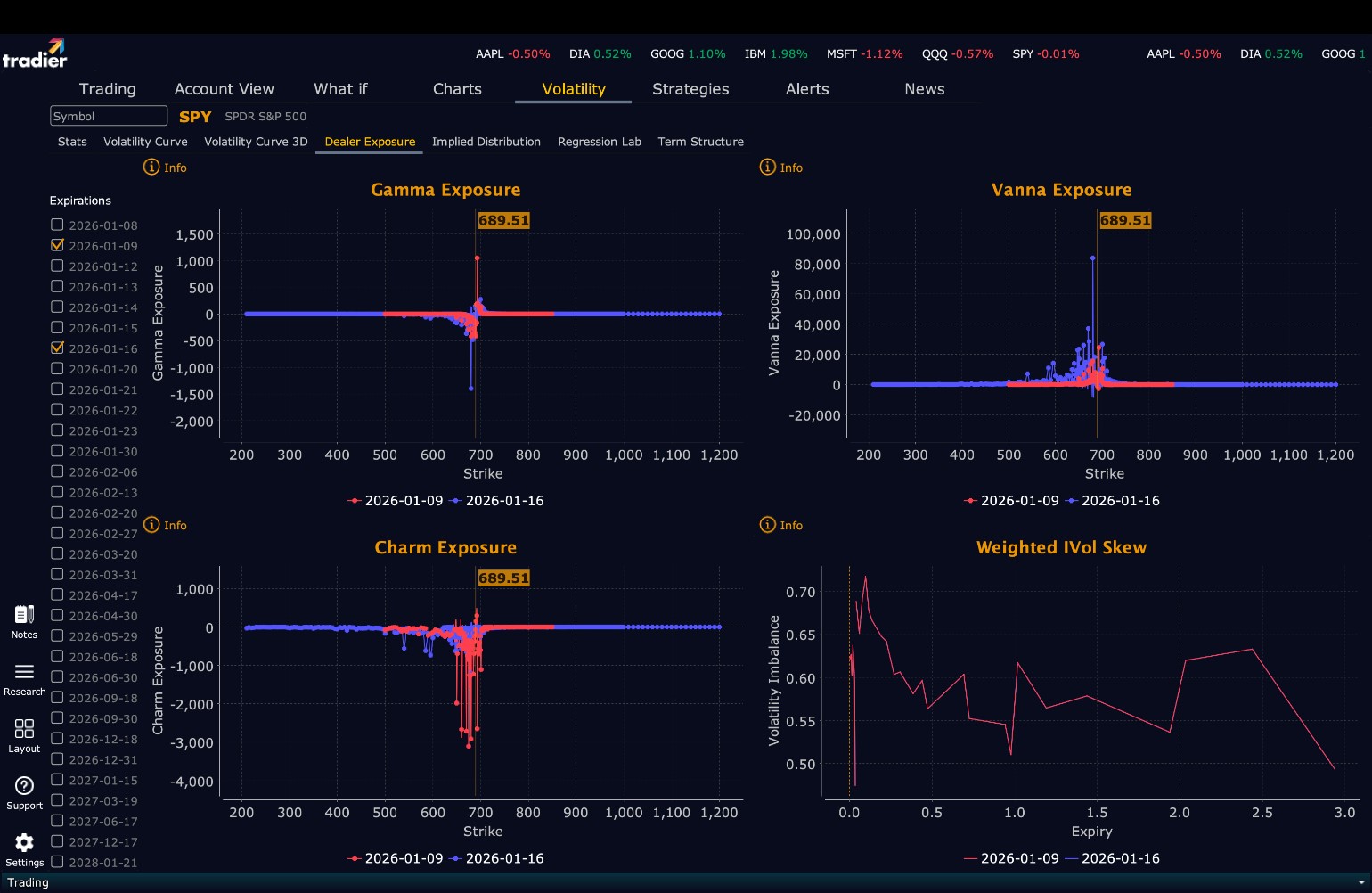

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $693 to $708 and higher strike Calls while also buying $690 to $692 Calls indicating the Dealers’ desire to participate in any rally on Friday. The ceiling for tomorrow appears to be $693. To the downside, Dealers are buying $689 to $565 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying little concern that prices could move significantly lower tomorrow. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $690 to $710 and higher strike Calls indicating the belief that prices may stagnate at current levels. The ceiling for the week appears to be $700. To the downside, Dealers are buying $689 to $565 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying, reflecting a market that is not concerned about lower prices. For the week Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Friday, respect the bullish structure but remain patient and flexible. Favor longs on pullbacks toward $688–$685 and limit shorts to failed breakouts near $694–$697. With major macro and legal catalysts ahead, manage risk aggressively and let price action confirm direction before committing.

Good luck and good trading!