Market Insights: Thursday, January 29th, 2026

Market Overview

US stocks fell on Thursday but pulled back from steeper losses as investors digested a turbulent mix of megacap earnings, geopolitical tension, and lingering uncertainty around AI spending. The tech-heavy Nasdaq Composite led declines, falling roughly 0.7%, weighed down heavily by a sharp selloff in Microsoft after its earnings report reignited concerns about rising capital expenditures and slowing cloud growth. The S&P 500 slipped about 0.2%, while the Dow Jones Industrial Average managed to finish slightly higher, reflecting rotation away from technology into more defensive and value-oriented names. Microsoft shares plunged more than 10%, marking one of the stock’s worst single-day performances in years, after the company disclosed higher-than-expected spending tied to AI infrastructure alongside softer quarterly cloud revenue growth. The move rattled investor confidence in near-term returns on massive AI investments and cast a shadow over the broader technology complex.

That pressure partially offset a powerful rally in Meta, whose shares surged more than 10% after the company delivered a stronger-than-expected revenue outlook and reaffirmed its aggressive push into artificial intelligence. Meta said it plans to spend up to $135 billion this year on data center expansion, reinforcing the view that the AI arms race remains intact even as investors debate its cost. Tesla also added to volatility, initially rising on an earnings beat before reversing lower to finish down more than 3% as investors focused on the company’s first-ever annual revenue decline and its strategic pivot away from EVs toward robotics and AI. With Apple set to report earnings after the close, markets remained on edge, bracing for further clarity on consumer demand and AI monetization. Beyond earnings, geopolitical risk re-emerged as President Trump warned Iran it must quickly agree to a nuclear deal or face potential military strikes. The rhetoric helped drive crude oil sharply higher, with Brent crude breaking above $70 per barrel as US naval activity increased in the region. Wall Street also continued to digest the Federal Reserve’s first policy decision of 2026, in which rates were left unchanged. While markets are still pricing in two quarter-point cuts by year-end, expectations are increasingly skewed toward easing later rather than sooner, especially as attention turns to Trump’s anticipated announcement of his pick to replace Chair Jerome Powell. Adding another layer of intrigue, reports surfaced that Amazon is in talks to invest as much as $50 billion in OpenAI, highlighting both the scale of capital flowing into AI and the intensifying competition among Big Tech players.

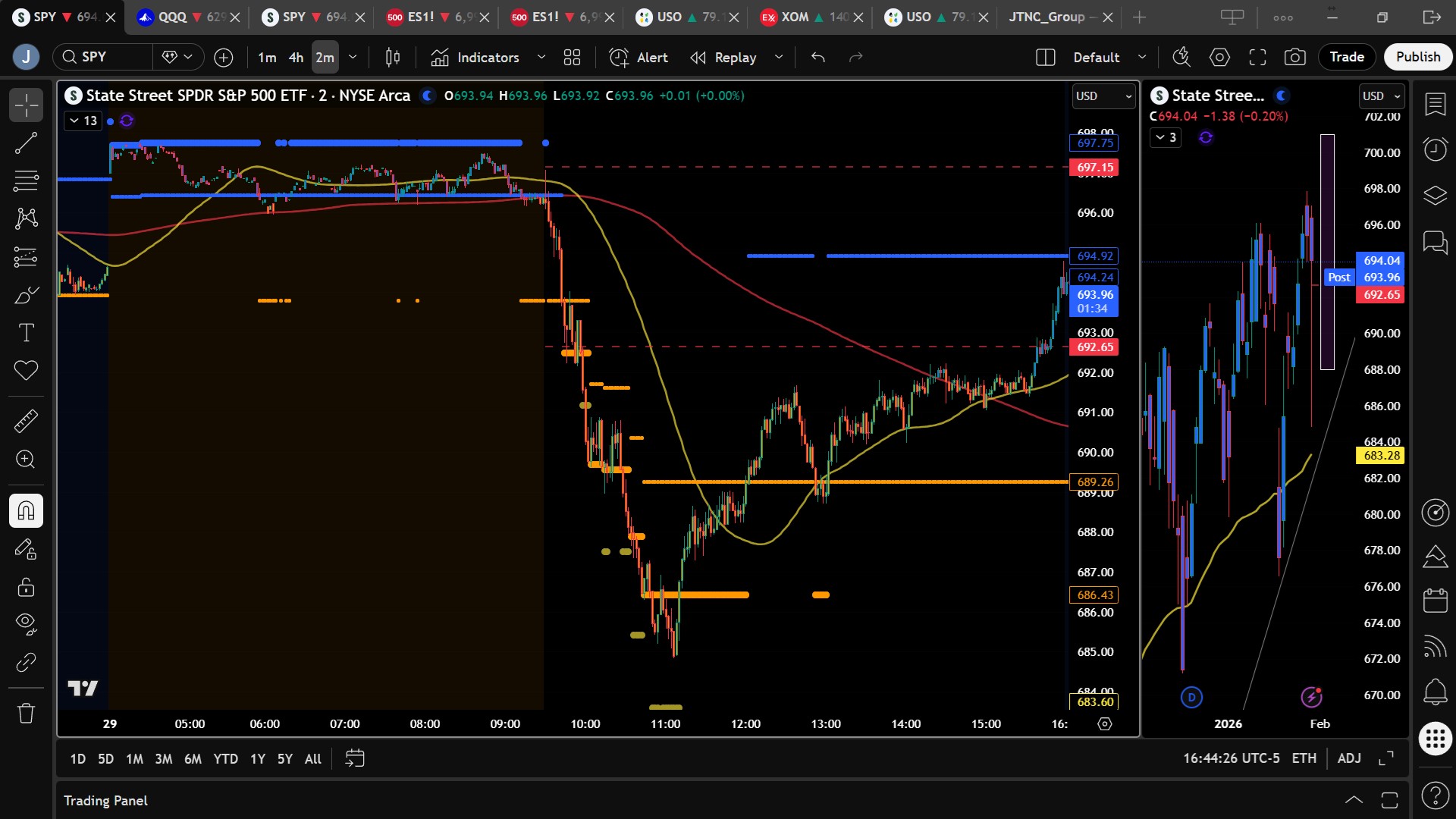

SPY Performance

SPY experienced a volatile session marked by a sharp morning selloff followed by a steady afternoon recovery. The ETF opened at $696.22 and initially pushed higher overnight, but selling quickly took control after the open. Price fell steadily through the morning, briefly pausing near $690 before accelerating lower to an intraday low of $684.83. Buyers stepped in decisively at that level, triggering a slow, grinding rebound through the afternoon. SPY closed at $694.07, down 0.19% on the day. Trading volume surged to 92.51 million shares, well above average, reflecting heightened participation and elevated emotion. Despite the intraday drawdown of more than 1.5%, the close well above $685 once again reinforced that bulls continue to defend this level with precision.

Major Indices Performance

Index performance reflected sharp divergence beneath the surface. The Nasdaq fell 0.72%, dragged lower by Microsoft’s collapse and broader tech weakness. The Dow rose 0.11%, benefiting from rotation into non-tech components, while the Russell 2000 edged up 0.03%, signaling relative stability among small caps. The mixed tape highlighted ongoing fragmentation rather than broad-based risk aversion.

Notable Stock Movements

It was a split session across the Magnificent Seven. Microsoft led the downside with a steep drop of more than 10%, weighing heavily on the Nasdaq. Meta surged as much as 10.40% following its earnings report, helping limit broader damage within megacap technology. Apple and Nvidia also finished higher, while the rest of the group lagged. Sustained weakness across both megacap technology and crypto would be required to signal a more durable market pullback.

Commodity and Cryptocurrency Updates

Commodities continued to signal inflationary and geopolitical stress. Crude oil surged 3.40% to $65.36, extending its rally as tensions in the Middle East escalated. Our model has been forecasting crude’s move toward $60 for several months, and while volatility remains possible, sustained trade above $56 keeps the door open for a broader push toward $70. Gold rose 1.54% to $5,422, adding to its historic run as investors continued to hedge policy and geopolitical risk. Bitcoin sold off sharply, falling 5.65% to close above $84,300, reflecting increased risk aversion in speculative assets.

Treasury Yield Information

The 10-year Treasury yield fell 0.45% to close near 4.232%, easing some pressure on equities after recent volatility. In our framework, yields above 4.5% create meaningful headwinds for stocks, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals significant equity risk, with a 20% or greater correction becoming likely near 5.2%. Thursday’s decline in yields helped stabilize equities during the afternoon rebound.

Previous Day’s Forecast Analysis

Wednesday’s framework emphasized that FOMC was unlikely to provide a clear directional catalyst and that SPY was vulnerable to failed breakouts above $697 and pullbacks toward key support. We highlighted $685 as the line that must hold to preserve bull control.

Market Performance vs. Forecast

Thursday’s action aligned closely with that outlook. SPY failed to sustain early strength, sold off sharply, tested $685, and then reversed higher. Once again, bulls defended that level almost to the penny, reinforcing its importance in the current market structure.

Premarket Analysis Summary

In Thursday’s premarket notes published at 7:11 AM, SPY was trading near $697.11 with upside targets at $697.15, $699, and $701, and downside levels at $696, $694.15, and $692.65. We noted that upside would be challenging without sustained trade above the bias level and that downside appeared limited absent an external shock.

Validation of the Analysis

The session validated that framework. SPY failed to hold above the bias level, sold off through multiple downside targets, and ultimately found strong demand below $685 before recovering. The afternoon rebound confirmed that while volatility is elevated, downside remains contained as long as key support holds.

Looking Ahead

Friday brings the Producer Price Index, which is expected to come in largely as anticipated and may prove to be a nonevent. Earnings from large-cap companies continue, and geopolitical headlines remain a wildcard capable of driving outsized moves.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish despite heightened volatility. SPY continues to trade above $685, keeping bulls in control. Resistance sits at $698, $699, $700, and $702, while support rests at $693, $690, $688, and $685. The $697–$700 zone remains heavily defended and favors failed-breakout setups.

Expected Price Action

SPY’s projected maximum range for Friday is $688 to $701, with the Call side dominating in a narrowing band that signals choppy price action with intermittent trending periods.

Trading Strategy

As long as SPY holds above $688–$685, longs remain favored on pullbacks. Shorts are preferred on failed breakouts near $698–$700. Given elevated volume and volatility, discipline and patience remain critical.

Model’s Projected Range

SPY’s projected maximum range for Friday is $688 to $701, with the Call side dominating in a narrowing band that signals choppy price action with intermittent trending price periods. Friday brings PPI, which is likely to come in as expected and be a nonevent. Unemployment Claims did nothing today, as anticipated, yet the market still tested $685 and was down more than 1.5% at the lows. True to form, the bulls defended $685 and reversed much of the decline, with SPY closing down just -0.20% at $694.04. Once again, this reinforced what we have said for weeks: above $685, the bulls control the market, almost to the penny. Earnings from large-cap companies continue over the next few weeks, and geopolitical headlines remain a wildcard, so traders should continue to trade what they see. Overnight SPY gapped up to new intraday highs near $697.84 and opened just above $696, but that strength quickly faded. The entire morning session saw steady selling, with only a brief pause near $690, before price finally reached a low of $684.83. Buyers stepped in there, and the afternoon session was a slow, grinding recovery that retraced more than half of the day’s losses. SPY closed well above $685, and as long as that level holds, the path toward $700 remains intact. Volume was well above average, which gives some pause about the durability of the rally. Overnight, bulls want to hold at least $688 to keep upside momentum intact. Bears are unlikely to engage unless $685 fails, and even then, $680 must break to create meaningful downside pressure. If $688 holds, bulls are likely to attempt another push toward $700, though a strong catalyst may be needed to clear it. The long-term trend remains intact above $640, and with February known for surprise selloffs, any deeper pullback should be viewed as a potential buy-the-dip opportunity for a spring or summer rally. Absent a catalyst, resistance sits at $698, $699, $700, and $702, while support is at $693, $690, $688, and $685. The $697–$700 zone is heavily defended, favoring failed-breakout shorts, while longs remain favored above $688. Crypto sold off sharply, down more than 5.5%, while most MAG stocks declined except Apple and Meta. Sustained weakness across both leadership groups would be required for a larger pullback. VIX rose 3.24% to 16.88 but remains in risk-on territory. SPY closed inside a redrawn bull trend channel from the April lows, with structural support near $682.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in wide, Ranging Market State with SPY closing mid-range. There were no extended targets at the close but for much of the morning session the herd was participating in the day’s decline with extended targets clearly in view, although they stopped printing before 11:30 am. After then stopped printing the herd had stepped away which led to the rally into the end of the day. Overnight the MSI rescaled to a ranging then bullish state where it opened. But shortly thereafter the MSI rescaled to a ranging state then put in a series of rescalings lower in a bearish state. Rapid rescalings with extended targets is the sign of a strong trend and that is what we saw all morning. By the afternoon the MSI had moved to a ranging state, which we do not favor trading. These are transition states without a trend, and are difficult to navigate. For tomorrow the MSI is forecasting choppy trading which could test both side of the MSI. MSI resistance is $694.92 with support at $689.26.

Key Levels and Market Movements:

Wednesday we stated, “the primary trend remains bullish as long as SPY holds above $685,” and added, “A sustained hold above $695 opens the door for a push toward $700,” while also noting, “The bias for Thursday favors selling failed breakouts above $696 and buying dips down to as low as $685, with a wide range favoring a trending market.” With the MSI opening in a narrow Bullish Trending Market State and no extended targets at the all-time highs, the correct plan was to follow that framework and look for a failed breakout. That failed breakout occurred in the premarket, but there was still a clear opportunity to join the short side once the MSI rescaled to a bearish state. As $694 gave way, trading level to level using MSI resistance and support was clean and straightforward. Once extended targets stopped printing near $685, reversing long made sense, again trading back to MSI resistance and trailing for additional gains. These were two solid setups that should have left traders green on the session. One trade a day is all that is required to earn a living. Once again, patience and discipline paid off, with level-to-level execution using the premarket, post-market roadmap, and MSI signals aligning perfectly with our broader framework for structure, trend, and execution. The MSI once again proved its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday has PPI, which is unlikely to move the market given the Fed’s dovish stance and positive view of the economy. The primary trend remains bullish as long as SPY holds above $685, and even after a selloff of more than 1.5%, the bulls stepped in and defended that level once again. This reinforces what we have said for weeks: above $685, the bulls have full control and the bears struggle to gain traction. A sustained hold above $695 opens the door for a push toward $700 and potentially higher. The bias for Friday favors selling failed breakouts above $697 and buying dips down to $685. Expect choppy trading and let the MSI determine the intraday trend as it rescales. For the bears to regain any meaningful traction, SPY must break below $680 and remain there. The long-term bull trend remains intact above $640. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $698 to $715 and higher strike Calls while buying $695 to $697 Calls indicating the Dealers’ desire to participate in any continuation of the recovery on Friday. The ceiling for tomorrow appears to be $699. To the downside, Dealers are buying $694 to $635 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying displaying some concern that prices could move lower. Dealer positioning has changed from neutral/slightly bullish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $696 to $720 and higher strike Calls while buying $695 Calls indicating the Dealers’ desire to participate in any rally next week. The ceiling for the week appears to be $705. To the downside, Dealers are buying $694 to $585 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a market that is a slightly concerned about lower prices but not overly so. For the week Dealer positioning is unchanged from slightly bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Friday, respect the bullish structure but remain selective. Favor buying pullbacks that hold above $688 and selling failed breakouts near $698–$701. Manage risk tightly, stay flexible, and trade what price confirms rather than anticipating headlines.

Good luck and good trading!