Market Insights: Thursday, January 15th, 2026

Market Overview

US stocks rebounded on Thursday, recovering from back-to-back losses as renewed confidence in the AI cycle and strong bank earnings helped stabilize sentiment and support a move higher across the major indices. The Dow Jones Industrial Average led the advance with a gain of roughly 0.6%, while the S&P 500 and Nasdaq Composite each rose about 0.3%, marking a constructive reversal after Wednesday’s tech-led pullback. The tone of the session was set early by strong results and commentary from the semiconductor space, where Taiwan Semiconductor Manufacturing delivered a powerful signal that AI-driven demand remains robust. TSMC reported a 35% jump in fourth-quarter profit and announced plans to increase capital expenditures to $56 billion in 2026, reinforcing confidence that Big Tech spending on AI infrastructure is not slowing. The update sparked a rally across chip-related stocks, with Nvidia rebounding sharply from the prior day’s decline and ending the session up more than 2%, helping lift the broader Nasdaq. The move marked a notable shift from Wednesday’s session, when tech weakness reignited concerns about a prolonged rotation out of megacaps. Financials also provided meaningful support as investors digested a fresh round of strong bank earnings. Goldman Sachs and Morgan Stanley both posted sharply higher profits, benefiting from a late-year surge in dealmaking activity, while BlackRock capped 2025 with record assets under management and an earnings beat. Shares across the group rallied, contributing to the Dow’s outperformance and helping broaden participation beyond technology. In commodities, oil prices fell sharply, with crude down nearly 5% as easing geopolitical tensions reduced the perceived risk of supply disruptions after President Trump signaled the US may be stepping back from a military response tied to Iran. Precious metals took a breather after a historic rally, with silver paring earlier losses into the afternoon, while gold slipped modestly but remained near record levels. Overall, Thursday’s session reflected a market regaining balance, with AI optimism and strong earnings offsetting geopolitical noise and reinforcing the view that the broader uptrend remains intact despite elevated volatility.

SPY Performance

SPY finished higher after a volatile session, opening at $694.59, pushing to an intraday high of $695.45, and then fading into the afternoon before stabilizing to close at $692.11, up 0.25% on the day. Trading volume totaled 69.34 million shares, slightly above average, signaling healthy participation without signs of capitulation or euphoria. Price action reflected repeated attempts to break through the $695.50 area, which proved too strong to overcome, followed by orderly profit taking. Despite the pullback from the highs, SPY remained firmly above the critical $685 level that defines bull control, reinforcing that Thursday’s action was consolidation within an uptrend rather than a reversal.

Major Indices Performance

Thursday’s gains were broad-based but uneven. The Dow outperformed with a 0.60% advance, supported by strength in industrials, materials, and financials. The S&P 500 rose 0.25%, tracking SPY’s recovery and remaining just below recent highs. The Nasdaq gained 0.25% as chip stocks rebounded, offsetting continued softness in parts of the megacap complex. The Russell 2000 added 0.84%, highlighting improving sentiment toward smaller-cap names and reinforcing the view that participation beneath the surface remains healthy.

Notable Stock Movements

It was a mostly red session across the Magnificent Seven, with the notable exceptions of Meta, Amazon, and Nvidia. Nvidia led the group higher, gaining as much as 2.18% on renewed optimism around AI demand following TSMC’s results and guidance. Meta and Amazon also finished green, while the rest of the group lagged, reflecting ongoing rotation within megacap leadership rather than broad-based selling. Outside of tech, bank stocks stood out as top performers following strong earnings from Goldman Sachs, Morgan Stanley, and BlackRock.

Commodity and Cryptocurrency Updates

Commodities sent a mixed signal as markets recalibrated geopolitical risk. Crude oil fell 4.87% to $59.00 after recently reaching the $60 level our model has been forecasting for months. While further downside is possible, sustained trade above $56 keeps the door open for a rebound toward $70 if supply dynamics tighten. Gold slipped 0.50% to $4,612 after its recent surge but remains near historic highs, underscoring persistent demand for hedges. Bitcoin fell 2.19% but held above $95,300, signaling consolidation rather than a breakdown after a strong multi-week run.

Treasury Yield Information

The 10-year Treasury yield rose 0.85% to close near 4.173%, reflecting improved risk appetite and reduced demand for safety. In our framework, yields above 4.5% begin to create headwinds for equities, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals significant equity risk, with a 20% or greater correction becoming likely near 5.2%. Thursday’s move higher in yields did little to disrupt equities, suggesting markets remain comfortable with current rate levels.

Previous Day’s Forecast Analysis

In Wednesday’s newsletter, we emphasized that despite the sharp selloff, bulls remained firmly in control above $685 and that repeated dip-buying behavior suggested the decline was corrective. We highlighted $688 and $686 as critical support levels and noted that a recovery back above $690 would likely follow if those zones held.

Market Performance vs. Forecast

Thursday’s price action validated that outlook. SPY held above the $688–$686 support zone overnight, rallied sharply into the open above $694, and spent much of the session consolidating near the highs. Although $695.50 capped upside, the ability to close green and remain above $690 confirmed that the prior day’s selloff has been absorbed.

Premarket Analysis Summary

In Thursday’s premarket notes published at 7:26 AM, SPY was trading near $692.65 with a bias level at $691.50. Upside targets were set at $693.50 and $695, while downside levels included $688.50 and $687.50, with deeper support near $686 and $684.50. The plan called for caution near upper targets and favored buying dips rather than chasing strength.

Validation of the Analysis

The intraday tape followed the premarket framework closely. SPY pushed into the $695 area, stalled as anticipated, and then rotated lower without breaking key support. Dips toward the $691–$692 zone attracted buyers, and downside momentum never accelerated, validating the expectation of consolidation rather than a cascade lower.

Looking Ahead

There are no major economic releases scheduled for Friday or early next week, shifting the focus toward earnings, options expiration, and geopolitical headlines. With OPEX approaching, markets may experience choppier, two-way trade and reduced follow-through.

Market Sentiment and Key Levels

Sentiment remains bullish but measured. SPY is firmly above the $685 bull-control level, keeping the broader uptrend intact. Resistance sits at $695, $699, and $700, while support rests at $690, $688, $685, and $684. A sustained break above $695 opens the door to a test of $700, while a failure below $688 would increase the risk of a deeper pullback.

Expected Price Action

SPY’s projected maximum range for Friday is $686 to $697. The Call side dominates in a wide but narrowing band, signaling trending action with periods of chop. With no scheduled data, intraday movement is likely to be driven by positioning, options flows, and headlines rather than fundamentals.

Trading Strategy

We continue to favor trading with the trend. Long setups are preferred on dips toward $690 and $688 that show clear support. Shorts are not favored unless $688 breaks cleanly or on failed breakouts near $695–$700. With OPEX approaching, fading extremes on both sides may offer the best risk-reward.

Model’s Projected Range

SPY’s projected maximum range for Friday is $686 to $697. The Call side dominates in a wide but narrowing band, signaling trending action with periods of chop. Friday has no scheduled news likely to move the market. Today’s Unemployment Claims were better than forecast, but most of the move happened overnight as SPY bounced off $688 and ripped higher into the open above $694, once again near all-time highs. SPY attempted new highs, but $695.50 proved too strong to overcome and after several hours with SPY pinned above $695, price sold off to close up 0.27% at $692.24. Banks and chips supported momentum and continue to position SPY for another attempt at new highs and a test of $700. Bulls remain firmly in control above $685 and continue to buy dips aggressively. The prior one-day decline is now behind us and the trend remains higher as long as $690 holds. A rally toward $700 remains a major test and will likely take time to overcome. Overnight, bulls will aim to defend $690, with a failure likely leading to $688 and then $685. There is heavy support near $684, making a move below that level unlikely without a major external catalyst. Volume was slightly above average today, but with OPEX tomorrow, Friday is likely to see choppy, two-way trading, with poor follow-through. Bears only gain real traction below $680, and with SPY well above $685, higher prices remain likely despite added volatility from OPEX or geopolitical headlines. Resistance sits at $695, $699, and $700. Support sits at $690, $688, $685, and $684. The $695 level is heavily defended and may cap upside, though a sustained break above it opens the door to $700, likely via a slow grind. Failed breakouts near $695 remain attractive, but with expected two-way trade, fading extremes on both sides makes sense. We do not favor shorts unless $688 breaks cleanly, while longs are preferred on dips to $690. We continue to favor trading with the trend and buying dips while bulls remain in control. Crypto pulled back today after recent strength, while most MAG stocks declined except Nvidia, Meta, and Amazon. Broad weakness across both groups would be required for a larger pullback. VIX fell 5.43% to 15.84, returning to risk-on territory. SPY remains in the lower portion of a strong bull trend with structural support near $684.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a narrow Bearish Trending Market State with SPY closing just below MSI resistance. There were no extended targets into the close, however in the premarket and for most of the morning session, as well as the late afternoon session, saw extended targets on both ends of the spectrum. The strong presence of extended targets before the open set up the rally to $695.50 but once extended targets stopped printing, the sell off commenced with SPY pulling back to close above Wednesday’s close and $685 that defines complete bull dominance. The MSI rescaled higher overnight and several times just before the open. But by the open, the MSI was in a wide bullish state where it remained until 2 pm when it began a series of rescalings lower, each being quite narrow which didn’t give much impetus to the decline. The MSI made it clear the drop was nothing more than a pullback and profit taking. For Friday the MSI is forecasting chop with a possible test of $690 which we suspect will hold, but also with a push back toward the all-time high, given how narrow the MSI range was at the close. MSI support is $691.50 with resistance at $692.28.

Key Levels and Market Movements:

Wednesday we stated, “today’s decline has not changed the broader dynamic. Bulls remain firmly in control, and dips continue to act as short-squeeze opportunities.” We also said, “tactical shorts are only favored above $695 on failed breakouts,” and added, “long setups above $688 remain the best opportunities for Thursday.” With that context, the MSI opened in a wide bullish state with extended targets above, so the plan was to buy dips and trade them to MSI resistance. Although price was elevated, a dip formed around 11 am and produced a clear failed breakdown at $693 that was buyable. The premarket identified $695 as major resistance, just above MSI resistance, so longs should have taken profits there. With extended targets printing, there was nothing to do but hold until they stopped, as we never fade extended targets. A less-than-perfect failed breakout near noon looked tempting for a short, but extended targets required patience. That opportunity came midafternoon when SPY fell below MSI resistance. Price continued lower, allowing clean level-to-level trades from MSI resistance to MSI support, with premarket levels providing additional targets. Following this structure made the session straightforward, with at least two solid trades that produced a nice gain. Traders who followed the post and premarket road maps, respected the MSI signals, stayed patient, and remained disciplined were rewarded, as the session aligned cleanly with our broader framework for structure, trend, and execution. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Friday has no scheduled news, but OPEX makes the session likely trappy and choppy with poor follow-through. Bulls remain in control and bears are sidelined, so the bias favors buying dips. The expected range is roughly $686 to $696, which favors fading the edges and taking quick profits at MSI and premarket levels. Dips toward $686–$685 are likely the downside extreme. Upside attempts near $695–$696 are likely to stall on first tests. Tactical shorts should be used cautiously and only on failed breakouts above $695 or a clean break below $686. Long setups above $690 remain the highest-probability trades. Macro risks persist, so stay alert to headlines. There is no meaningful bear case unless price falls below $680. As long as $690 holds, bulls will continue pressing toward $695 and ultimately $700. Gains above $696 may stall until $700 is cleared. The long-term bull trend remains intact above $640. As always, stay alert to macro risks and be prepared to trade what you see. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

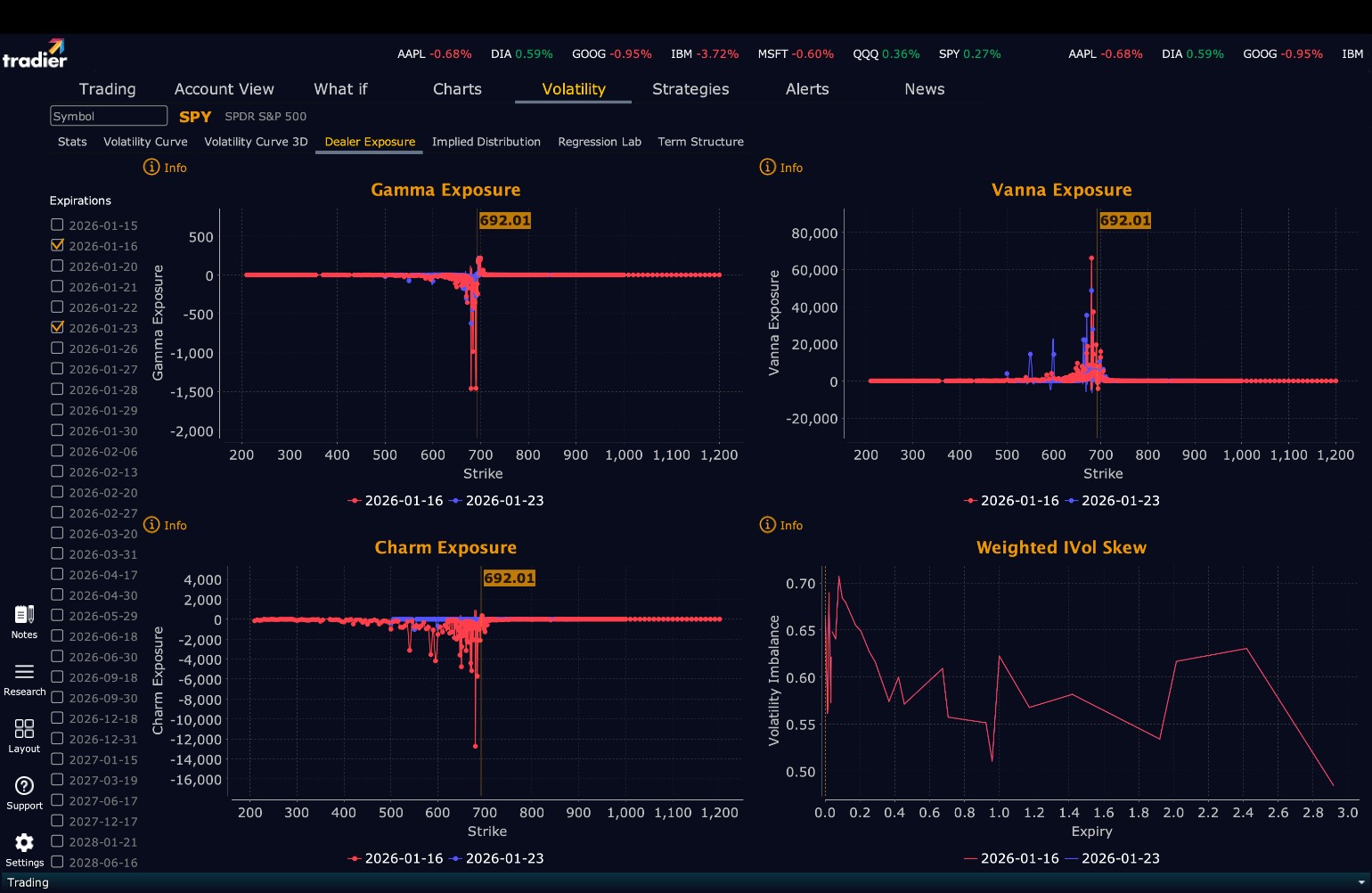

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $699 to $718 and higher strike Calls while also buying $693 to $698 Calls indicating the Dealers’ desire to participate in any rally tomorrow. The ceiling for tomorrow appears to be $700. To the downside, Dealers are buying $692 to $645 and lower strike Puts in a 2:1 ratio to the Calls they’re selling/buying displaying no concern that prices could move significantly lower. Dealer positioning is changed from neutral/slightly bearish to neutral/slightly bullish.

Looking Ahead to Next Friday:

Dealers are selling SPY $694 to $720 and higher strike Calls while also buying $693 Calls indicating the Dealers’ desire to participate in any rally next week. The ceiling for the week appears to be $697. To the downside, Dealers are buying $692 to $585 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying, reflecting a market that is not concerned about lower prices. For the week Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Friday, respect the bullish structure but expect choppy, two-way trading. Favor longs on pullbacks toward $690–$688 and limit shorts to failed breakouts near $695–$700. Manage risk tightly, stay flexible, and let price action at key levels guide decisions.

Good luck and good trading!