Market Insights: Friday, January 23rd, 2026

Market Overview

US stocks finished the week on a mixed note Friday, capping a volatile stretch marked by geopolitical noise, sharp sector rotations, and fading post-tariff relief. The Dow Jones Industrial Average declined roughly 0.6%, weighed down by weakness in industrials and select megacap names, while the S&P 500 finished near the flat line and the Nasdaq Composite edged higher by about 0.2%, supported by relative stability in technology. Despite the late-week rebound earlier in the week, all three major indices posted back-to-back weekly losses, underscoring how difficult it has been for markets to regain sustained momentum after recent shocks. Sentiment remained fragile as the initial relief sparked by President Trump softening his rhetoric on Greenland and pausing tariffs on NATO allies began to fade. While investors welcomed the de-escalation earlier in the week, the broader uncertainty around US-EU relations continued to weigh on the dollar and reinforce a gradual shift away from US assets. That dynamic helped drive continued strength in precious metals, with gold posting its best weekly performance since 2020 and silver surging above $100 per ounce, highlighting persistent demand for hard-asset hedges even as equities attempted to stabilize.

The technology sector delivered mixed signals. Intel shares sank sharply after the company issued weaker-than-expected forward guidance, reigniting concerns about the pace and credibility of its turnaround and its ability to compete effectively in AI data center chips. The earnings disappointment pressured sentiment across semiconductors, even as longer-term optimism around AI demand remained intact. At the same time, there were constructive developments on the US-China front, with reports indicating progress on a deal allowing TikTok and ByteDance to continue operating in the US through a partnership involving Oracle. Separately, Beijing reportedly signaled to domestic tech giants that preparations could begin for ordering Nvidia’s H200 chips, whose imports have been restricted, offering a potential tailwind for the AI supply chain. Looking ahead, investors are bracing for a heavy slate of catalysts, including a blockbuster earnings week and the Federal Reserve’s policy meeting. President Trump said he has narrowed down candidates to replace Fed Chair Jerome Powell and plans to name his pick soon, adding another layer of policy uncertainty as markets head into the final week of January.

SPY Performance

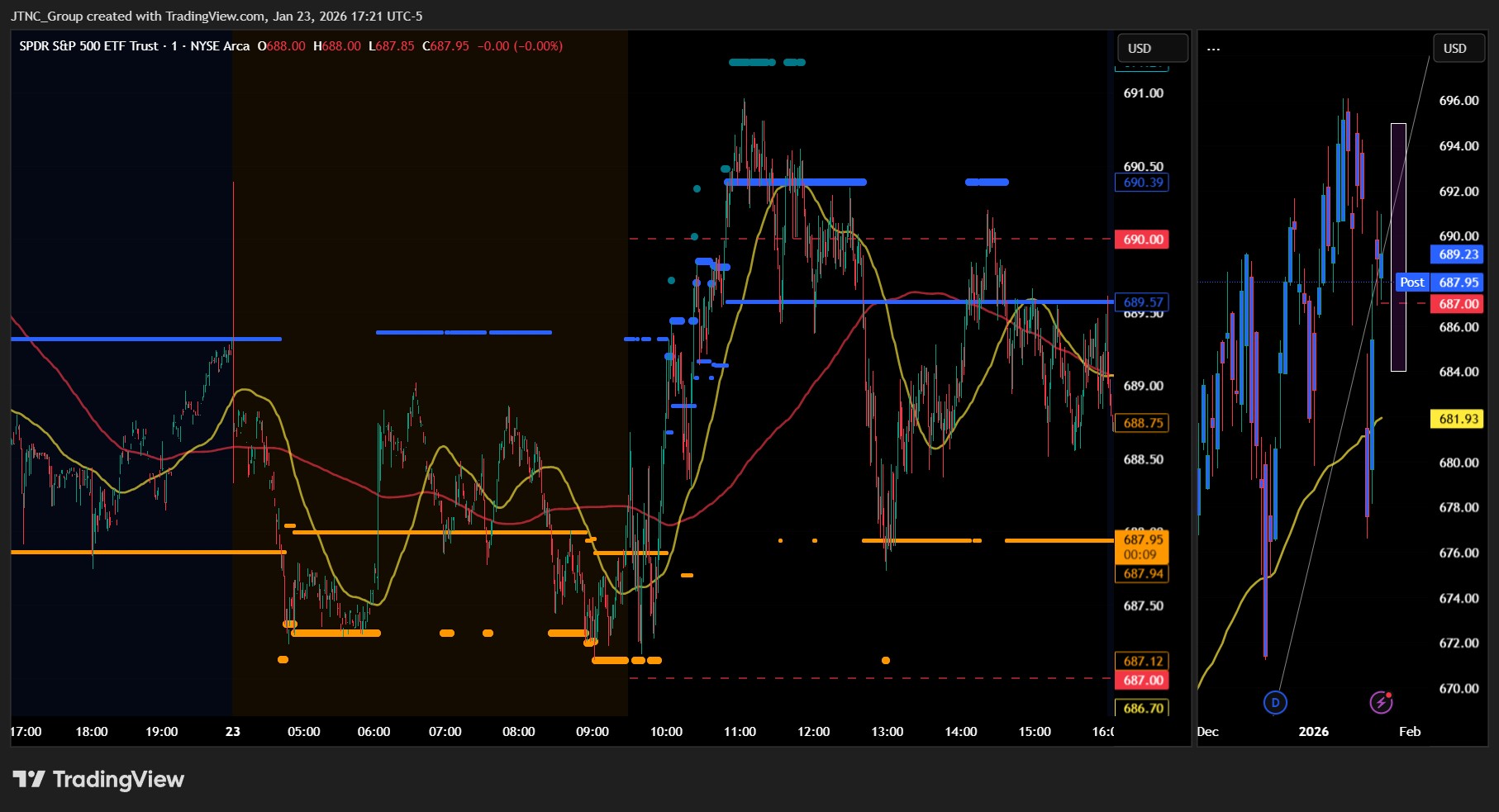

SPY spent the session locked in choppy, rangebound trade, reflecting a market still digesting the sharp moves from earlier in the week. The ETF opened at $688.07, pushed to an intraday high of $690.96, and dipped to a low of $687.17 before closing essentially unchanged at $689.10, up just 0.02% on the day. Trading volume came in at 58.10 million shares, slightly below average, reinforcing the view that participation was muted as traders waited for clearer direction. Price action was defined by failed attempts to sustain momentum above $690 and repeated defenses of the $687 area, highlighting an increasingly compressed range. Holding above $685 continues to keep bulls in control of the broader structure, but the inability to clear $691 confirms that upside remains heavily contested.

Major Indices Performance

Performance across the major indices reflected ongoing rotation and uncertainty. The Nasdaq rose 0.28%, supported by relative strength in select technology names. The Dow fell 0.58%, underperforming as industrials and defensives lagged. The Russell 2000 dropped 1.90%, signaling renewed caution toward small-cap stocks as volatility cooled but confidence failed to fully return. The S&P 500 finished marginally higher, but the mixed index performance underscored a market still struggling to establish leadership after a turbulent week.

Notable Stock Movements

It was a mostly green session across the Magnificent Seven, though leadership was uneven. Alphabet was the weakest performer, down 0.79%, while Tesla and Apple also lagged. Strength in other megacap names helped support the Nasdaq, but the lack of synchronized leadership across the group suggests caution rather than renewed risk appetite. Intel’s sharp post-earnings decline remained a focal point, reinforcing sensitivity around AI execution and capital spending expectations as earnings season ramps up.

Commodity and Cryptocurrency Updates

Commodities continued to send a strong signal beneath the surface. Crude oil surged 3.20% to $61.26, pushing decisively above the $60 level our model has been forecasting for several months. While further volatility is possible, sustained trade above $56 keeps the door open for a broader rally toward $70. Gold jumped 1.45% to $4,984, extending its historic run and marking one of its strongest weeks in years as investors sought protection from policy and geopolitical risk. Bitcoin rose 0.34% to close above $89,500, reflecting modest recovery after recent volatility but without a decisive breakout.

Treasury Yield Information

The 10-year Treasury yield slipped 0.38% to close near 4.235%, easing some pressure on equities. In our framework, yields above 4.5% begin to create meaningful headwinds for stocks, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals significant equity risk, with a 20% or greater correction becoming likely near 5.2%. Friday’s pullback in yields helped stabilize equities but did not provide a strong catalyst for upside.

Previous Day’s Forecast Analysis

In Thursday’s newsletter, we emphasized that as long as SPY held above $685, bulls would retain control and the path toward $700 would remain open, while noting that choppy consolidation was likely after the week’s extreme volatility.

Market Performance vs. Forecast

Friday’s session aligned with that outlook. SPY remained above $685 throughout the day, tested higher levels near $691, and then faded back into its range without breaking support. The lack of downside follow-through confirmed that bears remain sidelined, even as upside momentum stalled.

Premarket Analysis Summary

In Friday’s premarket notes published at 7:53 AM, SPY was trading near $688.51 with upside targets at $689.15, $690, and $692.65, and downside levels at $687, $684.65, and $682.65. The plan called for caution, noting that intraday participants would likely determine direction in a broadly uncertain environment.

Validation of the Analysis

The intraday tape validated that framework. SPY briefly pushed higher toward $691, failed to hold the level, and rotated back toward the mid-range. Support near $687 held cleanly, while upside progress stalled near resistance, producing the kind of choppy, rangebound session anticipated.

Looking Ahead

Monday and Tuesday feature no scheduled economic releases, leaving markets vulnerable to weekend risk and headline-driven gaps. Wednesday brings the Federal Funds Rate decision and FOMC statement, followed by Unemployment Claims on Thursday and PPI on Friday. Earnings will be a key driver, particularly from large-cap technology, as markets search for a catalyst to break the current range.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish but uncertain. SPY’s ability to hold above $685 keeps bulls in control, though conviction is lacking. Resistance sits at $690, $695, $696, and $698, while support rests at $688, $685, $682, and $680. The $693–$697 zone remains heavily defended and is likely to cap upside on initial tests.

Expected Price Action

SPY’s projected maximum range for Monday is $684 to $695, with the Call side dominating in a narrowing band that signals choppy price action with intermittent trending periods. With no scheduled data, positioning and geopolitical headlines are likely to drive movement.

Trading Strategy

As long as SPY holds above $685, longs remain favored on pullbacks toward $687–$683. Shorts are viable between $693 and $695 on failed breakout attempts. Chasing strength is discouraged, and patience remains critical in a rangebound environment.

Model’s Projected Range

SPY’s projected maximum range for Monday is $684 to $695, with the Call side dominating in a narrowing band that signals choppy price action with intermittent trending periods. Monday has no scheduled economic news, but weekend risk remains elevated given the potential for unexpected geopolitical announcements. PMI was a nonevent today and had little impact on price. SPY attempted to extend its rebound from the prior two sessions but failed to hold above $690, closing up just 0.04% at $689.23, but remaining above the $685 level that defines bull control. As long as price holds above $685, the path toward $700 remains open. Overnight SPY drifted lower to retest $687, which held multiple times, leaving price near $689 into the open. The session was largely choppy and difficult to trade, with another test of $687 after the open followed by a slow, stair-step grind higher that eventually reached $691. That level proved too difficult to clear, and after several hours of sideways action the market rolled back to where it began the day. Volume was below average, reflecting digestion after this week’s sharp up and down moves, a combination that typically produces rangebound conditions. Big Up + Big Down = Big Confusion…the trademark of a trading range. This range is likely to persist until an external catalyst emerges, potentially earnings from large-cap tech. As long as SPY remains above $685, bulls retain control, while bears remain sidelined unless price closes below $680. Over the weekend the market may continue attempting to break above $691 and push toward $696, where resistance is expected. A failure at $685 would require $680 to hold to prevent further downside, even though the long-term trend remains intact above $640. February is historically prone to surprise selloffs, so deeper weakness would not be shocking and should be viewed as a potential setup for a spring or summer rally. Traders should stay alert to geopolitical headlines and trade what price presents. Absent a catalyst, resistance sits at $690, $695, $696, and $698, while support is at $688, $685, $682, and $680. Upside above $695 is heavily defended, making failed breakouts there viable for shorts, while longs remain favored above $685. Crypto rallied back above $90K, while most MAG stocks rose except Alphabet, Tesla, and Apple. Sustained weakness across both leadership groups would be required for a larger pullback. VIX rose to 16.09 and remains in risk-on territory. SPY is slightly below its bull trend channel from the April lows, but a push higher would return it to the channel, while continued sideways action would likely result in a redraw that reflects a weakening, not broken, bull trend.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Ranging Market State with SPY closing mid-range. There were no extended targets at the close but several in the morning session above price until about noon, indicating the herd was participating in the push to $691. But the herd walked away for the afternoon session which gave way to SPY pulling back and basically ending the day unchanged. $689 was a magnet all day and while the market moved slightly higher and slightly lower all day, it always seemed to come back to $689, right in the middle of MSI’s range. Overnight the MSI rescaled lower to a bearish state but it was a narrow bearish state without extended targets. By the open the MSI was back in a ranging state and a brief dip to a bearish state was resolved by 10 am, after which the MSI began a series of rescalings higher with several narrow bullish ranges appearing. The herd kept the market moving higher but again as soon as these stopped printing, the market sold off and returned to the $689 level. For Monday the MSI is forecasting more of the same with likely sideways, choppy trading with an upward bias, absent an external catalyst. MSI support is $687.94 with resistance at $689.57.

Key Levels and Market Movements:

Friday we stated, “The market needs time to digest the past few sessions,” and added, “The bulls currently have the advantage, and a close above $685 keeps that edge intact,” while also noting that the bias favored selling failed breakouts near $693 and buying dips as low as $680. With the MSI opening in a wide ranging market state, the correct approach was patience, as we do not favor initiating trades while the MSI is ranging. By 9:40 am the MSI rescaled lower without extended targets, and a clear quadruple bottom near the prior day’s lows made MSI support a reasonable long entry to stay aligned with the broader trend. Because we always require T1 to be at least $1 from entry, MSI resistance was too close to use, which meant the premarket report became the correct guide for targets. The next premarket level at $689.15 appeared far from the $687.50 entry, but price reached it quickly by 10 am, validating the setup. The MSI also rescaled higher and confirmed this level as resistance, making it an ideal T1 where 70% of the position should be taken off. T2 was then set at the next MSI or premarket resistance level, which delivered additional gains. Once T2 was secured, the stop was moved to breakeven and the remaining 10% was trailed. The premarket and MSI both suggested a likely top above $690, and a failed breakout just before 11 am provided the structure needed to close the runner and consider a reversal. Because we never fade extended targets, the short was delayed until they stopped printing just before noon, at which point a short off MSI resistance became valid. SPY then worked lower through our predefined levels, producing a second profitable trade that was closed around 1 pm. This session again demonstrated how the newsletter framework, combined with the MSI and premarket levels, consistently provides one or two high-quality opportunities, which is all a trader needs to succeed. Overtrading remains the most common mistake, and today reinforced why focusing on a small number of well-structured trades, scaling properly, and following the MSI yields a high-probability and repeatable process with strong results. Traders who followed the post and premarket road maps, respected the MSI signals, stayed patient, and remained disciplined were rewarded, as the session aligned cleanly with our broader framework for structure, trend, and execution. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Monday has no economic news, but with earnings season starting in earnest, market direction is likely to come from company results and forward guidance. We continue to advise staying alert to headlines and macro developments so strategy can be adjusted as conditions change. The bulls currently have the advantage, and a close above $685 keeps that edge intact. A sustained hold above $685 sets the stage for a push toward $700. The bias for Monday favors selling failed breakouts above $693 and as high as $696, while buying dips as low as $682. For the bears to reassert themselves, SPY must break below $680 and stay there. The projected range is narrowing, which suggests volatility may continue to contract and produce choppy price action. The long-term bull trend remains intact above $640, making disciplined risk management and trading what price presents essential. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

Dealer Positioning Analysis

Dealers are selling SPY $695 to $715 and higher strike Calls while also buying $690 to $694 Calls indicating the Dealers’ desire to participate in any continuation rally on Monday. The ceiling for Monday appears to be $696. To the downside, Dealers are buying $689 to $635 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $690 to $720 and higher strike Calls indicating the Dealers’ belief that prices may not move much next week. The ceiling for the week appears to be $699. To the downside, Dealers are buying $689 to $585 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a market that is a bit more concerned about lower prices than previous weeks. For the week Dealer positioning is unchanged from slightly bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Monday, respect the bullish structure while remaining alert to headline risk. Favor buying pullbacks that hold above $683 and avoid chasing strength into the $690–$695 zone. Failed breakouts near resistance and failed breakdowns near support continue to offer the highest-probability setups. Manage risk tightly, stay flexible, and trade what price presents rather than what you expect.

Good luck and good trading!