Market Insights: Thursday, January 22nd, 2026

Market Overview

US stocks advanced for a second consecutive session on Thursday as investors continued to unwind geopolitical fear tied to Greenland and refocused on earnings, economic data, and the broader bull trend. Relief that President Trump formally paused his threatened tariffs on European allies helped stabilize sentiment after a volatile start to the week, allowing risk appetite to rebuild. The Nasdaq Composite led the advance, rising just under 0.9%, powered by renewed strength in large-cap technology and a sharp move higher in Tesla after the company announced it had begun robotaxi rides in Austin without a safety monitor present, a long-anticipated milestone that reignited optimism around autonomous driving. The Dow Jones Industrial Average gained roughly 0.6%, while the S&P 500 added about 0.5%, building on Wednesday’s strong rebound and confirming that the tariff scare had been largely priced out. Markets remained attentive to developments surrounding Greenland, however, after Trump reiterated that he had reached a “framework of a future deal” with NATO leadership while Denmark’s prime minister emphasized that the island’s sovereignty is not negotiable, keeping a layer of geopolitical uncertainty in the background. Beyond geopolitics, attention turned toward earnings, with Intel set to report after the close amid heightened focus on AI spending by Big Tech, memory constraints, and the chipmaker’s ongoing turnaround efforts. Procter & Gamble and GE Aerospace were also among notable companies reporting, adding to a busy earnings backdrop. On the macro front, investors digested a shutdown-delayed reading of the Fed’s preferred inflation gauge, which showed PCE prices rising at a 2.8% annual pace in November, alongside initial jobless claims that ticked only slightly higher, reinforcing expectations that the Federal Reserve will hold rates steady at its next meeting. GDP data showed the US economy grew at its fastest pace in two years through the third quarter of 2025, with growth revised up to 4.4%, underscoring ongoing economic resilience. Gold surged through $4,900 per ounce for the first time, extending a string of record highs as investors continued to hedge policy and geopolitical risk even as equities climbed. Overall, Thursday’s session reflected a market regaining balance after extreme volatility, with dip buyers once again asserting control as long as tariff risk remains off the table.

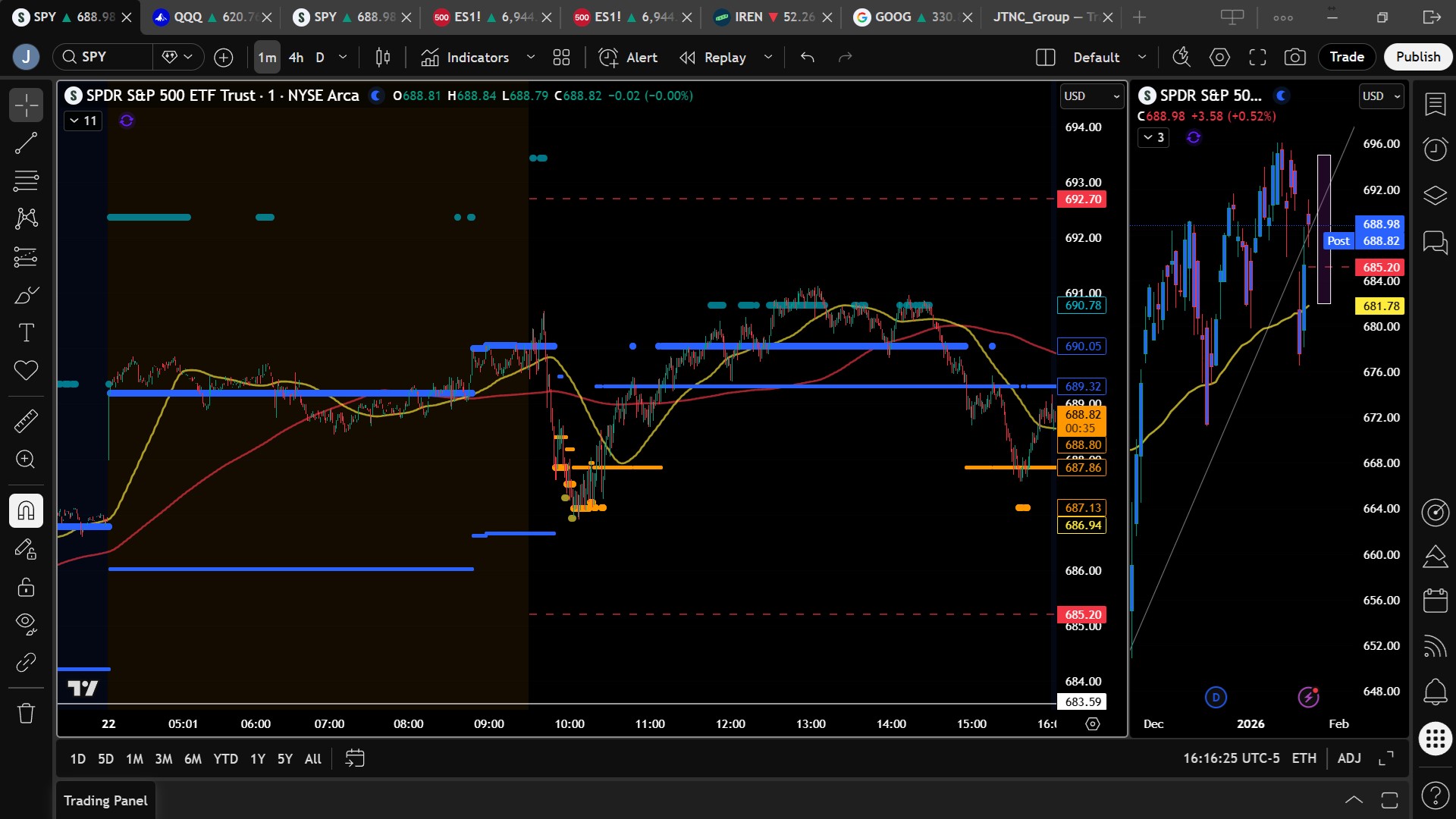

SPY Performance

SPY continued to build on its prior-day recovery, opening at $689.63 and trading in a relatively tight but constructive range throughout the session. The ETF reached an intraday high of $691.13 and a low of $686.92 before closing near the top of the range at $688.93, up 0.49% on the day. Trading volume came in at 68.61 million shares, about average, signaling consolidation rather than panic or euphoria following the wild swings earlier in the week. Price action reflected a market digesting gains, with one brief push lower and one higher, but no sustained momentum in either direction. Holding above the critical $685 level keeps bull control firmly intact and preserves the path toward higher resistance levels.

Major Indices Performance

Gains were steady across the major indices and reinforced the improving tone. The Nasdaq rose 0.91%, driven by strength in technology and AI-linked names. The Dow advanced 0.63%, supported by industrials and financials, while the Russell 2000 added 0.69%, highlighting improving sentiment toward smaller-cap stocks as volatility cooled. The S&P 500 finished solidly higher, confirming a second straight day of recovery after Tuesday’s sharp selloff.

Notable Stock Movements

It was a broadly positive session across the Magnificent Seven, with all names finishing green except Netflix, which fell 2.13% and continued to lag following its earnings report. Strength across the rest of the megacap complex reinforced the view that Tuesday’s selloff was driven by headline fear rather than a breakdown in leadership. Tesla stood out as a key driver of Nasdaq performance following optimism around its robotaxi announcement.

Commodity and Cryptocurrency Updates

Commodities and crypto sent mixed but informative signals. Crude oil fell 1.96% to $59.44, pulling back after recently tagging the $60 level our model has been forecasting for months. While further downside is possible, sustained trade above $56 keeps the door open for a renewed push toward $70. Gold surged 1.70% to $4,919, extending its historic rally and reinforcing strong demand for hard assets amid lingering macro and geopolitical uncertainty. Bitcoin slipped 0.88% but held above $89,400, signaling consolidation rather than a structural breakdown after recent volatility.

Treasury Yield Information

The 10-year Treasury yield edged higher by 0.05% to close near 4.253%. In our framework, yields above 4.5% begin to create meaningful headwinds for equities, while sustained trade above 4.8% often coincides with sharper market selloffs. A move above 5% historically signals significant equity risk, with a 20% or greater correction becoming likely near 5.2%. Thursday’s modest move did little to disrupt equities and kept financial conditions supportive.

Previous Day’s Forecast Analysis

In Wednesday’s newsletter, we emphasized that reclaiming and holding above $685 would restore full bull control and reopen the path toward $700. We noted that tariff de-escalation could drive a fast continuation higher and warned that volatility would likely remain elevated as the market digested rapid swings.

Market Performance vs. Forecast

Thursday’s action aligned with that framework. SPY remained firmly above $685, extended higher toward $691, and consolidated gains rather than giving them back. The lack of downside follow-through confirmed that bears remain sidelined while bulls continue to control the broader structure.

Premarket Analysis Summary

In Thursday’s premarket notes published at 8:11 AM, SPY was trading near $688.93 with a bullish bias above $688.20. Upside targets were outlined at $689.90 and $692.70, while downside levels were identified at $688.20, $685.20, $684.70, and $682.70. The plan favored cautious upside continuation while remaining alert to consolidation or profit taking.

Validation of the Analysis

The intraday tape validated that outlook. SPY held above the $688.20 bias, probed higher toward $691, and consolidated without triggering deeper downside targets. Selling pressure stalled well above the lower support zone, reinforcing the preference for consolidation rather than a renewed breakdown.

Looking Ahead

Friday brings PMI data as the lone scheduled economic release, though markets remain sensitive to any headlines from the administration given the recent geopolitical turbulence. With macro risks still present, unexpected news could move markets quickly despite a lighter calendar.

Market Sentiment and Key Levels

Sentiment remains cautiously bullish. SPY is firmly back above $685, placing bulls in control while bears remain sidelined unless price closes below $680. Resistance sits at $690, $694, $695, and $697, while support rests at $687, $683, and $677. The $693–$697 zone remains heavily defended and likely caps upside on initial tests.

Expected Price Action

SPY’s projected maximum range for Friday is $682 to $695, with the Call side dominating in a wide band that signals trending action mixed with periods of chop. With no major data beyond PMI, positioning and headlines are likely to drive intraday movement.

Trading Strategy

As long as SPY holds above $685, longs remain favored on pullbacks toward $687–$683. Shorts are viable between $693 and $695 on failed breakout attempts. Chasing strength is discouraged, and flexibility remains essential after the extreme volatility seen earlier in the week.

Model’s Projected Range

SPY’s projected maximum range for Friday is $682 to $695, with the Call side dominating in a wide band that signals trending action with periods of chop. Friday brings PMI and nothing more, although given the macro picture, anything out of the administration is possibly a market mover. PCE came in slightly hotter than the prior month but GDP was revised upward signifying a strong economy that has legs with unemployment claims also falling. A such SPY continued to build on its prior day recovery, moving up by 0.52% to close at $688.98, above the $685 level where bulls dominate opening the path to $700. Overnight SPY gapped higher and by the open, SPY was already above $690. The day had a move lower and one higher, but it was mostly muted and filled with choppy, consolidation…to be expected after a wild few days. Volume was average as the market digests everything that has transpired over the last few days. As long as price holds above $685, the bull are in complete control and the bears will remain sidelined until price closes below $680 where they may dip their toe once again. Overnight the market is likely to continue its attempt to break above $691 and push toward $695 where we expect the market to stall. If a test of $685 fails, $680 must hold to prevent bears from pressing lower, even though the long-term trend remains intact above $640. February is historically prone to surprise selloffs, so deeper weakness would not be shocking and should be viewed as a potential setup for a spring or summer rally. Traders should monitor geopolitical headlines closely and trade what price presents. Absent a catalyst for Friday, resistance sits at $690, $694, $695 and $697, while support rests at $687, $683, and $677. The $693–$697 zone is heavily defended and likely caps upside on initial tests. Longs above $683 remain favorable while shorts are viable between $693 and $695 on any failed breakout. Crypto pulled back slightly today while all Mag stocks rallied with the exception of Netflix which continues to decline. Broad weakness across both groups would be required for a larger pullback or trend reversal. VIX dropped more than 8% to 15.49, solidly in risk-on territory. SPY is back in its bull trend channel from the April lows but is resting right on the lower channel so another dip and its likely the model will redraw the channel to account for further weakness.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a Ranging Market State with SPY closing mid-range. There were no extended targets at the close but several in the premarket above price and for much of the late morning and early afternoon, holding price near $691. The MSI rescaled higher overnight several times indicating bull strength. After the open, the MSI rescaled lower to a bearish state however, each rescale was very narrow and didn’t demonstrate any real weakness. As such the MSI then rescaled to a ranging state and back to the bullish state it spent most of the day trading within. But the bullish state was also narrow, again indicating no real conviction by the bulls to seek higher prices either. As such by the close, the market had pulled back from its highs and the MSI setting in the current ranging state. MSI support is $687.86 with resistance at $689.32.

Key Levels and Market Movements:

Thursday we stated, “Thursday has quite a bit of economic data which could move the market,” and added, “Bulls currently have the edge and will continue to press as long as price remains above $685,” while noting, “The bias for tomorrow favors selling $690 on failed breakouts and buying any dips to $680.” With the MSI opening in a wide bullish state, extended targets printing, and multiple premarket rescalings higher, the plan was clearly to look for longs in the direction of the trend. With such a wide MSI, a test of MSI support before any sustained move higher was the most likely outcome. That is exactly what happened. SPY sold off shortly after the open, rescaled to a bearish state, and pushed lower before stabilizing just below $687, which aligned closely with MSI support from the opening range. Once extended targets stopped printing, the long entry at MSI support near $687.50 was the correct trade. Targeting MSI resistance for the first and second profit targets and then trailing using premarket levels provided an easy, high-probability setup. That trade produced clean profits. As the MSI later rescaled into a very narrow bullish state, the odds of a late-day pullback increased. Waiting patiently for extended targets to stop printing once again set up the next trade. The failed breakout near $690 followed the plan precisely and offered a low-stress short with two clean targets and a runner into the close. This session once again demonstrated how the newsletter framework works best when paired with the Market State Indicator and the premarket report as primary guides, resulting in a straightforward session with two solid, well-structured trades and strong gains. Traders who followed the post and premarket road maps, respected the MSI signals, stayed patient, and remained disciplined were rewarded, as the session aligned cleanly with our broader framework for structure, trend, and execution. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday has PMI data, which is unlikely to shape the day. The market needs time to digest the past few sessions. With earnings season starting in earnest next week, direction will likely come from company results and forward guidance on the economy. We continue to advise staying conscious of headlines and macro events so plans can be adjusted as needed. The bulls currently have the advantage, and a close above $685 keeps that edge intact. A sustained move above $685 sets the bulls up for a run toward $700. The bias for Friday favors selling failed breakouts near $693 and buying dips as low as $680. For the bears to reassert themselves, SPY must break below $680 and remain there. The projected range remains wide, so volatility should stay elevated with trending action mixed with intermittent chop. The long-term bull trend remains intact above $640, making risk management and trading what you see critical. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

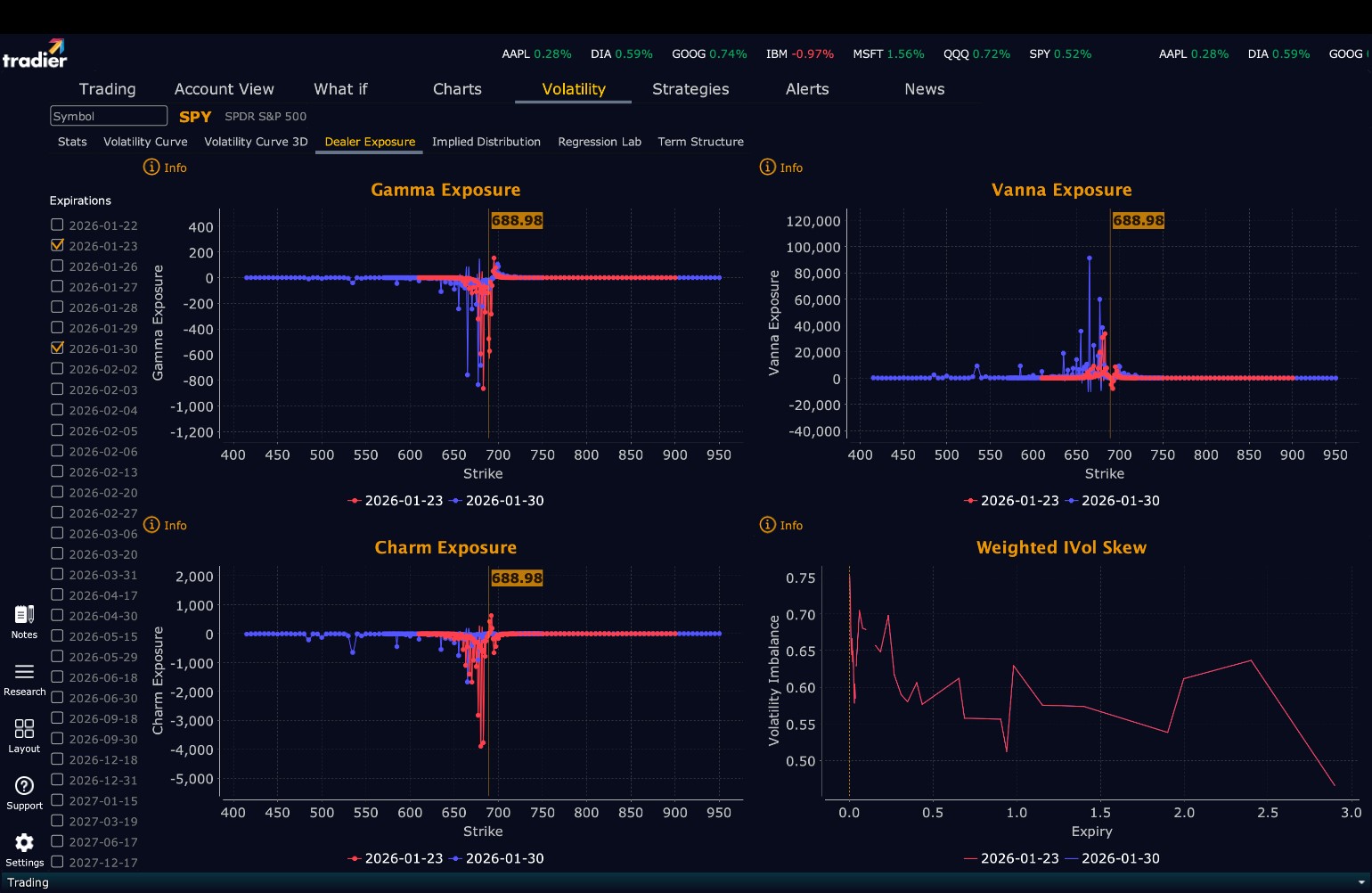

Dealer Positioning Analysis

Dealers are selling SPY $692 to $705 and higher strike Calls while also buying $689 to $691 Calls indicating the Dealers’ desire to participate in any continuation rally tomorrow. Dealers are no longer selling ATM Puts. The ceiling for tomorrow appears to be $695. To the downside, Dealers are buying $688 to $635 and lower strike Puts in a 3:1 ratio to the Calls/Puts they’re selling/buying displaying some concern that prices could move lower. Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish.

Looking Ahead to Next Friday:

Dealers are selling SPY $689 to $720 and higher strike Calls indicating the Dealers’ belief that prices may not move much next week. The ceiling for the week appears to be $699. To the downside, Dealers are buying $688 to $585 and lower strike Puts in a 4:1 ratio to the Calls they’re selling, reflecting a market that is a bit more concerned about lower prices than previous weeks. For the week Dealer positioning has changed from neutral/slightly bearish to slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Friday, respect the restored bullish structure while remaining alert to headline risk. Favor buying pullbacks that hold above $683 and avoid chasing strength into the $690–$695 zone. Manage risk tightly, stay flexible, and trade what price confirms rather than what headlines suggest.

Good luck and good trading!