Market Insights: Tuesday, January 13th, 2026

Market Overview

US stocks pulled back from record highs on Tuesday as a steady inflation report failed to provide a fresh catalyst for risk assets and the start of earnings season introduced new sources of uncertainty. The Dow Jones Industrial Average led the decline, falling roughly 0.8%, while the S&P 500 slipped about 0.2% and the Nasdaq Composite eased roughly 0.1%. The market reaction reflected a combination of profit taking near all-time highs, disappointment around early bank earnings, and heightened sensitivity to policy and geopolitical headlines. The December Consumer Price Index showed inflation holding steady, with headline CPI rising 2.7% year over year and 0.3% month over month, both in line with expectations. Core CPI came in slightly softer than forecast, rising 0.2% on the month and 2.6% year over year, the lowest annual pace since early 2021. While the inflation data reinforced the view that price pressures continue to cool gradually, it did little to spark a rally after last week’s strong gains. With the December jobs report already pointing to a cooling but still resilient labor market, traders largely solidified expectations that the Federal Reserve will hold rates steady at its upcoming meeting, while maintaining bets for the first of two quarter-point cuts later in the year, most likely beginning in June. Earnings season officially got underway with results from JPMorgan Chase, which missed expectations after taking a $2.2 billion hit tied to its Apple Card business, sending shares sharply lower and weighing on the broader financial sector. More bank earnings from Bank of America, Citigroup, and Morgan Stanley are due in the coming days, keeping investors cautious. Meanwhile, concerns about Federal Reserve independence remained in focus as global central bankers joined former US officials in condemning the Justice Department’s investigation into Chair Jerome Powell, which Powell has characterized as politically motivated pressure from President Trump. On the geopolitical front, Trump added another layer of uncertainty by warning that countries continuing to do business with Iran would face a 25% US tariff, compounding existing tensions tied to Venezuela and global trade. Taken together, Tuesday’s session reflected a market that is still firmly in a longer-term uptrend, but increasingly sensitive to earnings, policy risk, and geopolitical developments as it digests a heavy flow of information near record levels.

SPY Performance

SPY gave back a modest portion of recent gains, opening at $695.46 and trading lower through much of the session before stabilizing into the close. The ETF reached an intraday high of $696.09 early, set a low at $691.36, and finished the day at $693.87, down 0.19%. Trading volume came in at 71.50 million shares, slightly above average, suggesting some profit taking rather than a lack of participation. After CPI briefly pushed SPY to new intraday highs, sellers gradually took control, but downside momentum faded late in the session as buyers stepped in near the $691 area. The late-day rebound reinforced that dips continue to be bought and that the broader bullish structure remains intact above key support.

Major Indices Performance

Index performance showed broad but contained weakness. The Dow declined 0.80%, weighed down by financials following JPMorgan’s earnings miss. The S&P 500 slipped 0.20%, while the Nasdaq fell 0.10%, reflecting resilience in large-cap technology despite the overall pullback. The Russell 2000 dipped just 0.02%, signaling that smaller-cap stocks held up relatively well and that the move was more about rotation and digestion than a broad-based risk-off shift.

Notable Stock Movements

The Magnificent Seven delivered a mixed session, with roughly half of the group finishing higher and half lower. Alphabet led the upside with gains of up to 1.24%, helping support the Nasdaq, while Meta was the weakest performer, falling as much as 1.69%. The mixed performance underscored ongoing rotation within megacap leadership rather than coordinated selling. In the financial sector, JPMorgan fell sharply after its earnings miss, pressuring peers and contributing to the Dow’s underperformance.

Commodity and Cryptocurrency Updates

Commodities and crypto painted a more constructive picture beneath the surface. Crude oil surged 2.80% to $60.98, reaching the $60 level our model has been forecasting for several months. While further volatility is possible, sustained trade above $56 keeps the door open for a move toward $70. Gold slipped 0.45% to $4,594 after its recent surge but remains near record highs, reflecting ongoing demand for inflation and geopolitical hedges. Bitcoin rose 3.75% to close above $94,400, signaling strong risk appetite in crypto despite equity market consolidation.

Treasury Yield Information

The 10-year Treasury yield fell 0.31% to close near 4.173%, easing financial conditions and helping limit downside pressure in equities. In our framework, yields above 4.5% begin to create headwinds for stocks, while sustained trade above 4.8% often coincides with sharper selloffs. A move above 5% historically signals significant risk, with a 20% or greater correction becoming likely near 5.2%. Tuesday’s decline in yields reinforced the view that macro conditions remain supportive even as equities pause.

Previous Day’s Forecast Analysis

In Monday’s newsletter, we emphasized that above $690 the bulls remained firmly in control and that shallow pullbacks were likely to attract buyers rather than signal trend exhaustion. We highlighted $690 as a critical level bulls would want to defend.

Market Performance vs. Forecast

Tuesday’s action followed that roadmap closely. SPY pulled back modestly after setting new highs, found support near $691, and rebounded late in the session. The absence of sustained downside follow-through confirmed that the broader bullish trend remains intact.

Premarket Analysis Summary

In Tuesday’s premarket notes published at 7:20 AM, SPY was trading near $694.71 with a bias level at $695. We outlined upside targets at $697.50 and $700, while noting that failure to hold above the bias could lead to consolidation toward $694, $693.35, and potentially $692. Price action respected that framework, with early strength fading into consolidation rather than accelerating higher.

Validation of the Analysis

The intraday tape validated the premarket expectations. SPY briefly pushed higher following CPI, failed to hold above resistance, and consolidated lower through the session before a late-day bounce. Support levels held, and selling pressure never accelerated into a trend move.

Looking Ahead

Attention now turns to Wednesday’s PPI and Retail Sales data, followed by Unemployment Claims on Thursday. While these releases could add volatility, recent price action suggests markets are currently more sensitive to earnings and geopolitical headlines than to incremental macro data.

Market Sentiment and Key Levels

Sentiment remains bullish but increasingly selective. SPY continues to trade well above the $685 bull-control level, keeping the broader trend intact. Resistance sits at $694, $696, $700, and $703, while support rests at $692, $690, $688, and $685. Holding above $690 keeps momentum constructive, while a sustained break below $688 would open the door to a deeper pullback.

Expected Price Action

SPY’s projected maximum range for Wednesday is $688 to $700. The Put side dominates in an expanding band, signaling trending action with periods of chop. Volatility is likely to remain elevated as data, earnings, and geopolitical risks continue to interact.

Trading Strategy

We continue to favor trading with the broader trend. Long setups are preferred on pullbacks toward $692–$690 that show clear support. Shorts are only favored on a clean break below $690 without a fast recovery or on failed breakouts near $699–$700. Discipline and flexibility remain essential in this environment.

Model’s Projected Range

SPY’s projected maximum range for Wednesday is $688 to $700. The Put side dominates in an expanding band, signaling trending action with periods of chop. PPI and Retail Sales are due tomorrow and could add volatility, but they are unlikely to be decisive. Recent movement has been driven more by macro and geopolitical factors, and that trend continues. Today SPY fell 0.20% intraday but recovered late. A bounce from $691 pushed price back to nearly flat. Overnight action was choppy. CPI initially sent SPY to new intraday highs, but those gains faded by the open. Price trended lower most of the session before another late-day rally. Bulls continue to buy every dip. SPY remains well above $685, which keeps bulls firmly in control. The $700 level remains the key upside target. Volume was a little above average, suggesting some profit taking. The session was extremely choppy, with tight range after 1 pm. The longer-term bull structure remains intact. Overnight, bulls will defend $690 to maintain momentum. A dip to $690 is likely the maximum pullback bulls want to see. A break of $690 likely tests $688. A break of $688 opens $685 and a possible return to the $675–$685 range. Bears only gain real traction below $680. Today’s selloff attempt failed and turned into a late-day short squeeze. That move reinforced bullish commitment. Wednesday is likely choppy and volatile due to data and geopolitical risk. Resistance sits at $694, $696, and $700. Support sits at $692, $690, $688, and $685. The $696 level is heavily defended and may cap upside. Near $696 we favor failed breakouts. Shorts are favored only on a clean break of $690 without a fast recovery. We prefer to trade with the trend and buy dips above $690. Crypto was strong today. MAG stocks were mixed. Broad weakness in both would be required for a larger pullback. VIX rose 5.69% to 15.98 but still signals risk-on conditions. SPY remains in the lower portion of a strong bull trend with structural support near $682.

Market State Indicator (MSI) Forecast

Current Market State Overview:

The MSI ended the session in a narrow Bullish Trending Market State with SPY closing just above MSI support. There were no extended targets into the close but there were plenty in the premarket to the upside and to the downside during the day session which saw SPY fall to the lows of the day. But those stopped printing at 3:34 pm and a textbook failed breakdown rocketed price right back to basically unchanged. The MSI didn’t move overnight but during the day session rescaled several times through all three ranges. For Wednesday the MSI is forecasting chop with some upside possible but also, given the size of the range, possible retesting of the day’s lows. MSI support at $693.67 with resistance at $694.43.

Key Levels and Market Movements:

Monday we stated, “Tuesday has CPI which certainly can move the market.” We also said, “Price action is likely to chop and show brief weakness.” We added, “Dips toward $690 should attract buyers.” With that context, the MSI opened near all-time highs without extended targets and forecast weakness toward MSI resistance turned support. A textbook failed breakout after CPI made a short tempting. When SPY reached MSI support, there was little structure for a long. The MSI began rescaling lower into a very narrow ranging state. This is a state we do not favor trading. With extended targets still printing, buying the dip was premature. Around 10:30 am those targets stopped printing. Bulls stepped in and bought MSI support. Targeting MSI resistance produced multiple clean targets. By noon the MSI rescaled to a very narrow bullish state. That signaled limited strength. Traders fading the squeeze had a second short opportunity back into MSI support. Late in the day a clean failed breakdown formed. That setup provided a textbook long off MSI support with no extended targets blocking the entry. Three clear opportunities for those who use this tool, thanks to having a clear plan, maintaining patience and discipline, and staying aligned with MSI signals, market structure, and our broader trading framework. The MSI continues to prove its reliability as the cornerstone of our trading process.

Trading Strategy Based on MSI:

Wednesday has PPI and Retail Sales, and neither is likely to change the market’s direction. After more than a week of strong gains, the market paused but did not alter the dynamic. Bulls remain firmly in control. Dips continue to act as short-squeeze opportunities. The near-term trend is bullish. We favor buying dips. Tactical shorts are only favored above $696 on failed breakouts or on a clean break below $690. Long setups above $690 remain the best opportunities for Wednesday. Macro risks persist, so traders should stay alert to headlines. The MSI does not forecast strength or weakness, which points to chop unless an external catalyst appears. Upside resistance sits near $696. Dips should continue to attract buyers. There is no meaningful bear case unless price falls below $680. Bulls will defend $690. A failure there likely sends SPY to $688. A break of $688 opens a move back into the $675–$685 range. If support holds, bulls will push toward $696 and then $700. Gains above $696 may stall until $700 is cleared. The long-term bull trend remains intact above $640. Near-term control stays with the bulls as long as price holds above $685. As always, stay alert to macro risks and be prepared to trade what you see. Failed breakouts and failed breakdowns continue to offer the highest-probability setups, so remain flexible, avoid trading during Ranging Market States, and ensure all trades are fully aligned with MSI signals. Providing real-time insights into market control, momentum shifts, and actionable levels, the MSI when integrated with our Pre-Market and Post-Market Reports continues to sharpen execution precision and elevate trade quality. If you haven’t yet integrated MSI and our model levels into your process, now is the time. Contact your representative to get started as these tools are designed to support consistency and enhance performance.

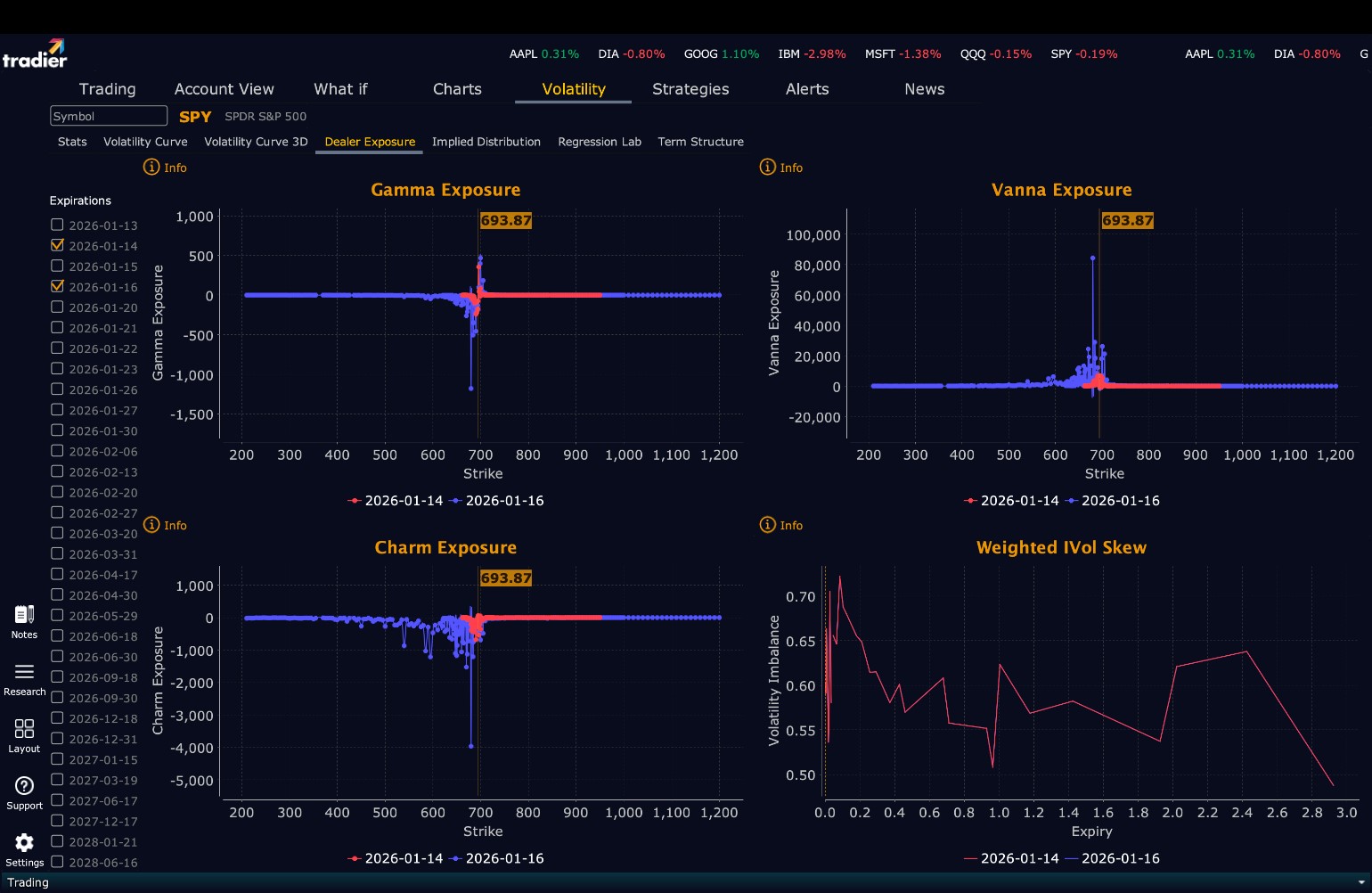

Dealer Positioning Analysis

Summary of Current Dealer Positioning:

Dealers are selling SPY $696 to $718 and higher strike Calls while also buying $694 to $695 Calls indicating the Dealers’ desire to participate in any rally tomorrow. The ceiling for tomorrow appears to be $700. To the downside, Dealers are buying $693 to $645 and lower strike Puts in a 2:1 ratio to the Calls they’re selling/buying displaying no concern that prices could move significantly lower. Dealer positioning is changed from neutral/slightly bearish to neutral/slightly bullish.

Looking Ahead to Friday:

Dealers are selling SPY $695 to $720 and higher strike Calls while also buying $694 Calls indicating the Dealers’ desire to participate in any rally this week. The ceiling for the week appears to be $700. To the downside, Dealers are buying $693 to $585 and lower strike Puts in a 3:1 ratio to the Calls they’re selling/buying, reflecting a market that is not concerned about lower prices. For the week Dealer positioning is unchanged from neutral/slightly bearish to neutral/slightly bearish. We advise reviewing Dealer positioning daily for directional clues. These positions evolve quickly and tracking them is essential for staying ahead of shifting market sentiment.

Recommendation for Traders

Into Wednesday, respect the bullish structure but expect choppy and volatile trade. Favor longs on pullbacks toward $692–$690 and limit shorts to failed breakouts near $699–$700. With multiple data points and earnings ahead, manage risk aggressively, stay flexible, and let price action at key levels guide decisions.

Good luck and good trading!